Key Insights

The North America Automated Test Equipment (ATE) market is projected to experience robust expansion, fueled by the increasing complexity and miniaturization of electronic components across key industries. With a projected Compound Annual Growth Rate (CAGR) of 7.72% from 2025, the market is anticipated to reach an estimated value of $9.86 billion by 2033. This growth is predominantly driven by the escalating demand for high-performance, reliable, and cost-effective testing solutions in sectors including consumer electronics, IT and telecommunications, and automotive. The rapid proliferation of advanced technologies such as 5G, AI, and IoT necessitates stringent testing to guarantee product quality, thereby accelerating the adoption of sophisticated ATE systems. Additionally, the aerospace and defense sector's continuous requirement for rigorous quality control and the healthcare industry's growing dependence on advanced medical devices are significant contributors to market momentum.

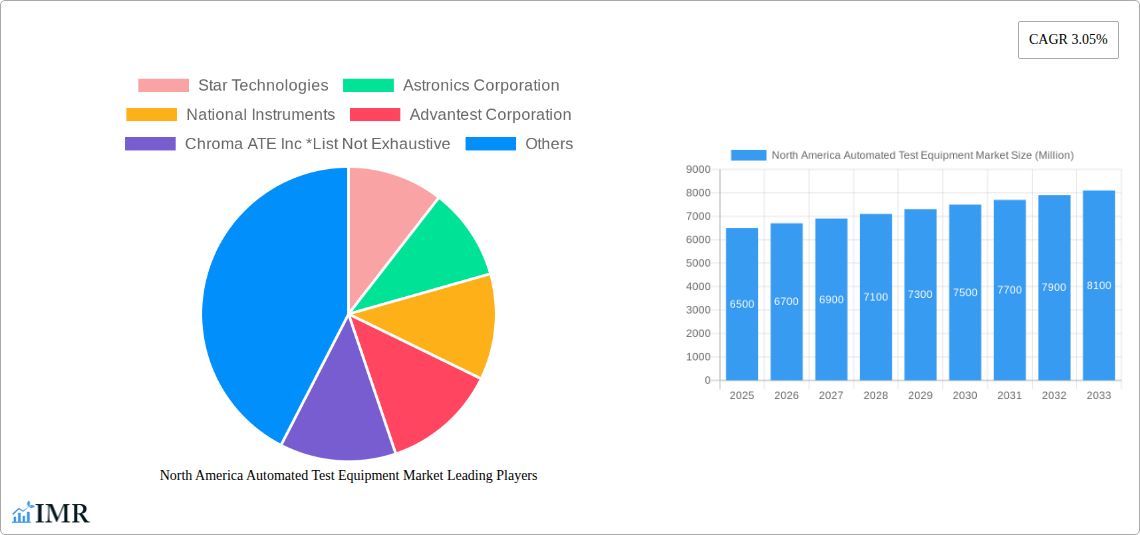

North America Automated Test Equipment Market Market Size (In Billion)

Key drivers shaping the North America ATE market include the relentless miniaturization of electronic devices and the integration of complex functionalities demanding enhanced testing precision. The widespread adoption of IoT devices, smart home technology, and connected vehicles is significantly increasing the volume of electronic components requiring validation. Innovations in ATE hardware and software, such as AI-driven testing, cloud-based solutions, and modular test platforms, are improving efficiency and reducing test cycles. However, high initial investment costs for advanced ATE systems and the need for skilled technicians represent potential market restraints. Despite these challenges, the prevailing trend towards manufacturing automation and an increased focus on product reliability are expected to ensure sustained market growth across North America.

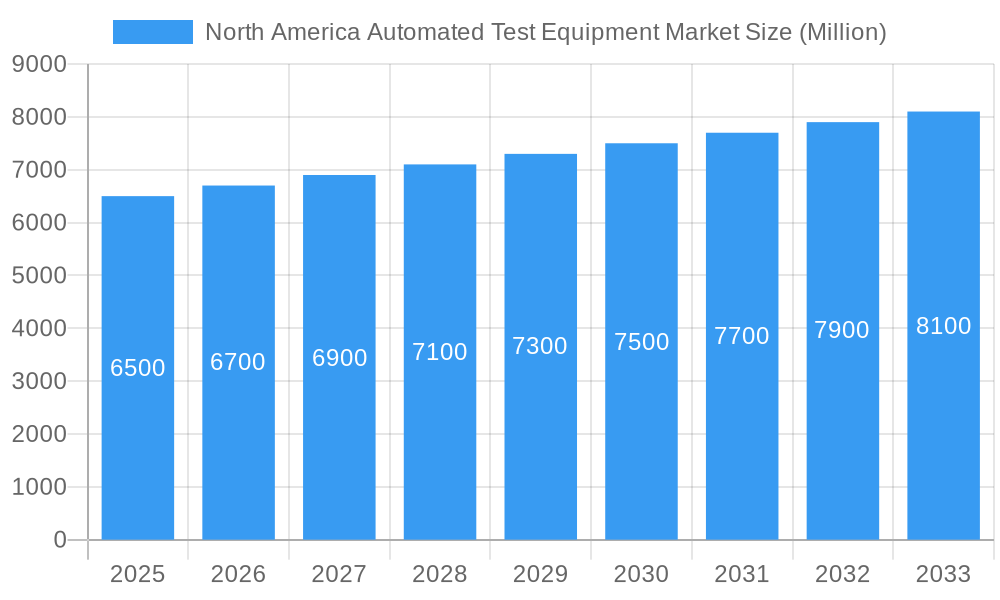

North America Automated Test Equipment Market Company Market Share

This report provides a comprehensive analysis of the North America Automated Test Equipment (ATE) market, examining its dynamics, growth prospects, and future potential. The study covers the period from 2019 to 2033, with 2025 as the base and estimated year. Market segmentation includes Type of Test Equipment (Memory, Non-Memory, Discrete, Test Handlers) and End-User Industry (Aerospace and Defense, Consumer Electronics, IT and Telecommunications, Automotive, Healthcare, Other End-Users). All market values are presented in billion.

North America Automated Test Equipment Market Dynamics & Structure

The North America Automated Test Equipment market exhibits a dynamic and evolving structure, characterized by significant technological innovation and a robust competitive landscape. Market concentration is moderately high, with key players vying for dominance through strategic acquisitions and technological advancements. Innovation drivers are primarily fueled by the increasing complexity of electronic devices, the demand for higher testing throughput and accuracy, and the relentless pursuit of cost optimization in manufacturing processes. Regulatory frameworks, particularly concerning product safety and emissions in sectors like automotive and aerospace, also play a crucial role in shaping ATE requirements. Competitive product substitutes, while present in manual testing solutions, are increasingly being superseded by the efficiency and reliability of ATE. End-user demographics reveal a strong demand from rapidly expanding sectors like consumer electronics and IT, alongside the stringent requirements of established industries such as aerospace and defense. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger players acquiring smaller, specialized firms to enhance their product portfolios and market reach. For instance, in the historical period (2019-2024), approximately 15-20 significant M&A deals were observed, signaling a proactive approach to market expansion and technology integration.

- Market Concentration: Moderately high, with a few key players holding substantial market share.

- Technological Innovation Drivers: Increasing complexity of electronics, demand for higher accuracy and throughput, cost reduction in manufacturing.

- Regulatory Frameworks: Product safety, emissions standards, and industry-specific compliance mandates.

- Competitive Product Substitutes: Primarily manual testing methods, facing declining relevance.

- End-User Demographics: Strong growth driven by consumer electronics, IT, automotive, and aerospace.

- M&A Trends: Consolidation through acquisitions to gain market share and technology expertise.

North America Automated Test Equipment Market Growth Trends & Insights

The North America Automated Test Equipment market is poised for robust growth, driven by an escalating demand for advanced testing solutions across diverse industries. The market size is projected to experience a significant upward trajectory, fueled by escalating adoption rates of sophisticated ATE systems. This growth is intrinsically linked to the rapid advancements in electronic components and the increasing complexity of the devices they power. Technological disruptions, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) into ATE for enhanced diagnostics and predictive maintenance, are revolutionizing testing paradigms. Furthermore, shifts in consumer behavior, particularly the insatiable demand for feature-rich and reliable consumer electronics, and the growing reliance on connected devices in IT and telecommunications, are creating sustained demand for effective testing. The Automotive sector's transition towards electric vehicles (EVs) and autonomous driving technologies necessitates more complex and precise testing of electronic control units (ECUs) and power electronics, further accelerating market expansion. Healthcare, with its increasing adoption of sophisticated medical devices, also presents a substantial growth avenue. The market penetration of ATE is expected to deepen as the economic benefits of reduced failure rates, improved product quality, and faster time-to-market become more evident.

The market size evolution indicates a Compound Annual Growth Rate (CAGR) of approximately 8.5% to 9.2% during the forecast period (2025-2033). This sustained growth is underpinned by consistent investments in research and development by ATE manufacturers, alongside significant capital expenditure by end-user industries to upgrade their testing infrastructure. The adoption rates are particularly high in the IT and Telecommunications sector, where the rapid product life cycles demand continuous and efficient testing. Consumer Electronics, driven by constant innovation and the demand for high-quality gadgets, also showcases strong adoption. The automotive industry's push towards electrification and advanced driver-assistance systems (ADAS) is a significant catalyst, requiring specialized ATE for battery management systems, sensor calibration, and powertrain testing. The trend towards miniaturization and increased functionality in electronic components demands ATE with finer resolution and higher precision. Consumer behavior shifts towards expecting seamless connectivity and robust performance in all electronic devices are placing immense pressure on manufacturers to ensure rigorous testing throughout the production cycle. This environment fosters a continuous need for upgrading and expanding ATE capabilities.

Dominant Regions, Countries, or Segments in North America Automated Test Equipment Market

Within the North America Automated Test Equipment market, the United States emerges as the dominant country, driven by its colossal consumer electronics industry, pioneering advancements in aerospace and defense, and its leadership in IT and telecommunications. This dominance is further bolstered by a strong ecosystem of ATE manufacturers and research institutions, fostering continuous innovation. The Consumer Electronics segment, closely followed by IT and Telecommunications, represents the largest end-user industry, accounting for an estimated 35-40% of the total market share in 2025. This is attributable to the sheer volume of production and the rapid innovation cycles within these sectors.

- Leading Country: United States, due to its extensive industrial base and technological prowess.

- Dominant End-User Industries:

- Consumer Electronics: High production volumes and rapid product development cycles.

- IT and Telecommunications: Proliferation of connected devices and cloud infrastructure.

- Key Drivers for Dominance:

- Economic Policies: Favorable business environments and investment incentives.

- Infrastructure: Advanced manufacturing capabilities and well-developed supply chains.

- Technological Adoption: Early and widespread adoption of advanced testing solutions.

- Research & Development: Significant investment in R&D by both ATE manufacturers and end-users.

The Non-Memory segment within the Type of Test Equipment is another significant driver, holding an estimated 40-45% market share in 2025. This is due to its broad applicability across various electronic components, including microprocessors, integrated circuits, and sensors, which are integral to all major end-user industries. The Aerospace and Defense sector, while smaller in volume, exerts a considerable influence due to its stringent testing requirements and high-value contracts, contributing significantly to revenue. The Automotive segment is rapidly growing, spurred by the EV revolution and the increasing integration of electronics in vehicles.

- Dominant Type of Test Equipment:

- Non-Memory: Crucial for testing a wide array of complex electronic components.

- Significant Growth Segments:

- Automotive: Driven by electrification and advanced driver-assistance systems (ADAS).

- Healthcare: Increasing adoption of sophisticated medical devices.

- Market Share and Growth Potential:

- Non-Memory ATE: Expected to maintain its leading position with a consistent CAGR of 8-9%.

- Automotive and Healthcare: Poised for higher growth rates, in the range of 10-12%, due to rapid technological advancements and regulatory pressures.

North America Automated Test Equipment Market Product Landscape

The North America Automated Test Equipment market product landscape is characterized by continuous innovation focused on enhancing testing speed, accuracy, and flexibility. Leading companies are introducing advanced ATE platforms integrating AI and machine learning for intelligent fault detection and predictive analytics, significantly reducing downtime and optimizing test processes. Applications span from high-volume production testing of consumer electronics to highly specialized and mission-critical testing for aerospace and defense components. Performance metrics such as increased test coverage, reduced test cycle times, and improved defect detection rates are key selling propositions. Technological advancements include the development of modular and scalable ATE systems that can be easily reconfigured to accommodate new product designs and evolving testing standards. The integration of cutting-edge software solutions for test program generation, data analysis, and remote diagnostics further elevates the performance and utility of these systems.

Key Drivers, Barriers & Challenges in North America Automated Test Equipment Market

Key Drivers: The North America Automated Test Equipment market is propelled by several key factors. The relentless miniaturization and increasing complexity of electronic devices necessitate more sophisticated and accurate testing methodologies, a void filled by ATE. The growing demand for high-quality, reliable products across all sectors, from consumer electronics to healthcare, compels manufacturers to invest in robust testing solutions. Furthermore, the rapid expansion of the automotive industry's electrification and the burgeoning IT and telecommunications sector, with its reliance on high-speed data transmission and complex network infrastructure, are major growth catalysts. Government initiatives promoting advanced manufacturing and technological innovation also contribute significantly.

Barriers & Challenges: Despite the strong growth drivers, the market faces several barriers and challenges. The high initial capital investment required for advanced ATE systems can be a deterrent for small and medium-sized enterprises (SMEs). The rapid pace of technological obsolescence demands continuous upgrades and reinvestment, posing a financial strain. Supply chain disruptions, as witnessed in recent global events, can impact the availability of critical components and lead to production delays. The scarcity of skilled labor proficient in operating and maintaining these sophisticated ATE systems presents another significant hurdle. Additionally, stringent cybersecurity requirements for ATE connected to sensitive networks, especially in aerospace and defense, add complexity and cost.

Emerging Opportunities in North America Automated Test Equipment Market

Emerging opportunities within the North America Automated Test Equipment market are diverse and promising. The accelerating adoption of Artificial Intelligence (AI) and Machine Learning (ML) in ATE presents a significant avenue for growth, enabling predictive maintenance, intelligent fault diagnosis, and optimized test strategies. The burgeoning Internet of Things (IoT) ecosystem, with its vast network of connected devices, requires extensive testing for connectivity, security, and interoperability, creating a substantial demand for specialized ATE solutions. The increasing complexity and miniaturization of semiconductors in advanced computing and mobile devices necessitate the development of ultra-high-precision testing equipment. Furthermore, the growing focus on sustainable manufacturing practices and the circular economy is creating opportunities for ATE that can efficiently test refurbished or remanufactured electronic components.

Growth Accelerators in the North America Automated Test Equipment Market Industry

Several catalysts are accelerating the long-term growth of the North America Automated Test Equipment market. Technological breakthroughs in areas like quantum computing and advanced sensor technology are pushing the boundaries of what can be tested, creating demand for next-generation ATE. Strategic partnerships between ATE manufacturers and end-user industries, such as collaborations between semiconductor foundries and test equipment providers, are fostering innovation and co-development of tailored solutions. Market expansion strategies, including the increasing adoption of ATE in emerging applications like 5G infrastructure deployment and advanced medical diagnostics, are opening new revenue streams. The growing emphasis on Industry 4.0 principles and smart manufacturing across all industrial sectors further fuels the demand for automated and data-driven testing solutions.

Key Players Shaping the North America Automated Test Equipment Market Market

- Star Technologies

- Astronics Corporation

- National Instruments

- Advantest Corporation

- Chroma ATE Inc

- Virginia Panel Corporation

- SPEA S p A

- Roos Instruments Inc

- MAC Panel Company

- Xcerra Corporation

- Aeroflex Inc

Notable Milestones in North America Automated Test Equipment Market Sector

- 2019: Advantest launches its first ATE platform with integrated AI capabilities for semiconductor testing.

- 2020: National Instruments announces a strategic partnership with a leading automotive OEM to develop advanced ATE for electric vehicle components.

- 2021: Chroma ATE Inc. expands its product line with new ATE solutions for 5G wireless testing.

- 2022: Astronics Corporation acquires a specialized ATE provider to strengthen its aerospace and defense testing portfolio.

- 2023: Xcerra Corporation introduces a new generation of ATE designed for high-volume manufacturing of advanced memory devices.

- 2024: The adoption of cloud-based ATE management systems sees a significant surge across various industries.

In-Depth North America Automated Test Equipment Market Market Outlook

The North America Automated Test Equipment market is projected for continued robust growth, driven by the fundamental need for comprehensive and accurate testing of increasingly complex electronic systems. The integration of AI and ML will continue to revolutionize testing paradigms, enabling predictive capabilities and self-optimizing test routines. The ongoing digital transformation across all industries, coupled with the expansion of 5G networks and the proliferation of IoT devices, will create sustained demand for advanced ATE solutions. Strategic collaborations between ATE manufacturers and technology leaders will further accelerate innovation, leading to the development of highly specialized and efficient testing equipment. The market's future is bright, with significant opportunities arising from emerging technologies and evolving consumer expectations for flawless electronic performance.

North America Automated Test Equipment Market Segmentation

-

1. Type of Test Equipment

- 1.1. Memory

- 1.2. Non Memory

- 1.3. Discrete

- 1.4. Test Handlers

-

2. End-User Industry

- 2.1. Aerospace and Defense

- 2.2. Consumer Electronics

- 2.3. IT and Telecommuications

- 2.4. Automotive

- 2.5. Healthcare

- 2.6. Other End-User

North America Automated Test Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Automated Test Equipment Market Regional Market Share

Geographic Coverage of North America Automated Test Equipment Market

North America Automated Test Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Emphasis of Test Market

- 3.3. Market Restrains

- 3.3.1. Too Much Competition Due to the Open Source; Network Congestion Due to Slow Network

- 3.4. Market Trends

- 3.4.1. Aerospace and Defense Industry is one of the Factor Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Automated Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Test Equipment

- 5.1.1. Memory

- 5.1.2. Non Memory

- 5.1.3. Discrete

- 5.1.4. Test Handlers

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Aerospace and Defense

- 5.2.2. Consumer Electronics

- 5.2.3. IT and Telecommuications

- 5.2.4. Automotive

- 5.2.5. Healthcare

- 5.2.6. Other End-User

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type of Test Equipment

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Star Technologies

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Astronics Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 National Instruments

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Advantest Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chroma ATE Inc *List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Virginia Panel Corporation (Mass-interconnect manufacturer)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SPEA S p A

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Roos Instruments Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MAC Panel Company (Mass-Interconnect solutions)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Xcerra Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Aeroflex Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Star Technologies

List of Figures

- Figure 1: North America Automated Test Equipment Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Automated Test Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: North America Automated Test Equipment Market Revenue billion Forecast, by Type of Test Equipment 2020 & 2033

- Table 2: North America Automated Test Equipment Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 3: North America Automated Test Equipment Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Automated Test Equipment Market Revenue billion Forecast, by Type of Test Equipment 2020 & 2033

- Table 5: North America Automated Test Equipment Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 6: North America Automated Test Equipment Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States North America Automated Test Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Automated Test Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Automated Test Equipment Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Automated Test Equipment Market?

The projected CAGR is approximately 7.72%.

2. Which companies are prominent players in the North America Automated Test Equipment Market?

Key companies in the market include Star Technologies, Astronics Corporation, National Instruments, Advantest Corporation, Chroma ATE Inc *List Not Exhaustive, Virginia Panel Corporation (Mass-interconnect manufacturer), SPEA S p A, Roos Instruments Inc, MAC Panel Company (Mass-Interconnect solutions), Xcerra Corporation, Aeroflex Inc.

3. What are the main segments of the North America Automated Test Equipment Market?

The market segments include Type of Test Equipment, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.86 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Emphasis of Test Market.

6. What are the notable trends driving market growth?

Aerospace and Defense Industry is one of the Factor Driving the Market.

7. Are there any restraints impacting market growth?

Too Much Competition Due to the Open Source; Network Congestion Due to Slow Network.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Automated Test Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Automated Test Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Automated Test Equipment Market?

To stay informed about further developments, trends, and reports in the North America Automated Test Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence