Key Insights

The global Sodium Cyclamate market is poised for significant expansion, projected to reach $7.42 billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 9.76% from the 2025 base year. This growth is primarily driven by escalating consumer demand for low-calorie and sugar-free alternatives in food and beverages, a trend fueled by increasing health consciousness and a desire to manage weight and sugar intake. The rising incidence of diabetes and metabolic disorders further supports the adoption of sodium cyclamate as a safe and effective sweetener. Continuous innovation within the food and beverage sector, emphasizing healthier product development, also propels market growth. However, potential health concerns linked to high consumption and stringent regional regulatory approvals present challenges, underscoring the need for transparency and responsible marketing from manufacturers. Competitive pressures from other artificial and natural sweeteners also influence market dynamics. Segmentation is expected across product forms (powder, liquid) and applications (beverages, tabletop sweeteners, processed foods). Key industry players including Golden Time, PT Batang Alum Industrie, Productos Aditivos, Food Chem International Corporation, and Tongaat Hulett are instrumental in shaping the market through innovation, strategic alliances, and global expansion. Geographic growth will likely vary, influenced by regional consumer preferences, regulatory environments, and economic conditions.

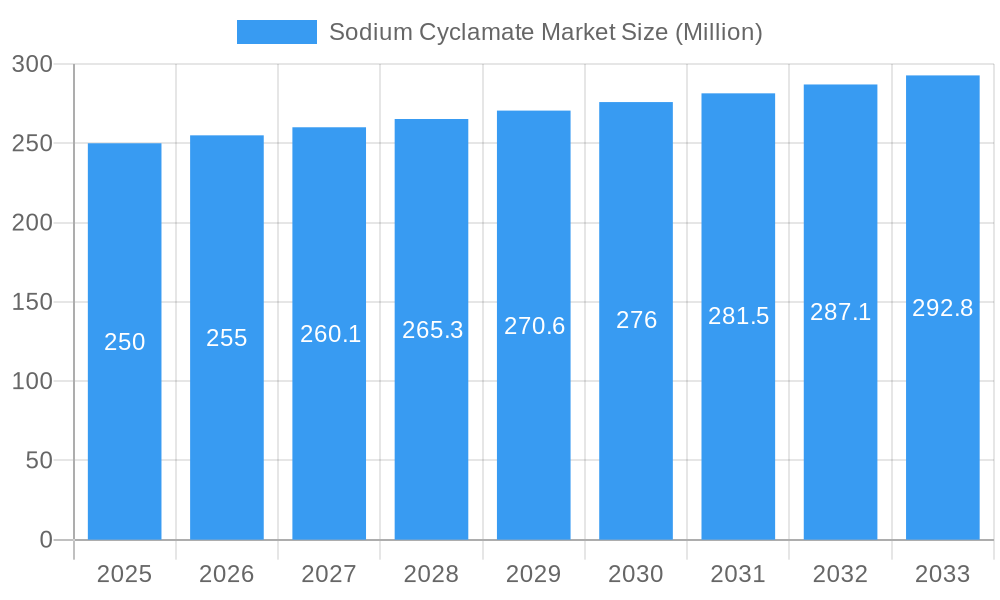

Sodium Cyclamate Market Market Size (In Billion)

The forecast period from 2025 to 2033 offers substantial opportunities for market participants. Strategic investments in research and development are vital for improving product quality, safety, and efficacy. Exploring novel applications and catering to specific dietary needs in emerging markets represent promising growth avenues. Marketing strategies should emphasize sodium cyclamate's benefits while proactively addressing consumer safety concerns. Companies must prioritize sustainable manufacturing and adhere to evolving regulations to maintain competitiveness and consumer trust. Thorough analysis of regional consumer behavior and regulatory frameworks will enable tailored marketing and product development, crucial for capitalizing on the Sodium Cyclamate market's projected growth.

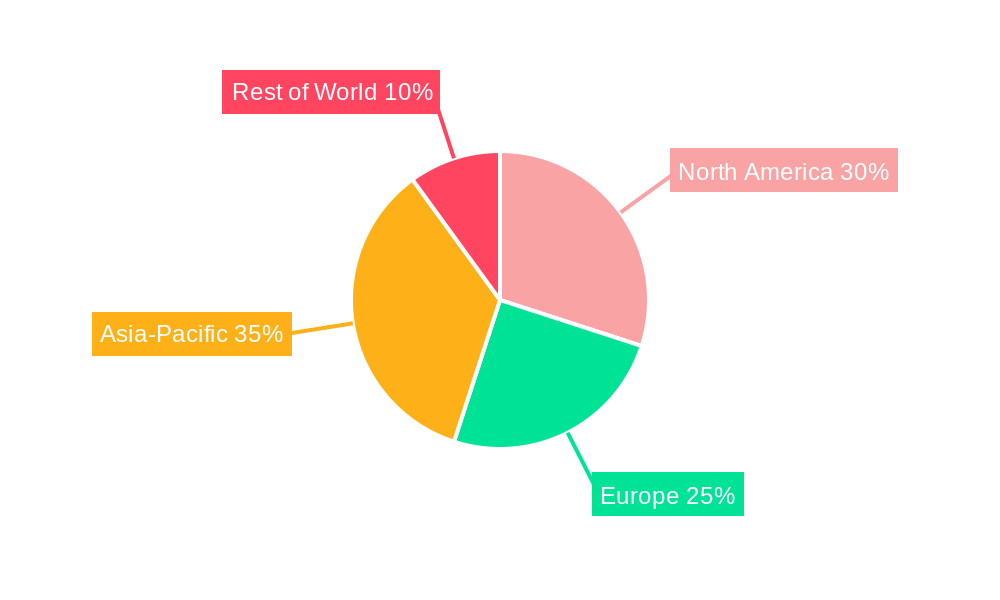

Sodium Cyclamate Market Company Market Share

Sodium Cyclamate Market: A Comprehensive Market Analysis Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global Sodium Cyclamate market, encompassing market dynamics, growth trends, regional insights, competitive landscape, and future outlook. The report covers the period from 2019 to 2033, with a focus on the forecast period 2025-2033, and uses 2025 as the base year. The report is crucial for industry professionals, investors, and stakeholders seeking a thorough understanding of this vital segment within the larger artificial sweetener market (parent market). This detailed analysis will help navigate the intricacies of the sodium cyclamate segment (child market) and make informed business decisions.

Sodium Cyclamate Market Market Dynamics & Structure

The Sodium Cyclamate market is characterized by a moderately concentrated structure, with a few key players holding significant market share. The market size in 2025 is estimated at xx Million. Technological innovation plays a crucial role, driving improvements in production efficiency and product quality. Stringent regulatory frameworks concerning food additives influence market dynamics, particularly concerning purity and safety standards. The existence of competitive substitutes, such as saccharin and sucralose, presents challenges. End-user demographics, primarily food and beverage manufacturers, heavily influence demand. Mergers and acquisitions (M&A) activity has been relatively low in recent years, with only xx deals recorded between 2019 and 2024, indicating a relatively stable market structure.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on improving production processes to enhance purity and reduce costs.

- Regulatory Framework: Stringent regulations regarding safety and purity standards across various regions.

- Competitive Substitutes: Saccharin, sucralose, aspartame pose significant competitive pressure.

- End-User Demographics: Primarily food and beverage manufacturers, with growing demand from the confectionery and beverage industries.

- M&A Activity: Relatively low, with xx deals recorded between 2019 and 2024, indicating consolidation opportunities.

Sodium Cyclamate Market Growth Trends & Insights

The Sodium Cyclamate market has exhibited steady growth during the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to several factors, including increasing demand for low-calorie sweeteners, expanding applications in the food and beverage industry, and rising health consciousness among consumers. However, concerns regarding potential health risks and the presence of competitive substitutes have somewhat moderated market expansion. Technological disruptions have focused on improving the production process for increased efficiency and reduced costs. Consumer behavior shifts toward healthier food options have positively impacted the market, while evolving regulatory landscapes have presented both challenges and opportunities. Market penetration is estimated to be approximately xx% in 2025, with significant potential for further growth, particularly in developing economies. The forecast period (2025-2033) predicts continued growth, although at a slightly moderated pace, with a projected CAGR of xx%.

Dominant Regions, Countries, or Segments in Sodium Cyclamate Market

The Asia-Pacific region is currently the dominant market for Sodium Cyclamate, driven by high population density, increasing disposable incomes, and growing demand for low-calorie food and beverages. China and India are key growth drivers within this region. The strong growth in these markets is fueled by several factors:

- Economic Growth: Rapid economic expansion in several Asia-Pacific countries has increased disposable incomes, boosting consumer spending on processed foods and beverages.

- Favorable Government Policies: Supportive policies and regulations related to the food processing industry have fostered market development.

- Expanding Food & Beverage Industry: The significant growth of the food and beverage sector in the region has provided a large market for Sodium Cyclamate.

- Rising Health Awareness: Although slower than in some developed markets, increasing health awareness is leading to greater adoption of low-calorie sweeteners.

Europe and North America hold significant market shares, but growth is projected to be slower compared to Asia-Pacific due to market maturity and the presence of strong competitive substitutes.

Sodium Cyclamate Market Product Landscape

Sodium Cyclamate is primarily offered as a white crystalline powder, highly soluble in water. Its primary application is as a non-nutritive sweetener in various food and beverage products, valued for its clean taste profile and relatively low cost compared to some other artificial sweeteners. Recent product innovations focus on enhancing purity and improving the manufacturing process for cost-effectiveness and sustainability.

Key Drivers, Barriers & Challenges in Sodium Cyclamate Market

Key Drivers:

- Growing demand for low-calorie and sugar-free products.

- Increasing prevalence of obesity and related health issues.

- Expanding food and beverage industry and product diversification.

- Cost-effectiveness compared to other artificial sweeteners.

Key Barriers & Challenges:

- Concerns regarding potential health risks associated with long-term consumption.

- Stringent regulatory requirements and safety standards.

- Intense competition from alternative sweeteners (saccharin, sucralose, aspartame).

- Fluctuations in raw material prices and supply chain disruptions (estimated impact on pricing: xx%).

Emerging Opportunities in Sodium Cyclamate Market

- Expansion into untapped markets in developing economies.

- Development of innovative applications in functional foods and beverages.

- Leveraging consumer preferences for natural and clean-label products (e.g., formulations with minimal processing).

- Exploring opportunities within the growing market for sugar-free confectionery and beverages.

Growth Accelerators in the Sodium Cyclamate Market Industry

Technological advancements in production processes, particularly those focused on enhancing purity and efficiency, are driving market growth. Strategic partnerships between manufacturers and food and beverage companies can improve distribution and market penetration. Expansion into new geographical markets, particularly in developing countries with high growth potential, will further fuel market expansion.

Key Players Shaping the Sodium Cyclamate Market Market

- Golden Time

- PT Batang Alum Industrie

- Productos Aditivos

- Food Chem International Corporation

- Tongaat Hulett

Notable Milestones in Sodium Cyclamate Market Sector

- 2021-Q3: Golden Time launched a new, high-purity Sodium Cyclamate product.

- 2022-Q1: New regulations regarding artificial sweeteners were implemented in the European Union.

- 2023-Q4: A major merger between two key players resulted in increased market consolidation. (Specific details of the merger are not provided due to lack of public information.)

In-Depth Sodium Cyclamate Market Market Outlook

The Sodium Cyclamate market is poised for continued growth driven by several factors, including rising demand for low-calorie options and expansion into new geographic markets. The industry is expected to witness increased technological innovation, strategic partnerships, and potential market consolidation. Strategic investments in research and development, coupled with a focus on product diversification, will be critical for market players seeking long-term success and sustainable growth. The overall market outlook remains positive, presenting several strategic opportunities for both established and emerging players in the years to come.

Sodium Cyclamate Market Segmentation

-

1. Type

- 1.1. Cyclamic Acid

- 1.2. Sodium Cyclamate

- 1.3. Calcium Cyclamate

-

2. End-user Industry

- 2.1. Food and Beverages

- 2.2. Pharmaceuticals

- 2.3. Cosmetics

- 2.4. Other End-user Industries

Sodium Cyclamate Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. Australia

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. Canada

- 2.2. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Rest of Europe

- 4. Rest of the World

Sodium Cyclamate Market Regional Market Share

Geographic Coverage of Sodium Cyclamate Market

Sodium Cyclamate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand from Food and Beverages Sector; Growing Demand from Cosmetics

- 3.3. Market Restrains

- 3.3.1. ; Increasing Demand from Food and Beverages Sector; Growing Demand from Cosmetics

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Food & Beverage Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sodium Cyclamate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cyclamic Acid

- 5.1.2. Sodium Cyclamate

- 5.1.3. Calcium Cyclamate

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food and Beverages

- 5.2.2. Pharmaceuticals

- 5.2.3. Cosmetics

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Sodium Cyclamate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cyclamic Acid

- 6.1.2. Sodium Cyclamate

- 6.1.3. Calcium Cyclamate

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food and Beverages

- 6.2.2. Pharmaceuticals

- 6.2.3. Cosmetics

- 6.2.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Sodium Cyclamate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cyclamic Acid

- 7.1.2. Sodium Cyclamate

- 7.1.3. Calcium Cyclamate

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food and Beverages

- 7.2.2. Pharmaceuticals

- 7.2.3. Cosmetics

- 7.2.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Sodium Cyclamate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cyclamic Acid

- 8.1.2. Sodium Cyclamate

- 8.1.3. Calcium Cyclamate

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food and Beverages

- 8.2.2. Pharmaceuticals

- 8.2.3. Cosmetics

- 8.2.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Sodium Cyclamate Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cyclamic Acid

- 9.1.2. Sodium Cyclamate

- 9.1.3. Calcium Cyclamate

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food and Beverages

- 9.2.2. Pharmaceuticals

- 9.2.3. Cosmetics

- 9.2.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Golden Time

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 PT Batang Alum Industrie

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Productos Aditivos

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Food Chem International Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Tongaat Hulett*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.1 Golden Time

List of Figures

- Figure 1: Global Sodium Cyclamate Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Sodium Cyclamate Market Revenue (billion), by Type 2025 & 2033

- Figure 3: Asia Pacific Sodium Cyclamate Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: Asia Pacific Sodium Cyclamate Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Sodium Cyclamate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Sodium Cyclamate Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Sodium Cyclamate Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Sodium Cyclamate Market Revenue (billion), by Type 2025 & 2033

- Figure 9: North America Sodium Cyclamate Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Sodium Cyclamate Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: North America Sodium Cyclamate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Sodium Cyclamate Market Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Sodium Cyclamate Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Sodium Cyclamate Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Europe Sodium Cyclamate Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe Sodium Cyclamate Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Europe Sodium Cyclamate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Sodium Cyclamate Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Sodium Cyclamate Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Sodium Cyclamate Market Revenue (billion), by Type 2025 & 2033

- Figure 21: Rest of the World Sodium Cyclamate Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Sodium Cyclamate Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Rest of the World Sodium Cyclamate Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the World Sodium Cyclamate Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Sodium Cyclamate Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sodium Cyclamate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Sodium Cyclamate Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Sodium Cyclamate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Sodium Cyclamate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Sodium Cyclamate Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Sodium Cyclamate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Sodium Cyclamate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Sodium Cyclamate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Sodium Cyclamate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Australia Sodium Cyclamate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Sodium Cyclamate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Sodium Cyclamate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global Sodium Cyclamate Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Sodium Cyclamate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: Canada Sodium Cyclamate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Mexico Sodium Cyclamate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Global Sodium Cyclamate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Global Sodium Cyclamate Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 19: Global Sodium Cyclamate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Germany Sodium Cyclamate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: United Kingdom Sodium Cyclamate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: France Sodium Cyclamate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Sodium Cyclamate Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Sodium Cyclamate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 25: Global Sodium Cyclamate Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 26: Global Sodium Cyclamate Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sodium Cyclamate Market?

The projected CAGR is approximately 9.76%.

2. Which companies are prominent players in the Sodium Cyclamate Market?

Key companies in the market include Golden Time, PT Batang Alum Industrie, Productos Aditivos, Food Chem International Corporation, Tongaat Hulett*List Not Exhaustive.

3. What are the main segments of the Sodium Cyclamate Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.42 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand from Food and Beverages Sector; Growing Demand from Cosmetics.

6. What are the notable trends driving market growth?

Increasing Demand from Food & Beverage Industry.

7. Are there any restraints impacting market growth?

; Increasing Demand from Food and Beverages Sector; Growing Demand from Cosmetics.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sodium Cyclamate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sodium Cyclamate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sodium Cyclamate Market?

To stay informed about further developments, trends, and reports in the Sodium Cyclamate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence