Key Insights

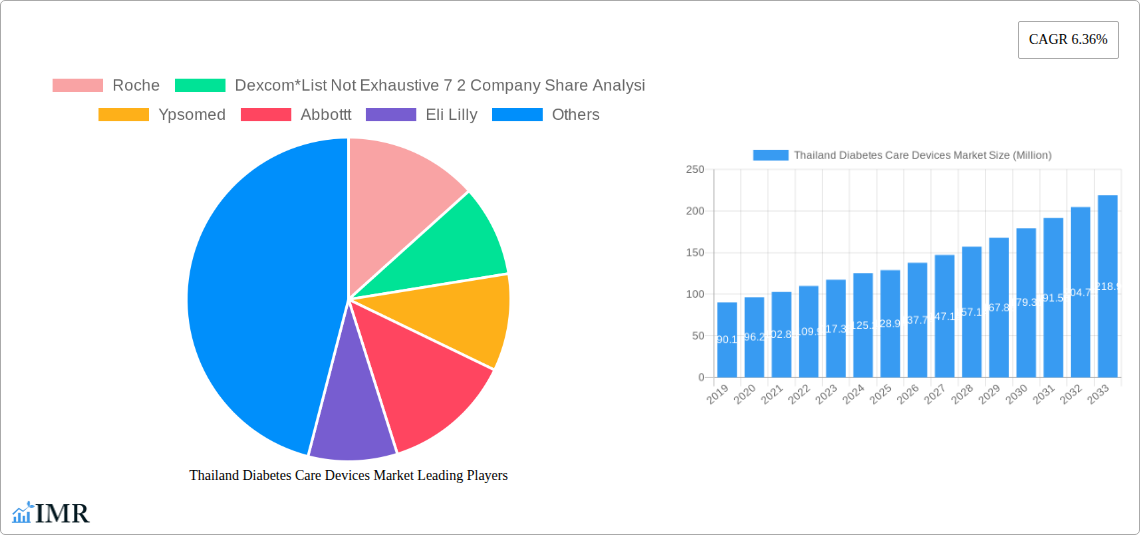

The Thailand Diabetes Care Devices Market is poised for significant expansion, projected to reach an estimated market size of USD 128.94 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 6.36% through 2033. This growth trajectory is primarily fueled by the increasing prevalence of diabetes in Thailand, a growing awareness of proactive diabetes management, and the subsequent demand for advanced monitoring and management solutions. Key market drivers include the rising incidence of Type 1 and Type 2 diabetes, an aging population increasingly susceptible to chronic conditions, and a growing middle class with greater purchasing power and access to healthcare. Furthermore, favorable government initiatives promoting preventative healthcare and the availability of innovative diabetes care technologies are contributing to market expansion. The market's dynamism is also influenced by continuous technological advancements in glucose monitoring and insulin delivery systems, making them more accessible, user-friendly, and effective for patients.

Thailand Diabetes Care Devices Market Market Size (In Million)

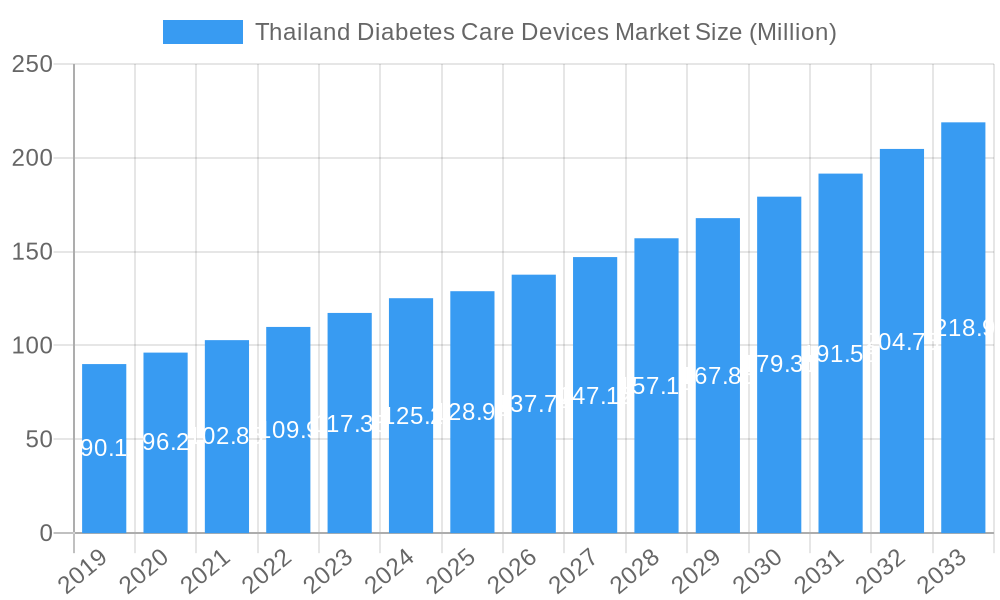

The market landscape is segmented into two primary categories: Monitoring Devices and Management Devices. Within monitoring devices, Self-monitoring Blood Glucose Devices, encompassing glucometers, test strips, and lancets, continue to hold a substantial share due to their affordability and widespread adoption. However, Continuous Blood Glucose Monitoring (CGM) systems, including advanced sensors and durable components, are experiencing rapid growth, driven by their superior accuracy, real-time data insights, and improved patient outcomes. On the management device front, insulin pumps, their reservoirs, and infusion sets are gaining traction, offering more precise and automated insulin delivery compared to traditional methods like insulin syringes, cartridges, and disposable pens. Key players such as Roche, Dexcom, Abbott, and Medtronic are at the forefront of innovation, introducing cutting-edge products and expanding their market reach within Thailand. The competitive landscape is characterized by strategic partnerships, product launches, and a focus on enhancing patient convenience and therapeutic efficacy.

Thailand Diabetes Care Devices Market Company Market Share

This in-depth report delivers an exhaustive analysis of the Thailand Diabetes Care Devices Market, providing critical insights into its current landscape, historical performance, and projected trajectory through 2033. Covering both parent market and child market segments, this study offers unparalleled detail for stakeholders seeking to navigate this dynamic sector. We meticulously examine the monitoring devices (including Self-monitoring Blood Glucose Devices like glucometer devices, test strips, lancets, and Continuous Blood Glucose Monitoring such as sensors and durables) and management devices (including insulin pump systems like insulin pump devices, insulin pump reservoirs, infusion sets, insulin syringes, insulin cartridges, and disposable pens). All values are presented in Million units, offering clear quantitative understanding.

Thailand Diabetes Care Devices Market Market Dynamics & Structure

The Thailand Diabetes Care Devices Market is characterized by a moderately concentrated structure, with key players like Roche, Dexcom, Ypsomed, Abbott, Eli Lilly, Sanofi, Medtronic, Tandem, Insulet, Lifescan (Johnson & Johnson), Becton and Dickinson, and Novo Nordisk driving innovation and market share. Technological innovation serves as a primary growth engine, with continuous advancements in continuous blood glucose monitoring (CGM) and insulin delivery systems enhancing patient outcomes and market adoption. The regulatory framework, overseen by the Thailand Food and Drug Administration (TFDA), plays a crucial role in market access and product approval, influencing the pace of new product introductions. Competitive product substitutes exist, particularly between traditional self-monitoring blood glucose (SMBG) devices and newer CGM technologies, offering varied price points and functionalities to cater to diverse patient needs. End-user demographics are shifting towards an aging population and a rising prevalence of type 2 diabetes, demanding more sophisticated and user-friendly diabetes management solutions. Mergers and acquisitions (M&A) trends, while not as prevalent as in more mature markets, are anticipated to increase as companies seek to consolidate market positions and acquire innovative technologies. For instance, collaborations like the one between Phillips-Medisize and GlucoModicum for a novel CGM device underscore the ongoing drive for innovation. Barriers to entry include high R&D costs, stringent regulatory approvals, and the need for extensive clinical validation.

- Market Concentration: Moderately concentrated with dominant global players.

- Technological Innovation Drivers: Advancements in CGM, smart insulin pens, and connected diabetes management platforms.

- Regulatory Frameworks: TFDA oversight impacting product approvals and market access.

- Competitive Product Substitutes: SMBG vs. CGM, traditional insulin delivery vs. advanced pumps.

- End-User Demographics: Increasing prevalence of diabetes, aging population, and demand for personalized care.

- M&A Trends: Growing interest in strategic partnerships and acquisitions to enhance product portfolios and market reach.

Thailand Diabetes Care Devices Market Growth Trends & Insights

The Thailand Diabetes Care Devices Market has witnessed consistent growth driven by an escalating diabetes burden and increasing awareness of advanced diabetes management technologies. The market size is projected to expand significantly, fueled by a rising adoption rate of both self-monitoring blood glucose (SMBG) and continuous blood glucose monitoring (CGM) systems. Technological disruptions, particularly the integration of artificial intelligence and smartphone connectivity into diabetes devices, are transforming patient care and driving demand for smarter solutions. Consumer behavior shifts are evident, with a growing preference for non-invasive or minimally invasive monitoring, improved data management capabilities, and personalized treatment approaches. The historical period (2019-2024) has laid the foundation for robust growth, with the base year of 2025 setting the stage for an accelerated trajectory during the forecast period (2025-2033). We anticipate a Compound Annual Growth Rate (CAGR) of xx% for the parent market and xx% for key child markets such as CGM devices. Market penetration for advanced devices like insulin pumps is expected to rise from xx% in 2025 to xx% by 2033. This growth is underpinned by increasing healthcare expenditure, government initiatives promoting diabetes awareness and management, and the availability of innovative insulin delivery devices like disposable pens and insulin cartridges. The shift from reactive to proactive diabetes management, empowered by real-time data from CGM sensors, is a significant trend reshaping the market landscape. Furthermore, the increasing affordability and accessibility of these devices, coupled with enhanced patient education, are contributing to a wider adoption across different socioeconomic segments.

Dominant Regions, Countries, or Segments in Thailand Diabetes Care Devices Market

The Monitoring Devices segment, particularly Continuous Blood Glucose Monitoring (CGM), is emerging as a dominant force driving growth within the Thailand Diabetes Care Devices Market. Within this segment, CGM Sensors and CGM Durables are experiencing rapid expansion due to their ability to provide real-time glucose data, reducing the need for frequent finger pricks and enabling better glycemic control. The widespread adoption of CGM is propelled by its superior accuracy, trend analysis capabilities, and integration with smart devices, allowing for proactive management of hyperglycemia and hypoglycemia. Geographically, major urban centers such as Bangkok, Chiang Mai, and Phuket are leading the adoption of advanced diabetes care devices due to higher disposable incomes, greater access to healthcare facilities, and increased awareness of cutting-edge medical technologies. The Management Devices segment, especially Insulin Pumps and Disposable Pens, also contributes significantly to market growth, offering more convenient and precise insulin delivery compared to traditional methods. The increasing prevalence of type 1 diabetes and a growing number of type 2 diabetes patients requiring intensive insulin therapy are key drivers for these products. Economic policies that support healthcare infrastructure development and subsidies for chronic disease management further bolster market expansion. The competitive landscape within these dominant segments is characterized by intense innovation and a focus on user-centric designs. For example, the recent approval of an Insulin Pen by the TFDA, suitable for Gan & Lee's 3mL cartridge insulin penfill, highlights the growing availability of advanced insulin delivery options that cater to precise dosing needs, further solidifying the dominance of innovative management devices. The Thai government's focus on improving public health outcomes and its investment in healthcare infrastructure are crucial factors enabling greater market penetration for both monitoring and management devices across the country.

- Dominant Segment: Continuous Blood Glucose Monitoring (CGM)

- Key Drivers: Real-time data, improved glycemic control, trend analysis, smartphone integration.

- Sub-Segments: CGM Sensors, CGM Durables.

- Dominant Regions: Major urban centers like Bangkok, Chiang Mai, Phuket.

- Key Drivers: Higher disposable income, advanced healthcare access, awareness of new technologies.

- Key Growth Area in Management Devices: Insulin Pumps and Disposable Pens.

- Drivers: Precision dosing, convenience, type 1 and advanced type 2 diabetes management.

Thailand Diabetes Care Devices Market Product Landscape

The product landscape of the Thailand Diabetes Care Devices Market is evolving rapidly with a strong emphasis on miniaturization, connectivity, and user-friendliness. Innovations in Continuous Blood Glucose Monitoring (CGM) are leading the charge, with new sensors offering extended wear times and improved accuracy. Glucometer devices are becoming smarter, featuring Bluetooth connectivity for seamless data transfer to mobile applications, facilitating better patient engagement and remote monitoring by healthcare providers. In the realm of management devices, insulin pumps are becoming more sophisticated, with advanced algorithms that can predict glucose trends and automate insulin delivery. Disposable pens and insulin cartridges are designed for precise and convenient dosing, simplifying insulin administration for patients of all ages. The integration of AI and machine learning into these devices is enabling personalized treatment recommendations and predictive analytics. Unique selling propositions revolve around reduced invasiveness, enhanced data accuracy, and seamless integration within the digital health ecosystem.

Key Drivers, Barriers & Challenges in Thailand Diabetes Care Devices Market

Key Drivers:

- Rising Diabetes Prevalence: The increasing incidence of diabetes in Thailand is the primary driver, necessitating advanced care devices.

- Technological Advancements: Continuous innovation in CGM and insulin delivery systems offers improved patient outcomes and convenience.

- Government Initiatives: Growing focus on chronic disease management and public health awareness campaigns.

- Increased Healthcare Expenditure: Higher disposable incomes and private healthcare spending support the adoption of premium devices.

Key Barriers & Challenges:

- High Cost of Advanced Devices: The initial investment for CGM and insulin pumps can be a significant barrier for a portion of the population.

- Regulatory Hurdles: Stringent approval processes for new medical devices can delay market entry.

- Limited Reimbursement Policies: Inadequate or inconsistent insurance coverage for advanced diabetes care devices.

- Healthcare Professional Training: Need for comprehensive training for healthcare providers to effectively utilize and recommend new technologies.

- Supply Chain Disruptions: Potential for interruptions in the global supply chain impacting the availability of essential components and finished products.

Emerging Opportunities in Thailand Diabetes Care Devices Market

Emerging opportunities in the Thailand Diabetes Care Devices Market lie in the development of more affordable and accessible CGM systems for a broader patient base. The untapped potential of remote patient monitoring platforms, integrating diabetes data with other health metrics, presents a significant avenue for growth. Furthermore, the increasing demand for personalized diabetes management solutions, driven by AI-powered analytics and tailored educational content, offers fertile ground for innovation. Expansion into rural and underserved areas with targeted distribution strategies and partnerships with local healthcare providers can unlock new market segments. The growing interest in preventative healthcare and early detection of diabetes complications also presents opportunities for integrated diagnostic and monitoring devices.

Growth Accelerators in the Thailand Diabetes Care Devices Market Industry

Growth accelerators in the Thailand Diabetes Care Devices Market include strategic partnerships between device manufacturers and healthcare providers to enhance patient education and support programs. Technological breakthroughs in sensor accuracy and battery life for CGM devices will further drive adoption. The development of user-friendly, integrated platforms that connect glucometers, CGM sensors, and insulin pens will streamline data management and treatment adherence. Market expansion strategies, focusing on increasing the availability of these devices through wider distribution channels and potentially government procurement programs, will also act as significant growth catalysts. The increasing investment in digital health infrastructure within Thailand is poised to accelerate the uptake of connected diabetes care solutions.

Key Players Shaping the Thailand Diabetes Care Devices Market Market

- Roche

- Dexcom

- Ypsomed

- Abbott

- Eli Lilly

- Sanofi

- Medtronic

- Tandem

- Insulet

- Lifescan (Johnson & Johnson)

- Becton and Dickinson

- Novo Nordisk

Notable Milestones in Thailand Diabetes Care Devices Market Sector

- October 2023: Phillips-Medisize and GlucoModicum collaborated on the creation of a novel CGM device known as the Talisman, integrating magnetohydrodynamic technology, advanced algorithms, and biosensors, designed to connect to a smartphone application for efficient data collection.

- April 2022: The Insulin Pen was approved by the Thailand Food and Drug Administration (TFDA) through the cooperation between Gan & Lee Thai partner and Gan & Lee. The approved Insulin Pen can be used with the Gan & Lee 3mL cartridge insulin penfill, allowing patients to set 1-60 units (U) of insulin for administration with a minimum scale accurate to 1 unit (U).

In-Depth Thailand Diabetes Care Devices Market Market Outlook

The Thailand Diabetes Care Devices Market is poised for significant expansion, driven by a confluence of increasing diabetes prevalence, rapid technological advancements, and evolving consumer preferences. Growth accelerators such as strategic collaborations, improvements in device performance, and the expansion of digital health ecosystems will further propel market growth. The future outlook emphasizes a shift towards highly integrated, personalized, and data-driven diabetes management. Stakeholders can anticipate substantial opportunities in developing innovative solutions that enhance patient outcomes, improve accessibility, and address the evolving needs of individuals living with diabetes in Thailand. The continuous innovation in CGM technology and the increasing adoption of smart insulin delivery systems will redefine the standard of care in the coming years.

Thailand Diabetes Care Devices Market Segmentation

-

1. Monitoring Devices

-

1.1. Self-monitoring Blood Glucose Devices

- 1.1.1. Glucometer Devices

- 1.1.2. Test Strips

- 1.1.3. Lancets

-

1.2. Continuous Blood Glucose Monitoring

- 1.2.1. Sensors

- 1.2.2. Durables

-

1.1. Self-monitoring Blood Glucose Devices

-

2. Management Devices

-

2.1. Insulin Pump

- 2.1.1. Insulin Pump Device

- 2.1.2. Insulin Pump Reservoir

- 2.1.3. Infusion Set

- 2.2. Insulin Syringes

- 2.3. Insulin Cartridges

- 2.4. Disposable Pens

-

2.1. Insulin Pump

Thailand Diabetes Care Devices Market Segmentation By Geography

- 1. Thailand

Thailand Diabetes Care Devices Market Regional Market Share

Geographic Coverage of Thailand Diabetes Care Devices Market

Thailand Diabetes Care Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.36% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Number of Preterm and Low-weight Births; Advanced Technology in Fetal and Prenatal Monitoring

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Procedures

- 3.4. Market Trends

- 3.4.1. Management Devices Segment is Having Highest Share in current year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Diabetes Care Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 5.1.1. Self-monitoring Blood Glucose Devices

- 5.1.1.1. Glucometer Devices

- 5.1.1.2. Test Strips

- 5.1.1.3. Lancets

- 5.1.2. Continuous Blood Glucose Monitoring

- 5.1.2.1. Sensors

- 5.1.2.2. Durables

- 5.1.1. Self-monitoring Blood Glucose Devices

- 5.2. Market Analysis, Insights and Forecast - by Management Devices

- 5.2.1. Insulin Pump

- 5.2.1.1. Insulin Pump Device

- 5.2.1.2. Insulin Pump Reservoir

- 5.2.1.3. Infusion Set

- 5.2.2. Insulin Syringes

- 5.2.3. Insulin Cartridges

- 5.2.4. Disposable Pens

- 5.2.1. Insulin Pump

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Monitoring Devices

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Roche

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dexcom*List Not Exhaustive 7 2 Company Share Analysi

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ypsomed

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Abbottt

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eli Lilly

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sanofi

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Medtronic

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tandem

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Insulet

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Lifescan (Johnson &Johnson)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Becton and Dickenson

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Novo Nordisk

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Roche

List of Figures

- Figure 1: Thailand Diabetes Care Devices Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Thailand Diabetes Care Devices Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Diabetes Care Devices Market Revenue Million Forecast, by Monitoring Devices 2020 & 2033

- Table 2: Thailand Diabetes Care Devices Market Revenue Million Forecast, by Management Devices 2020 & 2033

- Table 3: Thailand Diabetes Care Devices Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Thailand Diabetes Care Devices Market Revenue Million Forecast, by Monitoring Devices 2020 & 2033

- Table 5: Thailand Diabetes Care Devices Market Revenue Million Forecast, by Management Devices 2020 & 2033

- Table 6: Thailand Diabetes Care Devices Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Diabetes Care Devices Market?

The projected CAGR is approximately 6.36%.

2. Which companies are prominent players in the Thailand Diabetes Care Devices Market?

Key companies in the market include Roche, Dexcom*List Not Exhaustive 7 2 Company Share Analysi, Ypsomed, Abbottt, Eli Lilly, Sanofi, Medtronic, Tandem, Insulet, Lifescan (Johnson &Johnson), Becton and Dickenson, Novo Nordisk.

3. What are the main segments of the Thailand Diabetes Care Devices Market?

The market segments include Monitoring Devices, Management Devices.

4. Can you provide details about the market size?

The market size is estimated to be USD 128.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Number of Preterm and Low-weight Births; Advanced Technology in Fetal and Prenatal Monitoring.

6. What are the notable trends driving market growth?

Management Devices Segment is Having Highest Share in current year.

7. Are there any restraints impacting market growth?

Stringent Regulatory Procedures.

8. Can you provide examples of recent developments in the market?

October 2023: Phillips-Medisize and GlucoModicum collaborated on the creation of a novel CGM device known as the Talisman. This innovative device integrates magnetohydrodynamic technology, advanced algorithms, and biosensors. Additionally, it is designed to connect to a smartphone application for efficient data collection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Diabetes Care Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Diabetes Care Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Diabetes Care Devices Market?

To stay informed about further developments, trends, and reports in the Thailand Diabetes Care Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence