Key Insights

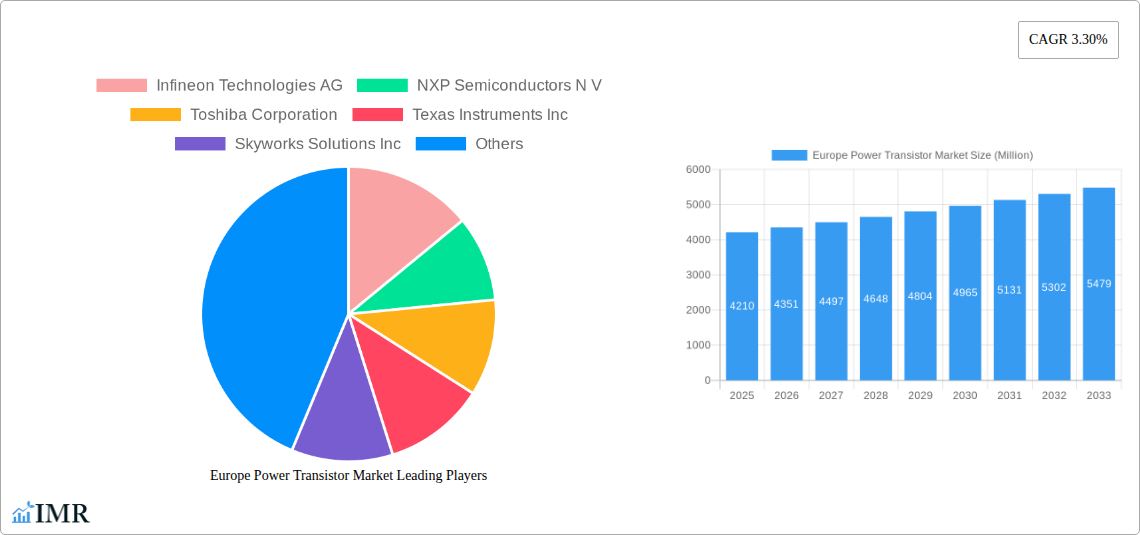

The Europe Power Transistor Market is poised for steady expansion, currently valued at an estimated USD 4.21 billion. This growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of 3.30% through 2033, indicating sustained demand for these critical semiconductor components. The market's expansion is primarily driven by the increasing adoption of electric vehicles (EVs), which rely heavily on power transistors for efficient power management and conversion within their intricate electrical systems. Furthermore, the ongoing electrification of industrial machinery and the burgeoning renewable energy sector, particularly solar and wind power, are significant contributors to this upward trajectory. These sectors demand robust and efficient power transistors to handle high voltages and currents, ensuring reliable energy generation and distribution. The market is also experiencing growth due to advancements in power semiconductor technology, leading to smaller, more efficient, and higher-performance transistors that cater to evolving application needs.

Europe Power Transistor Market Market Size (In Billion)

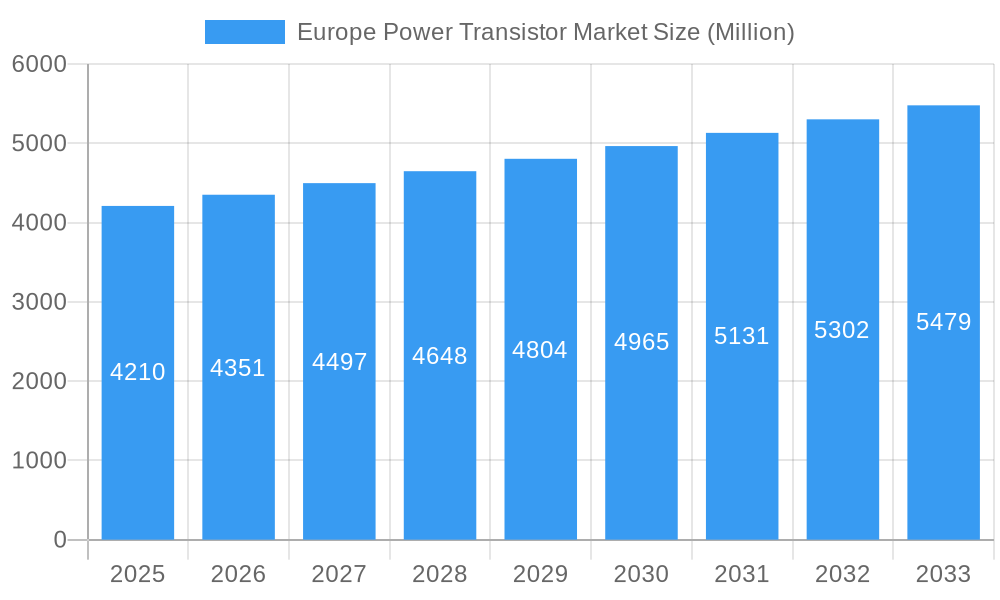

However, the market faces certain restraints, including the increasing complexity of supply chains and the potential for raw material price volatility, which can impact manufacturing costs and product pricing. Intense competition among established players and the emergence of new entrants also contribute to pricing pressures. Despite these challenges, key trends such as the rise of wide-bandgap semiconductor technologies like Silicon Carbide (SiC) and Gallium Nitride (GaN) are shaping the market, offering superior performance characteristics such as higher efficiency, increased temperature operation, and faster switching speeds. These advancements are crucial for meeting the stringent requirements of next-generation power electronics. The analysis further highlights segmentation across production, consumption, imports, exports, and price trends, providing a comprehensive view of market dynamics. Leading companies such as Infineon Technologies AG, NXP Semiconductors N.V., and Texas Instruments Inc. are actively innovating and expanding their portfolios to capitalize on these market opportunities within Europe.

Europe Power Transistor Market Company Market Share

Europe Power Transistor Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a detailed analysis of the Europe Power Transistor Market, encompassing parent and child market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, challenges, emerging opportunities, growth accelerators, and a comprehensive outlook. Leveraging high-traffic keywords such as "Europe Power Transistor," "IGBT Market Europe," "MOSFET Europe," "GaN Transistor Europe," "SiC Transistor Europe," "Automotive Power Transistors," "Industrial Power Transistors," and "Renewable Energy Power Transistors," this report is optimized for maximum search engine visibility and engagement with industry professionals. All values are presented in Million units, with a study period from 2019 to 2033, a base and estimated year of 2025, and a forecast period of 2025-2033.

Europe Power Transistor Market Market Dynamics & Structure

The Europe Power Transistor Market exhibits a moderate to high concentration, with leading players like Infineon Technologies AG, NXP Semiconductors N.V., and STMicroelectronics N.V. dominating the landscape. Technological innovation remains a key driver, fueled by the increasing demand for higher efficiency, miniaturization, and enhanced performance across various end-use industries. The relentless pursuit of advanced materials like Gallium Nitride (GaN) and Silicon Carbide (SiC) is reshaping the market, offering superior switching speeds and thermal management capabilities. Regulatory frameworks, particularly those focusing on energy efficiency standards and emissions reduction, are indirectly promoting the adoption of power transistors in electric vehicles and renewable energy systems. While competitive product substitutes exist, the unique advantages of advanced power transistors in specific applications limit their widespread displacement. End-user demographics are shifting towards industries with high power conversion needs, such as automotive (especially EVs), industrial automation, telecommunications, and consumer electronics. Mergers and acquisitions (M&A) activity, though not extensively high, signifies strategic consolidation and a drive for market share expansion by key players aiming to enhance their product portfolios and technological expertise. Innovation barriers include the high cost of R&D for next-generation materials and the complex manufacturing processes required for GaN and SiC devices.

- Market Concentration: Moderate to High, with significant influence from top 3-5 players.

- Technological Innovation Drivers: Energy efficiency, miniaturization, higher power density, adoption of wide-bandgap semiconductors (GaN, SiC).

- Regulatory Frameworks: EU directives on energy efficiency, emissions standards, and renewable energy targets.

- Competitive Product Substitutes: Traditional silicon-based power devices, though increasingly challenged by GaN and SiC.

- End-User Demographics: Automotive (EVs), industrial automation, renewable energy, telecommunications, consumer electronics.

- M&A Trends: Strategic acquisitions for technology integration and market expansion.

Europe Power Transistor Market Growth Trends & Insights

The Europe Power Transistor Market is poised for robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025-2033). This expansion is primarily driven by the accelerating adoption of electric vehicles (EVs), which necessitate high-performance power transistors for inverters, onboard chargers, and DC-DC converters. The ongoing industrial automation revolution, coupled with the increasing deployment of renewable energy sources such as solar and wind power, further propents the demand for efficient power management solutions. Technological disruptions, particularly the maturation and cost reduction of Wide-Bandgap (WBG) semiconductors like GaN and SiC, are enabling power transistors to achieve unprecedented levels of efficiency and power density. This allows for smaller, lighter, and more cost-effective power electronic systems, further stimulating adoption. Consumer behavior is increasingly influenced by sustainability concerns and the desire for energy-efficient products, indirectly boosting the demand for devices incorporating advanced power transistors. The market penetration of WBG power transistors is expected to witness a significant uptick, moving from niche applications to mainstream integration across various sectors. Market size evolution will be characterized by consistent upward trajectory, supported by substantial investments in R&D and manufacturing capabilities across Europe. Specific metrics such as market penetration rates for GaN and SiC in automotive applications are expected to rise from single digits to double digits within the forecast period. The demand for IGBTs and MOSFETs, while mature, will continue to grow steadily, particularly in industrial and consumer electronics segments.

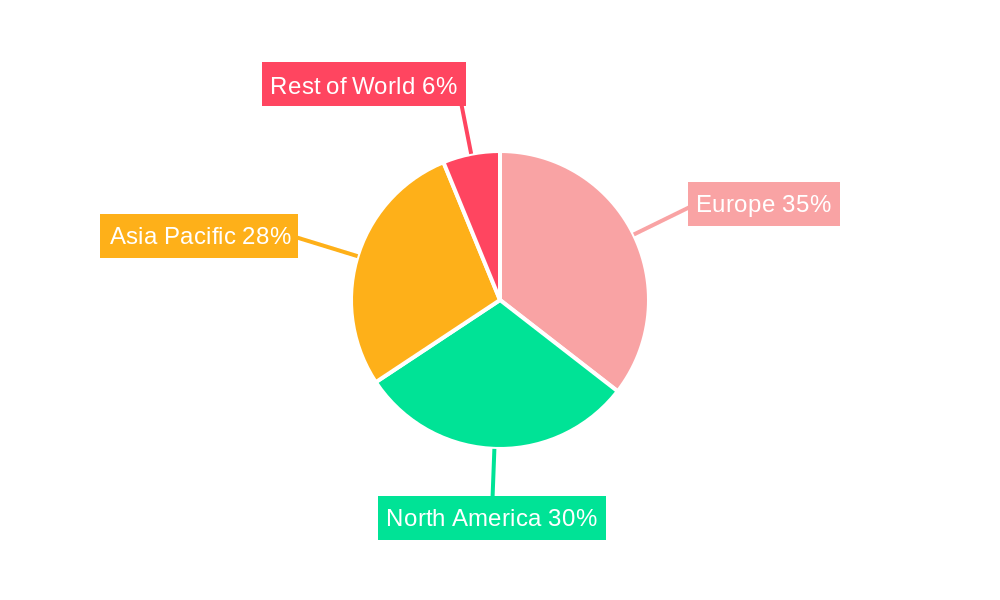

Dominant Regions, Countries, or Segments in Europe Power Transistor Market

Germany emerges as the dominant region within the Europe Power Transistor Market, driven by its robust automotive industry, strong industrial manufacturing base, and significant investments in renewable energy. The country's stringent environmental regulations and its commitment to advanced technological development create a fertile ground for the adoption of high-efficiency power transistors.

- Production Analysis: Germany leads in the production of high-performance power transistors, particularly SiC and GaN devices, due to the presence of key manufacturers and specialized research facilities. France and the Netherlands also contribute significantly to production capacity, focusing on specific product segments.

- Consumption Analysis: Germany accounts for the largest share of consumption, primarily fueled by its automotive sector's rapid transition to electric mobility. France, with its growing wind and solar energy infrastructure, and the UK, with its expanding data center and telecommunications sectors, are also major consumption hubs.

- Import Market Analysis (Value & Volume): Germany is a significant importer, sourcing specialized components and raw materials for its advanced manufacturing processes. Italy and Spain also exhibit substantial import volumes, often driven by renewable energy projects and industrial upgrades. Import volumes are projected to reach approximately 150 Million units by 2025 and expand to over 200 Million units by 2033. Import value is anticipated to reach around $750 Million in 2025 and grow to over $1.1 Billion by 2033.

- Export Market Analysis (Value & Volume): Germany is a net exporter of power transistors, with its high-quality, technologically advanced products sought after globally. Other significant exporters include the Netherlands and Sweden, contributing to Europe's strong position in the global power electronics supply chain. Export volumes are estimated to reach approximately 120 Million units in 2025 and increase to over 170 Million units by 2033. Export value is projected at around $600 Million in 2025, growing to over $900 Million by 2033.

- Price Trend Analysis: While silicon-based power transistors maintain a stable price trend, WBG semiconductors like GaN and SiC are experiencing a gradual price reduction due to economies of scale and improved manufacturing efficiencies. However, they continue to command a premium due to their superior performance characteristics.

Key drivers of German dominance include government incentives for EV adoption, substantial R&D funding for semiconductor technologies, and a highly skilled workforce. The country's focus on Industry 4.0 initiatives further propels the demand for advanced power electronics.

Europe Power Transistor Market Product Landscape

The Europe Power Transistor Market is characterized by a dynamic product landscape, driven by continuous innovation in materials and device architectures. Discrete power transistors, including IGBTs, MOSFETs, and increasingly, GaN and SiC devices, are central to power management solutions. Innovations are focused on enhancing power density, reducing switching losses, and improving thermal performance. For instance, advancements in trench technology for IGBTs and optimized gate structures for MOSFETs are yielding more efficient and compact components. The integration of WBG materials is enabling higher operating frequencies and voltage handling capabilities, opening new application avenues in high-power electric drives, advanced charging systems, and next-generation telecommunications infrastructure. Performance metrics such as lower Rds(on) for MOSFETs, lower Vce(sat) for IGBTs, and faster switching speeds for GaN and SiC devices are critical differentiators. The product landscape also includes power modules that integrate multiple transistors and associated components for enhanced power handling and ease of integration, particularly in high-power industrial and automotive applications.

Key Drivers, Barriers & Challenges in Europe Power Transistor Market

Key Drivers:

- Electric Vehicle (EV) Adoption: The rapid growth of the EV market in Europe is a primary catalyst, demanding high-performance power transistors for powertrain efficiency and battery management.

- Renewable Energy Expansion: The EU's ambitious renewable energy targets are driving the deployment of solar and wind farms, requiring robust power conversion solutions incorporating advanced transistors.

- Industrial Automation (Industry 4.0): The increasing adoption of automation in manufacturing processes necessitates energy-efficient power electronics, boosting demand for power transistors.

- Technological Advancements in WBG Semiconductors: The maturity and cost reduction of GaN and SiC technologies are enabling higher efficiency and smaller form factors, accelerating their adoption.

- Government Initiatives and Subsidies: EU and national policies promoting sustainability, energy efficiency, and technological innovation play a crucial role.

Key Barriers & Challenges:

- High R&D Costs: Developing next-generation GaN and SiC power transistors requires significant investment in research and development, impacting their initial cost.

- Manufacturing Complexity: The fabrication of WBG semiconductors involves complex processes and specialized equipment, posing manufacturing challenges and potentially leading to supply chain bottlenecks.

- Supply Chain Disruptions: Geopolitical factors and raw material availability can impact the supply chain of crucial materials for power transistor production.

- Competition from Mature Technologies: While WBG semiconductors offer superior performance, silicon-based solutions remain competitive in cost-sensitive applications, creating a pricing dilemma.

- Skilled Workforce Shortage: The specialized nature of power semiconductor design and manufacturing requires a skilled workforce, which can be a limiting factor for some companies.

Emerging Opportunities in Europe Power Transistor Market

Emerging opportunities within the Europe Power Transistor Market are abundant, driven by evolving technological demands and sustainability imperatives. The expansion of 5G infrastructure and the increasing adoption of data centers present a significant opportunity for high-frequency GaN power transistors. Furthermore, the burgeoning market for electric aviation and advanced mobility solutions, such as autonomous vehicles and drones, will create new demands for lightweight and highly efficient power electronics. The smart grid initiatives across Europe, aimed at improving energy distribution and management, will also spur demand for sophisticated power transistors. Growth in advanced industrial robotics and the increasing electrification of various industrial processes offer further untapped potential. Consumers' growing preference for energy-efficient appliances and smart home devices also contributes to market expansion.

Growth Accelerators in the Europe Power Transistor Market Industry

Several catalysts are accelerating the growth of the Europe Power Transistor Market. Technological breakthroughs in materials science, particularly advancements in the epitaxy of GaN and SiC wafers, are crucial for improving device performance and reducing manufacturing costs. Strategic partnerships between semiconductor manufacturers, system integrators, and original equipment manufacturers (OEMs) are vital for co-development and faster market penetration of new technologies. Market expansion strategies, including increased manufacturing capacity and the establishment of local R&D centers in key European regions, will further fuel growth. The continued emphasis on circular economy principles and sustainable manufacturing practices within the semiconductor industry will also act as a growth accelerator, encouraging the development of more environmentally friendly power solutions.

Key Players Shaping the Europe Power Transistor Market Market

- Infineon Technologies AG

- NXP Semiconductors N V

- Toshiba Corporation

- Texas Instruments Inc

- Skyworks Solutions Inc

- Mitsubishi Electric Corporation

- STMicroelectronics N V

- ON Semiconductor

- Renesas Electronics Corporation

Notable Milestones in Europe Power Transistor Market Sector

- March 2023: Toshiba Electronic Devices & Storage Corporation introduced the "GT30J65MRB" 650V discrete insulated gate bipolar transistor (IGBT). This IGBT is designed for power factor correction (PFC) circuits in air conditioners and large power supplies for industrial equipment. Toshiba's innovation focuses on optimizing trench structure, achieving an industry-leading low switching loss (turn-off switching loss) of 0.35 mJ, a reduction of roughly 42% compared to its predecessor, the GT50JR22. The new IGBT also features a diode with a significantly reduced forward voltage of 1.20V, approximately 43% lower than the GT50JR22, enhancing overall system efficiency.

- January 2023: NXP introduced the MMRF5018HS 125 W CW GaN on SiC RF Power Transistor. This transistor is housed in a NI-400HS air cavity ceramic package, ensuring low thermal resistance (Rth). The MMRF5018HS is engineered for CW, pulse, and wideband RF applications, offering high gain and robustness. Its multi-octave wideband performance is optimized for 1-2700 MHz applications. Addressing critical thermal management challenges at high power and wide bandwidths, the MMRF5018HS boasts a low channel-to-case thermal resistance of 1.21° C/W (FEA calculated) at 90°C and 109W dissipated. This launch signifies NXP's ongoing commitment to strengthening its wideband GaN portfolio.

In-Depth Europe Power Transistor Market Market Outlook

The Europe Power Transistor Market is on an upward trajectory, propelled by the unwavering momentum of electric vehicle adoption and the EU's aggressive pursuit of renewable energy targets. The increasing sophistication of industrial automation and the ongoing digital transformation across sectors are creating sustained demand for high-efficiency power management solutions. The continuous advancements in Wide-Bandgap semiconductor technologies, particularly GaN and SiC, are pivotal, offering solutions that are not only more efficient but also enable significant miniaturization and weight reduction in power electronic systems. Strategic investments in localized manufacturing and R&D by key players will solidify Europe's position in the global power transistor supply chain. The future outlook is characterized by sustained innovation, a growing emphasis on sustainable power solutions, and the expanding application scope of power transistors across a diverse range of burgeoning industries. The market is expected to witness consistent growth, driven by the synergistic effect of technological progress and supportive regulatory environments.

Europe Power Transistor Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Europe Power Transistor Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. France

- 4. Italy

Europe Power Transistor Market Regional Market Share

Geographic Coverage of Europe Power Transistor Market

Europe Power Transistor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in demand for connected devices; Increasing demand for power-efficient electronic devices

- 3.3. Market Restrains

- 3.3.1. High Cost of R&D and Fabrication; Availability of Substitutes

- 3.4. Market Trends

- 3.4.1. The Consumer Electronics Segment is Expected to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Power Transistor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United Kingdom

- 5.6.2. Germany

- 5.6.3. France

- 5.6.4. Italy

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United Kingdom Europe Power Transistor Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Germany Europe Power Transistor Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. France Europe Power Transistor Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Italy Europe Power Transistor Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Infineon Technologies AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 NXP Semiconductors N V

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Toshiba Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Texas Instruments Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Skyworks Solutions Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Mitsubishi Electric Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 STMicroelectronics N V

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 ON Semiconductor

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Renesas Electronics Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Europe Power Transistor Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Power Transistor Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Power Transistor Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Europe Power Transistor Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Europe Power Transistor Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Europe Power Transistor Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Europe Power Transistor Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Europe Power Transistor Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Europe Power Transistor Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Europe Power Transistor Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Europe Power Transistor Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Europe Power Transistor Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Europe Power Transistor Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Europe Power Transistor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Europe Power Transistor Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: Europe Power Transistor Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 15: Europe Power Transistor Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 16: Europe Power Transistor Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 17: Europe Power Transistor Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 18: Europe Power Transistor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Europe Power Transistor Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 20: Europe Power Transistor Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 21: Europe Power Transistor Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 22: Europe Power Transistor Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 23: Europe Power Transistor Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 24: Europe Power Transistor Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Europe Power Transistor Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Europe Power Transistor Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Europe Power Transistor Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Europe Power Transistor Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Europe Power Transistor Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Europe Power Transistor Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Power Transistor Market?

The projected CAGR is approximately 3.30%.

2. Which companies are prominent players in the Europe Power Transistor Market?

Key companies in the market include Infineon Technologies AG, NXP Semiconductors N V, Toshiba Corporation, Texas Instruments Inc, Skyworks Solutions Inc, Mitsubishi Electric Corporation, STMicroelectronics N V, ON Semiconductor, Renesas Electronics Corporation.

3. What are the main segments of the Europe Power Transistor Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in demand for connected devices; Increasing demand for power-efficient electronic devices.

6. What are the notable trends driving market growth?

The Consumer Electronics Segment is Expected to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

High Cost of R&D and Fabrication; Availability of Substitutes.

8. Can you provide examples of recent developments in the market?

March 2023: Toshiba Electronic Devices & Storage Corporation introduced the "GT30J65MRB" 650V discrete insulated gate bipolar transistor (IGBT) for power factor correction (PFC) circuits in air conditioners and large power supplies for industrial equipment. Toshiba incorporates the most recent method into its new IGBT. An optimized trench structure achieves an industry-leading low switching loss (turn-off switching loss) of 0.35 mJ, roughly 42% lower than the preceding product from Toshiba, GT50JR22. The new IGBT also includes a diode with a forward voltage of 1.20V, approximately 43% lower than the GT50JR22.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Power Transistor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Power Transistor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Power Transistor Market?

To stay informed about further developments, trends, and reports in the Europe Power Transistor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence