Key Insights

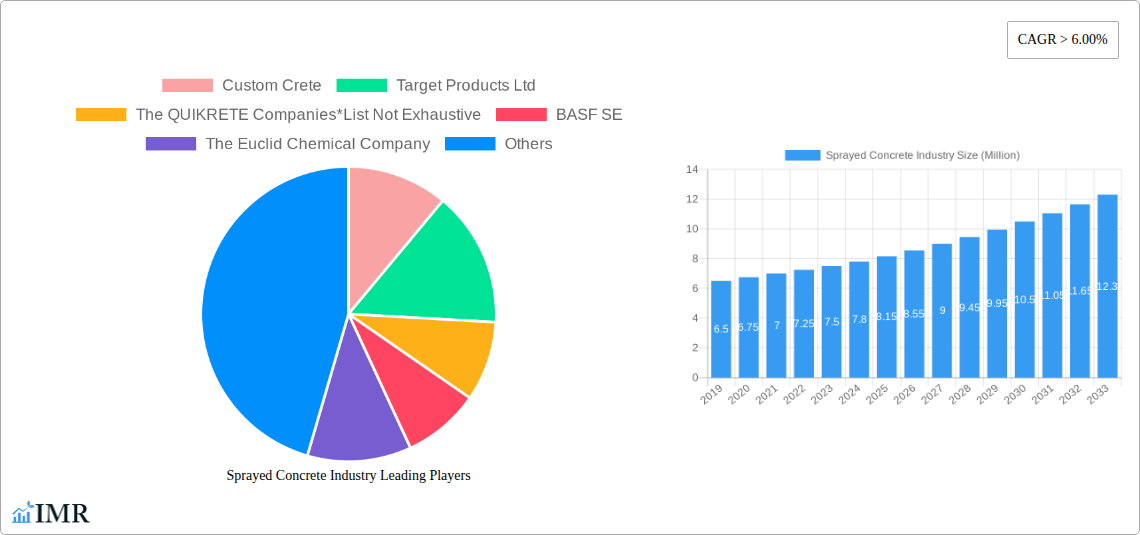

The global Sprayed Concrete market is poised for robust expansion, projected to reach a substantial market size of $9.29 billion by 2025, with a compelling Compound Annual Growth Rate (CAGR) exceeding 6.00% through 2033. This sustained growth is primarily fueled by the increasing demand from critical end-user industries, most notably infrastructure development, encompassing the construction of bridges, tunnels, and dams. The mining and tunneling sector also presents a significant growth avenue, driven by ongoing exploration and extraction activities worldwide. Furthermore, the rising emphasis on repairing and rehabilitating existing structures, coupled with the inherent benefits of sprayed concrete such as rapid application, cost-effectiveness, and superior structural integrity, are acting as powerful market accelerators. The versatility of sprayed concrete in applications like slope stabilization, seismic retrofitting, and decorative finishes further broadens its market appeal.

Sprayed Concrete Industry Market Size (In Million)

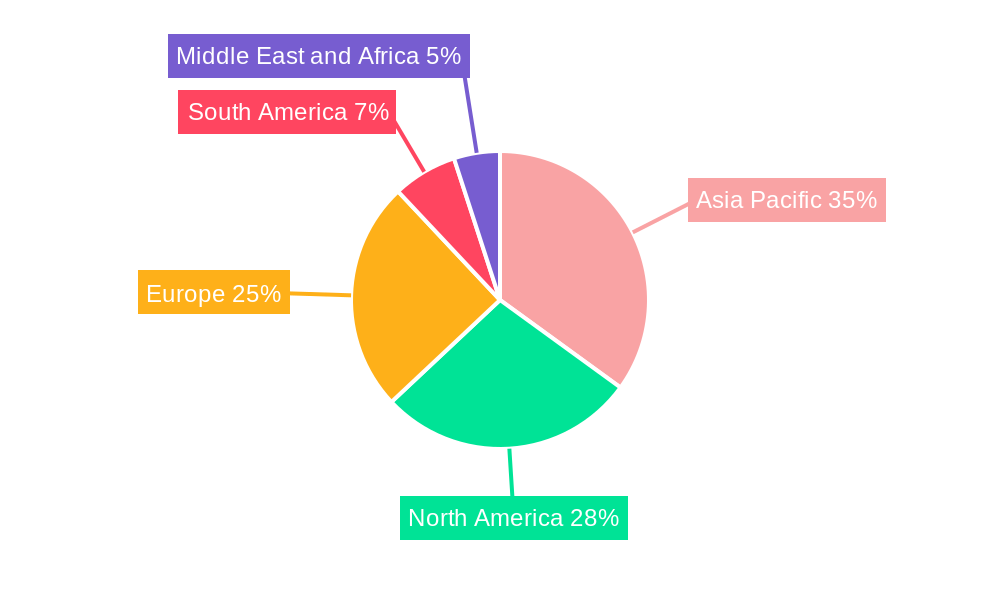

Geographically, the Asia Pacific region is expected to lead market growth, propelled by rapid urbanization, government investments in infrastructure projects in countries like China and India, and a burgeoning construction industry. North America and Europe, with their mature infrastructure and ongoing rehabilitation needs, will remain significant markets. Emerging economies in South America and the Middle East and Africa are also anticipated to contribute to the market’s upward trajectory as they invest in developing their infrastructure. The market is characterized by a competitive landscape with key players like Sika, BASF SE, and Cemex driving innovation in product development and application techniques. Advancements in admixture technology and robotic spraying systems are expected to enhance efficiency and safety, further bolstering market penetration across diverse applications.

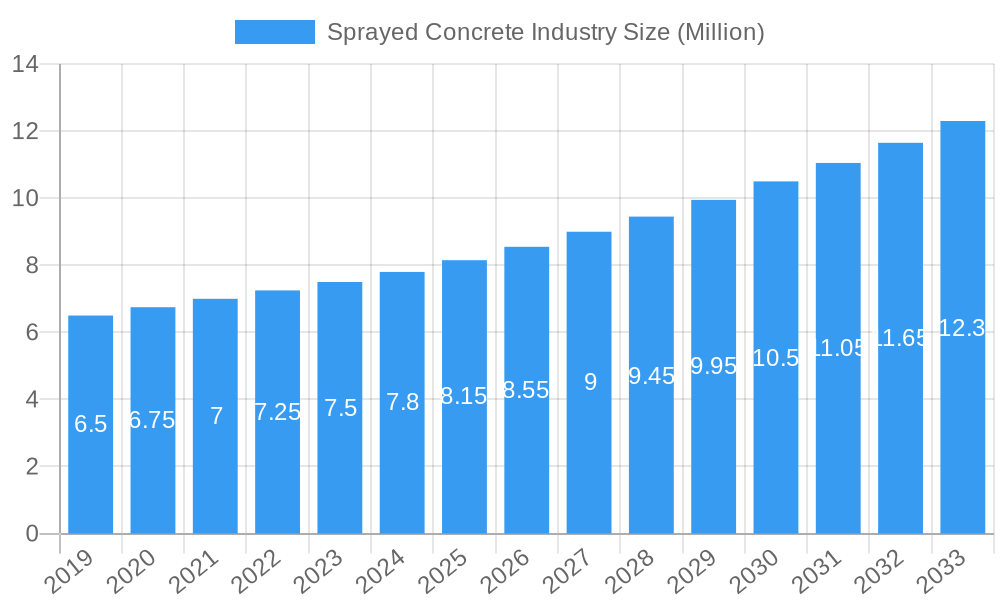

Sprayed Concrete Industry Company Market Share

This in-depth report provides a definitive analysis of the global sprayed concrete market, examining its intricate dynamics, growth trajectories, and future potential. Covering the historical period of 2019–2024 and extending to a detailed forecast for 2025–2033, with 2025 as the base and estimated year, this study offers invaluable insights for stakeholders. The report delves into market segmentation by process (Wet Spraying, Dry Spraying) and end-user industry (Infrastructure, Mining and Tunneling, Repair and Rehabilitation, Other En). We meticulously analyze parent and child market relationships, providing a holistic view of the industry's expansive reach. All monetary values are presented in Million USD for clarity and actionable decision-making.

Sprayed Concrete Industry Market Dynamics & Structure

The global sprayed concrete market exhibits a moderately concentrated structure, with a few key players like Sika, Cemex, and BASF SE holding significant market shares. However, the presence of numerous regional and specialized firms contributes to a dynamic competitive landscape. Technological innovation is a primary driver, with continuous advancements in admixtures, spraying equipment, and application techniques enhancing efficiency, durability, and sustainability. Regulatory frameworks, particularly those focused on environmental impact and safety standards, are increasingly influencing product development and adoption. Competitive product substitutes, while existing in niche applications, face challenges in matching the versatility and cost-effectiveness of sprayed concrete for core applications. End-user demographics are shifting, with a growing demand for rapid, durable, and cost-effective construction solutions in both new builds and repairs. Mergers and acquisitions (M&A) are a notable trend, as larger companies consolidate their market positions and expand their product portfolios. For instance, the historical period saw several strategic acquisitions aimed at enhancing technological capabilities and geographical reach. Innovation barriers include the significant capital investment required for advanced equipment and the specialized training needed for optimal application.

- Market Concentration: Moderately concentrated with significant influence from global giants and a competitive fringe of specialized players.

- Technological Innovation Drivers: Development of high-performance admixtures, advanced pumping and spraying equipment, and sustainable concrete formulations.

- Regulatory Frameworks: Increasing emphasis on environmental compliance, worker safety, and material performance standards.

- Competitive Product Substitutes: Traditional cast-in-place concrete, precast concrete elements, and alternative repair materials.

- End-User Demographics: Growing demand from infrastructure development, mining operations, and a burgeoning repair and rehabilitation sector.

- M&A Trends: Strategic acquisitions focused on market expansion, technology integration, and portfolio diversification.

Sprayed Concrete Industry Growth Trends & Insights

The sprayed concrete industry is poised for robust growth, driven by escalating global infrastructure investments and the inherent advantages of sprayed concrete technology. Market size is projected to expand significantly from its estimated value of $XX,XXX Million in 2025 to reach an anticipated $YY,YYY Million by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of approximately X.X% during the forecast period. Adoption rates for sprayed concrete are steadily increasing across various sectors, particularly in developing economies where rapid construction and cost-efficiency are paramount. Technological disruptions, such as the development of self-healing sprayed concrete and advanced robotic application systems, are set to further revolutionize the industry, enhancing performance and reducing labor dependency. Consumer behavior shifts are evident, with a growing preference for materials that offer faster project completion times, enhanced durability, and reduced environmental footprints. The integration of smart technologies for real-time monitoring of sprayed concrete application and curing is also emerging as a key differentiator. The market penetration of specialized sprayed concrete applications, like shotcrete for water retaining structures and geotechnical stabilization, continues to deepen. The inherent versatility of sprayed concrete, enabling its application on complex geometries and in challenging environments, underpins its sustained demand.

The historical period from 2019 to 2024 witnessed steady growth, fueled by a recovering global economy and increased construction activity post-pandemic. Key segments like infrastructure and mining have been consistent demand generators. The shift towards more sustainable construction practices also presents an opportunity, with ongoing research into lower-carbon sprayed concrete mixes. The ability to apply sprayed concrete efficiently in remote or difficult-to-access locations further solidifies its appeal. Furthermore, the increasing need for the rehabilitation and strengthening of aging infrastructure worldwide provides a substantial and enduring market for sprayed concrete solutions.

Dominant Regions, Countries, or Segments in Sprayed Concrete Industry

The Infrastructure end-user industry segment is currently the most dominant force driving growth in the global sprayed concrete market. This dominance is underpinned by substantial and ongoing investments in transportation networks, utilities, and public facilities worldwide. Regions such as North America and Europe have historically led in terms of market share, driven by mature economies with extensive infrastructure renewal programs and stringent performance requirements. However, Asia Pacific is emerging as the fastest-growing region, fueled by rapid urbanization, significant government spending on new infrastructure projects, and a burgeoning construction sector. Countries like China and India are key contributors to this regional growth.

Within the Infrastructure segment, applications such as bridge construction and repair, tunnel lining, and the construction of dams and retaining walls are major demand drivers. The Mining and Tunneling segment also plays a crucial role, with sprayed concrete being indispensable for ground support, excavation stabilization, and the construction of underground infrastructure. The Repair and Rehabilitation segment, though often smaller in individual project value, represents a consistent and significant market due to the aging infrastructure globally. The "Other En" segment, encompassing applications like architectural features and specialized industrial structures, also contributes to market diversification.

- Dominant End-User Industry: Infrastructure, characterized by large-scale projects and continuous demand for durable construction solutions.

- Leading Regions: North America and Europe, with Asia Pacific exhibiting the highest growth potential due to rapid development.

- Key Countries (Growth): China and India in Asia Pacific, driving demand through massive infrastructure development initiatives.

- Key Drivers (Infrastructure): Government stimulus packages, urbanization, need for improved transportation and utility networks.

- Key Drivers (Mining & Tunneling): Resource extraction activities, underground transportation projects, and geological stabilization requirements.

- Growth Potential (Asia Pacific): Fueled by increasing disposable incomes, population growth, and strategic governmental investments in infrastructure.

Sprayed Concrete Industry Product Landscape

The product landscape of the sprayed concrete industry is characterized by continuous innovation in formulations and application technologies. Advancements in admixtures, including superplasticizers, accelerators, and fibers, are enhancing the performance characteristics of sprayed concrete, leading to improved strength, reduced rebound, faster setting times, and greater durability. High-performance sprayed concrete, including fiber-reinforced sprayed concrete (FRSC) and specialized shotcrete for demanding environments, is gaining traction. Applications span from structural elements in buildings and bridges to critical geotechnical stabilization in mining and tunneling, and essential repair and rehabilitation of existing structures. Unique selling propositions revolve around the speed of application, ability to conform to complex shapes, and cost-effectiveness for specific use cases. Technological advancements are also focusing on eco-friendly and sustainable sprayed concrete solutions, incorporating recycled materials and low-carbon binders.

Key Drivers, Barriers & Challenges in Sprayed Concrete Industry

Key Drivers: The sprayed concrete industry is propelled by significant global investment in infrastructure development, including roads, bridges, and tunnels, where its speed and efficiency are paramount. The expanding mining sector's need for efficient ground support and stabilization, coupled with the ever-present requirement for repairing and rehabilitating aging concrete structures, provides a steady demand. Technological advancements in equipment and admixtures are enhancing performance and cost-effectiveness, while a growing awareness of the benefits of sprayed concrete in terms of durability and reduced environmental impact, particularly in comparison to some traditional methods, further fuels its adoption.

Barriers & Challenges: Significant capital investment for advanced spraying equipment can be a barrier for smaller enterprises. The need for skilled labor and specialized training for optimal application remains a challenge. Stringent environmental regulations concerning dust and material handling can increase operational costs. Fluctuations in raw material prices, particularly cement and aggregates, can impact profitability. Furthermore, competition from established traditional construction methods and emerging alternative materials necessitates continuous innovation and demonstration of sprayed concrete's superior value proposition. Supply chain disruptions for specialized admixtures can also pose a challenge.

Emerging Opportunities in Sprayed Concrete Industry

Emerging opportunities in the sprayed concrete industry lie in the increasing demand for sustainable construction solutions and the development of smart sprayed concrete. Innovations in low-carbon sprayed concrete mixes, utilizing supplementary cementitious materials and recycled aggregates, cater to the growing environmental consciousness in the construction sector. The application of sprayed concrete in prefabricated construction and modular building systems presents a significant untapped market. Furthermore, the integration of sensors and advanced monitoring systems for real-time quality control and performance analysis during and after application offers new avenues for value creation. The use of robotic spraying systems to enhance precision, safety, and efficiency in large-scale or hazardous projects is another promising area. The growing need for protective coatings and specialized linings in industrial applications also presents expanding opportunities.

Growth Accelerators in the Sprayed Concrete Industry Industry

Several key catalysts are accelerating the growth of the sprayed concrete industry. Technological breakthroughs in admixture chemistry, leading to faster setting times, higher strengths, and improved durability, are making sprayed concrete more attractive for a wider range of applications. The increasing global emphasis on infrastructure renewal and expansion, particularly in emerging economies, provides a substantial and sustained demand. Strategic partnerships between equipment manufacturers, admixture suppliers, and construction firms are fostering integrated solutions and driving market adoption. Furthermore, the development of specialized sprayed concrete products for niche markets, such as repair of marine structures and seismic retrofitting, is opening up new revenue streams and expanding the industry's reach. The continuous refinement of robotic and automated spraying systems is also a significant growth accelerator, promising increased efficiency and safety.

Key Players Shaping the Sprayed Concrete Industry Market

- Custom Crete

- Target Products Ltd

- The QUIKRETE Companies

- BASF SE

- The Euclid Chemical Company

- LKAB Berg & Betong

- Cemex

- Sika

- JE Tomes & Associates Inc

- Ductal

- HeidelbergCement

Notable Milestones in Sprayed Concrete Industry Sector

- 2019: Introduction of advanced fiber reinforcement technologies for enhanced sprayed concrete ductility.

- 2020: Increased focus on sustainable admixtures and recycled aggregates in sprayed concrete formulations.

- 2021: Significant advancements in robotic spraying systems for tunnel construction, improving efficiency and safety.

- 2022: Development of self-healing sprayed concrete formulations to extend the lifespan of structures.

- 2023: Growing adoption of sprayed concrete for rapid repair and rehabilitation of critical infrastructure post-natural disasters.

- 2024: Expansion of specialized sprayed concrete applications in precast and modular construction segments.

In-Depth Sprayed Concrete Industry Market Outlook

The outlook for the sprayed concrete industry remains exceptionally positive, driven by a confluence of global megatrends and continuous technological evolution. Future market growth will be significantly influenced by the ongoing global push for infrastructure development and the critical need for repairing and upgrading aging concrete structures. The increasing emphasis on sustainable construction practices will further boost demand for innovative, eco-friendly sprayed concrete solutions. Strategic collaborations and technological advancements in areas like high-performance fibers, advanced admixtures, and automation will unlock new applications and enhance existing ones. The industry is well-positioned to capitalize on these opportunities, offering cost-effective, durable, and versatile solutions for a diverse range of construction challenges worldwide, ensuring sustained and robust market expansion.

Sprayed Concrete Industry Segmentation

-

1. Process

- 1.1. Wet Spraying

- 1.2. Dry Spraying

-

2. End-User Industry

- 2.1. Infrastructure

- 2.2. Mining and Tunneling

- 2.3. Repair and Rehabilitation

- 2.4. Other En

Sprayed Concrete Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Sprayed Concrete Industry Regional Market Share

Geographic Coverage of Sprayed Concrete Industry

Sprayed Concrete Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from the Construction Sector; Growing Mining and Tunnel Activities; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Sprayed Concrete is Costlier than Traditional and Precast Concrete Types.; Environmental Issues Arising from the Dust Released in Dry Process

- 3.4. Market Trends

- 3.4.1. Increasing Demand From Construction Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sprayed Concrete Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. Wet Spraying

- 5.1.2. Dry Spraying

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Infrastructure

- 5.2.2. Mining and Tunneling

- 5.2.3. Repair and Rehabilitation

- 5.2.4. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. Asia Pacific Sprayed Concrete Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Process

- 6.1.1. Wet Spraying

- 6.1.2. Dry Spraying

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. Infrastructure

- 6.2.2. Mining and Tunneling

- 6.2.3. Repair and Rehabilitation

- 6.2.4. Other En

- 6.1. Market Analysis, Insights and Forecast - by Process

- 7. North America Sprayed Concrete Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Process

- 7.1.1. Wet Spraying

- 7.1.2. Dry Spraying

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. Infrastructure

- 7.2.2. Mining and Tunneling

- 7.2.3. Repair and Rehabilitation

- 7.2.4. Other En

- 7.1. Market Analysis, Insights and Forecast - by Process

- 8. Europe Sprayed Concrete Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Process

- 8.1.1. Wet Spraying

- 8.1.2. Dry Spraying

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. Infrastructure

- 8.2.2. Mining and Tunneling

- 8.2.3. Repair and Rehabilitation

- 8.2.4. Other En

- 8.1. Market Analysis, Insights and Forecast - by Process

- 9. South America Sprayed Concrete Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Process

- 9.1.1. Wet Spraying

- 9.1.2. Dry Spraying

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. Infrastructure

- 9.2.2. Mining and Tunneling

- 9.2.3. Repair and Rehabilitation

- 9.2.4. Other En

- 9.1. Market Analysis, Insights and Forecast - by Process

- 10. Middle East and Africa Sprayed Concrete Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Process

- 10.1.1. Wet Spraying

- 10.1.2. Dry Spraying

- 10.2. Market Analysis, Insights and Forecast - by End-User Industry

- 10.2.1. Infrastructure

- 10.2.2. Mining and Tunneling

- 10.2.3. Repair and Rehabilitation

- 10.2.4. Other En

- 10.1. Market Analysis, Insights and Forecast - by Process

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Custom Crete

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Target Products Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The QUIKRETE Companies*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BASF SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Euclid Chemical Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LKAB Berg & Betong

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cemex

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sika

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 JE Tomes & Associates Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ductal

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 HeidelbergCement

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Custom Crete

List of Figures

- Figure 1: Global Sprayed Concrete Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Sprayed Concrete Industry Revenue (Million), by Process 2025 & 2033

- Figure 3: Asia Pacific Sprayed Concrete Industry Revenue Share (%), by Process 2025 & 2033

- Figure 4: Asia Pacific Sprayed Concrete Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 5: Asia Pacific Sprayed Concrete Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 6: Asia Pacific Sprayed Concrete Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Sprayed Concrete Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Sprayed Concrete Industry Revenue (Million), by Process 2025 & 2033

- Figure 9: North America Sprayed Concrete Industry Revenue Share (%), by Process 2025 & 2033

- Figure 10: North America Sprayed Concrete Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 11: North America Sprayed Concrete Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 12: North America Sprayed Concrete Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Sprayed Concrete Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Sprayed Concrete Industry Revenue (Million), by Process 2025 & 2033

- Figure 15: Europe Sprayed Concrete Industry Revenue Share (%), by Process 2025 & 2033

- Figure 16: Europe Sprayed Concrete Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 17: Europe Sprayed Concrete Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 18: Europe Sprayed Concrete Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Sprayed Concrete Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Sprayed Concrete Industry Revenue (Million), by Process 2025 & 2033

- Figure 21: South America Sprayed Concrete Industry Revenue Share (%), by Process 2025 & 2033

- Figure 22: South America Sprayed Concrete Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 23: South America Sprayed Concrete Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 24: South America Sprayed Concrete Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Sprayed Concrete Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Sprayed Concrete Industry Revenue (Million), by Process 2025 & 2033

- Figure 27: Middle East and Africa Sprayed Concrete Industry Revenue Share (%), by Process 2025 & 2033

- Figure 28: Middle East and Africa Sprayed Concrete Industry Revenue (Million), by End-User Industry 2025 & 2033

- Figure 29: Middle East and Africa Sprayed Concrete Industry Revenue Share (%), by End-User Industry 2025 & 2033

- Figure 30: Middle East and Africa Sprayed Concrete Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Sprayed Concrete Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sprayed Concrete Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 2: Global Sprayed Concrete Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 3: Global Sprayed Concrete Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Sprayed Concrete Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 5: Global Sprayed Concrete Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: Global Sprayed Concrete Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Sprayed Concrete Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Sprayed Concrete Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan Sprayed Concrete Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea Sprayed Concrete Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Sprayed Concrete Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Sprayed Concrete Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 13: Global Sprayed Concrete Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 14: Global Sprayed Concrete Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States Sprayed Concrete Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Sprayed Concrete Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico Sprayed Concrete Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Sprayed Concrete Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 19: Global Sprayed Concrete Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 20: Global Sprayed Concrete Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany Sprayed Concrete Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Sprayed Concrete Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: France Sprayed Concrete Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Sprayed Concrete Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of Europe Sprayed Concrete Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global Sprayed Concrete Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 27: Global Sprayed Concrete Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 28: Global Sprayed Concrete Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil Sprayed Concrete Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Argentina Sprayed Concrete Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of South America Sprayed Concrete Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Sprayed Concrete Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 33: Global Sprayed Concrete Industry Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 34: Global Sprayed Concrete Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia Sprayed Concrete Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Africa Sprayed Concrete Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East and Africa Sprayed Concrete Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sprayed Concrete Industry?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Sprayed Concrete Industry?

Key companies in the market include Custom Crete, Target Products Ltd, The QUIKRETE Companies*List Not Exhaustive, BASF SE, The Euclid Chemical Company, LKAB Berg & Betong, Cemex, Sika, JE Tomes & Associates Inc, Ductal, HeidelbergCement.

3. What are the main segments of the Sprayed Concrete Industry?

The market segments include Process, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.29 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from the Construction Sector; Growing Mining and Tunnel Activities; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand From Construction Sector.

7. Are there any restraints impacting market growth?

Sprayed Concrete is Costlier than Traditional and Precast Concrete Types.; Environmental Issues Arising from the Dust Released in Dry Process.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sprayed Concrete Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sprayed Concrete Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sprayed Concrete Industry?

To stay informed about further developments, trends, and reports in the Sprayed Concrete Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence