Key Insights

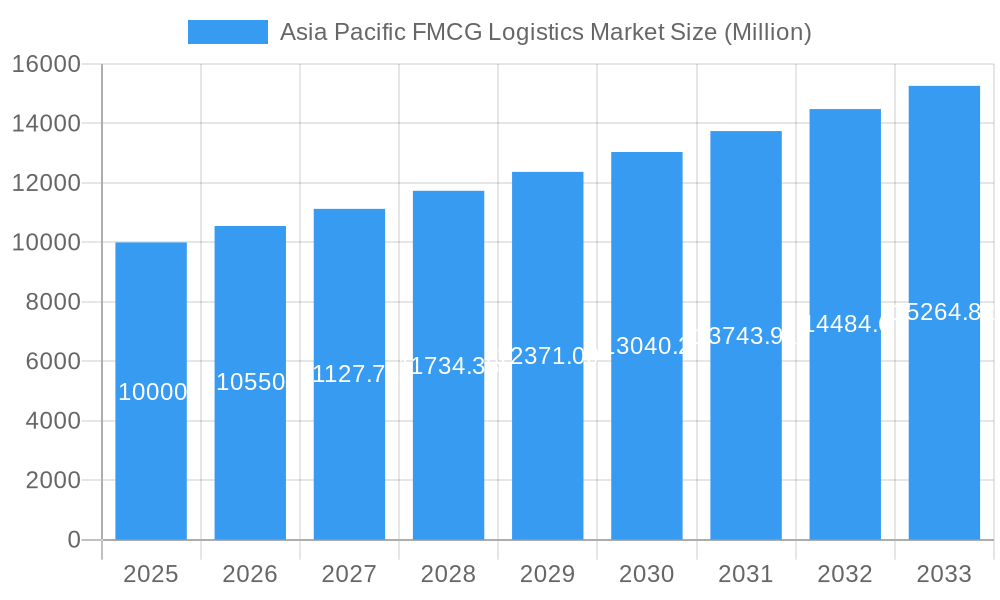

The Asia Pacific FMCG logistics market, valued at approximately $125.3 billion in 2025, is projected for substantial expansion. Driven by a growing middle class, rising disposable incomes, and increased e-commerce adoption, the market is forecast to achieve a compound annual growth rate (CAGR) of 4.2% from 2025 to 2033. Key growth catalysts include the demand for efficient supply chains, omnichannel strategies by FMCG firms, and the integration of AI and automation in logistics. The market is segmented by product category (food & beverage, personal care, household care, other consumables) and service type (transportation, warehousing, distribution, inventory management, value-added services). While major players like DHL, FedEx, and Kuehne + Nagel lead, opportunities exist for specialized providers in emerging economies such as India and China. Challenges include infrastructure gaps, fuel price volatility, and regulatory compliance. Growing emphasis on sustainability and ethical sourcing presents both opportunities and challenges.

Asia Pacific FMCG Logistics Market Market Size (In Billion)

The food and beverage sector is anticipated to lead the market due to high consumer demand and product perishability, requiring specialized logistics. E-commerce expansion is driving demand for last-mile delivery and efficient warehousing. Reaching smaller cities and rural areas necessitates infrastructure investment. The competitive environment features global and regional players, fostering price competition and service innovation. Geopolitical dynamics and potential supply chain disruptions represent ongoing risks.

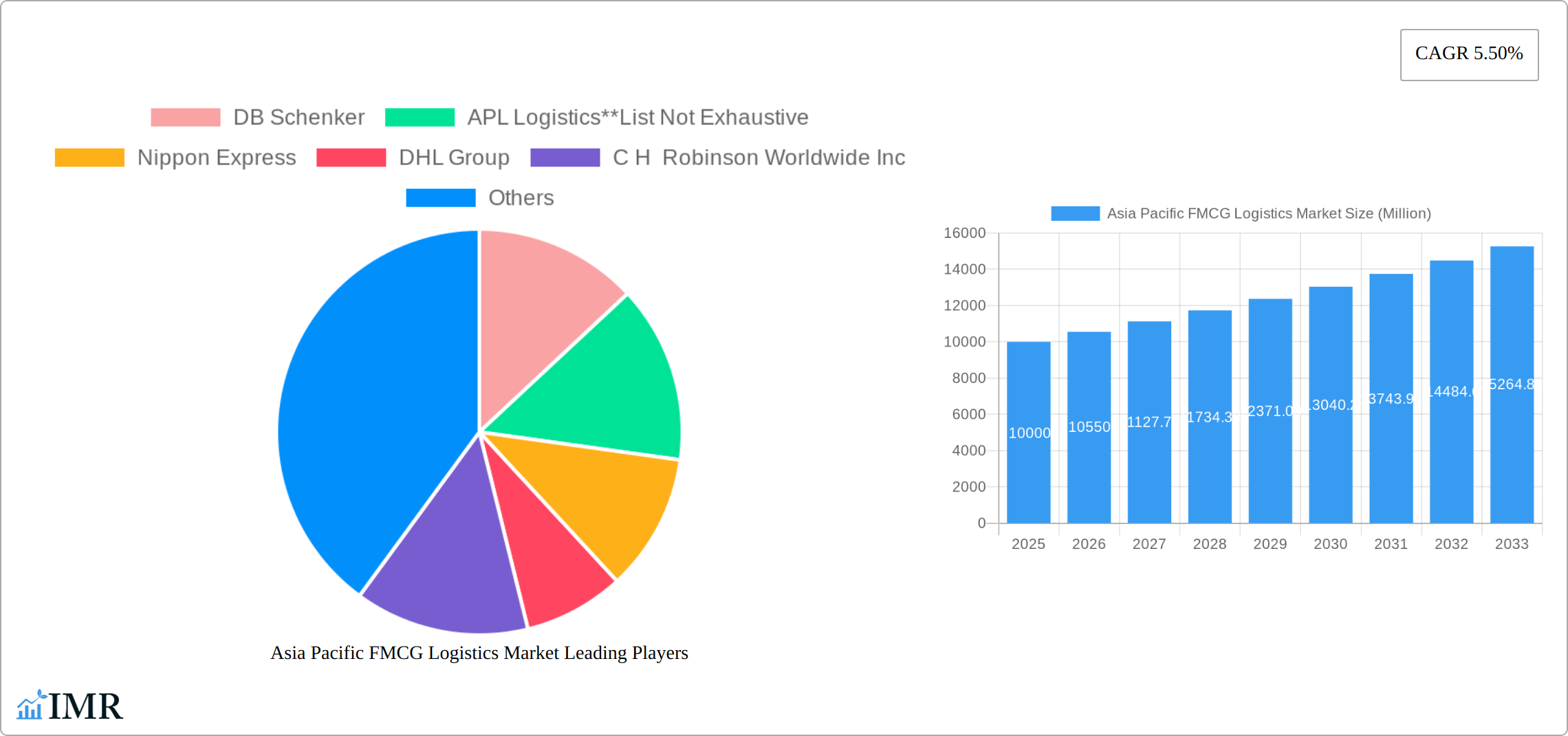

Asia Pacific FMCG Logistics Market Company Market Share

Asia Pacific FMCG Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia Pacific FMCG Logistics market, encompassing market dynamics, growth trends, dominant segments, and key players. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report uses 2025 as the estimated year, and utilizes data from the historical period of 2019-2024. Market values are presented in million units. This report is crucial for FMCG companies, logistics providers, investors, and policymakers seeking to understand and capitalize on opportunities within this rapidly evolving market.

Asia Pacific FMCG Logistics Market Dynamics & Structure

The Asia Pacific FMCG logistics market is characterized by a moderately concentrated landscape, with several major players commanding significant market share. The market's structure is influenced by technological innovation, particularly in areas like automation, data analytics, and sustainable logistics. Stringent regulatory frameworks regarding transportation, warehousing, and product safety influence operational efficiency. The presence of competitive product substitutes and the evolving demographics of end-users significantly shape market demand. Furthermore, mergers and acquisitions (M&A) activity is impacting market consolidation.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025, indicating a moderately concentrated landscape.

- Technological Innovation: Adoption of AI-powered route optimization and warehouse management systems is accelerating, driving efficiency gains. Barriers to innovation include high upfront investment costs and a lack of skilled workforce in some regions.

- Regulatory Frameworks: Varying regulations across countries impact compliance costs and operational complexities. Harmonization efforts are underway but remain fragmented.

- Competitive Product Substitutes: The rise of e-commerce and direct-to-consumer models is creating competitive pressure on traditional logistics channels.

- End-User Demographics: The growing middle class and increasing urbanization are fueling demand for FMCG products and, consequently, logistics services.

- M&A Trends: An estimated xx M&A deals were recorded in the APAC FMCG logistics sector between 2019-2024, indicating a trend of consolidation.

Asia Pacific FMCG Logistics Market Growth Trends & Insights

The Asia Pacific FMCG logistics market experienced robust growth during the historical period (2019-2024), driven by a combination of factors. Market size is projected to expand significantly during the forecast period (2025-2033), fueled by rising disposable incomes, e-commerce penetration, and evolving consumer preferences towards convenience and online shopping. Technological disruptions, such as the adoption of blockchain technology for enhanced supply chain transparency, contribute to market expansion. Consumer behavior shifts toward online purchases and subscription services are reshaping logistics requirements.

The market is expected to register a CAGR of xx% during the forecast period (2025-2033), exceeding the global average. This growth is largely attributed to the increasing demand for efficient and reliable logistics solutions to support the booming e-commerce sector. Market penetration of advanced logistics technologies is expected to rise to xx% by 2033.

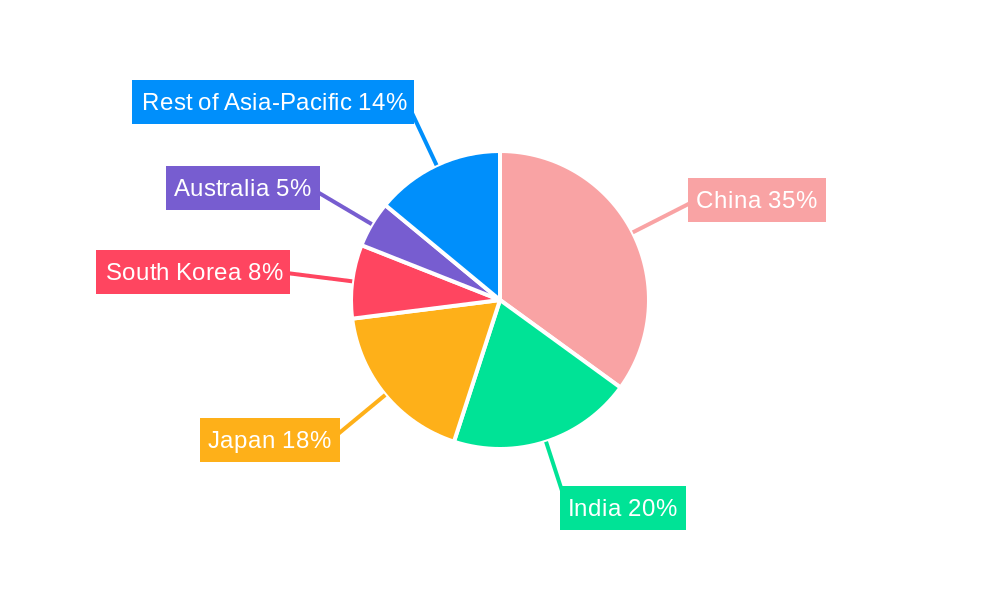

Dominant Regions, Countries, or Segments in Asia Pacific FMCG Logistics Market

China and India are the dominant markets within the Asia Pacific region, accounting for xx% and xx% of the total market value in 2025, respectively. Within product categories, the Food and Beverage segment holds the largest share, driven by high consumption levels and the need for temperature-controlled transportation. Transportation services constitute the largest segment within service types, followed by warehousing.

- Key Drivers in China & India:

- Robust economic growth and rising disposable incomes.

- Expanding e-commerce infrastructure and consumer adoption.

- Government initiatives to improve logistics infrastructure (e.g., investments in road and rail networks).

- Dominance Factors:

- Large consumer base and high FMCG consumption.

- Extensive manufacturing bases and robust supply chains.

- Favorable government policies supporting economic growth.

- Growth Potential:

- Continued urbanization and rising middle class.

- Expansion of cold chain logistics to cater to perishable goods.

- Increased adoption of technology-driven solutions.

Asia Pacific FMCG Logistics Market Product Landscape

The Asia Pacific FMCG logistics market is characterized by a dynamic and rapidly evolving product landscape, driven by an unceasing pursuit of efficiency, sustainability, and enhanced customer experience. Key advancements include sophisticated temperature-controlled transportation solutions, ensuring the integrity of perishable goods across diverse climates. Automated warehousing systems, featuring robotics, automated storage and retrieval systems (AS/RS), and advanced sorting technologies, are revolutionizing inventory management and order fulfillment. Furthermore, the widespread adoption of real-time tracking and visibility technologies, powered by IoT sensors, GPS, and blockchain, provides unprecedented transparency throughout the supply chain. These innovations collectively contribute to significant improvements in operational efficiency, substantial cost reductions, and a bolstered overall supply chain resilience. Unique selling propositions that are gaining traction include expedited delivery times, superior product traceability from origin to consumer, and a reduced environmental footprint achieved through the implementation of sustainable logistics practices such as optimized routing, electric vehicle adoption, and eco-friendly packaging solutions.

Key Drivers, Barriers & Challenges in Asia Pacific FMCG Logistics Market

Key Drivers: The Asia Pacific FMCG logistics market is experiencing robust growth fueled by a confluence of powerful factors. The rapid and sustained growth of e-commerce, coupled with the increasing urbanization across the region, has created a burgeoning demand for efficient last-mile delivery solutions. Rising disposable incomes are further stimulating consumer spending on FMCG products, thereby increasing logistics volumes. Proactive government initiatives promoting logistics infrastructure development, including the expansion of ports, roads, and digital networks, are laying a crucial foundation for market expansion. Concurrently, rapid technological advancements, particularly in the realms of Artificial Intelligence (AI), the Internet of Things (IoT), and big data analytics, are enabling more intelligent and optimized logistics operations. For instance, the strategic implementation of automated guided vehicles (AGVs) and robotic process automation (RPA) within warehouses is demonstrably increasing operational throughput and reducing labor-intensive tasks, thereby enhancing overall efficiency and accuracy.

Key Challenges: Despite the positive growth trajectory, the market grapples with several significant hurdles. Infrastructure limitations, particularly in emerging economies and certain sub-regions of Southeast Asia, continue to create logistical bottlenecks, leading to increased transit times and elevated operational costs. The complex and often divergent stringent regulatory compliance requirements across different nations within the Asia Pacific necessitate considerable effort and investment to ensure adherence. Intense market competition among logistics providers drives down margins, while the inherent volatility of fluctuating fuel prices poses a persistent threat to profitability and cost predictability. These combined challenges unfortunately contribute to a significant percentage of delayed deliveries, with an estimated XX% of deliveries experiencing delays in 2024 due to unforeseen disruptions and logistical inefficiencies.

Emerging Opportunities in Asia Pacific FMCG Logistics Market

Untapped markets in less-developed regions, particularly in Southeast Asia, present significant growth opportunities. The increasing demand for specialized logistics solutions, such as cold chain logistics for pharmaceutical and food products, offers promising prospects. The growing focus on sustainable and eco-friendly logistics practices opens new avenues for market players.

Growth Accelerators in the Asia Pacific FMCG Logistics Market Industry

The Asia Pacific FMCG logistics market industry is being propelled forward by several key growth accelerators. Foremost among these are the transformative technological advancements in automation, AI, and sophisticated data analytics. These innovations are not merely incremental improvements but are fundamentally reshaping logistics operations by significantly boosting efficiency, optimizing resource allocation, and enabling predictive capabilities for better demand forecasting and inventory management. The strategic formation of partnerships between leading logistics providers and prominent FMCG companies is another crucial growth driver. These collaborations foster enhanced supply chain integration, enabling seamless data flow, streamlined processes, and a more agile response to market dynamics. The persistent and accelerating expansion of e-commerce, coupled with the increasing adoption of omnichannel distribution strategies by retailers, is creating an unprecedented demand for flexible, scalable, and responsive logistics solutions capable of handling diverse order fulfillment requirements across online and offline channels.

Key Players Shaping the Asia Pacific FMCG Logistics Market Market

- DB Schenker

- APL Logistics

- Nippon Express

- DHL Group

- C.H. Robinson Worldwide Inc

- XPO Logistics

- Kuehne + Nagel International AG

- FedEx

- CEVA Logistics

- Agility Logistics

- Hellmann Worldwide Logistics

Notable Milestones in Asia Pacific FMCG Logistics Market Sector

- 2021 Q4: DHL Group further solidified its commitment to operational excellence in the region by launching a state-of-the-art, highly automated warehouse facility in Singapore, designed to handle the growing demands of e-commerce fulfillment and advanced supply chain solutions.

- 2022 Q1: DB Schenker, a global logistics powerhouse, announced a strategic partnership with a cutting-edge technology provider to implement advanced AI-powered route optimization software, aiming to enhance delivery efficiency, reduce carbon emissions, and improve customer service across its Asia Pacific operations.

- 2023 Q2: A significant strategic merger occurred between two prominent regional logistics providers operating within Southeast Asia. This consolidation is expected to create a larger, more integrated entity with expanded capabilities and a broader geographic reach, potentially reshaping the competitive landscape of the FMCG logistics sector in the sub-region. (Further details on the specific entities and the impact of this merger are still emerging, with an estimated market impact of XX%)

In-Depth Asia Pacific FMCG Logistics Market Market Outlook

The Asia Pacific FMCG logistics market is poised for a sustained period of robust growth, underpinned by a powerful combination of accelerating technological adoption, strong underlying economic expansion across key markets, and the continuous evolution of consumer preferences towards convenience and speed. The future landscape of this vital sector will be significantly shaped by strategic collaborations, substantial investments in modernizing and expanding critical infrastructure, and an increasingly pronounced emphasis on environmental sustainability. Opportunities abound for agile and forward-thinking players who can adeptly offer innovative, technology-driven solutions, demonstrate exceptional operational efficiency, and maintain a steadfast commitment to environmental responsibility. The market is projected to experience substantial expansion, with an estimated value reaching XX million units by 2033, reflecting the region's burgeoning consumer base and the critical role of efficient logistics in serving it.

Asia Pacific FMCG Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehous

- 1.3. Other Value-added Services

-

2. Product Category

- 2.1. Food and Beverage

- 2.2. Personal Care

- 2.3. Household Care

- 2.4. Other Consumables

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Singapore

- 3.6. Indonesia

- 3.7. Vietnam

- 3.8. Malaysia

- 3.9. Thailand

- 3.10. Australia

- 3.11. Rest of Asia-Pacific

Asia Pacific FMCG Logistics Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Singapore

- 6. Indonesia

- 7. Vietnam

- 8. Malaysia

- 9. Thailand

- 10. Australia

- 11. Rest of Asia Pacific

Asia Pacific FMCG Logistics Market Regional Market Share

Geographic Coverage of Asia Pacific FMCG Logistics Market

Asia Pacific FMCG Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strategic Location; Economic diversification

- 3.3. Market Restrains

- 3.3.1. Infrastructure challenges; Skilled workforce

- 3.4. Market Trends

- 3.4.1. Growing Cold Storage and Refrigerated Warehouses Market Worldwide

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehous

- 5.1.3. Other Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by Product Category

- 5.2.1. Food and Beverage

- 5.2.2. Personal Care

- 5.2.3. Household Care

- 5.2.4. Other Consumables

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Singapore

- 5.3.6. Indonesia

- 5.3.7. Vietnam

- 5.3.8. Malaysia

- 5.3.9. Thailand

- 5.3.10. Australia

- 5.3.11. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Singapore

- 5.4.6. Indonesia

- 5.4.7. Vietnam

- 5.4.8. Malaysia

- 5.4.9. Thailand

- 5.4.10. Australia

- 5.4.11. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. China Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Warehous

- 6.1.3. Other Value-added Services

- 6.2. Market Analysis, Insights and Forecast - by Product Category

- 6.2.1. Food and Beverage

- 6.2.2. Personal Care

- 6.2.3. Household Care

- 6.2.4. Other Consumables

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. Singapore

- 6.3.6. Indonesia

- 6.3.7. Vietnam

- 6.3.8. Malaysia

- 6.3.9. Thailand

- 6.3.10. Australia

- 6.3.11. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. India Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Warehous

- 7.1.3. Other Value-added Services

- 7.2. Market Analysis, Insights and Forecast - by Product Category

- 7.2.1. Food and Beverage

- 7.2.2. Personal Care

- 7.2.3. Household Care

- 7.2.4. Other Consumables

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. Singapore

- 7.3.6. Indonesia

- 7.3.7. Vietnam

- 7.3.8. Malaysia

- 7.3.9. Thailand

- 7.3.10. Australia

- 7.3.11. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Japan Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Warehous

- 8.1.3. Other Value-added Services

- 8.2. Market Analysis, Insights and Forecast - by Product Category

- 8.2.1. Food and Beverage

- 8.2.2. Personal Care

- 8.2.3. Household Care

- 8.2.4. Other Consumables

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. Singapore

- 8.3.6. Indonesia

- 8.3.7. Vietnam

- 8.3.8. Malaysia

- 8.3.9. Thailand

- 8.3.10. Australia

- 8.3.11. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. South Korea Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Warehous

- 9.1.3. Other Value-added Services

- 9.2. Market Analysis, Insights and Forecast - by Product Category

- 9.2.1. Food and Beverage

- 9.2.2. Personal Care

- 9.2.3. Household Care

- 9.2.4. Other Consumables

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. Singapore

- 9.3.6. Indonesia

- 9.3.7. Vietnam

- 9.3.8. Malaysia

- 9.3.9. Thailand

- 9.3.10. Australia

- 9.3.11. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Singapore Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Transportation

- 10.1.2. Warehous

- 10.1.3. Other Value-added Services

- 10.2. Market Analysis, Insights and Forecast - by Product Category

- 10.2.1. Food and Beverage

- 10.2.2. Personal Care

- 10.2.3. Household Care

- 10.2.4. Other Consumables

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. Singapore

- 10.3.6. Indonesia

- 10.3.7. Vietnam

- 10.3.8. Malaysia

- 10.3.9. Thailand

- 10.3.10. Australia

- 10.3.11. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Indonesia Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service

- 11.1.1. Transportation

- 11.1.2. Warehous

- 11.1.3. Other Value-added Services

- 11.2. Market Analysis, Insights and Forecast - by Product Category

- 11.2.1. Food and Beverage

- 11.2.2. Personal Care

- 11.2.3. Household Care

- 11.2.4. Other Consumables

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. South Korea

- 11.3.5. Singapore

- 11.3.6. Indonesia

- 11.3.7. Vietnam

- 11.3.8. Malaysia

- 11.3.9. Thailand

- 11.3.10. Australia

- 11.3.11. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Service

- 12. Vietnam Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Service

- 12.1.1. Transportation

- 12.1.2. Warehous

- 12.1.3. Other Value-added Services

- 12.2. Market Analysis, Insights and Forecast - by Product Category

- 12.2.1. Food and Beverage

- 12.2.2. Personal Care

- 12.2.3. Household Care

- 12.2.4. Other Consumables

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. China

- 12.3.2. India

- 12.3.3. Japan

- 12.3.4. South Korea

- 12.3.5. Singapore

- 12.3.6. Indonesia

- 12.3.7. Vietnam

- 12.3.8. Malaysia

- 12.3.9. Thailand

- 12.3.10. Australia

- 12.3.11. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Service

- 13. Malaysia Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Service

- 13.1.1. Transportation

- 13.1.2. Warehous

- 13.1.3. Other Value-added Services

- 13.2. Market Analysis, Insights and Forecast - by Product Category

- 13.2.1. Food and Beverage

- 13.2.2. Personal Care

- 13.2.3. Household Care

- 13.2.4. Other Consumables

- 13.3. Market Analysis, Insights and Forecast - by Geography

- 13.3.1. China

- 13.3.2. India

- 13.3.3. Japan

- 13.3.4. South Korea

- 13.3.5. Singapore

- 13.3.6. Indonesia

- 13.3.7. Vietnam

- 13.3.8. Malaysia

- 13.3.9. Thailand

- 13.3.10. Australia

- 13.3.11. Rest of Asia-Pacific

- 13.1. Market Analysis, Insights and Forecast - by Service

- 14. Thailand Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by Service

- 14.1.1. Transportation

- 14.1.2. Warehous

- 14.1.3. Other Value-added Services

- 14.2. Market Analysis, Insights and Forecast - by Product Category

- 14.2.1. Food and Beverage

- 14.2.2. Personal Care

- 14.2.3. Household Care

- 14.2.4. Other Consumables

- 14.3. Market Analysis, Insights and Forecast - by Geography

- 14.3.1. China

- 14.3.2. India

- 14.3.3. Japan

- 14.3.4. South Korea

- 14.3.5. Singapore

- 14.3.6. Indonesia

- 14.3.7. Vietnam

- 14.3.8. Malaysia

- 14.3.9. Thailand

- 14.3.10. Australia

- 14.3.11. Rest of Asia-Pacific

- 14.1. Market Analysis, Insights and Forecast - by Service

- 15. Australia Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - by Service

- 15.1.1. Transportation

- 15.1.2. Warehous

- 15.1.3. Other Value-added Services

- 15.2. Market Analysis, Insights and Forecast - by Product Category

- 15.2.1. Food and Beverage

- 15.2.2. Personal Care

- 15.2.3. Household Care

- 15.2.4. Other Consumables

- 15.3. Market Analysis, Insights and Forecast - by Geography

- 15.3.1. China

- 15.3.2. India

- 15.3.3. Japan

- 15.3.4. South Korea

- 15.3.5. Singapore

- 15.3.6. Indonesia

- 15.3.7. Vietnam

- 15.3.8. Malaysia

- 15.3.9. Thailand

- 15.3.10. Australia

- 15.3.11. Rest of Asia-Pacific

- 15.1. Market Analysis, Insights and Forecast - by Service

- 16. Rest of Asia Pacific Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 16.1. Market Analysis, Insights and Forecast - by Service

- 16.1.1. Transportation

- 16.1.2. Warehous

- 16.1.3. Other Value-added Services

- 16.2. Market Analysis, Insights and Forecast - by Product Category

- 16.2.1. Food and Beverage

- 16.2.2. Personal Care

- 16.2.3. Household Care

- 16.2.4. Other Consumables

- 16.3. Market Analysis, Insights and Forecast - by Geography

- 16.3.1. China

- 16.3.2. India

- 16.3.3. Japan

- 16.3.4. South Korea

- 16.3.5. Singapore

- 16.3.6. Indonesia

- 16.3.7. Vietnam

- 16.3.8. Malaysia

- 16.3.9. Thailand

- 16.3.10. Australia

- 16.3.11. Rest of Asia-Pacific

- 16.1. Market Analysis, Insights and Forecast - by Service

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2025

- 17.2. Company Profiles

- 17.2.1 DB Schenker

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 APL Logistics**List Not Exhaustive

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Nippon Express

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 DHL Group

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 C H Robinson Worldwide Inc

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 XPO Logistics

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Kuehne + Nagel International AG

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 FedEx

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 CEVA Logistics

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Agility Logistics

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Hellmann Worlwide Logistics

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.1 DB Schenker

List of Figures

- Figure 1: Asia Pacific FMCG Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific FMCG Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 3: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 7: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 10: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 11: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 14: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 15: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 18: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 19: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 22: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 23: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 26: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 27: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 30: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 31: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 32: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 33: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 34: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 35: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 36: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 38: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 39: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 40: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 42: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 43: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 44: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 45: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 46: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 47: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 48: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific FMCG Logistics Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Asia Pacific FMCG Logistics Market?

Key companies in the market include DB Schenker, APL Logistics**List Not Exhaustive, Nippon Express, DHL Group, C H Robinson Worldwide Inc, XPO Logistics, Kuehne + Nagel International AG, FedEx, CEVA Logistics, Agility Logistics, Hellmann Worlwide Logistics.

3. What are the main segments of the Asia Pacific FMCG Logistics Market?

The market segments include Service, Product Category, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 125.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Strategic Location; Economic diversification.

6. What are the notable trends driving market growth?

Growing Cold Storage and Refrigerated Warehouses Market Worldwide.

7. Are there any restraints impacting market growth?

Infrastructure challenges; Skilled workforce.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific FMCG Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific FMCG Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific FMCG Logistics Market?

To stay informed about further developments, trends, and reports in the Asia Pacific FMCG Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence