Key Insights

The United Kingdom timber cladding market is projected for substantial growth, driven by increasing consumer demand for sustainable and aesthetically pleasing construction materials. With a projected Compound Annual Growth Rate (CAGR) of 12.79%, the market is expected to expand from an estimated market size of £9.82 billion in the base year of 2025 to reach higher figures by 2033. This growth is fueled by a growing awareness and preference for eco-friendly construction solutions, supported by government initiatives promoting green building practices. Timber cladding offers a sustainable alternative with a lower carbon footprint and superior thermal insulation. Its natural aesthetic appeal and design versatility make it a preferred choice for residential and non-residential projects. Demand for high-quality species like Cedar, Larch, and Oak, known for their durability and natural resistance, is on the rise.

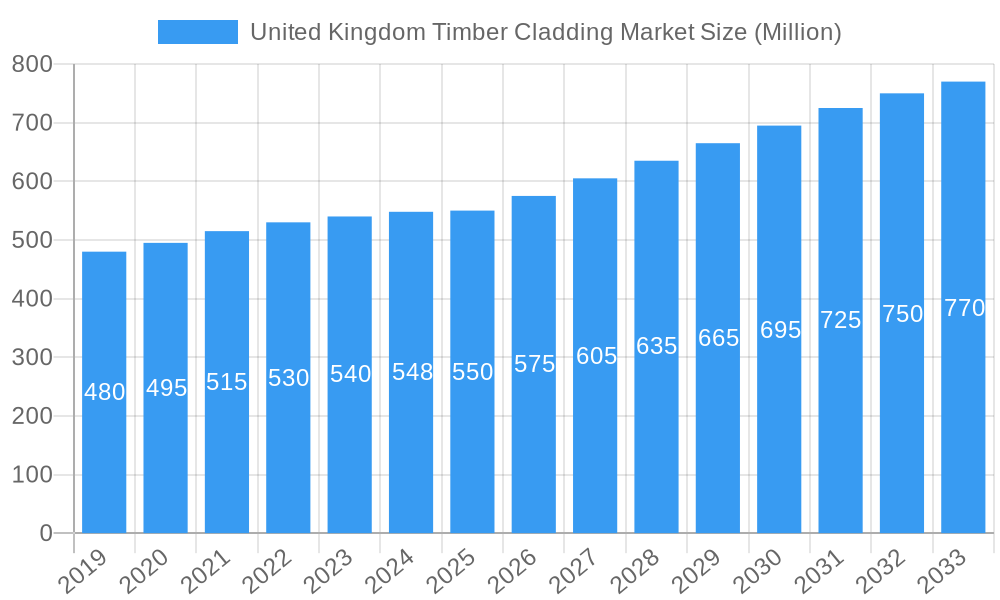

United Kingdom Timber Cladding Market Market Size (In Billion)

The evolving construction landscape, which prioritizes both performance and visual appeal, further supports market expansion. Modern architectural trends incorporating natural elements and increased property renovations with enhanced external finishes are key drivers. Potential challenges include fluctuations in raw material costs and the availability of skilled labor for installation. However, the inherent advantages of timber cladding, including its excellent lifecycle performance and contribution to building energy efficiency, are anticipated to mitigate these concerns. Leading companies such as Timbmet, BSW Timber Ltd, Howarth Timber Group, and Vastern Timber Limited are actively innovating to meet diverse market needs across residential, commercial, and public building sectors.

United Kingdom Timber Cladding Market Company Market Share

This comprehensive report provides critical insights into the United Kingdom timber cladding market, covering a study period from 2019 to 2033. The analysis focuses on market dynamics, growth trends, regional factors, product innovations, and key players. It incorporates detailed examination of market structures and utilizes relevant keywords for optimal SEO performance, catering to professionals in building design, construction, and material supply. The report integrates quantitative data, presented in billion units, and qualitative insights for a thorough understanding of this dynamic sector.

United Kingdom Timber Cladding Market Market Dynamics & Structure

The United Kingdom timber cladding market is characterized by a moderate level of market concentration, with several key players vying for market share. Technological innovation drivers, particularly in sustainable wood treatments and advanced manufacturing techniques, are significantly influencing product development and application possibilities for buildings and homes. Regulatory frameworks, including evolving building codes and fire safety standards, play a crucial role in shaping market entry and product acceptance. Competitive product substitutes, such as composite materials and engineered wood products, present a constant challenge, necessitating continuous innovation in natural timber solutions. End-user demographics, with a growing demand for aesthetically pleasing and environmentally responsible building materials, are increasingly dictating market preferences. Mergers and acquisitions (M&A) are a notable trend, with companies seeking to expand their product portfolios and geographical reach.

- Market Concentration: Moderate, with a mix of large established firms and specialized niche players.

- Technological Innovation: Focus on durability, weather resistance, fire retardancy, and sustainable sourcing.

- Regulatory Impact: Stringent fire safety regulations are a key consideration for product development and marketing.

- Competitive Landscape: Intense competition from both natural and engineered cladding alternatives.

- End-User Demographics: Rising preference for natural, sustainable, and visually appealing materials in both residential and non-residential sectors.

- M&A Trends: Strategic acquisitions aimed at vertical integration and market expansion.

United Kingdom Timber Cladding Market Growth Trends & Insights

The United Kingdom timber cladding market is poised for substantial growth driven by a confluence of economic, environmental, and aesthetic factors. Over the historical period (2019-2024), the market has witnessed steady adoption rates, particularly in the residential sector, fueled by a growing appreciation for natural building materials and a desire for unique architectural designs. The base year of 2025 marks a significant point from which the forecast period (2025-2033) is projected to exhibit accelerated expansion. Market size evolution is expected to be robust, with a projected CAGR of xx% through 2033. This upward trajectory is underpinned by increasing consumer awareness regarding the environmental benefits of timber, such as its carbon sequestration properties, aligning with the UK's ambitious sustainability targets. Technological disruptions are less about fundamental shifts and more about refinements in wood processing, treatment, and installation methods, enhancing durability, fire resistance, and ease of application. Consumer behavior is shifting towards a greater emphasis on biophilic design principles, where natural materials like timber cladding are integral to creating healthier and more aesthetically pleasing living and working environments. The demand for customized solutions and a wider range of wood species is also on the rise, offering significant opportunities for manufacturers and suppliers. Furthermore, government incentives for green building and renovation projects are expected to act as powerful growth accelerators. The increasing focus on renovation and retrofitting of existing building stock, alongside new construction projects, will continue to fuel the demand for timber cladding solutions across the nation. The interplay between market size evolution, adoption rates, technological refinements, and evolving consumer preferences will define the future landscape of the UK timber cladding industry.

Dominant Regions, Countries, or Segments in United Kingdom Timber Cladding Market

The United Kingdom timber cladding market's dominance is significantly influenced by regional economic activity, construction project pipelines, and regional preferences for specific wood types and applications. While the entire UK presents opportunities, certain regions and segments exhibit stronger growth potential.

Dominant Segment: Wall Cladding

Wall cladding represents the most significant segment within the UK timber cladding market, driven by its dual function of protecting the building envelope and enhancing its aesthetic appeal. This segment accounts for an estimated xx% of the total market value in 2025.

- Key Drivers for Wall Cladding Dominance:

- New Construction: The ongoing demand for new residential homes and commercial properties necessitates extensive use of wall cladding for both functional and design purposes.

- Renovation & Refurbishment: A substantial portion of the UK's building stock requires modernization, with wall cladding being a popular choice for improving energy efficiency and visual appeal.

- Architectural Versatility: Timber's inherent adaptability allows for a wide range of design styles, from traditional to contemporary, making it suitable for diverse architectural projects.

- Sustainability Credentials: Growing environmental consciousness among consumers and developers makes timber an attractive choice for visible building elements.

Dominant Product Segments:

Within the broader timber cladding market, specific wood species are leading the charge due to their unique properties and aesthetic qualities.

- Cedar: Holds a significant market share due to its natural durability, resistance to rot and insects, and beautiful natural coloring that weathers gracefully. It is highly sought after for its aesthetic appeal in premium residential and architectural projects. Estimated market share: xx%.

- Larch: Another highly durable softwood, Larch is valued for its strength, resistance to decay, and attractive reddish-brown hue. Its suitability for exposed exterior applications makes it a popular choice for both residential and non-residential buildings. Estimated market share: xx%.

- Oak: While a more premium and expensive option, Oak is prized for its strength, hardness, and classic, timeless appearance. It is often specified for high-end architectural projects and historical restorations where durability and a sophisticated look are paramount. Estimated market share: xx%.

- Other Products (Spruce, Chestnut, etc.): These species offer a more cost-effective alternative and are utilized in applications where specific durability or aesthetic requirements are less stringent. They are crucial for broadening the accessibility of timber cladding. Estimated market share: xx%.

Dominant End-User Industry:

- Residential: This segment is a primary driver, encompassing new builds and extensive renovation projects for individual homes. The desire for enhanced curb appeal, natural materials, and energy efficiency fuels demand. Estimated market share: xx%.

- Non-Residential: Includes commercial buildings, public institutions, and hospitality sectors. The growing trend of incorporating biophilic design and sustainable materials in corporate and public spaces is boosting demand in this sector. Estimated market share: xx%.

The interplay of these segments, driven by economic policies promoting construction and renovation, infrastructure development, and a strong consumer preference for natural, sustainable materials, solidifies the dominance of wall cladding, particularly with species like Cedar and Larch, within the residential and growing non-residential sectors.

United Kingdom Timber Cladding Market Product Landscape

The United Kingdom timber cladding market is distinguished by an array of product innovations focused on enhancing durability, sustainability, and design versatility. Cedar continues to be a premium choice, celebrated for its natural oils that provide inherent resistance to decay and insect attack, coupled with its attractive, natural weathering properties. Larch offers robust durability and a striking aesthetic, often favored for its strength in demanding exterior environments. Oak, though a higher investment, provides unparalleled hardness, longevity, and a classic, sophisticated finish for discerning architectural projects. Beyond these primary species, a growing range of 'other products' such as Spruce and Chestnut are gaining traction, offering more budget-friendly yet effective cladding solutions. Innovations in wood treatment, including acetylation and thermal modification, are extending the lifespan and improving the performance of various timber species, making them more resistant to moisture, UV degradation, and fire. These advancements are critical for meeting increasingly stringent building regulations and consumer expectations for low-maintenance, high-performance cladding systems.

Key Drivers, Barriers & Challenges in United Kingdom Timber Cladding Market

Key Drivers:

- Sustainability & Environmental Consciousness: Growing demand for natural, renewable building materials aligned with Net Zero targets.

- Aesthetic Appeal & Design Flexibility: Timber cladding offers a natural, warm aesthetic and versatility for diverse architectural styles.

- Energy Efficiency Improvements: Renovation and retrofitting projects often incorporate timber cladding for enhanced insulation and thermal performance.

- Government Initiatives & Green Building Standards: Support for sustainable construction practices and materials.

- Technological Advancements: Improved wood treatments enhancing durability and fire resistance.

Key Barriers & Challenges:

- Fire Safety Regulations: Stringent fire safety standards can pose a significant hurdle for certain timber cladding applications, requiring advanced treatments and careful specification.

- Maintenance Requirements: Perceived or actual maintenance needs, such as regular sealing or cleaning, can deter some consumers.

- Cost Competitiveness: While natural timber offers many benefits, it can sometimes be more expensive than composite or synthetic alternatives.

- Supply Chain Volatility: Fluctuations in timber availability and pricing due to global demand and logistical challenges.

- Durability Concerns: While modern treatments improve performance, concerns about long-term durability against extreme weather conditions can persist.

Emerging Opportunities in United Kingdom Timber Cladding Market

Emerging opportunities in the United Kingdom timber cladding market lie in the increasing demand for pre-finished and prefabricated cladding systems that simplify installation and reduce on-site labor. The growth of the sustainable building sector, particularly projects seeking BREEAM or LEED certifications, presents a significant avenue for responsibly sourced and certified timber cladding. Furthermore, the development of innovative fire-retardant treatments that maintain the natural aesthetic of wood will unlock new application possibilities in high-rise and sensitive urban developments. The increasing trend of timber frame construction also directly boosts the demand for complementary timber cladding solutions. Untapped markets in heritage restoration projects, where authentic natural materials are preferred, also represent a niche but valuable opportunity.

Growth Accelerators in the United Kingdom Timber Cladding Market Industry

Several catalysts are driving long-term growth in the UK timber cladding market. Technological breakthroughs in wood modification, such as advanced acetylation and thermal processing, are significantly enhancing timber's durability, stability, and resistance to decay and fire, thereby broadening its application spectrum. Strategic partnerships between timber suppliers, manufacturers, and architects are fostering innovation and creating bespoke cladding solutions tailored to specific project needs. The increasing focus on the circular economy and the embodied carbon benefits of timber construction are also gaining traction, positioning timber cladding as a preferred choice for environmentally conscious developments. Market expansion strategies, including aggressive marketing campaigns highlighting sustainability and aesthetic benefits, alongside a focus on educating specifiers and end-users, will further propel growth.

Key Players Shaping the United Kingdom Timber Cladding Market Market

- Timbmet

- BSW Timber Ltd

- Howarth Timber Group

- Vastern Timber Limited

- The Brookridge Group (Brookridge Timber)

- NORclad

- Accsys

- Glenalmond Timber Company Ltd

- Dura Composites Ltd

- Russwood ltd

- James Hardie Group

Notable Milestones in United Kingdom Timber Cladding Market Sector

- January 2022: Binderholz Group acquired BSW Timber Ltd. This acquisition will strengthen Binderholz Group's market position in the European solid wood processing industry.

- June 2021: Brickability Group acquired Taylor Maxwell Group Limited, the UK's leading timber and non-combustible cladding supplier to the construction industry, for GBP 63 million (USD 89.57 million). This acquisition will strengthen Brickability Group's market position.

In-Depth United Kingdom Timber Cladding Market Market Outlook

The future outlook for the United Kingdom timber cladding market is exceptionally promising, driven by a sustained and amplified demand for sustainable, aesthetically pleasing, and high-performance building materials. Growth accelerators, including advanced wood modification technologies and the increasing adoption of timber frame construction, are setting a strong foundation for continued expansion. The market is expected to benefit significantly from the UK's commitment to Net Zero targets, with timber cladding offering clear advantages in terms of reduced embodied carbon and a natural, biophilic appeal that resonates with modern architectural trends. Strategic collaborations and ongoing innovation in fire-retardant treatments will further solidify timber's position in a wider range of applications. The forecast period (2025-2033) anticipates robust market growth, fueled by both new construction and extensive renovation projects, making timber cladding a key material in the evolution of the UK's built environment.

United Kingdom Timber Cladding Market Segmentation

-

1. Product

- 1.1. Cedar

- 1.2. Larch

- 1.3. Oak

- 1.4. Other Products (Spruce, Chestnut, etc.)

-

2. Application

- 2.1. Roof Cladding

- 2.2. Wall Cladding

-

3. End-User Industry

- 3.1. Residential

- 3.2. Non-Residential

United Kingdom Timber Cladding Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Timber Cladding Market Regional Market Share

Geographic Coverage of United Kingdom Timber Cladding Market

United Kingdom Timber Cladding Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand in Residential and Non-Residential for Construction Activities; Increasing Demand for Strong and Lightweight Materials in Construction

- 3.3. Market Restrains

- 3.3.1. Timber Shortage; Combustibles Legislation

- 3.4. Market Trends

- 3.4.1. Rising Demand from the Residential Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Timber Cladding Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Cedar

- 5.1.2. Larch

- 5.1.3. Oak

- 5.1.4. Other Products (Spruce, Chestnut, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Roof Cladding

- 5.2.2. Wall Cladding

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Residential

- 5.3.2. Non-Residential

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Various Design Opportunities for Buildings and Home

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Timbmet

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BSW Timber Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Howarth Timber Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vastern Timber Limited*List Not Exhaustive 6 5 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 The Brookridge Group (Brookridge Timber)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 NORclad

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Accsys

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Glenalmond Timber Company Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dura Composites Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Russwood ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 James Hardie Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Various Design Opportunities for Buildings and Home

List of Figures

- Figure 1: United Kingdom Timber Cladding Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Timber Cladding Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Timber Cladding Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: United Kingdom Timber Cladding Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: United Kingdom Timber Cladding Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 4: United Kingdom Timber Cladding Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: United Kingdom Timber Cladding Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: United Kingdom Timber Cladding Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: United Kingdom Timber Cladding Market Revenue billion Forecast, by End-User Industry 2020 & 2033

- Table 8: United Kingdom Timber Cladding Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Timber Cladding Market?

The projected CAGR is approximately 12.79%.

2. Which companies are prominent players in the United Kingdom Timber Cladding Market?

Key companies in the market include Various Design Opportunities for Buildings and Home, Timbmet, BSW Timber Ltd, Howarth Timber Group, Vastern Timber Limited*List Not Exhaustive 6 5 MARKET OPPORTUNITIES AND FUTURE TRENDS, The Brookridge Group (Brookridge Timber), NORclad, Accsys, Glenalmond Timber Company Ltd, Dura Composites Ltd, Russwood ltd, James Hardie Group.

3. What are the main segments of the United Kingdom Timber Cladding Market?

The market segments include Product, Application, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.82 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand in Residential and Non-Residential for Construction Activities; Increasing Demand for Strong and Lightweight Materials in Construction.

6. What are the notable trends driving market growth?

Rising Demand from the Residential Segment.

7. Are there any restraints impacting market growth?

Timber Shortage; Combustibles Legislation.

8. Can you provide examples of recent developments in the market?

January 2022: Binderholz Group acquired BSW Timber Ltd. This acquisition will strengthen Binderholz Group's market position in the European solid wood processing industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Timber Cladding Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Timber Cladding Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Timber Cladding Market?

To stay informed about further developments, trends, and reports in the United Kingdom Timber Cladding Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence