Key Insights

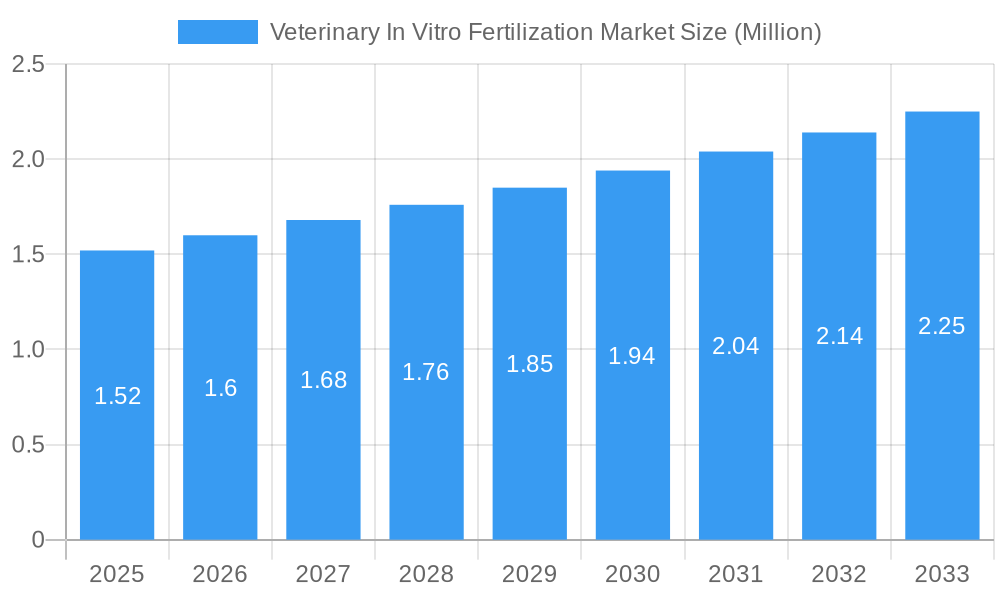

The global Veterinary In Vitro Fertilization (IVF) market is experiencing robust growth, with an estimated market size of 1.52 million in 2025, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.00% from 2025 to 2033. This upward trajectory is propelled by several key drivers, including the increasing demand for advanced reproductive technologies in companion animals and livestock, aiming to improve breeding efficiency and genetic selection. Furthermore, the rising awareness among pet owners and livestock producers about the benefits of IVF, such as overcoming infertility issues and preserving valuable genetics, significantly contributes to market expansion. The market is segmented into Instruments, Reagents/Consumables, and Services, with Instruments playing a pivotal role in facilitating IVF procedures. Techniques like Embryo Transfer and Artificial Insemination (AI) are widely adopted, while other emerging techniques are also gaining traction. End-users predominantly include veterinary hospitals and fertility clinics, underscoring the specialized nature of this market.

Veterinary In Vitro Fertilization Market Market Size (In Million)

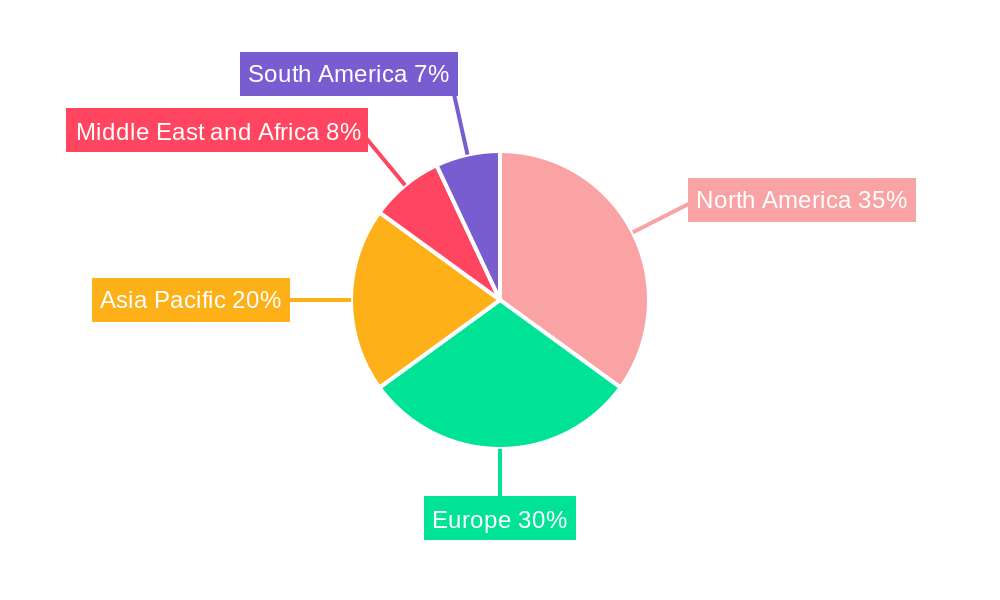

Several trends are shaping the veterinary IVF landscape, including technological advancements in cryopreservation and embryo manipulation, leading to higher success rates and wider accessibility of IVF services. The growing focus on animal welfare and the desire to maintain genetic diversity within animal populations also act as significant market accelerators. However, the market faces certain restraints, such as the high cost associated with IVF procedures, which can be a barrier for some pet owners and smaller livestock operations. The need for specialized expertise and trained professionals also presents a challenge, although this is being addressed through increased educational initiatives and training programs. Geographically, North America and Europe currently dominate the market due to the presence of established veterinary infrastructure and a higher adoption rate of advanced reproductive technologies. The Asia Pacific region is anticipated to witness the fastest growth due to increasing investments in animal husbandry and a burgeoning pet care market.

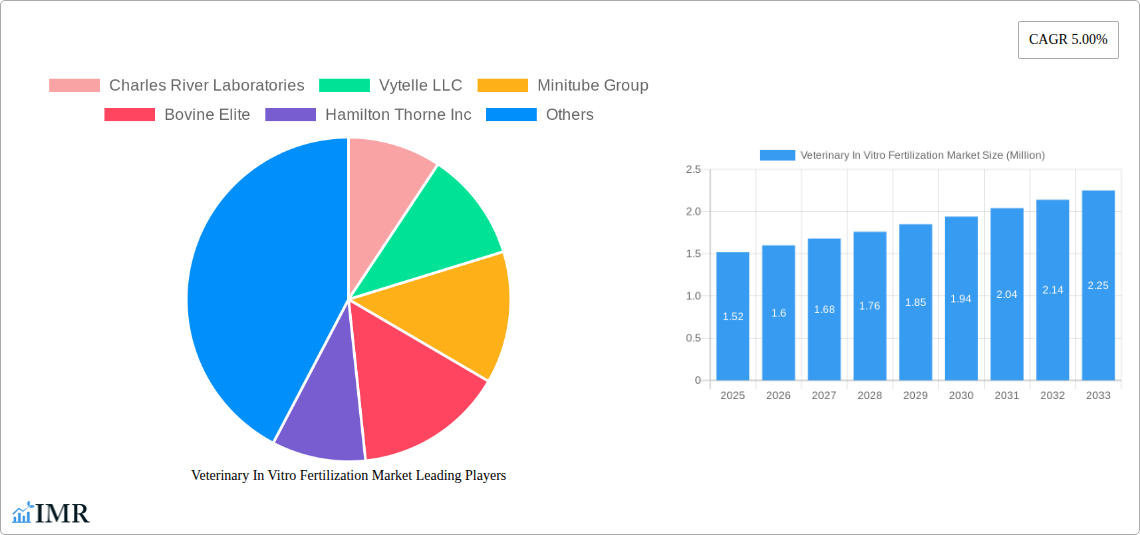

Veterinary In Vitro Fertilization Market Company Market Share

Here is a compelling, SEO-optimized report description for the Veterinary In Vitro Fertilization Market, integrated with high-traffic keywords and structured as requested:

Report Title: Veterinary In Vitro Fertilization (IVF) Market: Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2025-2033

Report Description: Unlock critical insights into the burgeoning Veterinary IVF Market with this comprehensive global industry analysis. Spanning the study period 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this report provides an in-depth examination of market dynamics, growth trends, and future opportunities. Discover the parent market of Assisted Reproductive Technologies (ART) and its significant impact on the veterinary sector. Our analysis delves into the child market segments, including advanced Instruments, essential Reagents/Consumables, and crucial Services. Explore innovative Techniques such as Embryo Transfer, widespread Artificial Insemination (AI), and other specialized methods. Understand the evolving landscape of End-Users, focusing on Veterinary Hospitals, specialized Fertility Clinics, and diverse Other End-Users. With detailed quantitative data and expert qualitative analysis, this report is indispensable for stakeholders seeking to capitalize on the rapid advancements in animal reproduction technology. Gain a competitive edge by understanding market concentration, technological innovation drivers, regulatory frameworks, competitive product substitutes, end-user demographics, and M&A trends. Charles River Laboratories, Vytelle LLC, Minitube Group, Bovine Elite, Hamilton Thorne Inc, Esco Medical, Eppendorf SE, SWINE GENETICS INTERNATIONAL, Vitrolife, Stroebech Media, IMV TECHNOLOGIES GROUP are among the key players shaping this dynamic industry.

Veterinary In Vitro Fertilization Market Market Dynamics & Structure

The Veterinary IVF Market exhibits a moderately concentrated structure, with a few key players dominating the landscape through strategic acquisitions and continuous technological innovation. The primary drivers of market growth are the increasing demand for advanced animal breeding technologies, fueled by the need for enhanced genetic improvement in livestock and companion animals, and the rising adoption of IVF procedures for conservation efforts. Regulatory frameworks, while generally supportive of animal welfare and breeding advancements, can introduce varying compliance requirements across different regions. Competitive product substitutes, primarily traditional breeding methods, are gradually being displaced by the superior efficiency and predictability offered by veterinary IVF. End-user demographics are expanding, with a growing number of veterinary hospitals and specialized fertility clinics investing in IVF capabilities.

- Market Concentration: Moderate, with key players focusing on product innovation and strategic partnerships.

- Technological Innovation Drivers: Demand for improved animal genetics, efficiency in breeding programs, and advancements in ART for both commercial and conservation purposes.

- Regulatory Frameworks: Varies by region, impacting market entry and product approvals for veterinary IVF technologies.

- Competitive Product Substitutes: Traditional breeding methods and natural reproduction are being outpaced by IVF efficiency.

- End-User Demographics: Expanding to include specialized animal reproduction centers and research institutions.

- M&A Trends: Active, with companies acquiring to strengthen their product portfolios and expand market reach in veterinary fertility solutions.

Veterinary In Vitro Fertilization Market Growth Trends & Insights

The Veterinary In Vitro Fertilization Market is projected to experience robust growth, driven by the escalating global demand for efficient and advanced animal reproduction solutions. This growth trajectory is underpinned by the parent market of Assisted Reproductive Technologies (ART) and the burgeoning sub-segments within the veterinary sector. The market size is expected to witness a significant expansion from approximately $550 million in the historical period to an estimated $980 million by 2033, showcasing a healthy Compound Annual Growth Rate (CAGR) of around 8.5% during the forecast period. Adoption rates for veterinary IVF are steadily increasing, propelled by a greater understanding of its benefits, including faster genetic improvement in livestock, enhanced success rates in breeding programs for companion animals, and vital contributions to wildlife conservation efforts. Technological disruptions are playing a pivotal role, with advancements in embryo cryopreservation, in vitro maturation (IVM), and genomic selection technologies significantly improving the efficacy and accessibility of veterinary IVF. Consumer behavior shifts are also influencing the market, as pet owners and livestock producers increasingly prioritize advanced reproductive technologies for preserving genetic lines, improving herd health, and ensuring the successful breeding of prized animals. The market penetration of veterinary IVF services is expanding beyond traditional large-scale agricultural operations to encompass specialized veterinary clinics and private breeding practices. The growing awareness of the economic benefits, such as reduced breeding cycles and improved offspring quality, further fuels market expansion. Furthermore, the integration of artificial intelligence in IVF workflows, as evidenced by Esco Medical's selection of Fairtility's CHLOE EQ, promises to enhance accuracy and streamline processes, accelerating adoption.

Dominant Regions, Countries, or Segments in Veterinary In Vitro Fertilization Market

The Veterinary In Vitro Fertilization Market is experiencing dynamic growth across various regions, with North America currently leading in terms of market share and adoption. This dominance is attributed to a confluence of factors including a highly developed veterinary infrastructure, significant investment in animal research and development, and a strong demand for advanced reproductive technologies in both livestock and companion animal sectors. The United States, in particular, stands out due to its large livestock population, a well-established network of veterinary fertility clinics, and proactive adoption of technological advancements.

Within the Product Type segment, Reagents/Consumables are driving significant growth, accounting for an estimated 40% of the market revenue in 2025. This is closely followed by Instruments at approximately 35%, and Services at 25%. The continuous innovation in media, cryoprotectants, and specialized tools for IVF procedures ensures a steady demand for these consumables.

In terms of Technique, Artificial Insemination (AI) remains a widely adopted method, but Embryo Transfer (ET) is witnessing a faster growth rate, projected to capture 30% of the market by 2025, driven by its ability to facilitate the transfer of superior genetics and increase pregnancy rates. Other techniques, including in vitro maturation (IVM) and oocyte pick-up (OPU), are also gaining traction.

The End-User segment is dominated by Veterinary Hospitals, representing an estimated 45% of the market in 2025, due to their comprehensive service offerings. Fertility Clinics follow closely at 30%, specializing in advanced reproductive procedures. The "Other End-Users" category, including research institutions and specialized breeding farms, is also showing promising growth.

- Leading Region: North America, driven by strong R&D, advanced infrastructure, and high demand for genetic improvement.

- Dominant Product Type Segment: Reagents/Consumables, vital for the procedural success of IVF.

- Key Technique Driver: Embryo Transfer, offering enhanced genetic dissemination and efficiency.

- Primary End-User: Veterinary Hospitals, serving as central hubs for advanced animal reproductive care.

- Growth Potential: Significant expansion in emerging economies in Asia-Pacific and Europe, fueled by increasing investments in animal agriculture and companion animal care.

Veterinary In Vitro Fertilization Market Product Landscape

The Veterinary IVF Market product landscape is characterized by continuous innovation aimed at enhancing efficiency, success rates, and accessibility of reproductive technologies. Key product advancements include sophisticated embryo culture media formulations that mimic natural physiological environments, improving embryo development and viability. High-precision micromanipulation instruments, such as advanced microscopes and microinjectors, enable delicate procedures like intracytoplasmic sperm injection (ICSI) in veterinary applications. Innovations in cryopreservation technology, including improved cryoprotectant agents and novel freezing protocols, are extending the viability and storage capabilities of veterinary embryos and oocytes. Furthermore, the integration of AI-driven decision support tools, like Fairtility's CHLOE EQ for MIRI time-lapse incubators, is revolutionizing workflow management, increasing accuracy, and optimizing embryologist performance. These technological advancements are crucial for driving improved outcomes in livestock breeding, companion animal reproduction, and wildlife conservation.

Key Drivers, Barriers & Challenges in Veterinary In Vitro Fertilization Market

The Veterinary IVF Market is propelled by several key drivers, including the escalating global demand for high-quality animal genetics in both livestock and companion animals, advancements in Assisted Reproductive Technologies (ART), and increasing investments in animal welfare and conservation initiatives. The growing recognition of IVF as a tool for faster genetic improvement and disease control further fuels market expansion.

- Technological Drivers: Innovations in embryo culture, cryopreservation, and assisted reproduction techniques.

- Economic Drivers: Demand for improved breeding efficiency and genetic enhancement in agriculture.

- Policy-Driven Factors: Government initiatives supporting animal health and agricultural productivity.

However, the market faces significant barriers and challenges. High costs associated with IVF procedures and equipment can be a restraint, particularly for smaller veterinary practices or in developing regions. Limited availability of skilled embryologists and specialized veterinary professionals trained in IVF techniques also poses a challenge. Regulatory hurdles and variations in approval processes across different countries can impede market penetration. Furthermore, the supply chain for specialized reagents and consumables can be vulnerable to disruptions, impacting the consistent delivery of services.

- Supply Chain Issues: Reliance on specialized global suppliers for critical reagents and equipment.

- Regulatory Hurdles: Diverse and evolving regulations across different countries for animal reproduction technologies.

- Competitive Pressures: Competition from traditional breeding methods and the need for continuous innovation to maintain market share.

- Cost of Technology: High initial investment for equipment and ongoing operational expenses.

Emerging Opportunities in Veterinary In Vitro Fertilization Market

Emerging opportunities in the Veterinary IVF Market are diverse and promising. The expansion of IVF applications for rare and endangered species conservation presents a significant avenue for growth. Advances in genomic selection coupled with IVF offer unprecedented potential for optimizing breeding programs in livestock, leading to improved disease resistance and productivity. The development of more cost-effective and user-friendly IVF technologies could democratize access, particularly for small and medium-sized veterinary practices and in emerging markets. Furthermore, the increasing trend of pet humanization is driving demand for advanced reproductive services for companion animals, including the preservation of genetic material and the successful breeding of desired traits. The integration of digital health platforms and AI in veterinary IVF workflows represents a substantial opportunity to enhance efficiency, data management, and diagnostic capabilities.

Growth Accelerators in the Veterinary In Vitro Fertilization Market Industry

Several catalysts are accelerating the long-term growth of the Veterinary IVF Market. Technological breakthroughs, such as the development of more efficient in vitro maturation (IVM) protocols and advancements in embryo biopsy for genetic testing, are continuously enhancing the success rates and scope of IVF procedures. Strategic partnerships between technology providers, research institutions, and veterinary service organizations are fostering collaboration and driving innovation. For instance, the acquisition of Gynétics Medical Products N.V. by Hamilton Thorne Ltd. strengthens their position in the consumables segment of the ART market. Market expansion strategies, including the development of localized training programs for veterinarians and the establishment of accessible IVF centers in underserved regions, are crucial for broader adoption. Furthermore, the increasing focus on precision livestock farming and the demand for enhanced animal welfare are acting as significant growth accelerators.

Key Players Shaping the Veterinary In Vitro Fertilization Market Market

- Charles River Laboratories

- Vytelle LLC

- Minitube Group

- Bovine Elite

- Hamilton Thorne Inc

- Esco Medical

- Eppendorf SE

- SWINE GENETICS INTERNATIONAL

- Vitrolife

- Stroebech Media

- IMV TECHNOLOGIES GROUP

Notable Milestones in Veterinary In Vitro Fertilization Market Sector

- October 2023: Hamilton Thorne Ltd. announced the acquisition of Gynétics Medical Products N.V., strengthening their presence in the ART consumables market.

- April 2023: Esco Medical selected Fairtility's CHLOE EQ as an AI decision support tool for its MIRI time-lapse incubators, aiming to enhance embryologist workflow, accuracy, and communication within IVF practices.

In-Depth Veterinary In Vitro Fertilization Market Market Outlook

The Veterinary IVF Market outlook is exceptionally positive, driven by ongoing technological innovation and increasing global demand for advanced animal reproduction solutions. Growth accelerators such as enhanced embryo cryopreservation techniques and the growing application of IVF in wildlife conservation are poised to significantly expand the market's reach. Strategic alliances and acquisitions, exemplified by Hamilton Thorne's recent M&A activity, will continue to consolidate market share and foster product development. The integration of AI, as seen with Esco Medical's adoption of CHLOE EQ, promises to optimize workflows and improve success rates, making veterinary IVF more accessible and efficient. Future growth will also be fueled by the expansion of specialized fertility clinics and the increasing demand from livestock producers for efficient genetic improvement. This dynamic landscape presents lucrative opportunities for stakeholders to invest in and capitalize on the evolution of animal reproductive technologies.

Veterinary In Vitro Fertilization Market Segmentation

-

1. Product Type

- 1.1. Instruments

- 1.2. Reagents/Consumables

- 1.3. Services

-

2. Technique

- 2.1. Embryo Transfer

- 2.2. Artificial Insemination (AI)

- 2.3. Other Techniques

-

3. End-User

- 3.1. Veterinary Hospitals

- 3.2. Fertility Clinics

- 3.3. Other End-Users

Veterinary In Vitro Fertilization Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Veterinary In Vitro Fertilization Market Regional Market Share

Geographic Coverage of Veterinary In Vitro Fertilization Market

Veterinary In Vitro Fertilization Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for High - Quality Breeding; Advancement in Reproductive Technology

- 3.3. Market Restrains

- 3.3.1. High costs associated with the Technology

- 3.4. Market Trends

- 3.4.1. Instruments Segment is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Veterinary In Vitro Fertilization Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Instruments

- 5.1.2. Reagents/Consumables

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Technique

- 5.2.1. Embryo Transfer

- 5.2.2. Artificial Insemination (AI)

- 5.2.3. Other Techniques

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Veterinary Hospitals

- 5.3.2. Fertility Clinics

- 5.3.3. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Veterinary In Vitro Fertilization Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Instruments

- 6.1.2. Reagents/Consumables

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by Technique

- 6.2.1. Embryo Transfer

- 6.2.2. Artificial Insemination (AI)

- 6.2.3. Other Techniques

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Veterinary Hospitals

- 6.3.2. Fertility Clinics

- 6.3.3. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Veterinary In Vitro Fertilization Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Instruments

- 7.1.2. Reagents/Consumables

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by Technique

- 7.2.1. Embryo Transfer

- 7.2.2. Artificial Insemination (AI)

- 7.2.3. Other Techniques

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Veterinary Hospitals

- 7.3.2. Fertility Clinics

- 7.3.3. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Veterinary In Vitro Fertilization Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Instruments

- 8.1.2. Reagents/Consumables

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by Technique

- 8.2.1. Embryo Transfer

- 8.2.2. Artificial Insemination (AI)

- 8.2.3. Other Techniques

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Veterinary Hospitals

- 8.3.2. Fertility Clinics

- 8.3.3. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Veterinary In Vitro Fertilization Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Instruments

- 9.1.2. Reagents/Consumables

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by Technique

- 9.2.1. Embryo Transfer

- 9.2.2. Artificial Insemination (AI)

- 9.2.3. Other Techniques

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Veterinary Hospitals

- 9.3.2. Fertility Clinics

- 9.3.3. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Veterinary In Vitro Fertilization Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Instruments

- 10.1.2. Reagents/Consumables

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by Technique

- 10.2.1. Embryo Transfer

- 10.2.2. Artificial Insemination (AI)

- 10.2.3. Other Techniques

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Veterinary Hospitals

- 10.3.2. Fertility Clinics

- 10.3.3. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Charles River Laboratories

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Vytelle LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Minitube Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bovine Elite

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hamilton Thorne Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Esco Medical

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Eppendorf SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SWINE GENETICS INTERNATIONAL

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Vitrolife

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Stroebech Media

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 IMV TECHNOLOGIES GROUP

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Charles River Laboratories

List of Figures

- Figure 1: Global Veterinary In Vitro Fertilization Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Veterinary In Vitro Fertilization Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Veterinary In Vitro Fertilization Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Veterinary In Vitro Fertilization Market Revenue (Million), by Technique 2025 & 2033

- Figure 5: North America Veterinary In Vitro Fertilization Market Revenue Share (%), by Technique 2025 & 2033

- Figure 6: North America Veterinary In Vitro Fertilization Market Revenue (Million), by End-User 2025 & 2033

- Figure 7: North America Veterinary In Vitro Fertilization Market Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America Veterinary In Vitro Fertilization Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Veterinary In Vitro Fertilization Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Veterinary In Vitro Fertilization Market Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Veterinary In Vitro Fertilization Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Veterinary In Vitro Fertilization Market Revenue (Million), by Technique 2025 & 2033

- Figure 13: Europe Veterinary In Vitro Fertilization Market Revenue Share (%), by Technique 2025 & 2033

- Figure 14: Europe Veterinary In Vitro Fertilization Market Revenue (Million), by End-User 2025 & 2033

- Figure 15: Europe Veterinary In Vitro Fertilization Market Revenue Share (%), by End-User 2025 & 2033

- Figure 16: Europe Veterinary In Vitro Fertilization Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Veterinary In Vitro Fertilization Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Veterinary In Vitro Fertilization Market Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Veterinary In Vitro Fertilization Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Veterinary In Vitro Fertilization Market Revenue (Million), by Technique 2025 & 2033

- Figure 21: Asia Pacific Veterinary In Vitro Fertilization Market Revenue Share (%), by Technique 2025 & 2033

- Figure 22: Asia Pacific Veterinary In Vitro Fertilization Market Revenue (Million), by End-User 2025 & 2033

- Figure 23: Asia Pacific Veterinary In Vitro Fertilization Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Asia Pacific Veterinary In Vitro Fertilization Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Veterinary In Vitro Fertilization Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Veterinary In Vitro Fertilization Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Veterinary In Vitro Fertilization Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Veterinary In Vitro Fertilization Market Revenue (Million), by Technique 2025 & 2033

- Figure 29: Middle East and Africa Veterinary In Vitro Fertilization Market Revenue Share (%), by Technique 2025 & 2033

- Figure 30: Middle East and Africa Veterinary In Vitro Fertilization Market Revenue (Million), by End-User 2025 & 2033

- Figure 31: Middle East and Africa Veterinary In Vitro Fertilization Market Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Middle East and Africa Veterinary In Vitro Fertilization Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East and Africa Veterinary In Vitro Fertilization Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Veterinary In Vitro Fertilization Market Revenue (Million), by Product Type 2025 & 2033

- Figure 35: South America Veterinary In Vitro Fertilization Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: South America Veterinary In Vitro Fertilization Market Revenue (Million), by Technique 2025 & 2033

- Figure 37: South America Veterinary In Vitro Fertilization Market Revenue Share (%), by Technique 2025 & 2033

- Figure 38: South America Veterinary In Vitro Fertilization Market Revenue (Million), by End-User 2025 & 2033

- Figure 39: South America Veterinary In Vitro Fertilization Market Revenue Share (%), by End-User 2025 & 2033

- Figure 40: South America Veterinary In Vitro Fertilization Market Revenue (Million), by Country 2025 & 2033

- Figure 41: South America Veterinary In Vitro Fertilization Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by Technique 2020 & 2033

- Table 3: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 4: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by Technique 2020 & 2033

- Table 7: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Veterinary In Vitro Fertilization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Veterinary In Vitro Fertilization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Veterinary In Vitro Fertilization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 13: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by Technique 2020 & 2033

- Table 14: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 15: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Veterinary In Vitro Fertilization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Veterinary In Vitro Fertilization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Veterinary In Vitro Fertilization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Veterinary In Vitro Fertilization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Spain Veterinary In Vitro Fertilization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Veterinary In Vitro Fertilization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 23: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by Technique 2020 & 2033

- Table 24: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 25: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Veterinary In Vitro Fertilization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Japan Veterinary In Vitro Fertilization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: India Veterinary In Vitro Fertilization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Australia Veterinary In Vitro Fertilization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Korea Veterinary In Vitro Fertilization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Veterinary In Vitro Fertilization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 33: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by Technique 2020 & 2033

- Table 34: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 35: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: GCC Veterinary In Vitro Fertilization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Africa Veterinary In Vitro Fertilization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Veterinary In Vitro Fertilization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 40: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by Technique 2020 & 2033

- Table 41: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 42: Global Veterinary In Vitro Fertilization Market Revenue Million Forecast, by Country 2020 & 2033

- Table 43: Brazil Veterinary In Vitro Fertilization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Argentina Veterinary In Vitro Fertilization Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Veterinary In Vitro Fertilization Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Veterinary In Vitro Fertilization Market?

The projected CAGR is approximately 5.00%.

2. Which companies are prominent players in the Veterinary In Vitro Fertilization Market?

Key companies in the market include Charles River Laboratories, Vytelle LLC, Minitube Group, Bovine Elite, Hamilton Thorne Inc, Esco Medical, Eppendorf SE, SWINE GENETICS INTERNATIONAL, Vitrolife, Stroebech Media, IMV TECHNOLOGIES GROUP.

3. What are the main segments of the Veterinary In Vitro Fertilization Market?

The market segments include Product Type, Technique, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for High - Quality Breeding; Advancement in Reproductive Technology.

6. What are the notable trends driving market growth?

Instruments Segment is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High costs associated with the Technology.

8. Can you provide examples of recent developments in the market?

October 2023: Hamilton Thorne Ltd. announced the acquisition of Gynétics Medical Products N.V. The acquisition helped strengthen the company footprint in consumables within the Assisted Reproductive Technology market

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Veterinary In Vitro Fertilization Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Veterinary In Vitro Fertilization Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Veterinary In Vitro Fertilization Market?

To stay informed about further developments, trends, and reports in the Veterinary In Vitro Fertilization Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence