Key Insights

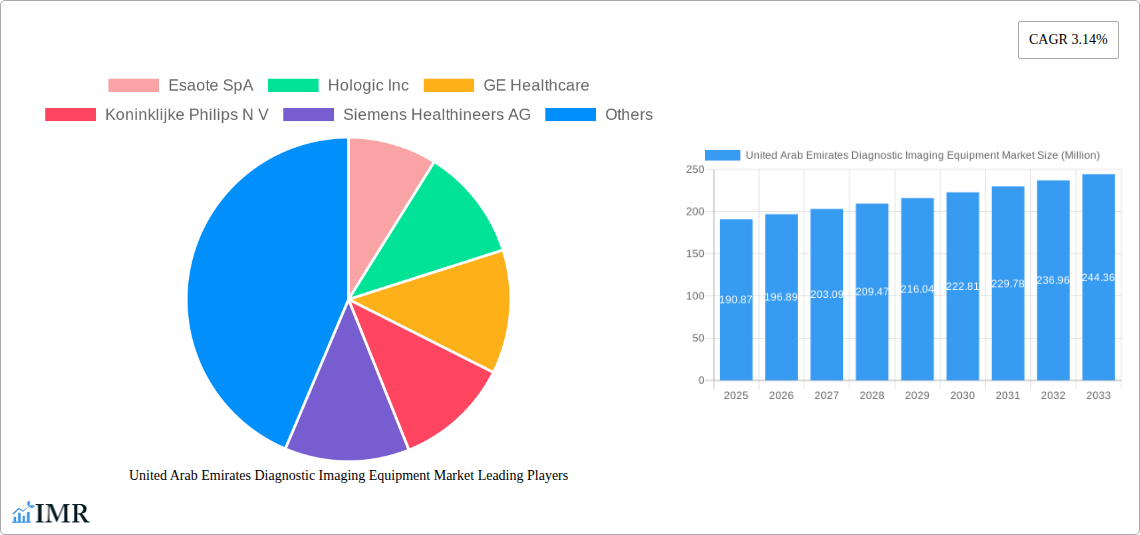

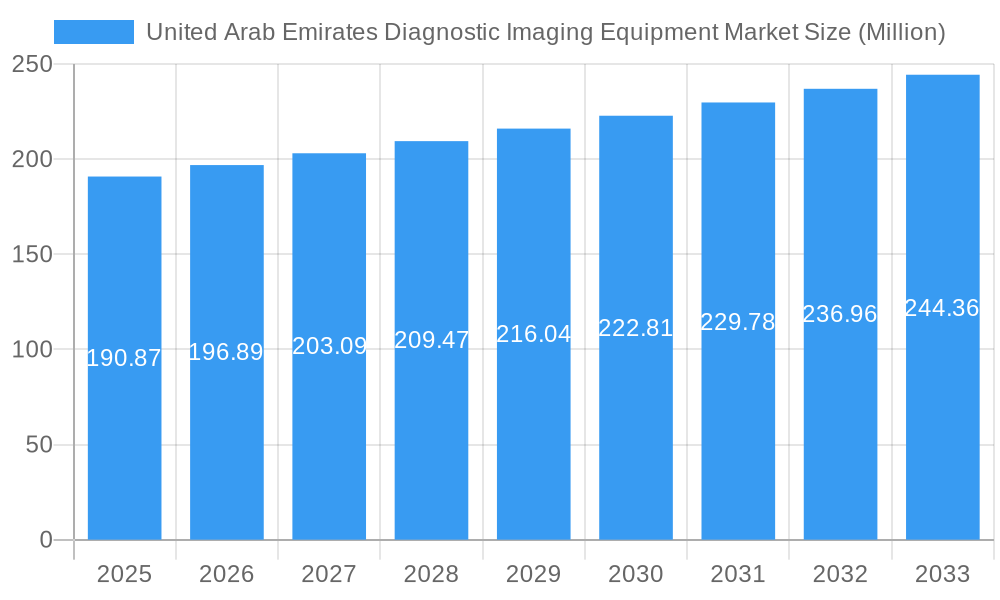

The United Arab Emirates (UAE) Diagnostic Imaging Equipment market is poised for steady expansion, with a market size of USD 190.87 million in the base year of 2025. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.14% from 2025 to 2033, indicating a healthy and sustained upward trajectory. This growth is primarily fueled by increasing healthcare investments, a rising prevalence of chronic diseases, and a growing demand for advanced diagnostic solutions. The UAE's commitment to developing a robust healthcare infrastructure, coupled with a strong focus on preventative care and early disease detection, forms the bedrock of this market's expansion. Furthermore, the increasing adoption of cutting-edge technologies such as AI-powered imaging analysis and advanced MRI and CT scanners by healthcare providers in the UAE is a significant driver. The region's proactive approach to adopting global healthcare standards and its appeal as a medical tourism hub further bolster the demand for sophisticated diagnostic imaging equipment.

United Arab Emirates Diagnostic Imaging Equipment Market Market Size (In Million)

Key modalities like MRI, Computed Tomography, and Ultrasound are expected to witness significant adoption, driven by their versatility in diagnosing a wide range of conditions from cardiology and oncology to neurology and orthopedics. Hospitals and specialized diagnostic centers form the primary end-user segments, reflecting the critical role of diagnostic imaging in patient care pathways. While technological advancements and increasing healthcare expenditure are strong drivers, potential restraints could include the high initial cost of advanced equipment and the need for skilled personnel to operate and interpret these sophisticated systems. However, the UAE's strategic initiatives in workforce development and its supportive regulatory environment are likely to mitigate these challenges, paving the way for continued growth and innovation in its diagnostic imaging equipment landscape.

United Arab Emirates Diagnostic Imaging Equipment Market Company Market Share

Comprehensive Report: United Arab Emirates Diagnostic Imaging Equipment Market - Trends, Opportunities & Key Players (2019-2033)

This in-depth report provides a granular analysis of the United Arab Emirates Diagnostic Imaging Equipment Market, meticulously dissecting its dynamics, growth trajectories, and future outlook. Covering the historical period from 2019 to 2024 and projecting growth through 2033, with a base and estimated year of 2025, this report offers actionable intelligence for stakeholders. We explore the market by modality (MRI, Computed Tomography, Ultrasound, X-Ray, Nuclear Imaging, Fluoroscopy, Mammography), application (Cardiology, Oncology, Neurology, Orthopedics, Gastroenterology, Gynecology, Other Applications), and end-user (Hospital, Diagnostic Centers, Others). All quantitative data is presented in Million units, ensuring clarity and precision.

United Arab Emirates Diagnostic Imaging Equipment Market Dynamics & Structure

The United Arab Emirates Diagnostic Imaging Equipment Market is characterized by a moderately concentrated structure, with key global players holding significant market share. Technological innovation is a primary driver, fueled by substantial government investment in healthcare infrastructure and a growing demand for advanced medical diagnostics. The regulatory framework, while evolving, generally supports the adoption of cutting-edge technologies and ensures quality standards. Competitive product substitutes are increasingly sophisticated, pushing manufacturers to differentiate through advanced features and integrated solutions. End-user demographics, marked by an aging population and a rise in lifestyle-related diseases, are creating a sustained demand for diagnostic imaging services. Merger and acquisition (M&A) trends are notable, with larger companies acquiring smaller, specialized firms to broaden their product portfolios and expand market reach.

- Market Concentration: Dominated by a few major global manufacturers.

- Technological Innovation: Driven by advancements in AI, miniaturization, and portable imaging solutions.

- Regulatory Framework: Supportive of advanced medical device adoption, with an increasing focus on data security and interoperability.

- Competitive Landscape: Intense competition, emphasizing product efficacy, cost-effectiveness, and after-sales service.

- End-User Demographics: Growing prevalence of chronic diseases and an increasing health-conscious population.

- M&A Trends: Strategic acquisitions to gain market share and access new technologies.

United Arab Emirates Diagnostic Imaging Equipment Market Growth Trends & Insights

The United Arab Emirates Diagnostic Imaging Equipment Market is poised for robust growth, driven by several key trends. The market size is expected to witness a healthy expansion, fueled by increasing healthcare expenditures and a strong government focus on developing a world-class healthcare ecosystem. Adoption rates for advanced imaging modalities, particularly MRI and CT scanners with enhanced resolution and reduced scan times, are on the rise. Technological disruptions, such as the integration of Artificial Intelligence (AI) in image analysis and diagnostic interpretation, are significantly enhancing efficiency and accuracy. Furthermore, shifts in consumer behavior, including a greater emphasis on preventive healthcare and early disease detection, are contributing to the increased demand for diagnostic imaging services. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period, with market penetration expected to deepen across all segments.

The increasing investment in public and private healthcare facilities across the UAE, coupled with a growing expatriate population seeking high-quality medical care, acts as a significant catalyst. The government's vision for a digitally integrated healthcare system also plays a crucial role, encouraging the adoption of connected imaging devices and Picture Archiving and Communication Systems (PACS). The rising incidence of cardiovascular diseases, oncology cases, and neurological disorders directly correlates with the demand for specialized imaging equipment like advanced MRI, CT, and PET scanners. Moreover, the push towards value-based healthcare is prompting the adoption of cost-effective yet high-performance diagnostic imaging solutions. The market's trajectory is also influenced by the continuous efforts to enhance radiology workflows, reduce patient exposure to radiation where possible, and improve the overall patient experience. The increasing sophistication of ultrasound technology for both diagnostic and therapeutic applications further bolsters market expansion. The UAE's strategic location and its ambition to become a regional healthcare hub attract both international patients and healthcare providers, indirectly driving the demand for state-of-the-art diagnostic imaging equipment.

Dominant Regions, Countries, or Segments in United Arab Emirates Diagnostic Imaging Equipment Market

Within the United Arab Emirates Diagnostic Imaging Equipment Market, hospitals emerge as the dominant end-user segment, largely due to their comprehensive healthcare services, higher patient volumes, and significant capital investment capabilities in advanced medical technology. The sheer scale of operations within major hospitals necessitates a wide array of diagnostic imaging modalities to cater to diverse medical specialties.

- Modality Dominance: While the entire spectrum of diagnostic imaging equipment is crucial, MRI and Computed Tomography (CT) hold a significant share due to their advanced diagnostic capabilities in detecting complex conditions. The increasing prevalence of neurological disorders and advanced cancer detection drives the demand for high-resolution MRI and CT scanners. Ultrasound also demonstrates strong growth, particularly in obstetrics, gynecology, and cardiology.

- Application Dominance: Oncology and Cardiology are leading application segments driving the demand for diagnostic imaging. The UAE's commitment to combating cancer through early detection and advanced treatment protocols, coupled with the rising incidence of cardiovascular diseases, directly translates to a higher demand for specialized imaging equipment like PET-CT scanners, advanced MRI for cardiac assessment, and sophisticated ultrasound devices for cardiac imaging. Neurology also shows substantial growth owing to the increasing diagnosis of stroke and other neurological conditions.

- End-User Dominance: Hospitals in major Emirates like Dubai and Abu Dhabi are the primary consumers of diagnostic imaging equipment. These institutions are at the forefront of adopting new technologies and expanding their diagnostic capabilities to meet the demands of a growing and health-conscious population. The UAE's vision to be a global leader in healthcare tourism further incentivizes hospitals to invest in cutting-edge imaging solutions. Diagnostic centers are also a growing segment, offering specialized imaging services and contributing to the overall market expansion, often focusing on outpatient diagnostics and screening.

The dominance of these segments is underpinned by several factors, including favorable government policies promoting healthcare infrastructure development, significant private sector investment, and a growing emphasis on preventive medicine and early disease detection. The continuous technological advancements in modalities like MRI and CT, enabling faster scan times and superior image quality, further solidify their prominent position. The burgeoning medical tourism sector in the UAE also contributes to this dominance, as international patients seek advanced diagnostic capabilities.

United Arab Emirates Diagnostic Imaging Equipment Market Product Landscape

The United Arab Emirates Diagnostic Imaging Equipment Market is characterized by a landscape rich in product innovation, with a strong emphasis on enhancing image quality, reducing scan times, and improving patient comfort. Key developments include the introduction of AI-powered imaging solutions that aid in faster and more accurate diagnoses, particularly in fields like radiology and mammography. Innovations in MRI technology focus on higher field strengths for superior resolution and faster scanning, while CT advancements are geared towards lower radiation doses and wider detector coverage. Ultrasound technology continues to evolve with enhanced portability and advanced imaging modes for a wider range of applications, including point-of-care diagnostics.

Key Drivers, Barriers & Challenges in United Arab Emirates Diagnostic Imaging Equipment Market

Key Drivers:

The United Arab Emirates Diagnostic Imaging Equipment Market is propelled by a confluence of factors. Increasing government investments in healthcare infrastructure and a strategic vision to become a regional healthcare hub are paramount. A rising prevalence of chronic diseases, including cardiovascular conditions, cancer, and neurological disorders, directly fuels the demand for advanced diagnostic imaging. The growing emphasis on preventive healthcare and early disease detection further amplifies the need for sophisticated imaging modalities. Furthermore, technological advancements, such as AI integration for enhanced diagnostics and improved workflow efficiency, are significant growth catalysts. The burgeoning medical tourism sector also plays a crucial role by necessitating world-class diagnostic capabilities.

Barriers & Challenges:

Despite the strong growth prospects, the market faces certain challenges. The high initial cost of advanced diagnostic imaging equipment can be a barrier, particularly for smaller healthcare providers. Stringent regulatory approval processes for new medical devices, while ensuring safety and efficacy, can sometimes lead to delays in market entry. The need for highly skilled radiographers and radiologists to operate and interpret complex imaging systems presents a human capital challenge. Moreover, cybersecurity concerns associated with connected imaging devices and patient data require robust solutions and continuous vigilance. Intense competition among global manufacturers can also put pressure on pricing and profit margins. Supply chain disruptions, as witnessed in recent global events, can impact the availability and delivery of critical equipment.

Emerging Opportunities in United Arab Emirates Diagnostic Imaging Equipment Market

Emerging opportunities in the United Arab Emirates Diagnostic Imaging Equipment Market lie in the growing demand for portable and point-of-care imaging solutions, particularly in remote areas or for emergency medical services. The increasing adoption of AI and machine learning algorithms for automated image analysis, predictive diagnostics, and workflow optimization presents a significant growth avenue. Furthermore, the development of specialized imaging techniques for personalized medicine, tailored to individual patient needs and genetic profiles, offers immense potential. The expansion of teleradiology services, facilitated by robust digital infrastructure, opens up opportunities to serve a wider patient base and enhance accessibility to expert interpretations. The focus on preventative health also drives opportunities for advanced screening tools and early detection technologies.

Growth Accelerators in the United Arab Emirates Diagnostic Imaging Equipment Market Industry

Several catalysts are accelerating long-term growth in the UAE's Diagnostic Imaging Equipment Market. Continued strategic partnerships between healthcare providers and technology manufacturers are crucial for the co-development and early adoption of innovative solutions. Government initiatives promoting digital transformation in healthcare, including the implementation of smart city concepts and e-health platforms, directly support the integration of advanced imaging technologies. Market expansion strategies by key players, focusing on building robust service networks and providing comprehensive training programs, are also vital. The increasing focus on research and development within the UAE, particularly in areas like AI in healthcare, will further spur the creation and adoption of next-generation diagnostic imaging equipment.

Key Players Shaping the United Arab Emirates Diagnostic Imaging Equipment Market Market

- Esaote SpA

- Hologic Inc

- GE Healthcare

- Koninklijke Philips N V

- Siemens Healthineers AG

- Toshiba Corporation

- Carestream Health

- Canon Medical Systems Corporation

- Fujifilm Holdings Corporation

Notable Milestones in United Arab Emirates Diagnostic Imaging Equipment Market Sector

- October 2022: The Ministry of Industry and Advanced Technology (MoIAT) announced the signing of a pair of MoU worth Dh 260 million (USD 7 million) between major pharmaceutical companies and medical devices companies in the United Arab Emirates.

- October 2022: The Abu Dhabi Health Services Company (SEHA) signed a collaboration agreement with Korean Lunit to test AI-based radiology. The PoC includes SEHA's trial of the Lunit INSIGHT CXR, an AI solution for chest X-ray analysis, and the Lunit INSIGHT MMG, an AI solution for mammography analysis, for evaluation.

- April 2022: NMC Royal Hospital launched Sharjah's first AI-driven state-of-the-art MRI scanner in the United Arab Emirates, which helps identify cancers and stroke severity apart from diagnosing heart, lung, liver, and bone diseases.

In-Depth United Arab Emirates Diagnostic Imaging Equipment Market Market Outlook

The future outlook for the United Arab Emirates Diagnostic Imaging Equipment Market is exceptionally promising, driven by sustained governmental commitment to healthcare excellence and a proactive approach to adopting cutting-edge technologies. Growth accelerators include the continued integration of Artificial Intelligence for enhanced diagnostic precision and workflow optimization, alongside the increasing demand for specialized imaging modalities catering to an aging population and the rising incidence of chronic diseases. Strategic partnerships between global technology providers and local healthcare institutions will further drive innovation and market penetration. The UAE's ambition to be a leading medical tourism destination will continue to necessitate and attract investments in state-of-the-art diagnostic imaging equipment, solidifying its position as a dynamic and rapidly evolving market. Opportunities for expansion into less saturated segments and the adoption of innovative service models, such as advanced teleradiology and portable imaging solutions, will shape the market's trajectory towards continued growth and advancement.

United Arab Emirates Diagnostic Imaging Equipment Market Segmentation

-

1. Modality

- 1.1. MRI

- 1.2. Computed Tomography

- 1.3. Ultrasound

- 1.4. X-Ray

- 1.5. Nuclear Imaging

- 1.6. Fluoroscopy

- 1.7. Mammography

-

2. Application

- 2.1. Cardiology

- 2.2. Oncology

- 2.3. Neurology

- 2.4. Orthopedics

- 2.5. Gastroenterology

- 2.6. Gynecology

- 2.7. Other Applications

-

3. End User

- 3.1. Hospital

- 3.2. Diagnostic Centers

- 3.3. Others

United Arab Emirates Diagnostic Imaging Equipment Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Diagnostic Imaging Equipment Market Regional Market Share

Geographic Coverage of United Arab Emirates Diagnostic Imaging Equipment Market

United Arab Emirates Diagnostic Imaging Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Chronic Diseases; Technological Advancements in Diagnostic Imaging

- 3.3. Market Restrains

- 3.3.1. High Cost of Diagnostic Imaging Procedures and Equipment

- 3.4. Market Trends

- 3.4.1. Oncology Segment Expects to Register a High CAGR Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Diagnostic Imaging Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Modality

- 5.1.1. MRI

- 5.1.2. Computed Tomography

- 5.1.3. Ultrasound

- 5.1.4. X-Ray

- 5.1.5. Nuclear Imaging

- 5.1.6. Fluoroscopy

- 5.1.7. Mammography

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiology

- 5.2.2. Oncology

- 5.2.3. Neurology

- 5.2.4. Orthopedics

- 5.2.5. Gastroenterology

- 5.2.6. Gynecology

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospital

- 5.3.2. Diagnostic Centers

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Modality

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Esaote SpA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hologic Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 GE Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Koninklijke Philips N V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens Healthineers AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Toshiba Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Carestream Health

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Canon Medical Systems Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fujifilm Holdings Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Esaote SpA

List of Figures

- Figure 1: United Arab Emirates Diagnostic Imaging Equipment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Arab Emirates Diagnostic Imaging Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: United Arab Emirates Diagnostic Imaging Equipment Market Revenue Million Forecast, by Modality 2020 & 2033

- Table 2: United Arab Emirates Diagnostic Imaging Equipment Market Volume K Unit Forecast, by Modality 2020 & 2033

- Table 3: United Arab Emirates Diagnostic Imaging Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: United Arab Emirates Diagnostic Imaging Equipment Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: United Arab Emirates Diagnostic Imaging Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: United Arab Emirates Diagnostic Imaging Equipment Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: United Arab Emirates Diagnostic Imaging Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: United Arab Emirates Diagnostic Imaging Equipment Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: United Arab Emirates Diagnostic Imaging Equipment Market Revenue Million Forecast, by Modality 2020 & 2033

- Table 10: United Arab Emirates Diagnostic Imaging Equipment Market Volume K Unit Forecast, by Modality 2020 & 2033

- Table 11: United Arab Emirates Diagnostic Imaging Equipment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: United Arab Emirates Diagnostic Imaging Equipment Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: United Arab Emirates Diagnostic Imaging Equipment Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: United Arab Emirates Diagnostic Imaging Equipment Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: United Arab Emirates Diagnostic Imaging Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United Arab Emirates Diagnostic Imaging Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Diagnostic Imaging Equipment Market?

The projected CAGR is approximately 3.14%.

2. Which companies are prominent players in the United Arab Emirates Diagnostic Imaging Equipment Market?

Key companies in the market include Esaote SpA, Hologic Inc, GE Healthcare, Koninklijke Philips N V, Siemens Healthineers AG, Toshiba Corporation, Carestream Health, Canon Medical Systems Corporation, Fujifilm Holdings Corporation.

3. What are the main segments of the United Arab Emirates Diagnostic Imaging Equipment Market?

The market segments include Modality, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 190.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Chronic Diseases; Technological Advancements in Diagnostic Imaging.

6. What are the notable trends driving market growth?

Oncology Segment Expects to Register a High CAGR Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Diagnostic Imaging Procedures and Equipment.

8. Can you provide examples of recent developments in the market?

In October 2022, the Ministry of Industry and Advanced Technology (MoIAT) announced the signing of a pair of MoU worth Dh 260 million (USD 7 million) between major pharmaceutical companies and medical devices companies in the United Arab Emirates.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Diagnostic Imaging Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Diagnostic Imaging Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Diagnostic Imaging Equipment Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Diagnostic Imaging Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence