Key Insights

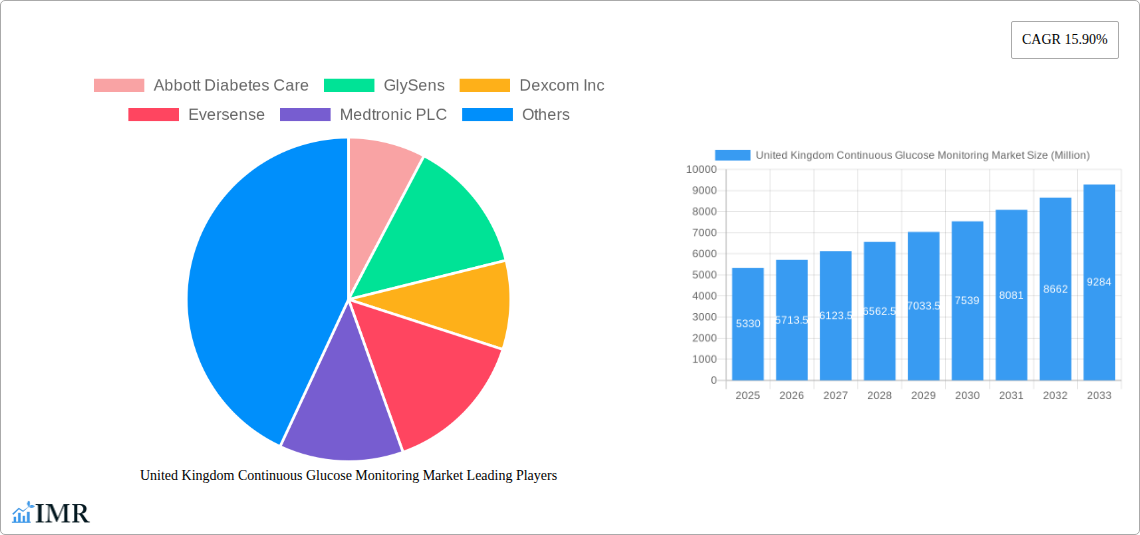

The United Kingdom Continuous Glucose Monitoring (CGM) market is poised for significant expansion, demonstrating robust growth driven by increasing diabetes prevalence and heightened awareness of effective diabetes management. The market is projected to reach an estimated USD 5.33 billion in 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 7.22% anticipated from 2025 to 2033. This upward trajectory is fueled by advancements in sensor technology, leading to more accurate and less invasive devices, coupled with a growing demand for durable and user-friendly CGM systems. The expanding product portfolio offered by key players like Abbott Diabetes Care, Dexcom Inc., and Medtronic PLC, alongside the introduction of innovative solutions, are further accelerating market adoption. The rising adoption of wearable technology and a proactive approach to health management among the UK population are also contributing factors, making CGM an integral part of daily life for individuals managing diabetes.

United Kingdom Continuous Glucose Monitoring Market Market Size (In Billion)

The United Kingdom CGM market's growth is underpinned by a confluence of technological innovation and evolving healthcare paradigms. Key drivers include the increasing incidence of Type 1 and Type 2 diabetes, coupled with a greater emphasis on personalized and proactive diabetes care. Technological advancements have led to the development of smaller, more discreet, and longer-lasting sensors, enhancing patient comfort and compliance. The market segments, particularly Sensors and Durables, are expected to see substantial growth as manufacturers continue to invest in research and development. While the market exhibits strong growth potential, potential restraints such as the initial cost of devices and the need for greater reimbursement coverage by healthcare providers in certain regions need to be addressed. Nevertheless, the overarching trend points towards widespread integration of CGM into routine diabetes management, improving patient outcomes and quality of life across the United Kingdom.

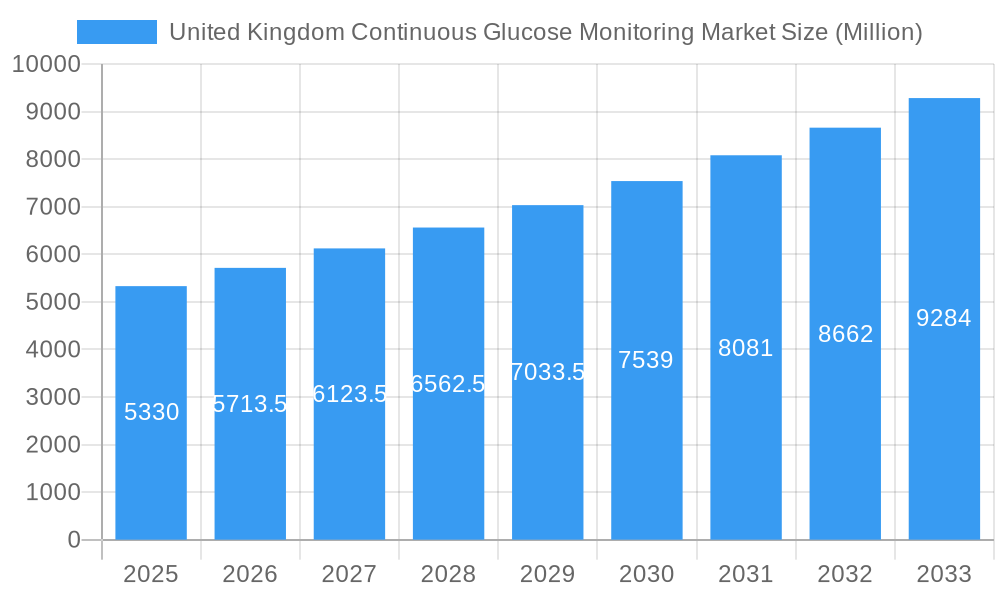

United Kingdom Continuous Glucose Monitoring Market Company Market Share

This in-depth report provides an exhaustive analysis of the United Kingdom's Continuous Glucose Monitoring (CGM) market. Covering the historical period from 2019 to 2024 and projecting future growth through 2033, with a base and estimated year of 2025, this report offers critical insights for stakeholders. We delve into market dynamics, growth trends, dominant segments, product innovations, key players, and emerging opportunities, providing a holistic view of this rapidly evolving sector. The report includes detailed segment analysis, focusing on Components (Sensors, Durables) and explores parent and child market relationships to capture a broader market understanding. All quantitative values are presented in billions of units.

United Kingdom Continuous Glucose Monitoring Market Market Dynamics & Structure

The United Kingdom Continuous Glucose Monitoring (CGM) market exhibits a dynamic and moderately concentrated structure, driven by technological innovation and increasing awareness of diabetes management. Key players like Abbott Diabetes Care, Dexcom Inc., and Medtronic PLC hold significant market share, leveraging their established product portfolios and extensive distribution networks. Technological advancements, particularly in sensor accuracy, wearability, and data connectivity, are primary innovation drivers. For instance, the development of smaller, more discreet, and longer-lasting sensors significantly enhances user experience and adoption.

- Market Concentration: Dominated by a few major players, with increasing competition from emerging companies.

- Technological Innovation: Focus on real-time data, predictive alerts, miniaturization of devices, and seamless integration with other health platforms.

- Regulatory Frameworks: Stringent regulatory approvals from bodies like the MHRA influence product lifecycles and market entry. The NHS's adoption policies also play a crucial role in market access and reimbursement.

- Competitive Product Substitutes: While CGM offers superior benefits, traditional blood glucose meters (BGMs) remain a substitute for cost-conscious or less digitally inclined segments of the population.

- End-User Demographics: Primarily individuals with Type 1 and Type 2 diabetes requiring intensive insulin therapy, as well as a growing segment of individuals with gestational diabetes and those seeking proactive health monitoring.

- M&A Trends: Limited significant M&A activity in the recent past, with a focus on organic growth and product development. However, strategic partnerships for data integration and distribution are becoming more prevalent. The market is projected to see increased consolidation or acquisition of innovative startups in the coming years, driven by the pursuit of advanced AI-driven analytics and personalized treatment solutions.

United Kingdom Continuous Glucose Monitoring Market Growth Trends & Insights

The United Kingdom Continuous Glucose Monitoring (CGM) market is poised for robust growth, fueled by a confluence of factors including rising diabetes prevalence, technological advancements, and increased healthcare provider and patient adoption. The market size evolution is directly correlated with improved clinical outcomes and enhanced quality of life for individuals living with diabetes. Adoption rates are steadily climbing as awareness of CGM's benefits over traditional blood glucose monitoring (BGM) intensifies. Clinically proven benefits, such as the reduction in HbA1c levels and decreased instances of hypoglycemia and hyperglycemia, are compelling factors driving this upward trend.

Technological disruptions are at the forefront of market expansion. Innovations in sensor technology, offering greater accuracy, longer wear times, and less invasiveness, are making CGM devices more accessible and appealing to a broader patient population. The integration of CGM data with smart devices and health apps is creating a connected ecosystem that empowers users with actionable insights and facilitates better disease management. This shift towards personalized and proactive diabetes care is reshaping consumer behavior. Patients are increasingly seeking tools that provide real-time feedback and enable them to make informed lifestyle and treatment decisions. The demand for seamless data sharing with healthcare professionals is also rising, promoting more collaborative care models.

The market penetration of CGM devices is expected to continue its upward trajectory, driven by supportive reimbursement policies and increasing clinician recommendations. The projected Compound Annual Growth Rate (CAGR) for the United Kingdom CGM market over the forecast period of 2025–2033 is estimated to be approximately 15-18%. This growth is supported by continuous research and development efforts, leading to next-generation devices with enhanced features and improved user interfaces. The focus on remote patient monitoring and the digitalization of healthcare further underscore the significant growth potential of the CGM market in the UK, making it an attractive investment and development landscape for healthcare technology companies.

Dominant Regions, Countries, or Segments in United Kingdom Continuous Glucose Monitoring Market

Within the United Kingdom Continuous Glucose Monitoring (CGM) market, the Sensors segment emerges as the dominant force, driving significant market growth and innovation. This dominance stems from the fundamental role of sensors as the core component of any CGM system. Their performance, accuracy, reliability, and cost directly impact the overall effectiveness and user experience of the technology. The increasing demand for more advanced, less invasive, and longer-lasting sensors is a primary driver for the growth within this segment.

- Dominance of Sensors: The sensor segment commands a substantial market share due to its indispensable nature in CGM technology. Continuous improvements in sensor materials, manufacturing processes, and data acquisition capabilities are key factors.

- Market Share: Estimated to account for over 60% of the total United Kingdom CGM market value.

- Growth Potential: High, driven by the necessity for sensor replacement and the ongoing development of novel sensor technologies.

- Key Drivers for Sensor Dominance:

- Technological Advancement: Innovations in enzyme technology, biosensors, and miniaturization lead to more accurate and user-friendly sensors.

- Wear Time & Comfort: Development of sensors that can be worn for longer periods (e.g., 10-14 days or more) reduces user burden and increases adherence.

- Accuracy & Reliability: Improved accuracy in glucose readings compared to traditional methods, minimizing false alarms and enhancing confidence in the data.

- Cost-Effectiveness: While initial sensor costs can be high, longer wear times and improved durability contribute to a more favorable cost-benefit ratio over time.

- Analysis of Dominance: The continuous need for sensor replacements ensures a steady revenue stream within this segment. Furthermore, breakthroughs in sensor technology, such as the development of electrochemical sensors with improved stability and reduced interference, are critical for the broader adoption and acceptance of CGM. The performance of these sensors directly influences the efficacy of the entire CGM system, making this segment the focal point of research and development investment.

The Durables segment, comprising the transmitter and receiver (or smartphone app), also plays a crucial role. While not as high in volume as sensors, the technological sophistication and connectivity features of durables are paramount for data interpretation, transmission, and user interaction. Innovations in these devices focus on seamless integration with wearable technology, advanced analytics, and user-friendly interfaces. The competitive landscape in durables involves significant R&D to offer features like real-time trend arrows, predictive alerts, and secure cloud connectivity for data sharing. The increasing adoption of smartphone-based CGM systems, where the smartphone acts as the receiver, also influences the growth and evolution of the durables segment.

- Durables Segment Contribution: Essential for data management and user engagement, contributing to the overall value proposition of CGM.

- Market Share: Accounts for approximately 30-35% of the United Kingdom CGM market value.

- Growth Potential: Moderate, driven by the need for device upgrades and enhanced connectivity features.

- Key Drivers for Durables:

- Connectivity: Bluetooth and wireless capabilities for seamless data transfer.

- User Interface: Intuitive design and comprehensive data visualization for ease of use.

- Integration: Compatibility with smartphones, smartwatches, and other health platforms.

- Data Analytics: Development of algorithms for personalized insights and predictive alerts.

United Kingdom Continuous Glucose Monitoring Market Product Landscape

The United Kingdom CGM market is characterized by a landscape of increasingly sophisticated and user-centric products. Innovations are focused on enhancing sensor accuracy, extending wear times, and improving data connectivity for seamless integration into daily life. Products like Abbott's FreeStyle Libre series, with its factory-calibrated, no-fingerstick required sensors, and Dexcom's G7, offering the fastest sensor warmup and advanced alerts, exemplify the technological advancements. These devices are designed to provide real-time glucose readings, trend arrows, and customizable alerts, empowering users with proactive diabetes management. The emphasis is on miniaturization, comfort, and long-term wearability, coupled with intuitive smartphone applications that offer comprehensive data analysis and report generation for both patients and healthcare providers.

Key Drivers, Barriers & Challenges in United Kingdom Continuous Glucose Monitoring Market

Key Drivers:

- Rising Diabetes Prevalence: The increasing incidence of Type 1 and Type 2 diabetes in the UK population necessitates advanced monitoring solutions.

- Technological Advancements: Continuous innovation in sensor accuracy, miniaturization, and data connectivity enhances user experience and clinical utility.

- Improved Clinical Outcomes: Proven benefits in HbA1c reduction, hypoglycemia prevention, and enhanced quality of life drive adoption among patients and healthcare professionals.

- Growing Awareness and Education: Increased understanding of CGM's advantages over traditional methods among patients and healthcare providers.

- NHS Initiatives: Favorable reimbursement policies and integrated care strategies within the National Health Service supporting CGM adoption.

Barriers & Challenges:

- Cost of Devices and Sensors: The ongoing expense of disposable sensors and the initial cost of durable components can be a significant barrier for some individuals and healthcare systems.

- Regulatory Hurdles: While approvals are in place, the process for new product introductions and updates can be lengthy.

- Data Overload and Interpretation: For some users, the volume of data generated by CGM devices can be overwhelming, requiring adequate training and support for effective interpretation.

- Technological Literacy: A segment of the population may face challenges adapting to the digital interfaces and connected nature of modern CGM systems.

- Supply Chain Disruptions: Global supply chain issues can potentially impact the availability of critical components and finished products.

Emerging Opportunities in United Kingdom Continuous Glucose Monitoring Market

Emerging opportunities in the United Kingdom CGM market lie in the expansion of CGM use beyond traditional diabetes management. This includes applications for pre-diabetes monitoring, gestational diabetes, and even for individuals participating in rigorous athletic training who need to optimize glucose levels for performance. The integration of CGM data with artificial intelligence (AI) and machine learning (ML) algorithms presents a significant opportunity for personalized predictive insights, potentially forecasting hypoglycemic or hyperglycemic events with even greater accuracy. Furthermore, developing CGM solutions tailored for specific age groups, such as pediatric populations with unique needs, and exploring non-invasive or minimally invasive sensor technologies will open new avenues for growth. The increasing trend towards remote patient monitoring and telehealth services also creates a demand for robust, data-driven CGM platforms that can facilitate proactive and efficient patient care management from a distance.

Growth Accelerators in the United Kingdom Continuous Glucose Monitoring Market Industry

Several catalysts are accelerating the growth of the United Kingdom Continuous Glucose Monitoring Market industry. Firstly, continuous technological breakthroughs in sensor design and functionality, leading to greater accuracy, longer wear times, and improved comfort, are key drivers. Secondly, strategic partnerships between CGM manufacturers, pharmaceutical companies, and healthcare providers are facilitating wider market access and integrated patient care solutions. These collaborations often involve data sharing agreements and joint marketing initiatives. Lastly, proactive market expansion strategies, including increased investment in direct-to-consumer marketing, educational outreach programs for healthcare professionals, and advocacy for favorable reimbursement policies by the NHS, are vital in broadening the market base and driving sustained growth. The growing acceptance of value-based healthcare models also encourages the adoption of CGM, as its proven ability to improve outcomes and reduce long-term healthcare costs aligns with these principles.

Key Players Shaping the United Kingdom Continuous Glucose Monitoring Market Market

- Abbott Diabetes Care

- GlySens

- Dexcom Inc.

- Eversense

- Medtronic PLC

- Other Company Share Analyse

- Ascensia Diabetes Care

Notable Milestones in United Kingdom Continuous Glucose Monitoring Market Sector

- October 2022: Abbott announced that a new study published in The New England Journal of Medicine demonstrated that for adults with Type-1 diabetes and suboptimal glycemic control, Abbott's FreeStyle Libre 2 glucose monitoring system provided significant reductions in glycated hemoglobin (HbA1c) compared to self-monitoring of blood glucose, which were sustained for the study duration of 24 weeks. The FreeStyle Libre 2 system was also linked to improvements in participant-reported quality of life outcomes, including overall satisfaction and reduced burden associated with glucose monitoring.

- April 2022: Dexcom released G7 in the United Kingdom. The company announced that the G7 is available for people with diabetes aged two years and older in the United Kingdom. Dexcom G7 has the fastest sensor warmup with no finger sticks or scanning required. It is clinically proven to lower A1C and reduce hyper- and hypoglycemia, supported by more peer-reviewed and clinical research.

In-Depth United Kingdom Continuous Glucose Monitoring Market Market Outlook

The future outlook for the United Kingdom Continuous Glucose Monitoring (CGM) market is exceptionally promising, driven by the continuous refinement of existing technologies and the exploration of novel applications. Growth accelerators like the integration of AI for predictive analytics and personalized treatment plans will further enhance user value and clinical efficacy. The increasing focus on preventative healthcare and the management of pre-diabetes also presents a significant untapped market segment. Strategic collaborations aimed at simplifying data access for both patients and clinicians, alongside robust educational initiatives, will foster deeper market penetration and sustained adoption. As CGM technology becomes more accessible, affordable, and integrated into the broader digital health ecosystem, its role in transforming diabetes care in the UK will continue to expand, solidifying its position as a cornerstone of modern diabetes management.

United Kingdom Continuous Glucose Monitoring Market Segmentation

-

1. Component

- 1.1. Sensors

- 1.2. Durables

United Kingdom Continuous Glucose Monitoring Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Continuous Glucose Monitoring Market Regional Market Share

Geographic Coverage of United Kingdom Continuous Glucose Monitoring Market

United Kingdom Continuous Glucose Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.22% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market

- 3.3. Market Restrains

- 3.3.1. Monopolized Supply Chain and High Cost of Devices

- 3.4. Market Trends

- 3.4.1. Growing Diabetes Population in the United Kingdom

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Continuous Glucose Monitoring Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Sensors

- 5.1.2. Durables

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Abbott Diabetes Care

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GlySens

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dexcom Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Eversense

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Medtronic PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Other Company Share Analyse

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ascensia Diabetes Care

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Abbott Diabetes Care

List of Figures

- Figure 1: United Kingdom Continuous Glucose Monitoring Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United Kingdom Continuous Glucose Monitoring Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Continuous Glucose Monitoring Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 2: United Kingdom Continuous Glucose Monitoring Market Volume K Unit Forecast, by Component 2020 & 2033

- Table 3: United Kingdom Continuous Glucose Monitoring Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: United Kingdom Continuous Glucose Monitoring Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: United Kingdom Continuous Glucose Monitoring Market Revenue undefined Forecast, by Component 2020 & 2033

- Table 6: United Kingdom Continuous Glucose Monitoring Market Volume K Unit Forecast, by Component 2020 & 2033

- Table 7: United Kingdom Continuous Glucose Monitoring Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: United Kingdom Continuous Glucose Monitoring Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Continuous Glucose Monitoring Market?

The projected CAGR is approximately 7.22%.

2. Which companies are prominent players in the United Kingdom Continuous Glucose Monitoring Market?

Key companies in the market include Abbott Diabetes Care, GlySens, Dexcom Inc, Eversense, Medtronic PLC, Other Company Share Analyse, Ascensia Diabetes Care.

3. What are the main segments of the United Kingdom Continuous Glucose Monitoring Market?

The market segments include Component.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rapidly Increasing Incidence and Prevalence of Diabetes; Technological Advancements in the Market.

6. What are the notable trends driving market growth?

Growing Diabetes Population in the United Kingdom.

7. Are there any restraints impacting market growth?

Monopolized Supply Chain and High Cost of Devices.

8. Can you provide examples of recent developments in the market?

October 2022: Abbott announced that a new study published in The New England Journal of Medicine demonstrated that for adults with Type-1 diabetes and suboptimal glycemic control, Abbott's FreeStyle Libre 2 glucose monitoring system provided significant reductions in glycated hemoglobin (HbA1c) compared to self-monitoring of blood glucose, which were sustained for the study duration of 24 weeks. The FreeStyle Libre 2 system was also linked to improvements in participant-reported quality of life outcomes, including overall satisfaction and reduced burden associated with glucose monitoring.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Continuous Glucose Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Continuous Glucose Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Continuous Glucose Monitoring Market?

To stay informed about further developments, trends, and reports in the United Kingdom Continuous Glucose Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence