Key Insights

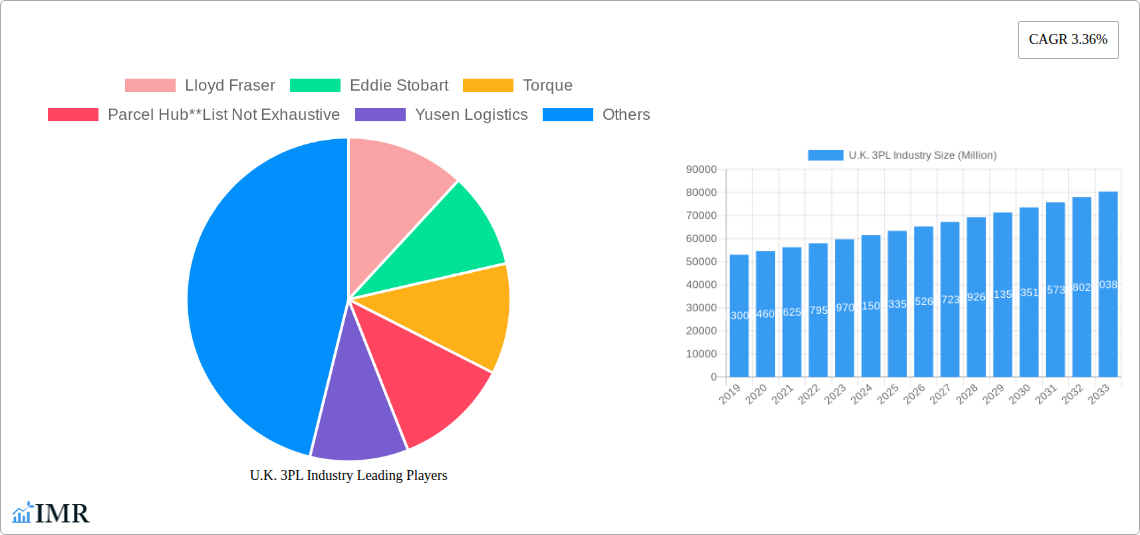

The United Kingdom's Third-Party Logistics (3PL) market is set for significant expansion, forecasted to reach £21.2 billion by 2025. This growth is driven by a Compound Annual Growth Rate (CAGR) of 0.3%, projecting sustained momentum through 2033. Increasing supply chain complexity is a primary catalyst, prompting businesses across diverse industries to delegate logistics operations to specialized 3PL providers. Key sectors fueling this trend include Manufacturing, Automotive, Oil & Gas, and Chemicals, all of which require efficient and dependable transportation, warehousing, and distribution. The Pharmaceuticals and Healthcare sector, with its stringent regulatory demands and specialized handling needs, is another substantial growth contributor. The dynamic e-commerce environment further amplifies the need for advanced warehousing and distribution solutions, propelling market growth.

U.K. 3PL Industry Market Size (In Billion)

Several converging trends are shaping the UK 3PL sector. A notable development is the increasing integration of technology and automation in warehousing and transportation management, enhancing efficiency, cost reduction, and operational visibility. This includes the deployment of advanced Warehouse Management Systems (WMS), route optimization software, and autonomous guided vehicles (AGVs). Sustainability is also a critical focus, with 3PL companies investing in eco-friendly fleets, sustainable warehousing practices, and optimized routing to reduce their carbon footprint. However, the market encounters challenges, including rising operational expenses such as fuel and labor costs. Geopolitical instability and potential trade disruptions can impact international logistics, necessitating provider adaptability and robust contingency plans. Evolving regulatory frameworks, particularly concerning environmental standards and labor practices, also require continuous adaptation and investment.

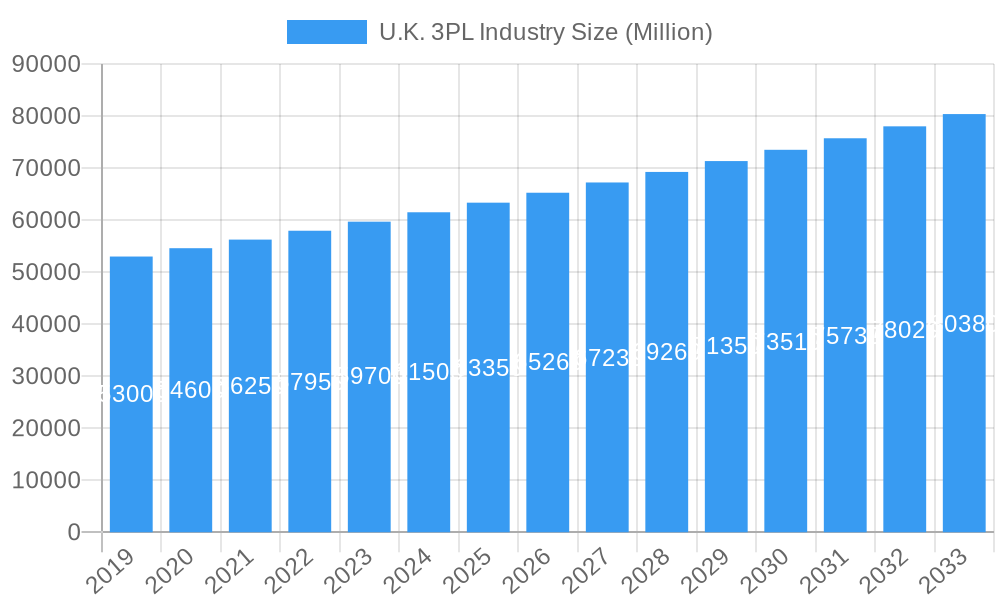

U.K. 3PL Industry Company Market Share

U.K. 3PL Industry: Comprehensive Market Analysis & Forecast (2019-2033)

This in-depth report provides a definitive analysis of the U.K. Third-Party Logistics (3PL) industry, covering market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. Delving into segments like Domestic Transportation Management, International Transportation Management, and Value-added Warehousing and Distribution, and examining end-user sectors from Manufacturing and Automotive to Pharmaceuticals and Healthcare, this study offers critical insights for stakeholders. With a focus on both parent and child market evolution, this report leverages high-traffic keywords for maximum SEO visibility. The study period spans 2019–2033, with 2025 as the base and estimated year, and a forecast period of 2025–2033, informed by historical data from 2019–2024. All monetary values are presented in millions of units.

U.K. 3PL Industry Market Dynamics & Structure

The U.K. 3PL market exhibits a moderately concentrated structure, with a few dominant players like DHL Supply Chain, XPO Logistics, and Wincanton holding significant market share. Technological innovation, particularly in areas of automation, AI-driven route optimization, and real-time tracking, is a key driver, propelling efficiency and customer service improvements. Regulatory frameworks, such as those governing emissions and driver hours, also shape operational strategies. Competitive product substitutes are emerging in the form of in-house logistics solutions and niche technology providers, though the integrated service offering of established 3PLs remains a strong differentiator. End-user demographics are increasingly sophisticated, demanding flexible, sustainable, and technology-enabled supply chain solutions. Mergers and acquisitions (M&A) are a prominent feature, driven by the pursuit of scale, market diversification, and enhanced service capabilities. For instance, industry consolidation aims to achieve cost efficiencies and expand geographic reach. Innovation barriers include the high capital investment required for advanced technologies and the need for skilled labor to operate and manage them.

- Market Concentration: Dominated by a few large-scale providers, with increasing strategic M&A activity.

- Technological Drivers: Automation, AI, IoT for real-time visibility, and data analytics are paramount.

- Regulatory Impact: Environmental policies and labor laws significantly influence operational costs and strategies.

- Competitive Landscape: Intense competition from established players and emerging technology-focused providers.

- End-User Demand: Shifting towards integrated, sustainable, and digitally enhanced logistics solutions.

- M&A Trends: Driven by consolidation, expansion of services, and acquisition of technological capabilities.

U.K. 3PL Industry Growth Trends & Insights

The U.K. 3PL industry is on a robust growth trajectory, fueled by evolving consumer expectations and the increasing complexity of global supply chains. The market size is projected to expand significantly over the forecast period (2025-2033), driven by a consistent Compound Annual Growth Rate (CAGR) of xx%. Adoption rates for advanced logistics technologies are accelerating, with businesses increasingly recognizing the value of outsourcing to specialized providers to enhance efficiency and reduce operational costs. Technological disruptions, such as the widespread implementation of warehouse automation, autonomous vehicles, and advanced route planning software, are fundamentally reshaping logistics operations. These innovations are not only improving speed and accuracy but also contributing to greater sustainability. Consumer behavior shifts, including the rise of e-commerce and the demand for faster, more flexible delivery options, are placing immense pressure on supply chains, necessitating sophisticated 3PL solutions. Market penetration is deepening across various sectors as companies seek to optimize their logistics networks. The increasing need for resilient and agile supply chains in the face of global uncertainties further bolsters the demand for reliable 3PL services. The drive for cost optimization and the strategic advantage of focusing on core competencies are key reasons for the growing reliance on third-party providers. The digitalization of supply chains, from order placement to final delivery, is another significant trend enhancing the value proposition of 3PLs.

Dominant Regions, Countries, or Segments in U.K. 3PL Industry

Within the U.K. 3PL industry, Domestic Transportation Management stands out as a dominant segment, driven by the vast and intricate internal distribution networks required by a mature economy. The burgeoning e-commerce sector, with its ever-increasing demand for timely and efficient last-mile deliveries, is a primary catalyst for this dominance. This segment is further bolstered by sectors like Retail and Consumer Goods, which rely heavily on a well-functioning domestic transport infrastructure. Economic policies promoting domestic trade and investment in transportation infrastructure, such as road and rail networks, play a crucial role in supporting its growth. The market share for Domestic Transportation Management is substantial, estimated at over 40 million units in terms of freight volume.

- Key Drivers for Domestic Transportation Management:

- E-commerce Boom: Surging online retail necessitates efficient last-mile delivery.

- Consumer Demand: Growing expectation for rapid and flexible delivery options.

- Infrastructure Investment: Government focus on improving road and rail networks.

- Retail Sector Needs: Continuous demand for product movement across the nation.

The Manufacturing and Automotive end-user segment is another significant growth engine, showcasing a high demand for specialized logistics solutions. This includes just-in-time delivery of components, finished goods warehousing, and complex supply chain management for global operations. Strategic partnerships between 3PLs and manufacturers are crucial for optimizing production schedules and reducing inventory holding costs. The sector’s market share is substantial, reflecting the high value and volume of goods moved.

- Key Drivers for Manufacturing and Automotive:

- Just-in-Time Manufacturing: Critical for efficient production and inventory management.

- Global Supply Chains: Complexity requires expert logistics management.

- Specialized Handling: Need for careful handling of raw materials and finished products.

- Cost Optimization: Outsourcing logistics to focus on core manufacturing activities.

Value-added Warehousing and Distribution is a rapidly expanding segment, moving beyond basic storage to offer services like kitting, co-packing, reverse logistics, and returns management. This is particularly crucial for sectors like Pharmaceuticals and Healthcare, where stringent quality control and specialized handling are paramount. The growth potential in this area is immense as businesses seek to streamline their entire supply chain operations.

- Key Drivers for Value-added Warehousing and Distribution:

- E-commerce Fulfillment: Demand for customized order picking and packing.

- Product Customization: Services like kitting and light assembly.

- Returns Management: Efficient processing of returned goods.

- Regulatory Compliance: Critical for sectors like healthcare and pharmaceuticals.

U.K. 3PL Industry Product Landscape

The U.K. 3PL industry's product landscape is characterized by a convergence of advanced technological solutions and integrated service offerings. Innovations in fleet management software, warehouse automation (robotics, automated guided vehicles), and sophisticated inventory management systems are at the forefront. These advancements enable enhanced visibility, predictive analytics, and optimized operational flows. Unique selling propositions often lie in the seamless integration of these technologies with end-to-end logistics services, providing clients with a holistic and efficient supply chain solution. For instance, real-time tracking systems offer unparalleled transparency from origin to destination, while AI-powered route optimization minimizes transit times and fuel consumption. The focus is on creating agile, scalable, and sustainable logistics products that cater to the evolving needs of diverse industries.

Key Drivers, Barriers & Challenges in U.K. 3PL Industry

Key Drivers:

- E-commerce Growth: The relentless expansion of online retail necessitates efficient and agile logistics solutions.

- Globalization & Complex Supply Chains: Businesses increasingly rely on 3PLs to manage intricate international and domestic networks.

- Cost Optimization & Focus on Core Competencies: Companies outsource logistics to reduce operational overhead and concentrate on their primary business activities.

- Technological Advancements: Adoption of automation, AI, and data analytics drives efficiency and service improvements.

Barriers & Challenges:

- Driver Shortage: A persistent issue impacting capacity and delivery times, estimated to affect xx% of operations.

- Infrastructure Congestion: Road and port congestion leads to delays and increased costs, impacting xx% of nationwide deliveries.

- Regulatory Compliance: Navigating evolving environmental and labor regulations requires significant investment and adaptation.

- Rising Fuel Costs: Volatile energy prices directly impact operational expenses, leading to price fluctuations in the market.

- Cybersecurity Threats: Protecting sensitive supply chain data from breaches is a growing concern.

Emerging Opportunities in U.K. 3PL Industry

Emerging opportunities in the U.K. 3PL industry lie in the growing demand for specialized and sustainable logistics solutions. The expansion of green logistics initiatives, including electric vehicle fleets and optimized routing for reduced emissions, presents a significant avenue. Furthermore, the increasing complexity of cold chain logistics for the pharmaceutical and food industries, coupled with the rise of direct-to-consumer (DTC) models for perishable goods, offers substantial growth potential. The development of intelligent warehousing solutions, incorporating AI for predictive maintenance and inventory management, is also a key area for innovation and service enhancement. The U.K.'s strong position in financial services and technology also creates opportunities for sophisticated supply chain finance integration and data analytics services.

Growth Accelerators in the U.K. 3PL Industry Industry

Several catalysts are accelerating the growth of the U.K. 3PL industry. The ongoing digital transformation of supply chains, from enhanced visibility through IoT devices to AI-driven demand forecasting, is a major driver. Strategic partnerships and collaborations between 3PLs and technology providers are fostering innovation and the development of more sophisticated service offerings. Furthermore, government initiatives aimed at improving national infrastructure and promoting sustainable logistics practices are creating a more conducive operating environment. The increasing trend of supply chain resilience, driven by lessons learned from recent global disruptions, is pushing companies to invest in more robust and agile 3PL solutions, further fueling market expansion.

Key Players Shaping the U.K. 3PL Industry Market

- Lloyd Fraser

- Eddie Stobart

- Torque

- Parcel Hub

- Yusen Logistics

- Wincanton

- XPO Logistics

- FedEx

- CEVA Logistics

- Tarlu Ltd

- Kuehne Nagel

- Bibby Distribution

- United Parcel Service of America

- Xpediator

- Schenker Limited

- Pointbid Logistics Systems Ltd

- DHL Supply Chain

- Rhenus Logistics

Notable Milestones in U.K. 3PL Industry Sector

- June 2023: Kuehne+Nagel signed an agreement to acquire Morgan Cargo, a leading South African, UK and Kenyan freight forwarder specialised in the transport and handling of perishable goods. During 2022 the company handled more than 40,000 tonnes of air freight and more than 20,000 TEU of sea freight globally, managed by approximately 450 logistics experts.

- February 2023: Wincanton announced a new four-year contract by Wickes that will extend and expand its mandate for the home improvement retailer. The new contract, which spans warehouse and transport operations, will see Wincanton become the sole supply chain partner for Wickes' kitchen and bathroom business in the UK. Wincanton is responsible for the management of Wickes' 400,000 sq ft kitchen and bathroom distribution centers in Northampton.

In-Depth U.K. 3PL Industry Market Outlook

The U.K. 3PL industry is poised for continued robust growth, driven by the persistent demand for efficient, technology-enabled, and sustainable supply chain solutions. Strategic investments in automation, AI, and data analytics by key players will further enhance service offerings and operational efficiencies. The increasing emphasis on supply chain resilience and agility in response to global uncertainties will solidify the indispensable role of 3PL providers. Emerging opportunities in green logistics, specialized cold chain management, and advanced warehousing services will shape the future landscape. Partnerships and collaborations are expected to become even more critical for innovation and market penetration, ultimately leading to a more integrated and sophisticated logistics ecosystem. The market outlook indicates significant potential for companies that can adapt to evolving customer needs and leverage cutting-edge technologies to deliver exceptional value.

U.K. 3PL Industry Segmentation

-

1. Services

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Oil & Gas and Chemicals

- 2.3. Distribu

- 2.4. Pharmaceuticals and Healthcare

- 2.5. Construction

- 2.6. Other End Users

U.K. 3PL Industry Segmentation By Geography

- 1. U.K.

U.K. 3PL Industry Regional Market Share

Geographic Coverage of U.K. 3PL Industry

U.K. 3PL Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Government Initiatives4.; Increase of Trade

- 3.3. Market Restrains

- 3.3.1. 4.; Shortage of Labor

- 3.4. Market Trends

- 3.4.1. Growth in Logistics Parks and Fulfilment Centers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. U.K. 3PL Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil & Gas and Chemicals

- 5.2.3. Distribu

- 5.2.4. Pharmaceuticals and Healthcare

- 5.2.5. Construction

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. U.K.

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lloyd Fraser

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Eddie Stobart

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Torque

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Parcel Hub**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yusen Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Wincanton

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 XPO Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FedEx

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CEVA Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Tarlu Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kuehne Nagel

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Bibby Distribution

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 United Parcel Service of America

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Xpediator

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Schenker Limited

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Pointbid Logistics Systems Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 DHL Supply Chain

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Rhenus Logistics

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 Lloyd Fraser

List of Figures

- Figure 1: U.K. 3PL Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: U.K. 3PL Industry Share (%) by Company 2025

List of Tables

- Table 1: U.K. 3PL Industry Revenue billion Forecast, by Services 2020 & 2033

- Table 2: U.K. 3PL Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: U.K. 3PL Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: U.K. 3PL Industry Revenue billion Forecast, by Services 2020 & 2033

- Table 5: U.K. 3PL Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: U.K. 3PL Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the U.K. 3PL Industry?

The projected CAGR is approximately 0.3%.

2. Which companies are prominent players in the U.K. 3PL Industry?

Key companies in the market include Lloyd Fraser, Eddie Stobart, Torque, Parcel Hub**List Not Exhaustive, Yusen Logistics, Wincanton, XPO Logistics, FedEx, CEVA Logistics, Tarlu Ltd, Kuehne Nagel, Bibby Distribution, United Parcel Service of America, Xpediator, Schenker Limited, Pointbid Logistics Systems Ltd, DHL Supply Chain, Rhenus Logistics.

3. What are the main segments of the U.K. 3PL Industry?

The market segments include Services, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.2 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Government Initiatives4.; Increase of Trade.

6. What are the notable trends driving market growth?

Growth in Logistics Parks and Fulfilment Centers.

7. Are there any restraints impacting market growth?

4.; Shortage of Labor.

8. Can you provide examples of recent developments in the market?

June 2023: Kuehne+Nagel signed an agreement to acquire Morgan Cargo, a leading South African, UK and Kenyan freight forwarder specialised in the transport and handling of perishable goods. During 2022 the company handled more than 40,000 tonnes of air freight and more than 20,000 TEU of sea freight globally, managed by approximately 450 logistics experts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "U.K. 3PL Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the U.K. 3PL Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the U.K. 3PL Industry?

To stay informed about further developments, trends, and reports in the U.K. 3PL Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence