Key Insights

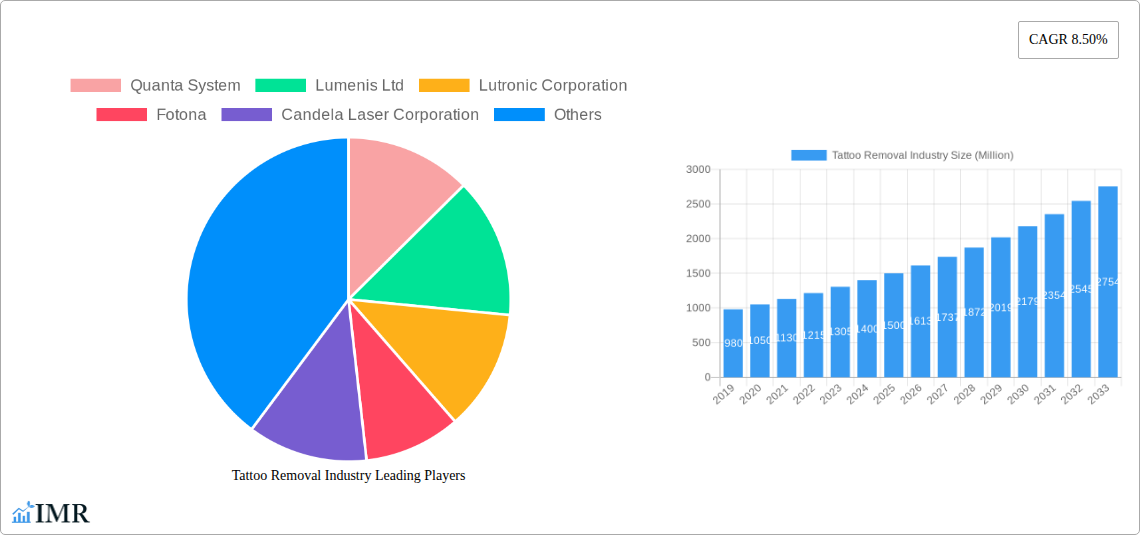

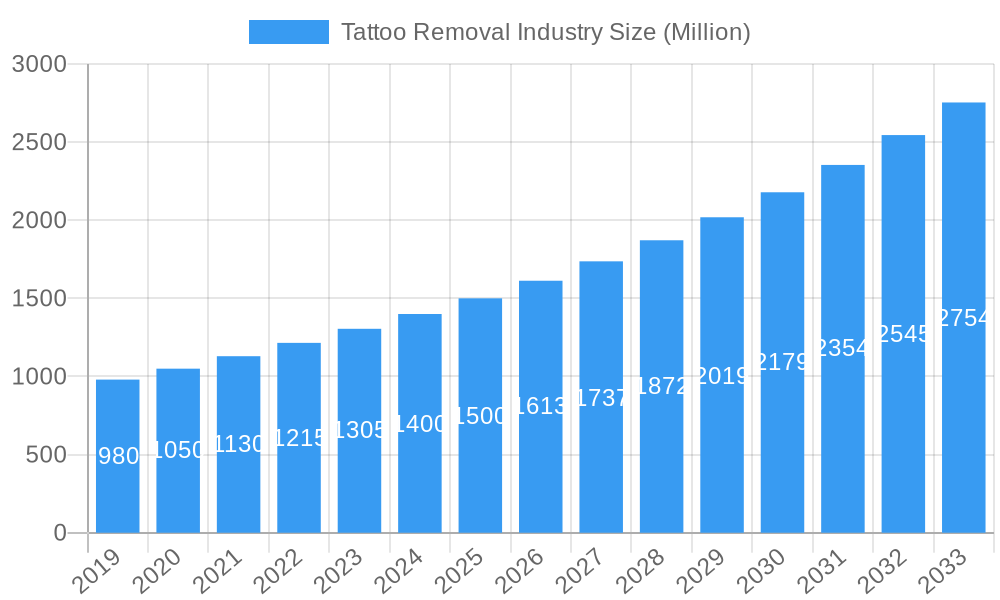

The global Tattoo Removal Industry is poised for significant expansion, projected to reach a substantial market size of approximately $1.5 billion by 2025. This robust growth is fueled by a Compound Annual Growth Rate (CAGR) of 8.50% from 2019 to 2033, indicating a sustained upward trajectory. The increasing prevalence of tattoos, coupled with evolving aesthetic preferences and a growing desire for body modification regret resolution, is a primary driver for this market. Advanced laser and radiofrequency technologies are leading the charge, offering more effective and less invasive removal options than ever before. The rising disposable incomes and a greater willingness among consumers to invest in cosmetic procedures further bolster demand. Hospitals and specialized laser centers are emerging as dominant end-user segments, equipped with the latest machinery and expertise to cater to a broad spectrum of tattoo removal needs. The market's dynamism is evident in the continuous innovation and competitive landscape driven by prominent companies such as Quanta System, Lumenis Ltd, and Candela Laser Corporation, all vying to capture market share through technological advancements and expanded service offerings.

Tattoo Removal Industry Market Size (In Million)

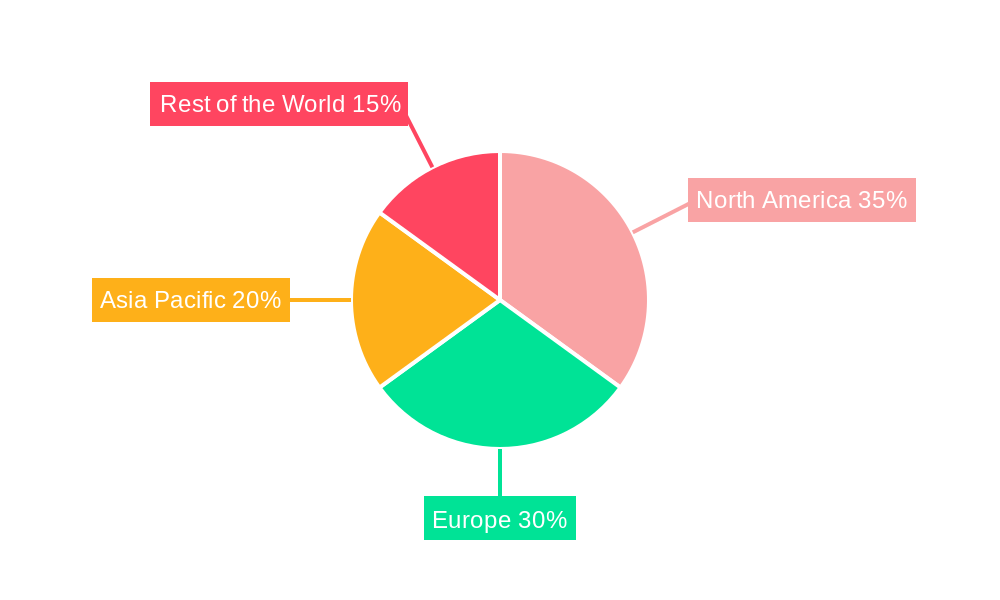

Geographically, North America and Europe currently represent the largest markets, driven by high consumer awareness and accessibility to advanced dermatological services. However, the Asia Pacific region is expected to witness the fastest growth in the coming years, owing to increasing disposable incomes, a burgeoning middle class, and a growing acceptance of cosmetic procedures. While the market is characterized by strong growth drivers, certain restraints, such as the high cost of removal procedures and the potential for side effects, may temper the pace of adoption in some demographics. Nonetheless, the overall outlook for the Tattoo Removal Industry remains exceptionally positive, with continuous technological improvements and a growing societal acceptance of tattoo removal as a viable aesthetic solution promising sustained market expansion throughout the forecast period. The industry's evolution will be closely watched, with innovations in energy-based devices and personalized treatment protocols shaping its future.

Tattoo Removal Industry Company Market Share

Tattoo Removal Industry: Comprehensive Market Analysis and Forecast (2019–2033)

This in-depth report provides a detailed examination of the global tattoo removal market, encompassing its current state, historical trajectory, and projected future. We delve into key market dynamics, growth trends, regional dominance, product innovations, and the strategic landscape of major players. With a robust forecast period from 2025 to 2033, this report offers actionable insights for stakeholders, including laser tattoo removal companies, dermatology clinics, hospitals and laser centers, and medical device manufacturers involved in the aesthetic and cosmetic surgery sectors. Our analysis prioritizes high-traffic keywords relevant to laser hair removal, skin rejuvenation, and body modification procedures to maximize SEO visibility.

Tattoo Removal Industry Market Dynamics & Structure

The tattoo removal industry exhibits a moderately fragmented market structure, characterized by a blend of established multinational corporations and emerging specialized providers. Technological innovation, particularly in laser technology and non-invasive aesthetic procedures, serves as a primary driver, pushing the boundaries of efficacy and patient comfort. Regulatory frameworks, including FDA approvals for medical devices and adherence to cosmetic treatment standards, influence market entry and product development. The prevalence of highly effective laser tattoo removal systems like those from Quanta System, Lumenis Ltd, Lutronic Corporation, Fotona, and Candela Laser Corporation, presents a competitive landscape where differentiation hinges on advanced features and demonstrable patient outcomes.

- Market Concentration: Moderate fragmentation with key players dominating specific technological niches.

- Technological Innovation Drivers: Advancements in picosecond lasers, Q-switched lasers, and radiofrequency devices are crucial for improved ink shattering and reduced side effects.

- Regulatory Frameworks: Stringent approval processes for medical devices and adherence to aesthetic treatment guidelines impact product launches and market access.

- Competitive Product Substitutes: While laser removal is dominant, emerging chemical peels and surgical excision are minor substitutes, largely limited by invasiveness and scarring potential.

- End-User Demographics: Primarily driven by individuals seeking to remove unwanted tattoos due to changing life circumstances, career aspirations, or aesthetic dissatisfaction. Age demographics skew towards millennials and Gen Z, who represent a significant portion of the tattooed population.

- M&A Trends: Consolidation is observed as larger entities acquire innovative startups to expand their product portfolios and market reach within the dermatology and cosmetic procedures market.

Tattoo Removal Industry Growth Trends & Insights

The tattoo removal industry is poised for robust growth, driven by an increasing acceptance of tattoo removal as a viable and accessible aesthetic procedure. The market size is projected to expand significantly, fueled by escalating consumer demand and continuous technological advancements in tattoo removal lasers. Adoption rates are accelerating as awareness of effective and less painful removal techniques spreads globally. Technological disruptions, including the development of faster laser systems and multi-wavelength devices, are enhancing treatment efficiency and client satisfaction, leading to higher treatment completion rates. Consumer behavior shifts are notable, with a growing segment of the population viewing tattoo removal not just as a solution for regret but as part of a comprehensive aesthetic management approach.

The global tattoo removal market size was valued at an estimated $500 million in 2023 and is forecasted to reach $1.2 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 9.5% during the forecast period. This expansion is underpinned by several key trends. Firstly, the increasing prevalence of tattoos among younger demographics, coupled with evolving societal attitudes and career aspirations, is creating a sustained demand for removal services. Secondly, advancements in laser tattoo removal technology, such as the introduction of picosecond lasers, have dramatically improved treatment outcomes, reducing the number of sessions required and minimizing side effects like scarring and hyperpigmentation. This technological leap has broadened the appeal of tattoo removal, making it a more attractive option for a wider range of individuals.

Furthermore, the aesthetic medicine market is experiencing a surge in demand for non-invasive and minimally invasive procedures. Tattoo removal fits perfectly within this trend, offering a comparatively less invasive alternative to surgical excision. The dermatology and cosmetic surgery clinics are increasingly investing in state-of-the-art tattoo removal devices to cater to this growing demand. The hospitals and laser centers segment also plays a crucial role, providing a trusted medical environment for these procedures. The parent market for tattoo removal includes the broader aesthetic and cosmetic surgery industry, while the child market focuses specifically on devices and services for tattoo and other pigmentary lesion removal. Market penetration is expected to deepen as more individuals gain access to information about effective removal methods and financing options. The shift towards personalized aesthetic treatments also contributes, as consumers seek tailored solutions for their specific tattoo characteristics.

Dominant Regions, Countries, or Segments in Tattoo Removal Industry

The North America region currently dominates the tattoo removal industry, driven by a mature aesthetic market, high disposable incomes, and a significant tattooed population. The United States, in particular, accounts for a substantial share of the global market. Key drivers of this dominance include strong consumer awareness of advanced laser tattoo removal treatments, a well-established network of dermatology clinics and specialized laser centers, and proactive adoption of new technologies by both practitioners and patients. The presence of leading tattoo removal device manufacturers and a favorable regulatory environment further bolster its leading position.

- Dominant Region: North America (specifically the United States)

- Market Share: Estimated 40% of the global tattoo removal market in the base year 2025.

- Key Drivers:

- High disposable income and consumer spending on aesthetic procedures.

- Significant prevalence of tattoos across various age groups.

- Early adoption and widespread availability of advanced laser tattoo removal technology, including picosecond and nanosecond lasers.

- Robust healthcare infrastructure with a high concentration of specialized dermatology clinics and cosmetic surgery centers.

- Effective marketing and public awareness campaigns highlighting the benefits of professional tattoo removal.

- Presence of key industry players and research & development hubs.

The Laser device segment within the Device category is the undisputed leader, accounting for an estimated 85% of the tattoo removal market share in 2025. This dominance is attributed to the superior efficacy of laser technology in shattering tattoo ink particles into smaller fragments that the body can naturally eliminate. Picosecond lasers and advanced Q-switched lasers offer faster treatment times, fewer sessions, and a reduced risk of scarring compared to other modalities. Radiofrequency devices represent a smaller but growing segment, often used in combination therapies or for specific skin concerns.

- Dominant Device Segment: Laser Devices

- Market Share (2025): Approximately 85%

- Growth Potential: Continuous innovation in laser wavelengths, pulse durations, and energy delivery systems to target a wider spectrum of ink colors and depths.

- Technological Advancements: Emphasis on multi-wavelength lasers for comprehensive ink removal and dual-mode systems offering both picosecond and nanosecond functionalities.

Within the End User segment, Hospitals and Laser Centers hold a significant market share, estimated at 45% in 2025, due to their comprehensive medical facilities and the presence of experienced medical professionals. Dermatology Clinics follow closely, accounting for approximately 40% of the market, as they specialize in skin treatments and often offer cutting-edge aesthetic procedures. The remaining share is captured by other specialized centers.

- Dominant End User Segment: Hospitals and Laser Centers

- Market Share (2025): Approximately 45%

- Key Strengths: Access to advanced medical equipment, multidisciplinary expertise, and established patient trust.

- Growth Factors: Increasing integration of aesthetic services within hospital settings and specialized laser centers offering dedicated tattoo removal programs.

Tattoo Removal Industry Product Landscape

The tattoo removal industry is characterized by a dynamic product landscape driven by continuous technological innovation in laser devices. Leading companies are focusing on developing advanced picosecond and nanosecond lasers with multiple wavelengths and adjustable pulse durations to effectively target a broad spectrum of tattoo ink colors and depths, including challenging hues like green and blue. These devices boast enhanced energy delivery systems and safety features to minimize side effects such as scarring, skin lightening, and burns. The unique selling propositions of these products lie in their speed of treatment, efficacy across diverse tattoo types, and improved patient comfort, leading to shorter treatment cycles and higher patient satisfaction. Alma Lasers Ltd and Hologic Inc (CynoSure Inc ) are prominent players in this segment, continually refining their laser tattoo removal systems to meet evolving market demands.

Key Drivers, Barriers & Challenges in Tattoo Removal Industry

Key Drivers:

- Technological Advancements: The development and refinement of advanced laser technologies, particularly picosecond lasers, are crucial. These lasers offer faster ink fragmentation, reduced treatment sessions, and a lower risk of side effects, making tattoo removal more effective and appealing.

- Increasing Tattoo Prevalence: A rising global trend of tattoo adoption, especially among younger demographics, directly translates into a larger pool of individuals seeking removal services later in life due to changing preferences or life events.

- Growing Aesthetic Awareness: Enhanced consumer awareness of and demand for non-invasive and minimally invasive aesthetic procedures, including skin rejuvenation and body modification treatments, fuels the tattoo removal market.

- Improved Device Efficacy & Safety: Innovations leading to safer and more effective devices with fewer side effects contribute to higher patient acceptance and satisfaction.

Barriers & Challenges:

- High Cost of Treatment: The multi-session nature and sophisticated technology involved can make tattoo removal an expensive procedure, posing a barrier for some potential clients. The average cost can range from $300 to $600 per session, with multiple sessions required.

- Regulatory Hurdles and Safety Concerns: Stringent regulatory approval processes for medical aesthetic devices and the inherent risks of skin damage (scarring, discoloration) if treatments are not performed correctly create challenges.

- Limited Insurance Coverage: Tattoo removal is often considered a cosmetic procedure and is rarely covered by health insurance, further increasing the out-of-pocket expense for consumers.

- Competition from Black Market/Unqualified Providers: The presence of less regulated and unqualified providers offering cheaper but potentially dangerous treatments can undermine the professional market and lead to adverse outcomes.

Emerging Opportunities in Tattoo Removal Industry

Emerging opportunities within the tattoo removal industry lie in the development of more targeted and efficient laser systems capable of removing a wider array of ink colors, including challenging shades like vibrant greens and blues, with fewer sessions. The integration of AI and machine learning in tattoo removal devices to personalize treatment protocols based on tattoo characteristics, skin type, and individual response presents a significant avenue for innovation. Furthermore, exploring synergistic treatment approaches, such as combining different laser modalities or integrating radiofrequency or ultrasound technologies, could enhance efficacy and reduce treatment times. Untapped markets in developing economies with growing disposable incomes and increasing adoption of aesthetic procedures also offer substantial growth potential. The expansion of mobile tattoo removal services or partnerships with tattoo parlors for fading services prior to cover-ups also represent niche opportunities.

Growth Accelerators in the Tattoo Removal Industry Industry

Several key accelerators are poised to propel the tattoo removal industry forward. Technological breakthroughs in laser physics and energy delivery systems are continuously improving the speed and effectiveness of ink eradication, making treatments more efficient and less burdensome for patients. Strategic partnerships between device manufacturers like Lumenis Ltd and Quanta System and prominent dermatology clinics and cosmetic surgery centers are expanding market reach and facilitating the adoption of the latest tattoo removal technologies. Furthermore, the increasing acceptance of tattoo removal as a standard aesthetic procedure, driven by a growing awareness of its benefits and the successful outcomes achieved by leading players like Cutera Inc and Fotona, is creating a sustained demand. The development of more affordable and accessible treatment options, potentially through innovative financing models or optimized treatment protocols, will also serve as a significant growth accelerator.

Key Players Shaping the Tattoo Removal Industry Market

- Quanta System

- Lumenis Ltd

- Lutronic Corporation

- Fotona

- Candela Laser Corporation

- Syneron Medical Ltd

- Cutera Inc

- Eclipse Lasers Ltd

- Astanza

- EL En SpA

- Hologic Inc (CynoSure Inc )

- Alma Lasers Ltd

- Asclepion Laser Technologies GMBH

Notable Milestones in Tattoo Removal Industry Sector

- March 2022: Delete Tattoo Removal & Medical Salon launched the "Delete Method," a new laser technique designed to minimize side effects such as scarring, skin lightening, burns, and skin darkening, enhancing patient safety and satisfaction.

- March 2022: Navarre Beach Tattoo Company expanded its service offerings to include laser tattoo removal and fading for cover-ups, utilizing the Astanza Duality laser. This laser's ultra-quick pulse durations, versatile wavelengths, and high peak power are noted for effectively shattering tattoo ink without damaging surrounding skin tissue.

In-Depth Tattoo Removal Industry Market Outlook

The tattoo removal industry is set for substantial growth, driven by a confluence of technological innovation, evolving consumer preferences, and expanding market access. The continuous refinement of laser tattoo removal devices, focusing on speed, efficacy, and reduced side effects, remains a primary growth catalyst. Strategic expansions by key players into untapped geographical regions and the increasing integration of tattoo removal services into broader aesthetic treatment portfolios will further accelerate market penetration. The growing understanding of tattoo removal as a legitimate and effective aesthetic procedure, coupled with the increasing number of individuals seeking to revise or remove unwanted tattoos, creates a fertile ground for future development. Companies that invest in research and development for next-generation tattoo removal technologies, explore synergistic treatment modalities, and focus on enhancing patient experience are well-positioned to capitalize on the projected market expansion in the coming years.

Tattoo Removal Industry Segmentation

-

1. Device

- 1.1. Laser

- 1.2. Radiofrequency

- 1.3. Other Devices

-

2. End User

- 2.1. Hospitals and Laser Centers

- 2.2. Dermatology Clinics

Tattoo Removal Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of the World

Tattoo Removal Industry Regional Market Share

Geographic Coverage of Tattoo Removal Industry

Tattoo Removal Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Employment Policies Refraining Tattoos; Changes in Lifestyles and Trends; Increasing Errors in Digital Body Sensing Devices Leading to Incorrect Results

- 3.3. Market Restrains

- 3.3.1. Excessive Cost Of The Procedures; Side Effects of Tattoo Removal

- 3.4. Market Trends

- 3.4.1. Laser Devices Segment is Expected to Hold a Significant Market Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tattoo Removal Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device

- 5.1.1. Laser

- 5.1.2. Radiofrequency

- 5.1.3. Other Devices

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals and Laser Centers

- 5.2.2. Dermatology Clinics

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Device

- 6. North America Tattoo Removal Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device

- 6.1.1. Laser

- 6.1.2. Radiofrequency

- 6.1.3. Other Devices

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals and Laser Centers

- 6.2.2. Dermatology Clinics

- 6.1. Market Analysis, Insights and Forecast - by Device

- 7. Europe Tattoo Removal Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device

- 7.1.1. Laser

- 7.1.2. Radiofrequency

- 7.1.3. Other Devices

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals and Laser Centers

- 7.2.2. Dermatology Clinics

- 7.1. Market Analysis, Insights and Forecast - by Device

- 8. Asia Pacific Tattoo Removal Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device

- 8.1.1. Laser

- 8.1.2. Radiofrequency

- 8.1.3. Other Devices

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals and Laser Centers

- 8.2.2. Dermatology Clinics

- 8.1. Market Analysis, Insights and Forecast - by Device

- 9. Rest of the World Tattoo Removal Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device

- 9.1.1. Laser

- 9.1.2. Radiofrequency

- 9.1.3. Other Devices

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals and Laser Centers

- 9.2.2. Dermatology Clinics

- 9.1. Market Analysis, Insights and Forecast - by Device

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Quanta System

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Lumenis Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Lutronic Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Fotona

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Candela Laser Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Syneron Medical Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Cutera Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Eclipse Lasers Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Astanza

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 EL En SpA

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Hologic Inc (CynoSure Inc )

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Alma Lasers Ltd

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Asclepion Laser Technologies GMBH

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Quanta System

List of Figures

- Figure 1: Global Tattoo Removal Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Tattoo Removal Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Tattoo Removal Industry Revenue (undefined), by Device 2025 & 2033

- Figure 4: North America Tattoo Removal Industry Volume (K Unit), by Device 2025 & 2033

- Figure 5: North America Tattoo Removal Industry Revenue Share (%), by Device 2025 & 2033

- Figure 6: North America Tattoo Removal Industry Volume Share (%), by Device 2025 & 2033

- Figure 7: North America Tattoo Removal Industry Revenue (undefined), by End User 2025 & 2033

- Figure 8: North America Tattoo Removal Industry Volume (K Unit), by End User 2025 & 2033

- Figure 9: North America Tattoo Removal Industry Revenue Share (%), by End User 2025 & 2033

- Figure 10: North America Tattoo Removal Industry Volume Share (%), by End User 2025 & 2033

- Figure 11: North America Tattoo Removal Industry Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Tattoo Removal Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Tattoo Removal Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Tattoo Removal Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Tattoo Removal Industry Revenue (undefined), by Device 2025 & 2033

- Figure 16: Europe Tattoo Removal Industry Volume (K Unit), by Device 2025 & 2033

- Figure 17: Europe Tattoo Removal Industry Revenue Share (%), by Device 2025 & 2033

- Figure 18: Europe Tattoo Removal Industry Volume Share (%), by Device 2025 & 2033

- Figure 19: Europe Tattoo Removal Industry Revenue (undefined), by End User 2025 & 2033

- Figure 20: Europe Tattoo Removal Industry Volume (K Unit), by End User 2025 & 2033

- Figure 21: Europe Tattoo Removal Industry Revenue Share (%), by End User 2025 & 2033

- Figure 22: Europe Tattoo Removal Industry Volume Share (%), by End User 2025 & 2033

- Figure 23: Europe Tattoo Removal Industry Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Tattoo Removal Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Tattoo Removal Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Tattoo Removal Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Tattoo Removal Industry Revenue (undefined), by Device 2025 & 2033

- Figure 28: Asia Pacific Tattoo Removal Industry Volume (K Unit), by Device 2025 & 2033

- Figure 29: Asia Pacific Tattoo Removal Industry Revenue Share (%), by Device 2025 & 2033

- Figure 30: Asia Pacific Tattoo Removal Industry Volume Share (%), by Device 2025 & 2033

- Figure 31: Asia Pacific Tattoo Removal Industry Revenue (undefined), by End User 2025 & 2033

- Figure 32: Asia Pacific Tattoo Removal Industry Volume (K Unit), by End User 2025 & 2033

- Figure 33: Asia Pacific Tattoo Removal Industry Revenue Share (%), by End User 2025 & 2033

- Figure 34: Asia Pacific Tattoo Removal Industry Volume Share (%), by End User 2025 & 2033

- Figure 35: Asia Pacific Tattoo Removal Industry Revenue (undefined), by Country 2025 & 2033

- Figure 36: Asia Pacific Tattoo Removal Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Tattoo Removal Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Tattoo Removal Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Rest of the World Tattoo Removal Industry Revenue (undefined), by Device 2025 & 2033

- Figure 40: Rest of the World Tattoo Removal Industry Volume (K Unit), by Device 2025 & 2033

- Figure 41: Rest of the World Tattoo Removal Industry Revenue Share (%), by Device 2025 & 2033

- Figure 42: Rest of the World Tattoo Removal Industry Volume Share (%), by Device 2025 & 2033

- Figure 43: Rest of the World Tattoo Removal Industry Revenue (undefined), by End User 2025 & 2033

- Figure 44: Rest of the World Tattoo Removal Industry Volume (K Unit), by End User 2025 & 2033

- Figure 45: Rest of the World Tattoo Removal Industry Revenue Share (%), by End User 2025 & 2033

- Figure 46: Rest of the World Tattoo Removal Industry Volume Share (%), by End User 2025 & 2033

- Figure 47: Rest of the World Tattoo Removal Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Rest of the World Tattoo Removal Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Rest of the World Tattoo Removal Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of the World Tattoo Removal Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Tattoo Removal Industry Revenue undefined Forecast, by Device 2020 & 2033

- Table 2: Global Tattoo Removal Industry Volume K Unit Forecast, by Device 2020 & 2033

- Table 3: Global Tattoo Removal Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Global Tattoo Removal Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 5: Global Tattoo Removal Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Tattoo Removal Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Tattoo Removal Industry Revenue undefined Forecast, by Device 2020 & 2033

- Table 8: Global Tattoo Removal Industry Volume K Unit Forecast, by Device 2020 & 2033

- Table 9: Global Tattoo Removal Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 10: Global Tattoo Removal Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 11: Global Tattoo Removal Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Tattoo Removal Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Tattoo Removal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States Tattoo Removal Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Tattoo Removal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Tattoo Removal Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Tattoo Removal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Tattoo Removal Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Tattoo Removal Industry Revenue undefined Forecast, by Device 2020 & 2033

- Table 20: Global Tattoo Removal Industry Volume K Unit Forecast, by Device 2020 & 2033

- Table 21: Global Tattoo Removal Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 22: Global Tattoo Removal Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 23: Global Tattoo Removal Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Tattoo Removal Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Tattoo Removal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Germany Tattoo Removal Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Tattoo Removal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Tattoo Removal Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Tattoo Removal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: France Tattoo Removal Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Tattoo Removal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Italy Tattoo Removal Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Tattoo Removal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Spain Tattoo Removal Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Tattoo Removal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Tattoo Removal Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Tattoo Removal Industry Revenue undefined Forecast, by Device 2020 & 2033

- Table 38: Global Tattoo Removal Industry Volume K Unit Forecast, by Device 2020 & 2033

- Table 39: Global Tattoo Removal Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 40: Global Tattoo Removal Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 41: Global Tattoo Removal Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Global Tattoo Removal Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Tattoo Removal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: China Tattoo Removal Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Tattoo Removal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Japan Tattoo Removal Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Tattoo Removal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: India Tattoo Removal Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Tattoo Removal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Australia Tattoo Removal Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Tattoo Removal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: South Korea Tattoo Removal Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Tattoo Removal Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Tattoo Removal Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Tattoo Removal Industry Revenue undefined Forecast, by Device 2020 & 2033

- Table 56: Global Tattoo Removal Industry Volume K Unit Forecast, by Device 2020 & 2033

- Table 57: Global Tattoo Removal Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 58: Global Tattoo Removal Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 59: Global Tattoo Removal Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Tattoo Removal Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tattoo Removal Industry?

The projected CAGR is approximately 10.26%.

2. Which companies are prominent players in the Tattoo Removal Industry?

Key companies in the market include Quanta System, Lumenis Ltd, Lutronic Corporation, Fotona, Candela Laser Corporation, Syneron Medical Ltd, Cutera Inc, Eclipse Lasers Ltd, Astanza, EL En SpA, Hologic Inc (CynoSure Inc ), Alma Lasers Ltd, Asclepion Laser Technologies GMBH.

3. What are the main segments of the Tattoo Removal Industry?

The market segments include Device, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Employment Policies Refraining Tattoos; Changes in Lifestyles and Trends; Increasing Errors in Digital Body Sensing Devices Leading to Incorrect Results.

6. What are the notable trends driving market growth?

Laser Devices Segment is Expected to Hold a Significant Market Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Excessive Cost Of The Procedures; Side Effects of Tattoo Removal.

8. Can you provide examples of recent developments in the market?

In March 2022, Delete Tattoo Removal & Medical Salon launched a new method called the Delete Method. This special laser minimizes common side effects of other laser tattoo removal technology, like scarring, skin lightening, burns, and skin darkening.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tattoo Removal Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tattoo Removal Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tattoo Removal Industry?

To stay informed about further developments, trends, and reports in the Tattoo Removal Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence