Key Insights

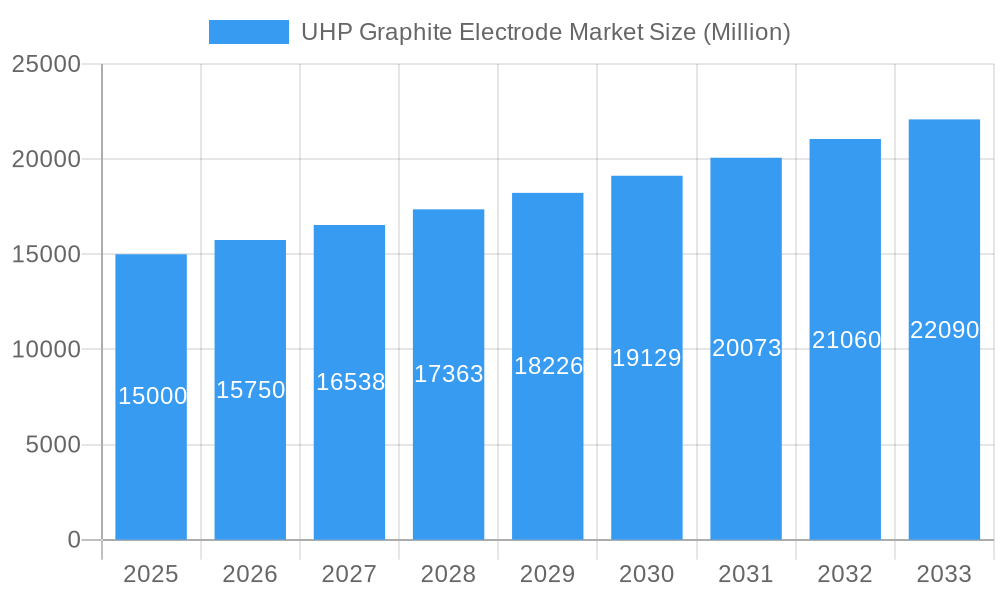

The UHP Graphite Electrode market is poised for substantial expansion, with a projected market size of $9.8 billion by 2025, exhibiting a robust CAGR of 9.4%. This growth is primarily propelled by escalating demand from the global steel industry, especially within emerging economies. Key drivers include rising steel production volumes, the increasing adoption of energy-efficient Electric Arc Furnaces (EAFs) in steelmaking, and ongoing technological innovations enhancing electrode performance and lifespan. Growing emphasis on sustainable steel production and stricter environmental regulations further bolster demand for high-quality graphite electrodes.

UHP Graphite Electrode Market Market Size (In Billion)

While raw material price volatility, geopolitical supply chain disruptions, and manufacturing-related environmental considerations present market challenges, the UHP Graphite Electrode sector is expected to maintain a strong upward trajectory. The market landscape features key players such as GrafTech International, Showa Denko K.K., and Nippon Carbon Co. Ltd., actively investing in R&D for improved electrode performance and cost reduction. Technological advancements, including the development of larger-diameter electrodes and enhanced formulations, are anticipated to drive market growth through the forecast period. Strategic collaborations and sustained expansion within the global steel industry paint a promising future for the UHP Graphite Electrode market.

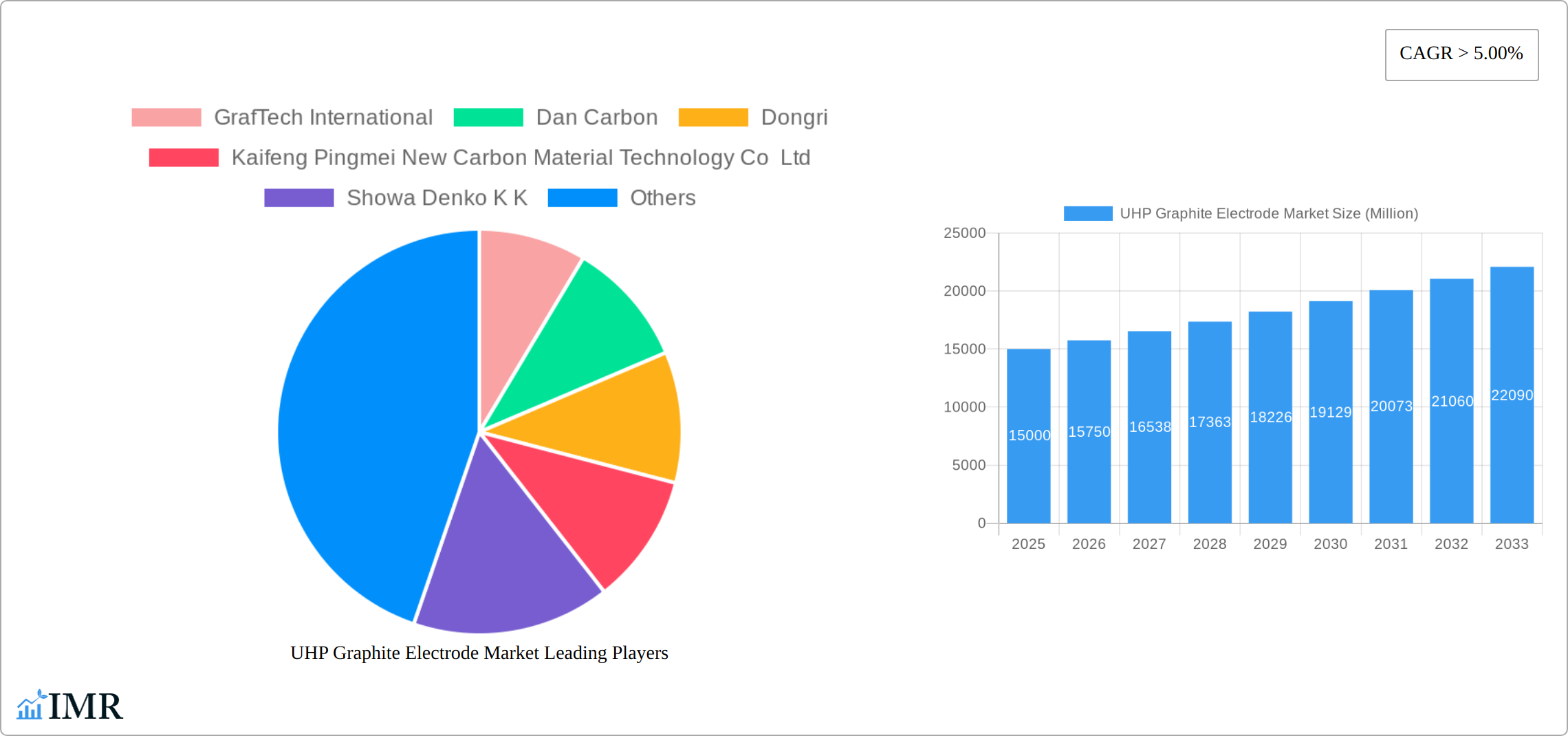

UHP Graphite Electrode Market Company Market Share

UHP Graphite Electrode Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the UHP Graphite Electrode market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report serves as an invaluable resource for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic sector. The parent market is the Graphite Electrode market, and the child market focuses specifically on Ultra-High Purity (UHP) graphite electrodes.

UHP Graphite Electrode Market Market Dynamics & Structure

The UHP (Ultra-High Power) Graphite Electrode market is shaped by a dynamic interplay of competitive forces and evolving industry trends. While the market exhibits a moderate level of concentration, with leading players commanding a significant portion of the global share (xx%), the landscape is constantly being redefined by innovation and strategic maneuvers. Technological advancements, particularly in enhancing electrode purity, electrical conductivity, and overall lifespan, are paramount drivers. Furthermore, increasingly stringent environmental regulations worldwide are not only influencing production processes but also propelling demand for high-performance, sustainable electrode solutions. Although substitute materials for graphite electrodes exist, their market penetration remains limited (xx%) due to inherent performance limitations and cost considerations. The steel industry, especially Electric Arc Furnace (EAF) steel production, remains the primary consumer, but burgeoning applications in other industrial sectors are poised to contribute to market diversification.

- Market Concentration: The UHP Graphite Electrode market is moderately concentrated, with the top 5 players estimated to hold approximately xx% of the market share in 2025. This indicates a consolidated yet competitive environment.

- Technological Innovation: A relentless focus on enhancing electrode purity, improving electrical conductivity for greater energy efficiency, and extending operational lifespan is a key competitive differentiator. Significant barriers to entry include substantial research and development investments and complexities in securing high-quality raw material sourcing.

- Regulatory Framework: A tightening global regulatory environment, particularly concerning emissions and sustainability in industrial processes, is a significant catalyst for the demand for advanced UHP graphite electrodes that offer superior performance and extended durability.

- Competitive Substitutes: While alternative electrode materials are being explored, their widespread adoption is hindered by current performance limitations and unfavorable cost-benefit ratios compared to UHP graphite electrodes.

- End-User Demographics: The steel industry, particularly EAF operations, constitutes the predominant end-user base. However, there is a notable upward trend in demand from emerging applications within other industrial sectors, representing an estimated xx% of market growth.

- M&A Trends: Reflecting strategies for consolidation, market expansion, and synergy creation, the UHP Graphite Electrode market has witnessed a notable xx number of mergers and acquisitions in the period spanning 2019 to 2024.

UHP Graphite Electrode Market Growth Trends & Insights

The UHP Graphite Electrode market experienced significant growth during the historical period (2019-2024), driven by the increasing adoption of EAF steelmaking globally. This trend is expected to continue throughout the forecast period (2025-2033), with a projected CAGR of xx%. Rising steel production, particularly in developing economies, is fueling demand. Technological advancements leading to improved electrode efficiency and lifespan further contribute to market expansion. Consumer behavior shifts towards sustainable manufacturing practices also favor UHP graphite electrodes due to their role in reducing carbon emissions. The market penetration rate is currently at xx% and is expected to reach xx% by 2033.

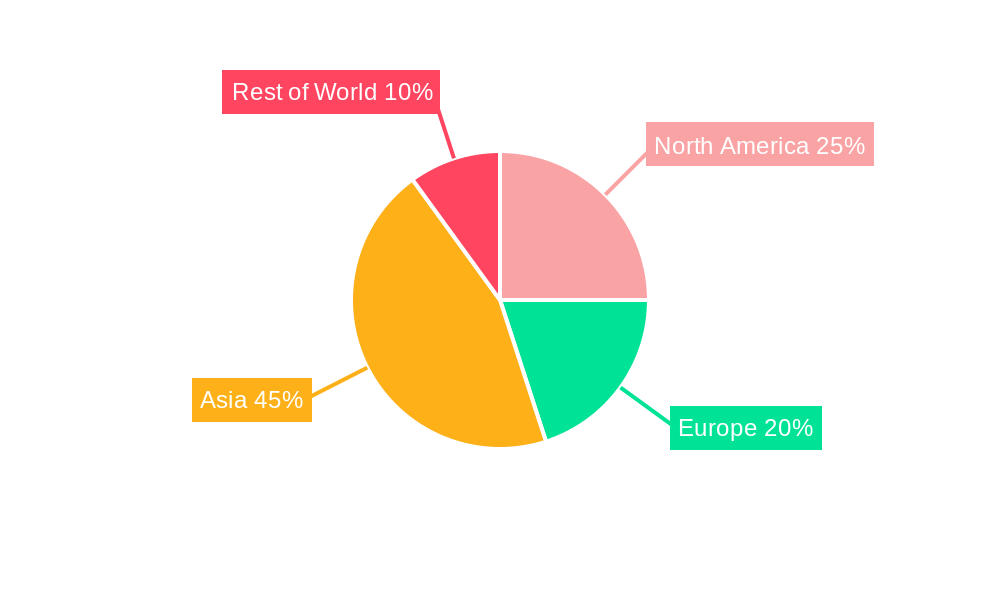

Dominant Regions, Countries, or Segments in UHP Graphite Electrode Market

China stands as the undisputed leader in the UHP Graphite Electrode market, accounting for an impressive xx% of global demand in 2025. This dominance is a direct consequence of China's colossal steel production capacity and the implementation of supportive government policies aimed at fostering industrial growth. Beyond China, Europe and North America are significant markets exhibiting steady growth. In Europe, this expansion is propelled by ambitious industrial decarbonization initiatives and a rising adoption rate of EAF technology. Similarly, North America's market growth is underpinned by substantial investments in modernizing its steel infrastructure and embracing advanced EAF technologies.

- China: The paramount market share is attributed to its unparalleled scale of steel production and strategic governmental support for industrial development.

- Europe: Experiencing robust growth driven by a strong commitment to decarbonization objectives and an increasing number of new EAF capacity installations.

- North America: Demonstrating consistent growth, largely fueled by strategic investments in upgrading steel manufacturing facilities and the adoption of state-of-the-art EAF technology.

UHP Graphite Electrode Market Product Landscape

UHP graphite electrodes are characterized by high purity, superior electrical conductivity, and extended operational lifespan compared to standard graphite electrodes. Continuous innovations focus on enhancing these properties to improve efficiency and reduce manufacturing costs. Key applications include EAF steelmaking, aluminum smelting, and other high-temperature industrial processes.

Key Drivers, Barriers & Challenges in UHP Graphite Electrode Market

Key Drivers:

- A sustained increase in global steel production, with a particular emphasis on the expanding role of Electric Arc Furnaces (EAFs).

- The implementation of increasingly stringent environmental regulations, which inherently promote cleaner steel production methodologies and necessitate high-efficiency electrodes.

- Continuous technological advancements in electrode design and material science, leading to enhanced performance characteristics and prolonged operational lifespans.

Key Challenges:

- Significant volatility in the pricing of essential raw materials, such as petroleum coke, which can impact production costs and profitability.

- Potential disruptions within global supply chains, affecting the timely availability of raw materials and the efficient delivery of finished electrode products.

- A highly competitive market environment characterized by intense rivalry among established manufacturers and the emergence of new players.

Emerging Opportunities in UHP Graphite Electrode Market

The UHP Graphite Electrode market is ripe with emerging opportunities, particularly in penetrating untapped geographical markets, including developing economies with burgeoning industrial sectors. Furthermore, the exploration of new applications, such as in advanced materials processing and specialized industrial furnaces, presents significant growth avenues. Continuous innovation in electrode design, material composition, and manufacturing processes holds the potential to further elevate performance metrics and enhance sustainability credentials. Strategic expansion into niche market segments, including those serving the renewable energy sector and advanced manufacturing industries, offers substantial long-term growth prospects.

Growth Accelerators in the UHP Graphite Electrode Market Industry

Technological breakthroughs in graphite processing and electrode design are primary growth accelerators. Strategic partnerships between electrode manufacturers and steel producers can enhance market penetration. Expanding production capacity to meet growing global demand and exploring new geographic markets are also crucial growth strategies.

Key Players Shaping the UHP Graphite Electrode Market Market

- GrafTech International

- Dan Carbon

- Dongri

- Kaifeng Pingmei New Carbon Material Technology Co Ltd

- Showa Denko K K

- Nippon Carbon Co Ltd

- Rongxing CARBON

- EPM Group (EL 6)

- Tokai Carbon Co Ltd

- Graphite India Limited

- HEG Limited

- SANGRAF International Inc

- FangDa Carbon

- ZHONGZE Group

- Nantong Yangzi Carbon

- Xingshi Group

- Shanxi Juxian Graphite New Material Co Ltd

Notable Milestones in UHP Graphite Electrode Market Sector

- May 2022: Tata Steel (India) installs 0.5 million tons EAF capacity in Rohtak.

- November 2021: Algoma (Canada) announces plans to build an EAF, reducing carbon emissions by 70%.

- July 2021: ArcelorMittal invests in a 2.4 million metric ton EAF facility.

In-Depth UHP Graphite Electrode Market Market Outlook

The UHP Graphite Electrode market is poised for sustained growth, driven by the global shift towards sustainable steelmaking and increasing demand from various industrial sectors. Strategic investments in R&D, expansion into new markets, and strategic partnerships will be crucial for capturing future market share. The market presents significant opportunities for companies with a strong focus on innovation and sustainability.

UHP Graphite Electrode Market Segmentation

-

1. Application

- 1.1. Electric Arc Furnace (EAF)

- 1.2. Basic Oxygen Furnace (BOF)

- 1.3. Non-Steel

UHP Graphite Electrode Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

UHP Graphite Electrode Market Regional Market Share

Geographic Coverage of UHP Graphite Electrode Market

UHP Graphite Electrode Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Steel Production through EAF Route; Increasing Emphasis on Steel Scrap Recycling

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Steel Production through EAF Route; Increasing Emphasis on Steel Scrap Recycling

- 3.4. Market Trends

- 3.4.1. Growing Demand for Steel Production through Electric Arc Furnace (EAF) Route

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UHP Graphite Electrode Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Electric Arc Furnace (EAF)

- 5.1.2. Basic Oxygen Furnace (BOF)

- 5.1.3. Non-Steel

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.2.2. North America

- 5.2.3. Europe

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific UHP Graphite Electrode Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Electric Arc Furnace (EAF)

- 6.1.2. Basic Oxygen Furnace (BOF)

- 6.1.3. Non-Steel

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America UHP Graphite Electrode Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Electric Arc Furnace (EAF)

- 7.1.2. Basic Oxygen Furnace (BOF)

- 7.1.3. Non-Steel

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe UHP Graphite Electrode Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Electric Arc Furnace (EAF)

- 8.1.2. Basic Oxygen Furnace (BOF)

- 8.1.3. Non-Steel

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America UHP Graphite Electrode Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Electric Arc Furnace (EAF)

- 9.1.2. Basic Oxygen Furnace (BOF)

- 9.1.3. Non-Steel

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa UHP Graphite Electrode Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Electric Arc Furnace (EAF)

- 10.1.2. Basic Oxygen Furnace (BOF)

- 10.1.3. Non-Steel

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 GrafTech International

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dan Carbon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dongri

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kaifeng Pingmei New Carbon Material Technology Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Showa Denko K K

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nippon Carbon Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rongxing CARBON

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 EPM Group (EL 6)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tokai Carbon Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Graphite India Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 HEG Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SANGRAF International Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 FangDa Carbon

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ZHONGZE Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Nantong Yangzi Carbon

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Xingshi Group

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Shanxi Juxian Graphite New Material Co Ltd*List Not Exhaustive

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 GrafTech International

List of Figures

- Figure 1: Global UHP Graphite Electrode Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific UHP Graphite Electrode Market Revenue (billion), by Application 2025 & 2033

- Figure 3: Asia Pacific UHP Graphite Electrode Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific UHP Graphite Electrode Market Revenue (billion), by Country 2025 & 2033

- Figure 5: Asia Pacific UHP Graphite Electrode Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America UHP Graphite Electrode Market Revenue (billion), by Application 2025 & 2033

- Figure 7: North America UHP Graphite Electrode Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America UHP Graphite Electrode Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America UHP Graphite Electrode Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe UHP Graphite Electrode Market Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe UHP Graphite Electrode Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe UHP Graphite Electrode Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe UHP Graphite Electrode Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America UHP Graphite Electrode Market Revenue (billion), by Application 2025 & 2033

- Figure 15: South America UHP Graphite Electrode Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America UHP Graphite Electrode Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America UHP Graphite Electrode Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa UHP Graphite Electrode Market Revenue (billion), by Application 2025 & 2033

- Figure 19: Middle East and Africa UHP Graphite Electrode Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Middle East and Africa UHP Graphite Electrode Market Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa UHP Graphite Electrode Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UHP Graphite Electrode Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global UHP Graphite Electrode Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global UHP Graphite Electrode Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global UHP Graphite Electrode Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: China UHP Graphite Electrode Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: India UHP Graphite Electrode Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Japan UHP Graphite Electrode Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: South Korea UHP Graphite Electrode Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Rest of Asia Pacific UHP Graphite Electrode Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global UHP Graphite Electrode Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global UHP Graphite Electrode Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United States UHP Graphite Electrode Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Canada UHP Graphite Electrode Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Mexico UHP Graphite Electrode Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Global UHP Graphite Electrode Market Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Global UHP Graphite Electrode Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Germany UHP Graphite Electrode Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom UHP Graphite Electrode Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy UHP Graphite Electrode Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: France UHP Graphite Electrode Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe UHP Graphite Electrode Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global UHP Graphite Electrode Market Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Global UHP Graphite Electrode Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Brazil UHP Graphite Electrode Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Argentina UHP Graphite Electrode Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Rest of South America UHP Graphite Electrode Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Global UHP Graphite Electrode Market Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Global UHP Graphite Electrode Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Saudi Arabia UHP Graphite Electrode Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa UHP Graphite Electrode Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa UHP Graphite Electrode Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UHP Graphite Electrode Market?

The projected CAGR is approximately 9.4%.

2. Which companies are prominent players in the UHP Graphite Electrode Market?

Key companies in the market include GrafTech International, Dan Carbon, Dongri, Kaifeng Pingmei New Carbon Material Technology Co Ltd, Showa Denko K K, Nippon Carbon Co Ltd, Rongxing CARBON, EPM Group (EL 6), Tokai Carbon Co Ltd, Graphite India Limited, HEG Limited, SANGRAF International Inc, FangDa Carbon, ZHONGZE Group, Nantong Yangzi Carbon, Xingshi Group, Shanxi Juxian Graphite New Material Co Ltd*List Not Exhaustive.

3. What are the main segments of the UHP Graphite Electrode Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Steel Production through EAF Route; Increasing Emphasis on Steel Scrap Recycling.

6. What are the notable trends driving market growth?

Growing Demand for Steel Production through Electric Arc Furnace (EAF) Route.

7. Are there any restraints impacting market growth?

Growing Demand for Steel Production through EAF Route; Increasing Emphasis on Steel Scrap Recycling.

8. Can you provide examples of recent developments in the market?

In May 2022, Tata Steel in India announced the installation of an Electric Arc Furnace (EAF) capacity of around 0.5 million in the Rohtak manufacturing unit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UHP Graphite Electrode Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UHP Graphite Electrode Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UHP Graphite Electrode Market?

To stay informed about further developments, trends, and reports in the UHP Graphite Electrode Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence