Key Insights

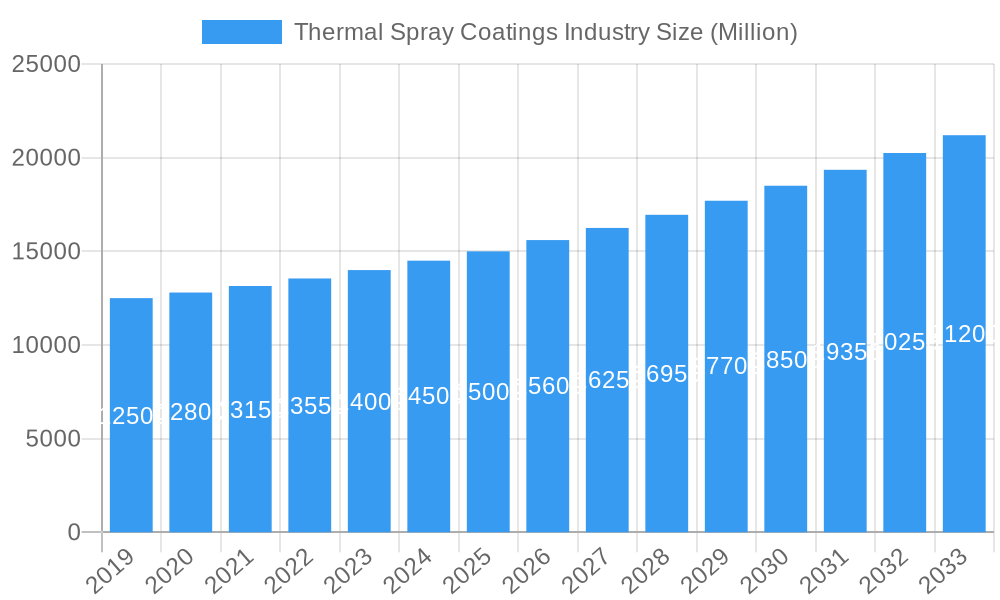

The global Thermal Spray Coatings Industry is poised for robust expansion, projecting a market size of approximately USD 15,500 million by 2025, with a compound annual growth rate (CAGR) exceeding 6.00% through 2033. This impressive growth trajectory is fueled by a confluence of critical drivers, primarily the escalating demand for enhanced material durability and performance across a wide spectrum of end-user industries. The aerospace sector, for instance, relies heavily on thermal spray coatings to improve resistance to high temperatures, wear, and corrosion in critical components. Similarly, the industrial gas turbine market is a significant contributor, benefiting from coatings that extend operational life and efficiency. The automotive industry's increasing focus on lightweighting and fuel efficiency further propels the adoption of these advanced protective layers, while the burgeoning electronics and medical device sectors present new avenues for growth, demanding specialized coatings for functionality and biocompatibility.

Thermal Spray Coatings Industry Market Size (In Billion)

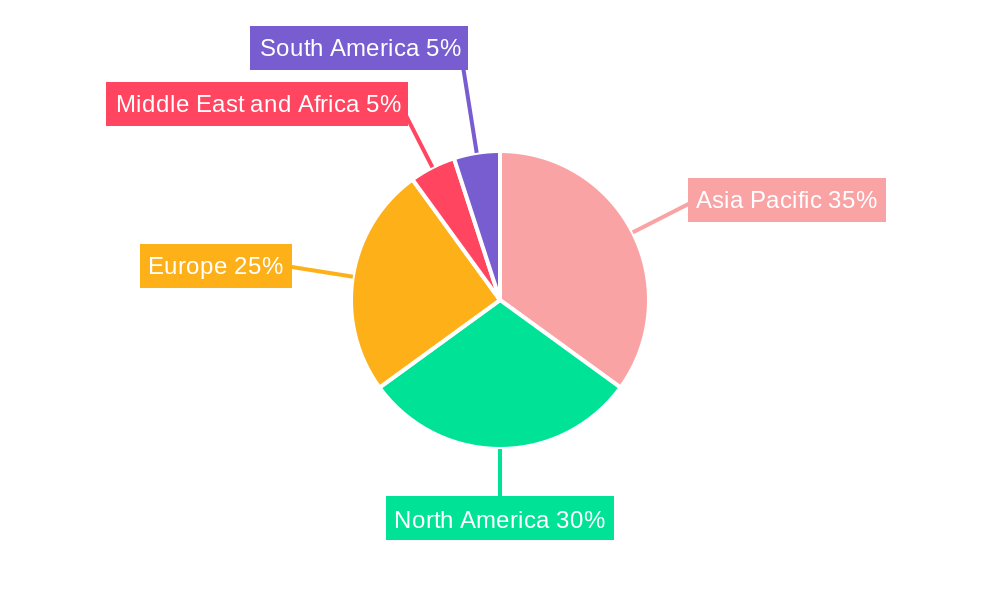

The industry's evolution is further shaped by several key trends, including the increasing use of advanced ceramic oxides, carbides, and metal-based powders, which offer superior performance characteristics. Innovations in processing techniques, such as those utilizing electric energy for enhanced precision and efficiency, are also gaining traction over traditional combustion methods. However, the industry is not without its restraints. The high initial investment costs associated with sophisticated thermal spray equipment and the need for skilled labor can present adoption challenges for smaller enterprises. Furthermore, stringent environmental regulations concerning emissions and waste management necessitate continuous innovation in cleaner and more sustainable coating processes. Geographically, Asia Pacific is emerging as a dominant force, driven by rapid industrialization and a growing manufacturing base, particularly in China and India. North America and Europe remain significant markets due to their established aerospace, automotive, and energy sectors, with ongoing technological advancements keeping them at the forefront of innovation.

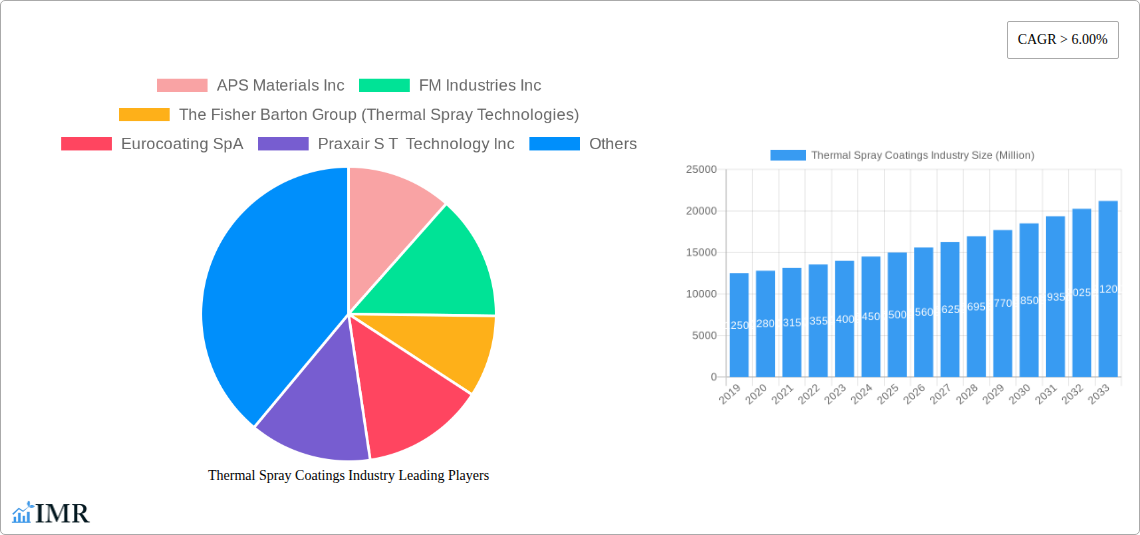

Thermal Spray Coatings Industry Company Market Share

This in-depth report provides an exhaustive analysis of the global Thermal Spray Coatings industry, exploring its market dynamics, growth trends, dominant segments, product innovations, key drivers, challenges, emerging opportunities, growth accelerators, and the competitive landscape. The report covers a study period from 2019 to 2033, with the base and estimated year being 2025, and a forecast period from 2025 to 2033, building upon historical data from 2019-2024. It offers critical insights for industry professionals, investors, and stakeholders seeking to understand the evolving market, its parent and child market segments, and strategic implications for future growth. The global Thermal Spray Coatings market size is projected to reach $XX,XXX Million by 2033, exhibiting a robust CAGR of X.XX% during the forecast period.

Thermal Spray Coatings Industry Market Dynamics & Structure

The global Thermal Spray Coatings industry is characterized by a moderately concentrated market structure, with a blend of large multinational corporations and specialized regional players. Technological innovation serves as a primary driver, fueled by the continuous demand for enhanced material performance, durability, and functional properties across various end-user industries. Regulatory frameworks, particularly those pertaining to environmental compliance and material safety, are influencing the adoption of advanced and sustainable coating technologies. Competitive product substitutes, such as physical vapor deposition (PVD) and chemical vapor deposition (CVD) coatings, present a challenge, albeit thermal spray coatings often offer superior cost-effectiveness and application versatility for specific needs. End-user demographics are increasingly sophisticated, demanding customized solutions for extreme environments and specialized applications, driving research and development in novel materials and processes. Mergers and acquisitions (M&A) activity remains a key strategy for market consolidation, technology acquisition, and market reach expansion, with approximately XX M&A deals recorded in the historical period (2019-2024), totaling an estimated value of $XX,XXX Million. Innovation barriers include the high capital investment for advanced equipment and the need for specialized skilled labor for application.

- Market Concentration: Moderate, with a few dominant global players and numerous regional specialists.

- Technological Innovation Drivers: Demand for enhanced wear resistance, corrosion protection, thermal insulation, and functional coatings.

- Regulatory Frameworks: Environmental regulations (e.g., VOC emissions) and material certification requirements are shaping technology choices.

- Competitive Product Substitutes: PVD, CVD, painting, electroplating, offering alternative solutions in certain applications.

- End-User Demographics: Increasing demand for tailored solutions for high-performance applications in aerospace, energy, and medical sectors.

- M&A Trends: Strategic acquisitions to expand product portfolios, geographic reach, and technological capabilities.

- Innovation Barriers: High R&D costs, skilled workforce requirements, and material science complexity.

Thermal Spray Coatings Industry Growth Trends & Insights

The Thermal Spray Coatings industry has witnessed substantial growth driven by an escalating demand for advanced material solutions across critical sectors. The market size evolution reflects a consistent upward trajectory, with the global market valued at $XX,XXX Million in 2024 and projected to expand significantly. Adoption rates for thermal spray coatings are increasing as industries recognize their ability to extend component lifespan, improve operational efficiency, and enable performance in harsh environments. Technological disruptions, such as the development of novel powder materials and advanced spraying techniques like plasma spray and HVOF (High-Velocity Oxygen Fuel), are key enablers of this growth. Consumer behavior shifts are evident, with a growing preference for sustainable solutions and coatings that reduce maintenance downtime and material waste. The industry’s market penetration is deepening, particularly in emerging economies and specialized niche applications within established markets. The projected CAGR of X.XX% during the forecast period (2025-2033) underscores the industry's robust expansion potential.

- Market Size Evolution: From an estimated $XX,XXX Million in 2024 to a projected $XX,XXX Million by 2033.

- Adoption Rates: Steadily increasing due to demonstrated performance benefits and cost-effectiveness in component protection and enhancement.

- Technological Disruptions: Advancements in coating materials (e.g., advanced ceramics, specialized alloys) and application processes (e.g., atmospheric plasma spray, cold spray).

- Consumer Behavior Shifts: Growing emphasis on lifecycle cost reduction, environmental sustainability, and enhanced product reliability.

- Market Penetration: Expanding into new applications and industries, including renewable energy, advanced manufacturing, and biomedical implants.

- CAGR: An anticipated X.XX% growth rate during the forecast period of 2025-2033.

Dominant Regions, Countries, or Segments in Thermal Spray Coatings Industry

The Aerospace segment stands out as a dominant force within the Thermal Spray Coatings industry, driven by stringent performance requirements and the critical need for durability, wear resistance, and thermal management in aircraft components. The parent market, encompassing the broader materials science and manufacturing sectors, provides a foundation for the growth of thermal spray coatings. Within this segment, Powder Coating Materials: Ceramic Oxides play a pivotal role, offering exceptional thermal barrier properties and wear resistance essential for engine components, airframes, and landing gear. The Electric Energy process also holds significant sway, enabling precise control over coating deposition and material properties. Geographically, North America and Europe currently lead the market, owing to their well-established aerospace and industrial gas turbine manufacturing hubs, robust R&D infrastructure, and a strong emphasis on technological advancement and component longevity. The presence of key industry players and a supportive regulatory environment further solidify their dominance. The Automotive sector, particularly in its pursuit of lightweighting and enhanced performance for internal combustion engines and electric vehicle components, is a rapidly growing child market.

- Dominant End-User Industry: Aerospace, valued at an estimated $X,XXX Million in 2025.

- Key Applications: Thermal Barrier Coatings (TBCs) for turbine blades, wear-resistant coatings for landing gear, corrosion protection for airframes.

- Growth Drivers: Increasing air travel, demand for fuel efficiency, and the development of next-generation aircraft.

- Dominant Powder Coating Material: Ceramic Oxides, accounting for approximately XX% of the powder coating materials market.

- Applications: High-temperature resistance, electrical insulation, wear resistance in critical components.

- Example: Yttria-stabilized zirconia (YSZ) for TBCs.

- Dominant Process: Electric Energy (e.g., Plasma Spray, Arc Spray), offering precise control and versatility.

- Market Share: Estimated XX% of the thermal spray processes market.

- Advantages: High deposition rates, ability to spray a wide range of materials.

- Dominant Regions:

- North America: Strong presence in aerospace and industrial gas turbines, significant R&D investment.

- Europe: Advanced manufacturing capabilities, significant demand from automotive and industrial sectors.

- Key Growth Drivers in Dominant Segments:

- Economic Policies: Government incentives for advanced manufacturing and R&D.

- Infrastructure: Robust aerospace and industrial manufacturing infrastructure.

- Technological Advancements: Continuous innovation in materials and processes.

- Performance Demands: Increasing need for high-temperature resistance, wear resistance, and corrosion protection.

Thermal Spray Coatings Industry Product Landscape

The product landscape of the Thermal Spray Coatings industry is characterized by continuous innovation, catering to increasingly demanding performance requirements. Products range from advanced ceramic oxides for high-temperature thermal barrier coatings in gas turbines to wear-resistant carbide composites for industrial machinery and biocompatible metallic coatings for medical implants. Unique selling propositions often lie in the tailored formulation of powders, precise control over the spraying process, and the resulting microstructural integrity of the applied coating. Technological advancements are focused on developing coatings with superior adhesion, reduced porosity, and enhanced functional properties such as self-healing capabilities and electrical conductivity. The application of these coatings extends from aerospace engine components and automotive pistons to oil and gas exploration equipment and consumer electronics. The estimated market value of specialized powder coating materials is projected to reach $X,XXX Million by 2033.

Key Drivers, Barriers & Challenges in Thermal Spray Coatings Industry

Key Drivers: The primary forces propelling the Thermal Spray Coatings industry include the relentless pursuit of enhanced material performance, including superior wear resistance, corrosion protection, and thermal insulation across critical sectors like aerospace and energy. Technological advancements in coating materials and application processes, such as High-Velocity Oxygen Fuel (HVOF) and advanced plasma spraying, are significant drivers. Furthermore, the drive towards extending the lifespan of components, reducing maintenance costs, and improving operational efficiency in demanding environments fuels market growth. Favorable economic policies supporting advanced manufacturing and R&D initiatives also contribute to the expansion.

- Performance Enhancement: Demand for improved durability and functionality.

- Technological Advancements: Innovations in materials and spraying techniques.

- Cost Reduction & Efficiency: Extending component life and reducing maintenance.

- Industry-Specific Demands: Requirements from aerospace, energy, and automotive sectors.

Barriers & Challenges: Significant challenges include the high capital investment required for advanced thermal spray equipment and the need for a highly skilled workforce proficient in operating these sophisticated systems. Supply chain disruptions for specialized raw materials can impact production timelines and costs. Stringent regulatory hurdles, particularly concerning environmental impact and material safety certifications, can add complexity and increase compliance costs. Intense competitive pressures from alternative coating technologies and established players striving for market share also present a considerable challenge. The estimated cost of compliance with evolving environmental regulations is projected to be $XX Million annually.

- High Capital Investment: Cost of advanced equipment and infrastructure.

- Skilled Workforce Shortage: Need for specialized training and expertise.

- Supply Chain Volatility: Fluctuations in raw material availability and pricing.

- Regulatory Hurdles: Compliance with environmental and safety standards.

- Competitive Pressures: From alternative coating methods and market players.

Emerging Opportunities in Thermal Spray Coatings Industry

Emerging opportunities in the Thermal Spray Coatings industry are rife with potential, particularly in the expansion of applications within the renewable energy sector, such as coatings for wind turbine blades and solar panel components to enhance their durability and efficiency. The growing demand for advanced biomedical implants, requiring biocompatible and wear-resistant coatings, presents a significant untapped market. Furthermore, the development of smart coatings with self-healing or sensing capabilities offers innovative application potential. The increasing adoption of additive manufacturing (3D printing) technologies in conjunction with thermal spray processes opens new avenues for creating complex geometries with enhanced functional properties. The projected market value of specialized biomedical coatings is estimated to reach $X,XXX Million by 2033.

- Renewable Energy Applications: Coatings for wind turbines, solar panels, and energy storage systems.

- Biomedical Devices: Biocompatible, wear-resistant, and antibacterial coatings for implants.

- Smart Coatings: Development of self-healing, sensing, or energy-harvesting coatings.

- Additive Manufacturing Integration: Combining thermal spray with 3D printing for complex functional parts.

Growth Accelerators in the Thermal Spray Coatings Industry Industry

Growth accelerators in the Thermal Spray Coatings industry are primarily driven by continuous technological breakthroughs in material science and application processes. Strategic partnerships between research institutions and industry players are fostering innovation and accelerating the development of next-generation coatings. Market expansion strategies, particularly targeting emerging economies with growing industrial bases and infrastructure development, represent significant growth catalysts. The increasing adoption of thermal spray coatings as a preferred solution for extending component life and improving performance in harsh environments is a fundamental accelerator. Furthermore, the trend towards lightweighting and increased fuel efficiency in the automotive and aerospace sectors is directly benefiting the demand for high-performance thermal spray solutions.

- Technological Breakthroughs: Novel material compositions and advanced application techniques.

- Strategic Partnerships: Collaborations driving innovation and market penetration.

- Market Expansion: Targeting high-growth emerging economies and niche applications.

- Component Longevity Focus: Industry-wide emphasis on extending product lifecycles.

Key Players Shaping the Thermal Spray Coatings Industry Market

- APS Materials Inc

- FM Industries Inc

- The Fisher Barton Group (Thermal Spray Technologies)

- Eurocoating SpA

- Praxair S T Technology Inc

- TOCALO Co Ltd

- Chromalloy Gas Turbine LLC

- Kennametal Inc

- Oerlikon Metco

- FW Gartner Thermal Spraying (Curtis-Wright)

- ASB Industries Inc

- Bodycote PLC

- Thermion

Notable Milestones in Thermal Spray Coatings Industry Sector

- February 2023: Kennametal Inc. introduced KCP25C with KENGold, a new higher-performance turning grade with advanced coating technology, improving wear resistance and metal removal rates for steel-turning applications.

- November 2022: Bodycote announced the expansion of its thermal spray coatings capability in the Middle East through a partnership with Mathevon Group, focusing on developing the market, particularly in Saudi Arabia.

In-Depth Thermal Spray Coatings Industry Market Outlook

The future market outlook for the Thermal Spray Coatings industry is exceptionally promising, driven by several key growth accelerators. The continued demand for enhanced material performance and component longevity across critical sectors like aerospace, energy, and automotive will remain a primary impetus. Technological advancements, particularly in the development of novel coating materials with superior properties and the refinement of application processes, will unlock new application potentials. Strategic partnerships and market expansion initiatives targeting high-growth regions and niche segments are poised to further fuel this expansion. The industry's ability to provide cost-effective solutions for extending product lifecycles and improving operational efficiencies positions it for sustained growth and innovation, with the global market value projected to reach $XX,XXX Million by 2033.

Thermal Spray Coatings Industry Segmentation

-

1. Powder Coating Materials

- 1.1. Ceramic Oxides

- 1.2. Carbides

- 1.3. Metals

- 1.4. Polymers and Other Powder Coating Materials

-

2. Process

- 2.1. Combustion

- 2.2. Electric Energy

-

3. End-user Industry

- 3.1. Aerospace

- 3.2. Industrial Gas Turbines

- 3.3. Automotive

- 3.4. Electronics

- 3.5. Medical Devices

- 3.6. Energy and Power

- 3.7. Oil and Gas

- 3.8. Other End-user Industries

Thermal Spray Coatings Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Australia

- 2. Rest of Asia Pacific

-

3. North America

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

-

4. Europe

- 4.1. Germany

- 4.2. United Kingdom

- 4.3. Italy

- 4.4. France

- 4.5. Rest of Europe

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

-

6. Middle East and Africa

- 6.1. Saudi Arabia

- 6.2. South Africa

- 6.3. Rest of Middle East and Africa

Thermal Spray Coatings Industry Regional Market Share

Geographic Coverage of Thermal Spray Coatings Industry

Thermal Spray Coatings Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Usage of Thermal Spray Coatings in Medical Devices; Rising Popularity of Thermal Spray Ceramic Coatings; Growing Application in Aerospace Industry

- 3.3. Market Restrains

- 3.3.1. Issues Regarding Process Reliability and Consistency; Stringent Government Regulations for Thermal Spray Coatings

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Aerospace Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Thermal Spray Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Powder Coating Materials

- 5.1.1. Ceramic Oxides

- 5.1.2. Carbides

- 5.1.3. Metals

- 5.1.4. Polymers and Other Powder Coating Materials

- 5.2. Market Analysis, Insights and Forecast - by Process

- 5.2.1. Combustion

- 5.2.2. Electric Energy

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Aerospace

- 5.3.2. Industrial Gas Turbines

- 5.3.3. Automotive

- 5.3.4. Electronics

- 5.3.5. Medical Devices

- 5.3.6. Energy and Power

- 5.3.7. Oil and Gas

- 5.3.8. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. Rest of Asia Pacific

- 5.4.3. North America

- 5.4.4. Europe

- 5.4.5. South America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Powder Coating Materials

- 6. Asia Pacific Thermal Spray Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Powder Coating Materials

- 6.1.1. Ceramic Oxides

- 6.1.2. Carbides

- 6.1.3. Metals

- 6.1.4. Polymers and Other Powder Coating Materials

- 6.2. Market Analysis, Insights and Forecast - by Process

- 6.2.1. Combustion

- 6.2.2. Electric Energy

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Aerospace

- 6.3.2. Industrial Gas Turbines

- 6.3.3. Automotive

- 6.3.4. Electronics

- 6.3.5. Medical Devices

- 6.3.6. Energy and Power

- 6.3.7. Oil and Gas

- 6.3.8. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Powder Coating Materials

- 7. Rest of Asia Pacific Thermal Spray Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Powder Coating Materials

- 7.1.1. Ceramic Oxides

- 7.1.2. Carbides

- 7.1.3. Metals

- 7.1.4. Polymers and Other Powder Coating Materials

- 7.2. Market Analysis, Insights and Forecast - by Process

- 7.2.1. Combustion

- 7.2.2. Electric Energy

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Aerospace

- 7.3.2. Industrial Gas Turbines

- 7.3.3. Automotive

- 7.3.4. Electronics

- 7.3.5. Medical Devices

- 7.3.6. Energy and Power

- 7.3.7. Oil and Gas

- 7.3.8. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Powder Coating Materials

- 8. North America Thermal Spray Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Powder Coating Materials

- 8.1.1. Ceramic Oxides

- 8.1.2. Carbides

- 8.1.3. Metals

- 8.1.4. Polymers and Other Powder Coating Materials

- 8.2. Market Analysis, Insights and Forecast - by Process

- 8.2.1. Combustion

- 8.2.2. Electric Energy

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Aerospace

- 8.3.2. Industrial Gas Turbines

- 8.3.3. Automotive

- 8.3.4. Electronics

- 8.3.5. Medical Devices

- 8.3.6. Energy and Power

- 8.3.7. Oil and Gas

- 8.3.8. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Powder Coating Materials

- 9. Europe Thermal Spray Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Powder Coating Materials

- 9.1.1. Ceramic Oxides

- 9.1.2. Carbides

- 9.1.3. Metals

- 9.1.4. Polymers and Other Powder Coating Materials

- 9.2. Market Analysis, Insights and Forecast - by Process

- 9.2.1. Combustion

- 9.2.2. Electric Energy

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Aerospace

- 9.3.2. Industrial Gas Turbines

- 9.3.3. Automotive

- 9.3.4. Electronics

- 9.3.5. Medical Devices

- 9.3.6. Energy and Power

- 9.3.7. Oil and Gas

- 9.3.8. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Powder Coating Materials

- 10. South America Thermal Spray Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Powder Coating Materials

- 10.1.1. Ceramic Oxides

- 10.1.2. Carbides

- 10.1.3. Metals

- 10.1.4. Polymers and Other Powder Coating Materials

- 10.2. Market Analysis, Insights and Forecast - by Process

- 10.2.1. Combustion

- 10.2.2. Electric Energy

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Aerospace

- 10.3.2. Industrial Gas Turbines

- 10.3.3. Automotive

- 10.3.4. Electronics

- 10.3.5. Medical Devices

- 10.3.6. Energy and Power

- 10.3.7. Oil and Gas

- 10.3.8. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Powder Coating Materials

- 11. Middle East and Africa Thermal Spray Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Powder Coating Materials

- 11.1.1. Ceramic Oxides

- 11.1.2. Carbides

- 11.1.3. Metals

- 11.1.4. Polymers and Other Powder Coating Materials

- 11.2. Market Analysis, Insights and Forecast - by Process

- 11.2.1. Combustion

- 11.2.2. Electric Energy

- 11.3. Market Analysis, Insights and Forecast - by End-user Industry

- 11.3.1. Aerospace

- 11.3.2. Industrial Gas Turbines

- 11.3.3. Automotive

- 11.3.4. Electronics

- 11.3.5. Medical Devices

- 11.3.6. Energy and Power

- 11.3.7. Oil and Gas

- 11.3.8. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Powder Coating Materials

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 APS Materials Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 FM Industries Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 The Fisher Barton Group (Thermal Spray Technologies)

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Eurocoating SpA

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Praxair S T Technology Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 TOCALO Co Ltd*List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Chromalloy Gas Turbine LLC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Kennametal Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Oerlikon Metco

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 FW Gartner Thermal Spraying (Curtis-Wright)

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 ASB Industries Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Bodycote PLC

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Thermion

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 APS Materials Inc

List of Figures

- Figure 1: Global Thermal Spray Coatings Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Thermal Spray Coatings Industry Volume Breakdown (Million, %) by Region 2025 & 2033

- Figure 3: Asia Pacific Thermal Spray Coatings Industry Revenue (undefined), by Powder Coating Materials 2025 & 2033

- Figure 4: Asia Pacific Thermal Spray Coatings Industry Volume (Million), by Powder Coating Materials 2025 & 2033

- Figure 5: Asia Pacific Thermal Spray Coatings Industry Revenue Share (%), by Powder Coating Materials 2025 & 2033

- Figure 6: Asia Pacific Thermal Spray Coatings Industry Volume Share (%), by Powder Coating Materials 2025 & 2033

- Figure 7: Asia Pacific Thermal Spray Coatings Industry Revenue (undefined), by Process 2025 & 2033

- Figure 8: Asia Pacific Thermal Spray Coatings Industry Volume (Million), by Process 2025 & 2033

- Figure 9: Asia Pacific Thermal Spray Coatings Industry Revenue Share (%), by Process 2025 & 2033

- Figure 10: Asia Pacific Thermal Spray Coatings Industry Volume Share (%), by Process 2025 & 2033

- Figure 11: Asia Pacific Thermal Spray Coatings Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific Thermal Spray Coatings Industry Volume (Million), by End-user Industry 2025 & 2033

- Figure 13: Asia Pacific Thermal Spray Coatings Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: Asia Pacific Thermal Spray Coatings Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 15: Asia Pacific Thermal Spray Coatings Industry Revenue (undefined), by Country 2025 & 2033

- Figure 16: Asia Pacific Thermal Spray Coatings Industry Volume (Million), by Country 2025 & 2033

- Figure 17: Asia Pacific Thermal Spray Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Thermal Spray Coatings Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Rest of Asia Pacific Thermal Spray Coatings Industry Revenue (undefined), by Powder Coating Materials 2025 & 2033

- Figure 20: Rest of Asia Pacific Thermal Spray Coatings Industry Volume (Million), by Powder Coating Materials 2025 & 2033

- Figure 21: Rest of Asia Pacific Thermal Spray Coatings Industry Revenue Share (%), by Powder Coating Materials 2025 & 2033

- Figure 22: Rest of Asia Pacific Thermal Spray Coatings Industry Volume Share (%), by Powder Coating Materials 2025 & 2033

- Figure 23: Rest of Asia Pacific Thermal Spray Coatings Industry Revenue (undefined), by Process 2025 & 2033

- Figure 24: Rest of Asia Pacific Thermal Spray Coatings Industry Volume (Million), by Process 2025 & 2033

- Figure 25: Rest of Asia Pacific Thermal Spray Coatings Industry Revenue Share (%), by Process 2025 & 2033

- Figure 26: Rest of Asia Pacific Thermal Spray Coatings Industry Volume Share (%), by Process 2025 & 2033

- Figure 27: Rest of Asia Pacific Thermal Spray Coatings Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 28: Rest of Asia Pacific Thermal Spray Coatings Industry Volume (Million), by End-user Industry 2025 & 2033

- Figure 29: Rest of Asia Pacific Thermal Spray Coatings Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Rest of Asia Pacific Thermal Spray Coatings Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 31: Rest of Asia Pacific Thermal Spray Coatings Industry Revenue (undefined), by Country 2025 & 2033

- Figure 32: Rest of Asia Pacific Thermal Spray Coatings Industry Volume (Million), by Country 2025 & 2033

- Figure 33: Rest of Asia Pacific Thermal Spray Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Rest of Asia Pacific Thermal Spray Coatings Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: North America Thermal Spray Coatings Industry Revenue (undefined), by Powder Coating Materials 2025 & 2033

- Figure 36: North America Thermal Spray Coatings Industry Volume (Million), by Powder Coating Materials 2025 & 2033

- Figure 37: North America Thermal Spray Coatings Industry Revenue Share (%), by Powder Coating Materials 2025 & 2033

- Figure 38: North America Thermal Spray Coatings Industry Volume Share (%), by Powder Coating Materials 2025 & 2033

- Figure 39: North America Thermal Spray Coatings Industry Revenue (undefined), by Process 2025 & 2033

- Figure 40: North America Thermal Spray Coatings Industry Volume (Million), by Process 2025 & 2033

- Figure 41: North America Thermal Spray Coatings Industry Revenue Share (%), by Process 2025 & 2033

- Figure 42: North America Thermal Spray Coatings Industry Volume Share (%), by Process 2025 & 2033

- Figure 43: North America Thermal Spray Coatings Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 44: North America Thermal Spray Coatings Industry Volume (Million), by End-user Industry 2025 & 2033

- Figure 45: North America Thermal Spray Coatings Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: North America Thermal Spray Coatings Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 47: North America Thermal Spray Coatings Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: North America Thermal Spray Coatings Industry Volume (Million), by Country 2025 & 2033

- Figure 49: North America Thermal Spray Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: North America Thermal Spray Coatings Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Europe Thermal Spray Coatings Industry Revenue (undefined), by Powder Coating Materials 2025 & 2033

- Figure 52: Europe Thermal Spray Coatings Industry Volume (Million), by Powder Coating Materials 2025 & 2033

- Figure 53: Europe Thermal Spray Coatings Industry Revenue Share (%), by Powder Coating Materials 2025 & 2033

- Figure 54: Europe Thermal Spray Coatings Industry Volume Share (%), by Powder Coating Materials 2025 & 2033

- Figure 55: Europe Thermal Spray Coatings Industry Revenue (undefined), by Process 2025 & 2033

- Figure 56: Europe Thermal Spray Coatings Industry Volume (Million), by Process 2025 & 2033

- Figure 57: Europe Thermal Spray Coatings Industry Revenue Share (%), by Process 2025 & 2033

- Figure 58: Europe Thermal Spray Coatings Industry Volume Share (%), by Process 2025 & 2033

- Figure 59: Europe Thermal Spray Coatings Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 60: Europe Thermal Spray Coatings Industry Volume (Million), by End-user Industry 2025 & 2033

- Figure 61: Europe Thermal Spray Coatings Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 62: Europe Thermal Spray Coatings Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 63: Europe Thermal Spray Coatings Industry Revenue (undefined), by Country 2025 & 2033

- Figure 64: Europe Thermal Spray Coatings Industry Volume (Million), by Country 2025 & 2033

- Figure 65: Europe Thermal Spray Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Europe Thermal Spray Coatings Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Thermal Spray Coatings Industry Revenue (undefined), by Powder Coating Materials 2025 & 2033

- Figure 68: South America Thermal Spray Coatings Industry Volume (Million), by Powder Coating Materials 2025 & 2033

- Figure 69: South America Thermal Spray Coatings Industry Revenue Share (%), by Powder Coating Materials 2025 & 2033

- Figure 70: South America Thermal Spray Coatings Industry Volume Share (%), by Powder Coating Materials 2025 & 2033

- Figure 71: South America Thermal Spray Coatings Industry Revenue (undefined), by Process 2025 & 2033

- Figure 72: South America Thermal Spray Coatings Industry Volume (Million), by Process 2025 & 2033

- Figure 73: South America Thermal Spray Coatings Industry Revenue Share (%), by Process 2025 & 2033

- Figure 74: South America Thermal Spray Coatings Industry Volume Share (%), by Process 2025 & 2033

- Figure 75: South America Thermal Spray Coatings Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 76: South America Thermal Spray Coatings Industry Volume (Million), by End-user Industry 2025 & 2033

- Figure 77: South America Thermal Spray Coatings Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 78: South America Thermal Spray Coatings Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 79: South America Thermal Spray Coatings Industry Revenue (undefined), by Country 2025 & 2033

- Figure 80: South America Thermal Spray Coatings Industry Volume (Million), by Country 2025 & 2033

- Figure 81: South America Thermal Spray Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Thermal Spray Coatings Industry Volume Share (%), by Country 2025 & 2033

- Figure 83: Middle East and Africa Thermal Spray Coatings Industry Revenue (undefined), by Powder Coating Materials 2025 & 2033

- Figure 84: Middle East and Africa Thermal Spray Coatings Industry Volume (Million), by Powder Coating Materials 2025 & 2033

- Figure 85: Middle East and Africa Thermal Spray Coatings Industry Revenue Share (%), by Powder Coating Materials 2025 & 2033

- Figure 86: Middle East and Africa Thermal Spray Coatings Industry Volume Share (%), by Powder Coating Materials 2025 & 2033

- Figure 87: Middle East and Africa Thermal Spray Coatings Industry Revenue (undefined), by Process 2025 & 2033

- Figure 88: Middle East and Africa Thermal Spray Coatings Industry Volume (Million), by Process 2025 & 2033

- Figure 89: Middle East and Africa Thermal Spray Coatings Industry Revenue Share (%), by Process 2025 & 2033

- Figure 90: Middle East and Africa Thermal Spray Coatings Industry Volume Share (%), by Process 2025 & 2033

- Figure 91: Middle East and Africa Thermal Spray Coatings Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 92: Middle East and Africa Thermal Spray Coatings Industry Volume (Million), by End-user Industry 2025 & 2033

- Figure 93: Middle East and Africa Thermal Spray Coatings Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 94: Middle East and Africa Thermal Spray Coatings Industry Volume Share (%), by End-user Industry 2025 & 2033

- Figure 95: Middle East and Africa Thermal Spray Coatings Industry Revenue (undefined), by Country 2025 & 2033

- Figure 96: Middle East and Africa Thermal Spray Coatings Industry Volume (Million), by Country 2025 & 2033

- Figure 97: Middle East and Africa Thermal Spray Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 98: Middle East and Africa Thermal Spray Coatings Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by Powder Coating Materials 2020 & 2033

- Table 2: Global Thermal Spray Coatings Industry Volume Million Forecast, by Powder Coating Materials 2020 & 2033

- Table 3: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by Process 2020 & 2033

- Table 4: Global Thermal Spray Coatings Industry Volume Million Forecast, by Process 2020 & 2033

- Table 5: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Thermal Spray Coatings Industry Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global Thermal Spray Coatings Industry Volume Million Forecast, by Region 2020 & 2033

- Table 9: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by Powder Coating Materials 2020 & 2033

- Table 10: Global Thermal Spray Coatings Industry Volume Million Forecast, by Powder Coating Materials 2020 & 2033

- Table 11: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by Process 2020 & 2033

- Table 12: Global Thermal Spray Coatings Industry Volume Million Forecast, by Process 2020 & 2033

- Table 13: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Thermal Spray Coatings Industry Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Thermal Spray Coatings Industry Volume Million Forecast, by Country 2020 & 2033

- Table 17: China Thermal Spray Coatings Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: China Thermal Spray Coatings Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 19: India Thermal Spray Coatings Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: India Thermal Spray Coatings Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Thermal Spray Coatings Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Japan Thermal Spray Coatings Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea Thermal Spray Coatings Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: South Korea Thermal Spray Coatings Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Thermal Spray Coatings Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Australia Thermal Spray Coatings Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by Powder Coating Materials 2020 & 2033

- Table 28: Global Thermal Spray Coatings Industry Volume Million Forecast, by Powder Coating Materials 2020 & 2033

- Table 29: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by Process 2020 & 2033

- Table 30: Global Thermal Spray Coatings Industry Volume Million Forecast, by Process 2020 & 2033

- Table 31: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 32: Global Thermal Spray Coatings Industry Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 33: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: Global Thermal Spray Coatings Industry Volume Million Forecast, by Country 2020 & 2033

- Table 35: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by Powder Coating Materials 2020 & 2033

- Table 36: Global Thermal Spray Coatings Industry Volume Million Forecast, by Powder Coating Materials 2020 & 2033

- Table 37: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by Process 2020 & 2033

- Table 38: Global Thermal Spray Coatings Industry Volume Million Forecast, by Process 2020 & 2033

- Table 39: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 40: Global Thermal Spray Coatings Industry Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 41: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Global Thermal Spray Coatings Industry Volume Million Forecast, by Country 2020 & 2033

- Table 43: United States Thermal Spray Coatings Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: United States Thermal Spray Coatings Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 45: Canada Thermal Spray Coatings Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Canada Thermal Spray Coatings Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 47: Mexico Thermal Spray Coatings Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Mexico Thermal Spray Coatings Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 49: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by Powder Coating Materials 2020 & 2033

- Table 50: Global Thermal Spray Coatings Industry Volume Million Forecast, by Powder Coating Materials 2020 & 2033

- Table 51: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by Process 2020 & 2033

- Table 52: Global Thermal Spray Coatings Industry Volume Million Forecast, by Process 2020 & 2033

- Table 53: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 54: Global Thermal Spray Coatings Industry Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 55: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 56: Global Thermal Spray Coatings Industry Volume Million Forecast, by Country 2020 & 2033

- Table 57: Germany Thermal Spray Coatings Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Germany Thermal Spray Coatings Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 59: United Kingdom Thermal Spray Coatings Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: United Kingdom Thermal Spray Coatings Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 61: Italy Thermal Spray Coatings Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Italy Thermal Spray Coatings Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 63: France Thermal Spray Coatings Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: France Thermal Spray Coatings Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 65: Rest of Europe Thermal Spray Coatings Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: Rest of Europe Thermal Spray Coatings Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 67: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by Powder Coating Materials 2020 & 2033

- Table 68: Global Thermal Spray Coatings Industry Volume Million Forecast, by Powder Coating Materials 2020 & 2033

- Table 69: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by Process 2020 & 2033

- Table 70: Global Thermal Spray Coatings Industry Volume Million Forecast, by Process 2020 & 2033

- Table 71: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 72: Global Thermal Spray Coatings Industry Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 73: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 74: Global Thermal Spray Coatings Industry Volume Million Forecast, by Country 2020 & 2033

- Table 75: Brazil Thermal Spray Coatings Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: Brazil Thermal Spray Coatings Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 77: Argentina Thermal Spray Coatings Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 78: Argentina Thermal Spray Coatings Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 79: Rest of South America Thermal Spray Coatings Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 80: Rest of South America Thermal Spray Coatings Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 81: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by Powder Coating Materials 2020 & 2033

- Table 82: Global Thermal Spray Coatings Industry Volume Million Forecast, by Powder Coating Materials 2020 & 2033

- Table 83: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by Process 2020 & 2033

- Table 84: Global Thermal Spray Coatings Industry Volume Million Forecast, by Process 2020 & 2033

- Table 85: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 86: Global Thermal Spray Coatings Industry Volume Million Forecast, by End-user Industry 2020 & 2033

- Table 87: Global Thermal Spray Coatings Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 88: Global Thermal Spray Coatings Industry Volume Million Forecast, by Country 2020 & 2033

- Table 89: Saudi Arabia Thermal Spray Coatings Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 90: Saudi Arabia Thermal Spray Coatings Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 91: South Africa Thermal Spray Coatings Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 92: South Africa Thermal Spray Coatings Industry Volume (Million) Forecast, by Application 2020 & 2033

- Table 93: Rest of Middle East and Africa Thermal Spray Coatings Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 94: Rest of Middle East and Africa Thermal Spray Coatings Industry Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thermal Spray Coatings Industry?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Thermal Spray Coatings Industry?

Key companies in the market include APS Materials Inc, FM Industries Inc, The Fisher Barton Group (Thermal Spray Technologies), Eurocoating SpA, Praxair S T Technology Inc, TOCALO Co Ltd*List Not Exhaustive, Chromalloy Gas Turbine LLC, Kennametal Inc, Oerlikon Metco, FW Gartner Thermal Spraying (Curtis-Wright), ASB Industries Inc, Bodycote PLC, Thermion.

3. What are the main segments of the Thermal Spray Coatings Industry?

The market segments include Powder Coating Materials, Process, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased Usage of Thermal Spray Coatings in Medical Devices; Rising Popularity of Thermal Spray Ceramic Coatings; Growing Application in Aerospace Industry.

6. What are the notable trends driving market growth?

Increasing Demand from the Aerospace Industry.

7. Are there any restraints impacting market growth?

Issues Regarding Process Reliability and Consistency; Stringent Government Regulations for Thermal Spray Coatings.

8. Can you provide examples of recent developments in the market?

February 2023: Kennametal Inc. introduced a new, higher-performance turning grade with advanced coating technology. KCP25C with KENGold is the first choice for metal-cutting inserts with improved wear and higher metal removal rates for steel-turning applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thermal Spray Coatings Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thermal Spray Coatings Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thermal Spray Coatings Industry?

To stay informed about further developments, trends, and reports in the Thermal Spray Coatings Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence