Key Insights

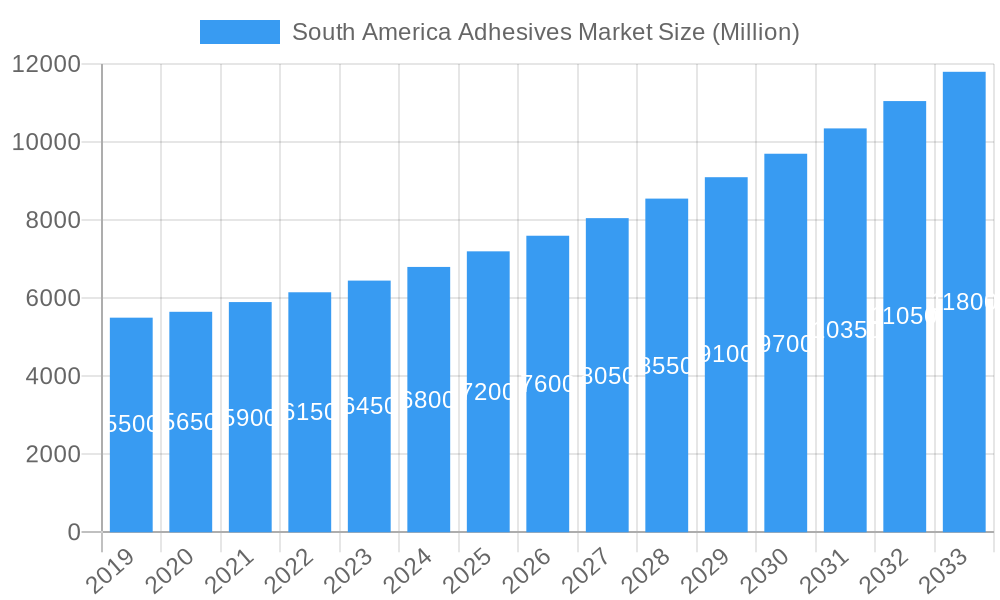

The South America Adhesives Market is poised for robust expansion, projected to reach a significant market size by 2033, driven by a compound annual growth rate (CAGR) exceeding 5.00%. This sustained growth is largely attributable to the burgeoning demand across key end-user industries. The building and construction sector, a cornerstone of many South American economies, continues to be a primary consumer of adhesives, fueled by increasing infrastructure development, urbanization, and renovation activities. Similarly, the automotive industry's recovery and growth, coupled with the expanding aerospace sector, contribute substantially to market dynamics. Furthermore, the packaging industry's continuous evolution towards more sustainable and efficient solutions, along with the footwear and leather segment's enduring presence, are vital growth enablers. Emerging applications in the healthcare sector and the ever-present demand from woodwork and joinery further solidify the market's upward trajectory.

South America Adhesives Market Market Size (In Billion)

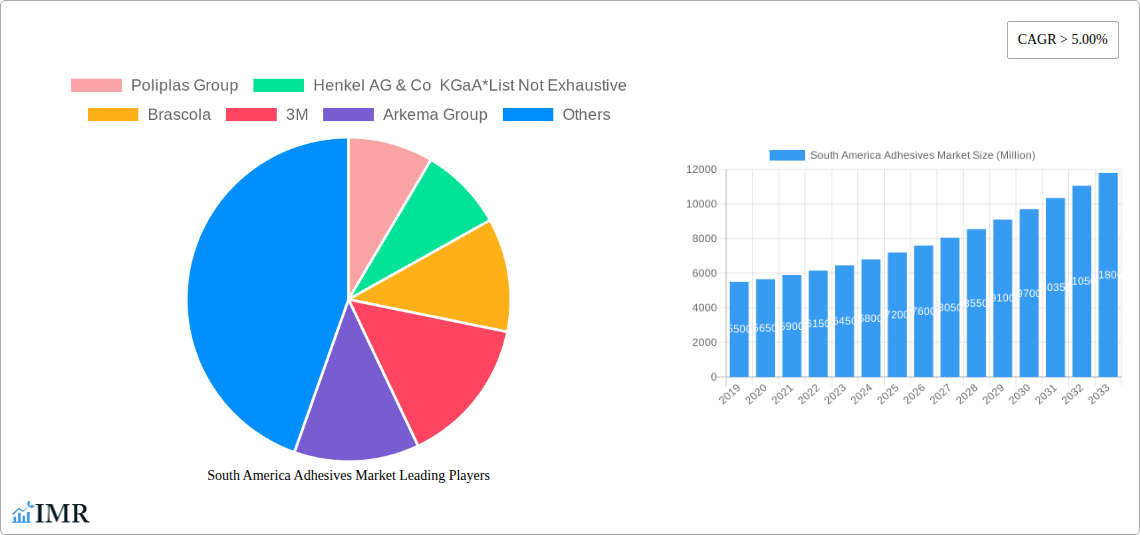

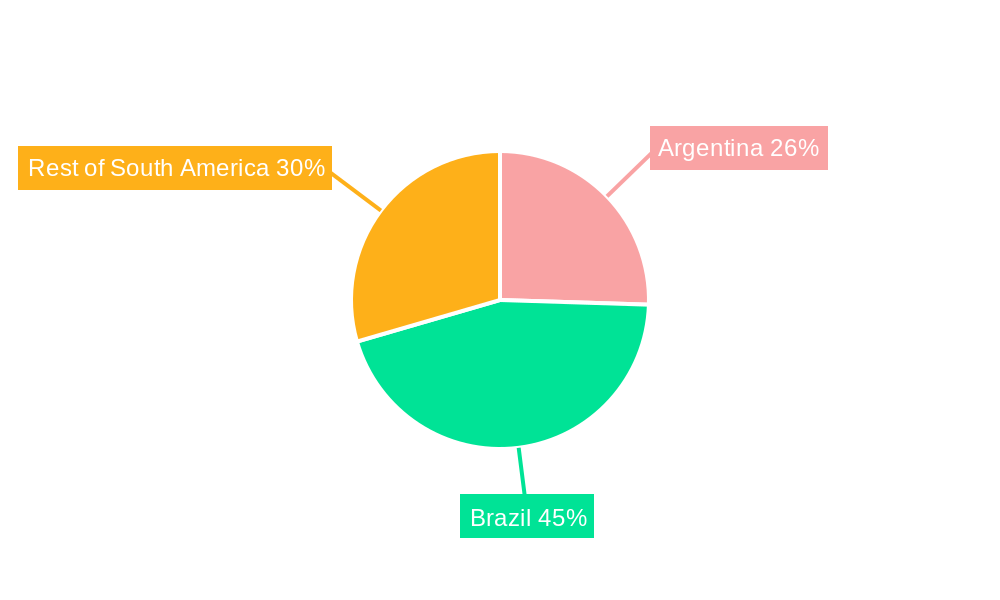

Technological advancements are playing a crucial role in shaping market preferences. The shift towards water-borne and UV-cured adhesives, driven by environmental regulations and a growing emphasis on sustainability, is gaining momentum, offering safer and more eco-friendly bonding solutions. While solvent-borne adhesives maintain a significant presence, their market share is expected to moderate. Hot melt and reactive adhesive technologies also cater to specific industrial needs, ensuring a diverse technological landscape. In terms of resin types, silicone, polyurethane, and acrylic-based adhesives are expected to dominate, owing to their versatile properties and broad applicability across various sectors. The market's geographical scope, encompassing Argentina, Brazil, and the Rest of South America, presents varied opportunities and challenges, with Brazil expected to remain a dominant force due to its larger industrial base and economic activity. Leading global and regional players like Henkel AG & Co KGaA, 3M, H.B. Fuller Company, and local powerhouses such as Poliplas Group and Brascola are actively investing and innovating to capture market share.

South America Adhesives Market Company Market Share

Unlock the potential of the South American adhesives market with our comprehensive report. This in-depth analysis provides critical insights into market dynamics, growth trends, regional dominance, product innovations, and key players. With data spanning the historical period of 2019-2024, a base year of 2025, and a forecast period extending to 2033, this report is your definitive guide to navigating this dynamic industry. We cover a wide range of segments including end-user industries like Building and Construction, Automotive, and Packaging, as well as technologies such as Water-borne, Hot Melt, and Reactive Adhesives, and resin types like Silicone, Polyurethane, and Acrylic. All values are presented in Million units.

South America Adhesives Market Market Dynamics & Structure

The South American adhesives market is characterized by a moderate to high level of concentration, with key players like Poliplas Group, Henkel AG & Co KGaA, Brascola, and 3M holding significant market shares. Technological innovation is a crucial driver, fueled by the demand for higher performance, sustainable, and application-specific adhesive solutions across various end-user industries. Regulatory frameworks, particularly concerning environmental impact and safety standards, are increasingly influencing product development and market entry. Competitive product substitutes, such as mechanical fasteners, are present but often fall short in areas like weight reduction, design flexibility, and aesthetic appeal, especially in sectors like automotive and aerospace. End-user demographics are evolving, with growing demand from sectors like sustainable packaging, e-commerce fulfillment, and advanced healthcare applications. Mergers and acquisitions (M&A) activity, while not as robust as in more mature markets, plays a role in market consolidation and expansion of product portfolios. For instance, strategic partnerships aimed at enhancing product offerings and market reach are becoming more prevalent.

- Market Concentration: Moderate to High, with key players dominating specific niches.

- Technological Innovation Drivers: Demand for eco-friendly solutions, enhanced performance, and automation compatibility.

- Regulatory Frameworks: Focus on VOC reduction, biodegradability, and worker safety.

- Competitive Product Substitutes: Mechanical fasteners, welding, but with limitations in specialized applications.

- End-User Demographics: Shifting towards sustainable packaging, medical devices, and lightweight automotive components.

- M&A Trends: Strategic alliances and targeted acquisitions for portfolio expansion and market access.

South America Adhesives Market Growth Trends & Insights

The South American adhesives market is poised for robust growth, driven by a confluence of economic development, industrial expansion, and evolving consumer preferences. The market size is expected to witness a significant upward trajectory throughout the forecast period. Adoption rates for advanced adhesive technologies, such as low-VOC formulations and high-performance reactive systems, are increasing as industries prioritize sustainability and enhanced product functionality. Technological disruptions, including advancements in bio-based adhesives and smart adhesive systems capable of self-healing or sensing, are beginning to influence market dynamics. Consumer behavior shifts are playing a pivotal role, with a growing demand for lightweight, durable, and aesthetically pleasing products in sectors ranging from automotive to consumer electronics. The burgeoning e-commerce sector, for example, is driving demand for specialized packaging adhesives that ensure product integrity during transit and enhance unboxing experiences.

Furthermore, the increasing focus on infrastructure development and urbanization across South America is directly translating into higher demand for construction adhesives used in flooring, roofing, and structural applications. The automotive industry's push towards lightweighting and electrification necessitates innovative bonding solutions that can replace traditional joining methods. Healthcare applications are also a significant growth area, with demand for biocompatible and sterilizable adhesives for medical devices and wound care. The packaging segment, driven by consumer goods and the aforementioned e-commerce boom, continues to be a major contributor to market growth, with a particular emphasis on flexible packaging and food-grade adhesives. The region’s textile and footwear industries, while facing global competition, continue to rely on specialized adhesives for their manufacturing processes. This evolving landscape presents numerous opportunities for adhesive manufacturers to innovate and capture market share. The compound annual growth rate (CAGR) for the South American adhesives market is projected to be substantial, reflecting these positive trends. Market penetration of specialty adhesives is expected to rise as industries become more sophisticated in their requirements.

Dominant Regions, Countries, or Segments in South America Adhesives Market

Brazil stands out as the dominant country within the South American adhesives market, propelled by its large industrial base, significant population, and extensive manufacturing capabilities. Its robust automotive sector, coupled with a thriving construction industry and a massive packaging market, makes it a focal point for adhesive consumption. Brazil's economic policies often encourage domestic production and attract foreign investment, further bolstering the adhesives sector.

From an End-User Industry perspective, Packaging and Building and Construction are the leading segments driving market growth. The burgeoning e-commerce market in Brazil and other South American nations has significantly increased the demand for packaging adhesives, emphasizing solutions for flexible packaging, labeling, and protective cushioning. In the Building and Construction sector, urbanization, infrastructure projects, and a growing demand for housing solutions fuel the consumption of adhesives for flooring, tiling, insulation, and structural bonding.

In terms of Technology, Water-borne adhesives are experiencing substantial growth due to their low VOC emissions and environmental friendliness, aligning with increasing regulatory pressures and consumer demand for sustainable products. Hot Melt adhesives also hold a significant share, particularly in packaging and woodworking applications, owing to their fast setting times and strong bond strengths. The Reactive adhesive segment, including polyurethanes and epoxies, is crucial for demanding applications in automotive, aerospace, and construction, where high performance and durability are paramount.

Analyzing Resin Types, Polyurethane and Acrylic adhesives are prominent due to their versatility and wide range of applications across industries like automotive, construction, and packaging. VAE/EVA adhesives are widely used in packaging, woodworking, and footwear. The Silicone resin type is gaining traction in high-temperature applications and specialized industrial uses.

The Rest of South America, encompassing countries like Argentina, Colombia, Chile, and Peru, collectively represents a significant and growing market. Argentina, with its established industrial sectors in automotive and packaging, contributes substantially. Chile’s strong mining and forestry sectors create demand for specific adhesive applications, while Colombia’s growing manufacturing base and infrastructure development initiatives are also key drivers. These regions, while individually smaller than Brazil, offer substantial growth potential and are increasingly important for adhesive manufacturers looking to diversify their market presence.

South America Adhesives Market Product Landscape

The South America adhesives market is witnessing a dynamic product landscape driven by innovation and the pursuit of enhanced performance. Product developments are increasingly focused on eco-friendly formulations, such as water-borne and bio-based adhesives, to meet stringent environmental regulations and growing consumer demand for sustainability. High-performance adhesives with improved bond strength, durability, and resistance to extreme conditions are being developed for demanding applications in the automotive, aerospace, and construction sectors. For instance, advancements in reactive adhesives like epoxies and polyurethanes are enabling lighter and stronger composite structures in vehicles. Furthermore, specialized adhesives for niche applications, such as medical devices, electronics assembly, and flexible packaging, are gaining prominence. The trend towards customization and application-specific solutions allows manufacturers to differentiate their offerings and address unique industry challenges, pushing the boundaries of adhesive technology.

Key Drivers, Barriers & Challenges in South America Adhesives Market

Key Drivers:

- Industrial Growth & Urbanization: Expansion of manufacturing sectors like automotive, construction, and packaging, coupled with increased urbanization, fuels demand for adhesives.

- Sustainability Focus: Growing awareness and regulatory push for environmentally friendly adhesives, including low-VOC and water-borne formulations, are driving innovation and adoption.

- Infrastructure Development: Government investments in infrastructure projects across the region necessitate significant use of construction adhesives.

- Technological Advancements: Development of high-performance, specialty adhesives tailored for specific applications enhances product functionality and market penetration.

- E-commerce Boom: The rapid growth of online retail drives demand for packaging adhesives that ensure product integrity and enhance shipping efficiency.

Barriers & Challenges:

- Economic Volatility: Fluctuations in regional economies and currency devaluation can impact investment decisions and purchasing power for adhesives.

- Supply Chain Disruptions: Reliance on imported raw materials and logistical challenges can lead to increased costs and delays.

- Raw Material Price Volatility: Fluctuations in the prices of key raw materials like petrochemicals can affect profit margins.

- Competition from Substitutes: While not always a direct replacement, mechanical fasteners and other joining methods can pose competition in certain applications.

- Skilled Workforce Shortage: A lack of specialized expertise in adhesive application and formulation can be a limiting factor for some companies.

- Regulatory Compliance: Navigating diverse and evolving regulatory landscapes across different countries can be complex and costly.

Emerging Opportunities in South America Adhesives Market

Emerging opportunities in the South American adhesives market lie in the increasing demand for sustainable and high-performance solutions. The growing focus on electric vehicles and lightweight automotive components presents a significant avenue for advanced bonding materials. The expansion of the healthcare sector, driven by an aging population and increased healthcare spending, opens doors for specialized medical-grade adhesives. Furthermore, the rising middle class and growing consumer spending power are fueling demand for aesthetically pleasing and durable consumer goods, requiring innovative adhesive applications. The untapped potential in segments like renewable energy installations (e.g., solar panel assembly) and advanced electronics manufacturing also offers substantial growth prospects.

Growth Accelerators in the South America Adhesives Market Industry

Several catalysts are accelerating growth in the South American adhesives market. Technological breakthroughs, such as the development of faster-curing adhesives and those with enhanced thermal or chemical resistance, are enabling new applications and improving manufacturing efficiency. Strategic partnerships between adhesive manufacturers and end-users are crucial for co-developing tailor-made solutions that meet specific industry needs. Market expansion strategies, including establishing local production facilities and distribution networks, are helping companies to better serve regional demands and reduce logistical costs. Furthermore, the increasing adoption of automation in manufacturing processes is creating demand for adhesives that are compatible with automated dispensing and application systems.

Key Players Shaping the South America Adhesives Market Market

- Poliplas Group

- Henkel AG & Co KGaA

- Brascola

- 3M

- Arkema Group

- Dow

- H B Fuller Company

- Soudal Holding N V

- Sika AG

- AVERY DENNISON CORPORATION

Notable Milestones in South America Adhesives Market Sector

- January 2023: H.B. Fuller Company introduced Swift®melt 1515-I, a new adhesive formulation specifically designed for medical applications, enhancing its product offering in the healthcare sector.

- July 2021: H.B. Fuller announced a strategic agreement with Covestro, aiming to offer a portfolio of sustainable adhesives in the market, signaling a strong commitment to environmentally conscious product development and market positioning.

In-Depth South America Adhesives Market Market Outlook

The future outlook for the South American adhesives market is exceptionally promising, driven by sustained industrial expansion, a strong impetus towards sustainability, and continuous technological innovation. The increasing adoption of advanced materials in sectors like automotive and aerospace will necessitate high-performance bonding solutions. Growth accelerators, including strategic collaborations and the development of smart adhesives, will further bolster market penetration. Untapped regions and niche applications within healthcare and electronics present significant expansion opportunities for agile and innovative players. The ongoing shift towards a circular economy will also favor the development and adoption of recyclable and biodegradable adhesive formulations, ensuring long-term market relevance and profitability.

South America Adhesives Market Segmentation

-

1. End-User Industry

- 1.1. Building and Construction

- 1.2. Aerospace

- 1.3. Automotive

- 1.4. Footwear and Leather

- 1.5. Healthcare

- 1.6. Packaging

- 1.7. Woodwork and Joinery

- 1.8. Other End-user Industries

-

2. Technology

- 2.1. Water-borne

- 2.2. Solvent-borne

- 2.3. Reactive

- 2.4. Hot Melt

- 2.5. UV-Cured Adhesives

- 2.6. Other Technologies

-

3. Resin Type

- 3.1. Silicone

- 3.2. Polyurethane

- 3.3. Acrylic

- 3.4. Epoxy

- 3.5. Cyanoacrylate

- 3.6. VAE/EVA

- 3.7. Other Resin Types

-

4. Geography

- 4.1. Argentina

- 4.2. Brazil

- 4.3. Rest of South America

South America Adhesives Market Segmentation By Geography

- 1. Argentina

- 2. Brazil

- 3. Rest of South America

South America Adhesives Market Regional Market Share

Geographic Coverage of South America Adhesives Market

South America Adhesives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand from Packaging Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Limited Resistance to Moisture and Water; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Packaging Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Building and Construction

- 5.1.2. Aerospace

- 5.1.3. Automotive

- 5.1.4. Footwear and Leather

- 5.1.5. Healthcare

- 5.1.6. Packaging

- 5.1.7. Woodwork and Joinery

- 5.1.8. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Water-borne

- 5.2.2. Solvent-borne

- 5.2.3. Reactive

- 5.2.4. Hot Melt

- 5.2.5. UV-Cured Adhesives

- 5.2.6. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Resin Type

- 5.3.1. Silicone

- 5.3.2. Polyurethane

- 5.3.3. Acrylic

- 5.3.4. Epoxy

- 5.3.5. Cyanoacrylate

- 5.3.6. VAE/EVA

- 5.3.7. Other Resin Types

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Argentina

- 5.4.2. Brazil

- 5.4.3. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Argentina

- 5.5.2. Brazil

- 5.5.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. Argentina South America Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6.1.1. Building and Construction

- 6.1.2. Aerospace

- 6.1.3. Automotive

- 6.1.4. Footwear and Leather

- 6.1.5. Healthcare

- 6.1.6. Packaging

- 6.1.7. Woodwork and Joinery

- 6.1.8. Other End-user Industries

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Water-borne

- 6.2.2. Solvent-borne

- 6.2.3. Reactive

- 6.2.4. Hot Melt

- 6.2.5. UV-Cured Adhesives

- 6.2.6. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by Resin Type

- 6.3.1. Silicone

- 6.3.2. Polyurethane

- 6.3.3. Acrylic

- 6.3.4. Epoxy

- 6.3.5. Cyanoacrylate

- 6.3.6. VAE/EVA

- 6.3.7. Other Resin Types

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Argentina

- 6.4.2. Brazil

- 6.4.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by End-User Industry

- 7. Brazil South America Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-User Industry

- 7.1.1. Building and Construction

- 7.1.2. Aerospace

- 7.1.3. Automotive

- 7.1.4. Footwear and Leather

- 7.1.5. Healthcare

- 7.1.6. Packaging

- 7.1.7. Woodwork and Joinery

- 7.1.8. Other End-user Industries

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Water-borne

- 7.2.2. Solvent-borne

- 7.2.3. Reactive

- 7.2.4. Hot Melt

- 7.2.5. UV-Cured Adhesives

- 7.2.6. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by Resin Type

- 7.3.1. Silicone

- 7.3.2. Polyurethane

- 7.3.3. Acrylic

- 7.3.4. Epoxy

- 7.3.5. Cyanoacrylate

- 7.3.6. VAE/EVA

- 7.3.7. Other Resin Types

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Argentina

- 7.4.2. Brazil

- 7.4.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by End-User Industry

- 8. Rest of South America South America Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-User Industry

- 8.1.1. Building and Construction

- 8.1.2. Aerospace

- 8.1.3. Automotive

- 8.1.4. Footwear and Leather

- 8.1.5. Healthcare

- 8.1.6. Packaging

- 8.1.7. Woodwork and Joinery

- 8.1.8. Other End-user Industries

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Water-borne

- 8.2.2. Solvent-borne

- 8.2.3. Reactive

- 8.2.4. Hot Melt

- 8.2.5. UV-Cured Adhesives

- 8.2.6. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by Resin Type

- 8.3.1. Silicone

- 8.3.2. Polyurethane

- 8.3.3. Acrylic

- 8.3.4. Epoxy

- 8.3.5. Cyanoacrylate

- 8.3.6. VAE/EVA

- 8.3.7. Other Resin Types

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Argentina

- 8.4.2. Brazil

- 8.4.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by End-User Industry

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Poliplas Group

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Henkel AG & Co KGaA*List Not Exhaustive

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Brascola

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 3M

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Arkema Group

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Dow

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 H B Fuller Company

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Soudal Holding N V

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Sika AG

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 AVERY DENNISON CORPORATION

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Poliplas Group

List of Figures

- Figure 1: South America Adhesives Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Adhesives Market Share (%) by Company 2025

List of Tables

- Table 1: South America Adhesives Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 2: South America Adhesives Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: South America Adhesives Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 4: South America Adhesives Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: South America Adhesives Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South America Adhesives Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 7: South America Adhesives Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 8: South America Adhesives Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 9: South America Adhesives Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: South America Adhesives Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: South America Adhesives Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 12: South America Adhesives Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 13: South America Adhesives Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 14: South America Adhesives Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: South America Adhesives Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: South America Adhesives Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 17: South America Adhesives Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 18: South America Adhesives Market Revenue Million Forecast, by Resin Type 2020 & 2033

- Table 19: South America Adhesives Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: South America Adhesives Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Adhesives Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the South America Adhesives Market?

Key companies in the market include Poliplas Group, Henkel AG & Co KGaA*List Not Exhaustive, Brascola, 3M, Arkema Group, Dow, H B Fuller Company, Soudal Holding N V, Sika AG, AVERY DENNISON CORPORATION.

3. What are the main segments of the South America Adhesives Market?

The market segments include End-User Industry, Technology, Resin Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand from Packaging Industry; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand from Packaging Industry.

7. Are there any restraints impacting market growth?

; Limited Resistance to Moisture and Water; Other Restraints.

8. Can you provide examples of recent developments in the market?

In January 2023, H.B. Fuller Company introduced Swift®melt 1515-I, for medical applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Adhesives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Adhesives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Adhesives Market?

To stay informed about further developments, trends, and reports in the South America Adhesives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence