Key Insights

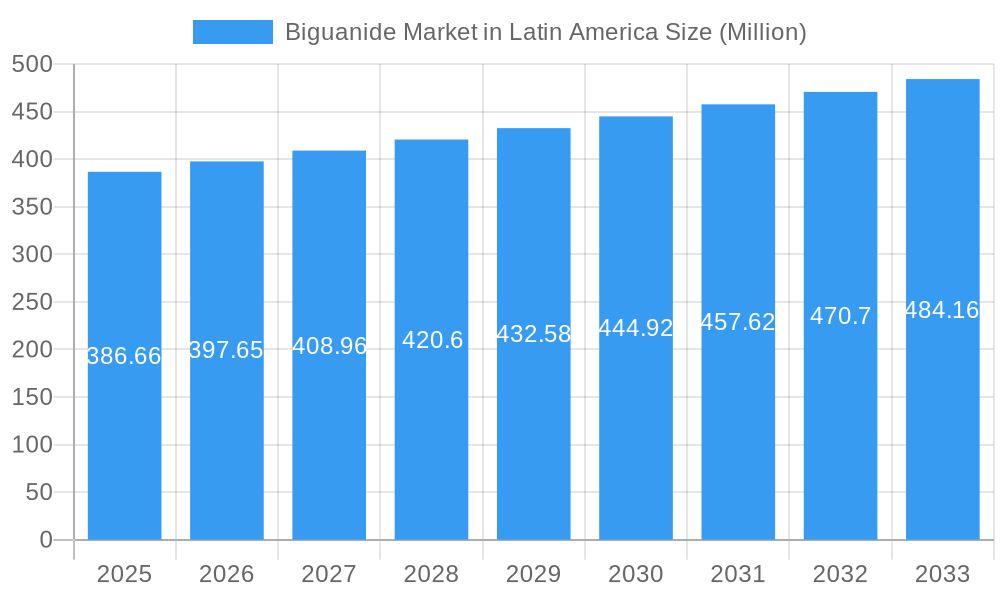

The Latin American Biguanide Market is poised for steady expansion, projected to reach approximately $386.66 million by 2025, with a compound annual growth rate (CAGR) of 2.80% extending through the forecast period of 2025-2033. This growth is primarily fueled by the escalating prevalence of Type 2 Diabetes Mellitus across the region, a condition for which biguanides like Metformin serve as a cornerstone therapy. Rising healthcare expenditure, increasing access to diagnostic tools, and growing awareness among both patients and healthcare providers about effective diabetes management are significant drivers. Furthermore, the expanding retail pharmacy network and the continuous role of hospitals and clinics in diabetes care contribute to sustained demand for biguanide medications. While Metformin dominates the product type segment due to its efficacy and safety profile, Buformin also holds a niche. The overwhelming preference for oral administration further solidifies the market's trajectory.

Biguanide Market in Latin America Market Size (In Million)

Despite the positive outlook, the market faces certain restraints. These include potential side effects associated with biguanide use, such as gastrointestinal disturbances and lactic acidosis, which can impact patient adherence and physician prescribing patterns. Moreover, the availability of alternative antidiabetic medications and evolving treatment guidelines may present competitive pressures. However, the affordability of biguanides compared to newer classes of diabetes drugs, particularly in price-sensitive Latin American economies, is expected to mitigate these challenges and ensure continued market penetration. Efforts by pharmaceutical companies to enhance drug delivery systems and patient education programs are also anticipated to bolster market growth in the coming years.

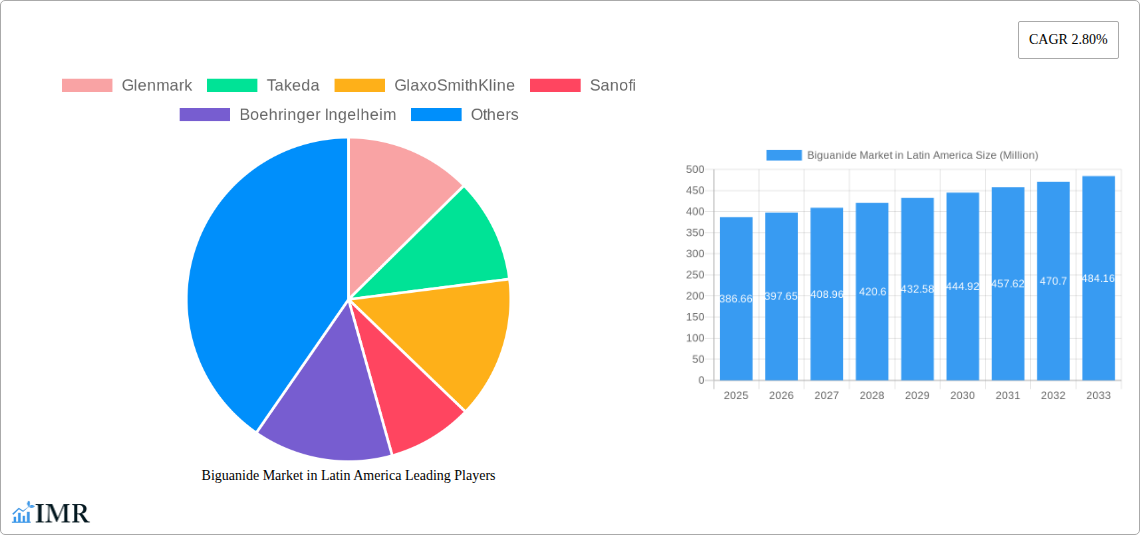

Biguanide Market in Latin America Company Market Share

Biguanide Market in Latin America: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the Latin American Biguanide Market, focusing on Metformin and Buformin sales, Oral and Intravenous administration routes, Type 2 Diabetes Mellitus treatment, and end-user dynamics across Hospitals, Retail Pharmacies, and Clinics. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report offers critical insights for industry professionals, investors, and stakeholders navigating this dynamic sector. Quantified data in Million units and a wealth of industry-specific keywords ensure maximum SEO visibility and engagement.

Biguanide Market in Latin America Market Dynamics & Structure

The Latin American Biguanide market is characterized by a moderate to high concentration of key players, with global pharmaceutical giants such as Takeda, Sanofi, and Boehringer Ingelheim holding significant market shares. Technological innovation drivers are primarily focused on improving drug delivery mechanisms for Metformin, enhancing patient adherence, and developing combination therapies for Type 2 Diabetes Mellitus. Regulatory frameworks across Latin American countries, while varied, are generally supportive of accessible diabetes management solutions, albeit with increasing scrutiny on drug pricing and generic competition. Competitive product substitutes, particularly newer classes of anti-diabetic drugs like SGLT2 inhibitors and GLP-1 receptor agonists, present a growing challenge to traditional biguanide therapies, prompting manufacturers to focus on cost-effectiveness and established efficacy. End-user demographics reveal a rising prevalence of type 2 diabetes, driven by lifestyle changes and an aging population, thereby fueling sustained demand. Mergers & Acquisition (M&A) trends are anticipated to focus on regional expansion and portfolio diversification, with potential consolidation among smaller local manufacturers and strategic partnerships to enhance market penetration. For instance, M&A deal volumes in recent years indicate a trend towards acquiring local distribution networks and manufacturing capabilities. Innovation barriers include stringent clinical trial requirements and the high cost of research and development for novel biguanide derivatives.

Biguanide Market in Latin America Growth Trends & Insights

The Latin American Biguanide Market is poised for steady growth, projected to exhibit a Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period. This expansion is underpinned by increasing diabetes prevalence, improved access to healthcare infrastructure, and growing awareness about diabetes management. The market size evolution demonstrates a consistent upward trajectory, driven by the widespread use of Metformin as a first-line treatment for Type 2 Diabetes Mellitus. Adoption rates for biguanide therapies remain high due to their proven efficacy, safety profile, and affordability, making them a cornerstone of diabetes care across the region. Technological disruptions, while less pronounced in the core biguanide molecule, are evident in advancements in formulations and combination therapies that enhance patient convenience and therapeutic outcomes. Consumer behavior shifts indicate a growing demand for integrated healthcare solutions, including digital health platforms and personalized treatment plans, which biguanide manufacturers are beginning to address. Market penetration of biguanide treatments is already substantial, with opportunities for further growth in underserved populations and emerging economies within Latin America. The increasing burden of chronic diseases and the imperative for cost-effective healthcare solutions will continue to propel the demand for these essential medications.

Dominant Regions, Countries, or Segments in Biguanide Market in Latin America

The Type 2 Diabetes Mellitus segment is the undisputed driver of growth within the Latin American Biguanide market, accounting for over 90% of the total market volume. Within product types, Metformin remains the dominant force, its widespread use and cost-effectiveness making it the preferred choice for healthcare providers and patients across the region. The Oral route of administration consistently leads, offering unparalleled convenience and patient compliance compared to Intravenous options. Consequently, Retail Pharmacies and Hospitals emerge as the primary end-users, with retail pharmacies serving as the frontline for accessibility and hospitals catering to more complex patient needs and prescriptions.

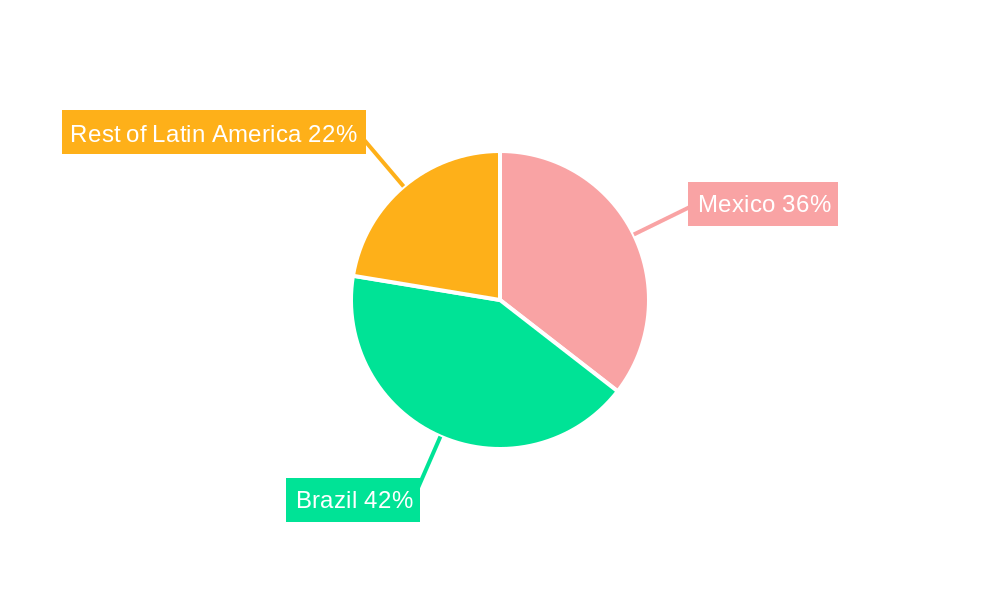

- Brazil and Mexico are the leading countries in the Latin American Biguanide market, driven by their large populations, increasing incidence of type 2 diabetes, and developing healthcare infrastructures. Economic policies supporting affordable healthcare and robust distribution networks contribute significantly to their market dominance.

- The Type 2 Diabetes Mellitus application segment’s dominance is fueled by a growing obese population, sedentary lifestyles, and an aging demographic, all contributing to a higher risk and prevalence of the disease. Government-led diabetes awareness campaigns and screening programs further bolster this segment.

- The Oral route of administration's leadership is a direct consequence of its ease of use, lower cost, and established patient acceptance. This segment’s growth is intrinsically linked to the overall expansion of the biguanide market.

- Retail Pharmacies play a crucial role in ensuring broad market access to biguanide medications, especially for outpatients managing chronic conditions. Their extensive reach and direct consumer interaction make them vital for consistent sales.

- Hospitals represent a significant market share due to inpatient prescriptions, emergency treatments, and specialized diabetes care programs. Their purchasing power and influence on treatment protocols contribute to market demand.

Biguanide Market in Latin America Product Landscape

The biguanide product landscape in Latin America is largely defined by the established efficacy and affordability of Metformin. Key innovations focus on combination therapies, such as those involving Metformin with SGLT2 inhibitors, to offer enhanced glycemic control and potential cardiovascular benefits, as exemplified by recent FDA approvals for such combinations. While Buformin has a more niche presence, its unique pharmacological profile offers an alternative for specific patient populations. Manufacturers are emphasizing improved patient adherence through extended-release formulations and patient education programs, aiming to maximize the therapeutic benefits of these foundational diabetes medications.

Key Drivers, Barriers & Challenges in Biguanide Market in Latin America

Key Drivers:

- Rising Prevalence of Type 2 Diabetes Mellitus: An escalating obese population and sedentary lifestyles are fueling an unprecedented rise in type 2 diabetes cases across Latin America.

- Affordability and Efficacy of Metformin: As a cost-effective and well-established treatment, Metformin remains the cornerstone of diabetes management, driving consistent demand.

- Expanding Healthcare Access and Infrastructure: Improvements in healthcare systems and increased accessibility to medical facilities in emerging economies are facilitating wider distribution and uptake of biguanide therapies.

- Government Initiatives and Awareness Programs: Public health campaigns promoting diabetes awareness and early detection further boost market demand.

Key Barriers & Challenges:

- Competition from Newer Drug Classes: The emergence of novel anti-diabetic medications, such as GLP-1 receptor agonists and SGLT2 inhibitors, poses a competitive threat, particularly for patients requiring more intensive glycemic control or those with specific comorbidities.

- Regulatory Hurdles and Price Controls: Stringent regulatory approval processes and government-imposed price controls in some Latin American countries can impact profitability and market entry for new biguanide formulations or generics.

- Supply Chain Disruptions: Geopolitical factors and logistical complexities within Latin America can lead to intermittent supply chain disruptions, affecting product availability and potentially impacting patient treatment continuity.

- Side Effects and Patient Adherence Issues: While generally safe, gastrointestinal side effects associated with biguanides can sometimes lead to poor patient adherence, necessitating effective patient education and management strategies.

Emerging Opportunities in Biguanide Market in Latin America

Emerging opportunities in the Latin American biguanide market lie in the development of novel fixed-dose combination therapies that address unmet patient needs and simplify treatment regimens. Untapped markets within more remote or economically disadvantaged regions present significant growth potential, requiring targeted distribution strategies and affordable product offerings. Evolving consumer preferences lean towards personalized medicine and digital health integration, creating opportunities for manufacturers to develop connected devices or apps that monitor adherence and glucose levels in conjunction with biguanide therapy. Furthermore, exploring the potential of biguanides in other therapeutic areas, beyond diabetes, could unlock new revenue streams.

Growth Accelerators in the Biguanide Market in Latin America Industry

Technological breakthroughs in drug delivery, such as improved sustained-release formulations of Metformin, will accelerate market growth by enhancing patient compliance and reducing the frequency of dosing. Strategic partnerships between biguanide manufacturers and local distributors or healthcare providers will be crucial for expanding market reach, particularly in underserved areas. Furthermore, market expansion strategies focusing on robust clinical education for healthcare professionals about the benefits and optimal use of biguanides, including in combination therapies, will drive increased prescription rates. The increasing focus on preventative healthcare and early diagnosis of diabetes will also act as a significant growth accelerator.

Key Players Shaping the Biguanide Market in Latin America Market

- Glenmark

- Takeda

- GlaxoSmithKline

- Sanofi

- Boehringer Ingelheim

- Merck

- Bristol-Myers Squibb

Notable Milestones in Biguanide Market in Latin America Sector

- February 2023: Zydus Lifesciences Limited, received tentative approval from the FDA for Invokamet tablets (canagliflozin and metformin hydrochloride combination). Canagliflozin and metformin combination products are indicated as an adjunct to diet and exercise to improve glycemic control in adults with type 2 diabetes mellitus who are not adequately controlled on a regimen containing metformin or canagliflozin or in patients already being treated with both canagliflozin and metformin.

- July 2022: Zydus Lifesciences announced that it received final approval from the FDA to market Empagliflozin and Metformin Hydrochloride tablets in multiple strengths. Empagliflozin and Metformin Hydrochloride tablets are used with proper diet and exercise to improve glycemic control in adults with type 2 diabetes mellitus. They are also used to lower the risk of cardiovascular death in patients with type 2 diabetes mellitus and established cardiovascular disease.

In-Depth Biguanide Market in Latin America Market Outlook

The future outlook for the Latin American Biguanide market remains robust, driven by the persistent and growing burden of type 2 diabetes. Growth accelerators will include the continued dominance of Metformin, coupled with strategic integration of biguanides into newer combination therapies offering enhanced patient benefits. The market will see increased focus on accessibility and affordability, especially in emerging economies within the region. Opportunities for innovation lie in patient-centric solutions, such as improved formulations and digital health integrations, which will be pivotal in capturing market share and ensuring long-term growth. Manufacturers who can effectively navigate the evolving regulatory landscapes and cater to the diverse needs of the Latin American population will be well-positioned for sustained success.

Biguanide Market in Latin America Segmentation

-

1. Product Type

- 1.1. Metformin

- 1.2. Buformin

-

2. Route of Administration

- 2.1. Oral

- 2.2. Intravenous

-

3. Application

- 3.1. Type 2 Diabetes Mellitus

- 3.2. Other

-

4. End-User

- 4.1. Hospitals

- 4.2. Retail Pharmacies

- 4.3. Clinics

Biguanide Market in Latin America Segmentation By Geography

- 1. Mexico

- 2. Brazil

- 3. Rest of Latin America

Biguanide Market in Latin America Regional Market Share

Geographic Coverage of Biguanide Market in Latin America

Biguanide Market in Latin America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advancement in the Technology of Chromatography Instruments; Significance of Chromatography Based Studies in Drug Approval

- 3.3. Market Restrains

- 3.3.1. Rising Price of Equipment

- 3.4. Market Trends

- 3.4.1. Rising diabetes prevalence

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Biguanide Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Metformin

- 5.1.2. Buformin

- 5.2. Market Analysis, Insights and Forecast - by Route of Administration

- 5.2.1. Oral

- 5.2.2. Intravenous

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Type 2 Diabetes Mellitus

- 5.3.2. Other

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Hospitals

- 5.4.2. Retail Pharmacies

- 5.4.3. Clinics

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Mexico

- 5.5.2. Brazil

- 5.5.3. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Mexico Biguanide Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Metformin

- 6.1.2. Buformin

- 6.2. Market Analysis, Insights and Forecast - by Route of Administration

- 6.2.1. Oral

- 6.2.2. Intravenous

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Type 2 Diabetes Mellitus

- 6.3.2. Other

- 6.4. Market Analysis, Insights and Forecast - by End-User

- 6.4.1. Hospitals

- 6.4.2. Retail Pharmacies

- 6.4.3. Clinics

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Brazil Biguanide Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Metformin

- 7.1.2. Buformin

- 7.2. Market Analysis, Insights and Forecast - by Route of Administration

- 7.2.1. Oral

- 7.2.2. Intravenous

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Type 2 Diabetes Mellitus

- 7.3.2. Other

- 7.4. Market Analysis, Insights and Forecast - by End-User

- 7.4.1. Hospitals

- 7.4.2. Retail Pharmacies

- 7.4.3. Clinics

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of Latin America Biguanide Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Metformin

- 8.1.2. Buformin

- 8.2. Market Analysis, Insights and Forecast - by Route of Administration

- 8.2.1. Oral

- 8.2.2. Intravenous

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Type 2 Diabetes Mellitus

- 8.3.2. Other

- 8.4. Market Analysis, Insights and Forecast - by End-User

- 8.4.1. Hospitals

- 8.4.2. Retail Pharmacies

- 8.4.3. Clinics

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Glenmark

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Takeda

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 GlaxoSmithKline

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Sanofi

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Boehringer Ingelheim

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Merck

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Bristol-Myers Squibb

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 Glenmark

List of Figures

- Figure 1: Biguanide Market in Latin America Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Biguanide Market in Latin America Share (%) by Company 2025

List of Tables

- Table 1: Biguanide Market in Latin America Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Biguanide Market in Latin America Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Biguanide Market in Latin America Revenue Million Forecast, by Route of Administration 2020 & 2033

- Table 4: Biguanide Market in Latin America Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 5: Biguanide Market in Latin America Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Biguanide Market in Latin America Volume K Unit Forecast, by Application 2020 & 2033

- Table 7: Biguanide Market in Latin America Revenue Million Forecast, by End-User 2020 & 2033

- Table 8: Biguanide Market in Latin America Volume K Unit Forecast, by End-User 2020 & 2033

- Table 9: Biguanide Market in Latin America Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Biguanide Market in Latin America Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Biguanide Market in Latin America Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Biguanide Market in Latin America Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 13: Biguanide Market in Latin America Revenue Million Forecast, by Route of Administration 2020 & 2033

- Table 14: Biguanide Market in Latin America Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 15: Biguanide Market in Latin America Revenue Million Forecast, by Application 2020 & 2033

- Table 16: Biguanide Market in Latin America Volume K Unit Forecast, by Application 2020 & 2033

- Table 17: Biguanide Market in Latin America Revenue Million Forecast, by End-User 2020 & 2033

- Table 18: Biguanide Market in Latin America Volume K Unit Forecast, by End-User 2020 & 2033

- Table 19: Biguanide Market in Latin America Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Biguanide Market in Latin America Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Biguanide Market in Latin America Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Biguanide Market in Latin America Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 23: Biguanide Market in Latin America Revenue Million Forecast, by Route of Administration 2020 & 2033

- Table 24: Biguanide Market in Latin America Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 25: Biguanide Market in Latin America Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Biguanide Market in Latin America Volume K Unit Forecast, by Application 2020 & 2033

- Table 27: Biguanide Market in Latin America Revenue Million Forecast, by End-User 2020 & 2033

- Table 28: Biguanide Market in Latin America Volume K Unit Forecast, by End-User 2020 & 2033

- Table 29: Biguanide Market in Latin America Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Biguanide Market in Latin America Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Biguanide Market in Latin America Revenue Million Forecast, by Product Type 2020 & 2033

- Table 32: Biguanide Market in Latin America Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 33: Biguanide Market in Latin America Revenue Million Forecast, by Route of Administration 2020 & 2033

- Table 34: Biguanide Market in Latin America Volume K Unit Forecast, by Route of Administration 2020 & 2033

- Table 35: Biguanide Market in Latin America Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Biguanide Market in Latin America Volume K Unit Forecast, by Application 2020 & 2033

- Table 37: Biguanide Market in Latin America Revenue Million Forecast, by End-User 2020 & 2033

- Table 38: Biguanide Market in Latin America Volume K Unit Forecast, by End-User 2020 & 2033

- Table 39: Biguanide Market in Latin America Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Biguanide Market in Latin America Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Biguanide Market in Latin America?

The projected CAGR is approximately 2.80%.

2. Which companies are prominent players in the Biguanide Market in Latin America?

Key companies in the market include Glenmark, Takeda, GlaxoSmithKline, Sanofi, Boehringer Ingelheim, Merck, Bristol-Myers Squibb.

3. What are the main segments of the Biguanide Market in Latin America?

The market segments include Product Type , Route of Administration , Application , End-User .

4. Can you provide details about the market size?

The market size is estimated to be USD 386.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Advancement in the Technology of Chromatography Instruments; Significance of Chromatography Based Studies in Drug Approval.

6. What are the notable trends driving market growth?

Rising diabetes prevalence.

7. Are there any restraints impacting market growth?

Rising Price of Equipment.

8. Can you provide examples of recent developments in the market?

February 2023: Zydus Lifesciences Limited, received tentative approval from the FDA for Invokamet tablets (canagliflozin and metformin hydrochloride combination). Canagliflozin and metformin combination products are indicated as an adjunct to diet and exercise to improve glycemic control in adults with type 2 diabetes mellitus who are not adequately controlled on a regimen containing metformin or canagliflozin or in patients already being treated with both canagliflozin and metformin.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Biguanide Market in Latin America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Biguanide Market in Latin America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Biguanide Market in Latin America?

To stay informed about further developments, trends, and reports in the Biguanide Market in Latin America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence