Key Insights

The global two-wheeler lubricants market is projected to reach $39.2 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 3.7%. Growth is driven by increasing two-wheeler adoption in emerging economies, particularly in Asia Pacific, fueled by a growing middle class and rising disposable incomes. Technological advancements in lubricants enhance engine performance and longevity, further stimulating market expansion. Consumer awareness regarding vehicle maintenance and the use of high-quality lubricants also contributes significantly to this growth.

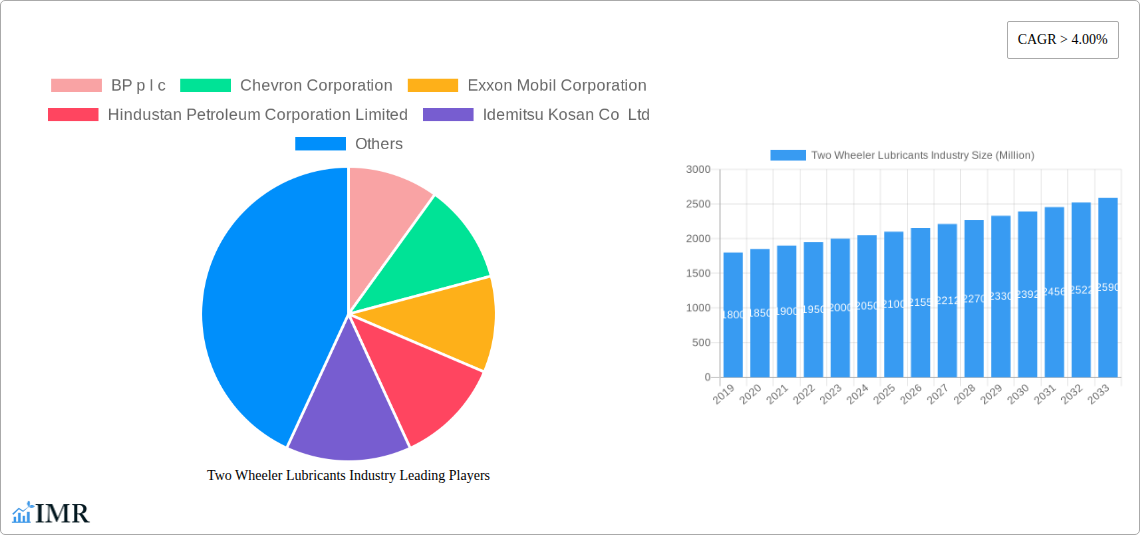

Two Wheeler Lubricants Industry Market Size (In Billion)

Key market drivers include the expanding two-wheeler fleet in urban areas, offering cost-effective transportation. Innovations in lubricant formulations, including synthetic and semi-synthetic oils, provide superior engine protection. While fluctuating raw material prices pose a restraint, the demand for specialized and eco-friendly lubricants presents significant opportunities for market players.

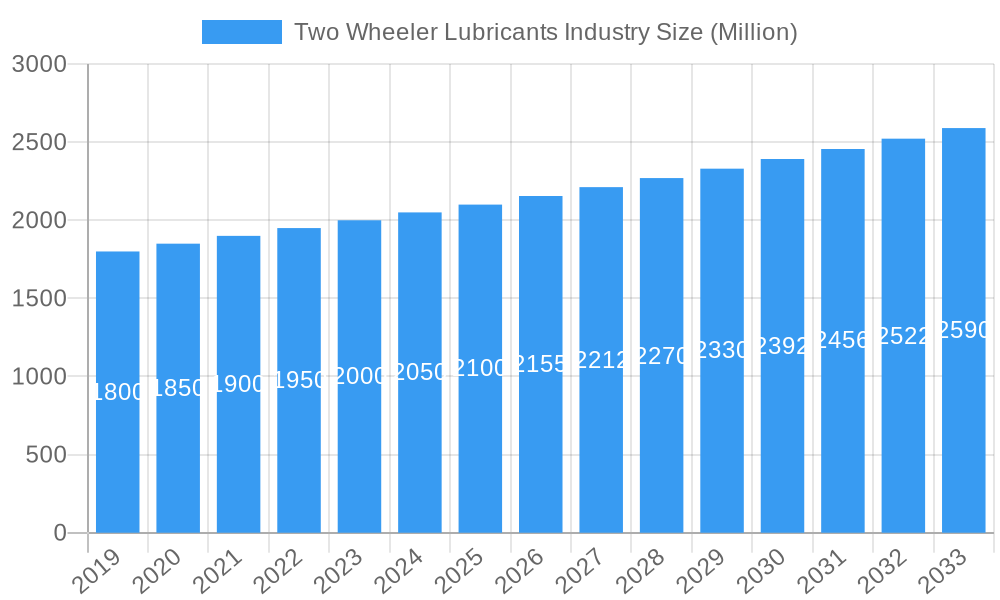

Two Wheeler Lubricants Industry Company Market Share

Two Wheeler Lubricants Industry: Comprehensive Market Analysis and Future Outlook (2019-2033)

This in-depth report delivers a definitive analysis of the global Two Wheeler Lubricants market, forecasting its trajectory from 2019 to 2033. Leveraging a robust methodology with 2025 as the base and estimated year, this study delves into market dynamics, growth trends, regional dominance, product landscape, and key strategic factors. We dissect the intricacies of the motorcycle lubricants market and scooter lubricants market, providing critical insights for stakeholders including engine oil for motorcycles, hydraulic oil for two-wheelers, brake oil for bikes, and chain oil for motorcycles. Discover detailed market segmentation, competitive landscapes, technological advancements, and the impact of pivotal industry developments, including recent M&A activities and product launches. With a focus on quantitative data and actionable intelligence, this report is an essential resource for lubricant manufacturers, automotive component suppliers, aftermarket service providers, and investment firms seeking to capitalize on the burgeoning two-wheeler lubricant sector.

Two Wheeler Lubricants Industry Market Dynamics & Structure

The global Two Wheeler Lubricants market exhibits a moderately concentrated structure, characterized by the significant presence of multinational corporations alongside regional players. Key drivers of technological innovation include the development of advanced synthetic formulations offering superior wear protection, extended drain intervals, and enhanced fuel efficiency for increasingly sophisticated two-wheeler engines. Regulatory frameworks, particularly emissions standards and lubricant performance specifications, play a crucial role in shaping product development and market entry strategies. Competitive product substitutes are limited in the core lubricant function, but innovations in additive technology and base oil composition continually redefine performance benchmarks. End-user demographics are shifting, with a growing middle class in emerging economies fueling demand for reliable and high-performance motorcycle and scooter lubricants. Mergers and acquisitions (M&A) activity, such as Shell's acquisition of Allied Reliability, aim to consolidate market presence and expand service offerings.

- Market Concentration: Dominated by a few large global players, but with significant opportunities for specialized and regional brands.

- Technological Innovation Drivers: Demand for enhanced fuel efficiency, extended engine life, reduced emissions, and compatibility with newer engine technologies.

- Regulatory Frameworks: Evolving environmental regulations and performance standards from bodies like API, JASO, and national automotive associations.

- Competitive Product Substitutes: Primarily related to alternative additive packages and base oil types (mineral, semi-synthetic, full synthetic).

- End-User Demographics: Growth driven by urbanization, rising disposable incomes, and increasing adoption of two-wheelers for personal mobility, especially in Asia Pacific.

- M&A Trends: Strategic acquisitions to expand geographical reach, diversify product portfolios, and gain access to new technologies or customer segments.

Two Wheeler Lubricants Industry Growth Trends & Insights

The global two-wheeler lubricants market is poised for robust expansion, driven by a confluence of factors including escalating vehicle parc, increasing disposable incomes, and a growing preference for personal mobility solutions, particularly in developing economies. The market size evolution is marked by a steady upward trend, with adoption rates for higher-performance lubricants like synthetic and semi-synthetic formulations witnessing significant acceleration. Technological disruptions are manifesting in the form of advanced additive packages that enhance engine protection, reduce friction, and improve fuel economy, directly responding to evolving consumer demands for both performance and sustainability. Consumer behavior shifts are characterized by a greater awareness of lubricant quality and its impact on vehicle longevity and performance. The forecasted CAGR of 11.5% for the period 2025-2033 underscores the market's dynamism. Current market penetration of advanced lubricants stands at approximately 45% of the total market volume in developed regions, with emerging markets showing rapid growth potential. The increasing sophistication of two-wheeler engines, coupled with a rising trend of premiumization, is compelling consumers to opt for lubricants that offer superior protection and performance benefits, even at a higher price point. Furthermore, the growing acceptance of e-two-wheelers is indirectly influencing the demand for specialized lubricants for their unique components, though the primary focus remains on internal combustion engine lubricants. The motorcycle lubricant market is a significant contributor to this growth, driven by the passion and performance expectations of motorcycle enthusiasts, while the scooter lubricant market benefits from the convenience and affordability offered to urban commuters.

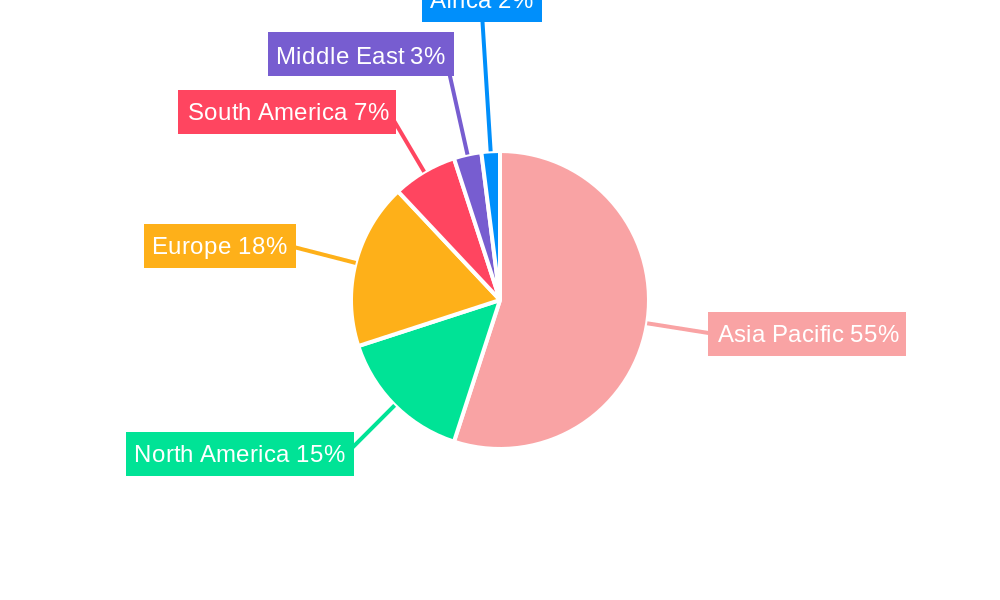

Dominant Regions, Countries, or Segments in Two Wheeler Lubricants Industry

The Asia Pacific region stands as the undisputed leader in the two-wheeler lubricants industry, primarily driven by the sheer volume of two-wheeler sales and usage in countries like India, China, and Southeast Asian nations. Within this region, India emerges as a paramount market due to its massive motorcycle and scooter parc, a rapidly growing middle class, and a strong emphasis on affordability and reliability in lubricants. The dominance is further cemented by favorable economic policies promoting local manufacturing and a burgeoning aftermarket service infrastructure for two-wheelers.

The Product Type: Engine Oil segment within the two-wheeler lubricants market is the most significant contributor to overall market value and volume. This is directly attributable to engine oil's essential role in the internal combustion process of every motorcycle and scooter.

Key Drivers of Dominance in Asia Pacific and India:

- High Two-Wheeler Penetration: India boasts the world's largest two-wheeler market, with millions of units sold annually, creating a continuous demand for engine oil.

- Urbanization and Commuting Needs: The increasing urban population relies heavily on two-wheelers for daily commutes, driving consistent lubricant consumption.

- Affordability and Accessibility: While premium lubricants are gaining traction, the demand for cost-effective yet reliable engine oils remains substantial.

- Government Initiatives: Policies supporting the automotive sector and local manufacturing have fostered growth in lubricant production and distribution.

- Aftermarket Services: A well-established network of independent garages and service centers ensures regular lubricant replacement.

The End-user Industry: Motorcycles segment also holds a dominant position, fueled by a passionate consumer base that prioritizes performance and protection, leading to higher consumption of advanced lubricant formulations. The scooters segment, while also substantial, represents a larger volume of lower-viscosity and potentially more frequently replaced lubricants due to its urban commuting focus. The market share for engine oil is estimated to be around 70% of the total two-wheeler lubricants market value, followed by chain oil, brake oil, and hydraulic oil. The growth potential in emerging markets within Asia Pacific, coupled with increasing disposable incomes, suggests a sustained upward trajectory for these dominant segments.

Two Wheeler Lubricants Industry Product Landscape

The product landscape for two-wheeler lubricants is characterized by continuous innovation aimed at enhancing engine performance, longevity, and fuel efficiency. Engine oils are at the forefront, with advancements in synthetic base stocks and additive packages leading to superior thermal stability, wear protection, and reduced friction. Hydraulic oils are being formulated for smoother operation of clutch and suspension systems. Brake fluids are developed to offer consistent braking performance under extreme temperatures and to prevent corrosion. Chain oils are engineered for better adhesion, reduced wear, and protection against environmental elements. Unique selling propositions often revolve around extended drain intervals, specific viscosity grades for diverse operating conditions, and compliance with stringent industry standards like JASO MA/MA2. Technological advancements focus on developing biodegradable and low-emission lubricant options to meet growing environmental concerns.

Key Drivers, Barriers & Challenges in Two Wheeler Lubricants Industry

Key Drivers:

- Growing Two-Wheeler Sales: The increasing global demand for affordable and convenient personal transportation, especially in emerging economies, is a primary growth catalyst.

- Technological Advancements: Development of high-performance synthetic lubricants that offer improved fuel economy, extended engine life, and better protection.

- Increasing Disposable Incomes: Rising purchasing power in developing countries allows consumers to opt for premium and high-quality lubricants.

- Stringent Emission Norms: The push for cleaner emissions encourages the use of advanced lubricants that optimize engine performance and reduce pollutants.

- Aftermarket Service Demand: A robust aftermarket for vehicle maintenance and repair ensures a consistent demand for lubricants.

Barriers & Challenges:

- Price Sensitivity: A significant portion of the market, particularly in developing regions, remains price-sensitive, hindering the adoption of premium lubricants.

- Counterfeit Products: The prevalence of counterfeit lubricants poses a threat to brand reputation and genuine product sales.

- Supply Chain Disruptions: Geopolitical events, raw material volatility, and logistical challenges can impact the availability and cost of base oils and additives.

- Regulatory Hurdles: Compliance with diverse and evolving lubricant standards across different regions can be complex and costly.

- Competition from Electric Two-Wheelers: While currently a niche, the long-term shift towards electric mobility could impact the demand for traditional engine lubricants.

Emerging Opportunities in Two Wheeler Lubricants Industry

Emerging opportunities within the two-wheeler lubricants industry lie in the development of eco-friendly and bio-based lubricants, catering to increasing environmental consciousness among consumers. The growing penetration of connected vehicle technology presents an avenue for smart lubricants that can provide real-time performance data. Untapped markets in specific developing regions with rapidly growing two-wheeler adoption rates offer significant growth potential. Furthermore, the demand for specialized lubricants for high-performance and electric two-wheelers is an emerging niche with high-value prospects. Innovative applications, such as advanced friction modifiers and enhanced cooling properties in lubricants, will also drive market expansion.

Growth Accelerators in the Two Wheeler Lubricants Industry Industry

Several catalysts are propelling the long-term growth of the two-wheeler lubricants industry. Technological breakthroughs in additive chemistry and synthetic base oil production are enabling the creation of lubricants with unprecedented performance characteristics, including extended drain intervals and superior engine protection. Strategic partnerships between lubricant manufacturers and original equipment manufacturers (OEMs) are crucial for co-developing lubricants that meet the specific needs of new engine designs. Market expansion strategies, particularly focusing on emerging economies through localized production and distribution networks, are key to capturing a larger share of the growing demand. Furthermore, increasing consumer awareness campaigns highlighting the benefits of using high-quality lubricants are fostering a premiumization trend.

Key Players Shaping the Two Wheeler Lubricants Industry Market

- BP p l c

- Chevron Corporation

- Exxon Mobil Corporation

- Hindustan Petroleum Corporation Limited

- Idemitsu Kosan Co Ltd

- PT Pertamina (Persero)

- Petroliam Nasional Berhad (PETRONAS)

- Shell plc

- China Petrochemical Corporation

- TotalEnergies

Notable Milestones in Two Wheeler Lubricants Industry Sector

- December 2022: Shell acquired Allied Reliability, a provider of industrial products and services, to further expand its North American Lubricants Business.

- November 2022: ENEOS Motor Oil company launched a complete line-up of lubricants for cars and motorcycles to enhance its presence in the Philippines market.

In-Depth Two Wheeler Lubricants Industry Market Outlook

The future market outlook for the two-wheeler lubricants industry is exceptionally positive, driven by sustained demand from emerging economies and continuous technological innovation. Growth accelerators such as the development of advanced synthetic formulations, strategic OEM collaborations, and targeted market expansion initiatives will further solidify the industry's trajectory. The increasing emphasis on vehicle longevity and performance, coupled with a growing environmental consciousness, will foster the adoption of premium and sustainable lubricant solutions. Strategic opportunities lie in capitalizing on the burgeoning demand for specialized lubricants in high-growth regions and for evolving two-wheeler technologies, ensuring a robust and dynamic market performance in the coming years.

Two Wheeler Lubricants Industry Segmentation

-

1. Product Type

- 1.1. Engine Oil

- 1.2. Hydraulic Oil

- 1.3. Brake Oil

- 1.4. Chain Oil

-

2. End-user Industry

- 2.1. Motorcycles

- 2.2. Scooters

Two Wheeler Lubricants Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

- 2.4. Rest of North America

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Russia

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Two Wheeler Lubricants Industry Regional Market Share

Geographic Coverage of Two Wheeler Lubricants Industry

Two Wheeler Lubricants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Engine Oils from Developing Countries; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Engine Oils from Developing Countries; Other Drivers

- 3.4. Market Trends

- 3.4.1. Increasing Usage of Engine Oils

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Two Wheeler Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oil

- 5.1.2. Hydraulic Oil

- 5.1.3. Brake Oil

- 5.1.4. Chain Oil

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Motorcycles

- 5.2.2. Scooters

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Asia Pacific Two Wheeler Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Engine Oil

- 6.1.2. Hydraulic Oil

- 6.1.3. Brake Oil

- 6.1.4. Chain Oil

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Motorcycles

- 6.2.2. Scooters

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. North America Two Wheeler Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Engine Oil

- 7.1.2. Hydraulic Oil

- 7.1.3. Brake Oil

- 7.1.4. Chain Oil

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Motorcycles

- 7.2.2. Scooters

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Two Wheeler Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Engine Oil

- 8.1.2. Hydraulic Oil

- 8.1.3. Brake Oil

- 8.1.4. Chain Oil

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Motorcycles

- 8.2.2. Scooters

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Two Wheeler Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Engine Oil

- 9.1.2. Hydraulic Oil

- 9.1.3. Brake Oil

- 9.1.4. Chain Oil

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Motorcycles

- 9.2.2. Scooters

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East Two Wheeler Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Engine Oil

- 10.1.2. Hydraulic Oil

- 10.1.3. Brake Oil

- 10.1.4. Chain Oil

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Motorcycles

- 10.2.2. Scooters

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Saudi Arabia Two Wheeler Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Engine Oil

- 11.1.2. Hydraulic Oil

- 11.1.3. Brake Oil

- 11.1.4. Chain Oil

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Motorcycles

- 11.2.2. Scooters

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 BP p l c

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Chevron Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Exxon Mobil Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Hindustan Petroleum Corporation Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Idemitsu Kosan Co Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 PT Pertamina(Persero)

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Petroliam Nasional Berhad (PETRONAS)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Shell plc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 China Petrochemical Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 TotalEnergies*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 BP p l c

List of Figures

- Figure 1: Global Two Wheeler Lubricants Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Two Wheeler Lubricants Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: Asia Pacific Two Wheeler Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Asia Pacific Two Wheeler Lubricants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: Asia Pacific Two Wheeler Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Asia Pacific Two Wheeler Lubricants Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: Asia Pacific Two Wheeler Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Two Wheeler Lubricants Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 9: North America Two Wheeler Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: North America Two Wheeler Lubricants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: North America Two Wheeler Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: North America Two Wheeler Lubricants Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: North America Two Wheeler Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Two Wheeler Lubricants Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Europe Two Wheeler Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe Two Wheeler Lubricants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: Europe Two Wheeler Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Two Wheeler Lubricants Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe Two Wheeler Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Two Wheeler Lubricants Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: South America Two Wheeler Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Two Wheeler Lubricants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: South America Two Wheeler Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: South America Two Wheeler Lubricants Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Two Wheeler Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Two Wheeler Lubricants Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East Two Wheeler Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East Two Wheeler Lubricants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Middle East Two Wheeler Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East Two Wheeler Lubricants Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Two Wheeler Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Saudi Arabia Two Wheeler Lubricants Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 33: Saudi Arabia Two Wheeler Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 34: Saudi Arabia Two Wheeler Lubricants Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 35: Saudi Arabia Two Wheeler Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 36: Saudi Arabia Two Wheeler Lubricants Industry Revenue (billion), by Country 2025 & 2033

- Figure 37: Saudi Arabia Two Wheeler Lubricants Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Japan Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: South Korea Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of North America Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 21: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Germany Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Italy Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Russia Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 29: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Brazil Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Argentina Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 35: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 36: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 38: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 39: Global Two Wheeler Lubricants Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 40: South Africa Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East Two Wheeler Lubricants Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Two Wheeler Lubricants Industry?

The projected CAGR is approximately 3.7%.

2. Which companies are prominent players in the Two Wheeler Lubricants Industry?

Key companies in the market include BP p l c, Chevron Corporation, Exxon Mobil Corporation, Hindustan Petroleum Corporation Limited, Idemitsu Kosan Co Ltd, PT Pertamina(Persero), Petroliam Nasional Berhad (PETRONAS), Shell plc, China Petrochemical Corporation, TotalEnergies*List Not Exhaustive.

3. What are the main segments of the Two Wheeler Lubricants Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 39.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Engine Oils from Developing Countries; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Usage of Engine Oils.

7. Are there any restraints impacting market growth?

Increasing Demand for Engine Oils from Developing Countries; Other Drivers.

8. Can you provide examples of recent developments in the market?

December 2022: Shell acquired Allied Reliability, a provider of industrial products and services, to further expand its North American Lubricants Business.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Two Wheeler Lubricants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Two Wheeler Lubricants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Two Wheeler Lubricants Industry?

To stay informed about further developments, trends, and reports in the Two Wheeler Lubricants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence