Key Insights

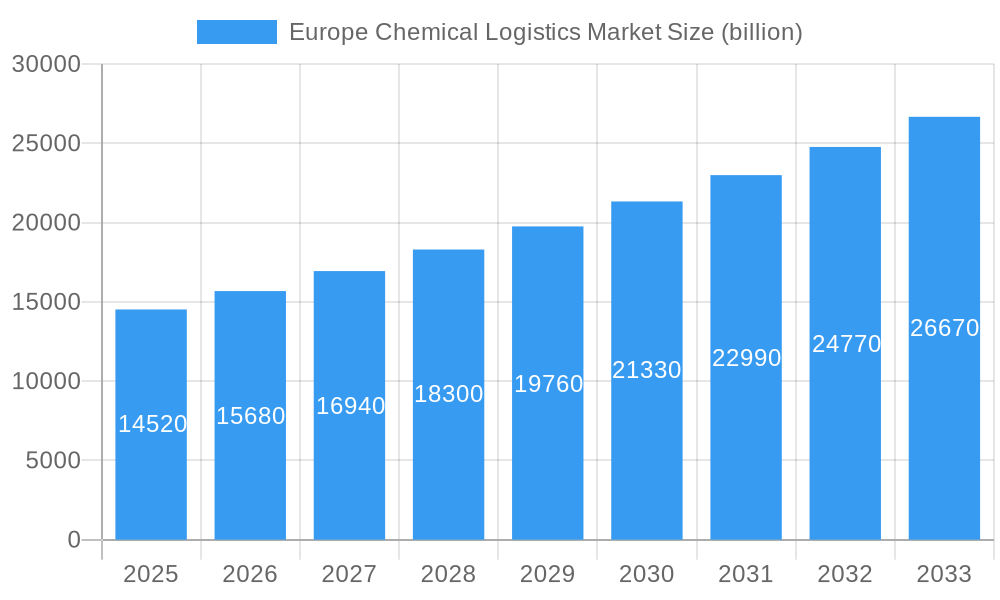

The Europe Chemical Logistics Market is poised for robust growth, with an estimated market size of $14.52 billion in 2025, projected to expand at a Compound Annual Growth Rate (CAGR) of 8.09% through 2033. This dynamic market is propelled by several key drivers, including the increasing demand for specialized chemical products across diverse industries such as pharmaceuticals, cosmetics, and oil and gas. The escalating complexity of chemical supply chains, coupled with stringent regulatory compliance requirements, further necessitates sophisticated logistics solutions. Furthermore, the growing emphasis on sustainability and the adoption of eco-friendly transportation methods are shaping market trends, encouraging the use of multimodal transport and optimized warehousing to reduce environmental impact and operational costs.

Europe Chemical Logistics Market Market Size (In Billion)

While the market exhibits strong growth potential, certain restraints could influence its trajectory. These may include fluctuating fuel prices, geopolitical uncertainties impacting trade routes, and the significant capital investment required for advanced logistics infrastructure. Nevertheless, the industry is witnessing a surge in demand for integrated logistics services, encompassing transportation, warehousing, and value-added services like temperature-controlled storage and hazardous material handling. Key segments like Road transportation are expected to maintain dominance, supported by rail, sea, and pipeline for specific chemical types and volumes. The Pharmaceutical and Oil and Gas industries represent significant end-users, driving the need for reliable and secure chemical logistics. Major players are actively investing in technological advancements and expanding their service portfolios to cater to evolving market needs.

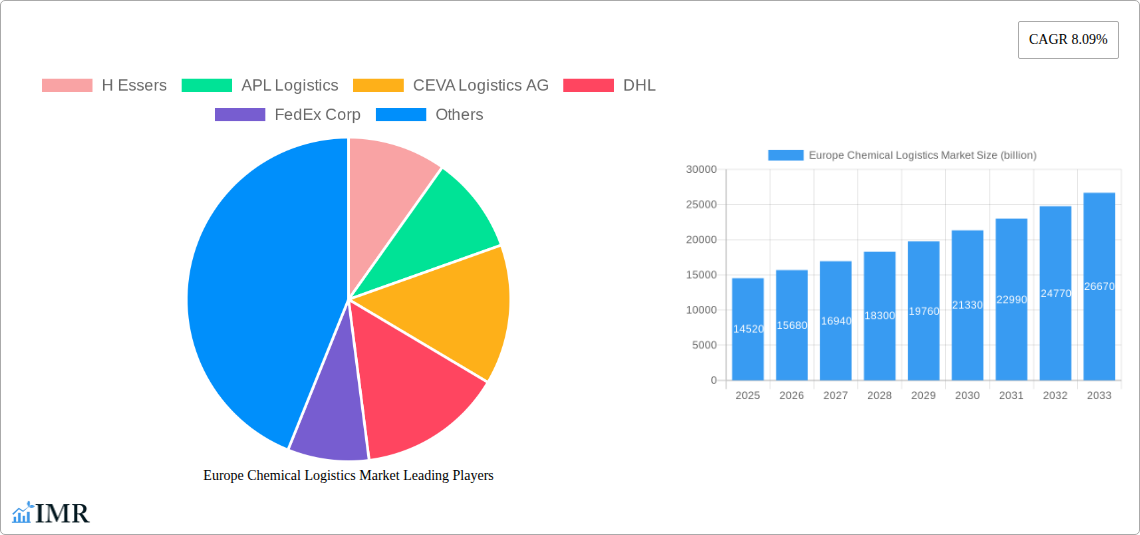

Europe Chemical Logistics Market Company Market Share

Unlocking the Potential: Europe Chemical Logistics Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Chemical Logistics Market, a critical sector underpinning the continent's robust chemical industry. Covering the historical period of 2019-2024, base year 2025, and a forecast period extending to 2033, this research offers invaluable insights into market dynamics, growth trends, regional dominance, and key players. We meticulously analyze the interplay between parent and child markets, identifying opportunities and challenges across diverse service segments, transportation modes, and end-user industries. With a focus on actionable intelligence, this report is an indispensable resource for logistics providers, chemical manufacturers, investors, and industry stakeholders seeking to navigate and capitalize on the evolving European chemical logistics landscape. The estimated market size for 2025 is projected to be $XXX billion, with significant growth anticipated throughout the forecast period.

Europe Chemical Logistics Market Market Dynamics & Structure

The Europe Chemical Logistics Market is characterized by a moderately concentrated landscape, with leading players like DHL, CEVA Logistics AG, and DB Schenker BTT holding significant shares. Technological innovation is a key driver, with advancements in real-time tracking, automation in warehouses, and sustainable logistics solutions gaining traction. Regulatory frameworks, particularly those concerning hazardous material handling and environmental compliance (e.g., REACH regulations), significantly influence operational strategies and investment decisions. The competitive product substitute landscape is relatively stable, but the emergence of integrated digital platforms and specialized logistics providers is a noteworthy trend. End-user demographics reveal a strong reliance on the Pharmaceutical Industry, the Oil and Gas Industry, and the Specialty Chemicals Industry, each with distinct logistical needs. Mergers and acquisitions (M&A) remain a prominent strategy for market consolidation and expansion, with an estimated XX M&A deals recorded in the historical period, reflecting a strategic drive for enhanced capabilities and geographical reach. For instance, the expansion of specialized chemical warehousing facilities by Rhenus Logistics exemplifies a strategic response to growing demand.

- Market Concentration: Dominated by a few large global players and a growing number of niche specialists.

- Technological Innovation: Focus on digitalization, automation, and sustainability in chemical supply chains.

- Regulatory Influence: Stringent safety and environmental regulations shaping operational practices.

- End-User Dependence: Significant demand from pharmaceutical, oil & gas, and specialty chemical sectors.

- M&A Activity: Strategic consolidation and capability enhancement through acquisitions.

Europe Chemical Logistics Market Growth Trends & Insights

The Europe Chemical Logistics Market is poised for robust growth, driven by escalating demand for specialized transportation and warehousing solutions across diverse chemical sub-sectors. The market size is projected to expand from an estimated $XXX billion in 2025 to $XXX billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. Adoption rates for advanced logistics technologies, such as AI-powered route optimization and IoT-enabled inventory management, are steadily increasing, particularly within the Pharmaceutical Industry and the Specialty Chemicals Industry, where precision and security are paramount. Technological disruptions, including the integration of blockchain for enhanced supply chain transparency and the growing adoption of electric and hydrogen-powered fleets for reduced emissions, are reshaping operational efficiencies. Consumer behavior shifts, particularly the increasing preference for sustainable products and transparent supply chains, are compelling logistics providers to invest in eco-friendly solutions and robust traceability systems. The market penetration of specialized chemical logistics services is expected to deepen as regulatory compliance becomes more stringent and the complexity of chemical supply chains increases.

- Market Size Evolution: Projected to grow significantly from $XXX billion in 2025 to $XXX billion by 2033.

- CAGR: XX% anticipated growth during the forecast period (2025-2033).

- Adoption Rates: Rising adoption of digital and sustainable logistics technologies.

- Technological Disruptions: Blockchain, AI, and sustainable transportation influencing the market.

- Consumer Behavior Shifts: Demand for transparency and eco-friendly logistics.

- Market Penetration: Increasing reliance on specialized chemical logistics providers.

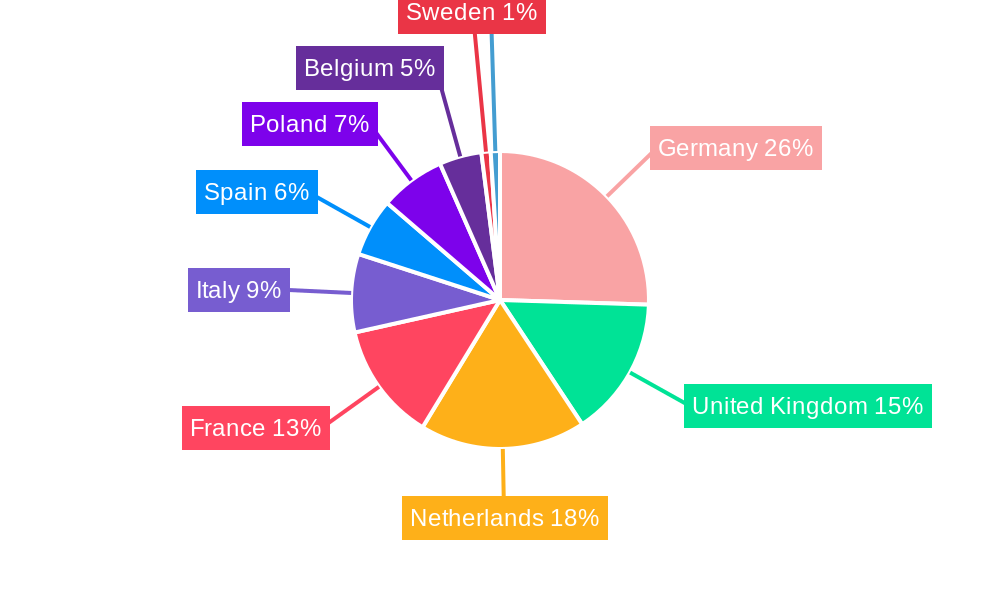

Dominant Regions, Countries, or Segments in Europe Chemical Logistics Market

Within the Europe Chemical Logistics Market, Germany stands out as the dominant country, fueled by its status as a manufacturing powerhouse for the chemical industry. Its advanced infrastructure, coupled with stringent regulatory compliance and a strong emphasis on technological integration, positions it at the forefront. The Transportation segment, particularly Road and Rail modes, demonstrates significant dominance due to the high volume of intra-European chemical trade. The Pharmaceutical Industry and the Specialty Chemicals Industry are the primary end-user segments driving this dominance, with their inherent need for temperature-controlled, secure, and timely deliveries.

In terms of services, Transportation accounts for the largest market share, estimated at XX% in the base year 2025, followed by Warehousing at XX% and Other Value-added Services at XX%. This reflects the fundamental need for moving large quantities of chemicals across the continent. The Road mode of transportation is expected to hold the largest share within the transportation segment, estimated at XX%, owing to its flexibility and extensive network coverage. Rail transportation follows closely at XX%, gaining traction for bulk shipments and long-haul routes due to its environmental benefits. The Oil and Gas Industry also contributes significantly to the demand for logistics services, particularly in regions with substantial petrochemical operations.

Key drivers for Germany's dominance include strong government support for industrial innovation, extensive investment in logistics infrastructure such as multimodal hubs, and a highly skilled workforce. The country's proactive approach to environmental regulations and its commitment to sustainable logistics solutions further solidify its leadership. The market share of Germany within the European chemical logistics market is estimated at XX% in 2025, with a projected growth potential of XX% by 2033. The interplay between efficient transportation networks and specialized warehousing solutions for hazardous and non-hazardous chemicals creates a self-reinforcing ecosystem that attracts and retains chemical manufacturing and logistics operations.

- Dominant Country: Germany, due to its extensive chemical industry and advanced logistics infrastructure.

- Dominant Service Segment: Transportation, accounting for the largest market share.

- Dominant Mode of Transportation: Road, followed by Rail, for efficient movement of chemicals.

- Key End Users Driving Demand: Pharmaceutical Industry and Specialty Chemicals Industry, due to specialized handling needs.

- Growth Drivers in Dominant Regions: Strong infrastructure, technological adoption, and regulatory compliance.

Europe Chemical Logistics Market Product Landscape

The Europe Chemical Logistics Market's product landscape is defined by the sophisticated array of specialized solutions designed to meet the stringent requirements of chemical handling. This includes an increasing portfolio of temperature-controlled containers, advanced packaging solutions for hazardous materials, and digital platforms for real-time tracking and inventory management. Performance metrics are heavily scrutinized, focusing on delivery timeliness, cargo integrity, and adherence to safety protocols. Unique selling propositions often revolve around sustainability initiatives, such as the use of low-emission vehicles and optimized route planning to minimize carbon footprint. Technological advancements are evident in the integration of IoT sensors for continuous monitoring of chemical conditions during transit and storage, ensuring compliance with sensitive product requirements. The development of multimodal transport solutions, seamlessly integrating road, rail, and sea freight, further enhances efficiency and cost-effectiveness for various chemical products.

Key Drivers, Barriers & Challenges in Europe Chemical Logistics Market

Key Drivers:

- Growing Chemical Production: Increased output from the pharmaceutical, specialty chemicals, and petrochemical sectors drives demand for logistics services.

- E-commerce Expansion: The rise of online retail for certain chemical products necessitates efficient last-mile delivery solutions.

- Technological Advancements: Innovations in digitalization, automation, and sustainable logistics enhance operational efficiency and safety.

- Stringent Regulations: Compliance with evolving safety and environmental standards necessitates specialized logistics expertise.

Barriers & Challenges:

- Supply Chain Disruptions: Geopolitical events, natural disasters, and labor shortages can lead to significant disruptions.

- High Operational Costs: The specialized nature of chemical logistics, including safety equipment and trained personnel, results in higher operational expenses.

- Infrastructure Limitations: In some regions, underdeveloped infrastructure can hinder efficient transportation and warehousing.

- Cybersecurity Threats: The increasing reliance on digital platforms makes the industry vulnerable to cyberattacks, posing risks to sensitive data and operational continuity.

Emerging Opportunities in Europe Chemical Logistics Market

Emerging opportunities in the Europe Chemical Logistics Market lie in the growing demand for sustainable logistics solutions, including the adoption of electric and hydrogen-powered fleets and the optimization of supply chains to reduce carbon emissions. The expansion of e-commerce for specialized chemicals presents a niche but growing market requiring tailored last-mile delivery strategies. Furthermore, the increasing focus on circular economy principles within the chemical industry creates opportunities for logistics providers to support reverse logistics and waste management services. The development of digital twins for chemical supply chains offers advanced simulation and optimization capabilities, promising to enhance efficiency and resilience.

Growth Accelerators in the Europe Chemical Logistics Market Industry

The Europe Chemical Logistics Market is experiencing significant growth acceleration driven by strategic partnerships and collaborations between chemical manufacturers and logistics providers, fostering integrated supply chain solutions. Investment in advanced digital technologies, such as AI-powered predictive analytics for demand forecasting and automated warehouse management systems, is crucial for optimizing operations and reducing costs. The increasing emphasis on sustainability and ESG (Environmental, Social, and Governance) compliance by businesses is prompting logistics companies to adopt greener transportation methods and energy-efficient warehousing, opening new avenues for growth and differentiation. Furthermore, expansion into emerging European markets with developing chemical industries presents substantial growth potential for logistics service providers.

Key Players Shaping the Europe Chemical Logistics Market Market

- H Essers

- APL Logistics

- CEVA Logistics AG

- DHL

- FedEx Corp

- XPO Logistics

- JCL Logistics

- Log4Chem

- Schneider National Inc

- Rhenus Logistics

- DB Schenker BTT

- RMI Global Logistics Services

- Univar Inc

- Chemical Express

- Broekman Logistics

- BDP International Inc

- DSV Panalpina AS

Notable Milestones in Europe Chemical Logistics Market Sector

- September 2023: The German Chemical Industry Association (Verband der Chemischen Industrie e.V., or VCI) and DACHSER Chem Logistics have extended their purchasing partnership in logistics ahead of time by five years. Early contract extension to 2029 reflects sound collaboration and ongoing trust in DACHSER's specialized chemical logistics capabilities.

- May 2023: Wincanton, a leading supply chain partner for UK business, and Tata Chemicals Europe (“TCE”) have signed a 10-year warehousing and logistics contract. The long-term partnership confirms Wincanton’s integral role in supporting TCE’s strategic growth plans, which include a UK-first from British Salt Limited – TCE’s high purity salt manufacturing business, highlighting the importance of long-term strategic alliances in the sector.

In-Depth Europe Chemical Logistics Market Market Outlook

The future outlook for the Europe Chemical Logistics Market is exceptionally promising, fueled by continued innovation and strategic expansion. Growth accelerators will center on the deeper integration of digital solutions, including advanced data analytics and AI for predictive logistics, enhancing efficiency and responsiveness. The ongoing shift towards sustainable practices will drive significant investment in green transportation modes and energy-efficient warehousing, creating a competitive advantage for environmentally conscious providers. Furthermore, strategic partnerships and mergers are expected to continue, consolidating the market and enhancing service offerings. The increasing demand from burgeoning end-user industries, coupled with the need for specialized handling of complex chemical products, will ensure sustained market growth and evolving service requirements, positioning the market for robust expansion.

Europe Chemical Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehous

- 1.3. Other Value-added Services

-

2. Mode of Transportation

- 2.1. Road

- 2.2. Rail

- 2.3. Sea

- 2.4. Pipeline

-

3. End User

- 3.1. Pharmaceutical Industry

- 3.2. Cosmetics Industry

- 3.3. Oil and Gas Industry

- 3.4. Specialty Chemicals Industry

- 3.5. Other End Users (like Coating Industry)

Europe Chemical Logistics Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. Netherlands

- 4. France

- 5. Italy

- 6. Spain

- 7. Poland

- 8. Belgium

- 9. Sweden

- 10. Rest of Europe

Europe Chemical Logistics Market Regional Market Share

Geographic Coverage of Europe Chemical Logistics Market

Europe Chemical Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Efficiency and Time Efficiency; Increasing E-commerce Sector

- 3.3. Market Restrains

- 3.3.1. Regulatory Environment; Technical Limitations

- 3.4. Market Trends

- 3.4.1. Europe is the second largest Chemical Producer Globally

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehous

- 5.1.3. Other Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 5.2.1. Road

- 5.2.2. Rail

- 5.2.3. Sea

- 5.2.4. Pipeline

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pharmaceutical Industry

- 5.3.2. Cosmetics Industry

- 5.3.3. Oil and Gas Industry

- 5.3.4. Specialty Chemicals Industry

- 5.3.5. Other End Users (like Coating Industry)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. Netherlands

- 5.4.4. France

- 5.4.5. Italy

- 5.4.6. Spain

- 5.4.7. Poland

- 5.4.8. Belgium

- 5.4.9. Sweden

- 5.4.10. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Germany Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Warehous

- 6.1.3. Other Value-added Services

- 6.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 6.2.1. Road

- 6.2.2. Rail

- 6.2.3. Sea

- 6.2.4. Pipeline

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Pharmaceutical Industry

- 6.3.2. Cosmetics Industry

- 6.3.3. Oil and Gas Industry

- 6.3.4. Specialty Chemicals Industry

- 6.3.5. Other End Users (like Coating Industry)

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. United Kingdom Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Warehous

- 7.1.3. Other Value-added Services

- 7.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 7.2.1. Road

- 7.2.2. Rail

- 7.2.3. Sea

- 7.2.4. Pipeline

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Pharmaceutical Industry

- 7.3.2. Cosmetics Industry

- 7.3.3. Oil and Gas Industry

- 7.3.4. Specialty Chemicals Industry

- 7.3.5. Other End Users (like Coating Industry)

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Netherlands Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Warehous

- 8.1.3. Other Value-added Services

- 8.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 8.2.1. Road

- 8.2.2. Rail

- 8.2.3. Sea

- 8.2.4. Pipeline

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Pharmaceutical Industry

- 8.3.2. Cosmetics Industry

- 8.3.3. Oil and Gas Industry

- 8.3.4. Specialty Chemicals Industry

- 8.3.5. Other End Users (like Coating Industry)

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. France Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Warehous

- 9.1.3. Other Value-added Services

- 9.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 9.2.1. Road

- 9.2.2. Rail

- 9.2.3. Sea

- 9.2.4. Pipeline

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Pharmaceutical Industry

- 9.3.2. Cosmetics Industry

- 9.3.3. Oil and Gas Industry

- 9.3.4. Specialty Chemicals Industry

- 9.3.5. Other End Users (like Coating Industry)

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Italy Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Transportation

- 10.1.2. Warehous

- 10.1.3. Other Value-added Services

- 10.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 10.2.1. Road

- 10.2.2. Rail

- 10.2.3. Sea

- 10.2.4. Pipeline

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Pharmaceutical Industry

- 10.3.2. Cosmetics Industry

- 10.3.3. Oil and Gas Industry

- 10.3.4. Specialty Chemicals Industry

- 10.3.5. Other End Users (like Coating Industry)

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Spain Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service

- 11.1.1. Transportation

- 11.1.2. Warehous

- 11.1.3. Other Value-added Services

- 11.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 11.2.1. Road

- 11.2.2. Rail

- 11.2.3. Sea

- 11.2.4. Pipeline

- 11.3. Market Analysis, Insights and Forecast - by End User

- 11.3.1. Pharmaceutical Industry

- 11.3.2. Cosmetics Industry

- 11.3.3. Oil and Gas Industry

- 11.3.4. Specialty Chemicals Industry

- 11.3.5. Other End Users (like Coating Industry)

- 11.1. Market Analysis, Insights and Forecast - by Service

- 12. Poland Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Service

- 12.1.1. Transportation

- 12.1.2. Warehous

- 12.1.3. Other Value-added Services

- 12.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 12.2.1. Road

- 12.2.2. Rail

- 12.2.3. Sea

- 12.2.4. Pipeline

- 12.3. Market Analysis, Insights and Forecast - by End User

- 12.3.1. Pharmaceutical Industry

- 12.3.2. Cosmetics Industry

- 12.3.3. Oil and Gas Industry

- 12.3.4. Specialty Chemicals Industry

- 12.3.5. Other End Users (like Coating Industry)

- 12.1. Market Analysis, Insights and Forecast - by Service

- 13. Belgium Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Service

- 13.1.1. Transportation

- 13.1.2. Warehous

- 13.1.3. Other Value-added Services

- 13.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 13.2.1. Road

- 13.2.2. Rail

- 13.2.3. Sea

- 13.2.4. Pipeline

- 13.3. Market Analysis, Insights and Forecast - by End User

- 13.3.1. Pharmaceutical Industry

- 13.3.2. Cosmetics Industry

- 13.3.3. Oil and Gas Industry

- 13.3.4. Specialty Chemicals Industry

- 13.3.5. Other End Users (like Coating Industry)

- 13.1. Market Analysis, Insights and Forecast - by Service

- 14. Sweden Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by Service

- 14.1.1. Transportation

- 14.1.2. Warehous

- 14.1.3. Other Value-added Services

- 14.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 14.2.1. Road

- 14.2.2. Rail

- 14.2.3. Sea

- 14.2.4. Pipeline

- 14.3. Market Analysis, Insights and Forecast - by End User

- 14.3.1. Pharmaceutical Industry

- 14.3.2. Cosmetics Industry

- 14.3.3. Oil and Gas Industry

- 14.3.4. Specialty Chemicals Industry

- 14.3.5. Other End Users (like Coating Industry)

- 14.1. Market Analysis, Insights and Forecast - by Service

- 15. Rest of Europe Europe Chemical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - by Service

- 15.1.1. Transportation

- 15.1.2. Warehous

- 15.1.3. Other Value-added Services

- 15.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 15.2.1. Road

- 15.2.2. Rail

- 15.2.3. Sea

- 15.2.4. Pipeline

- 15.3. Market Analysis, Insights and Forecast - by End User

- 15.3.1. Pharmaceutical Industry

- 15.3.2. Cosmetics Industry

- 15.3.3. Oil and Gas Industry

- 15.3.4. Specialty Chemicals Industry

- 15.3.5. Other End Users (like Coating Industry)

- 15.1. Market Analysis, Insights and Forecast - by Service

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2025

- 16.2. Company Profiles

- 16.2.1 H Essers

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 APL Logistics

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 CEVA Logistics AG

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 DHL

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 FedEx Corp

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 XPO Logistics

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 JCL Logistics

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Log4Chem

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Schneider National Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Rhenus Logistics

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 DB Schenker BTT

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 RMI Global Logistics Services**List Not Exhaustive

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Univar Inc

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Chemical Express

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.15 Broekman Logistics

- 16.2.15.1. Overview

- 16.2.15.2. Products

- 16.2.15.3. SWOT Analysis

- 16.2.15.4. Recent Developments

- 16.2.15.5. Financials (Based on Availability)

- 16.2.16 BDP International Inc

- 16.2.16.1. Overview

- 16.2.16.2. Products

- 16.2.16.3. SWOT Analysis

- 16.2.16.4. Recent Developments

- 16.2.16.5. Financials (Based on Availability)

- 16.2.17 DSV Panalpina AS

- 16.2.17.1. Overview

- 16.2.17.2. Products

- 16.2.17.3. SWOT Analysis

- 16.2.17.4. Recent Developments

- 16.2.17.5. Financials (Based on Availability)

- 16.2.1 H Essers

List of Figures

- Figure 1: Europe Chemical Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Chemical Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 3: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Europe Chemical Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 7: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Europe Chemical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 10: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 11: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Europe Chemical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 14: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 15: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 16: Europe Chemical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 18: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 19: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 20: Europe Chemical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 22: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 23: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 24: Europe Chemical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 26: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 27: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 28: Europe Chemical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 30: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 31: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 32: Europe Chemical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 33: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 34: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 35: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 36: Europe Chemical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 38: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 39: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 40: Europe Chemical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Europe Chemical Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 42: Europe Chemical Logistics Market Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 43: Europe Chemical Logistics Market Revenue billion Forecast, by End User 2020 & 2033

- Table 44: Europe Chemical Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Chemical Logistics Market?

The projected CAGR is approximately 8.09%.

2. Which companies are prominent players in the Europe Chemical Logistics Market?

Key companies in the market include H Essers, APL Logistics, CEVA Logistics AG, DHL, FedEx Corp, XPO Logistics, JCL Logistics, Log4Chem, Schneider National Inc, Rhenus Logistics, DB Schenker BTT, RMI Global Logistics Services**List Not Exhaustive, Univar Inc, Chemical Express, Broekman Logistics, BDP International Inc, DSV Panalpina AS.

3. What are the main segments of the Europe Chemical Logistics Market?

The market segments include Service, Mode of Transportation, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.52 billion as of 2022.

5. What are some drivers contributing to market growth?

Cost Efficiency and Time Efficiency; Increasing E-commerce Sector.

6. What are the notable trends driving market growth?

Europe is the second largest Chemical Producer Globally.

7. Are there any restraints impacting market growth?

Regulatory Environment; Technical Limitations.

8. Can you provide examples of recent developments in the market?

September 2023: The German Chemical Industry Association (Verband der Chemischen Industrie e.V., or VCI) and DACHSER Chem Logistics have extended their purchasing partnership in logistics ahead of time by five years. Early contract extension to 2029 reflects sound collaboration

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Chemical Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Chemical Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Chemical Logistics Market?

To stay informed about further developments, trends, and reports in the Europe Chemical Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence