Key Insights

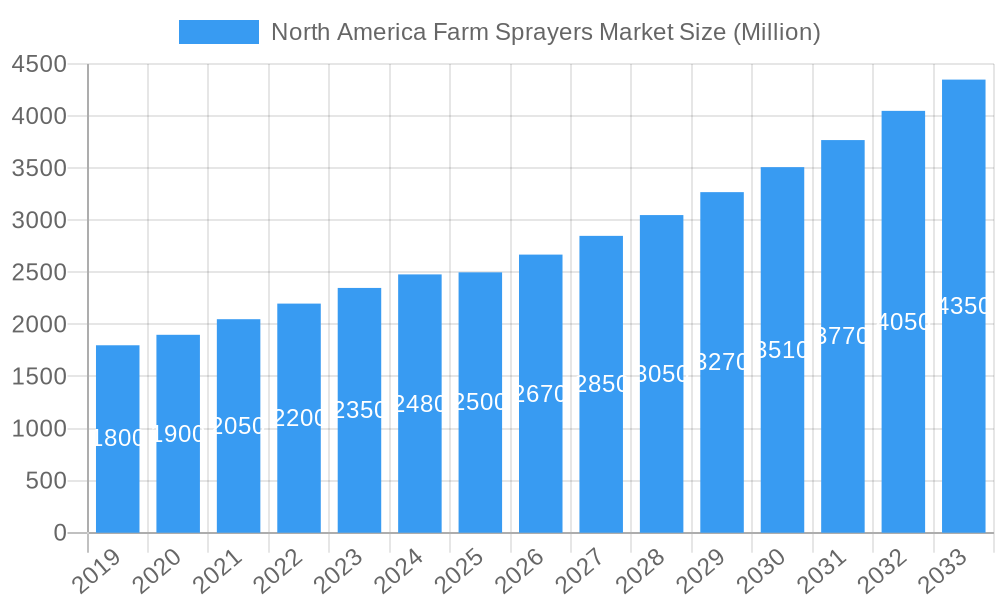

The North American farm sprayers market is poised for robust growth, projected to reach an estimated $2,500 Million by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 7.20% through 2033. This expansion is fueled by several key drivers, including the increasing demand for precision agriculture technologies that enhance crop yields and reduce input costs, alongside a growing need for efficient and sustainable farming practices. The adoption of advanced spraying technologies, such as GPS-guided systems, automated boom controls, and variable rate application, is becoming paramount for farmers seeking to optimize resource allocation and minimize environmental impact. Furthermore, government initiatives promoting agricultural modernization and subsidies supporting the adoption of innovative farm equipment are contributing significantly to market momentum. The segment analysis reveals strong performance in Production and Consumption, with Import and Export markets showing consistent value and volume increases, reflecting global demand and regional specialization in sprayer manufacturing and utilization.

North America Farm Sprayers Market Market Size (In Billion)

Key trends shaping the North American farm sprayers market include the rising popularity of self-propelled sprayers due to their efficiency and maneuverability in large-scale farming operations, alongside a growing interest in drone-based sprayers for niche applications and targeted pest management. The integration of IoT and data analytics into sprayer technology is enabling real-time monitoring and predictive maintenance, further boosting operational efficiency. However, the market faces certain restraints, such as the high initial investment cost for advanced sprayer models, which can be a barrier for small to medium-sized farms. Stringent environmental regulations regarding pesticide application and disposal also necessitate continuous technological advancements and compliance efforts. Despite these challenges, the market is characterized by intense competition among established players like Deere & Company, AGCO Corporation, and GUSS AG, who are actively engaged in research and development to introduce innovative solutions and capture market share across diverse agricultural landscapes in North America.

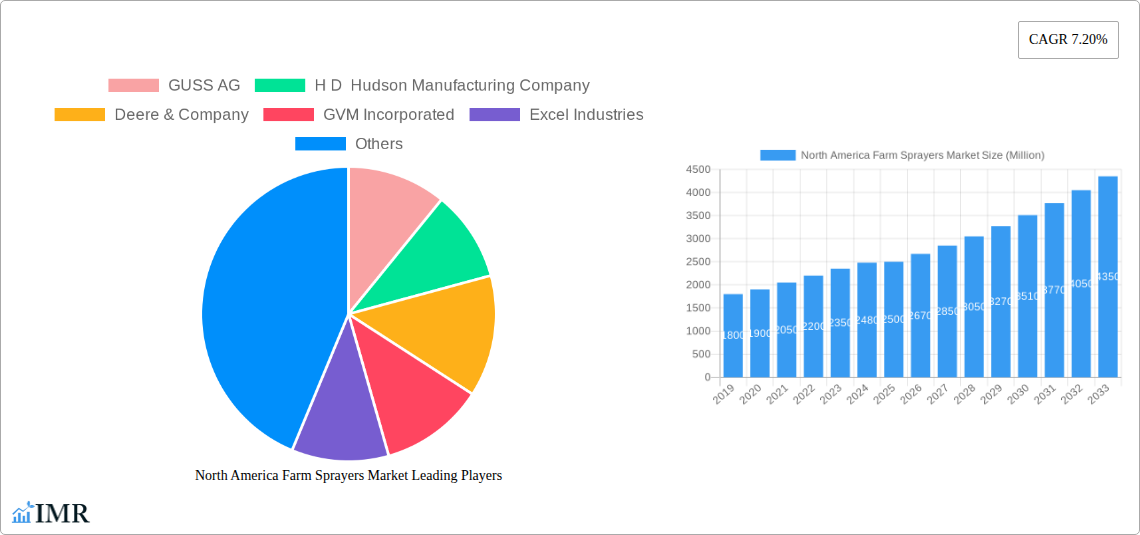

North America Farm Sprayers Market Company Market Share

North America Farm Sprayers Market: Comprehensive Report Description

This in-depth report provides an exhaustive analysis of the North America Farm Sprayers Market, meticulously segmented and analyzed across production, consumption, import/export dynamics, and pricing trends. The study covers a comprehensive period from 2019 to 2033, with a deep dive into the base year of 2025 and a robust forecast for 2025–2033. Leveraging high-traffic keywords such as "farm sprayers North America," "agricultural spraying equipment," "precision agriculture technology," "crop protection solutions," "vertical farming sprayers," and "smart farming machinery," this report is optimized for maximum search engine visibility and designed to engage industry professionals including farmers, agricultural equipment manufacturers, distributors, technology providers, and policymakers. We dissect parent and child markets to offer a granular understanding of market segmentation and growth drivers. All quantitative data is presented in Million units for clarity and comparability.

North America Farm Sprayers Market Market Dynamics & Structure

The North America Farm Sprayers Market is characterized by a dynamic interplay of technological innovation, evolving agricultural practices, and a robust regulatory landscape. Market concentration varies across different sprayer types, with leading players dominating specific niches. Key drivers of technological innovation include the increasing demand for precision agriculture, the adoption of smart farming solutions, and the development of advanced spraying technologies such as drone sprayers and robotic systems. Regulatory frameworks, particularly concerning environmental impact and pesticide application, significantly influence product development and market entry. Competitive product substitutes are emerging, including alternative pest management techniques and integrated crop protection strategies. End-user demographics are shifting, with a growing segment of tech-savvy farmers seeking efficient, data-driven solutions. Mergers and acquisitions (M&A) trends indicate a consolidation among key players and strategic partnerships aimed at expanding product portfolios and market reach.

- Market Concentration: Moderate to high in specific segments like large-scale agricultural sprayers, with a growing number of specialized players in emerging areas like drone and robotic sprayers.

- Technological Innovation Drivers: Precision agriculture adoption, sensor technology advancements, AI and IoT integration, development of autonomous spraying systems, and sustainable agriculture initiatives.

- Regulatory Frameworks: Environmental protection agency (EPA) regulations, pesticide application guidelines, emissions standards, and safety certifications play a crucial role.

- Competitive Product Substitutes: Biological pest control, integrated pest management (IPM), mechanical weeding, and alternative crop protection methods.

- End-User Demographics: Aging farmer population in some regions, alongside a growing cohort of younger, technically inclined farmers adopting innovative solutions.

- M&A Trends: Strategic acquisitions to gain market share in precision spraying, partnerships for R&D in autonomous solutions, and integration of software platforms with hardware.

North America Farm Sprayers Market Growth Trends & Insights

The North America Farm Sprayers Market is poised for significant expansion, driven by a confluence of factors that are reshaping agricultural operations. The market size is projected to evolve from approximately 380 Million units in 2024 to an estimated 650 Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around 6.5% during the forecast period (2025–2033). Adoption rates of advanced spraying technologies are accelerating, fueled by the need for enhanced crop yields, reduced chemical usage, and improved operational efficiency. Technological disruptions, such as the integration of GPS guidance systems, variable rate application (VRA) capabilities, and real-time monitoring through IoT sensors, are transforming traditional spraying methods. Consumer behavior shifts, influenced by demands for sustainable and organic produce, are indirectly impacting the farm sprayers market by pushing for more precise and environmentally friendly application methods. The increasing adoption of precision agriculture techniques, including the use of drone sprayers and automated guidance systems, is a key trend. Market penetration of smart farm sprayers is expected to rise steadily as farmers recognize the economic and environmental benefits. The report leverages extensive market research data, including farmer surveys, expert interviews, and economic modeling, to deliver these insights.

- Market Size Evolution: Projected growth from 380 Million units (2024) to 650 Million units (2033).

- CAGR: Approximately 6.5% during the forecast period (2025–2033).

- Adoption Rates: Rapid increase in the uptake of precision spraying technologies.

- Technological Disruptions: Integration of AI, IoT, drone technology, and autonomous systems.

- Consumer Behavior Shifts: Growing demand for sustainable agriculture influencing sprayer technology choices.

- Market Penetration: Increasing adoption of smart farm sprayers in large-scale and medium-scale agricultural operations.

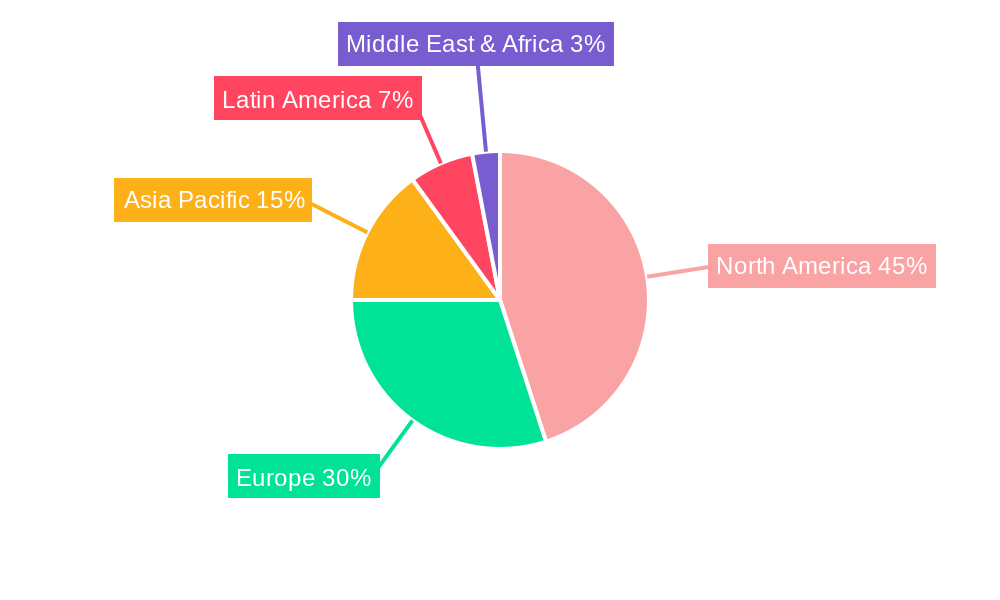

Dominant Regions, Countries, or Segments in North America Farm Sprayers Market

The North America Farm Sprayers Market's dominance is multifaceted, with distinct regions, countries, and product segments driving overall growth. Within the United States, the Corn Belt region emerges as a leading force, propelled by extensive corn and soybean cultivation which necessitates widespread use of crop protection chemicals. The sheer scale of agricultural operations, coupled with a high adoption rate of advanced machinery and precision agriculture technologies, solidifies its position. Canada also contributes significantly, with provinces like Ontario and Saskatchewan showing strong demand for efficient spraying solutions due to their substantial grain and oilseed production.

Analyzing by Production Analysis: , the United States leads in the manufacturing of sophisticated and high-capacity farm sprayers, driven by established companies and a strong R&D infrastructure. Consumption Analysis: mirrors production, with the U.S. consuming the largest volume of farm sprayers due to its vast agricultural land.

In terms of Import Market Analysis (Value & Volume): , while North America has significant domestic production, specialized components and certain types of advanced sprayers might be imported to meet specific technological demands. The Value of imports can be driven by high-end, technologically advanced equipment, while Volume might be less substantial compared to domestic production.

Export Market Analysis (Value & Volume): , North American manufacturers export a considerable volume of farm sprayers, particularly to Latin America and other agricultural economies, leveraging their technological prowess and product quality. The Value of exports is significant due to the premium pricing of advanced spraying systems.

Price Trend Analysis: , prices are influenced by technological sophistication, capacity, brand reputation, and raw material costs. The introduction of smart and autonomous sprayers commands higher price points, reflecting their enhanced capabilities and ROI for farmers.

Industry Developments: , the continuous innovation in precision spraying, including the integration of AI for pest detection and automated boom height control, further entrenches the dominance of regions and segments that readily adopt these advancements. The increasing emphasis on environmental sustainability is also driving the demand for targeted application systems, which are more prevalent in technologically advanced agricultural settings.

- Dominant Region: United States.

- Key Country Drivers: Economic policies supporting agriculture, robust infrastructure for distribution, high farmer income, and proactive adoption of new technologies.

- Production Dominance: United States leads in advanced sprayer manufacturing.

- Consumption Dominance: United States due to its vast agricultural land.

- Import/Export Dynamics: Value driven by high-end technology, volume influenced by domestic production capacity.

- Price Trend Influences: Technology, capacity, brand, and raw material costs.

North America Farm Sprayers Market Product Landscape

The North America Farm Sprayers Market is characterized by a diverse and rapidly evolving product landscape. Innovations range from highly specialized agricultural drone sprayers offering unparalleled precision for spot spraying and targeted chemical application, to robust, large-capacity self-propelled sprayers designed for expansive farmlands. Key applications include crop protection against pests and diseases, nutrient application for enhanced growth, and weed management. Performance metrics focus on application accuracy, swath width, tank capacity, fuel efficiency, and ease of operation. Unique selling propositions often lie in advanced features like boom control systems, GPS guidance, variable rate technology, and integrated data management software that optimizes resource utilization. Technological advancements are pushing towards greater autonomy, real-time data feedback, and reduced environmental impact through drift reduction technologies.

Key Drivers, Barriers & Challenges in North America Farm Sprayers Market

Key Drivers

The North America Farm Sprayers Market is propelled by several critical drivers, including the escalating global demand for food security, necessitating increased agricultural productivity. The rapid adoption of precision agriculture technologies, such as GPS guidance, variable rate application, and smart sensors, is significantly enhancing the efficiency and effectiveness of spraying operations. Government initiatives and subsidies promoting sustainable farming practices and technological adoption further bolster market growth. The increasing prevalence of crop diseases and pest infestations, exacerbated by climate change, also drives the demand for advanced crop protection solutions.

- Precision Agriculture Adoption: Farmers are increasingly investing in technologies that optimize resource usage and improve yields.

- Food Security Demands: The need to produce more food efficiently fuels demand for advanced agricultural machinery.

- Sustainable Farming Initiatives: Growing awareness and regulatory push for environmentally friendly practices.

- Climate Change Impact: Increased pest and disease outbreaks require more effective crop protection.

Barriers & Challenges

Despite strong growth potential, the market faces several barriers and challenges. The high initial investment cost of advanced farm sprayers can be a significant deterrent for small and medium-sized farms. The availability of skilled labor to operate and maintain sophisticated equipment is also a concern. Stringent environmental regulations regarding chemical usage and application methods can add complexity and compliance costs. Furthermore, the market experiences intense competition, with numerous players vying for market share, leading to price pressures. Supply chain disruptions, particularly concerning component sourcing and logistics, can impact production timelines and costs.

- High Initial Investment: The cost of advanced sprayers can be prohibitive for some farmers.

- Skilled Labor Shortage: Lack of trained personnel to operate and service complex machinery.

- Stringent Environmental Regulations: Compliance costs and complexities in chemical application.

- Intense Market Competition: Leading to price pressures and market fragmentation.

- Supply Chain Vulnerabilities: Potential for disruptions impacting production and delivery.

Emerging Opportunities in North America Farm Sprayers Market

Emerging opportunities within the North America Farm Sprayers Market are diverse and promising. The burgeoning field of vertical farming presents a significant untapped market for specialized indoor spraying solutions, focusing on controlled environments and unique application needs. The integration of artificial intelligence (AI) and machine learning (ML) in sprayer technology, enabling predictive maintenance, autonomous operation, and highly personalized crop treatment, represents a substantial growth avenue. The increasing consumer preference for organic and residue-free produce is spurring innovation in biological spray applications and precision application technologies that minimize chemical drift. Furthermore, the development of IoT-enabled sprayer networks for real-time field data collection and analysis offers opportunities for data-driven farming solutions and enhanced farm management.

Growth Accelerators in the North America Farm Sprayers Market Industry

Several catalysts are accelerating the long-term growth of the North America Farm Sprayers Market. Technological breakthroughs in areas such as drone autonomy, sensor accuracy, and spray nozzle efficiency are continually enhancing the performance and cost-effectiveness of spraying solutions. Strategic partnerships between equipment manufacturers, software developers, and agricultural research institutions are fostering innovation and accelerating the development of integrated farm management systems. Market expansion strategies, including the introduction of rental and leasing models for expensive equipment, are making advanced technologies more accessible to a wider range of farmers. The growing focus on data analytics and farm management software that seamlessly integrate with sprayer operations is creating a more connected and intelligent agricultural ecosystem, driving further adoption.

Key Players Shaping the North America Farm Sprayers Market Market

- GUSS AG

- H D Hudson Manufacturing Company

- Deere & Company

- GVM Incorporated

- Excel Industries

- EQUIPMENT TECHNOLOGIES INC.

- Jacto Inc

- AGCO Corporation

Notable Milestones in North America Farm Sprayers Market Sector

- 2019: Launch of advanced autonomous spraying systems by several key players, marking a significant step towards robotic farming.

- 2020: Increased adoption of drone sprayers for targeted pest control and application of biological agents.

- 2021: Introduction of AI-powered weed detection and spot-spraying technologies in self-propelled sprayers.

- 2022: Significant investments in R&D for developing more sustainable and environmentally friendly spraying solutions.

- 2023: Expansion of precision agriculture technology integration, including advanced GPS guidance and variable rate application capabilities across a wider range of sprayer models.

- 2024: Emergence of collaborative robot (cobot) sprayers designed for smaller-scale and specialized farming operations.

In-Depth North America Farm Sprayers Market Market Outlook

The outlook for the North America Farm Sprayers Market is exceptionally positive, driven by a convergence of technological advancement and evolving agricultural demands. Growth accelerators such as the relentless pursuit of precision agriculture, the integration of AI and IoT for smarter farm management, and the increasing emphasis on sustainable and eco-friendly practices will continue to shape the market. Strategic partnerships and market expansion initiatives will further democratize access to advanced spraying technologies. The market is poised for sustained growth, offering significant opportunities for innovation and investment in solutions that enhance efficiency, reduce environmental impact, and contribute to global food security.

North America Farm Sprayers Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

North America Farm Sprayers Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Farm Sprayers Market Regional Market Share

Geographic Coverage of North America Farm Sprayers Market

North America Farm Sprayers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Brazilian Farm Structure and Consolidation of Smaller Farms; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost of Equipment and Price Sensitivity; Data Privacy Concerns

- 3.4. Market Trends

- 3.4.1. Favorable Government Subsidies is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Farm Sprayers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 GUSS AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 H D Hudson Manufacturing Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Deere & Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GVM Incorporated

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Excel Industries

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EQUIPMENT TECHNOLOGIES IN

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jacto Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AGCO Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 GUSS AG

List of Figures

- Figure 1: North America Farm Sprayers Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Farm Sprayers Market Share (%) by Company 2025

List of Tables

- Table 1: North America Farm Sprayers Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Farm Sprayers Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Farm Sprayers Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Farm Sprayers Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Farm Sprayers Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Farm Sprayers Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: North America Farm Sprayers Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Farm Sprayers Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Farm Sprayers Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Farm Sprayers Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Farm Sprayers Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Farm Sprayers Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United States North America Farm Sprayers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Farm Sprayers Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Farm Sprayers Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Farm Sprayers Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the North America Farm Sprayers Market?

Key companies in the market include GUSS AG, H D Hudson Manufacturing Company, Deere & Company, GVM Incorporated, Excel Industries, EQUIPMENT TECHNOLOGIES IN, Jacto Inc, AGCO Corporation.

3. What are the main segments of the North America Farm Sprayers Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Brazilian Farm Structure and Consolidation of Smaller Farms; Technological Advancements.

6. What are the notable trends driving market growth?

Favorable Government Subsidies is Driving the Market.

7. Are there any restraints impacting market growth?

High Cost of Equipment and Price Sensitivity; Data Privacy Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Farm Sprayers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Farm Sprayers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Farm Sprayers Market?

To stay informed about further developments, trends, and reports in the North America Farm Sprayers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence