Key Insights

The South America Commercial Vehicles Lubricants Market is projected for substantial expansion, expected to reach a market size of $3195.63 million by 2024, with a Compound Annual Growth Rate (CAGR) of 10.2% through 2033. This growth is underpinned by increasing demand for commercial vehicles, driven by expanding trade volumes, ongoing infrastructure development, and the surge in e-commerce, all of which emphasize the need for efficient logistics and transportation. Key market segments include engine oils, which hold the largest share due to their critical function in vehicle performance and durability. Hydraulic fluids are essential for heavy machinery, while transmission and gear oils ensure smooth powertrain operation. Greases contribute significantly to reducing friction and wear in diverse mechanical components.

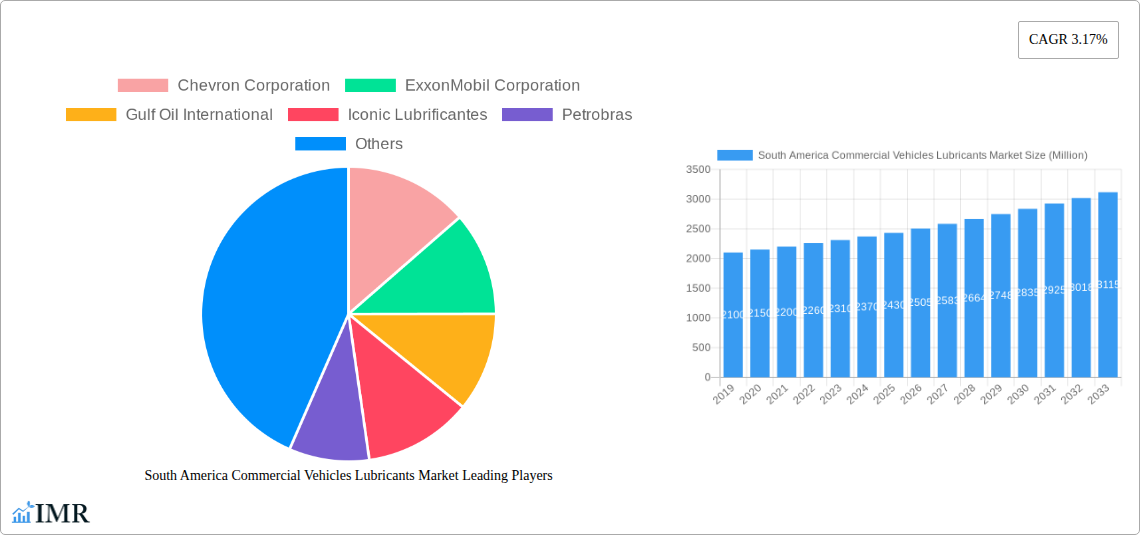

South America Commercial Vehicles Lubricants Market Market Size (In Billion)

Several key trends are influencing the South American commercial vehicle lubricants sector. A primary growth catalyst is the increasing adoption of advanced lubricant formulations engineered for superior fuel efficiency, extended service intervals, and enhanced wear protection. These formulations align with evolving environmental standards and the objective of reducing operational costs for fleet operators. Furthermore, advancements in commercial vehicle engine technology necessitate high-performance lubricants capable of withstanding elevated operating temperatures and pressures. Nevertheless, the market encounters challenges such as volatile raw material pricing, impacting base oil and additive costs. Economic instability in certain South American economies and the substantial capital investment required for fleet modernization also present potential growth limitations. Despite these hurdles, robust economic activity and the continuous requirement for goods movement across the region will sustain demand for essential commercial vehicle lubricants.

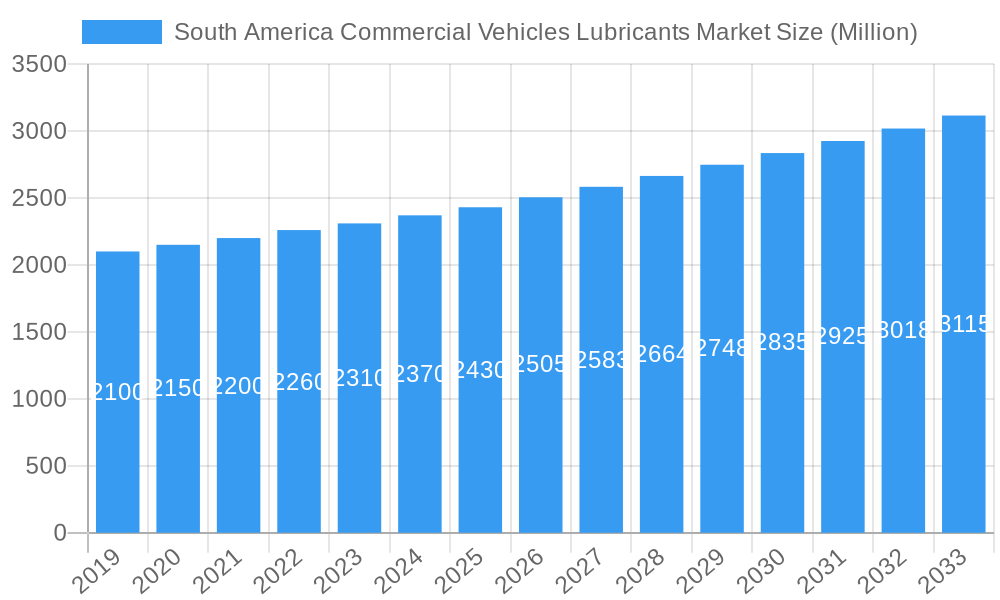

South America Commercial Vehicles Lubricants Market Company Market Share

South America Commercial Vehicles Lubricants Market: Comprehensive Report

This report provides an in-depth analysis of the South America commercial vehicles lubricants market, exploring its dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, emerging opportunities, growth accelerators, key players, and notable milestones. It offers a granular view of the market from 2019 to 2033, with a focus on the base year 2025 and a detailed forecast period from 2025–2033.

South America Commercial Vehicles Lubricants Market Market Dynamics & Structure

The South America commercial vehicles lubricants market is characterized by a moderately concentrated landscape, with major global players and significant regional entities vying for market share. Technological innovation is a key driver, with lubricant manufacturers continuously developing advanced formulations to meet evolving engine technologies, emission standards, and fuel efficiency requirements. Regulatory frameworks, particularly concerning environmental impact and product standards, play a crucial role in shaping product development and market entry. Competitive product substitutes, while present, are often differentiated by performance, brand reputation, and specialized applications. End-user demographics, including the growth of the logistics and transportation sectors, construction, and mining, significantly influence demand patterns. Mergers and acquisitions (M&A) activity, though not extensive, has been observed as companies seek to consolidate their market position, expand product portfolios, and gain access to new distribution channels. The market is poised for steady growth, driven by increasing vehicle parc and the adoption of higher-quality lubricants.

- Market Concentration: Moderately concentrated, with significant presence of multinational corporations and regional players.

- Technological Innovation: Driven by demand for fuel efficiency, extended drain intervals, and reduced emissions.

- Regulatory Frameworks: Stringent environmental regulations and product quality standards influence development.

- Competitive Landscape: Dominated by established brands with a focus on performance and brand loyalty.

- End-User Demographics: Growing logistics, construction, and mining sectors are key demand drivers.

- M&A Trends: Strategic acquisitions to enhance market reach and product offerings.

South America Commercial Vehicles Lubricants Market Growth Trends & Insights

The South America commercial vehicles lubricants market is experiencing robust growth, propelled by a burgeoning logistics sector, expanding infrastructure development, and an increasing vehicle parc across the region. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period. Adoption rates for synthetic and semi-synthetic lubricants are on the rise, driven by their superior performance characteristics, including enhanced engine protection, extended drain intervals, and improved fuel economy, translating into lower operational costs for fleet owners. Technological disruptions, such as the development of low-viscosity lubricants and advanced additive technologies, are playing a pivotal role in optimizing engine performance and meeting stringent emission norms. Consumer behavior is shifting towards a greater appreciation for high-performance, long-lasting lubricants that offer a competitive advantage in terms of operational efficiency and reduced maintenance downtime. The overall market penetration of premium lubricants is expected to increase as businesses prioritize reliability and cost-effectiveness. The demand for specialized lubricants catering to specific commercial vehicle applications, such as heavy-duty diesel engines, transmissions, and hydraulic systems, is also a significant growth indicator.

Dominant Regions, Countries, or Segments in South America Commercial Vehicles Lubricants Market

The Engine Oils segment, within the Product Type classification, is the dominant force driving growth in the South America commercial vehicles lubricants market. Brazil and Argentina stand out as leading countries, accounting for a substantial share of the regional market. The sheer size of their commercial vehicle fleets, coupled with significant economic activity in sectors like logistics, agriculture, and mining, fuels the high demand for engine oils. For instance, Brazil's extensive road network and its role as a major exporter of agricultural and mineral commodities necessitate a large and actively utilized fleet of commercial vehicles, directly impacting engine oil consumption. Argentina's robust agricultural sector also contributes significantly to this demand.

Key drivers for the dominance of engine oils include:

- Extensive Vehicle Parc: A large and continuously growing number of commercial trucks, buses, and other heavy-duty vehicles rely heavily on engine oils for lubrication and protection.

- Economic Activity: Thriving logistics, transportation, agriculture, and mining sectors are the primary consumers of commercial vehicles, directly translating into demand for engine oils.

- Maintenance Requirements: Regular oil changes are a fundamental aspect of commercial vehicle maintenance, ensuring engine longevity and optimal performance.

- Technological Advancements: The development of advanced engine oil formulations, such as those designed for extended drain intervals and fuel efficiency, further stimulates demand for higher-quality products within this segment.

- Replacement Market Dominance: While new vehicle sales contribute, the aftermarket replacement market for engine oils constitutes a significant portion of the overall demand.

- Infrastructure Development: Ongoing infrastructure projects across South America necessitate increased use of construction vehicles, further boosting the demand for engine lubricants.

The market share for engine oils is estimated to be around xx% of the total South America commercial vehicles lubricants market. The growth potential for this segment remains exceptionally high due to the continuous operational needs of the commercial vehicle fleet.

South America Commercial Vehicles Lubricants Market Product Landscape

The South America commercial vehicles lubricants market showcases a dynamic product landscape driven by innovation and the pursuit of enhanced performance. Engine oils, in particular, are witnessing advancements in synthetic formulations that offer superior protection against wear and tear, improved fuel efficiency, and extended drain intervals, catering to the demanding operational needs of heavy-duty vehicles. Greases are being developed with specialized properties for extreme temperatures and heavy loads in applications like chassis and wheel bearings. Hydraulic fluids are evolving to meet the requirements of modern construction and agricultural machinery, offering better thermal stability and seal compatibility. Transmission and gear oils are incorporating advanced additive packages to reduce friction, improve gear protection, and ensure smooth operation in diverse operating conditions. These product innovations are crucial for enhancing vehicle longevity, reducing maintenance costs, and meeting increasingly stringent environmental regulations within the South American commercial transport sector.

Key Drivers, Barriers & Challenges in South America Commercial Vehicles Lubricants Market

Key Drivers:

- Growing Logistics and Transportation Sector: Increased e-commerce and trade activities are boosting demand for commercial vehicles, consequently increasing lubricant consumption.

- Infrastructure Development Projects: Major construction and mining initiatives across the region necessitate a larger fleet of heavy-duty machinery and trucks.

- Technological Advancements in Lubricants: Development of higher-performance, fuel-efficient, and longer-lasting lubricants is driving adoption of premium products.

- Increasing Vehicle Parc: The overall growth in the number of commercial vehicles on the road directly translates to higher lubricant demand.

- Government Initiatives: Policies supporting fleet modernization and emission control standards can indirectly boost the demand for advanced lubricants.

Barriers & Challenges:

- Economic Volatility: Fluctuations in regional economies can impact fleet expansion and maintenance budgets.

- Counterfeit Products: The presence of counterfeit lubricants poses a significant threat to market integrity and brand reputation, impacting genuine product sales.

- Price Sensitivity: Some end-users, particularly smaller fleet operators, may prioritize cost over premium lubricant performance.

- Supply Chain Disruptions: Geopolitical factors and logistical challenges can impact the availability and cost of raw materials and finished products.

- Informal Market Practices: The prevalence of informal maintenance practices can lead to the use of sub-standard lubricants, affecting overall market quality.

Emerging Opportunities in South America Commercial Vehicles Lubricants Market

Emerging opportunities in the South America commercial vehicles lubricants market lie in the increasing adoption of specialized lubricants for hybrid and electric commercial vehicles, as the region gradually embraces cleaner transportation technologies. The growing demand for biodegradable and environmentally friendly lubricants presents a significant untapped market, particularly in ecologically sensitive regions. Furthermore, the expansion of fleet management services and the integration of IoT for predictive maintenance offer avenues for lubricant providers to offer value-added services, thereby strengthening customer relationships and market penetration. The development of e-commerce platforms for lubricant distribution also presents an opportunity to reach a wider customer base and streamline the purchasing process for fleet operators.

Growth Accelerators in the South America Commercial Vehicles Lubricants Market Industry

Several key catalysts are accelerating the growth of the South America commercial vehicles lubricants market. The relentless pursuit of fuel efficiency by fleet operators, driven by rising fuel costs and environmental concerns, is a major accelerator, pushing demand for advanced, low-viscosity lubricants. The ongoing modernization of commercial fleets across key economies like Brazil and Argentina, often supported by government incentives and evolving business needs, directly translates into higher consumption of quality lubricants. Strategic partnerships between lubricant manufacturers and original equipment manufacturers (OEMs) are also crucial, as these collaborations ensure that lubricants are optimized for the latest engine technologies, thereby enhancing performance and reliability. Furthermore, the increasing adoption of digital tools for fleet management and maintenance scheduling is indirectly promoting the use of superior lubricants that offer extended drain intervals, reducing downtime and operational costs.

Key Players Shaping the South America Commercial Vehicles Lubricants Market Market

- Chevron Corporation

- ExxonMobil Corporation

- Gulf Oil International

- Iconic Lubrificantes

- Petrobras

- Petronas Lubricants International

- Royal Dutch Shell Plc

- Terpel

- TotalEnergies

- YP

Notable Milestones in South America Commercial Vehicles Lubricants Market Sector

- January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions, impacting their strategic focus and product development in various markets.

- October 2021: Ipiranga stations in Brazil began offering Texaco lubricants, a brand long recommended by major automakers in Brazil and worldwide, over the whole network, signifying an expansion of distribution and brand presence.

- July 2021: Gulf Oil reached the 80 service station mark in Argentina through which it sells its lubricant products to its customers, indicating significant network expansion and market penetration in a key South American country.

In-Depth South America Commercial Vehicles Lubricants Market Market Outlook

The future outlook for the South America commercial vehicles lubricants market is exceptionally positive, fueled by a confluence of growth accelerators. The continued expansion of the logistics and transportation infrastructure, driven by e-commerce growth and regional trade agreements, will sustain a strong demand for commercial vehicles and their associated lubricant needs. Furthermore, the increasing awareness among fleet operators regarding the long-term economic benefits of using high-performance synthetic lubricants, such as reduced fuel consumption and extended engine life, will continue to drive the adoption of premium products. Strategic collaborations between lubricant manufacturers and OEMs will also play a pivotal role in shaping the market by ensuring the development and availability of lubricants tailored to the evolving needs of advanced engine technologies. The ongoing push towards sustainability and stricter emission regulations is also expected to create new market opportunities for environmentally friendly and fuel-efficient lubricant solutions. The market is poised for sustained growth, with significant potential for innovation and expansion in the coming years.

South America Commercial Vehicles Lubricants Market Segmentation

-

1. Product Type

- 1.1. Engine Oils

- 1.2. Greases

- 1.3. Hydraulic Fluids

- 1.4. Transmission & Gear Oils

South America Commercial Vehicles Lubricants Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Commercial Vehicles Lubricants Market Regional Market Share

Geographic Coverage of South America Commercial Vehicles Lubricants Market

South America Commercial Vehicles Lubricants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Largest Segment By Product Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Commercial Vehicles Lubricants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oils

- 5.1.2. Greases

- 5.1.3. Hydraulic Fluids

- 5.1.4. Transmission & Gear Oils

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Chevron Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ExxonMobil Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gulf Oil International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Iconic Lubrificantes

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Petrobras

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Petronas Lubricants International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Royal Dutch Shell Plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Terpel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TotalEnergies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 YP

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Chevron Corporation

List of Figures

- Figure 1: South America Commercial Vehicles Lubricants Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: South America Commercial Vehicles Lubricants Market Share (%) by Company 2025

List of Tables

- Table 1: South America Commercial Vehicles Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: South America Commercial Vehicles Lubricants Market Revenue million Forecast, by Region 2020 & 2033

- Table 3: South America Commercial Vehicles Lubricants Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 4: South America Commercial Vehicles Lubricants Market Revenue million Forecast, by Country 2020 & 2033

- Table 5: Brazil South America Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: Argentina South America Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: Chile South America Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Colombia South America Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Peru South America Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Venezuela South America Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Ecuador South America Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Bolivia South America Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Paraguay South America Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Uruguay South America Commercial Vehicles Lubricants Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Commercial Vehicles Lubricants Market?

The projected CAGR is approximately 10.2%.

2. Which companies are prominent players in the South America Commercial Vehicles Lubricants Market?

Key companies in the market include Chevron Corporation, ExxonMobil Corporation, Gulf Oil International, Iconic Lubrificantes, Petrobras, Petronas Lubricants International, Royal Dutch Shell Plc, Terpel, TotalEnergies, YP.

3. What are the main segments of the South America Commercial Vehicles Lubricants Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3195.63 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Largest Segment By Product Type : Engine Oils.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2022: Effective April 1, ExxonMobil Corporation was organized along three business lines - ExxonMobil Upstream Company, ExxonMobil Product Solutions and ExxonMobil Low Carbon Solutions.October 2021: Ipiranga stations in Brazil began offering Texaco lubricants, a brand long recommended by major automakers in Brazil and worldwide, over the whole network.July 2021: Gulf Oil reached the 80 service station mark in Argentina through which it sells its lubricant products to its customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Commercial Vehicles Lubricants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Commercial Vehicles Lubricants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Commercial Vehicles Lubricants Market?

To stay informed about further developments, trends, and reports in the South America Commercial Vehicles Lubricants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence