Key Insights

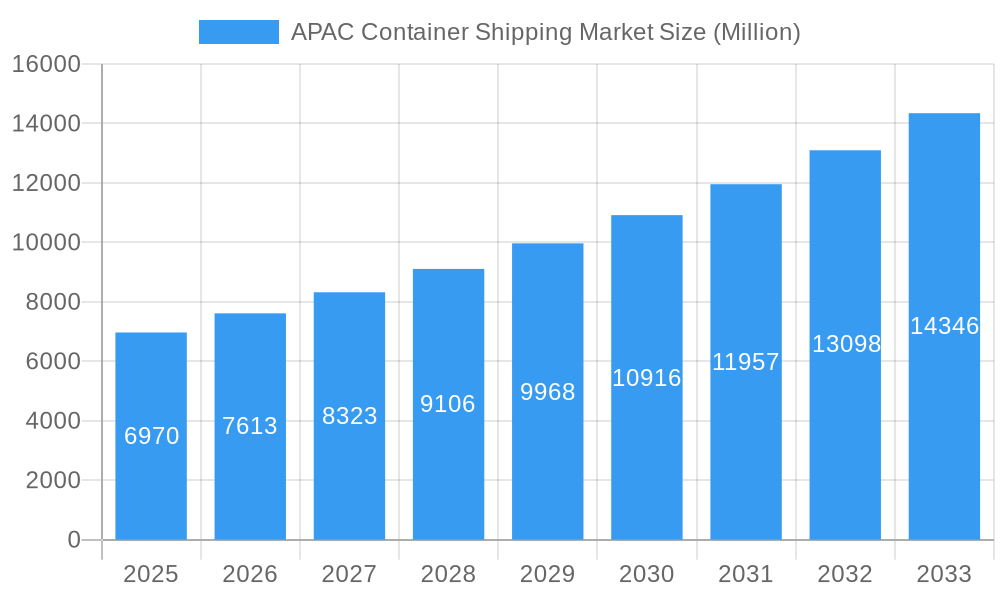

The Asia-Pacific (APAC) container shipping market, valued at $6.97 billion in 2025, is projected to experience robust growth, driven by the region's expanding e-commerce sector, increasing industrialization, and rising cross-border trade. A Compound Annual Growth Rate (CAGR) of 9.07% from 2025 to 2033 indicates a significant market expansion. Key growth drivers include the surging demand for consumer goods, particularly from China and India, coupled with infrastructure developments enhancing port efficiency and connectivity across the region. The increasing adoption of larger container vessels (High Cube Containers) further contributes to market growth by optimizing cargo capacity and reducing shipping costs. However, potential restraints include geopolitical uncertainties, fluctuating fuel prices, and the ongoing impact of global supply chain disruptions. Segment-wise, sea transport dominates the market, owing to the cost-effectiveness and scale of operations compared to road, rail, and air freight. Within APAC, China, India, and other major economies are primary contributors, exhibiting high growth potential due to their robust manufacturing sectors and export-oriented economies. The competitive landscape is characterized by large global players like Maersk and CIMC, alongside regional players catering to specific market niches. Future growth will likely be influenced by advancements in container technology, digitalization of shipping processes, and sustainability initiatives aiming to reduce environmental impact. The market's steady expansion is expected to continue through 2033, fueled by the enduring need for efficient and reliable container shipping solutions within and beyond the APAC region. Strategic partnerships, investments in infrastructure, and technological innovations will be crucial for companies to gain a competitive edge in this rapidly evolving market.

APAC Container Shipping Market Market Size (In Billion)

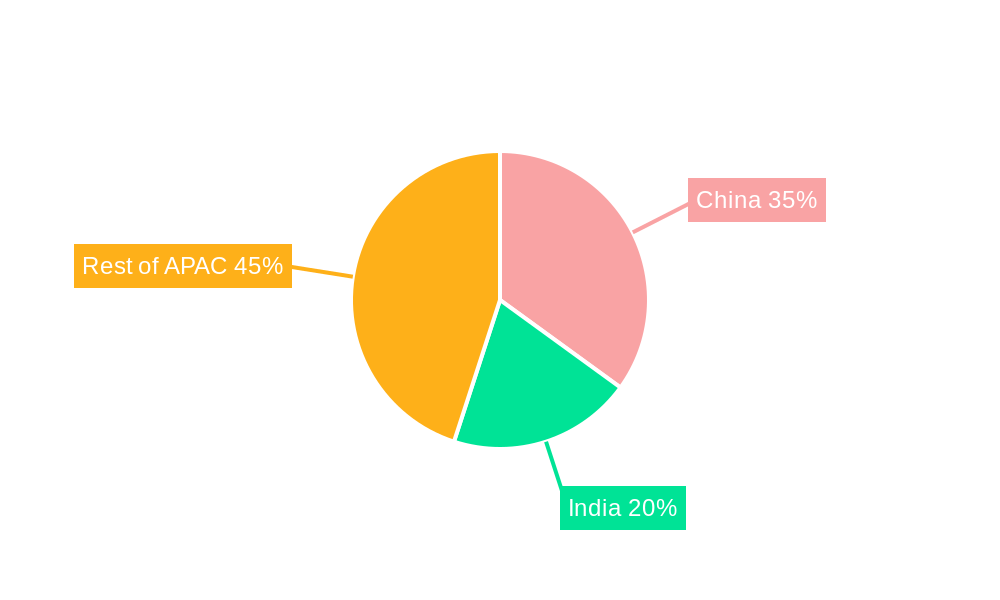

The diverse segments within the APAC container shipping market present various investment opportunities. The "By Size" segment shows significant potential for High Cube Containers, which are expected to gain traction due to their increased cargo capacity and cost efficiency. The "By Mode of Transportation" segment indicates that maritime transport remains dominant, although rail transport is poised for growth driven by infrastructure improvements and efforts to reduce reliance on road transport. Analyzing the "By Country" segment reveals the most promising growth markets in the APAC region. China and India, due to their significant manufacturing output and import/export volumes, represent major investment opportunities. Other Southeast Asian nations like Vietnam and Indonesia also show strong growth potential, driven by industrialization and increasing global trade. Understanding regional dynamics and tailoring strategies to specific market needs will be essential for players seeking success in this expansive and dynamic market.

APAC Container Shipping Market Company Market Share

APAC Container Shipping Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific (APAC) container shipping market, covering the period from 2019 to 2033. It delves into market dynamics, growth trends, dominant segments, and key players, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report segments the market by container size (small, large, high cube), mode of transportation (road, sea, rail, air), and country (Australia, Bangladesh, China, India, Indonesia, Japan, Pakistan, Philippines, Thailand, Vietnam), providing granular data for informed decision-making. The market size is valued in Million units.

APAC Container Shipping Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the APAC container shipping industry. We examine market concentration, identifying the leading players and their market share, along with the impact of mergers and acquisitions (M&A) activities. Technological innovation, including advancements in container design and logistics technologies, is also assessed, alongside its impact on market growth and efficiency. Regulatory frameworks and their influence on market operations are explored.

- Market Concentration: The APAC container shipping market exhibits a moderately concentrated structure, with a few major players holding significant market share. For example, Maersk commands a xx% market share, while CIMC holds approximately xx%. The remaining market share is distributed among numerous regional and smaller players.

- Technological Innovation: Technological advancements such as smart containers with integrated sensors, improved tracking systems, and optimized route planning software are driving efficiency and reducing operational costs. However, high initial investment costs and integration challenges represent barriers to wider adoption.

- Regulatory Framework: Varying regulations across APAC countries impact operational efficiency and costs. Harmonization of regulations could significantly benefit the market.

- M&A Activity: The number of M&A deals in the APAC container shipping sector has shown xx% growth during the historical period (2019-2024), indicating consolidation trends within the market.

APAC Container Shipping Market Growth Trends & Insights

This section presents a detailed analysis of the APAC container shipping market's historical, current, and projected growth trajectory. We examine market size evolution, adoption rates of new technologies, and how evolving consumer behavior is shaping the industry. The analysis incorporates key performance indicators (KPIs), including the Compound Annual Growth Rate (CAGR) and market penetration rates across different segments. The data reveals a xx Million units market size in 2025, projected to reach xx Million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is driven by factors such as rising e-commerce, increasing globalization, and infrastructural improvements across the region. Specific examples of technological disruptions and their impacts are analyzed, including the rise of automated container terminals and digital freight platforms.

Dominant Regions, Countries, or Segments in APAC Container Shipping Market

This section identifies the key regions, countries, and segments within the APAC container shipping market that are driving growth. We analyze market share, growth potential, and the underlying factors driving dominance. China, with its massive manufacturing base and export-oriented economy, stands as the dominant player, accounting for approximately xx% of the total market share. Other key contributors include India and Vietnam, fuelled by rapid economic growth and expanding trade activities. Sea transport remains the dominant mode of transportation, holding xx% market share, followed by Road transport with xx%. Large containers are the most widely used accounting for xx% of the market.

- China: Dominance is driven by its large manufacturing base, high export volume, and extensive port infrastructure.

- India: Rapid economic growth and a growing middle class are contributing to increased demand for container shipping services.

- Vietnam: The country's growing manufacturing sector and foreign direct investment are driving demand.

- Sea Transportation: The cost-effectiveness and capacity of sea transport makes it the preferred mode for large-scale shipments.

APAC Container Shipping Market Product Landscape

The APAC container shipping market showcases a diverse range of products and services, encompassing various container sizes (small, large, high cube), specialized containers (refrigerated, tank containers), and related logistics solutions. Recent innovations focus on enhancing durability, efficiency, and tracking capabilities. Smart containers with IoT sensors provide real-time data on location, temperature, and other key parameters, which significantly improve supply chain visibility and security. The adoption of these technological advancements is steadily increasing, leading to improved efficiency and reduced costs.

Key Drivers, Barriers & Challenges in APAP Container Shipping Market

Key Drivers:

- Rising e-commerce and global trade volume.

- Infrastructure development in emerging APAC economies.

- Technological advancements in container technology and logistics.

Challenges and Restraints:

- Geopolitical uncertainties and trade wars.

- Port congestion and operational inefficiencies.

- Fluctuations in fuel prices and exchange rates.

- Supply chain disruptions are estimated to cause a xx% decrease in market growth in 2024.

Emerging Opportunities in APAC Container Shipping Market

The APAC container shipping market presents several emerging opportunities, including the growth of e-commerce logistics, the increasing demand for specialized containers (e.g., refrigerated and tank containers), and the expansion into underserved markets within the region. The adoption of innovative technologies like blockchain for enhanced supply chain transparency and automation of port operations is opening new avenues for growth and efficiency gains. Furthermore, the rise of intermodal transport solutions, integrating sea, rail, and road transport, presents significant opportunities for optimizing delivery routes and reducing costs.

Growth Accelerators in the APAC Container Shipping Market Industry

Long-term growth in the APAC container shipping market is projected to be significantly boosted by technological advancements such as automation in ports and improved supply chain management systems. Strategic alliances and collaborations between shipping lines and logistics providers will further optimize operational efficiency and reduce costs. Expanding into underserved markets in Southeast Asia and further developing infrastructure will open new markets and provide growth opportunities.

Key Players Shaping the APAC Container Shipping Market Market

- Maersk

- CXIC (CHANGZHOU XINHUACHANG INT'L CONTAINERS Co Ltd)

- Group Containers Company Limited

- Sea Box Inc

- China International Marine Containers (Group) Ltd (CIMC)

- Guangdong Fuwa Engineering Group Co Ltd

- Singamas Container Holdings Limited

- W&K Conatiners Ltd

- TLS Offshore Containers International Pvt Ltd

- Florens Asset Management Company Limited

- China Eastern Containers

Notable Milestones in APAC Container Shipping Market Sector

- April 2023: CIMC and POWIN established a joint venture to expand into the energy storage sector. This strategic move signals a diversification effort by CIMC, leveraging its expertise in manufacturing and POWIN's leadership in energy storage solutions.

- March 2023: Maersk launched the Captain Peter Integrated package, enhancing data integration and visibility for customers, improving supply chain efficiency.

In-Depth APAC Container Shipping Market Market Outlook

The APAC container shipping market is poised for sustained growth over the next decade, driven by the region's robust economic expansion and the continuous evolution of its infrastructure. Strategic partnerships, technological innovation, and a focus on supply chain optimization will be crucial for players to maintain their competitiveness. The market presents considerable opportunities for businesses focusing on innovation, efficiency, and sustainable solutions. The continued rise of e-commerce and the increasing demand for specialized containers will fuel this growth.

APAC Container Shipping Market Segmentation

-

1. Size

- 1.1. Small

- 1.2. Large

- 1.3. High Cube Containers

-

2. Mode of Transportation

- 2.1. Road

- 2.2. Sea

- 2.3. Rail

- 2.4. Air

APAC Container Shipping Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Container Shipping Market Regional Market Share

Geographic Coverage of APAC Container Shipping Market

APAC Container Shipping Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Demand for Pharmaceutical Products4.; Increasing Demand for frozen persihable commodities

- 3.3. Market Restrains

- 3.3.1. 4.; Operational and Financial Challenges Associated with Reefer Containers

- 3.4. Market Trends

- 3.4.1. Preference for maritime trade over aerial trade growing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Container Shipping Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Size

- 5.1.1. Small

- 5.1.2. Large

- 5.1.3. High Cube Containers

- 5.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 5.2.1. Road

- 5.2.2. Sea

- 5.2.3. Rail

- 5.2.4. Air

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Size

- 6. North America APAC Container Shipping Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Size

- 6.1.1. Small

- 6.1.2. Large

- 6.1.3. High Cube Containers

- 6.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 6.2.1. Road

- 6.2.2. Sea

- 6.2.3. Rail

- 6.2.4. Air

- 6.1. Market Analysis, Insights and Forecast - by Size

- 7. South America APAC Container Shipping Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Size

- 7.1.1. Small

- 7.1.2. Large

- 7.1.3. High Cube Containers

- 7.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 7.2.1. Road

- 7.2.2. Sea

- 7.2.3. Rail

- 7.2.4. Air

- 7.1. Market Analysis, Insights and Forecast - by Size

- 8. Europe APAC Container Shipping Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Size

- 8.1.1. Small

- 8.1.2. Large

- 8.1.3. High Cube Containers

- 8.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 8.2.1. Road

- 8.2.2. Sea

- 8.2.3. Rail

- 8.2.4. Air

- 8.1. Market Analysis, Insights and Forecast - by Size

- 9. Middle East & Africa APAC Container Shipping Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Size

- 9.1.1. Small

- 9.1.2. Large

- 9.1.3. High Cube Containers

- 9.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 9.2.1. Road

- 9.2.2. Sea

- 9.2.3. Rail

- 9.2.4. Air

- 9.1. Market Analysis, Insights and Forecast - by Size

- 10. Asia Pacific APAC Container Shipping Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Size

- 10.1.1. Small

- 10.1.2. Large

- 10.1.3. High Cube Containers

- 10.2. Market Analysis, Insights and Forecast - by Mode of Transportation

- 10.2.1. Road

- 10.2.2. Sea

- 10.2.3. Rail

- 10.2.4. Air

- 10.1. Market Analysis, Insights and Forecast - by Size

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Maersk

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CXIC (CHANGZHOU XINHUACHANG INT'L CONTAINERS Co Ltd) Group Containers Company Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sea Box Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China International Marine Containers (Group) Ltd (CIMC)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Guangdong Fuwa Engineering Group Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Singamas Container Holdings Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 W&K Conatiners Ltd **List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TLS Offshore Containers International Pvt Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Florens Asset Management Company Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 China Eastern Containers

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Maersk

List of Figures

- Figure 1: Global APAC Container Shipping Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America APAC Container Shipping Market Revenue (Million), by Size 2025 & 2033

- Figure 3: North America APAC Container Shipping Market Revenue Share (%), by Size 2025 & 2033

- Figure 4: North America APAC Container Shipping Market Revenue (Million), by Mode of Transportation 2025 & 2033

- Figure 5: North America APAC Container Shipping Market Revenue Share (%), by Mode of Transportation 2025 & 2033

- Figure 6: North America APAC Container Shipping Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America APAC Container Shipping Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America APAC Container Shipping Market Revenue (Million), by Size 2025 & 2033

- Figure 9: South America APAC Container Shipping Market Revenue Share (%), by Size 2025 & 2033

- Figure 10: South America APAC Container Shipping Market Revenue (Million), by Mode of Transportation 2025 & 2033

- Figure 11: South America APAC Container Shipping Market Revenue Share (%), by Mode of Transportation 2025 & 2033

- Figure 12: South America APAC Container Shipping Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America APAC Container Shipping Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe APAC Container Shipping Market Revenue (Million), by Size 2025 & 2033

- Figure 15: Europe APAC Container Shipping Market Revenue Share (%), by Size 2025 & 2033

- Figure 16: Europe APAC Container Shipping Market Revenue (Million), by Mode of Transportation 2025 & 2033

- Figure 17: Europe APAC Container Shipping Market Revenue Share (%), by Mode of Transportation 2025 & 2033

- Figure 18: Europe APAC Container Shipping Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe APAC Container Shipping Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa APAC Container Shipping Market Revenue (Million), by Size 2025 & 2033

- Figure 21: Middle East & Africa APAC Container Shipping Market Revenue Share (%), by Size 2025 & 2033

- Figure 22: Middle East & Africa APAC Container Shipping Market Revenue (Million), by Mode of Transportation 2025 & 2033

- Figure 23: Middle East & Africa APAC Container Shipping Market Revenue Share (%), by Mode of Transportation 2025 & 2033

- Figure 24: Middle East & Africa APAC Container Shipping Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa APAC Container Shipping Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific APAC Container Shipping Market Revenue (Million), by Size 2025 & 2033

- Figure 27: Asia Pacific APAC Container Shipping Market Revenue Share (%), by Size 2025 & 2033

- Figure 28: Asia Pacific APAC Container Shipping Market Revenue (Million), by Mode of Transportation 2025 & 2033

- Figure 29: Asia Pacific APAC Container Shipping Market Revenue Share (%), by Mode of Transportation 2025 & 2033

- Figure 30: Asia Pacific APAC Container Shipping Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific APAC Container Shipping Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Container Shipping Market Revenue Million Forecast, by Size 2020 & 2033

- Table 2: Global APAC Container Shipping Market Revenue Million Forecast, by Mode of Transportation 2020 & 2033

- Table 3: Global APAC Container Shipping Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global APAC Container Shipping Market Revenue Million Forecast, by Size 2020 & 2033

- Table 5: Global APAC Container Shipping Market Revenue Million Forecast, by Mode of Transportation 2020 & 2033

- Table 6: Global APAC Container Shipping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global APAC Container Shipping Market Revenue Million Forecast, by Size 2020 & 2033

- Table 11: Global APAC Container Shipping Market Revenue Million Forecast, by Mode of Transportation 2020 & 2033

- Table 12: Global APAC Container Shipping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global APAC Container Shipping Market Revenue Million Forecast, by Size 2020 & 2033

- Table 17: Global APAC Container Shipping Market Revenue Million Forecast, by Mode of Transportation 2020 & 2033

- Table 18: Global APAC Container Shipping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global APAC Container Shipping Market Revenue Million Forecast, by Size 2020 & 2033

- Table 29: Global APAC Container Shipping Market Revenue Million Forecast, by Mode of Transportation 2020 & 2033

- Table 30: Global APAC Container Shipping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global APAC Container Shipping Market Revenue Million Forecast, by Size 2020 & 2033

- Table 38: Global APAC Container Shipping Market Revenue Million Forecast, by Mode of Transportation 2020 & 2033

- Table 39: Global APAC Container Shipping Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific APAC Container Shipping Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Container Shipping Market?

The projected CAGR is approximately 9.07%.

2. Which companies are prominent players in the APAC Container Shipping Market?

Key companies in the market include Maersk, CXIC (CHANGZHOU XINHUACHANG INT'L CONTAINERS Co Ltd) Group Containers Company Limited, Sea Box Inc, China International Marine Containers (Group) Ltd (CIMC), Guangdong Fuwa Engineering Group Co Ltd, Singamas Container Holdings Limited, W&K Conatiners Ltd **List Not Exhaustive, TLS Offshore Containers International Pvt Ltd, Florens Asset Management Company Limited, China Eastern Containers.

3. What are the main segments of the APAC Container Shipping Market?

The market segments include Size, Mode of Transportation.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.97 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Demand for Pharmaceutical Products4.; Increasing Demand for frozen persihable commodities.

6. What are the notable trends driving market growth?

Preference for maritime trade over aerial trade growing.

7. Are there any restraints impacting market growth?

4.; Operational and Financial Challenges Associated with Reefer Containers.

8. Can you provide examples of recent developments in the market?

April 2023: CIMC and POWIN set up a joint venture to deepen cooperation in energy storage business. Powin is an American battery energy storage system integrator and manufacturer headquartered in Portland, Oregon. It was engaged in the energy storage field for nearly 10 years, and is one of the head energy storage integrators in the United States. According to the ranking released by Navigant Research, a market research organization in the United States, Powin is ranked among the TOP 3 global energy storage system integrators in recent years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Container Shipping Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Container Shipping Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Container Shipping Market?

To stay informed about further developments, trends, and reports in the APAC Container Shipping Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence