Key Insights

The United Arab Emirates (UAE) floor coatings market is poised for significant expansion, projected to reach 482.12 million by 2025. This growth is driven by a robust compound annual growth rate (CAGR) of 4.1%. The market encompasses diverse product segments including Epoxy, Polyaspartics, Acrylic, and Polyurethane, each addressing distinct performance and aesthetic demands. Epoxy coatings, valued for their superior durability and chemical resistance, are expected to lead in industrial and commercial applications. Polyaspartics are gaining popularity due to their rapid curing properties and UV stability, ideal for high-traffic environments. Acrylic coatings offer an economical and easily applicable solution, while Polyurethanes provide exceptional flexibility and abrasion resistance. The market's reach is further expanded by a variety of substrate materials, with concrete flooring being a dominant choice in construction.

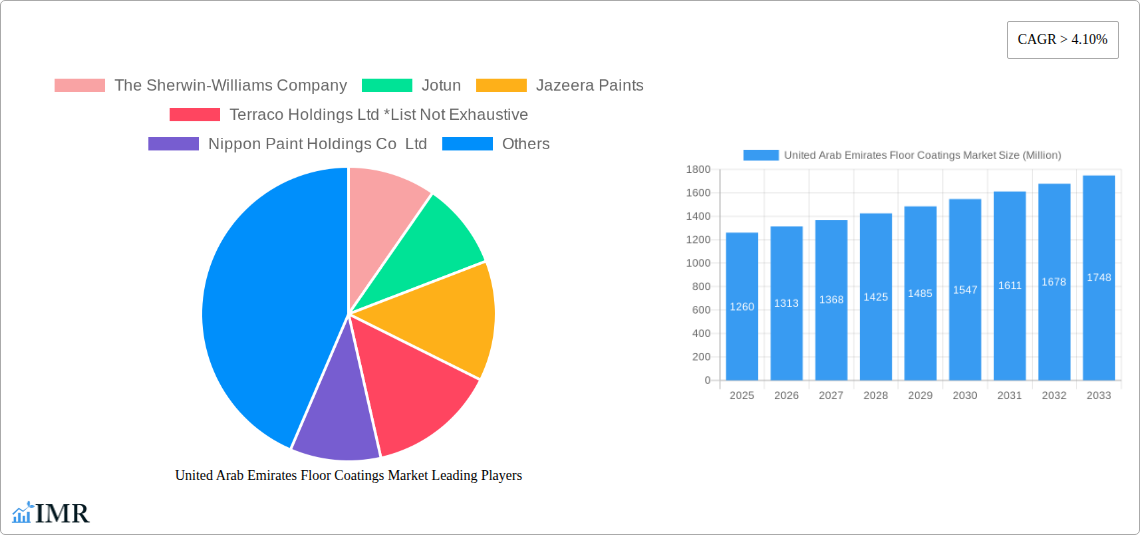

United Arab Emirates Floor Coatings Market Market Size (In Million)

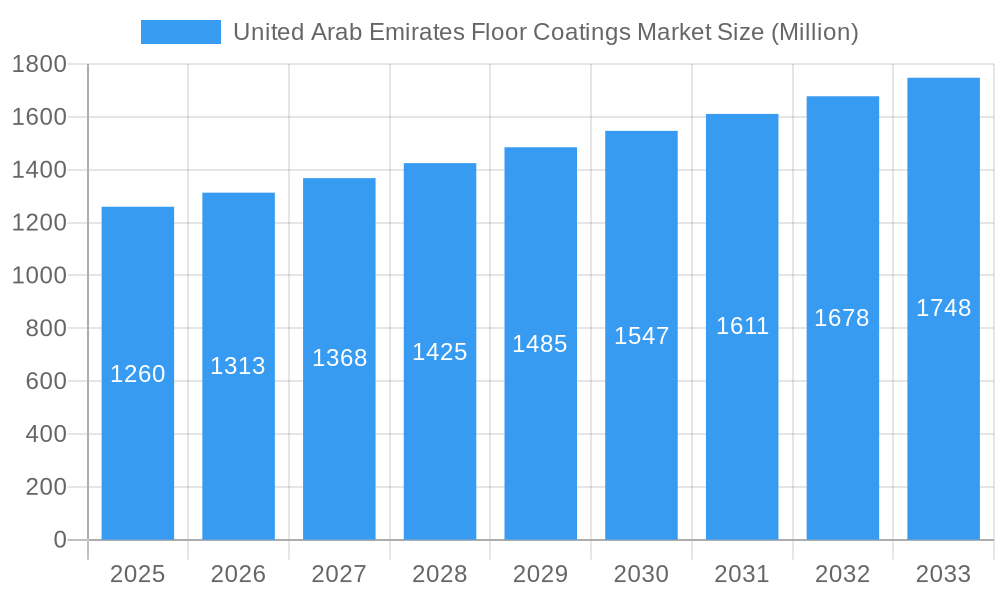

Key growth catalysts include substantial infrastructure development, a thriving construction sector, and a growing emphasis on enhancing the aesthetic and functional appeal of residential, commercial, and industrial spaces. The UAE's ambitious urban development initiatives and the escalating demand for high-performance, visually appealing floor finishes are major contributors. Moreover, increasing end-user awareness of the advantages offered by specialized floor coatings, such as improved safety, hygiene, and longevity, is accelerating adoption. The competitive landscape features prominent players like The Sherwin-Williams Company, Jotun, Nippon Paint Holdings Co Ltd, and Akzo Nobel N V, who are actively engaged in product innovation and portfolio expansion to meet evolving customer needs and regulatory requirements. A notable trend is the rising demand for eco-friendly and low-VOC (Volatile Organic Compound) coatings, aligning with the UAE's sustainability objectives.

United Arab Emirates Floor Coatings Market Company Market Share

This report delivers a comprehensive analysis of the United Arab Emirates (UAE) Floor Coatings Market, providing critical insights into its dynamics, growth trajectory, and future potential. Covering a study period from 2019 to 2033, with a base year of 2025, this extensive report is indispensable for industry stakeholders seeking to understand market evolution, identify growth opportunities, and formulate successful strategies.

United Arab Emirates Floor Coatings Market Market Dynamics & Structure

The United Arab Emirates floor coatings market exhibits a moderately concentrated structure, with key global and regional players vying for market share. Technological innovation is a primary driver, pushing the development of advanced formulations that offer enhanced durability, aesthetic appeal, and environmental sustainability. Regulatory frameworks, particularly those focused on VOC emissions and building safety standards, are shaping product development and market entry strategies. Competitive product substitutes, such as traditional tiles and natural materials, present a continuous challenge, necessitating continuous innovation and value proposition enhancement. End-user demographics are shifting, with a growing demand for sophisticated and high-performance coatings in both residential and commercial sectors. Mergers and acquisitions (M&A) trends, while not at their peak, are expected to play a role in market consolidation and expansion, particularly for companies seeking to broaden their product portfolios and geographical reach. For instance, the residential segment's growing demand for visually appealing and durable finishes, coupled with the commercial sector's need for robust, low-maintenance solutions in high-traffic areas, are key demographic influences. The increasing focus on sustainable building practices is also influencing material selection and coating technologies. The market concentration is estimated to be around 60% held by the top 10 players. Barriers to innovation include the high cost of R&D for specialized coatings and the need for extensive testing to meet stringent building codes.

United Arab Emirates Floor Coatings Market Growth Trends & Insights

The UAE floor coatings market is poised for substantial growth, driven by a confluence of economic development, infrastructure expansion, and evolving consumer preferences. The market size is projected to expand from an estimated USD 350 million in 2025 to over USD 600 million by 2033, showcasing a Compound Annual Growth Rate (CAGR) of approximately 6.5%. This growth is fueled by increasing adoption rates of advanced coating technologies such as epoxy and polyaspartics, which offer superior performance characteristics compared to conventional options. Technological disruptions, including the development of antimicrobial and self-healing coatings, are creating new market segments and enhancing the value proposition for end-users. Consumer behavior shifts are characterized by a growing appreciation for aesthetic versatility, ease of maintenance, and the long-term cost-effectiveness of high-quality floor coatings. The commercial sector's rapid expansion, particularly in hospitality, retail, and healthcare, is a significant contributor to this market's evolution. For example, the demand for durable and aesthetically pleasing flooring in shopping malls and hotels is a key driver. The increasing awareness of the environmental impact of building materials also influences purchasing decisions, favoring eco-friendly and low-VOC (Volatile Organic Compound) coatings. The market penetration of specialized coatings is estimated to be around 45% in 2025, with significant room for expansion. Furthermore, the rising disposable incomes and the desire for modern living spaces in the residential segment are translating into increased spending on premium flooring solutions. The trend towards sustainable construction practices is also creating opportunities for water-based and low-emission coatings.

Dominant Regions, Countries, or Segments in United Arab Emirates Floor Coatings Market

Within the UAE floor coatings market, Dubai and Abu Dhabi stand out as the dominant economic hubs, driving significant demand across all segments. The commercial end-user industry is currently the largest segment, accounting for an estimated 50% market share in 2025, largely due to extensive construction and renovation projects in hospitality, retail, and corporate sectors. Dubai's status as a global tourism and business destination necessitates high-performance, aesthetically pleasing, and durable flooring solutions in hotels, shopping malls, and office buildings. Abu Dhabi, with its focus on infrastructure development and government projects, also contributes significantly to this segment's growth.

The Epoxy product type is the most dominant, holding an estimated 40% market share due to its exceptional durability, chemical resistance, and versatility, making it ideal for industrial and commercial applications. Concrete floors, prevalent in most infrastructure and industrial settings, are the primary floor material benefiting from these coatings, representing approximately 65% of the market for coatings. The resilience and cost-effectiveness of concrete as a substrate, when enhanced with epoxy coatings, make it a preferred choice for warehouses, factories, and parking facilities.

The Residential end-user industry is experiencing robust growth, driven by increasing urbanization, a growing expatriate population, and the demand for modern, aesthetically appealing living spaces. This segment is projected to witness a higher CAGR than the commercial sector over the forecast period. The growing preference for seamless, hygienic, and visually striking floors in homes is boosting the demand for a wider range of coatings, including polyurethane and acrylics, which offer diverse aesthetic options and good performance. Key drivers include the government's focus on developing smart cities and sustainable infrastructure, which indirectly fuels demand for high-quality construction materials, including advanced floor coatings. The increasing disposable income and a strong desire for modern interior designs further propel the demand for premium floor coatings in new builds and renovations.

United Arab Emirates Floor Coatings Market Product Landscape

The UAE floor coatings market is characterized by continuous product innovation, with manufacturers focusing on enhancing performance metrics and expanding application possibilities. Epoxy coatings remain a stalwart, valued for their exceptional durability, chemical resistance, and seamless finish, making them ideal for heavy-duty industrial and commercial spaces. Polyaspartic coatings are gaining traction for their rapid curing times, UV stability, and superior abrasion resistance, offering a high-performance alternative. Acrylic coatings are increasingly favored in the residential and commercial sectors for their aesthetic versatility, ease of application, and cost-effectiveness, offering a wide spectrum of colors and finishes. Polyurethane coatings provide a balance of flexibility, abrasion resistance, and aesthetic appeal, suitable for various applications requiring both durability and visual enhancement. The development of self-leveling, low-VOC, and antimicrobial formulations represents the cutting edge of product innovation, addressing the growing demand for healthier, more sustainable, and user-friendly flooring solutions across all end-user industries.

Key Drivers, Barriers & Challenges in United Arab Emirates Floor Coatings Market

Key Drivers:

- Robust Infrastructure Development: Ongoing and planned mega-projects, including new airports, transportation networks, and commercial complexes, are significantly boosting demand for durable and high-performance floor coatings.

- Growing Tourism and Hospitality Sector: The UAE's ambition to be a global tourism hub necessitates the construction and renovation of hotels, resorts, and entertainment venues, driving demand for aesthetically appealing and long-lasting floor finishes.

- Increasing Urbanization and Residential Construction: A growing population and a continuous influx of expatriates fuel the demand for residential properties, leading to increased construction and renovation activities.

- Technological Advancements: Innovations in coating formulations, such as eco-friendly, quick-curing, and antimicrobial solutions, are meeting evolving consumer and industry needs.

- Government Initiatives and Regulations: Initiatives promoting sustainable building practices and stringent safety standards are indirectly encouraging the adoption of advanced and compliant floor coating technologies.

Barriers & Challenges:

- Intense Price Competition: The presence of numerous local and international players leads to significant price pressure, challenging profit margins.

- Skilled Labor Shortage: The specialized nature of applying certain floor coatings can lead to challenges in finding and retaining skilled labor.

- Economic Volatility: Fluctuations in global and regional economic conditions can impact construction spending and, consequently, demand for floor coatings.

- Supply Chain Disruptions: Global supply chain issues can affect the availability and cost of raw materials, impacting production and pricing.

- Environmental Regulations: While driving innovation, evolving and sometimes stringent environmental regulations can necessitate costly product reformulation and compliance measures. The estimated impact of supply chain disruptions on project timelines can be up to 15%.

Emerging Opportunities in United Arab Emirates Floor Coatings Market

The UAE floor coatings market presents compelling emerging opportunities in niche applications and advanced technologies. The increasing focus on healthcare infrastructure expansion creates a significant opportunity for antimicrobial and hygienic floor coatings in hospitals and clinics, addressing stringent infection control requirements. The burgeoning e-commerce sector and the resulting demand for advanced warehousing and logistics facilities offer a substantial market for high-performance industrial floor coatings that can withstand heavy traffic and chemical exposure. Furthermore, the growing interest in sustainable and green building practices is opening doors for manufacturers offering low-VOC, recycled content, and bio-based floor coating solutions. The development of smart flooring solutions, incorporating features like embedded sensors or self-healing capabilities, represents a future frontier for innovation and market differentiation.

Growth Accelerators in the United Arab Emirates Floor Coatings Market Industry

Several catalysts are accelerating the growth trajectory of the UAE floor coatings market. The government's ambitious infrastructure development plans, including Vision 2030 and beyond, are creating a sustained demand for construction materials, with floor coatings being an integral part of these projects. Strategic partnerships and collaborations between raw material suppliers, coating manufacturers, and application specialists are fostering innovation and enabling the development of tailored solutions for specific market needs. Furthermore, the increasing adoption of advanced application technologies, such as spray-applied systems and robotic application, are enhancing efficiency and reducing labor costs, making high-quality coatings more accessible. The continuous focus on research and development to create coatings with enhanced properties like superior scratch resistance, UV protection, and ease of maintenance is also a significant growth accelerator.

Key Players Shaping the United Arab Emirates Floor Coatings Market Market

- The Sherwin-Williams Company

- Jotun

- Jazeera Paints

- Terraco Holdings Ltd

- Nippon Paint Holdings Co Ltd

- Caparol Paints

- Kansai Nerolac Paints Limited

- Hempel A/S

- Akzo Nobel N V

- Sigma Paints

- Berger Paints Emirates Limited

- National Paints Factories Co Ltd

- Thermilate Middle East

- Ritver Paints & Coatings

Notable Milestones in United Arab Emirates Floor Coatings Market Sector

- 2022: Launch of advanced self-leveling epoxy formulations by multiple key players, enhancing ease of application and finish quality.

- 2021: Increased focus on sustainable and low-VOC coating solutions from major manufacturers in response to growing environmental regulations and consumer awareness.

- 2020: Introduction of rapid-curing polyaspartic coatings in the commercial sector, enabling faster project completion times.

- 2019: Significant investment by leading companies in R&D for antimicrobial floor coatings, driven by demand from the healthcare and hospitality sectors.

- 2023: Several companies announced strategic partnerships to expand their distribution networks and product offerings across the UAE.

In-Depth United Arab Emirates Floor Coatings Market Market Outlook

The future outlook for the United Arab Emirates floor coatings market is exceptionally robust, driven by sustained government investment in infrastructure, a thriving tourism sector, and increasing residential development. Growth accelerators such as technological innovation in eco-friendly and high-performance coatings, coupled with strategic market expansion initiatives by key players, will continue to propel market expansion. The market is expected to witness increasing demand for specialized coatings catering to specific industry needs, including those with enhanced durability, aesthetic appeal, and sustainability features. Strategic opportunities lie in capitalizing on the growth of the warehousing and logistics sector, the expanding healthcare industry, and the ongoing trend towards premium residential finishes. The market is well-positioned for continued growth, with an estimated market size exceeding USD 700 million by 2033.

United Arab Emirates Floor Coatings Market Segmentation

-

1. Product Type

- 1.1. Epoxy

- 1.2. Polyaspartics

- 1.3. Acrylic

- 1.4. Polyurethane

- 1.5. Other Product Types

-

2. Floor Material

- 2.1. Wood

- 2.2. Concrete

- 2.3. Other Floor Materials

-

3. End-user Industry

- 3.1. Residential

- 3.2. Commercial

- 3.3. Industrial

United Arab Emirates Floor Coatings Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Floor Coatings Market Regional Market Share

Geographic Coverage of United Arab Emirates Floor Coatings Market

United Arab Emirates Floor Coatings Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of the Advantages of Floor Coatings; Increasing Construction Activities in United Arab Emirates

- 3.3. Market Restrains

- 3.3.1. Harmful environmental impact of conventional Floor coatings

- 3.4. Market Trends

- 3.4.1. Epoxy Floor Coatings are Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Floor Coatings Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Epoxy

- 5.1.2. Polyaspartics

- 5.1.3. Acrylic

- 5.1.4. Polyurethane

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Floor Material

- 5.2.1. Wood

- 5.2.2. Concrete

- 5.2.3. Other Floor Materials

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Sherwin-Williams Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jotun

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jazeera Paints

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Terraco Holdings Ltd *List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nippon Paint Holdings Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Caparol Paints

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kansai Nerolac Paints Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hempel A/S

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Akzo Nobel N V

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sigma Paints

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Berger Paints Emirates Limited

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 National Paints Factories Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Thermilate Middle East

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Ritver Paints & Coatings

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 The Sherwin-Williams Company

List of Figures

- Figure 1: United Arab Emirates Floor Coatings Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: United Arab Emirates Floor Coatings Market Share (%) by Company 2025

List of Tables

- Table 1: United Arab Emirates Floor Coatings Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: United Arab Emirates Floor Coatings Market Volume liter Forecast, by Product Type 2020 & 2033

- Table 3: United Arab Emirates Floor Coatings Market Revenue million Forecast, by Floor Material 2020 & 2033

- Table 4: United Arab Emirates Floor Coatings Market Volume liter Forecast, by Floor Material 2020 & 2033

- Table 5: United Arab Emirates Floor Coatings Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 6: United Arab Emirates Floor Coatings Market Volume liter Forecast, by End-user Industry 2020 & 2033

- Table 7: United Arab Emirates Floor Coatings Market Revenue million Forecast, by Region 2020 & 2033

- Table 8: United Arab Emirates Floor Coatings Market Volume liter Forecast, by Region 2020 & 2033

- Table 9: United Arab Emirates Floor Coatings Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 10: United Arab Emirates Floor Coatings Market Volume liter Forecast, by Product Type 2020 & 2033

- Table 11: United Arab Emirates Floor Coatings Market Revenue million Forecast, by Floor Material 2020 & 2033

- Table 12: United Arab Emirates Floor Coatings Market Volume liter Forecast, by Floor Material 2020 & 2033

- Table 13: United Arab Emirates Floor Coatings Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 14: United Arab Emirates Floor Coatings Market Volume liter Forecast, by End-user Industry 2020 & 2033

- Table 15: United Arab Emirates Floor Coatings Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: United Arab Emirates Floor Coatings Market Volume liter Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Floor Coatings Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the United Arab Emirates Floor Coatings Market?

Key companies in the market include The Sherwin-Williams Company, Jotun, Jazeera Paints, Terraco Holdings Ltd *List Not Exhaustive, Nippon Paint Holdings Co Ltd, Caparol Paints, Kansai Nerolac Paints Limited, Hempel A/S, Akzo Nobel N V, Sigma Paints, Berger Paints Emirates Limited, National Paints Factories Co Ltd, Thermilate Middle East, Ritver Paints & Coatings.

3. What are the main segments of the United Arab Emirates Floor Coatings Market?

The market segments include Product Type, Floor Material, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 482.12 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of the Advantages of Floor Coatings; Increasing Construction Activities in United Arab Emirates.

6. What are the notable trends driving market growth?

Epoxy Floor Coatings are Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Harmful environmental impact of conventional Floor coatings.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Floor Coatings Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Floor Coatings Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Floor Coatings Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Floor Coatings Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence