Key Insights

The United Kingdom foam insulation market is experiencing significant expansion, propelled by stringent energy efficiency regulations, heightened environmental consciousness, and the growing need for superior building performance. With a projected Compound Annual Growth Rate (CAGR) of 7% from a base year of 2025, the market is forecast to reach $7.47 billion. This growth is underpinned by several pivotal drivers. Primarily, the UK's commitment to carbon emission reduction and enhanced building energy efficiency is directly stimulating demand for advanced foam insulation. Secondly, escalating energy costs are incentivizing both residential and commercial entities to adopt insulation solutions for cost savings. Thirdly, technological advancements in foam insulation are yielding more durable, efficient, and sustainable products. Key market segments contributing to this expansion include Polyisocyanurate, Polyurethane, and Polystyrene foams, recognized for their cost-effectiveness and excellent thermal properties. The building and construction sector remains the dominant end-user, though growth is also anticipated in transportation and consumer appliances. Intense competition among leading firms like Kingspan Group, Saint-Gobain, and BASF SE fosters continuous innovation and price optimization. Challenges, however, include volatile raw material pricing and potential regulatory adjustments, necessitating ongoing research into sustainable and high-performance alternatives.

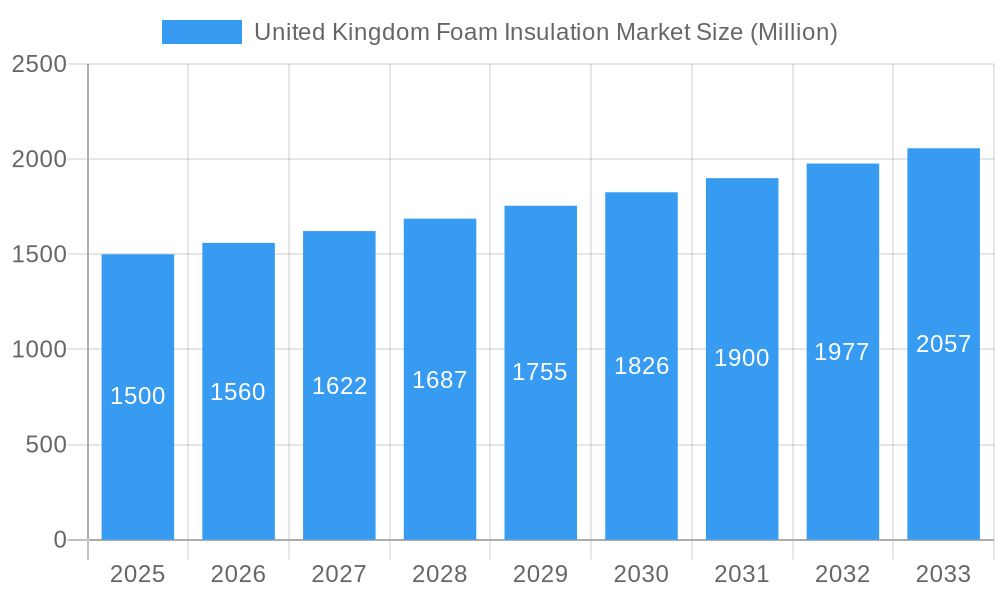

United Kingdom Foam Insulation Market Market Size (In Billion)

While the market outlook is robust, certain constraints exist. The upfront installation costs of foam insulation can present a barrier for some consumers. Additionally, environmental concerns surrounding specific foam types, particularly those containing HFCs, are accelerating the transition to more eco-friendly alternatives. To address these challenges, manufacturers are prioritizing research and development to enhance product sustainability and performance, alongside efforts to improve cost-effectiveness and installation simplicity to broaden market appeal. The long-term forecast for the UK foam insulation market remains highly optimistic, supported by government initiatives, technological progress, and increasing consumer demand for energy efficiency and sustainable construction. Significant market growth is anticipated as materials science and construction innovations facilitate wider adoption of high-performance foam insulation across various sectors.

United Kingdom Foam Insulation Market Company Market Share

United Kingdom Foam Insulation Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Kingdom foam insulation market, covering market dynamics, growth trends, key players, and future outlook. The report segments the market by type (polystyrene, polyurethane and polyisocyanurate, polyolefin, elastomeric, phenolic, other types) and end-user industry (building and construction, transportation, consumer appliances, other end-user industries), offering granular insights for strategic decision-making. The study period spans from 2019 to 2033, with 2025 as the base and estimated year.

The report includes detailed analysis of:

- Market Size & Growth: Historical data (2019-2024), current estimates (2025), and future forecasts (2025-2033) in Million units.

- Competitive Landscape: Market share analysis of key players like Bauder Ltd, Recticel, Saint-Gobain, Xtratherm Ltd, Ramsay Rubber, Armacell, EcoTherm Insulation (UK) Limited, Owens Corning, Kingspan Group, BASF SE, Dow, Knauf Insulation, Covestro AG, Johns Manville, Zotefoams PLC, BAU UK Ltd, Hunstman International LLC, and JSJ Foam Insulation.

- Industry Trends & Developments: In-depth coverage of recent mergers & acquisitions (M&A) activities and their impact on the market.

This report is an essential resource for businesses, investors, and market analysts seeking a thorough understanding of the UK foam insulation market.

United Kingdom Foam Insulation Market Dynamics & Structure

The UK foam insulation market is characterized by moderate concentration, with a few major players holding significant market share, while numerous smaller companies cater to niche segments. Technological innovation, driven by the need for higher energy efficiency and sustainable building practices, is a key driver. Stringent building regulations and environmental policies in the UK create a favourable regulatory environment for foam insulation adoption. However, the market also faces competition from alternative insulation materials, such as mineral wool and fibreglass. The demographics of end-users, particularly the growing focus on retrofitting existing buildings and new construction projects incorporating energy-efficient designs, significantly impact market demand. Furthermore, the market witnesses frequent M&A activities, reflecting the consolidation trend within the industry.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share (2025).

- Technological Innovation: Focus on improving thermal performance, reducing flammability, and enhancing sustainability.

- Regulatory Framework: Stringent building codes and environmental regulations incentivize adoption of high-performance insulation materials.

- Competitive Product Substitutes: Mineral wool, fibreglass, and other insulation materials pose competitive pressure.

- End-User Demographics: Growing demand from both residential and commercial sectors, driven by energy efficiency targets and building renovations.

- M&A Trends: Significant M&A activity observed in recent years (e.g., Owens Corning's acquisition of Natural Polymers LLC, Xtratherm's acquisition of Ballytherm's UK operations), indicating industry consolidation.

United Kingdom Foam Insulation Market Growth Trends & Insights

The UK foam insulation market experienced substantial growth during the historical period (2019-2024), driven by increasing awareness of energy efficiency and government initiatives promoting sustainable building practices. The market size is estimated at xx Million units in 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). Adoption rates are high in new construction, but the retrofitting market presents significant untapped potential. Technological disruptions, such as the introduction of advanced foam formulations with improved insulation properties and ease of installation, further accelerate market growth. Consumer behaviour is shifting towards eco-friendly and high-performance insulation solutions, creating demand for sustainable and efficient products. The rising construction activities and government initiatives to enhance energy efficiency in buildings are the major factors that propel the market.

Dominant Regions, Countries, or Segments in United Kingdom Foam Insulation Market

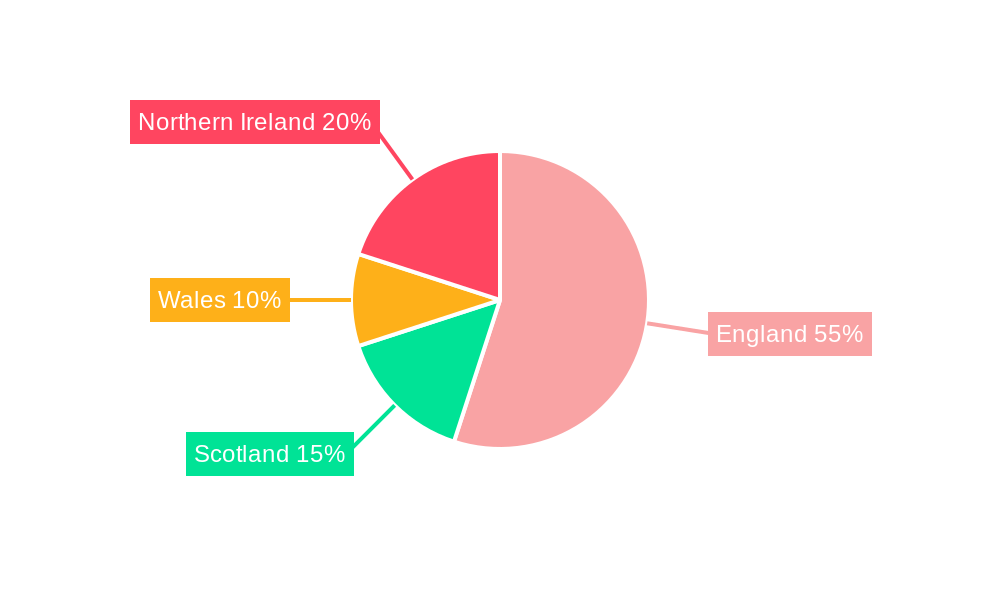

The building and construction sector dominates the UK foam insulation market, accounting for approximately xx% of total consumption in 2025. Within the types segment, polyurethane and polyisocyanurate foams hold the largest market share due to their superior thermal performance and versatility. Geographically, the South East and London regions experience the highest demand, driven by high construction activity and a larger existing building stock. Key growth drivers include:

- Government Policies: Incentives and regulations promoting energy efficiency in buildings.

- Infrastructure Development: Significant investments in infrastructure projects stimulate demand for insulation materials.

- Rising Construction Activity: Increase in both residential and commercial construction drives market expansion.

- Energy Prices: Fluctuations in energy prices influence the demand for energy-efficient building solutions.

The dominance of the building and construction sector is expected to continue throughout the forecast period due to continuous growth in this sector. The market growth will be driven by government regulations, rising energy prices and the construction of new homes.

United Kingdom Foam Insulation Market Product Landscape

The UK foam insulation market offers a diverse range of products, including spray foams, rigid boards, and loose-fill insulation, each catering to different applications and performance requirements. Recent product innovations focus on improving thermal performance, enhancing fire resistance, and incorporating sustainable materials. Manufacturers are emphasizing the unique selling propositions of their products, such as ease of installation, improved durability, and reduced environmental impact. Technological advancements like the use of nanomaterials and advanced manufacturing processes lead to superior insulation performance and improved product attributes.

Key Drivers, Barriers & Challenges in United Kingdom Foam Insulation Market

Key Drivers:

- Stringent Building Regulations: Demand for energy-efficient buildings is driving foam insulation adoption.

- Government Incentives: Grants and tax breaks encourage the use of energy-efficient materials.

- Rising Energy Costs: Higher energy bills motivate homeowners and businesses to improve insulation.

Key Challenges:

- Supply Chain Disruptions: Global events, such as the pandemic, have affected the availability and cost of raw materials. This has resulted in an xx% increase in prices during the historical period.

- Regulatory Hurdles: Complex building regulations and approval processes can slow down project implementation.

- Competitive Pressures: Alternative insulation materials pose a competitive threat to the market.

Emerging Opportunities in United Kingdom Foam Insulation Market

- Retrofit Market: Significant untapped potential in retrofitting existing buildings.

- Sustainable Products: Growing demand for eco-friendly and recyclable foam insulation solutions.

- Innovative Applications: Expansion into new applications, such as industrial and transportation sectors.

Growth Accelerators in the United Kingdom Foam Insulation Market Industry

Technological breakthroughs in foam insulation, including the development of high-performance materials with enhanced thermal properties and improved fire resistance, are crucial growth catalysts. Strategic partnerships between insulation manufacturers and building contractors facilitate market penetration and drive adoption. Expansion strategies focusing on niche markets, such as sustainable building projects and industrial applications, offer promising growth opportunities.

Key Players Shaping the United Kingdom Foam Insulation Market Market

- Bauder Ltd

- Recticel

- Saint-Gobain

- Xtratherm Ltd

- Ramsay Rubber

- Armacell

- EcoTherm Insulation (UK) Limited

- Owens Corning

- Kingspan Group

- BASF SE

- Dow

- Knauf Insulation

- Covestro AG

- Johns Manville

- Zotefoams PLC

- BAU UK Ltd

- Hunstman International LLC

- JSJ Foam Insulation

Notable Milestones in United Kingdom Foam Insulation Market Sector

- June 2022: Owens Corning acquired Natural Polymers LLC, strengthening its position in the spray polyurethane foam insulation market.

- July 2021: Xtratherm acquired Ballytherm's Ireland and UK operations, expanding its manufacturing capacity in the UK.

In-Depth United Kingdom Foam Insulation Market Market Outlook

The UK foam insulation market is poised for robust growth throughout the forecast period, driven by strong demand from the building and construction sector, government initiatives promoting energy efficiency, and technological advancements in foam insulation materials. Strategic opportunities exist in expanding into the retrofit market, developing sustainable products, and exploring innovative applications. The market will continue to see consolidation as larger players make acquisitions to gain a bigger market share. The long-term outlook remains positive, with significant potential for market expansion.

United Kingdom Foam Insulation Market Segmentation

-

1. Types

- 1.1. Polystyrene

- 1.2. Polyurethane and Polyisocyanurate

- 1.3. Polyolefin

- 1.4. Elastomeric

- 1.5. Phenolic

- 1.6. Other Types

-

2. End-user Industry

- 2.1. Building and Construction

- 2.2. Transportation

- 2.3. Consumer Appliances

- 2.4. Other End-user Industries

United Kingdom Foam Insulation Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Foam Insulation Market Regional Market Share

Geographic Coverage of United Kingdom Foam Insulation Market

United Kingdom Foam Insulation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage in the Building and Construction; Higher Demand for Polyurethane and Polyisocyanate Foam

- 3.3. Market Restrains

- 3.3.1. Growing Health Concerns; Challenges in Mortgaging or Reselling Houses with Foam Insulation

- 3.4. Market Trends

- 3.4.1. Increasing Usage in the Building and Construction Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Foam Insulation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Types

- 5.1.1. Polystyrene

- 5.1.2. Polyurethane and Polyisocyanurate

- 5.1.3. Polyolefin

- 5.1.4. Elastomeric

- 5.1.5. Phenolic

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Building and Construction

- 5.2.2. Transportation

- 5.2.3. Consumer Appliances

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Types

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bauder Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Recticel

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Saint-Gobain

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Xtratherm Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ramsay Rubber

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Armacell

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 EcoTherm Insulation (UK) Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Owens Corning

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kingspan Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Dow

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Knauf Insulation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Covestro AG

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Johns Manville

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Zotefoams PLC

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 BAU UK Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Hunstman International LLC

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 JSJ Foam Insulation

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 Bauder Ltd

List of Figures

- Figure 1: United Kingdom Foam Insulation Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Foam Insulation Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Foam Insulation Market Revenue billion Forecast, by Types 2020 & 2033

- Table 2: United Kingdom Foam Insulation Market Volume K Tons Forecast, by Types 2020 & 2033

- Table 3: United Kingdom Foam Insulation Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: United Kingdom Foam Insulation Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 5: United Kingdom Foam Insulation Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: United Kingdom Foam Insulation Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: United Kingdom Foam Insulation Market Revenue billion Forecast, by Types 2020 & 2033

- Table 8: United Kingdom Foam Insulation Market Volume K Tons Forecast, by Types 2020 & 2033

- Table 9: United Kingdom Foam Insulation Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 10: United Kingdom Foam Insulation Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 11: United Kingdom Foam Insulation Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Foam Insulation Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Foam Insulation Market?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the United Kingdom Foam Insulation Market?

Key companies in the market include Bauder Ltd, Recticel, Saint-Gobain, Xtratherm Ltd, Ramsay Rubber, Armacell, EcoTherm Insulation (UK) Limited, Owens Corning, Kingspan Group, BASF SE, Dow, Knauf Insulation, Covestro AG, Johns Manville, Zotefoams PLC, BAU UK Ltd, Hunstman International LLC, JSJ Foam Insulation.

3. What are the main segments of the United Kingdom Foam Insulation Market?

The market segments include Types, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.47 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage in the Building and Construction; Higher Demand for Polyurethane and Polyisocyanate Foam.

6. What are the notable trends driving market growth?

Increasing Usage in the Building and Construction Segment.

7. Are there any restraints impacting market growth?

Growing Health Concerns; Challenges in Mortgaging or Reselling Houses with Foam Insulation.

8. Can you provide examples of recent developments in the market?

In June 2022, Owens Corning acquired Natural Polymers LLC, based in Cortland, Illinois, an innovative spray polyurethane foam insulation manufacturer primarily recognized for building and construction applications. This acquisition is a part of Owens Corning's strategy to tap higher-growth segments while strengthening its core building and construction products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Foam Insulation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Foam Insulation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Foam Insulation Market?

To stay informed about further developments, trends, and reports in the United Kingdom Foam Insulation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence