Key Insights

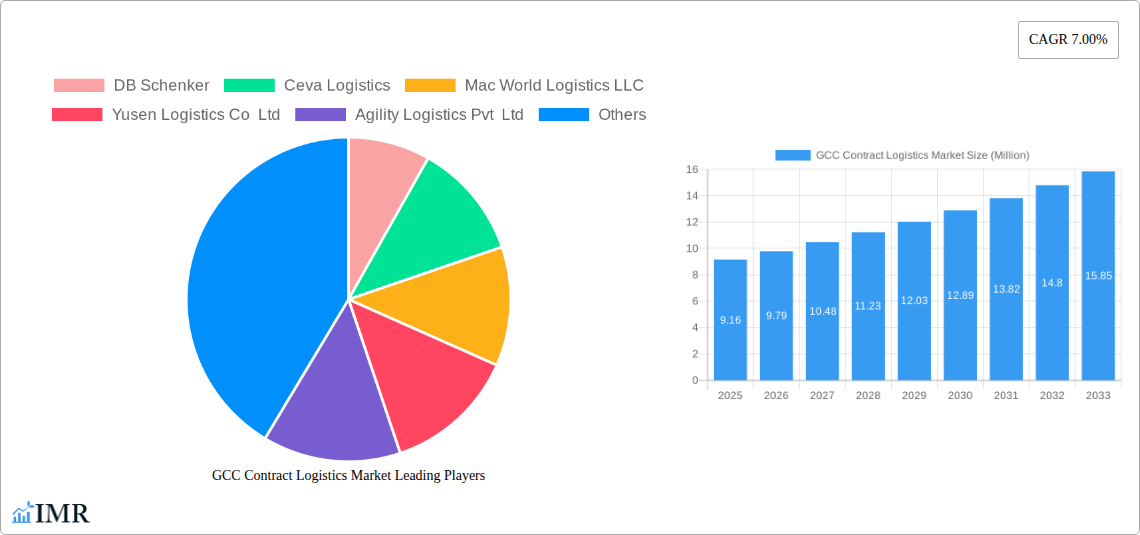

The GCC Contract Logistics Market is poised for substantial growth, projected to reach a market size of USD 9.16 Million in 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 7.00%. This expansion is fueled by several key factors. The increasing demand for specialized logistics services, particularly from the rapidly developing manufacturing and automotive sectors in the region, is a significant driver. Furthermore, the burgeoning e-commerce landscape across consumer goods and retail necessitates sophisticated warehousing, transportation, and last-mile delivery solutions, all of which fall under the purview of contract logistics. The high-tech and healthcare industries are also increasingly outsourcing their complex supply chain needs to specialized providers, seeking efficiency, cost optimization, and regulatory compliance. The Middle East region's strategic location and ongoing investments in infrastructure development further bolster the market's potential.

GCC Contract Logistics Market Market Size (In Million)

The market's trajectory is further shaped by emerging trends and certain restraining factors. While outsourcing of logistics operations is a dominant trend, indicating a preference for specialized expertise and reduced capital expenditure for end-users, the internal operational capabilities of some larger enterprises in sectors like manufacturing and automotive might present a slight counter-trend. However, the overall inclination towards leveraging third-party logistics (3PL) providers for enhanced efficiency and scalability is undeniable. Challenges such as fluctuating fuel prices and the need for skilled labor in specialized logistics roles could present headwinds. Nevertheless, the continuous innovation in technology, including automation in warehouses and advanced tracking systems, along with a strong focus on sustainability initiatives, is expected to mitigate these restraints and propel the GCC Contract Logistics Market towards sustained and significant growth through 2033.

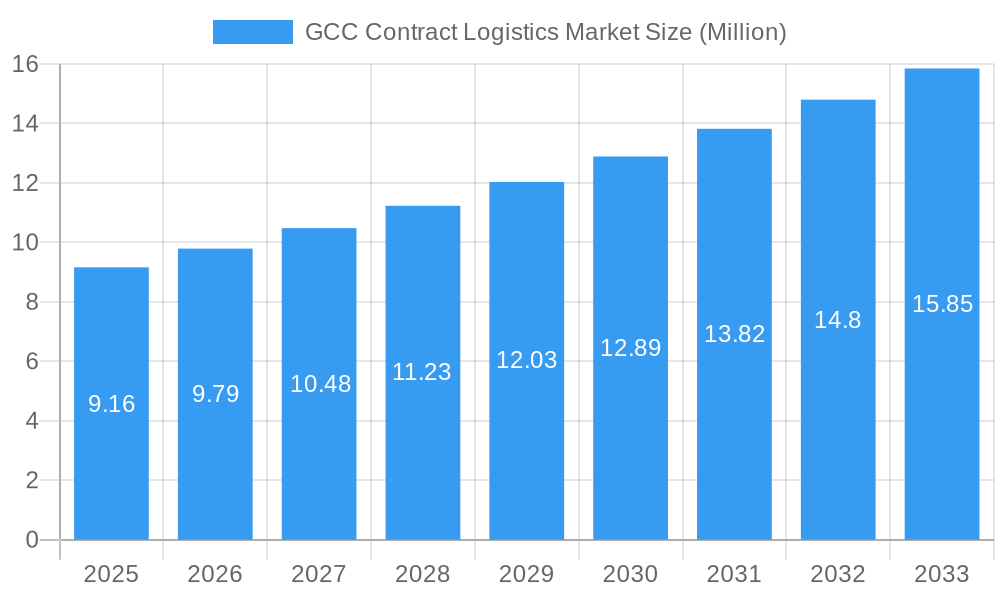

GCC Contract Logistics Market Company Market Share

This comprehensive report provides an in-depth analysis of the GCC Contract Logistics Market, a critical sector experiencing rapid transformation driven by e-commerce expansion, economic diversification, and evolving consumer demands. We forecast significant growth for contract logistics services across the Gulf Cooperation Council (GCC) region, with key opportunities emerging in specialized warehousing, last-mile delivery, and integrated supply chain solutions. Our analysis covers the historical period from 2019 to 2024, with a detailed forecast extending from 2025 to 2033, using 2025 as the base and estimated year. Values are presented in Million units.

GCC Contract Logistics Market Market Dynamics & Structure

The GCC Contract Logistics Market is characterized by increasing market concentration, with major global players and established regional providers vying for dominance. Technological innovation is a key driver, encompassing advancements in warehouse automation, supply chain visibility software, and route optimization. Regulatory frameworks, while generally supportive of trade, can present varying complexities across different GCC nations, impacting operational efficiency. Competitive product substitutes include in-house logistics operations, though the trend is strongly towards outsourcing for greater flexibility and cost-effectiveness. End-user demographics are shifting, with a burgeoning demand from manufacturing and automotive, consumer goods and retail, and high-tech sectors. Mergers and acquisitions (M&A) are actively reshaping the landscape, as companies seek to expand their service offerings and geographic reach.

- Market Concentration: Dominated by a blend of global giants and strong regional players, indicating a competitive yet consolidating market.

- Technological Innovation: Driven by adoption of AI, IoT, and robotics in warehousing and transportation, enhancing efficiency and data analytics.

- Regulatory Frameworks: Evolving trade agreements and customs facilitations are generally favorable, but localized compliance remains crucial.

- Competitive Substitutes: Growing preference for outsourced solutions over in-house logistics due to cost savings and scalability.

- End-User Demographics: Significant growth anticipated from e-commerce-driven sectors like consumer goods and retail, alongside continued demand from manufacturing and automotive.

- M&A Trends: Active consolidation and strategic partnerships to gain market share and diversify service portfolios.

GCC Contract Logistics Market Growth Trends & Insights

The GCC Contract Logistics Market is poised for substantial expansion, projected to grow at a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is underpinned by the region's aggressive economic diversification strategies, which are attracting significant foreign investment and boosting industrial output. The surge in e-commerce penetration across GCC nations has fundamentally reshaped consumer behavior, driving an unprecedented demand for efficient, reliable, and fast delivery services. This necessitates sophisticated contract logistics solutions that can manage complex supply chains, from warehousing and inventory management to last-mile fulfillment. Technological adoption rates are accelerating, with companies investing heavily in digitalization to achieve end-to-end supply chain visibility and operational excellence. The adoption of advanced analytics, artificial intelligence (AI), and automation in warehouses and transportation networks is becoming a standard practice, leading to improved efficiency, reduced operational costs, and enhanced customer satisfaction. We anticipate a market size evolution from USD xx,xxx million in 2025 to USD xx,xxx million by 2033. The market penetration of outsourced contract logistics is expected to rise significantly as businesses recognize the strategic advantages of partnering with specialized logistics providers. Consumer behavior shifts, including the demand for same-day or next-day deliveries and personalized services, are pushing contract logistics providers to innovate and offer more tailored solutions. The integration of sustainable logistics practices is also gaining traction, aligning with the region's broader environmental goals and influencing procurement decisions.

Dominant Regions, Countries, or Segments in GCC Contract Logistics Market

The Outsourced segment is a dominant force within the GCC Contract Logistics Market, outpacing the growth of insourced operations. This dominance is fueled by businesses increasingly recognizing the strategic imperative of offloading complex logistics functions to specialized providers, thereby allowing them to focus on core competencies. The flexibility, scalability, and cost efficiencies offered by outsourced solutions are particularly appealing to the region's burgeoning small and medium-sized enterprises (SMEs) as well as large corporations navigating rapid market changes.

Within the end-user categories, Consumer Goods and Retail is a primary growth engine, driven by the explosive expansion of e-commerce. The proliferation of online shopping platforms and the increasing purchasing power of consumers in GCC nations have created a massive demand for sophisticated warehousing, inventory management, and last-mile delivery services. Retailers are partnering with contract logistics providers to ensure timely and efficient fulfillment of online orders, manage returns, and maintain optimal stock levels across diverse product portfolios.

Dominant Segment - Type: Outsourced Contract Logistics

- Key Drivers: Cost optimization, enhanced flexibility and scalability, access to specialized expertise and technology, focus on core business activities.

- Market Share: Projected to hold over xx% of the total contract logistics market by 2033.

- Growth Potential: High, driven by increasing complexity of supply chains and growing number of SMEs seeking efficient logistics solutions.

Dominant Segment - End User: Consumer Goods and Retail

- Key Drivers: E-commerce boom, changing consumer purchasing habits, demand for faster delivery times and personalized services, expansion of online marketplaces.

- Market Share: Expected to account for approximately xx% of the contract logistics market revenue by 2033.

- Growth Potential: Significant, with continuous innovation in last-mile delivery and omnichannel logistics strategies.

Other significant end-user segments include Manufacturing and Automotive, which require specialized handling and just-in-time delivery capabilities, and Healthcare and Pharmaceuticals, demanding stringent adherence to temperature control and regulatory compliance. The High-tech sector also contributes to market growth, with its need for secure storage and rapid distribution of sensitive electronic goods.

GCC Contract Logistics Market Product Landscape

The GCC Contract Logistics Market is characterized by a diverse and evolving product landscape, moving beyond traditional warehousing and transportation. Key innovations include advanced Warehouse Management Systems (WMS) with AI-driven inventory optimization, automated guided vehicles (AGVs) and robotic arms for enhanced picking and packing efficiency, and real-time track-and-trace solutions leveraging IoT and blockchain technology for unparalleled supply chain visibility. Performance metrics such as order accuracy rates, on-time delivery percentages, and cost per shipment are continually improving due to these technological integrations. Unique selling propositions often revolve around specialized capabilities like cold chain logistics, hazardous material handling, and reverse logistics management, catering to specific industry needs.

Key Drivers, Barriers & Challenges in GCC Contract Logistics Market

Key Drivers:

- Economic Diversification: Government initiatives promoting industrial growth and non-oil sector development are creating demand for sophisticated logistics.

- E-commerce Boom: Rapid online retail growth necessitates efficient warehousing, inventory, and last-mile delivery solutions.

- Technological Advancements: Automation, AI, and data analytics are improving operational efficiency and service offerings.

- Infrastructure Development: Significant investments in ports, airports, and road networks are facilitating smoother goods movement.

- Globalization and Trade: Increased international trade and the establishment of free trade zones boost demand for cross-border logistics.

Barriers & Challenges:

- Talent Shortage: A significant challenge is the availability of skilled labor in specialized logistics roles.

- Regulatory Variations: Navigating diverse customs procedures and regulatory frameworks across different GCC countries can be complex.

- Geopolitical Instability: Regional political dynamics can introduce supply chain disruptions and affect investment confidence.

- High Operational Costs: Land acquisition, labor, and energy costs can be considerable, impacting profitability.

- Cybersecurity Threats: Increased reliance on digital systems exposes logistics operations to potential cyberattacks.

Emerging Opportunities in GCC Contract Logistics Market

Emerging opportunities in the GCC Contract Logistics Market lie in the burgeoning demand for specialized logistics services, particularly within the cold chain logistics segment, driven by the growing healthcare and food & beverage industries. The rapid development of e-fulfillment centers tailored for online retailers presents a significant growth avenue. Furthermore, the increasing focus on sustainability and green logistics opens doors for providers offering eco-friendly transportation and warehousing solutions. The integration of advanced analytics and AI for predictive logistics and demand forecasting is another key opportunity to enhance efficiency and customer satisfaction. Lastly, exploring untapped markets within the broader GCC region and offering integrated, end-to-end supply chain solutions will be crucial for capturing future growth.

Growth Accelerators in the GCC Contract Logistics Market Industry

Several catalysts are propelling the long-term growth of the GCC Contract Logistics Market. Foremost among these is the continuous drive towards digital transformation, with companies investing heavily in automation, AI, and data analytics to optimize operations and enhance customer experience. Strategic partnerships and mergers and acquisitions are consolidating the market, leading to the emergence of larger, more capable players with expanded service portfolios. Government initiatives promoting logistics hubs and infrastructure development, such as the expansion of ports and airports, are critical growth enablers. The increasing adoption of sustainable logistics practices by businesses aligns with global environmental trends and creates new market niches. Finally, the ongoing diversification of GCC economies away from oil is fostering industrial growth, directly translating into higher demand for contract logistics services.

Key Players Shaping the GCC Contract Logistics Market Market

- DB Schenker

- Ceva Logistics

- Mac World Logistics LLC

- Yusen Logistics Co Ltd

- Agility Logistics Pvt Ltd

- Almajdouie Logistics Co LLC

- Gulf Warehousing Company QPSC (GWC)

- Hellmann Worldwide Logistics GmbH & Co KG

- Al Futtaim Logistics

- Al Naboodah Group Enterprises Hala Supply Chain Services

- Mohebi Logistics

- Integrated National Logistics

- Global Shipping & Logistics

- United Parcel Service Inc

- Globus Logistics

- Al-Jabri Logistics

- LSC Logistics and Warehousing Co

- Deutsche Post DHL Group (DHL Supply Chain)

- DSV

Notable Milestones in GCC Contract Logistics Market Sector

- March 2023: Kuwaiti logistics specialist Agility formed a joint venture (Yanmu) with Hassan Allam Holding to build and operate warehouses in Egypt, with an initial investment of approximately USD 100 million. The venture plans to open its first logistics park in August 2023, featuring a 270,000 sq m site near Cairo airport.

- February 2023: Denmark-headquartered DSV announced its fourth expansion in Bahrain, investing USD 18 million in a new facility to further service Gulf markets, marking their second expansion in the country within three years.

In-Depth GCC Contract Logistics Market Market Outlook

The GCC Contract Logistics Market is on an upward trajectory, driven by sustained economic growth and increasing integration into global supply chains. Key opportunities lie in the digitalization of operations, enhancing efficiency through AI and automation, and expanding specialized services like cold chain and e-commerce fulfillment. Strategic investments in infrastructure and supportive government policies are creating a favorable environment for expansion. The market is expected to witness continued consolidation through M&A activities, leading to stronger, more integrated logistics providers. Emerging trends such as the adoption of green logistics practices and the leveraging of advanced data analytics for predictive supply chain management will shape future growth. Overall, the outlook for the GCC Contract Logistics Market is robust, promising substantial returns for stakeholders who can adapt to evolving demands and technological advancements.

GCC Contract Logistics Market Segmentation

-

1. Type

- 1.1. Insourced

- 1.2. Outsourced

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Consumer Goods and Retail

- 2.3. High-tech

- 2.4. Healthcare and Pharmaceuticals

- 2.5. Other End Users

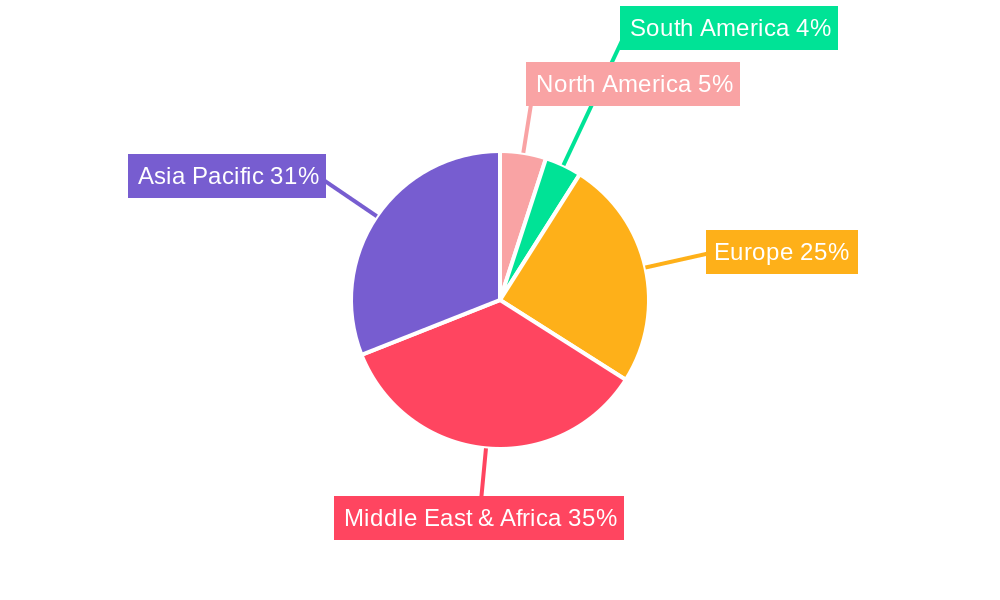

GCC Contract Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

GCC Contract Logistics Market Regional Market Share

Geographic Coverage of GCC Contract Logistics Market

GCC Contract Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increase in Trade Activities4.; Growth in the manufacturing industry

- 3.3. Market Restrains

- 3.3.1. 4.; Regulatory Challenges

- 3.4. Market Trends

- 3.4.1. Growth in E-commerce Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GCC Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insourced

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Consumer Goods and Retail

- 5.2.3. High-tech

- 5.2.4. Healthcare and Pharmaceuticals

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America GCC Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Insourced

- 6.1.2. Outsourced

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Manufacturing and Automotive

- 6.2.2. Consumer Goods and Retail

- 6.2.3. High-tech

- 6.2.4. Healthcare and Pharmaceuticals

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America GCC Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Insourced

- 7.1.2. Outsourced

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Manufacturing and Automotive

- 7.2.2. Consumer Goods and Retail

- 7.2.3. High-tech

- 7.2.4. Healthcare and Pharmaceuticals

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe GCC Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Insourced

- 8.1.2. Outsourced

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Manufacturing and Automotive

- 8.2.2. Consumer Goods and Retail

- 8.2.3. High-tech

- 8.2.4. Healthcare and Pharmaceuticals

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa GCC Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Insourced

- 9.1.2. Outsourced

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Manufacturing and Automotive

- 9.2.2. Consumer Goods and Retail

- 9.2.3. High-tech

- 9.2.4. Healthcare and Pharmaceuticals

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific GCC Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Insourced

- 10.1.2. Outsourced

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Manufacturing and Automotive

- 10.2.2. Consumer Goods and Retail

- 10.2.3. High-tech

- 10.2.4. Healthcare and Pharmaceuticals

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DB Schenker

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Ceva Logistics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mac World Logistics LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Yusen Logistics Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Agility Logistics Pvt Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Almajdouie Logistics Co LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gulf Warehousing Company QPSC (GWC)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hellmann Worldwide Logistics GmbH & Co KG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Al Futtaim Logistics

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Al Naboodah Group Enterprises Hala Supply Chain Services Mohebi Logistics Integrated National Logistics Global Shipping & Logistics United Parcel Service Inc Globus Logistics Al-Jabri Logistics LSC Logistics and Warehousing Co

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Deutsche Post DHL Group (DHL Supply Chain)*6 3 Other Companies (Key Information/Overview)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 DB Schenker

List of Figures

- Figure 1: Global GCC Contract Logistics Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America GCC Contract Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America GCC Contract Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America GCC Contract Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 5: North America GCC Contract Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America GCC Contract Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America GCC Contract Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America GCC Contract Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 9: South America GCC Contract Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America GCC Contract Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 11: South America GCC Contract Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: South America GCC Contract Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America GCC Contract Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe GCC Contract Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe GCC Contract Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe GCC Contract Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 17: Europe GCC Contract Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe GCC Contract Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe GCC Contract Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa GCC Contract Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa GCC Contract Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa GCC Contract Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 23: Middle East & Africa GCC Contract Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East & Africa GCC Contract Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa GCC Contract Logistics Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific GCC Contract Logistics Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific GCC Contract Logistics Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific GCC Contract Logistics Market Revenue (Million), by End User 2025 & 2033

- Figure 29: Asia Pacific GCC Contract Logistics Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Asia Pacific GCC Contract Logistics Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific GCC Contract Logistics Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GCC Contract Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global GCC Contract Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global GCC Contract Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global GCC Contract Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global GCC Contract Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global GCC Contract Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global GCC Contract Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global GCC Contract Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global GCC Contract Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global GCC Contract Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global GCC Contract Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 18: Global GCC Contract Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global GCC Contract Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global GCC Contract Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 30: Global GCC Contract Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global GCC Contract Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global GCC Contract Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 39: Global GCC Contract Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific GCC Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GCC Contract Logistics Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the GCC Contract Logistics Market?

Key companies in the market include DB Schenker, Ceva Logistics, Mac World Logistics LLC, Yusen Logistics Co Ltd, Agility Logistics Pvt Ltd, Almajdouie Logistics Co LLC, Gulf Warehousing Company QPSC (GWC), Hellmann Worldwide Logistics GmbH & Co KG, Al Futtaim Logistics, Al Naboodah Group Enterprises Hala Supply Chain Services Mohebi Logistics Integrated National Logistics Global Shipping & Logistics United Parcel Service Inc Globus Logistics Al-Jabri Logistics LSC Logistics and Warehousing Co, Deutsche Post DHL Group (DHL Supply Chain)*6 3 Other Companies (Key Information/Overview).

3. What are the main segments of the GCC Contract Logistics Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.16 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increase in Trade Activities4.; Growth in the manufacturing industry.

6. What are the notable trends driving market growth?

Growth in E-commerce Driving the Market.

7. Are there any restraints impacting market growth?

4.; Regulatory Challenges.

8. Can you provide examples of recent developments in the market?

March 2023: Kuwaiti logistics specialist Agility has formed a joint venture with the development arm of Hassan Allam Holding to build and run warehouses in Egypt. The venture, Yanmu, is due to open its first logistics park in August with an initial investment of about USD 100 million, Agility said in a stock market filing. The development, a 270,000sq m site about 10 miles from Cairo airport, will be part-financed by equity and debt.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GCC Contract Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GCC Contract Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GCC Contract Logistics Market?

To stay informed about further developments, trends, and reports in the GCC Contract Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence