Key Insights

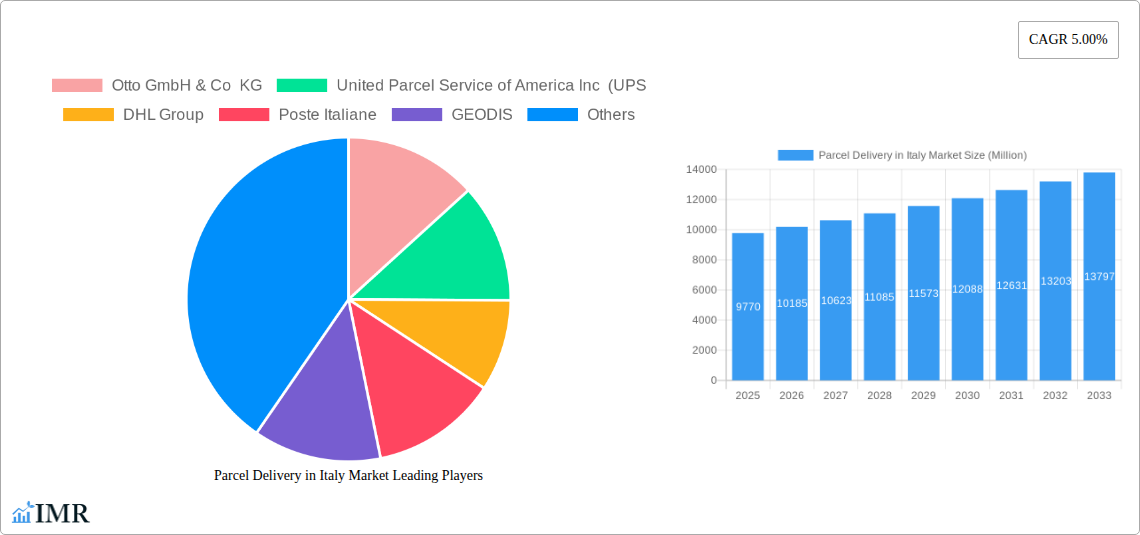

The Italian parcel delivery market is forecast to reach 9.77 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 4.23% from 2025 to 2033. This growth is primarily propelled by the expanding e-commerce sector, which stimulates demand for domestic and international parcel services. Key drivers include the increasing consumer reliance on online shopping and the rise in cross-border e-commerce. Innovations in last-mile delivery, emphasizing speed and efficiency, are also increasing demand for express delivery. Business-to-business (B2B) transactions, particularly in manufacturing and wholesale/retail, contribute significantly as companies optimize supply chains. The healthcare sector, with its growing need for specialized medical supply and pharmaceutical delivery, is also a notable growth segment.

Parcel Delivery in Italy Market Market Size (In Billion)

While robust demand supports market expansion, potential restraints include rising fuel and labor costs, alongside evolving environmental and labor regulations. However, widespread digital transformation and the adoption of advanced logistics technologies are anticipated to mitigate these challenges. The competitive environment features both global and domestic players. Technological advancements like automated sorting, real-time tracking, and optimized route planning are becoming essential for enhancing operational efficiency and customer satisfaction. The market's adaptability, influenced by consumer behavior and technological innovation, indicates sustained expansion.

Parcel Delivery in Italy Market Company Market Share

Comprehensive Report: Parcel Delivery in Italy Market (2019–2033)

Unlock critical insights into the dynamic Italian parcel delivery landscape with this in-depth market analysis. Covering domestic and international shipments, express and non-express services, B2B, B2C, and C2C models, alongside diverse shipment weights and transport modes, this report provides an unparalleled view of market evolution. Deep dive into end-user industries, including E-Commerce, BFSI, Healthcare, Manufacturing, Primary Industry, and Wholesale & Retail Trade. Analyze market size, growth drivers, restraints, challenges, and emerging opportunities from the base year 2025 through the forecast period of 2025–2033, with historical data from 2019–2024. Essential for industry professionals seeking to navigate and capitalize on the burgeoning Italian parcel and logistics sector.

Parcel Delivery in Italy Market Market Dynamics & Structure

The Italian parcel delivery market is characterized by a moderately concentrated structure, with a few dominant players like DHL Group, UPS, FedEx, and Poste Italiane holding significant market share. However, the landscape is continuously evolving due to intense competition and the proliferation of smaller, specialized logistics providers. Technological innovation is a key driver, with advancements in automation, AI-powered route optimization, and real-time tracking enhancing operational efficiency and customer experience. Regulatory frameworks, particularly those related to e-commerce, cross-border trade, and environmental sustainability, are shaping market operations and compliance requirements. Competitive product substitutes, while not direct parcel delivery services, include alternative transport methods and local courier networks, pushing incumbents to innovate. End-user demographics are increasingly influenced by the booming e-commerce sector, demanding faster, more flexible, and sustainable delivery options. Mergers and acquisitions (M&A) trends are notable, as larger entities seek to consolidate their market position, expand service portfolios, and gain access to new customer segments or geographical areas. For instance, strategic acquisitions aim to bolster capabilities in niche sectors like pharmaceutical logistics. Innovation barriers, such as high capital investment for infrastructure and technology adoption, and the complexity of last-mile delivery in densely populated urban areas, pose challenges for new entrants and smaller players.

- Market Concentration: Moderate to high, with key players dominating market share.

- Technological Innovation: Driven by automation, AI, and real-time tracking for efficiency.

- Regulatory Frameworks: Impacting e-commerce, cross-border trade, and sustainability practices.

- Competitive Landscape: Includes established global players, national postal services, and agile local couriers.

- End-User Demand: Shaped by e-commerce growth and consumer expectations for speed and convenience.

- M&A Trends: Focused on market consolidation, service diversification, and regional expansion.

Parcel Delivery in Italy Market Growth Trends & Insights

The Italian parcel delivery market is poised for robust growth, fueled by the sustained expansion of e-commerce and evolving consumer purchasing habits. The market is projected to witness a significant Compound Annual Growth Rate (CAGR) over the forecast period. This expansion is intrinsically linked to the increasing adoption of online shopping across all demographics, driven by convenience, wider product selection, and competitive pricing. Technological disruptions are playing a pivotal role, with the integration of Artificial Intelligence (AI) and Machine Learning (ML) in logistics operations becoming increasingly prevalent. These technologies are optimizing delivery routes, improving sorting efficiency, and enhancing predictive analytics for demand forecasting, thereby reducing operational costs and delivery times. The adoption rate of advanced tracking systems and smart lockers is also on the rise, catering to the demand for greater transparency and flexibility in parcel reception. Consumer behavior shifts are demonstrably favoring faster delivery speeds and more environmentally conscious shipping options. This has led to an increased demand for express delivery services and a growing preference for carriers that offer sustainable logistics solutions, such as electric vehicle fleets and optimized delivery routes to minimize carbon emissions. The overall market penetration of formalized parcel delivery services is expected to deepen as more businesses, particularly SMEs, recognize the importance of reliable logistics for their online sales channels. The shift towards business-to-consumer (B2C) deliveries, a direct consequence of e-commerce proliferation, continues to be a dominant trend, influencing network design and service offerings. Furthermore, the increasing complexity of supply chains, driven by global trade dynamics and the need for resilience, is spurring innovation in last-mile delivery solutions and cross-border logistics capabilities. The market's trajectory is also influenced by investments in digital infrastructure and the ongoing digitization of traditional retail sectors, further integrating online and offline commerce.

Dominant Regions, Countries, or Segments in Parcel Delivery in Italy Market

The E-Commerce end-user industry stands out as the dominant segment driving growth in the Italian parcel delivery market. Its exponential expansion, fueled by widespread internet penetration and evolving consumer preferences for online shopping, directly translates into a surge in parcel volumes. The increasing reliance on e-commerce for a vast array of goods, from fashion and electronics to groceries and pharmaceuticals, necessitates efficient and reliable delivery networks. This dominance is further amplified by the underlying trend of Business-to-Consumer (B2C) model, which directly serves the end-user purchasing online. Within the B2C model, Light Weight Shipments are particularly prevalent due to the nature of many e-commerce purchases, which often consist of smaller, easily transportable items.

- Dominant End User Industry: E-Commerce is the primary growth engine, accounting for a substantial portion of parcel volumes due to increasing online retail penetration.

- Dominant Model: Business-to-Consumer (B2C) transactions, directly linked to e-commerce, represent the largest share of deliveries.

- Dominant Shipment Weight: Light Weight Shipments are highly prevalent, aligning with the typical size and weight of goods purchased online.

- Dominant Mode of Transport: Road transport remains the backbone for domestic deliveries, offering flexibility and cost-effectiveness for last-mile distribution. International deliveries increasingly utilize a multimodal approach, often integrating Air freight for speed.

- Dominant Speed of Delivery: While Express delivery caters to urgent needs and premium services, Non-Express delivery dominates in terms of sheer volume due to cost considerations for a broad range of e-commerce goods.

The growth in these segments is underpinned by several factors:

- Economic Policies: Government initiatives supporting digital transformation and e-commerce, alongside favorable trade policies for cross-border online sales.

- Infrastructure Development: Continuous investment in road networks and logistics hubs facilitates efficient movement of parcels across the country. The expansion of warehousing and fulfillment centers closer to urban centers further bolsters delivery speeds.

- Consumer Behavior: A growing comfort and preference for online shopping, coupled with the expectation of fast and affordable delivery, fuels demand.

- Technological Adoption: Increased use of smartphones and digital payment methods simplifies the online purchasing process, further boosting e-commerce volumes.

- Market Penetration: The relatively high penetration of internet access and smartphones across Italy ensures a broad consumer base for online retail.

While Domestic deliveries form a significant chunk due to the sheer volume of internal consumption, International deliveries are experiencing rapid growth, driven by cross-border e-commerce. The increasing integration of the Italian market into global supply chains also contributes to this trend. The analysis indicates that companies focusing on optimizing their B2C operations, handling light-weight shipments efficiently, and leveraging road transport for last-mile delivery, while strategically incorporating air freight for international express services, are best positioned to capitalize on current market dynamics.

Parcel Delivery in Italy Market Product Landscape

The product landscape in the Italian parcel delivery market is increasingly defined by innovative solutions aimed at enhancing speed, efficiency, and customer experience. This includes the development of advanced tracking systems that offer real-time visibility from pickup to delivery, utilizing GPS, RFID, and IoT technologies. Smart locker networks are expanding, providing secure and convenient drop-off and pick-up points, particularly in urban areas, addressing last-mile challenges and customer availability. Companies are also investing in eco-friendly packaging and delivery options, such as electric vehicles and optimized routing software, to meet growing sustainability demands. Furthermore, the integration of AI and automation in sorting and warehousing facilities is a key technological advancement, improving throughput and reducing errors. Performance metrics are increasingly focused on delivery success rates, transit times, cost per parcel, and customer satisfaction scores, with continuous efforts to minimize damage and loss.

Key Drivers, Barriers & Challenges in Parcel Delivery in Italy Market

Key Drivers:

The Italian parcel delivery market is propelled by the persistent and robust growth of e-commerce, which directly translates into higher shipment volumes. Technological advancements, including automation, AI-driven route optimization, and real-time tracking, are crucial for enhancing operational efficiency and meeting customer expectations. Shifting consumer behaviors towards online purchasing and demand for faster, more convenient delivery options also act as significant catalysts. Government support for digitalization and e-commerce infrastructure development further bolsters the market.

Barriers & Challenges:

Significant barriers include the high capital investment required for infrastructure development, fleet expansion, and technology adoption. Navigating complex and sometimes fragmented regulatory frameworks, particularly concerning labor laws and urban logistics, presents challenges. Supply chain disruptions, exacerbated by geopolitical events and unforeseen circumstances, can impact transit times and costs. Intense competitive pressures from both global giants and local players necessitate continuous innovation and cost management. The final mile delivery in dense urban areas, characterized by traffic congestion and limited parking, remains a persistent logistical hurdle.

Emerging Opportunities in Parcel Delivery in Italy Market

Emerging opportunities in the Italian parcel delivery market lie in the expansion of specialized logistics for high-growth sectors like healthcare (pharmaceutical delivery) and the increasing demand for sustainable, green logistics solutions. The growing B2B e-commerce segment and the potential for hyperlocal delivery services present untapped markets. Innovations in drone delivery and autonomous vehicles, though still nascent, hold significant future potential for revolutionizing last-mile delivery. Furthermore, the integration of parcel delivery services with broader supply chain management solutions offers opportunities for value-added services and deeper client partnerships.

Growth Accelerators in the Parcel Delivery in Italy Market Industry

The long-term growth of the Italian parcel delivery market is being significantly accelerated by continued advancements in automation and AI, enabling more efficient sorting, warehousing, and route planning, thereby reducing operational costs and delivery times. Strategic partnerships and collaborations between logistics providers, e-commerce platforms, and technology companies are fostering innovation and expanding service reach. Market expansion strategies, including the acquisition of smaller regional players and the development of specialized delivery networks for niche industries, are also key growth accelerators. The increasing focus on sustainability, driven by consumer demand and regulatory pressures, is spurring investment in greener fleets and logistics solutions, creating new market segments and driving competitive advantage.

Key Players Shaping the Parcel Delivery in Italy Market Market

- Otto GmbH & Co KG

- United Parcel Service of America Inc (UPS)

- DHL Group

- Poste Italiane

- GEODIS

- FedEx

- Asendia

- International Distributions Services (including GLS)

- La Poste Group (including BRT)

- Logista

Notable Milestones in Parcel Delivery in Italy Market Sector

- September 2023: The Otto Group plans to deploy Covariant robots to increase operational efficiency, build resilience against labor market challenges, and improve the overall quality of work within their fulfillment centers. This initiative signifies a commitment to advanced automation for enhanced logistics operations.

- July 2023: Logista completed the acquisition of Gramma Farmaceutici, a company specializing in logistics services for the Italian pharmaceutical industry. This strategic acquisition was a part of Logista's expansion plan in Italy to further strengthen its position in pharmaceutical distribution, highlighting M&A activity in specialized logistics.

- April 2023: GEODIS announced it expanded its direct-to-customer cross-border delivery service offering by opening two new airport gateway facilities in the United States, Italy, and other European nations. This expansion underscores a focus on enhancing international logistics capabilities and cross-border service offerings.

In-Depth Parcel Delivery in Italy Market Market Outlook

The outlook for the Italian parcel delivery market remains highly optimistic, propelled by the enduring growth of e-commerce and the ongoing digital transformation across various industries. Continued investment in automation, artificial intelligence, and sustainable logistics solutions will be pivotal in shaping the future of the market. Strategic partnerships and market consolidation through M&A will likely intensify as companies seek to expand their service portfolios and geographical reach. The evolving demands of consumers for faster, more personalized, and eco-friendly delivery options will drive innovation in last-mile logistics, creating opportunities for specialized service providers. Emerging technologies like drone delivery and advanced robotics are poised to play an increasingly significant role in enhancing efficiency and addressing logistical challenges, promising a dynamic and expanding future for the Italian parcel delivery sector.

Parcel Delivery in Italy Market Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. International

-

2. Speed Of Delivery

- 2.1. Express

- 2.2. Non-Express

-

3. Model

- 3.1. Business-to-Business (B2B)

- 3.2. Business-to-Consumer (B2C)

- 3.3. Consumer-to-Consumer (C2C)

-

4. Shipment Weight

- 4.1. Heavy Weight Shipments

- 4.2. Light Weight Shipments

- 4.3. Medium Weight Shipments

-

5. Mode Of Transport

- 5.1. Air

- 5.2. Road

- 5.3. Others

-

6. End User Industry

- 6.1. E-Commerce

- 6.2. Financial Services (BFSI)

- 6.3. Healthcare

- 6.4. Manufacturing

- 6.5. Primary Industry

- 6.6. Wholesale and Retail Trade (Offline)

- 6.7. Others

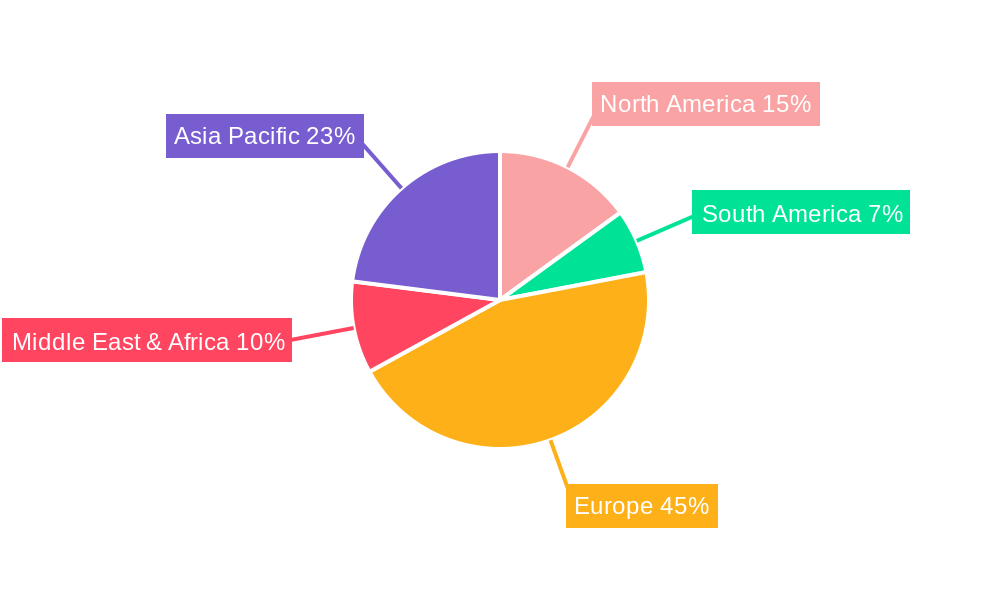

Parcel Delivery in Italy Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Parcel Delivery in Italy Market Regional Market Share

Geographic Coverage of Parcel Delivery in Italy Market

Parcel Delivery in Italy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exhibitions and Conferences are driving the market; Sports Events are driving the market growth

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labor

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Parcel Delivery in Italy Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. International

- 5.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 5.2.1. Express

- 5.2.2. Non-Express

- 5.3. Market Analysis, Insights and Forecast - by Model

- 5.3.1. Business-to-Business (B2B)

- 5.3.2. Business-to-Consumer (B2C)

- 5.3.3. Consumer-to-Consumer (C2C)

- 5.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 5.4.1. Heavy Weight Shipments

- 5.4.2. Light Weight Shipments

- 5.4.3. Medium Weight Shipments

- 5.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.5.1. Air

- 5.5.2. Road

- 5.5.3. Others

- 5.6. Market Analysis, Insights and Forecast - by End User Industry

- 5.6.1. E-Commerce

- 5.6.2. Financial Services (BFSI)

- 5.6.3. Healthcare

- 5.6.4. Manufacturing

- 5.6.5. Primary Industry

- 5.6.6. Wholesale and Retail Trade (Offline)

- 5.6.7. Others

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. North America

- 5.7.2. South America

- 5.7.3. Europe

- 5.7.4. Middle East & Africa

- 5.7.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. North America Parcel Delivery in Italy Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Destination

- 6.1.1. Domestic

- 6.1.2. International

- 6.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 6.2.1. Express

- 6.2.2. Non-Express

- 6.3. Market Analysis, Insights and Forecast - by Model

- 6.3.1. Business-to-Business (B2B)

- 6.3.2. Business-to-Consumer (B2C)

- 6.3.3. Consumer-to-Consumer (C2C)

- 6.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 6.4.1. Heavy Weight Shipments

- 6.4.2. Light Weight Shipments

- 6.4.3. Medium Weight Shipments

- 6.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 6.5.1. Air

- 6.5.2. Road

- 6.5.3. Others

- 6.6. Market Analysis, Insights and Forecast - by End User Industry

- 6.6.1. E-Commerce

- 6.6.2. Financial Services (BFSI)

- 6.6.3. Healthcare

- 6.6.4. Manufacturing

- 6.6.5. Primary Industry

- 6.6.6. Wholesale and Retail Trade (Offline)

- 6.6.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Destination

- 7. South America Parcel Delivery in Italy Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Destination

- 7.1.1. Domestic

- 7.1.2. International

- 7.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 7.2.1. Express

- 7.2.2. Non-Express

- 7.3. Market Analysis, Insights and Forecast - by Model

- 7.3.1. Business-to-Business (B2B)

- 7.3.2. Business-to-Consumer (B2C)

- 7.3.3. Consumer-to-Consumer (C2C)

- 7.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 7.4.1. Heavy Weight Shipments

- 7.4.2. Light Weight Shipments

- 7.4.3. Medium Weight Shipments

- 7.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 7.5.1. Air

- 7.5.2. Road

- 7.5.3. Others

- 7.6. Market Analysis, Insights and Forecast - by End User Industry

- 7.6.1. E-Commerce

- 7.6.2. Financial Services (BFSI)

- 7.6.3. Healthcare

- 7.6.4. Manufacturing

- 7.6.5. Primary Industry

- 7.6.6. Wholesale and Retail Trade (Offline)

- 7.6.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Destination

- 8. Europe Parcel Delivery in Italy Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Destination

- 8.1.1. Domestic

- 8.1.2. International

- 8.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 8.2.1. Express

- 8.2.2. Non-Express

- 8.3. Market Analysis, Insights and Forecast - by Model

- 8.3.1. Business-to-Business (B2B)

- 8.3.2. Business-to-Consumer (B2C)

- 8.3.3. Consumer-to-Consumer (C2C)

- 8.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 8.4.1. Heavy Weight Shipments

- 8.4.2. Light Weight Shipments

- 8.4.3. Medium Weight Shipments

- 8.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 8.5.1. Air

- 8.5.2. Road

- 8.5.3. Others

- 8.6. Market Analysis, Insights and Forecast - by End User Industry

- 8.6.1. E-Commerce

- 8.6.2. Financial Services (BFSI)

- 8.6.3. Healthcare

- 8.6.4. Manufacturing

- 8.6.5. Primary Industry

- 8.6.6. Wholesale and Retail Trade (Offline)

- 8.6.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Destination

- 9. Middle East & Africa Parcel Delivery in Italy Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Destination

- 9.1.1. Domestic

- 9.1.2. International

- 9.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 9.2.1. Express

- 9.2.2. Non-Express

- 9.3. Market Analysis, Insights and Forecast - by Model

- 9.3.1. Business-to-Business (B2B)

- 9.3.2. Business-to-Consumer (B2C)

- 9.3.3. Consumer-to-Consumer (C2C)

- 9.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 9.4.1. Heavy Weight Shipments

- 9.4.2. Light Weight Shipments

- 9.4.3. Medium Weight Shipments

- 9.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 9.5.1. Air

- 9.5.2. Road

- 9.5.3. Others

- 9.6. Market Analysis, Insights and Forecast - by End User Industry

- 9.6.1. E-Commerce

- 9.6.2. Financial Services (BFSI)

- 9.6.3. Healthcare

- 9.6.4. Manufacturing

- 9.6.5. Primary Industry

- 9.6.6. Wholesale and Retail Trade (Offline)

- 9.6.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Destination

- 10. Asia Pacific Parcel Delivery in Italy Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Destination

- 10.1.1. Domestic

- 10.1.2. International

- 10.2. Market Analysis, Insights and Forecast - by Speed Of Delivery

- 10.2.1. Express

- 10.2.2. Non-Express

- 10.3. Market Analysis, Insights and Forecast - by Model

- 10.3.1. Business-to-Business (B2B)

- 10.3.2. Business-to-Consumer (B2C)

- 10.3.3. Consumer-to-Consumer (C2C)

- 10.4. Market Analysis, Insights and Forecast - by Shipment Weight

- 10.4.1. Heavy Weight Shipments

- 10.4.2. Light Weight Shipments

- 10.4.3. Medium Weight Shipments

- 10.5. Market Analysis, Insights and Forecast - by Mode Of Transport

- 10.5.1. Air

- 10.5.2. Road

- 10.5.3. Others

- 10.6. Market Analysis, Insights and Forecast - by End User Industry

- 10.6.1. E-Commerce

- 10.6.2. Financial Services (BFSI)

- 10.6.3. Healthcare

- 10.6.4. Manufacturing

- 10.6.5. Primary Industry

- 10.6.6. Wholesale and Retail Trade (Offline)

- 10.6.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Destination

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Otto GmbH & Co KG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 United Parcel Service of America Inc (UPS

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 DHL Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Poste Italiane

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GEODIS

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 FedEx

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Asendia

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 International Distributions Services (including GLS)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 La Poste Group (including BRT)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Logista

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Otto GmbH & Co KG

List of Figures

- Figure 1: Global Parcel Delivery in Italy Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Parcel Delivery in Italy Market Revenue (billion), by Destination 2025 & 2033

- Figure 3: North America Parcel Delivery in Italy Market Revenue Share (%), by Destination 2025 & 2033

- Figure 4: North America Parcel Delivery in Italy Market Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 5: North America Parcel Delivery in Italy Market Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 6: North America Parcel Delivery in Italy Market Revenue (billion), by Model 2025 & 2033

- Figure 7: North America Parcel Delivery in Italy Market Revenue Share (%), by Model 2025 & 2033

- Figure 8: North America Parcel Delivery in Italy Market Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 9: North America Parcel Delivery in Italy Market Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 10: North America Parcel Delivery in Italy Market Revenue (billion), by Mode Of Transport 2025 & 2033

- Figure 11: North America Parcel Delivery in Italy Market Revenue Share (%), by Mode Of Transport 2025 & 2033

- Figure 12: North America Parcel Delivery in Italy Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 13: North America Parcel Delivery in Italy Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 14: North America Parcel Delivery in Italy Market Revenue (billion), by Country 2025 & 2033

- Figure 15: North America Parcel Delivery in Italy Market Revenue Share (%), by Country 2025 & 2033

- Figure 16: South America Parcel Delivery in Italy Market Revenue (billion), by Destination 2025 & 2033

- Figure 17: South America Parcel Delivery in Italy Market Revenue Share (%), by Destination 2025 & 2033

- Figure 18: South America Parcel Delivery in Italy Market Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 19: South America Parcel Delivery in Italy Market Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 20: South America Parcel Delivery in Italy Market Revenue (billion), by Model 2025 & 2033

- Figure 21: South America Parcel Delivery in Italy Market Revenue Share (%), by Model 2025 & 2033

- Figure 22: South America Parcel Delivery in Italy Market Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 23: South America Parcel Delivery in Italy Market Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 24: South America Parcel Delivery in Italy Market Revenue (billion), by Mode Of Transport 2025 & 2033

- Figure 25: South America Parcel Delivery in Italy Market Revenue Share (%), by Mode Of Transport 2025 & 2033

- Figure 26: South America Parcel Delivery in Italy Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 27: South America Parcel Delivery in Italy Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 28: South America Parcel Delivery in Italy Market Revenue (billion), by Country 2025 & 2033

- Figure 29: South America Parcel Delivery in Italy Market Revenue Share (%), by Country 2025 & 2033

- Figure 30: Europe Parcel Delivery in Italy Market Revenue (billion), by Destination 2025 & 2033

- Figure 31: Europe Parcel Delivery in Italy Market Revenue Share (%), by Destination 2025 & 2033

- Figure 32: Europe Parcel Delivery in Italy Market Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 33: Europe Parcel Delivery in Italy Market Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 34: Europe Parcel Delivery in Italy Market Revenue (billion), by Model 2025 & 2033

- Figure 35: Europe Parcel Delivery in Italy Market Revenue Share (%), by Model 2025 & 2033

- Figure 36: Europe Parcel Delivery in Italy Market Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 37: Europe Parcel Delivery in Italy Market Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 38: Europe Parcel Delivery in Italy Market Revenue (billion), by Mode Of Transport 2025 & 2033

- Figure 39: Europe Parcel Delivery in Italy Market Revenue Share (%), by Mode Of Transport 2025 & 2033

- Figure 40: Europe Parcel Delivery in Italy Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 41: Europe Parcel Delivery in Italy Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 42: Europe Parcel Delivery in Italy Market Revenue (billion), by Country 2025 & 2033

- Figure 43: Europe Parcel Delivery in Italy Market Revenue Share (%), by Country 2025 & 2033

- Figure 44: Middle East & Africa Parcel Delivery in Italy Market Revenue (billion), by Destination 2025 & 2033

- Figure 45: Middle East & Africa Parcel Delivery in Italy Market Revenue Share (%), by Destination 2025 & 2033

- Figure 46: Middle East & Africa Parcel Delivery in Italy Market Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 47: Middle East & Africa Parcel Delivery in Italy Market Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 48: Middle East & Africa Parcel Delivery in Italy Market Revenue (billion), by Model 2025 & 2033

- Figure 49: Middle East & Africa Parcel Delivery in Italy Market Revenue Share (%), by Model 2025 & 2033

- Figure 50: Middle East & Africa Parcel Delivery in Italy Market Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 51: Middle East & Africa Parcel Delivery in Italy Market Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 52: Middle East & Africa Parcel Delivery in Italy Market Revenue (billion), by Mode Of Transport 2025 & 2033

- Figure 53: Middle East & Africa Parcel Delivery in Italy Market Revenue Share (%), by Mode Of Transport 2025 & 2033

- Figure 54: Middle East & Africa Parcel Delivery in Italy Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 55: Middle East & Africa Parcel Delivery in Italy Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 56: Middle East & Africa Parcel Delivery in Italy Market Revenue (billion), by Country 2025 & 2033

- Figure 57: Middle East & Africa Parcel Delivery in Italy Market Revenue Share (%), by Country 2025 & 2033

- Figure 58: Asia Pacific Parcel Delivery in Italy Market Revenue (billion), by Destination 2025 & 2033

- Figure 59: Asia Pacific Parcel Delivery in Italy Market Revenue Share (%), by Destination 2025 & 2033

- Figure 60: Asia Pacific Parcel Delivery in Italy Market Revenue (billion), by Speed Of Delivery 2025 & 2033

- Figure 61: Asia Pacific Parcel Delivery in Italy Market Revenue Share (%), by Speed Of Delivery 2025 & 2033

- Figure 62: Asia Pacific Parcel Delivery in Italy Market Revenue (billion), by Model 2025 & 2033

- Figure 63: Asia Pacific Parcel Delivery in Italy Market Revenue Share (%), by Model 2025 & 2033

- Figure 64: Asia Pacific Parcel Delivery in Italy Market Revenue (billion), by Shipment Weight 2025 & 2033

- Figure 65: Asia Pacific Parcel Delivery in Italy Market Revenue Share (%), by Shipment Weight 2025 & 2033

- Figure 66: Asia Pacific Parcel Delivery in Italy Market Revenue (billion), by Mode Of Transport 2025 & 2033

- Figure 67: Asia Pacific Parcel Delivery in Italy Market Revenue Share (%), by Mode Of Transport 2025 & 2033

- Figure 68: Asia Pacific Parcel Delivery in Italy Market Revenue (billion), by End User Industry 2025 & 2033

- Figure 69: Asia Pacific Parcel Delivery in Italy Market Revenue Share (%), by End User Industry 2025 & 2033

- Figure 70: Asia Pacific Parcel Delivery in Italy Market Revenue (billion), by Country 2025 & 2033

- Figure 71: Asia Pacific Parcel Delivery in Italy Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 2: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 3: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Model 2020 & 2033

- Table 4: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 5: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 6: Global Parcel Delivery in Italy Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 7: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 9: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 10: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Model 2020 & 2033

- Table 11: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 12: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 13: Global Parcel Delivery in Italy Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 14: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United States Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 19: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 20: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Model 2020 & 2033

- Table 21: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 22: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 23: Global Parcel Delivery in Italy Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 24: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Brazil Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Argentina Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of South America Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 29: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 30: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Model 2020 & 2033

- Table 31: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 32: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 33: Global Parcel Delivery in Italy Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 34: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 35: United Kingdom Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Germany Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: France Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Italy Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Spain Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Russia Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Benelux Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Nordics Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Rest of Europe Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 45: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 46: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Model 2020 & 2033

- Table 47: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 48: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 49: Global Parcel Delivery in Italy Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 50: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 51: Turkey Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Israel Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 53: GCC Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: North Africa Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 55: South Africa Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: Rest of Middle East & Africa Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 57: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 58: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Speed Of Delivery 2020 & 2033

- Table 59: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Model 2020 & 2033

- Table 60: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Shipment Weight 2020 & 2033

- Table 61: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 62: Global Parcel Delivery in Italy Market Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 63: Global Parcel Delivery in Italy Market Revenue billion Forecast, by Country 2020 & 2033

- Table 64: China Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 65: India Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Japan Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 67: South Korea Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: ASEAN Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 69: Oceania Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: Rest of Asia Pacific Parcel Delivery in Italy Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Parcel Delivery in Italy Market?

The projected CAGR is approximately 4.23%.

2. Which companies are prominent players in the Parcel Delivery in Italy Market?

Key companies in the market include Otto GmbH & Co KG, United Parcel Service of America Inc (UPS, DHL Group, Poste Italiane, GEODIS, FedEx, Asendia, International Distributions Services (including GLS), La Poste Group (including BRT), Logista.

3. What are the main segments of the Parcel Delivery in Italy Market?

The market segments include Destination, Speed Of Delivery, Model, Shipment Weight, Mode Of Transport, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.77 billion as of 2022.

5. What are some drivers contributing to market growth?

Exhibitions and Conferences are driving the market; Sports Events are driving the market growth.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Lack of Skilled Labor.

8. Can you provide examples of recent developments in the market?

September 2023: The Otto Group plans to deploy Covariant robots to increase operational efficiency, build resilience against labor market challenges, and improve the overall quality of work within their fulfillment centers.July 2023: Logista completed the acquisition of Gramma Farmaceutici, a company specializing in logistics services for the Italian pharmaceutical industry. This strategic acquisition was a part of Logista's expansion plan in Italy to further strengthen its position in pharmaceutical distribution.April 2023: GEODIS announced it expanded its direct-to-customer cross-border delivery service offering by opening two new airport gateway facilities in the United States, Italy, and other European nations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Parcel Delivery in Italy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Parcel Delivery in Italy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Parcel Delivery in Italy Market?

To stay informed about further developments, trends, and reports in the Parcel Delivery in Italy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence