Key Insights

The Canada Customs Clearance Market is experiencing significant growth, propelled by expanding international trade and increasing cross-border cargo volumes. With a projected market size of $16.9 billion in the base year 2025, the market is forecasted to achieve a Compound Annual Growth Rate (CAGR) of 0.1% through 2033. Key growth drivers include the burgeoning e-commerce sector, which demands efficient and swift customs processing for a rising number of international shipments. Canada's active engagement in global trade agreements and its strategic geographic position as a North American gateway further stimulate import and export activities, thereby increasing the demand for customs brokerage and clearance services. The escalating complexity of trade regulations and the critical need for expert navigation of these requirements also highlight the indispensable role of customs clearance providers.

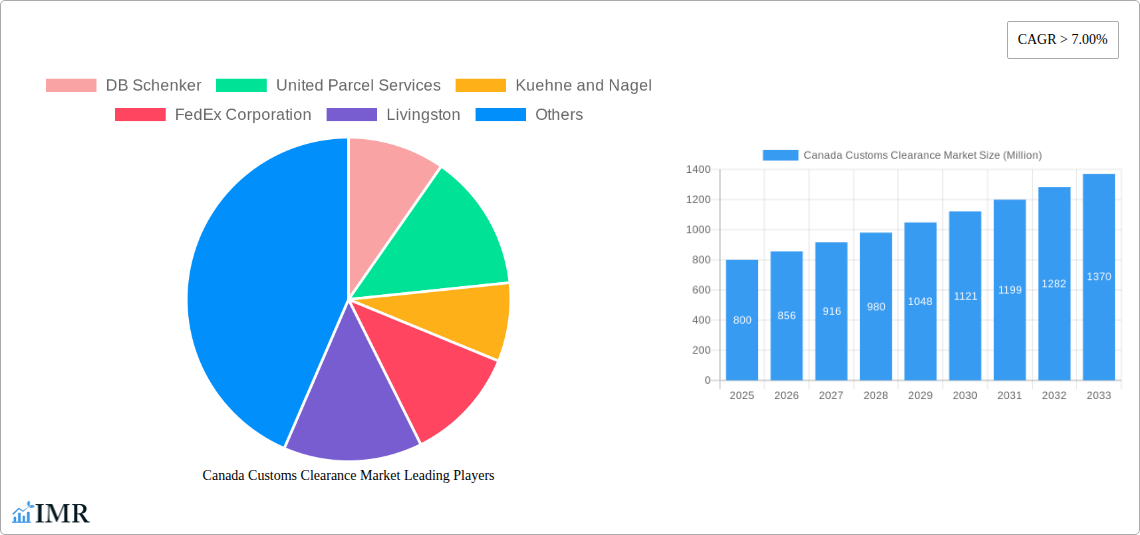

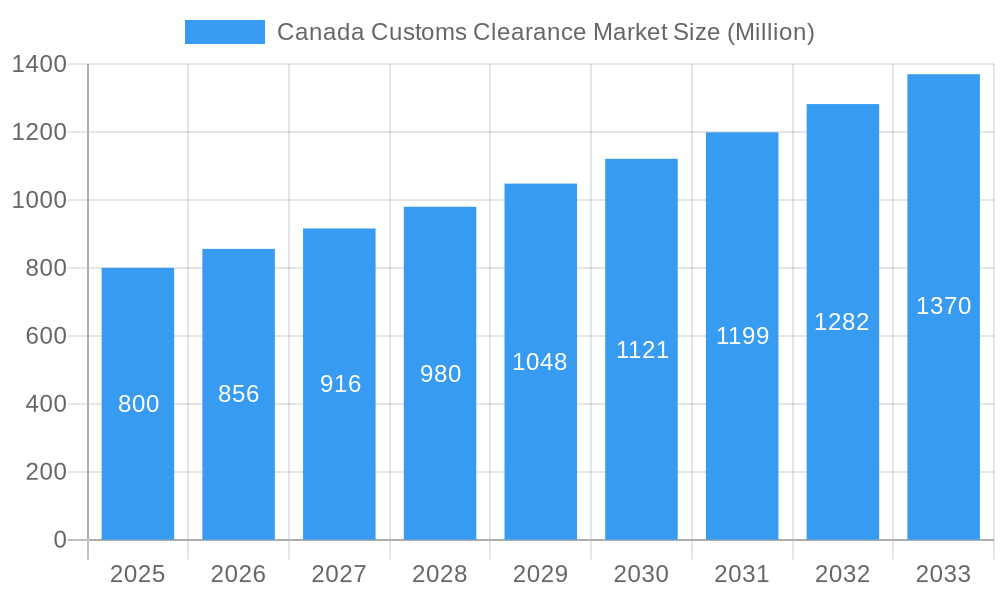

Canada Customs Clearance Market Market Size (In Billion)

Market segmentation reveals the diverse requirements within Canada's trade ecosystem. Sea freight remains a primary mode for bulk goods and raw materials, while air freight serves time-sensitive and high-value cargo, each necessitating specialized customs clearance. Cross-border land transport, particularly between Canada and the United States, constitutes a substantial segment due to extensive bilateral trade. Leading market participants, including DB Schenker, United Parcel Services, Kuehne + Nagel, FedEx Corporation, and DHL Group Logistics, are actively competing, offering comprehensive services from documentation and tariff classification to duty payment and regulatory compliance. Technological integration, with advancements in digital platforms and AI-powered solutions enhancing efficiency and accuracy in customs processes, is also shaping the market's trajectory. However, potential challenges such as evolving trade policies, geopolitical uncertainties, and the demand for skilled customs professionals may influence the growth rate.

Canada Customs Clearance Market Company Market Share

Canada Customs Clearance Market Analysis: Growth, Trends, and Forecast (2025-2033)

Acquire in-depth insights into the Canada Customs Clearance Market with this comprehensive analysis. Covering the projection period from 2025 to 2033, this study examines market dynamics, growth drivers, dominant segments, and key players influencing this critical industry. Understand the intricacies of Canadian import/export services, cross-border logistics, and freight forwarding solutions vital for businesses trading with or operating in Canada. This report is an essential resource for customs brokers, supply chain professionals, logistics providers, and government bodies aiming to navigate and leverage the evolving Canadian customs clearance landscape.

Canada Customs Clearance Market Market Dynamics & Structure

The Canada Customs Clearance Market is characterized by a moderately concentrated structure, with a few key players dominating service provision, yet offering ample opportunities for niche providers. Technological innovation is a significant driver, with increasing adoption of digital platforms for electronic customs declarations, automated compliance checks, and AI-powered risk assessment. Regulatory frameworks, overseen by the Canada Border Services Agency (CBSA), are stringent and continuously updated, demanding sophisticated compliance strategies. Competitive product substitutes are minimal within the core customs clearance function, though integrated logistics solutions incorporating clearance offer a broader competitive landscape. End-user demographics span a wide range of industries, from manufacturing and retail to technology and agriculture, all reliant on efficient import and export processes. Mergers and acquisitions (M&A) are moderately active, driven by the desire for expanded service portfolios and geographical reach. For example, the trend of global logistics companies acquiring specialized Canadian customs brokerage firms aims to offer end-to-end solutions. Innovation barriers include the high cost of sophisticated IT integration and the need for continuous training to keep pace with evolving regulations. The market value in 2025 is projected to be USD 5,500 Million, with an estimated volume of 280 Million units processed.

- Market Concentration: Moderate, with key players like DB Schenker and DHL Group Logistics holding significant market share.

- Technological Innovation: Driven by digital customs solutions, blockchain for supply chain traceability, and predictive analytics for compliance.

- Regulatory Frameworks: Dominated by CBSA regulations, emphasizing accuracy, security, and timely processing.

- Competitive Substitutes: Primarily in the form of integrated logistics providers offering a full suite of services.

- End-User Demographics: Broad, encompassing all sectors involved in international trade.

- M&A Trends: Focus on consolidating services and expanding digital capabilities.

Canada Customs Clearance Market Growth Trends & Insights

The Canada Customs Clearance Market is poised for robust growth, driven by increasing trade volumes and the ongoing digital transformation of global supply chains. The market size is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period of 2025–2033, reaching an estimated value of USD 7,800 Million by 2033. Adoption rates of advanced customs clearance software and digital documentation platforms are rapidly increasing as businesses seek to streamline operations, reduce processing times, and mitigate compliance risks. Technological disruptions, such as the implementation of the Single Window Initiative by the CBSA, are creating significant efficiencies and driving the demand for integrated freight and customs services. Consumer behavior shifts, particularly the surge in e-commerce, have led to a dramatic increase in smaller, more frequent shipments, placing additional pressure on customs clearance processes and necessitating faster, more automated solutions. The market penetration of fully digitalized customs processes is expected to exceed 70% by 2030.

The historical period (2019-2024) has seen a steady upward trajectory, fueled by post-pandemic recovery and a renewed focus on resilient supply chains. The market size in the base year of 2025 is estimated at USD 5,500 Million, with an estimated volume of 280 Million units processed, reflecting a strong rebound and continued expansion. The increasing complexity of international trade agreements and the growing emphasis on supply chain security further underscore the critical role of efficient and compliant customs clearance. Innovations in data analytics are enabling customs brokers to proactively identify potential issues and offer more value-added services to their clients, moving beyond mere transactional processing to strategic trade facilitation. The adoption of AI for anomaly detection and fraud prevention is also a significant trend, enhancing the integrity of the customs system. The overall outlook points to a market that is not only growing in volume but also evolving in sophistication and technological integration, providing a more secure and efficient environment for Canadian businesses engaged in international trade.

Dominant Regions, Countries, or Segments in Canada Customs Clearance Market

The Cross-Border Land Transport segment stands out as the dominant force driving growth within the Canada Customs Clearance Market. This dominance is intrinsically linked to Canada's extensive land border with the United States, the world's largest trading relationship. The sheer volume of goods and services that traverse this border daily necessitates a highly efficient and robust customs clearance infrastructure. The 2025 market size for Cross-Border Land Transport is estimated at USD 3,800 Million, representing approximately 69% of the total market.

Key drivers contributing to the supremacy of Cross-Border Land Transport include:

- Economic Policies: Favorable trade agreements like the Canada-United States-Mexico Agreement (CUSMA) foster seamless trade, reducing tariffs and non-tariff barriers, thereby encouraging higher volumes of land-based shipments.

- Infrastructure: Significant investments in border crossing infrastructure, including advanced inspection technologies and dedicated lanes for commercial traffic, facilitate faster processing times. Major hubs like the Ambassador Bridge and the Detroit-Windsor Tunnel are critical arteries of North American commerce.

- Industry Demand: The vast majority of Canada's retail goods, automotive parts, agricultural products, and manufactured goods are transported via land, making this mode indispensable for day-to-day commerce.

- Technological Integration: The implementation of digital systems like the Advanced Commercial Information (ACI) program by the CBSA, coupled with private sector adoption of tracking and logistics management software, enhances the efficiency and transparency of land border crossings. This allows for pre-arrival processing, significantly reducing wait times.

- Cost-Effectiveness: For many goods, land transport remains the most cost-effective and timely mode for short to medium-haul distances, particularly within North America.

While Sea and Air transport segments are crucial for international trade, their contribution to the overall volume and value of customs clearance in Canada, when compared to the sheer scale of US-Canada land trade, is comparatively smaller. The Sea segment (estimated 2025 market size USD 900 Million) is vital for bulk commodities and intercontinental trade, but clearance processes are often more complex and time-consuming due to port operations and international vessel movements. The Air segment (estimated 2025 market size USD 800 Million) is indispensable for high-value, time-sensitive goods, but its volume is significantly lower than land transport. Therefore, the future growth and immediate impact on the Canada Customs Clearance Market will continue to be heavily influenced by the efficiency and volume handled within the Cross-Border Land Transport segment.

Canada Customs Clearance Market Product Landscape

The Canada Customs Clearance Market product landscape is dominated by sophisticated software solutions and integrated service platforms. These offerings are designed to automate and optimize the complex process of declaring goods, paying duties and taxes, and ensuring compliance with Canadian regulations. Key innovations include electronic data interchange (EDI) for seamless data transfer, risk assessment tools utilizing artificial intelligence to identify high-risk shipments, and online portals for clients to track their declarations in real-time. Performance metrics are centered on processing speed, accuracy rates, and cost reduction for clients. Unique selling propositions often revolve around specialized industry knowledge, such as expertise in agricultural imports or hazardous materials, and the ability to provide end-to-end supply chain visibility. Technological advancements are pushing towards predictive analytics to anticipate regulatory changes and blockchain solutions to enhance transparency and security in the clearance process.

Key Drivers, Barriers & Challenges in Canada Customs Clearance Market

Key Drivers:

- Growing International Trade: Canada's active participation in global commerce necessitates efficient customs clearance for a steady flow of imports and exports.

- Technological Advancements: The adoption of digital platforms, AI, and automation significantly streamlines customs processes, improving speed and accuracy.

- Government Initiatives: Programs like the Canada Border Services Agency's (CBSA) Single Window Initiative aim to simplify and harmonize border procedures.

- E-commerce Boom: The surge in online retail increases the volume of smaller shipments, demanding faster and more agile customs processing.

- Supply Chain Resilience Focus: Businesses are prioritizing robust and compliant supply chains, making efficient customs clearance a critical component.

Barriers & Challenges:

- Regulatory Complexity and Change: Navigating intricate and evolving customs regulations requires constant adaptation and expertise.

- Data Security and Privacy Concerns: Handling sensitive trade data necessitates stringent security measures and compliance with privacy laws.

- Skilled Labor Shortage: A demand for experienced customs brokers and trade compliance professionals can lead to recruitment challenges.

- Infrastructure Limitations: While improving, some border points and logistics hubs can experience congestion, impacting processing times.

- Geopolitical and Economic Volatility: International trade is susceptible to global events, tariffs, and economic downturns that can impact import/export volumes and customs revenue. The March 2022 tariff changes impacting goods from Russia and Belarus exemplify how geopolitical events can directly alter customs duty application and create complexities.

Emerging Opportunities in Canada Customs Clearance Market

Emerging opportunities in the Canada Customs Clearance Market lie in leveraging advanced technologies and catering to evolving trade patterns. The increasing demand for specialized customs consulting services for complex goods, such as those in the technology and pharmaceutical sectors, presents a significant avenue for growth. The further integration of Internet of Things (IoT) devices for real-time shipment tracking and condition monitoring can offer enhanced value-added services. Furthermore, the growing emphasis on sustainable trade practices may lead to opportunities in developing customs clearance solutions that prioritize eco-friendly logistics and compliance with environmental regulations. Untapped markets in regions with developing trade infrastructure and evolving consumer preferences for imported goods also offer significant expansion potential.

Growth Accelerators in the Canada Customs Clearance Market Industry

Growth in the Canada Customs Clearance Market is being significantly accelerated by strategic investments in digital transformation and a commitment to innovation by key industry players. The ongoing development and widespread adoption of AI-powered predictive analytics are enabling customs brokers to proactively identify potential compliance issues, thereby reducing delays and penalties for clients. Furthermore, partnerships between customs brokers and technology providers are creating more integrated and seamless customs clearance solutions, offering end-to-end visibility and automation. Market expansion strategies are increasingly focusing on offering value-added services beyond basic clearance, such as trade advisory, tariff engineering, and supply chain optimization, which differentiate providers and capture greater market share. The March 2023 development of a new branch by Air Menzies International (AMI) near Toronto Pearson International Airport, offering comprehensive wholesale airfreight services including customs clearance, is a prime example of this expansion and service enhancement.

Key Players Shaping the Canada Customs Clearance Market Market

- DB Schenker

- United Parcel Services

- Kuehne and Nagel

- FedEx Corporation

- Livingston

- Argo Customs

- Universal Logistics

- DHL Group Logistics

- World Wide Customs Brokers Limited

- A N Deringer

Notable Milestones in Canada Customs Clearance Market Sector

- March 2023: Air Menzies International (AMI) established a new branch near Toronto Pearson International Airport, expanding its wholesale airfreight services to include comprehensive customs clearance and documentation support, enhancing air cargo facilitation.

- March 2022: The Department of Finance Canada announced the Most-Favoured-Nation Tariff Withdrawal Order (2022-1), removing Russia and Belarus from MFN tariff entitlement and applying a 35% General Tariff on their imports, significantly altering customs duty calculations and compliance requirements for affected goods.

In-Depth Canada Customs Clearance Market Market Outlook

The future outlook for the Canada Customs Clearance Market is exceptionally bright, fueled by sustained global trade growth and the relentless march of technological innovation. Growth accelerators will continue to be centered on the digital transformation of trade processes, with an increasing reliance on AI for automated compliance checks and risk management. Strategic opportunities will emerge for companies that can offer specialized expertise in navigating increasingly complex international trade regulations and agreements. The market is expected to witness further consolidation as larger players seek to integrate specialized services and expand their technological capabilities. The ongoing focus on supply chain resilience and security will also drive demand for robust and transparent customs clearance solutions, positioning the market for continued expansion and evolution.

Canada Customs Clearance Market Segmentation

-

1. Mode Of Transport

- 1.1. Sea

- 1.2. Air

- 1.3. Cross-Border Land Transport

Canada Customs Clearance Market Segmentation By Geography

- 1. Canada

Canada Customs Clearance Market Regional Market Share

Geographic Coverage of Canada Customs Clearance Market

Canada Customs Clearance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing international trade; Complex custom regulations

- 3.3. Market Restrains

- 3.3.1. Regulatory Challenges; Geopolitical Uncertainity

- 3.4. Market Trends

- 3.4.1. Increasing International Trade Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Customs Clearance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 5.1.1. Sea

- 5.1.2. Air

- 5.1.3. Cross-Border Land Transport

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Mode Of Transport

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 United Parcel Services

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kuehne and Nagel

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 FedEx Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Livingston

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Argo Customs

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Universal Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DHL Group Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 World Wide Customs Brokers Limited**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 A N Deringer

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Canada Customs Clearance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Customs Clearance Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Customs Clearance Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 2: Canada Customs Clearance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Canada Customs Clearance Market Revenue billion Forecast, by Mode Of Transport 2020 & 2033

- Table 4: Canada Customs Clearance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Customs Clearance Market?

The projected CAGR is approximately 0.1%.

2. Which companies are prominent players in the Canada Customs Clearance Market?

Key companies in the market include DB Schenker, United Parcel Services, Kuehne and Nagel, FedEx Corporation, Livingston, Argo Customs, Universal Logistics, DHL Group Logistics, World Wide Customs Brokers Limited**List Not Exhaustive, A N Deringer.

3. What are the main segments of the Canada Customs Clearance Market?

The market segments include Mode Of Transport.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing international trade; Complex custom regulations.

6. What are the notable trends driving market growth?

Increasing International Trade Driving the Market.

7. Are there any restraints impacting market growth?

Regulatory Challenges; Geopolitical Uncertainity.

8. Can you provide examples of recent developments in the market?

March 2023: Air Menzies International (AMI), a Canadian airfreight reseller, has built a new branch near Toronto Pearson International Airport. The new branch is AMI's second in Canada, and it will provide a wide range of wholesale airfreight services, including door-to-door services on global import and export shipments; exports with consolidation and 'Back2Back'; 'Quick2Ship,' AMI's express shipment platform; X-ray screening and warehousing services; and customs clearance and documentation support.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Customs Clearance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Customs Clearance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Customs Clearance Market?

To stay informed about further developments, trends, and reports in the Canada Customs Clearance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence