Key Insights

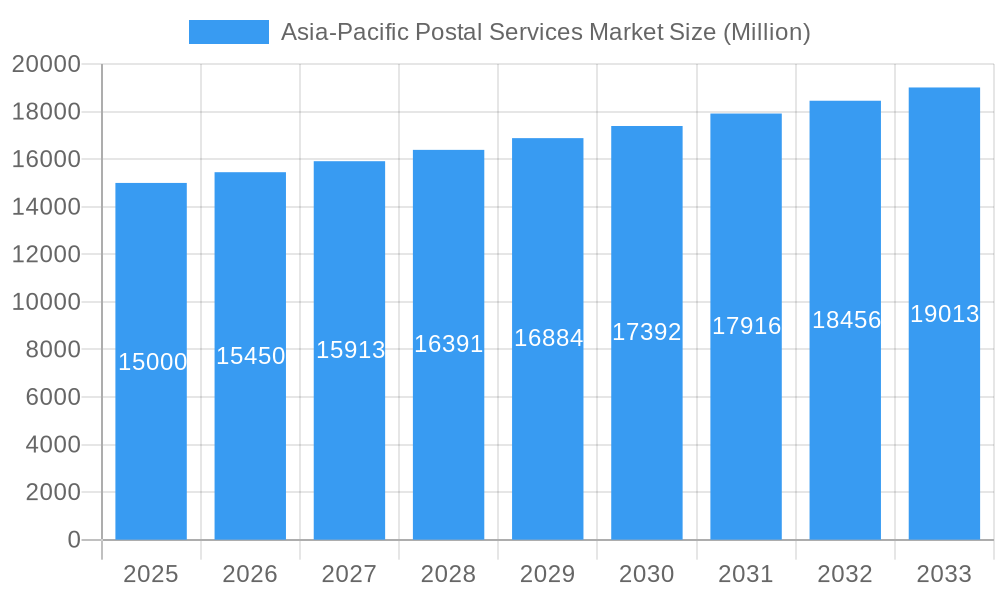

The Asia-Pacific postal services market is poised for substantial expansion, projected to reach a market size of $172.37 billion by 2025. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 7.7%, anticipated from 2025 to 2033. Key growth drivers include the burgeoning e-commerce sector, which is intensifying demand for express parcel and letter delivery, both domestically and internationally. Escalating cross-border trade and globalization, particularly within rapidly developing economies such as India and China, are further propelling market advancement. Technological innovations, including automated sorting and enhanced tracking, are improving operational efficiency and customer satisfaction. The increasing integration of digital solutions is also enhancing convenience and delivery speed. However, the market faces challenges such as intense competition from private couriers, volatile fuel costs affecting operational expenditures, and the imperative for continuous infrastructure modernization to manage escalating parcel volumes. The market is segmented by service type (express and standard), item type (letters and parcels), destination (domestic and international), and key regional markets including India, China, Japan, Singapore, South Korea, Australia, and New Zealand.

Asia-Pacific Postal Services Market Market Size (In Billion)

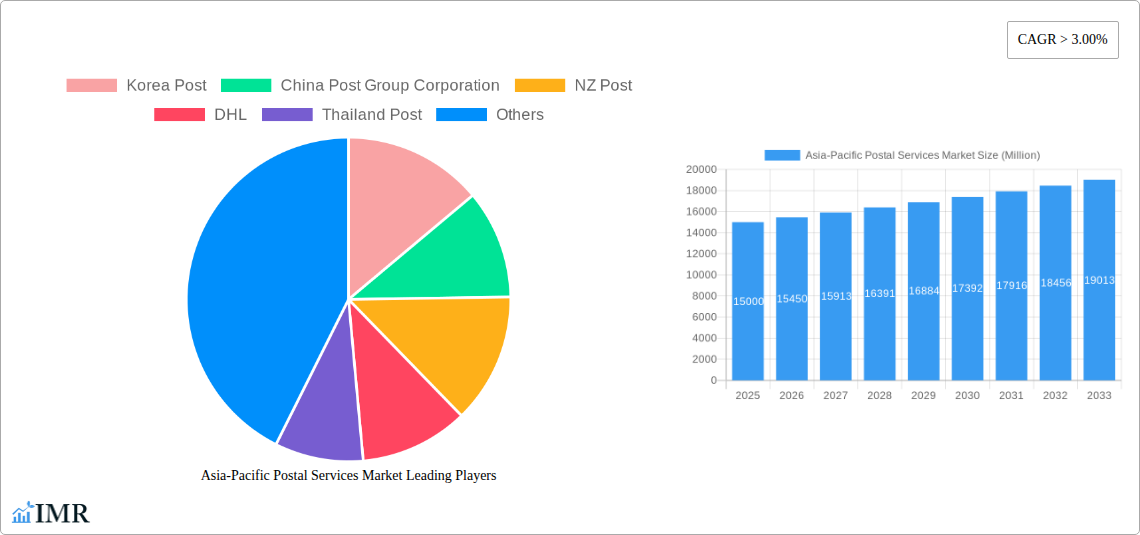

The competitive environment is characterized by a mix of established national postal operators (e.g., India Post, China Post Group Corporation, Japan Post Co Ltd, Australia Post, and Singapore Post Limited) and leading global private players (e.g., DHL, FedEx). While national postal services leverage their extensive networks and infrastructure, they are increasingly challenged by private entities offering specialized services and expedited delivery. Future growth in the Asia-Pacific postal services market will be contingent upon sustained e-commerce expansion, strategic infrastructure development, technological adoption, and the agility of postal providers to meet evolving consumer and business demands. Partnerships and technological investments are crucial for maintaining competitive advantage and market share within this dynamic sector. Service differentiation through value-added offerings and superior customer experience will be pivotal for future market positioning.

Asia-Pacific Postal Services Market Company Market Share

Asia-Pacific Postal Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific Postal Services market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period and utilizes 2025 as the base year. The market is segmented by type (Express Postal Services, Standard Postal Services), item (Letter, Parcel), destination (Domestic, International), and country (India, China, Japan, Singapore, South Korea, Australia, New Zealand, Rest of Asia-Pacific). Key players analyzed include Korea Post, China Post Group Corporation, NZ Post, DHL, Thailand Post, Australian Postal Corporation, Hongkong Post, FedEx, India Post, Singapore Post Limited, Japan Post Co Ltd, DTDC EXPRESS LTD, Pos Malaysia Berhad, and Pos Indonesia. This report is an essential resource for industry professionals, investors, and anyone seeking to understand the complexities and opportunities within this dynamic market. The total market size is predicted to reach xx Million by 2033.

Asia-Pacific Postal Services Market Dynamics & Structure

The Asia-Pacific postal services market exhibits a complex interplay of factors influencing its structure and growth. Market concentration is moderate, with a few dominant players like China Post and Japan Post alongside numerous smaller national and regional operators. Technological innovation, driven by the need for improved efficiency and tracking capabilities, is a key driver, though implementation varies across countries due to infrastructure limitations and digital literacy disparities. Regulatory frameworks, often differing significantly between nations, impact pricing, service standards, and market access. Competitive product substitutes, such as private courier services and digital communication platforms, exert increasing pressure, particularly in the express segment. End-user demographics, with a growing middle class and expanding e-commerce activities, are key growth drivers, particularly in the parcel segment. M&A activity remains relatively modest but strategic partnerships are increasing.

- Market Concentration: Moderate, with a mix of large national operators and smaller private players.

- Technological Innovation: A key driver, but implementation varies based on infrastructure and digital literacy.

- Regulatory Frameworks: Diverse across the region, influencing pricing, service standards, and market access.

- Competitive Substitutes: Private courier services and digital communication pose increasing competition.

- End-User Demographics: A growing middle class and e-commerce expansion fuel demand, especially for parcels.

- M&A Activity: Relatively low, but strategic partnerships are on the rise. The total value of M&A deals in the last five years was approximately xx Million.

Asia-Pacific Postal Services Market Growth Trends & Insights

The Asia-Pacific postal services market has witnessed significant growth over the past few years, driven by the burgeoning e-commerce sector and increasing cross-border trade. The market size, currently estimated at xx Million in 2025, is projected to grow at a CAGR of xx% during the forecast period (2025-2033), reaching xx Million by 2033. This growth is fueled by rising adoption rates of online shopping, particularly in developing economies, leading to an increased demand for both domestic and international parcel delivery services. Technological advancements, such as automated sorting systems and improved tracking technologies, are enhancing operational efficiency. Consumer behavior shifts towards convenience and speed are driving the demand for express postal services. Market penetration of postal services remains high but varies across countries, with higher penetration in developed economies. The adoption of digital technologies and mobile payment systems is also accelerating market growth.

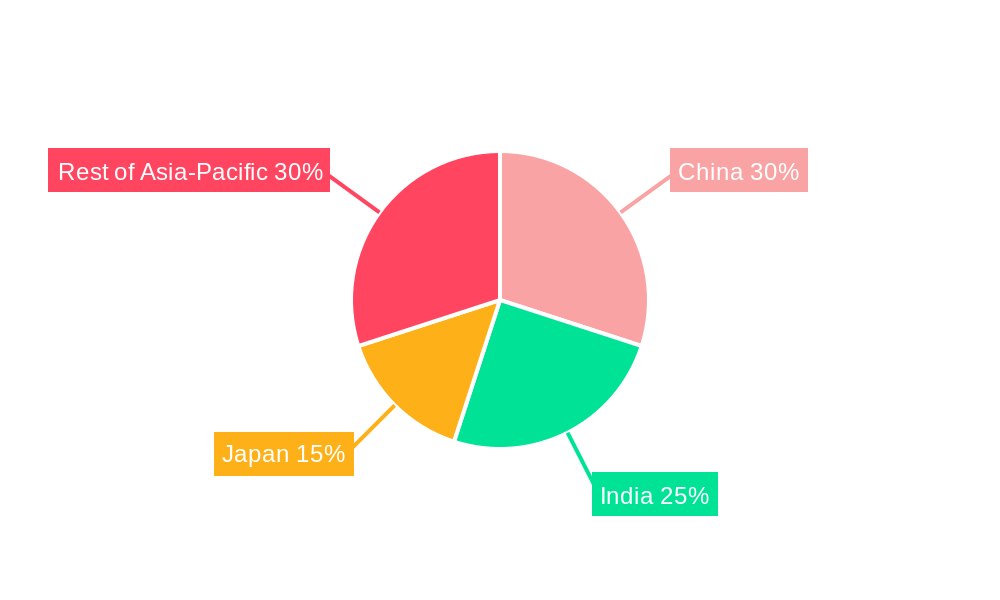

Dominant Regions, Countries, or Segments in Asia-Pacific Postal Services Market

China and India, with their vast populations and rapidly expanding e-commerce sectors, dominate the Asia-Pacific postal services market, representing a combined market share of approximately xx%. The express postal services segment exhibits higher growth compared to standard postal services due to the increasing preference for faster delivery times, particularly for e-commerce shipments. The parcel segment is experiencing the fastest growth owing to the rise of e-commerce. The international segment shows promising growth potential as cross-border trade continues to expand. Several factors contribute to the dominance of these regions and segments: robust economic growth, expanding middle-class populations, significant investments in infrastructure, and supportive government policies promoting e-commerce and logistics development.

- Key Drivers in China and India: Rapid e-commerce growth, large populations, and substantial investments in logistics infrastructure.

- Express Postal Services: Driven by rising demand for faster delivery times, particularly for e-commerce.

- Parcel Segment: Experiencing the fastest growth due to the surge in online shopping.

- International Segment: High growth potential due to expanding cross-border trade.

Asia-Pacific Postal Services Market Product Landscape

The Asia-Pacific postal services market features a diverse product landscape encompassing a range of services tailored to varying customer needs. Standard postal services include letter and parcel delivery, while express services provide faster and more reliable delivery options, often with enhanced tracking capabilities. Innovations include the use of automation and digital technologies for efficient sorting, tracking, and delivery. The focus is increasingly on improving last-mile delivery, particularly in rural areas, through partnerships with local delivery networks and leveraging innovative solutions. The unique selling propositions revolve around speed, reliability, cost-effectiveness, and advanced tracking systems. Technological advancements include the implementation of AI-powered sorting systems, drone delivery trials, and enhanced digital tracking platforms.

Key Drivers, Barriers & Challenges in Asia-Pacific Postal Services Market

Key Drivers: The expanding e-commerce sector, growing middle class, increasing cross-border trade, and government initiatives promoting logistics development are key drivers. Technological advancements such as automated sorting systems and improved tracking technologies are improving efficiency.

Key Barriers and Challenges: Infrastructure limitations in certain regions hinder efficient delivery. Competition from private courier services and regulatory hurdles in some markets pose significant challenges. Supply chain disruptions caused by geopolitical events can impact delivery times and costs. The estimated impact of these challenges on market growth is a reduction of approximately xx% in the next five years.

Emerging Opportunities in Asia-Pacific Postal Services Market

Untapped markets in rural areas and underserved communities present significant opportunities for expansion. Innovative applications such as drone delivery and the integration of blockchain technology for enhanced security and transparency are emerging trends. The evolving consumer preference for convenience and personalized services provides avenues for customized delivery solutions. The growth of cross-border e-commerce opens doors for specialized international shipping services.

Growth Accelerators in the Asia-Pacific Postal Services Market Industry

Technological breakthroughs in automation, tracking, and delivery systems are driving efficiency gains and cost reductions. Strategic partnerships between postal services and e-commerce platforms are streamlining delivery processes. Expanding into underserved markets and offering specialized services tailored to specific customer segments are vital growth strategies. Government support for infrastructure development and e-commerce initiatives will further accelerate market growth.

Key Players Shaping the Asia-Pacific Postal Services Market Market

- Korea Post

- China Post Group Corporation

- NZ Post

- DHL

- Thailand Post

- Australian Postal Corporation

- Hongkong Post

- FedEx

- India Post

- Singapore Post Limited

- Japan Post Co Ltd

- DTDC EXPRESS LTD

- Pos Malaysia Berhad

- Pos Indonesia

Notable Milestones in Asia-Pacific Postal Services Market Sector

- September 2022: The Australian Government and Australia Post launched the Pacific Postal Development Partnership, receiving a USD 450,000 contribution to improve postal services in the Pacific region. This initiative improves efficiency and security, benefiting consumers and businesses.

- July 2022: China's postal sector announced a green transformation plan, aiming to recycle 700 million corrugated boxes and utilize 10 million recyclable boxes, alongside using more new energy vehicles and green distribution hubs.

In-Depth Asia-Pacific Postal Services Market Market Outlook

The Asia-Pacific postal services market is poised for sustained growth, driven by the continuing expansion of e-commerce, technological advancements, and supportive government policies. Strategic investments in infrastructure, technological upgrades, and the expansion into untapped markets will be key factors shaping the market's future trajectory. The market presents significant opportunities for both established players and new entrants, particularly those focusing on innovation, efficiency, and customer-centric services. The projected market size indicates a substantial growth potential for the coming years, presenting an attractive investment landscape.

Asia-Pacific Postal Services Market Segmentation

-

1. Type

- 1.1. Express Postal Services

- 1.2. Standard Postal Services

-

2. Item

- 2.1. Letter

- 2.2. Parcel

-

3. Destination

- 3.1. Domestic

- 3.2. International

Asia-Pacific Postal Services Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Postal Services Market Regional Market Share

Geographic Coverage of Asia-Pacific Postal Services Market

Asia-Pacific Postal Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise In eCommerce; Rise In Urbanization

- 3.3. Market Restrains

- 3.3.1. The Risk of Package Theft or Damage; Cost Efficiency

- 3.4. Market Trends

- 3.4.1. Liberalization Affecting the Market Share of Designated Operators

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Postal Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Express Postal Services

- 5.1.2. Standard Postal Services

- 5.2. Market Analysis, Insights and Forecast - by Item

- 5.2.1. Letter

- 5.2.2. Parcel

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Korea Post

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Post Group Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 NZ Post

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DHL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Thailand Post

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Australian Postal Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hongkong Post**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FedEx

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 India Post

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Singapore Post Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Japan Post Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DTDC EXPRESS LTD

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Pos Malaysia Berhad

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Pos Indonesia

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Korea Post

List of Figures

- Figure 1: Asia-Pacific Postal Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Postal Services Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Postal Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Postal Services Market Revenue billion Forecast, by Item 2020 & 2033

- Table 3: Asia-Pacific Postal Services Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 4: Asia-Pacific Postal Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Postal Services Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Asia-Pacific Postal Services Market Revenue billion Forecast, by Item 2020 & 2033

- Table 7: Asia-Pacific Postal Services Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 8: Asia-Pacific Postal Services Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Postal Services Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Postal Services Market?

The projected CAGR is approximately 7.7%.

2. Which companies are prominent players in the Asia-Pacific Postal Services Market?

Key companies in the market include Korea Post, China Post Group Corporation, NZ Post, DHL, Thailand Post, Australian Postal Corporation, Hongkong Post**List Not Exhaustive, FedEx, India Post, Singapore Post Limited, Japan Post Co Ltd, DTDC EXPRESS LTD, Pos Malaysia Berhad, Pos Indonesia.

3. What are the main segments of the Asia-Pacific Postal Services Market?

The market segments include Type, Item, Destination.

4. Can you provide details about the market size?

The market size is estimated to be USD 172.37 billion as of 2022.

5. What are some drivers contributing to market growth?

Rise In eCommerce; Rise In Urbanization.

6. What are the notable trends driving market growth?

Liberalization Affecting the Market Share of Designated Operators.

7. Are there any restraints impacting market growth?

The Risk of Package Theft or Damage; Cost Efficiency.

8. Can you provide examples of recent developments in the market?

Sept 2022: The Australian Government and Australia Post announced a new Pacific Postal Development Partnership to strengthen postal services in the Pacific by signing a joint declaration with the Universal Postal Union (UPU) and Asian-Pacific Postal Union (APPU) to improve the efficiency and security of postal services between Australia and Pacific island countries, benefiting consumers and businesses. To support the three-year partnership, the government has provided Australia Post with a USD 450,000 contribution to target improvements to postal systems, processes, technology, and training in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Postal Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Postal Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Postal Services Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Postal Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence