Key Insights

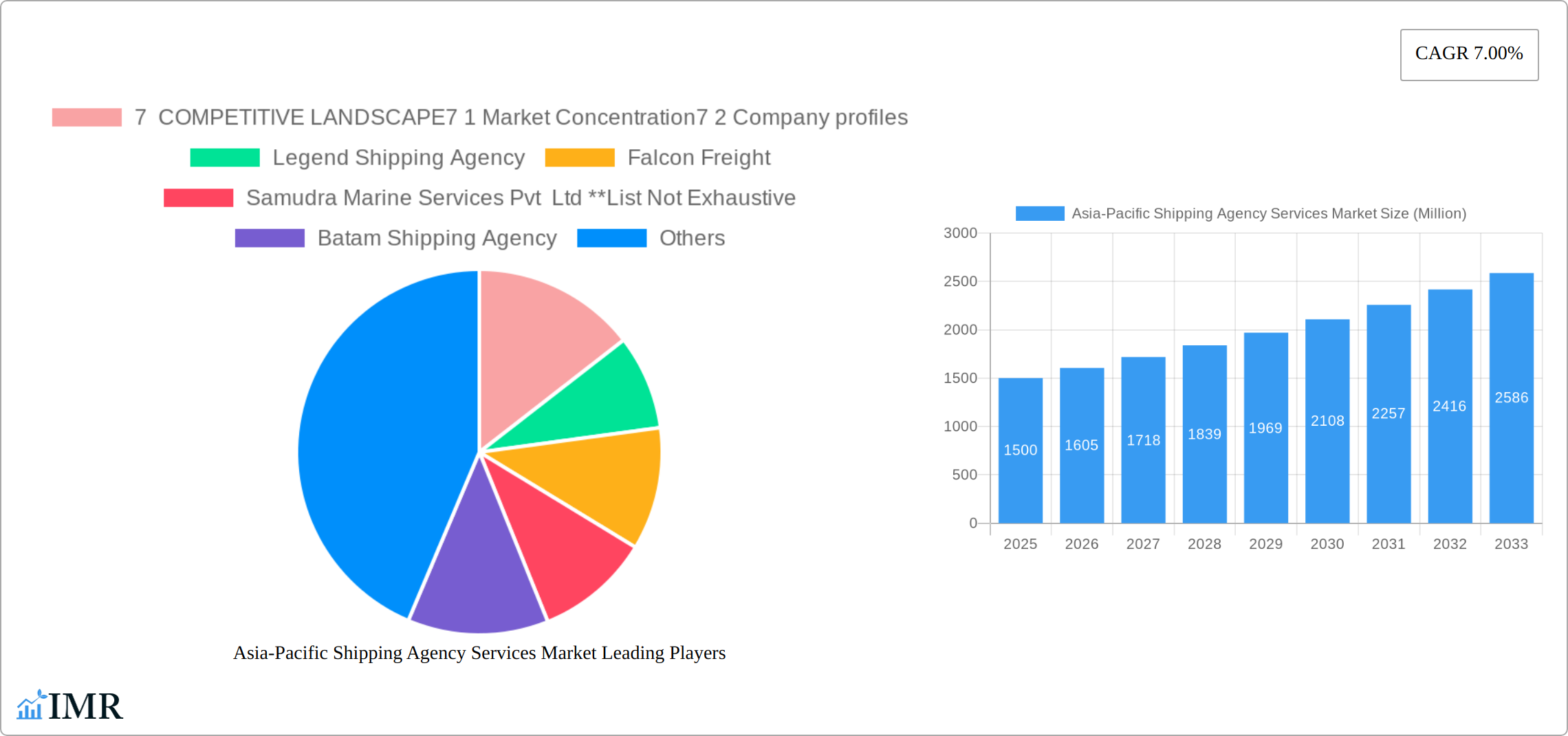

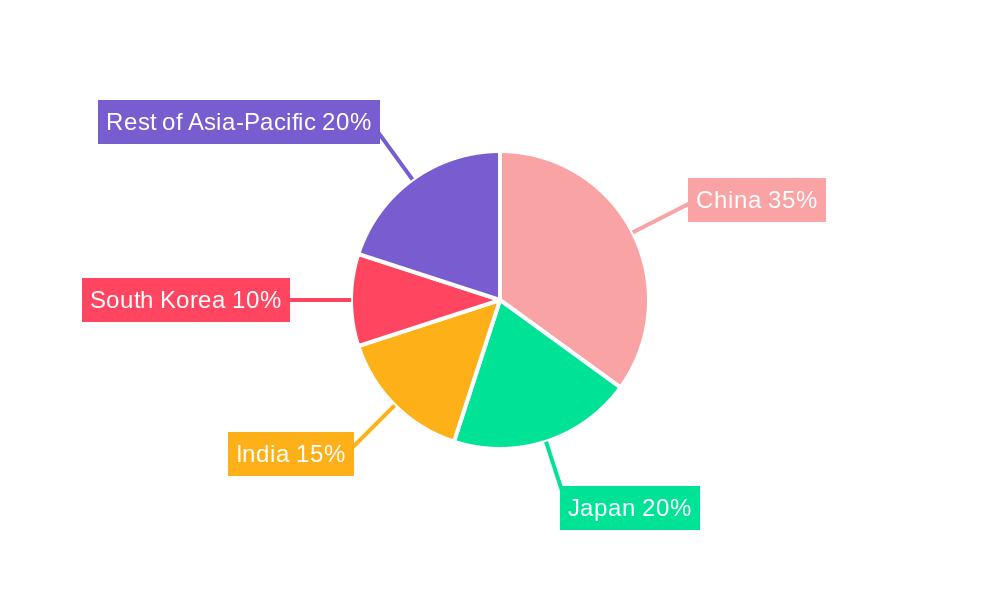

The Asia-Pacific shipping agency services market is experiencing robust growth, driven by the region's expanding maritime trade and increasing globalization. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR and historical period data), is projected to maintain a Compound Annual Growth Rate (CAGR) of 7.00% from 2025 to 2033. Key drivers include the burgeoning e-commerce sector fueling demand for efficient logistics, rising cross-border trade within Asia-Pacific, and the continuous expansion of port infrastructure in major economies like China, India, and Japan. Furthermore, the increasing adoption of advanced technologies like digitalization and automation in shipping operations contributes to streamlined processes and higher efficiency, thereby boosting market growth. The market is segmented by type (Port Agency, Cargo Agency, Charter Agency, Others), application (Ship Owner, Lessee), and service (Packaging Services, Shipping Services, Custom Clearance Services, Logistical Support Services, Other Services). While the exact market share for each segment is unavailable, it's reasonable to assume that Port and Cargo Agencies constitute the largest shares, reflecting their core role in facilitating shipping operations. The rapid development of China's economy and its significant role in global trade likely positions it as the largest national market within the Asia-Pacific region, followed by Japan, India, and South Korea.

Asia-Pacific Shipping Agency Services Market Market Size (In Billion)

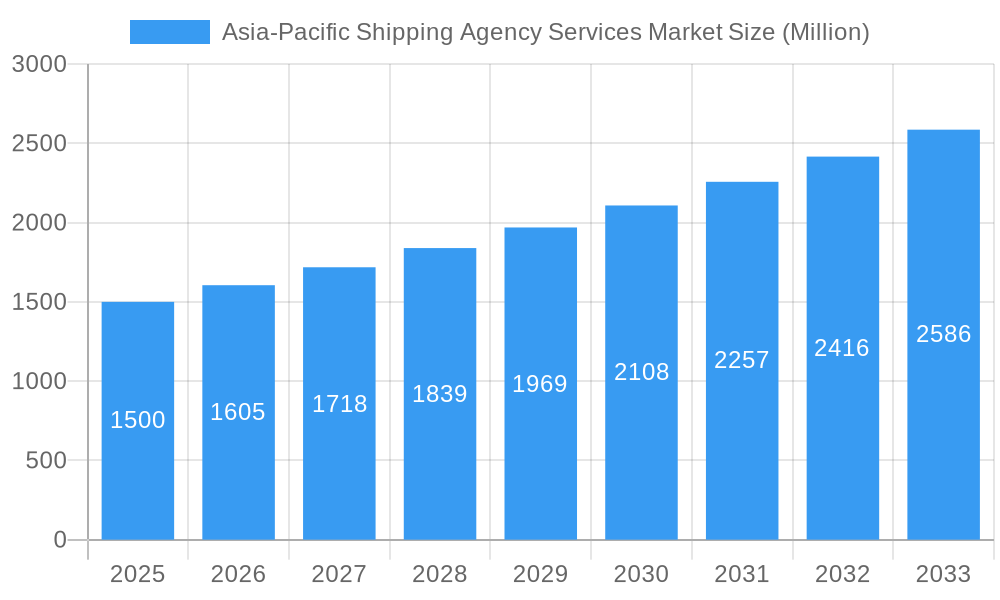

However, the market faces certain restraints. These include geopolitical uncertainties that can impact trade flows, fluctuating fuel prices affecting shipping costs, and the potential for supply chain disruptions. Nevertheless, the long-term outlook for the Asia-Pacific shipping agency services market remains positive, propelled by sustained economic growth in the region and the increasing reliance on efficient and reliable shipping networks. The competitive landscape is moderately concentrated, with several established players and a mix of smaller, regional agencies competing for market share. Companies like Legend Shipping Agency, Falcon Freight, and Samudra Marine Services Pvt Ltd are likely to play key roles in shaping the market's future, along with several other regional players. Strategic partnerships, investments in technology, and the expansion of service offerings will be crucial for companies seeking to maintain a competitive edge in this dynamic market.

Asia-Pacific Shipping Agency Services Market Company Market Share

Asia-Pacific Shipping Agency Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific Shipping Agency Services Market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. The market is segmented by Type (Port Agency, Cargo Agency, Charter Agency, Others), Application (Ship Owner, Lessee), and Service (Packaging Services, Shipping Services, Custom Clearance Services, Logistical Support Services, Other Services). The report is crucial for businesses, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic market.

Asia-Pacific Shipping Agency Services Market Dynamics & Structure

The Asia-Pacific Shipping Agency Services market is characterized by moderate concentration, with several key players holding significant market share. Market concentration is estimated at xx% in 2025. Technological innovation, particularly in digitalization and automation of shipping processes, is a key driver. Stringent regulatory frameworks governing maritime operations and customs clearance significantly impact market dynamics. The emergence of innovative logistical solutions and integrated service providers represents a competitive pressure. End-user demographics are heavily influenced by the growth of e-commerce and international trade. M&A activity remains moderate, with xx deals recorded in the past five years.

- Market Concentration: xx% in 2025 (estimated)

- Technological Innovation: Focus on digitalization and automation of processes.

- Regulatory Framework: Stringent rules governing maritime operations and customs clearance.

- Competitive Substitutes: Integrated logistics providers and innovative solutions.

- End-User Demographics: Driven by e-commerce growth and international trade expansion.

- M&A Activity: xx deals recorded in the past five years (estimated).

Asia-Pacific Shipping Agency Services Market Growth Trends & Insights

The Asia-Pacific Shipping Agency Services market has demonstrated robust expansion, fueled by the surge in global trade activities and the ever-increasing need for streamlined and efficient logistics operations. From 2019 to 2024, the market experienced significant momentum, with its size in 2024 estimated to be **[Insert Market Size in XXX million]**. This growth trajectory is expected to continue into the forecast period of 2025-2033, albeit at a more measured pace. Key factors driving this sustained expansion include ongoing technological innovations, evolving consumer preferences that demand faster and more dependable shipping, and the relentless growth of e-commerce across the region. The market penetration is projected to reach **[Insert Market Penetration Percentage]** by 2033. Emerging technological advancements, such as the integration of blockchain for enhanced transparency and security in transactions, are anticipated to significantly redefine the market's operational landscape and competitive dynamics.

Dominant Regions, Countries, or Segments in Asia-Pacific Shipping Agency Services Market

Leading the market's upward trajectory are China and several Southeast Asian nations, owing to their sophisticated port infrastructure, thriving economies, and increasing integration into the global trade network. The Port Agency segment is anticipated to maintain its dominant market share, followed closely by the Cargo Agency segment. In terms of applications, the Ship Owner segment currently holds the largest market share, while the Lessee segment is poised for substantial growth during the forecast period.

Key Growth Catalysts:

- Exceptional port infrastructure in major global trade hubs like Shanghai, Singapore, and Hong Kong.

- Dynamic economic expansion across a multitude of Asia-Pacific economies.

- Accelerated participation in international trade and the burgeoning e-commerce sector.

- Favorable government policies and initiatives aimed at fostering logistics development and infrastructure upgrades.

- Increasing demand for specialized shipping services catering to diverse industries.

Dominant Market Segments:

- By Service Type: Port Agency continues to command the largest market share, with Cargo Agency and Charter Agency also holding significant positions and demonstrating growth potential.

- By Application: The Ship Owner segment remains the largest by market share, while the Lessee segment is projected to experience notable expansion due to the growing complexity of shipping needs.

Asia-Pacific Shipping Agency Services Market Product Landscape

The market offers a wide range of services, including port agency, cargo agency, and charter agency services. Recent innovations focus on integrated logistics platforms that offer end-to-end solutions encompassing packaging, shipping, customs clearance, and logistical support. These platforms leverage technology to enhance efficiency, transparency, and traceability. Unique selling propositions are centered around specialized expertise in specific trade routes and comprehensive service packages.

Key Drivers, Barriers & Challenges in Asia-Pacific Shipping Agency Services Market

Key Drivers:

- The continuous surge in global trade volumes and the exponential growth of e-commerce activities.

- A heightened demand for more efficient, reliable, and cost-effective logistics and shipping solutions.

- The widespread adoption of cutting-edge technologies, including digitalization and automation, enhancing operational efficiency.

- Proactive government investments and strategies focused on modernizing and expanding port infrastructure.

- Increasing adoption of digital platforms for booking, tracking, and managing shipments.

Key Challenges:

- Persistent geopolitical uncertainties and trade tensions that can disrupt established trade routes.

- Volatility in fuel prices and other operational expenses, impacting profitability.

- Intense competition from a large and diverse pool of market players, leading to price pressures.

- Navigating and adhering to complex and evolving regulatory compliance requirements across different jurisdictions.

- Susceptibility to global supply chain disruptions caused by unforeseen events, leading to delays and increased costs.

- The need for continuous investment in technology to keep pace with market evolution.

Emerging Opportunities in Asia-Pacific Shipping Agency Services Market

- Expansion into less-developed markets with growing trade potential.

- Development of specialized services for niche industries.

- Integration of emerging technologies (AI, IoT, blockchain) for improved efficiency.

- Focus on sustainable and environmentally friendly practices.

- Growing demand for integrated logistics solutions.

Growth Accelerators in the Asia-Pacific Shipping Agency Services Market Industry

The Asia-Pacific Shipping Agency Services market is strategically positioned for sustained and accelerated growth, largely driven by transformative technological advancements. Innovations in Artificial Intelligence (AI) for sophisticated route optimization and predictive analytics are set to revolutionize operational efficiency. Furthermore, the forging of strategic alliances and partnerships between established shipping agencies and pioneering technology providers is instrumental in the development and deployment of novel, value-added solutions. The expansion into nascent and emerging markets, coupled with the creation of bespoke service offerings tailored to the specific requirements of niche industries, are also significant factors propelling market expansion and solidifying competitive advantages.

Key Players Shaping the Asia-Pacific Shipping Agency Services Market Market

- Legend Shipping Agency

- Falcon Freight

- Samudra Marine Services Pvt Ltd

- Batam Shipping Agency

- Bansar

- Intermodal Shipping Inc

- Albatross Shipping Agencies

- Sinotrans

- International Clearing and Shipping Agency(India) Pvt Ltd

- HS Lanka

Notable Milestones in Asia-Pacific Shipping Agency Services Market Sector

- November 2022: GAC strategically broadened its operational footprint in East Asia by inaugurating a new office in Taichung, Taiwan, enhancing its service capabilities in the region.

- June 2022: Sinotrans took a significant step forward by launching a consolidated port facility within the Guangdong-Hong Kong-Macao Bay area, dramatically improving regional connectivity and logistical efficiency.

- [Insert Recent Milestone 1]: [Brief Description of Milestone 1]

- [Insert Recent Milestone 2]: [Brief Description of Milestone 2]

In-Depth Asia-Pacific Shipping Agency Services Market Outlook

The Asia-Pacific Shipping Agency Services market is expected to witness continued growth, driven by the factors highlighted above. Strategic investments in infrastructure, technological innovation, and strategic partnerships will play a key role in shaping the future of the market. Companies that embrace digitalization and offer comprehensive, integrated solutions are best positioned to capture market share and drive long-term success. The market is projected to reach xx million by 2033.

Asia-Pacific Shipping Agency Services Market Segmentation

-

1. Type

- 1.1. Port Agency

- 1.2. Cargo Agency

- 1.3. Charter Agency

- 1.4. Others

-

2. Application

- 2.1. Ship Owner

- 2.2. Lessee

-

3. Service

- 3.1. Packaging Services

- 3.2. Shipping Services

- 3.3. Custom Clearance Services

- 3.4. Logistical Support Services

- 3.5. Other Services

-

4. Geography

- 4.1. India

- 4.2. China

- 4.3. Japan

- 4.4. Australia

- 4.5. Rest of Asia-Pacific

Asia-Pacific Shipping Agency Services Market Segmentation By Geography

- 1. India

- 2. China

- 3. Japan

- 4. Australia

- 5. Rest of Asia Pacific

Asia-Pacific Shipping Agency Services Market Regional Market Share

Geographic Coverage of Asia-Pacific Shipping Agency Services Market

Asia-Pacific Shipping Agency Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Industrial Growth Supporting the Market; Global Trade Driving the Market

- 3.3. Market Restrains

- 3.3.1. Compliance Challenges Affecting the Market; Limited Infrastructure Inhibiting the Market

- 3.4. Market Trends

- 3.4.1. China to Dominate the Asia-Pacific Shipping Agency Services Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Shipping Agency Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Port Agency

- 5.1.2. Cargo Agency

- 5.1.3. Charter Agency

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Ship Owner

- 5.2.2. Lessee

- 5.3. Market Analysis, Insights and Forecast - by Service

- 5.3.1. Packaging Services

- 5.3.2. Shipping Services

- 5.3.3. Custom Clearance Services

- 5.3.4. Logistical Support Services

- 5.3.5. Other Services

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. India

- 5.4.2. China

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.5.2. China

- 5.5.3. Japan

- 5.5.4. Australia

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. India Asia-Pacific Shipping Agency Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Port Agency

- 6.1.2. Cargo Agency

- 6.1.3. Charter Agency

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Ship Owner

- 6.2.2. Lessee

- 6.3. Market Analysis, Insights and Forecast - by Service

- 6.3.1. Packaging Services

- 6.3.2. Shipping Services

- 6.3.3. Custom Clearance Services

- 6.3.4. Logistical Support Services

- 6.3.5. Other Services

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. India

- 6.4.2. China

- 6.4.3. Japan

- 6.4.4. Australia

- 6.4.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. China Asia-Pacific Shipping Agency Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Port Agency

- 7.1.2. Cargo Agency

- 7.1.3. Charter Agency

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Ship Owner

- 7.2.2. Lessee

- 7.3. Market Analysis, Insights and Forecast - by Service

- 7.3.1. Packaging Services

- 7.3.2. Shipping Services

- 7.3.3. Custom Clearance Services

- 7.3.4. Logistical Support Services

- 7.3.5. Other Services

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. India

- 7.4.2. China

- 7.4.3. Japan

- 7.4.4. Australia

- 7.4.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia-Pacific Shipping Agency Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Port Agency

- 8.1.2. Cargo Agency

- 8.1.3. Charter Agency

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Ship Owner

- 8.2.2. Lessee

- 8.3. Market Analysis, Insights and Forecast - by Service

- 8.3.1. Packaging Services

- 8.3.2. Shipping Services

- 8.3.3. Custom Clearance Services

- 8.3.4. Logistical Support Services

- 8.3.5. Other Services

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. India

- 8.4.2. China

- 8.4.3. Japan

- 8.4.4. Australia

- 8.4.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia-Pacific Shipping Agency Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Port Agency

- 9.1.2. Cargo Agency

- 9.1.3. Charter Agency

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Ship Owner

- 9.2.2. Lessee

- 9.3. Market Analysis, Insights and Forecast - by Service

- 9.3.1. Packaging Services

- 9.3.2. Shipping Services

- 9.3.3. Custom Clearance Services

- 9.3.4. Logistical Support Services

- 9.3.5. Other Services

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. India

- 9.4.2. China

- 9.4.3. Japan

- 9.4.4. Australia

- 9.4.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia-Pacific Shipping Agency Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Port Agency

- 10.1.2. Cargo Agency

- 10.1.3. Charter Agency

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Ship Owner

- 10.2.2. Lessee

- 10.3. Market Analysis, Insights and Forecast - by Service

- 10.3.1. Packaging Services

- 10.3.2. Shipping Services

- 10.3.3. Custom Clearance Services

- 10.3.4. Logistical Support Services

- 10.3.5. Other Services

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. India

- 10.4.2. China

- 10.4.3. Japan

- 10.4.4. Australia

- 10.4.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 7 COMPETITIVE LANDSCAPE7 1 Market Concentration7 2 Company profiles

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Legend Shipping Agency

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Falcon Freight

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Samudra Marine Services Pvt Ltd **List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Batam Shipping Agency

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bansar

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Intermodal Shipping Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Albatross Shipping Agencies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sinotrans

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 International Clearing and Shipping Agency(India) Pvt Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 HS Lanka

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 7 COMPETITIVE LANDSCAPE7 1 Market Concentration7 2 Company profiles

List of Figures

- Figure 1: Asia-Pacific Shipping Agency Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Shipping Agency Services Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 4: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 9: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 14: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 19: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 24: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 29: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Shipping Agency Services Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Asia-Pacific Shipping Agency Services Market?

Key companies in the market include 7 COMPETITIVE LANDSCAPE7 1 Market Concentration7 2 Company profiles, Legend Shipping Agency, Falcon Freight, Samudra Marine Services Pvt Ltd **List Not Exhaustive, Batam Shipping Agency, Bansar, Intermodal Shipping Inc, Albatross Shipping Agencies, Sinotrans, International Clearing and Shipping Agency(India) Pvt Ltd, HS Lanka.

3. What are the main segments of the Asia-Pacific Shipping Agency Services Market?

The market segments include Type, Application, Service, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Industrial Growth Supporting the Market; Global Trade Driving the Market.

6. What are the notable trends driving market growth?

China to Dominate the Asia-Pacific Shipping Agency Services Market.

7. Are there any restraints impacting market growth?

Compliance Challenges Affecting the Market; Limited Infrastructure Inhibiting the Market.

8. Can you provide examples of recent developments in the market?

November 2022: GAC is one of the leading providers of ship agency services worldwide. It is expanding its presence in East Asia and the Asia-Pacific region by establishing a new office in Taiwan's second-largest port, Taichung.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Shipping Agency Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Shipping Agency Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Shipping Agency Services Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Shipping Agency Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence