Key Insights

The global Bone Morphogenetic Proteins (BMPs) market is projected for robust expansion, estimated to reach USD 572 million by 2025, driven by a significant CAGR of 9.6% from the base year 2025 through 2033. This growth is propelled by the escalating incidence of orthopedic conditions and the increasing preference for minimally invasive surgical techniques. BMPs are vital in bone healing and regeneration, essential for managing diverse musculoskeletal disorders. Innovations in recombinant BMP technology have enhanced efficacy and safety, accelerating market adoption. Substantial R&D investments by leading biotechnology and pharmaceutical firms further bolster market growth by expanding BMP applications and improving therapeutic results.

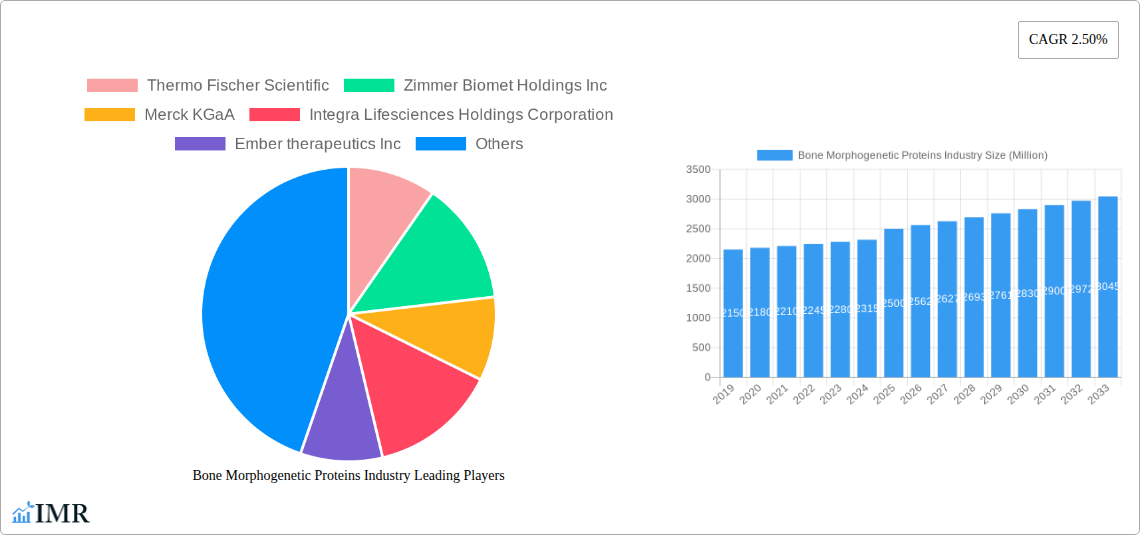

Bone Morphogenetic Proteins Industry Market Size (In Million)

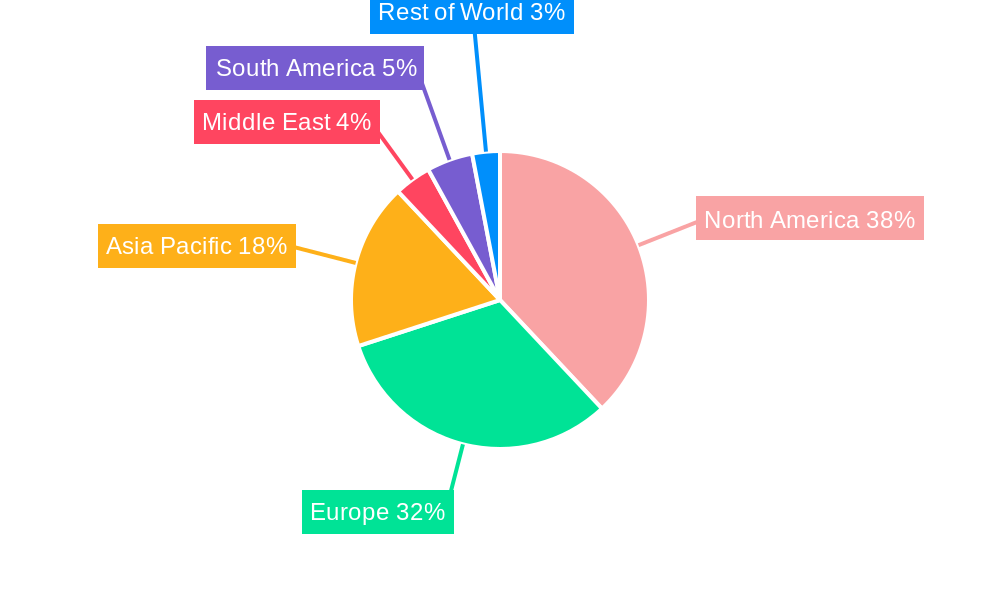

The market is segmented by BMP type, with recombinant BMPs leading due to their superior quality and scalability. Key applications encompass spinal fusion, trauma management, reconstructive surgery, and oral-maxillofacial procedures. The rising prevalence of spinal deformities, degenerative disc diseases, trauma cases, and demand for aesthetic/functional reconstructive surgeries are primary drivers for these segments. While high therapy costs and regulatory approvals present challenges, the growing geriatric population and increased awareness of advanced treatments ensure a positive market outlook. North America and Europe currently dominate market share, with the Asia Pacific region poised for considerable growth.

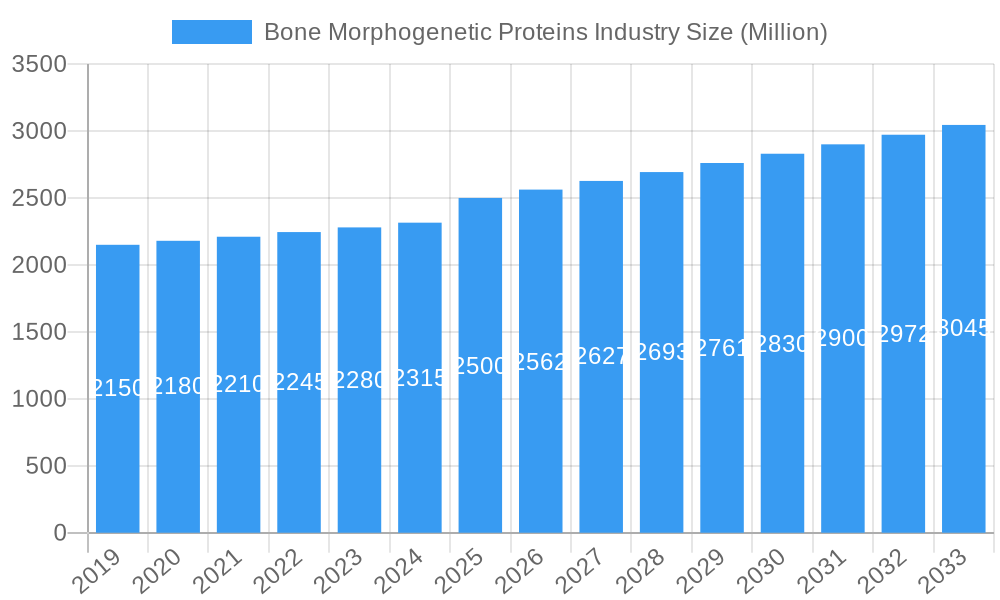

Bone Morphogenetic Proteins Industry Company Market Share

This report delivers a comprehensive analysis of the global Bone Morphogenetic Proteins (BMPs) industry, providing critical insights into market dynamics, growth trends, regional leadership, product innovations, and key players. Covering the historical period (2019-2024) and a forecast period extending to 2033, with a base year of 2025, this report is an indispensable resource for stakeholders aiming to understand and leverage opportunities within the dynamic BMPs market.

Bone Morphogenetic Proteins Industry Market Dynamics & Structure

The Bone Morphogenetic Proteins (BMPs) industry is characterized by a dynamic interplay of technological innovation, stringent regulatory oversight, and evolving end-user demographics. Market concentration is moderate, with several key players vying for dominance. Technological advancements in recombinant BMP production and delivery systems are primary drivers, enabling broader applications and improved patient outcomes. The regulatory landscape, overseen by bodies like the FDA and EMA, significantly influences product development and market entry, requiring rigorous clinical trials and approvals for new indications. Competitive product substitutes, such as autografts and allografts in orthopedic procedures, present a constant challenge, though BMPs offer advantages in terms of reduced donor site morbidity and predictable outcomes.

- Market Concentration: Moderate, with a significant presence of both established and emerging players.

- Technological Innovation Drivers: Advancements in protein engineering, biomaterial scaffolding, and drug delivery systems.

- Regulatory Frameworks: Strict approval processes by health authorities, impacting R&D timelines and market access.

- Competitive Product Substitutes: Autografts, allografts, synthetic bone graft substitutes.

- End-User Demographics: Growing elderly population with age-related orthopedic conditions, increasing sports-related injuries, and advancements in reconstructive surgery.

- M&A Trends: Strategic acquisitions and partnerships aimed at expanding product portfolios, accessing new technologies, and gaining market share.

Bone Morphogenetic Proteins Industry Growth Trends & Insights

The global Bone Morphogenetic Proteins (BMPs) industry is poised for substantial growth, driven by an increasing prevalence of orthopedic and spinal conditions, coupled with advancements in regenerative medicine. The market size is projected to expand significantly, with an estimated Compound Annual Growth Rate (CAGR) of approximately 9.5% from 2025 to 2033. Adoption rates are steadily rising as clinical evidence supporting the efficacy of BMPs in spinal fusion, trauma repair, and reconstructive surgeries accumulates. Technological disruptions, including the development of novel BMP variants with enhanced osteoinductive potential and the integration of BMPs with advanced biomaterials and 3D printing technologies for personalized bone regeneration, are reshaping the market. Consumer behavior shifts are evident, with a growing preference for less invasive procedures and treatments that promote natural bone healing, directly benefiting the BMPs market.

The increasing incidence of degenerative bone diseases, such as osteoarthritis and osteoporosis, especially within aging populations worldwide, is a primary catalyst for market expansion. Furthermore, a rise in sports-related injuries and an increased awareness of regenerative medicine treatments among both patients and healthcare professionals are contributing to higher adoption rates. The development of recombinant BMPs, particularly recombinant human bone morphogenetic protein-2 (rhBMP-2), has revolutionized spinal fusion procedures by offering a viable alternative to autologous bone grafts, reducing surgical complications and improving fusion rates. This has led to a sustained increase in the demand for BMPs in spinal fusion applications, which currently represent the largest segment within the overall market.

Technological advancements are not limited to the production of BMPs but also encompass their delivery mechanisms. Innovations in biodegradable scaffolds, hydrogels, and microparticle-based delivery systems are enhancing the localized and controlled release of BMPs, thereby improving their therapeutic efficacy and minimizing off-target effects. These advancements are crucial for expanding the application of BMPs into more complex reconstructive surgeries and challenging fracture healing scenarios. Moreover, ongoing research into other BMP family members, such as BMP-7 and BMP-9, is uncovering their unique osteogenic and chondrogenic properties, paving the way for new therapeutic applications in cartilage repair and osteoarthritis management.

The competitive landscape is dynamic, with ongoing research and development efforts focused on improving the cost-effectiveness and accessibility of BMP-based treatments. Companies are investing heavily in clinical trials to expand the approved indications for existing BMP products and to bring new BMPs to market. The integration of digital health technologies and personalized medicine approaches is also expected to influence the future of the BMPs market, enabling tailored treatment strategies based on individual patient needs and genetic profiles. As the understanding of bone biology deepens and therapeutic technologies mature, the BMPs industry is set to play an increasingly vital role in orthopedic and regenerative medicine.

Dominant Regions, Countries, or Segments in Bone Morphogenetic Proteins Industry

The Bone Morphogenetic Proteins (BMPs) industry exhibits distinct regional and segment-specific growth patterns. North America, particularly the United States, currently dominates the market, driven by a high prevalence of orthopedic conditions, advanced healthcare infrastructure, significant R&D investments, and a favorable reimbursement landscape for innovative medical technologies. The Spinal Fusion segment is the leading application, accounting for a substantial market share of approximately 45% in 2025. This dominance is attributed to the increasing aging population, a rise in degenerative spinal disorders, and the widespread adoption of rhBMP-2 for lumbar and cervical fusion procedures.

North America (Dominant Region):

- Key Drivers: High incidence of spinal and orthopedic diseases, robust healthcare spending, strong presence of leading BMP manufacturers, and supportive regulatory pathways for product approvals.

- Market Share: Estimated to hold over 40% of the global BMPs market by 2025.

- Growth Potential: Continued growth fueled by an aging population and advancements in minimally invasive surgical techniques.

Europe (Significant Market):

- Key Drivers: Growing awareness of regenerative medicine, increasing demand for advanced orthopedic treatments, and government initiatives promoting healthcare innovation.

- Market Share: Expected to capture around 25% of the global market by 2025.

- Growth Potential: Expansion driven by increasing diagnostic rates for bone-related ailments and a focus on improving patient outcomes.

Asia Pacific (Fastest Growing Region):

- Key Drivers: Rapidly expanding healthcare infrastructure, a large and growing patient population, increasing disposable incomes, and a rising awareness of advanced medical treatments.

- Market Share: Projected to grow at the highest CAGR, reaching approximately 20% of the global market by 2025.

- Growth Potential: Significant untapped potential in countries like China and India, with ongoing investments in medical technology and healthcare access.

Recombin (Dominant Type):

- Key Drivers: High biological activity, ability to be produced in large quantities with consistent purity, and extensive clinical validation for various applications.

- Market Share: Recombinant BMPs, particularly rhBMP-2, are expected to account for over 70% of the BMPs market by 2025.

- Growth Potential: Continued innovation in recombinant protein engineering and manufacturing processes will further solidify their dominance.

Spinal Fusion (Dominant Application):

- Key Drivers: Efficacy in promoting bone fusion, reducing the need for autograft harvesting, and improving surgical outcomes for degenerative disc disease, scoliosis, and vertebral fractures.

- Market Share: Estimated to represent 45% of the total BMPs market in 2025.

- Growth Potential: Sustained demand driven by the aging population and the increasing number of spinal fusion surgeries performed globally.

Trauma (Growing Application):

- Key Drivers: Potential to accelerate fracture healing and improve outcomes in complex fractures.

- Market Share: Projected to grow at a CAGR of 10% from 2025-2033.

- Growth Potential: Expanding applications in treating non-unions and delayed unions.

Reconstructive Surgery (Significant Application):

- Key Drivers: Use in craniofacial reconstruction, limb reconstruction, and reconstructive procedures following trauma or tumor resection.

- Market Share: Expected to capture around 15% of the market in 2025.

- Growth Potential: Advancements in biomaterials and tissue engineering will enhance its role in complex reconstructive interventions.

Oral-Maxillofacial (Niche but Growing Application):

- Key Drivers: Applications in alveolar ridge augmentation, sinus lifts, and dental implant procedures.

- Market Share: Expected to represent about 5% of the market in 2025.

- Growth Potential: Driven by the increasing demand for aesthetic and functional dental reconstructions.

Bone Morphogenetic Proteins Industry Product Landscape

The Bone Morphogenetic Proteins (BMPs) product landscape is characterized by continuous innovation focused on enhancing efficacy, safety, and delivery. Recombinant BMPs, such as recombinant human bone morphogenetic protein-2 (rhBMP-2) and recombinant human bone morphogenetic protein-7 (rhBMP-7), are the most prevalent and commercially successful products. These proteins are often delivered via biocompatible scaffolds, including collagen sponges, synthetic polymers, and demineralized bone matrices. Key product advancements include the development of sustained-release formulations, targeted delivery systems, and combination therapies that synergize BMPs with other growth factors or stem cells to optimize bone regeneration. Performance metrics revolve around osteoinductive potential, fusion rates in clinical studies, and patient-reported outcomes, with ongoing research aiming to improve the bioactivity and reduce immunogenicity of BMP products.

Key Drivers, Barriers & Challenges in Bone Morphogenetic Proteins Industry

Key Drivers:

- Technological Advancements: Continuous innovation in recombinant protein production, biomaterial scaffolding, and delivery systems.

- Growing Incidence of Orthopedic and Spinal Conditions: Aging populations, lifestyle changes, and increased sports participation contribute to demand.

- Demand for Minimally Invasive Procedures: BMPs enable effective bone healing with less reliance on autografts, aligning with patient preference.

- Clinical Evidence and Product Approvals: Expanding body of research demonstrating efficacy and successful regulatory approvals for new indications.

- Investments in Regenerative Medicine: Significant funding from both public and private sectors fuels R&D.

Key Barriers & Challenges:

- High Cost of Production and Treatment: BMPs and associated delivery systems can be expensive, limiting accessibility in some markets.

- Regulatory Hurdles and Approval Times: Stringent clinical trial requirements and lengthy approval processes can delay market entry.

- Potential Side Effects and Safety Concerns: While generally safe, some BMPs have been associated with adverse events, requiring careful patient selection and monitoring.

- Competition from Alternative Therapies: Autografts, allografts, and synthetic bone graft substitutes remain significant competitors.

- Reimbursement Policies: Inconsistent or inadequate reimbursement policies in certain regions can hinder market adoption.

- Supply Chain Complexities: Ensuring a consistent and high-quality supply of recombinant proteins can be challenging.

Emerging Opportunities in Bone Morphogenetic Proteins Industry

Emerging opportunities within the Bone Morphogenetic Proteins (BMPs) industry lie in the expansion of applications beyond traditional orthopedic and spinal procedures. Significant potential exists in areas such as cartilage repair, dental regeneration (periodontal defects, socket preservation), and craniofacial reconstruction, especially in complex cases. The development of novel BMP variants with enhanced osteogenic or chondrogenic properties, and their integration with advanced biomaterials, 3D-printed scaffolds, and cell-based therapies (stem cells, progenitor cells), presents a significant avenue for innovation. Furthermore, exploring BMPs for wound healing and tissue engineering applications, coupled with personalized medicine approaches that tailor BMP treatments based on genetic profiles, represents a promising frontier for future growth and market penetration.

Growth Accelerators in the Bone Morphogenetic Proteins Industry Industry

Several factors are accelerating the growth of the Bone Morphogenetic Proteins (BMPs) industry. Technological breakthroughs in protein engineering are leading to more potent and targeted BMP formulations. Strategic partnerships between biopharmaceutical companies, medical device manufacturers, and research institutions are fostering innovation and expediting product development. Market expansion strategies, including entering emerging economies with growing healthcare needs and investing in clinical trials to broaden approved indications, are key accelerators. The increasing focus on regenerative medicine and the shift towards evidence-based regenerative therapies are also significant drivers propelling the industry forward.

Key Players Shaping the Bone Morphogenetic Proteins Industry Market

- Thermo Fischer Scientific

- Zimmer Biomet Holdings Inc

- Merck KGaA

- Integra Lifesciences Holdings Corporation

- Ember therapeutics Inc

- Medtronic PLC

- Bio-Techne (R&D Systems Inc)

- Johnson & Johnson

- Stryker Corporation

- Pfizer Inc

Notable Milestones in Bone Morphogenetic Proteins Industry Sector

- August 2022: Orthofix Medical Inc. entered into a strategic partnership agreement with CGBio for the clinical development and commercialization of Novosis recombinant human bone morphogenetic protein-2 (rhBMP-2) bone growth materials and other future tissue regenerative solutions for the United States and Canadian markets. This collaboration is set to expand the reach of innovative BMP-based solutions in North America.

- February 2022: Orthofix Medical launched Opus BA, a bone graft substitute designed for cervical and lumbar spine fusion procedures. Opus BA acts as a scaffold, enabling bone to grow across its surface, and is gradually absorbed and replaced by natural bone during the healing process, enhancing fusion success rates.

In-Depth Bone Morphogenetic Proteins Industry Market Outlook

The outlook for the Bone Morphogenetic Proteins (BMPs) industry remains exceptionally bright, driven by ongoing technological advancements and an expanding understanding of regenerative medicine. Future market potential is significant, with innovations in personalized medicine, novel BMP variants, and sophisticated delivery systems expected to unlock new therapeutic avenues and enhance patient outcomes. Strategic opportunities lie in addressing unmet clinical needs in complex bone repair, cartilage regeneration, and early-stage osteoarthritis treatment. The growing demand for minimally invasive and effective regenerative therapies positions BMPs as a cornerstone of future orthopedic and reconstructive care, promising sustained growth and transformative impact on patient well-being globally.

Bone Morphogenetic Proteins Industry Segmentation

-

1. Type

- 1.1. Recombin

- 1.2. Recombin

-

2. Application

- 2.1. Spinal Fusion

- 2.2. Trauma

- 2.3. Reconstructive Surgery

- 2.4. Oral-maxillofacial

Bone Morphogenetic Proteins Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South korea

- 3.6. Rest of Asia Pacific

- 4. Middle East

-

5. GCC

- 5.1. South Africa

- 5.2. Rest of Middle East

-

6. South America

- 6.1. Brazil

- 6.2. Argentina

- 6.3. Rest of South America

Bone Morphogenetic Proteins Industry Regional Market Share

Geographic Coverage of Bone Morphogenetic Proteins Industry

Bone Morphogenetic Proteins Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Incidences of Sports-related Injury; Rising Demand for Minimally Invasive Surgeries; Technological Advancements

- 3.3. Market Restrains

- 3.3.1. High Cost of Procedure; Alternative Treatment Availability

- 3.4. Market Trends

- 3.4.1. Spinal Fusion is Expected to Hold the Significant Market Share in the Application Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bone Morphogenetic Proteins Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Recombin

- 5.1.2. Recombin

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Spinal Fusion

- 5.2.2. Trauma

- 5.2.3. Reconstructive Surgery

- 5.2.4. Oral-maxillofacial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East

- 5.3.5. GCC

- 5.3.6. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Bone Morphogenetic Proteins Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Recombin

- 6.1.2. Recombin

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Spinal Fusion

- 6.2.2. Trauma

- 6.2.3. Reconstructive Surgery

- 6.2.4. Oral-maxillofacial

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Bone Morphogenetic Proteins Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Recombin

- 7.1.2. Recombin

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Spinal Fusion

- 7.2.2. Trauma

- 7.2.3. Reconstructive Surgery

- 7.2.4. Oral-maxillofacial

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Bone Morphogenetic Proteins Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Recombin

- 8.1.2. Recombin

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Spinal Fusion

- 8.2.2. Trauma

- 8.2.3. Reconstructive Surgery

- 8.2.4. Oral-maxillofacial

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East Bone Morphogenetic Proteins Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Recombin

- 9.1.2. Recombin

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Spinal Fusion

- 9.2.2. Trauma

- 9.2.3. Reconstructive Surgery

- 9.2.4. Oral-maxillofacial

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. GCC Bone Morphogenetic Proteins Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Recombin

- 10.1.2. Recombin

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Spinal Fusion

- 10.2.2. Trauma

- 10.2.3. Reconstructive Surgery

- 10.2.4. Oral-maxillofacial

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. South America Bone Morphogenetic Proteins Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Recombin

- 11.1.2. Recombin

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Spinal Fusion

- 11.2.2. Trauma

- 11.2.3. Reconstructive Surgery

- 11.2.4. Oral-maxillofacial

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Thermo Fischer Scientific

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Zimmer Biomet Holdings Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Merck KGaA

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Integra Lifesciences Holdings Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Ember therapeutics Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Medtronic PLC

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Bio-Techne (R&D Systems Inc )

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Johnson & Johnson

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Stryker Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Pfizer Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Thermo Fischer Scientific

List of Figures

- Figure 1: Global Bone Morphogenetic Proteins Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Bone Morphogenetic Proteins Industry Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: North America Bone Morphogenetic Proteins Industry Revenue (million), by Type 2025 & 2033

- Figure 4: North America Bone Morphogenetic Proteins Industry Volume (K Tons), by Type 2025 & 2033

- Figure 5: North America Bone Morphogenetic Proteins Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Bone Morphogenetic Proteins Industry Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Bone Morphogenetic Proteins Industry Revenue (million), by Application 2025 & 2033

- Figure 8: North America Bone Morphogenetic Proteins Industry Volume (K Tons), by Application 2025 & 2033

- Figure 9: North America Bone Morphogenetic Proteins Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Bone Morphogenetic Proteins Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Bone Morphogenetic Proteins Industry Revenue (million), by Country 2025 & 2033

- Figure 12: North America Bone Morphogenetic Proteins Industry Volume (K Tons), by Country 2025 & 2033

- Figure 13: North America Bone Morphogenetic Proteins Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Bone Morphogenetic Proteins Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Bone Morphogenetic Proteins Industry Revenue (million), by Type 2025 & 2033

- Figure 16: Europe Bone Morphogenetic Proteins Industry Volume (K Tons), by Type 2025 & 2033

- Figure 17: Europe Bone Morphogenetic Proteins Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Bone Morphogenetic Proteins Industry Volume Share (%), by Type 2025 & 2033

- Figure 19: Europe Bone Morphogenetic Proteins Industry Revenue (million), by Application 2025 & 2033

- Figure 20: Europe Bone Morphogenetic Proteins Industry Volume (K Tons), by Application 2025 & 2033

- Figure 21: Europe Bone Morphogenetic Proteins Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Bone Morphogenetic Proteins Industry Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Bone Morphogenetic Proteins Industry Revenue (million), by Country 2025 & 2033

- Figure 24: Europe Bone Morphogenetic Proteins Industry Volume (K Tons), by Country 2025 & 2033

- Figure 25: Europe Bone Morphogenetic Proteins Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Bone Morphogenetic Proteins Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Bone Morphogenetic Proteins Industry Revenue (million), by Type 2025 & 2033

- Figure 28: Asia Pacific Bone Morphogenetic Proteins Industry Volume (K Tons), by Type 2025 & 2033

- Figure 29: Asia Pacific Bone Morphogenetic Proteins Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Bone Morphogenetic Proteins Industry Volume Share (%), by Type 2025 & 2033

- Figure 31: Asia Pacific Bone Morphogenetic Proteins Industry Revenue (million), by Application 2025 & 2033

- Figure 32: Asia Pacific Bone Morphogenetic Proteins Industry Volume (K Tons), by Application 2025 & 2033

- Figure 33: Asia Pacific Bone Morphogenetic Proteins Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific Bone Morphogenetic Proteins Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific Bone Morphogenetic Proteins Industry Revenue (million), by Country 2025 & 2033

- Figure 36: Asia Pacific Bone Morphogenetic Proteins Industry Volume (K Tons), by Country 2025 & 2033

- Figure 37: Asia Pacific Bone Morphogenetic Proteins Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Bone Morphogenetic Proteins Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East Bone Morphogenetic Proteins Industry Revenue (million), by Type 2025 & 2033

- Figure 40: Middle East Bone Morphogenetic Proteins Industry Volume (K Tons), by Type 2025 & 2033

- Figure 41: Middle East Bone Morphogenetic Proteins Industry Revenue Share (%), by Type 2025 & 2033

- Figure 42: Middle East Bone Morphogenetic Proteins Industry Volume Share (%), by Type 2025 & 2033

- Figure 43: Middle East Bone Morphogenetic Proteins Industry Revenue (million), by Application 2025 & 2033

- Figure 44: Middle East Bone Morphogenetic Proteins Industry Volume (K Tons), by Application 2025 & 2033

- Figure 45: Middle East Bone Morphogenetic Proteins Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Middle East Bone Morphogenetic Proteins Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: Middle East Bone Morphogenetic Proteins Industry Revenue (million), by Country 2025 & 2033

- Figure 48: Middle East Bone Morphogenetic Proteins Industry Volume (K Tons), by Country 2025 & 2033

- Figure 49: Middle East Bone Morphogenetic Proteins Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East Bone Morphogenetic Proteins Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: GCC Bone Morphogenetic Proteins Industry Revenue (million), by Type 2025 & 2033

- Figure 52: GCC Bone Morphogenetic Proteins Industry Volume (K Tons), by Type 2025 & 2033

- Figure 53: GCC Bone Morphogenetic Proteins Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: GCC Bone Morphogenetic Proteins Industry Volume Share (%), by Type 2025 & 2033

- Figure 55: GCC Bone Morphogenetic Proteins Industry Revenue (million), by Application 2025 & 2033

- Figure 56: GCC Bone Morphogenetic Proteins Industry Volume (K Tons), by Application 2025 & 2033

- Figure 57: GCC Bone Morphogenetic Proteins Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: GCC Bone Morphogenetic Proteins Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: GCC Bone Morphogenetic Proteins Industry Revenue (million), by Country 2025 & 2033

- Figure 60: GCC Bone Morphogenetic Proteins Industry Volume (K Tons), by Country 2025 & 2033

- Figure 61: GCC Bone Morphogenetic Proteins Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: GCC Bone Morphogenetic Proteins Industry Volume Share (%), by Country 2025 & 2033

- Figure 63: South America Bone Morphogenetic Proteins Industry Revenue (million), by Type 2025 & 2033

- Figure 64: South America Bone Morphogenetic Proteins Industry Volume (K Tons), by Type 2025 & 2033

- Figure 65: South America Bone Morphogenetic Proteins Industry Revenue Share (%), by Type 2025 & 2033

- Figure 66: South America Bone Morphogenetic Proteins Industry Volume Share (%), by Type 2025 & 2033

- Figure 67: South America Bone Morphogenetic Proteins Industry Revenue (million), by Application 2025 & 2033

- Figure 68: South America Bone Morphogenetic Proteins Industry Volume (K Tons), by Application 2025 & 2033

- Figure 69: South America Bone Morphogenetic Proteins Industry Revenue Share (%), by Application 2025 & 2033

- Figure 70: South America Bone Morphogenetic Proteins Industry Volume Share (%), by Application 2025 & 2033

- Figure 71: South America Bone Morphogenetic Proteins Industry Revenue (million), by Country 2025 & 2033

- Figure 72: South America Bone Morphogenetic Proteins Industry Volume (K Tons), by Country 2025 & 2033

- Figure 73: South America Bone Morphogenetic Proteins Industry Revenue Share (%), by Country 2025 & 2033

- Figure 74: South America Bone Morphogenetic Proteins Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bone Morphogenetic Proteins Industry Revenue million Forecast, by Type 2020 & 2033

- Table 2: Global Bone Morphogenetic Proteins Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Global Bone Morphogenetic Proteins Industry Revenue million Forecast, by Application 2020 & 2033

- Table 4: Global Bone Morphogenetic Proteins Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Global Bone Morphogenetic Proteins Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: Global Bone Morphogenetic Proteins Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Global Bone Morphogenetic Proteins Industry Revenue million Forecast, by Type 2020 & 2033

- Table 8: Global Bone Morphogenetic Proteins Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: Global Bone Morphogenetic Proteins Industry Revenue million Forecast, by Application 2020 & 2033

- Table 10: Global Bone Morphogenetic Proteins Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: Global Bone Morphogenetic Proteins Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: Global Bone Morphogenetic Proteins Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: United States Bone Morphogenetic Proteins Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: United States Bone Morphogenetic Proteins Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Canada Bone Morphogenetic Proteins Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Canada Bone Morphogenetic Proteins Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 17: Mexico Bone Morphogenetic Proteins Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Bone Morphogenetic Proteins Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: Global Bone Morphogenetic Proteins Industry Revenue million Forecast, by Type 2020 & 2033

- Table 20: Global Bone Morphogenetic Proteins Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 21: Global Bone Morphogenetic Proteins Industry Revenue million Forecast, by Application 2020 & 2033

- Table 22: Global Bone Morphogenetic Proteins Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 23: Global Bone Morphogenetic Proteins Industry Revenue million Forecast, by Country 2020 & 2033

- Table 24: Global Bone Morphogenetic Proteins Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Germany Bone Morphogenetic Proteins Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Germany Bone Morphogenetic Proteins Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Bone Morphogenetic Proteins Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Bone Morphogenetic Proteins Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: France Bone Morphogenetic Proteins Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: France Bone Morphogenetic Proteins Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Italy Bone Morphogenetic Proteins Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Italy Bone Morphogenetic Proteins Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Spain Bone Morphogenetic Proteins Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Spain Bone Morphogenetic Proteins Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Bone Morphogenetic Proteins Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Bone Morphogenetic Proteins Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Global Bone Morphogenetic Proteins Industry Revenue million Forecast, by Type 2020 & 2033

- Table 38: Global Bone Morphogenetic Proteins Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 39: Global Bone Morphogenetic Proteins Industry Revenue million Forecast, by Application 2020 & 2033

- Table 40: Global Bone Morphogenetic Proteins Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 41: Global Bone Morphogenetic Proteins Industry Revenue million Forecast, by Country 2020 & 2033

- Table 42: Global Bone Morphogenetic Proteins Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 43: China Bone Morphogenetic Proteins Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: China Bone Morphogenetic Proteins Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: Japan Bone Morphogenetic Proteins Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Japan Bone Morphogenetic Proteins Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: India Bone Morphogenetic Proteins Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: India Bone Morphogenetic Proteins Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Australia Bone Morphogenetic Proteins Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: Australia Bone Morphogenetic Proteins Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: South korea Bone Morphogenetic Proteins Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: South korea Bone Morphogenetic Proteins Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Bone Morphogenetic Proteins Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Bone Morphogenetic Proteins Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 55: Global Bone Morphogenetic Proteins Industry Revenue million Forecast, by Type 2020 & 2033

- Table 56: Global Bone Morphogenetic Proteins Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 57: Global Bone Morphogenetic Proteins Industry Revenue million Forecast, by Application 2020 & 2033

- Table 58: Global Bone Morphogenetic Proteins Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 59: Global Bone Morphogenetic Proteins Industry Revenue million Forecast, by Country 2020 & 2033

- Table 60: Global Bone Morphogenetic Proteins Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 61: Global Bone Morphogenetic Proteins Industry Revenue million Forecast, by Type 2020 & 2033

- Table 62: Global Bone Morphogenetic Proteins Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 63: Global Bone Morphogenetic Proteins Industry Revenue million Forecast, by Application 2020 & 2033

- Table 64: Global Bone Morphogenetic Proteins Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 65: Global Bone Morphogenetic Proteins Industry Revenue million Forecast, by Country 2020 & 2033

- Table 66: Global Bone Morphogenetic Proteins Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 67: South Africa Bone Morphogenetic Proteins Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 68: South Africa Bone Morphogenetic Proteins Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 69: Rest of Middle East Bone Morphogenetic Proteins Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 70: Rest of Middle East Bone Morphogenetic Proteins Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 71: Global Bone Morphogenetic Proteins Industry Revenue million Forecast, by Type 2020 & 2033

- Table 72: Global Bone Morphogenetic Proteins Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 73: Global Bone Morphogenetic Proteins Industry Revenue million Forecast, by Application 2020 & 2033

- Table 74: Global Bone Morphogenetic Proteins Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 75: Global Bone Morphogenetic Proteins Industry Revenue million Forecast, by Country 2020 & 2033

- Table 76: Global Bone Morphogenetic Proteins Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 77: Brazil Bone Morphogenetic Proteins Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 78: Brazil Bone Morphogenetic Proteins Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 79: Argentina Bone Morphogenetic Proteins Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 80: Argentina Bone Morphogenetic Proteins Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 81: Rest of South America Bone Morphogenetic Proteins Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 82: Rest of South America Bone Morphogenetic Proteins Industry Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bone Morphogenetic Proteins Industry?

The projected CAGR is approximately 9.6%.

2. Which companies are prominent players in the Bone Morphogenetic Proteins Industry?

Key companies in the market include Thermo Fischer Scientific, Zimmer Biomet Holdings Inc , Merck KGaA, Integra Lifesciences Holdings Corporation, Ember therapeutics Inc, Medtronic PLC, Bio-Techne (R&D Systems Inc ), Johnson & Johnson, Stryker Corporation, Pfizer Inc.

3. What are the main segments of the Bone Morphogenetic Proteins Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 572 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Incidences of Sports-related Injury; Rising Demand for Minimally Invasive Surgeries; Technological Advancements.

6. What are the notable trends driving market growth?

Spinal Fusion is Expected to Hold the Significant Market Share in the Application Segment.

7. Are there any restraints impacting market growth?

High Cost of Procedure; Alternative Treatment Availability.

8. Can you provide examples of recent developments in the market?

In August 2022, Orthofix Medical Inc. entered into a strategic partnership agreement with CGBio, for the clinical development and commercialization of Novosis recombinant human bone morphogenetic protein-2 (rhBMP-2) bone growth materials and other future tissue regenerative solutions for the United States and Canadian markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bone Morphogenetic Proteins Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bone Morphogenetic Proteins Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bone Morphogenetic Proteins Industry?

To stay informed about further developments, trends, and reports in the Bone Morphogenetic Proteins Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence