Key Insights

The South America fluoropolymer market is projected to experience robust growth, reaching an estimated $10.511 billion by 2025 and expanding at a Compound Annual Growth Rate (CAGR) of 5.88% through 2033. This expansion is primarily driven by escalating demand from pivotal end-user sectors, including automotive, building and construction, and electrical and electronics. In the automotive industry, the imperative for lightweight, durable, and chemically resistant components in fuel systems, wire insulation, and seals significantly fuels market growth. The building and construction sector is increasingly adopting fluoropolymers for architectural coatings, membranes, and high-performance piping, owing to their superior weatherability and chemical inertness. Concurrently, the rapidly advancing electrical and electronics sector, propelled by innovations in semiconductors and advanced wiring, continues to elevate demand for fluoropolymers due to their exceptional dielectric properties and thermal stability.

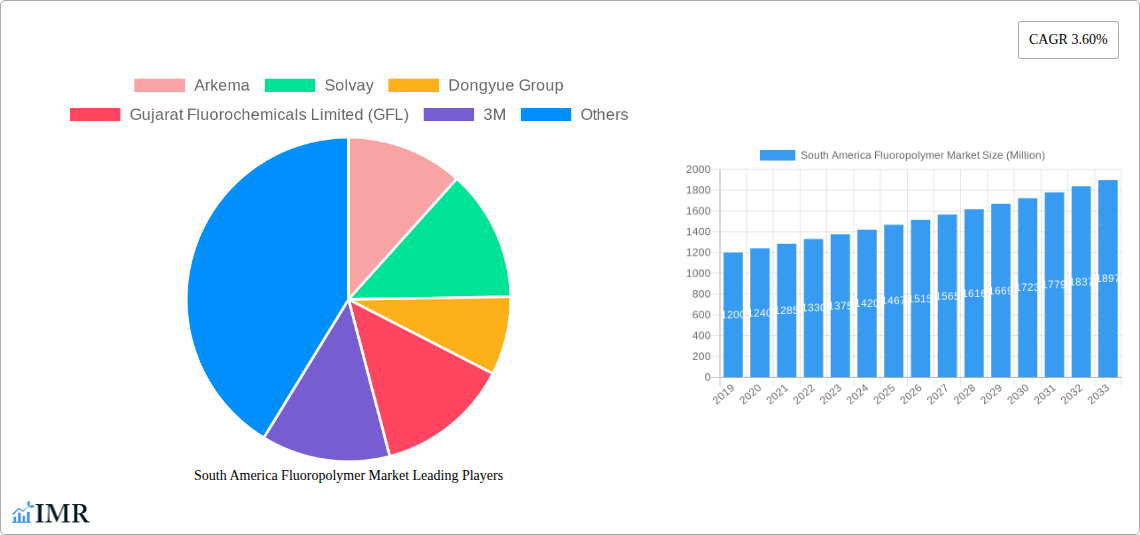

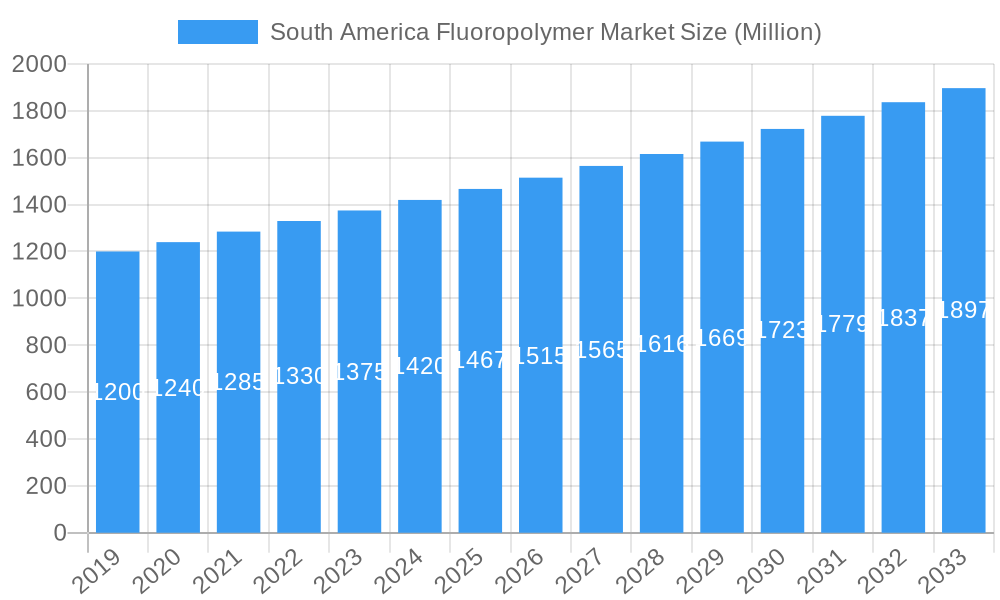

South America Fluoropolymer Market Market Size (In Billion)

Geographically, Brazil is anticipated to lead the South American fluoropolymer market, attributed to its substantial industrial infrastructure and escalating manufacturing investments. Key markets such as Argentina, Chile, and Colombia are also expected to make significant contributions to market expansion. The market landscape is characterized by a diverse array of sub-resin types, with Polytetrafluoroethylene (PTFE) and Polyvinylidene Fluoride (PVDF) commanding substantial market share due to their extensive applicability. Emerging applications in specialized domains are also spurring interest in Ethylenetetrafluoroethylene (ETFE) and Fluorinated Ethylene-propylene (FEP). While numerous opportunities exist, potential challenges include the high production costs associated with certain fluoropolymers, stringent environmental regulations governing fluorinated compounds, and the availability of substitute materials for specific applications. Nevertheless, ongoing research and development focused on enhancing production efficiency and exploring novel applications are poised to mitigate these impediments, ensuring a positive growth trajectory for the South American fluoropolymer market.

South America Fluoropolymer Market Company Market Share

This comprehensive report offers a critical analysis of the South America Fluoropolymer Market, providing unparalleled insights into market dynamics, growth trajectories, and future opportunities. Tailored for industry professionals aiming to comprehend the evolving landscape of high-performance polymers, this study examines key segments, dominant players, and impactful industry developments. With a forecast horizon extending to 2033, this report serves as an indispensable guide for navigating and capitalizing on the South American fluoropolymer sector.

South America Fluoropolymer Market Market Dynamics & Structure

The South America Fluoropolymer Market is characterized by a moderately concentrated landscape, with global players Arkema, Solvay, 3M, and The Chemours Company holding significant market shares. Technological innovation is a primary driver, particularly the development of advanced fluoropolymer grades for demanding applications in the automotive, electrical & electronics, and industrial sectors. Regulatory frameworks, while evolving, generally support the adoption of high-performance materials that meet stringent environmental and safety standards. Competitive product substitutes exist, but the unique properties of fluoropolymers, such as exceptional chemical resistance, thermal stability, and non-stick characteristics, limit their widespread displacement. End-user demographics are shifting towards sectors prioritizing sustainability and high performance, influencing demand for specific resin types like PVDF and PTFE. Mergers and acquisitions (M&A) are a growing trend, with companies strategically acquiring smaller players or expanding capacities to gain market foothold and enhance product portfolios. For instance, Arkema's acquisition of Agiplast in May 2021 signals a strategic move towards integrated manufacturing of bio-based and recycled materials, reflecting a broader industry trend towards sustainability. While R&D investment is robust, innovation barriers include the high cost of raw materials and specialized manufacturing processes. The market is poised for significant expansion driven by increased industrialization and technological advancements across the region.

- Market Concentration: Moderate, dominated by a few key global players.

- Technological Innovation: Driven by demand for enhanced performance and sustainability in key industries.

- Regulatory Frameworks: Generally supportive of high-performance materials, with increasing focus on environmental compliance.

- Competitive Substitutes: Limited for applications requiring extreme resistance and durability.

- End-User Demographics: Growing demand from aerospace, automotive, building & construction, and electrical & electronics sectors.

- M&A Trends: Increasing strategic acquisitions to enhance market presence and product offerings.

South America Fluoropolymer Market Growth Trends & Insights

The South America Fluoropolymer Market is experiencing robust growth, projected to witness a significant Compound Annual Growth Rate (CAGR) during the forecast period of 2025–2033. This expansion is fueled by a confluence of factors, including escalating demand from burgeoning end-user industries and continuous technological advancements in polymer science. The adoption rates of fluoropolymers are on an upward trajectory as industries increasingly recognize their superior performance characteristics compared to conventional plastics. Technological disruptions, such as the development of novel manufacturing techniques and the introduction of more sustainable fluoropolymer alternatives, are reshaping the market. Consumer behavior shifts, particularly a heightened emphasis on durability, energy efficiency, and environmental responsibility in product design, are also playing a crucial role. For instance, the growing demand for electric vehicles (EVs) is directly translating into increased consumption of fluoropolymers for battery components, wiring insulation, and lightweight structural elements. Similarly, the expansion of renewable energy infrastructure, such as solar panels and wind turbines, necessitates the use of fluoropolymers for their protective coatings and components. The market penetration of fluoropolymers is expected to deepen across existing applications and expand into new frontiers as their unique properties are better understood and leveraged. The market size evolution is directly linked to the economic development of key South American nations and their commitment to industrial modernization. Insights derived from the study period of 2019–2024, with a base year of 2025, reveal a consistent upward trend, laying a strong foundation for future growth. The estimated market size for 2025 reflects this optimistic outlook.

Dominant Regions, Countries, or Segments in South America Fluoropolymer Market

The South America Fluoropolymer Market is experiencing significant growth, with distinct regional and segment leaders emerging. Within the End User Industry segment, Electrical and Electronics is a dominant force, driven by the burgeoning demand for advanced consumer electronics, telecommunications infrastructure, and the accelerating adoption of electric vehicles (EVs) across countries like Brazil and Mexico. The superior electrical insulation properties, high-temperature resistance, and chemical inertness of fluoropolymers like PTFE and PVDF make them indispensable in this sector. The Automotive industry also represents a significant growth driver, with increasing use of fluoropolymers for fuel hoses, seals, gaskets, and under-the-hood components that require resistance to aggressive fuels and high temperatures.

In terms of Sub Resin Type, Polytetrafluoroethylene (PTFE) and Polyvinylidene Fluoride (PVDF) are expected to command substantial market shares. PTFE's exceptional non-stick properties and chemical resistance make it ideal for cookware, industrial coatings, and seals, while PVDF's excellent weatherability, chemical resistance, and piezoelectric properties are increasingly utilized in construction (architectural coatings), battery technology, and chemical processing equipment. The Building and Construction sector is a notable contributor, with fluoropolymer-based coatings offering long-term durability and aesthetic appeal for facades, roofing, and architectural membranes.

- Dominant End User Industry: Electrical and Electronics, driven by consumer electronics, EVs, and telecommunications.

- Key Country Markets: Brazil and Mexico are anticipated to lead demand due to industrialization and technological adoption.

- Dominant Sub Resin Types: Polytetrafluoroethylene (PTFE) and Polyvinylidene Fluoride (PVDF) due to their versatile properties.

- Emerging Segment Growth: Automotive and Building & Construction sectors showing strong upward trends.

- Growth Drivers: Economic development, infrastructure projects, and demand for high-performance, sustainable materials.

South America Fluoropolymer Market Product Landscape

The product landscape of the South America Fluoropolymer Market is characterized by continuous innovation and diversification. Manufacturers are increasingly focusing on developing advanced fluoropolymer grades tailored to specific, high-performance applications. Unique selling propositions often revolve around enhanced thermal stability, superior chemical resistance, improved mechanical strength, and greater processing efficiency. Technological advancements are enabling the creation of specialized materials such as Ethylenetetrafluoroethylene (ETFE) for architectural membranes offering excellent light transmission and durability, and Fluorinated Ethylene-propylene (FEP) for wire and cable insulation demanding high-temperature performance and flexibility. The development of sustainable fluoropolymer variants, like Arkema's bio-based Kynar PVDF grades, represents a significant product innovation, catering to the growing demand for eco-friendly materials.

Key Drivers, Barriers & Challenges in South America Fluoropolymer Market

Key Drivers: The South America Fluoropolymer Market is propelled by several key factors. Technological innovation driving demand for high-performance materials in sectors like automotive, aerospace, and electronics is a primary driver. The increasing adoption of electric vehicles and renewable energy infrastructure further bolsters demand for fluoropolymers' unique properties. Furthermore, government initiatives promoting industrial growth and infrastructure development across South America create a fertile ground for market expansion. The inherent superior properties of fluoropolymers, such as exceptional chemical and thermal resistance, continue to make them indispensable in demanding applications.

Barriers & Challenges: Despite the promising outlook, the market faces certain challenges. The high cost of raw materials and complex manufacturing processes contribute to the overall higher price of fluoropolymers, which can be a barrier to adoption in price-sensitive applications. Stringent environmental regulations concerning the production and disposal of certain fluorinated compounds necessitate continuous investment in compliance and R&D for greener alternatives. Supply chain disruptions and geopolitical uncertainties can impact the availability and pricing of key raw materials. Moreover, intense competition from both established players and emerging regional manufacturers poses a challenge for market share acquisition.

Emerging Opportunities in South America Fluoropolymer Market

Emerging opportunities in the South America Fluoropolymer Market lie in the burgeoning demand for sustainable solutions and the expansion into new application areas. The increasing focus on circular economy principles presents opportunities for developing and implementing recycling technologies for fluoropolymers. The growing automotive sector, particularly the rapid growth of electric vehicles, offers significant potential for PVDF in battery components and for fluoropolymers in lightweighting initiatives. The expansion of the renewable energy sector, including solar and wind power, will continue to drive demand for durable and weather-resistant fluoropolymer coatings and components. Furthermore, untapped markets within the medical device and pharmaceutical industries, which require high-purity and chemically inert materials, represent a promising avenue for growth.

Growth Accelerators in the South America Fluoropolymer Market Industry

Several catalysts are accelerating the long-term growth of the South America Fluoropolymer Market. Technological breakthroughs in polymerization techniques and material science are leading to the development of novel fluoropolymer grades with enhanced properties and broader applicability. Strategic partnerships and collaborations between raw material suppliers, manufacturers, and end-users are fostering innovation and market penetration. Market expansion strategies by key players, including capacity expansions and the establishment of local manufacturing facilities, are crucial for meeting regional demand and reducing lead times. The increasing global emphasis on sustainability is a significant growth accelerator, pushing for the development and adoption of bio-based and recycled fluoropolymer solutions.

Key Players Shaping the South America Fluoropolymer Market Market

- Arkema

- Solvay

- Dongyue Group

- Gujarat Fluorochemicals Limited (GFL)

- 3M

- AGC Inc

- The Chemours Company

Notable Milestones in South America Fluoropolymer Market Sector

- June 2021: Arkema launched new sustainable Kynar PVDF grades for lithium-ion batteries that claim to be made of 100% renewable attributed carbon derived from crude tall oil bio-feedstock, addressing the growing demand for eco-friendly battery materials.

- May 2021: Arkema acquired Agiplast, becoming the first fully integrated high-performance polymer manufacturer offering both bio-based and recycled materials, aimed at addressing resource scarcity and end-of-life product challenges.

- December 2018: The Chemours Company expanded its TEFLON PFA polymer production capacity by 25% to cater to the growing demand from the semiconductor industry, highlighting the crucial role of fluoropolymers in advanced electronics manufacturing.

In-Depth South America Fluoropolymer Market Market Outlook

The outlook for the South America Fluoropolymer Market is exceptionally positive, driven by a sustained demand for high-performance and sustainable materials. Growth accelerators such as ongoing technological advancements in material science and the expansion of key end-user industries like automotive and electrical & electronics will continue to fuel market expansion. Strategic initiatives, including capacity enhancements and the development of innovative, eco-friendly fluoropolymer variants, are crucial for capturing future market potential. The increasing integration of fluoropolymers in critical applications, from renewable energy infrastructure to advanced medical devices, underscores their indispensable role. The market is poised for significant growth, presenting lucrative opportunities for stakeholders who can adapt to evolving technological landscapes and sustainability demands.

South America Fluoropolymer Market Segmentation

-

1. End User Industry

- 1.1. Aerospace

- 1.2. Automotive

- 1.3. Building and Construction

- 1.4. Electrical and Electronics

- 1.5. Industrial and Machinery

- 1.6. Other End-user Industries

-

2. Sub Resin Type

- 2.1. Ethylenetetrafluoroethylene (ETFE)

- 2.2. Fluorinated Ethylene-propylene (FEP)

- 2.3. Polytetrafluoroethylene (PTFE)

- 2.4. Polyvinylfluoride (PVF)

- 2.5. Polyvinylidene Fluoride (PVDF)

- 2.6. Other Sub Resin Types

South America Fluoropolymer Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Fluoropolymer Market Regional Market Share

Geographic Coverage of South America Fluoropolymer Market

South America Fluoropolymer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.88% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For the Manufacturing of ABS Resins; Increasing Demand For Alpha-methyl Styrene In the Electronics Segment

- 3.3. Market Restrains

- 3.3.1. Hazardous Waste Release During the Production of Alpha Methyl Styrene; Other Restraints

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Fluoropolymer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Aerospace

- 5.1.2. Automotive

- 5.1.3. Building and Construction

- 5.1.4. Electrical and Electronics

- 5.1.5. Industrial and Machinery

- 5.1.6. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Sub Resin Type

- 5.2.1. Ethylenetetrafluoroethylene (ETFE)

- 5.2.2. Fluorinated Ethylene-propylene (FEP)

- 5.2.3. Polytetrafluoroethylene (PTFE)

- 5.2.4. Polyvinylfluoride (PVF)

- 5.2.5. Polyvinylidene Fluoride (PVDF)

- 5.2.6. Other Sub Resin Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arkema

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Solvay

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dongyue Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gujarat Fluorochemicals Limited (GFL)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 3M

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AGC Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Chemours Compan

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Arkema

List of Figures

- Figure 1: South America Fluoropolymer Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Fluoropolymer Market Share (%) by Company 2025

List of Tables

- Table 1: South America Fluoropolymer Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 2: South America Fluoropolymer Market Revenue billion Forecast, by Sub Resin Type 2020 & 2033

- Table 3: South America Fluoropolymer Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South America Fluoropolymer Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 5: South America Fluoropolymer Market Revenue billion Forecast, by Sub Resin Type 2020 & 2033

- Table 6: South America Fluoropolymer Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Brazil South America Fluoropolymer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Argentina South America Fluoropolymer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Chile South America Fluoropolymer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Colombia South America Fluoropolymer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Peru South America Fluoropolymer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Venezuela South America Fluoropolymer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Ecuador South America Fluoropolymer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Bolivia South America Fluoropolymer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Paraguay South America Fluoropolymer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Uruguay South America Fluoropolymer Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Fluoropolymer Market?

The projected CAGR is approximately 5.88%.

2. Which companies are prominent players in the South America Fluoropolymer Market?

Key companies in the market include Arkema, Solvay, Dongyue Group, Gujarat Fluorochemicals Limited (GFL), 3M, AGC Inc, The Chemours Compan.

3. What are the main segments of the South America Fluoropolymer Market?

The market segments include End User Industry, Sub Resin Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.511 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For the Manufacturing of ABS Resins; Increasing Demand For Alpha-methyl Styrene In the Electronics Segment.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Hazardous Waste Release During the Production of Alpha Methyl Styrene; Other Restraints.

8. Can you provide examples of recent developments in the market?

June 2021: Arkema launched new sustainable Kynar PVDF grades for lithium-ion batteries that claim to be made of 100% renewable attributed carbon derived from crude tall oil bio-feedstock.May 2021: Arkema acquired Agiplast to become the first fully integrated high-performance polymer manufacturer offering both bio-based and recycled materials. The acquisition was aimed at addressing the challenges of resource scarcity and end-of-life products.December 2018: The Chemours Company expanded its TEFLON PFA polymer production capacity by 25% to cater to growing demand from the semiconductor industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Fluoropolymer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Fluoropolymer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Fluoropolymer Market?

To stay informed about further developments, trends, and reports in the South America Fluoropolymer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence