Key Insights

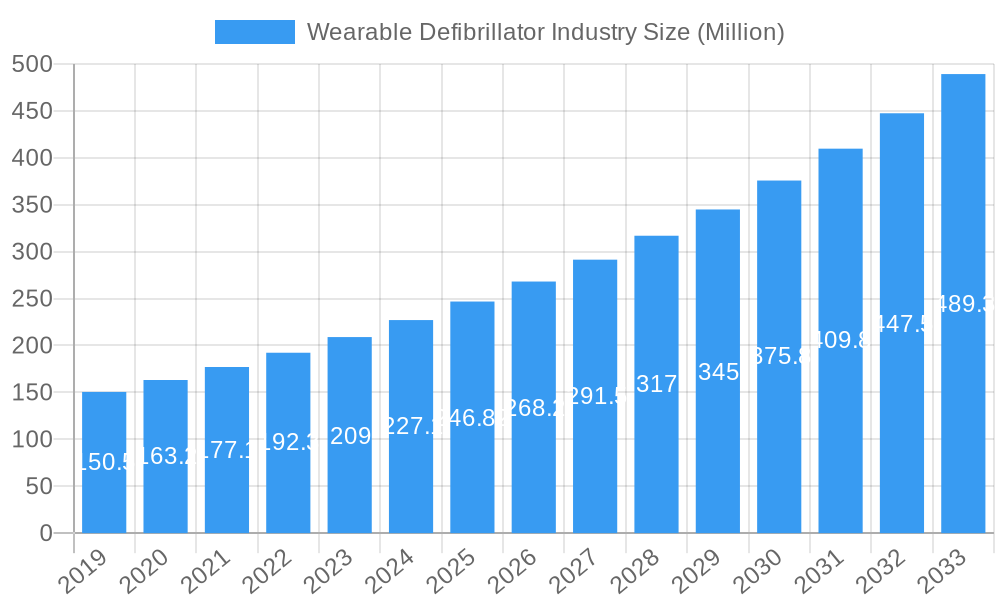

The global Wearable Defibrillator market is poised for significant expansion, projected to reach $246.82 Million in 2025 and grow at a robust 9.23% CAGR over the forecast period of 2019-2033. This impressive growth is primarily fueled by increasing awareness of sudden cardiac arrest (SCA) and the critical role early defibrillation plays in survival rates. Advancements in miniaturization, battery life, and user-friendly interfaces are making wearable defibrillators more accessible and appealing, particularly for individuals with pre-existing cardiac conditions or those at high risk. The growing prevalence of cardiovascular diseases globally, coupled with an aging population, directly contributes to the escalating demand for these life-saving devices. Furthermore, favorable regulatory landscapes and increasing healthcare expenditure in key regions are creating a conducive environment for market players to innovate and expand their product offerings. The shift towards home-based healthcare solutions also bodes well for the wearable defibrillator market, empowering patients to take a more proactive role in managing their cardiac health.

Wearable Defibrillator Industry Market Size (In Million)

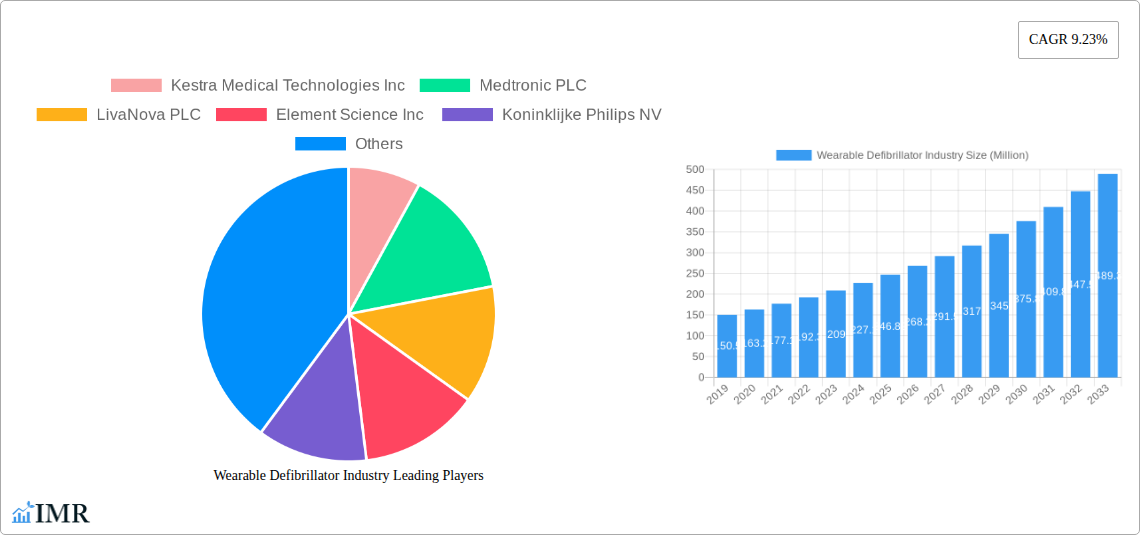

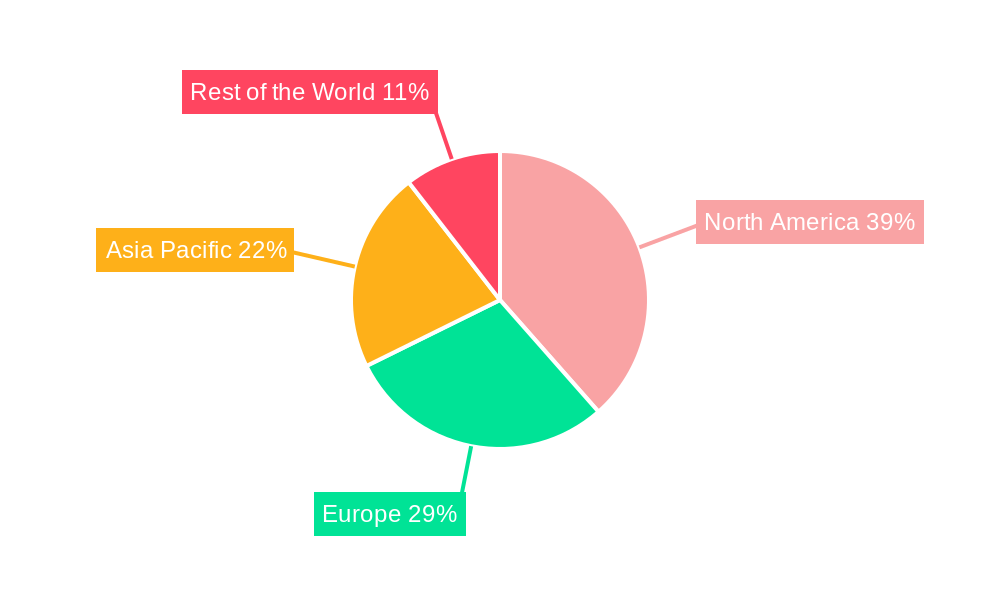

The market segmentation reveals a strong emphasis on the Pediatric and Adult demographics, reflecting the widespread applicability of wearable defibrillators across age groups, though special considerations for pediatric use are a growing area of innovation. The Home and Hospitals and Cardiology Clinics end-user segments are expected to dominate, driven by the need for immediate access to defibrillation in both familiar environments and professional healthcare settings. Regionally, North America is anticipated to lead the market, owing to a high incidence of cardiovascular diseases, advanced healthcare infrastructure, and a strong adoption rate of new medical technologies. Europe and the Asia Pacific regions are also expected to witness substantial growth, driven by increasing healthcare investments and a rising awareness of cardiac emergencies. Key players such as Medtronic PLC, Koninklijke Philips NV, and Boston Scientific Corporation are actively investing in research and development, strategizing to capture a significant share of this expanding market.

Wearable Defibrillator Industry Company Market Share

Wearable Defibrillator Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a critical analysis of the global Wearable Defibrillator market, offering unparalleled insights into its dynamics, growth trajectories, and competitive landscape from 2019 to 2033. Delve into the evolving parent and child market segments, explore technological advancements, and understand the strategic imperatives for success in this life-saving medical device sector. Leveraging high-traffic keywords such as "wearable defibrillator," "cardiac arrest treatment," "sudden cardiac arrest," "implantable cardioverter-defibrillator (ICD)," "automated external defibrillator (AED)," and "cardiovascular devices," this report is optimized for maximum search engine visibility and designed to equip industry professionals, investors, and stakeholders with actionable intelligence. All quantitative values are presented in million units for clarity and ease of comparison.

Wearable Defibrillator Industry Market Dynamics & Structure

The Wearable Defibrillator market is characterized by a dynamic interplay of technological innovation, stringent regulatory oversight, and evolving end-user needs. Market concentration is moderate, with key players vying for market share through continuous product development and strategic alliances. Technological innovation is a paramount driver, focusing on miniaturization, enhanced user-friendliness, improved battery life, and advanced sensing capabilities to detect arrhythmias accurately. Regulatory frameworks, including FDA approvals and CE marking, play a crucial role in market access and product differentiation. Competitive product substitutes, such as traditional implantable cardioverter-defibrillators (ICDs) and advanced manual external defibrillators (AEDs), present ongoing challenges, necessitating clear value propositions for wearable solutions. End-user demographics are increasingly segmented, with a growing emphasis on the adult and geriatric populations due to rising cardiovascular disease prevalence. Merger and acquisition (M&A) trends are anticipated to shape market consolidation, driven by the pursuit of synergistic technologies and expanded market reach.

- Market Concentration: Moderate, with key players investing heavily in R&D.

- Technological Innovation: Focus on miniaturization, AI-driven arrhythmia detection, and remote monitoring.

- Regulatory Frameworks: Strict adherence to FDA, EMA, and other regional health authority guidelines is essential.

- Competitive Substitutes: Traditional ICDs and advanced AEDs.

- End-User Demographics: Increasing demand from adults and geriatrics.

- M&A Trends: Expected to drive market consolidation and technological integration.

Wearable Defibrillator Industry Growth Trends & Insights

The Wearable Defibrillator industry is poised for robust expansion, driven by a confluence of factors including the escalating global burden of cardiovascular diseases, advancements in portable medical technology, and a growing emphasis on proactive cardiac care. The market size is projected to witness significant growth, with adoption rates steadily increasing as the benefits of early intervention for sudden cardiac arrest (SCA) become more widely recognized. Technological disruptions, such as the integration of artificial intelligence for predictive analytics and the development of non-invasive sensing technologies, are reshaping the product landscape and enhancing treatment efficacy. Consumer behavior shifts towards greater personal health monitoring and a preference for discreet, user-friendly medical devices further fuel market penetration.

The study period from 2019 to 2033, with 2025 as the base and estimated year, will capture a transformative phase. Historically, the market has seen a gradual but consistent rise, building momentum as clinical evidence supporting wearable defibrillation efficacy accumulates. The forecast period (2025–2033) is expected to witness an accelerated growth curve, driven by broader market acceptance, favorable reimbursement policies, and expanded indications for use. The CAGR (Compound Annual Growth Rate) within this period is projected to be substantial, reflecting the industry's maturation and its increasing importance in cardiovascular emergency response.

Key growth trends include:

- Rising Cardiovascular Disease Prevalence: A primary driver for increased demand for cardiac monitoring and intervention devices.

- Technological Advancements: Miniaturization, improved battery life, enhanced user interface, and AI integration.

- Increased Awareness of Sudden Cardiac Arrest: Growing public and medical community understanding of the critical time window for intervention.

- Home Healthcare Trend: The shift towards monitoring and managing chronic conditions at home increases the appeal of wearable devices.

- Favorable Reimbursement Policies: As evidence of efficacy grows, insurers are more likely to cover wearable defibrillator solutions.

- Aging Global Population: The geriatric demographic, with a higher risk of cardiac events, represents a significant market segment.

- Investment in R&D: Continuous innovation by leading companies to develop more sophisticated and user-friendly devices.

The market penetration of wearable defibrillators is still in its nascent stages compared to established medical devices, presenting a vast untapped potential. Early adopters include patients with high-risk cardiac conditions, post-cardiac surgery individuals, and those awaiting heart transplants. The evolving consumer behavior, driven by a desire for autonomy in managing health and a growing comfort with wearable technology, is a significant catalyst. Furthermore, the cost-effectiveness of wearable defibrillators, in terms of potentially preventing hospitalizations and reducing the severity of cardiac events, is becoming a more prominent consideration for healthcare providers and payers.

Dominant Regions, Countries, or Segments in Wearable Defibrillator Industry

The Adult demographic segment is currently the dominant force driving growth within the Wearable Defibrillator industry, owing to the highest prevalence of cardiovascular diseases and sudden cardiac arrest events in this population group. This segment encompasses individuals aged 18-64 who are at increased risk due to factors such as existing heart conditions, a history of cardiac events, or genetic predispositions. The Home end-user segment is also experiencing rapid expansion, driven by the increasing acceptance of remote patient monitoring and the desire for greater independence and peace of mind among individuals managing chronic cardiac conditions. The convenience and accessibility of wearable defibrillators for home use, coupled with the potential to reduce emergency room visits, are key factors contributing to their adoption.

Geographically, North America currently leads the market, propelled by its advanced healthcare infrastructure, high disposable income, substantial investment in R&D, and a well-established regulatory pathway for medical devices. The region's proactive approach to cardiovascular health and early adoption of novel medical technologies have cemented its leadership position. The United States, in particular, benefits from a large patient pool at risk for cardiac arrest and a strong emphasis on patient-centric care.

Key drivers for dominance in these segments include:

- Adult Demography:

- Highest incidence of cardiovascular diseases and SCA.

- Increasing awareness and diagnosis of cardiac arrhythmias.

- Availability of advanced diagnostic tools for risk stratification.

- Growing adoption of cardiac rehabilitation programs.

- Home End-User Segment:

- Trend towards home-based healthcare and remote patient monitoring.

- Desire for increased patient autonomy and reduced hospital reliance.

- Technological advancements making devices more user-friendly for home use.

- Potential for significant cost savings for healthcare systems.

- North America Region:

- Advanced healthcare infrastructure and high per capita healthcare spending.

- Robust research and development ecosystem.

- Supportive regulatory environment for medical device innovation.

- High prevalence of cardiovascular risk factors.

- Early adoption of advanced medical technologies.

While the Pediatric segment is smaller in absolute terms, it represents a significant area of future growth potential, driven by advancements in miniaturization and specialized designs for younger patients with congenital heart conditions. Similarly, the Hospitals and Cardiology Clinics end-user segment remains critical for initial diagnosis, patient management, and rehabilitation, providing a strong foundation for the widespread adoption of wearable defibrillators. The market share within these dominant segments is expected to remain robust throughout the forecast period, with continuous innovation and market penetration strategies further solidifying their positions.

Wearable Defibrillator Industry Product Landscape

The Wearable Defibrillator industry is witnessing a rapid evolution in its product landscape, characterized by innovations aimed at enhancing portability, user-friendliness, and diagnostic accuracy. Current offerings include wearable cardioverter-defibrillators (WCDs) and personal external defibrillators (PCDs) designed for continuous monitoring and immediate intervention. These devices are becoming increasingly discreet and comfortable, often resembling conventional clothing or accessories, thereby improving patient compliance. Advanced features include sophisticated arrhythmia detection algorithms, wireless connectivity for remote patient monitoring by healthcare professionals, and long-lasting rechargeable batteries. The focus is on developing non-invasive technologies that can reliably distinguish between life-threatening arrhythmias and benign events, minimizing false alarms while ensuring rapid response when critical.

Key Drivers, Barriers & Challenges in Wearable Defibrillator Industry

Key Drivers:

The Wearable Defibrillator market is propelled by a confluence of critical drivers. Foremost is the escalating global burden of cardiovascular diseases, particularly sudden cardiac arrest (SCA), which creates an urgent need for accessible and immediate intervention solutions. Technological advancements, such as miniaturization, enhanced battery life, and sophisticated AI-powered arrhythmia detection, are making these devices more effective and user-friendly. The increasing adoption of remote patient monitoring and the broader trend towards home-based healthcare further bolster demand. Furthermore, growing awareness among patients and healthcare providers about the benefits of early defibrillation is a significant market catalyst.

Barriers & Challenges:

Despite its promising outlook, the Wearable Defibrillator industry faces several significant barriers and challenges. High manufacturing costs can translate into substantial device prices, posing an affordability challenge for a significant portion of the population and impacting reimbursement discussions. Stringent regulatory approval processes, while necessary for patient safety, can prolong time-to-market for new innovations. Concerns regarding false alarms and the potential for inappropriate shocks can lead to patient anxiety and physician hesitancy. Supply chain disruptions, particularly for specialized electronic components, can impact production volumes. Finally, a lack of widespread public awareness and understanding of wearable defibrillator technology compared to traditional AEDs can hinder adoption rates.

Emerging Opportunities in Wearable Defibrillator Industry

Emerging opportunities in the Wearable Defibrillator industry lie in the development of more personalized treatment algorithms that leverage continuous patient data to predict and prevent cardiac events with greater accuracy. The integration of wearable defibrillators with comprehensive telehealth platforms presents a significant opportunity to create seamless care pathways, enabling real-time data analysis and proactive interventions by healthcare providers. Untapped markets in developing regions with rising cardiovascular disease rates offer substantial growth potential, provided that cost-effective and accessible solutions can be developed. Furthermore, exploring innovative applications beyond SCA, such as post-operative monitoring for high-risk cardiac surgery patients, can broaden the market reach. Evolving consumer preferences for proactive health management and preventative care will continue to drive demand for sophisticated yet unobtrusive wearable health technologies.

Growth Accelerators in the Wearable Defibrillator Industry Industry

Several catalysts are accelerating the growth of the Wearable Defibrillator industry. Technological breakthroughs in miniaturization and sensor accuracy are enabling the development of more compact, comfortable, and effective devices. Strategic partnerships between medical device manufacturers, technology companies, and healthcare providers are crucial for integrating these devices into existing healthcare ecosystems and clinical workflows. Market expansion strategies targeting specific patient populations with high cardiac event risks, such as those with hypertrophic cardiomyopathy or long QT syndrome, are vital. The development of robust clinical evidence demonstrating improved patient outcomes and cost-effectiveness will further drive adoption and investment, solidifying the role of wearable defibrillators in modern cardiac care.

Key Players Shaping the Wearable Defibrillator Industry Market

- Kestra Medical Technologies Inc

- Medtronic PLC

- LivaNova PLC

- Element Science Inc

- Koninklijke Philips NV

- Stryker Corporation

- Boston Scientific Corporation

- Nihon Kohden Corporation

- Asahi Kasei Corporation (ZOLL Medical Corporation)

Notable Milestones in Wearable Defibrillator Industry Sector

- August 2022: Element Science reported the first patient to be successfully saved with defibrillation early in the enrollment of the Investigational Device Exception (IDE) study for their Jewel Patch Wearable Cardioverter Defibrillator (P-WCD).

- March 2022: Rapid Response Revival launched CellAED, a portable defibrillator with sophisticated technology, designed to improve the survival chances of patients experiencing sudden cardiac arrest in the United Kingdom.

In-Depth Wearable Defibrillator Industry Market Outlook

The future outlook for the Wearable Defibrillator industry is exceptionally promising, driven by sustained innovation and increasing global healthcare focus on cardiovascular health. Growth accelerators such as advancements in AI-driven predictive analytics, non-invasive sensing technologies, and seamless integration with telehealth platforms will empower more proactive and personalized cardiac care. The expansion into emerging markets, coupled with a growing awareness of sudden cardiac arrest prevention, will unlock significant new demand. Strategic collaborations and potential market consolidation through mergers and acquisitions are expected to streamline development and enhance market penetration. As reimbursement policies evolve to recognize the value of wearable defibrillators in reducing long-term healthcare costs, the market is set for exponential growth, solidifying its position as a critical component of the cardiovascular medical device landscape.

Wearable Defibrillator Industry Segmentation

-

1. Demography

- 1.1. Pediatric

- 1.2. Adults

- 1.3. Geriatric

-

2. End-user

- 2.1. Home

- 2.2. Hospitals and Cardiology Clinics

- 2.3. Others End-users

Wearable Defibrillator Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of the World

Wearable Defibrillator Industry Regional Market Share

Geographic Coverage of Wearable Defibrillator Industry

Wearable Defibrillator Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevelance of Cardiovascular Disorders; Increasing Elderly Population; Ease of Use for Non-invasive Devices

- 3.3. Market Restrains

- 3.3.1. Regulatory Uncertainty; Privacy and Information Security Issues in Wearable Devices

- 3.4. Market Trends

- 3.4.1. Adult Segment Expected to Register a High CAGR in the Studied Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wearable Defibrillator Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Demography

- 5.1.1. Pediatric

- 5.1.2. Adults

- 5.1.3. Geriatric

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Home

- 5.2.2. Hospitals and Cardiology Clinics

- 5.2.3. Others End-users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Demography

- 6. North America Wearable Defibrillator Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Demography

- 6.1.1. Pediatric

- 6.1.2. Adults

- 6.1.3. Geriatric

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Home

- 6.2.2. Hospitals and Cardiology Clinics

- 6.2.3. Others End-users

- 6.1. Market Analysis, Insights and Forecast - by Demography

- 7. Europe Wearable Defibrillator Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Demography

- 7.1.1. Pediatric

- 7.1.2. Adults

- 7.1.3. Geriatric

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Home

- 7.2.2. Hospitals and Cardiology Clinics

- 7.2.3. Others End-users

- 7.1. Market Analysis, Insights and Forecast - by Demography

- 8. Asia Pacific Wearable Defibrillator Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Demography

- 8.1.1. Pediatric

- 8.1.2. Adults

- 8.1.3. Geriatric

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Home

- 8.2.2. Hospitals and Cardiology Clinics

- 8.2.3. Others End-users

- 8.1. Market Analysis, Insights and Forecast - by Demography

- 9. Rest of the World Wearable Defibrillator Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Demography

- 9.1.1. Pediatric

- 9.1.2. Adults

- 9.1.3. Geriatric

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Home

- 9.2.2. Hospitals and Cardiology Clinics

- 9.2.3. Others End-users

- 9.1. Market Analysis, Insights and Forecast - by Demography

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Kestra Medical Technologies Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Medtronic PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 LivaNova PLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Element Science Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Koninklijke Philips NV

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Stryker Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Boston Scientific Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Nihon Kohden Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Asahi Kasei Corporation (ZOLL Medical Corporation)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Kestra Medical Technologies Inc

List of Figures

- Figure 1: Global Wearable Defibrillator Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Wearable Defibrillator Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Wearable Defibrillator Industry Revenue (Million), by Demography 2025 & 2033

- Figure 4: North America Wearable Defibrillator Industry Volume (K Unit), by Demography 2025 & 2033

- Figure 5: North America Wearable Defibrillator Industry Revenue Share (%), by Demography 2025 & 2033

- Figure 6: North America Wearable Defibrillator Industry Volume Share (%), by Demography 2025 & 2033

- Figure 7: North America Wearable Defibrillator Industry Revenue (Million), by End-user 2025 & 2033

- Figure 8: North America Wearable Defibrillator Industry Volume (K Unit), by End-user 2025 & 2033

- Figure 9: North America Wearable Defibrillator Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 10: North America Wearable Defibrillator Industry Volume Share (%), by End-user 2025 & 2033

- Figure 11: North America Wearable Defibrillator Industry Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Wearable Defibrillator Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Wearable Defibrillator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Wearable Defibrillator Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Wearable Defibrillator Industry Revenue (Million), by Demography 2025 & 2033

- Figure 16: Europe Wearable Defibrillator Industry Volume (K Unit), by Demography 2025 & 2033

- Figure 17: Europe Wearable Defibrillator Industry Revenue Share (%), by Demography 2025 & 2033

- Figure 18: Europe Wearable Defibrillator Industry Volume Share (%), by Demography 2025 & 2033

- Figure 19: Europe Wearable Defibrillator Industry Revenue (Million), by End-user 2025 & 2033

- Figure 20: Europe Wearable Defibrillator Industry Volume (K Unit), by End-user 2025 & 2033

- Figure 21: Europe Wearable Defibrillator Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 22: Europe Wearable Defibrillator Industry Volume Share (%), by End-user 2025 & 2033

- Figure 23: Europe Wearable Defibrillator Industry Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Wearable Defibrillator Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Wearable Defibrillator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Wearable Defibrillator Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Wearable Defibrillator Industry Revenue (Million), by Demography 2025 & 2033

- Figure 28: Asia Pacific Wearable Defibrillator Industry Volume (K Unit), by Demography 2025 & 2033

- Figure 29: Asia Pacific Wearable Defibrillator Industry Revenue Share (%), by Demography 2025 & 2033

- Figure 30: Asia Pacific Wearable Defibrillator Industry Volume Share (%), by Demography 2025 & 2033

- Figure 31: Asia Pacific Wearable Defibrillator Industry Revenue (Million), by End-user 2025 & 2033

- Figure 32: Asia Pacific Wearable Defibrillator Industry Volume (K Unit), by End-user 2025 & 2033

- Figure 33: Asia Pacific Wearable Defibrillator Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 34: Asia Pacific Wearable Defibrillator Industry Volume Share (%), by End-user 2025 & 2033

- Figure 35: Asia Pacific Wearable Defibrillator Industry Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Wearable Defibrillator Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Wearable Defibrillator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Wearable Defibrillator Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Rest of the World Wearable Defibrillator Industry Revenue (Million), by Demography 2025 & 2033

- Figure 40: Rest of the World Wearable Defibrillator Industry Volume (K Unit), by Demography 2025 & 2033

- Figure 41: Rest of the World Wearable Defibrillator Industry Revenue Share (%), by Demography 2025 & 2033

- Figure 42: Rest of the World Wearable Defibrillator Industry Volume Share (%), by Demography 2025 & 2033

- Figure 43: Rest of the World Wearable Defibrillator Industry Revenue (Million), by End-user 2025 & 2033

- Figure 44: Rest of the World Wearable Defibrillator Industry Volume (K Unit), by End-user 2025 & 2033

- Figure 45: Rest of the World Wearable Defibrillator Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 46: Rest of the World Wearable Defibrillator Industry Volume Share (%), by End-user 2025 & 2033

- Figure 47: Rest of the World Wearable Defibrillator Industry Revenue (Million), by Country 2025 & 2033

- Figure 48: Rest of the World Wearable Defibrillator Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Rest of the World Wearable Defibrillator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of the World Wearable Defibrillator Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wearable Defibrillator Industry Revenue Million Forecast, by Demography 2020 & 2033

- Table 2: Global Wearable Defibrillator Industry Volume K Unit Forecast, by Demography 2020 & 2033

- Table 3: Global Wearable Defibrillator Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 4: Global Wearable Defibrillator Industry Volume K Unit Forecast, by End-user 2020 & 2033

- Table 5: Global Wearable Defibrillator Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Wearable Defibrillator Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Wearable Defibrillator Industry Revenue Million Forecast, by Demography 2020 & 2033

- Table 8: Global Wearable Defibrillator Industry Volume K Unit Forecast, by Demography 2020 & 2033

- Table 9: Global Wearable Defibrillator Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 10: Global Wearable Defibrillator Industry Volume K Unit Forecast, by End-user 2020 & 2033

- Table 11: Global Wearable Defibrillator Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Wearable Defibrillator Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Wearable Defibrillator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Wearable Defibrillator Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Wearable Defibrillator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Wearable Defibrillator Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Wearable Defibrillator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Wearable Defibrillator Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Wearable Defibrillator Industry Revenue Million Forecast, by Demography 2020 & 2033

- Table 20: Global Wearable Defibrillator Industry Volume K Unit Forecast, by Demography 2020 & 2033

- Table 21: Global Wearable Defibrillator Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 22: Global Wearable Defibrillator Industry Volume K Unit Forecast, by End-user 2020 & 2033

- Table 23: Global Wearable Defibrillator Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Wearable Defibrillator Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Wearable Defibrillator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Wearable Defibrillator Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Wearable Defibrillator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Wearable Defibrillator Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Wearable Defibrillator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: France Wearable Defibrillator Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Wearable Defibrillator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Italy Wearable Defibrillator Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Wearable Defibrillator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Spain Wearable Defibrillator Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Wearable Defibrillator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Wearable Defibrillator Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Wearable Defibrillator Industry Revenue Million Forecast, by Demography 2020 & 2033

- Table 38: Global Wearable Defibrillator Industry Volume K Unit Forecast, by Demography 2020 & 2033

- Table 39: Global Wearable Defibrillator Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 40: Global Wearable Defibrillator Industry Volume K Unit Forecast, by End-user 2020 & 2033

- Table 41: Global Wearable Defibrillator Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Global Wearable Defibrillator Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Wearable Defibrillator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: China Wearable Defibrillator Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Wearable Defibrillator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Japan Wearable Defibrillator Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Wearable Defibrillator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: India Wearable Defibrillator Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Wearable Defibrillator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Australia Wearable Defibrillator Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Wearable Defibrillator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: South Korea Wearable Defibrillator Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Wearable Defibrillator Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Wearable Defibrillator Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Wearable Defibrillator Industry Revenue Million Forecast, by Demography 2020 & 2033

- Table 56: Global Wearable Defibrillator Industry Volume K Unit Forecast, by Demography 2020 & 2033

- Table 57: Global Wearable Defibrillator Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 58: Global Wearable Defibrillator Industry Volume K Unit Forecast, by End-user 2020 & 2033

- Table 59: Global Wearable Defibrillator Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Wearable Defibrillator Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wearable Defibrillator Industry?

The projected CAGR is approximately 9.23%.

2. Which companies are prominent players in the Wearable Defibrillator Industry?

Key companies in the market include Kestra Medical Technologies Inc, Medtronic PLC, LivaNova PLC, Element Science Inc , Koninklijke Philips NV, Stryker Corporation, Boston Scientific Corporation, Nihon Kohden Corporation, Asahi Kasei Corporation (ZOLL Medical Corporation).

3. What are the main segments of the Wearable Defibrillator Industry?

The market segments include Demography, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 246.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevelance of Cardiovascular Disorders; Increasing Elderly Population; Ease of Use for Non-invasive Devices.

6. What are the notable trends driving market growth?

Adult Segment Expected to Register a High CAGR in the Studied Market.

7. Are there any restraints impacting market growth?

Regulatory Uncertainty; Privacy and Information Security Issues in Wearable Devices.

8. Can you provide examples of recent developments in the market?

August 2022: Element Science reported the first patient to be successfully saved with defibrillation early in the enrollment of the Investigational Device Exception (IDE) study for their Jewel Patch Wearable Cardioverter Defibrillator (P-WCD).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wearable Defibrillator Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wearable Defibrillator Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wearable Defibrillator Industry?

To stay informed about further developments, trends, and reports in the Wearable Defibrillator Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence