Key Insights

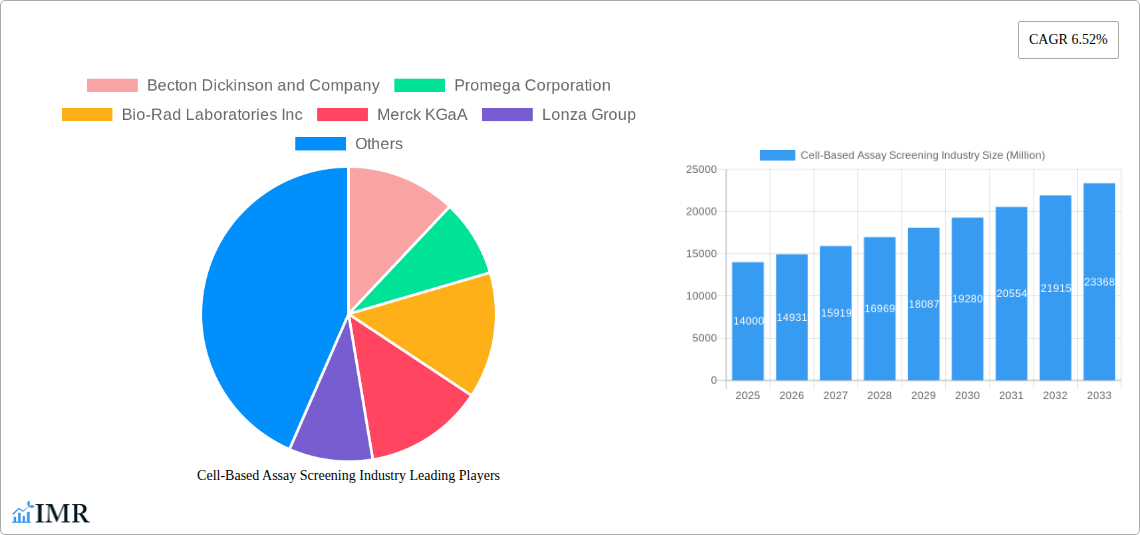

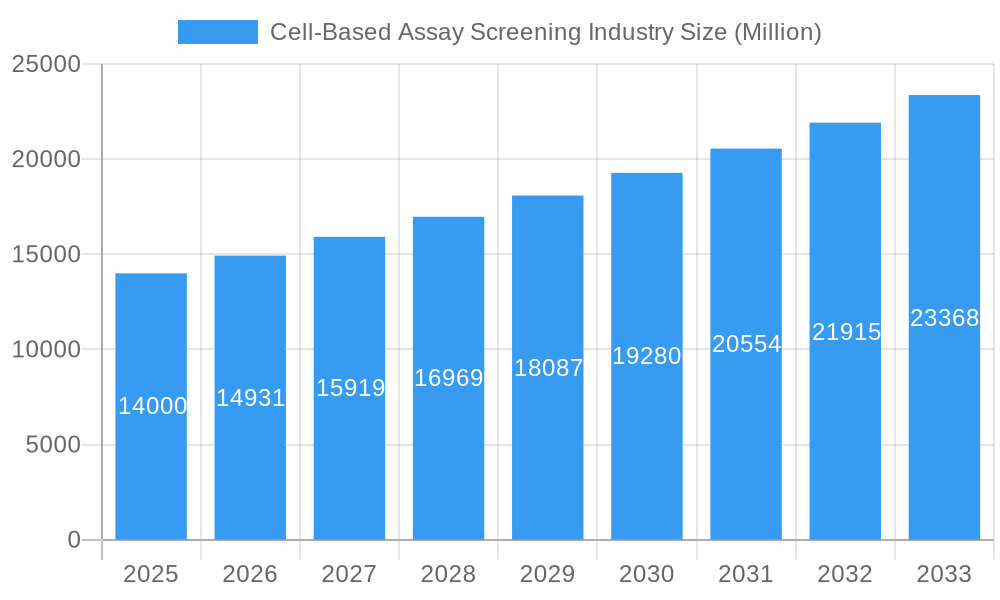

The global Cell-Based Assay Screening market is poised for robust expansion, projected to reach an estimated market size of approximately USD 14,000 million by 2025, driven by a Compound Annual Growth Rate (CAGR) of 6.52% through 2033. This sustained growth trajectory is underpinned by significant advancements in drug discovery and development. The pharmaceutical and biotechnology sectors are leading the charge, heavily investing in high-throughput screening (HTS) technologies that leverage sophisticated cell lines, reagents, kits, and microplates to accelerate the identification of novel drug candidates. Emerging trends such as the integration of automated handling systems and label-free detection technologies are further enhancing efficiency and accuracy in screening processes. The increasing prevalence of chronic diseases and the ongoing need for novel therapeutics are key demand drivers, pushing research institutions and commercial entities to adopt cutting-edge cell-based assay screening solutions.

Cell-Based Assay Screening Industry Market Size (In Billion)

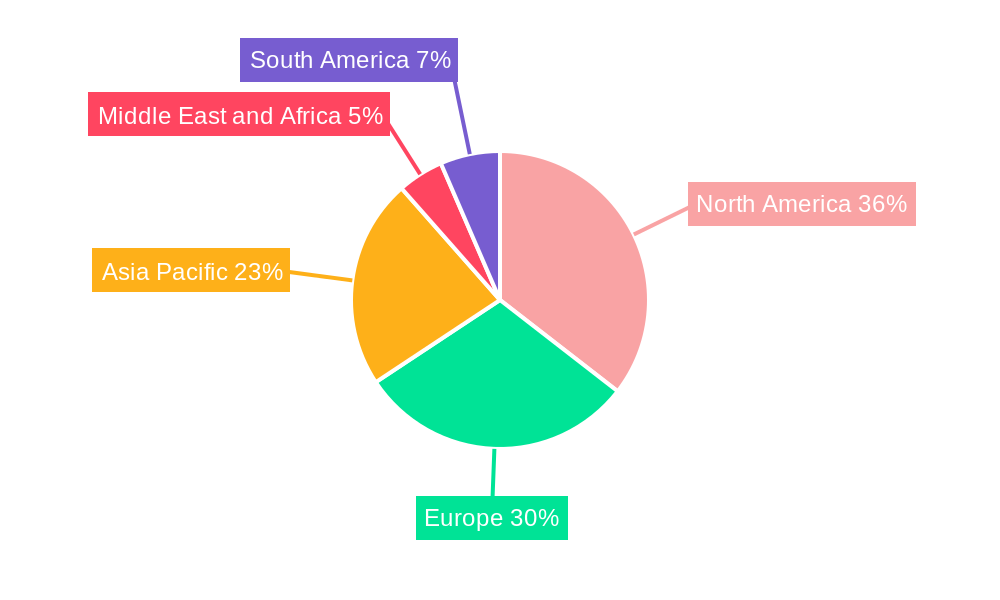

Key restraints in the market include the high cost associated with advanced screening technologies and the intricate regulatory landscape for drug development. However, these are being increasingly offset by the development of more cost-effective solutions and the growing accessibility of advanced technologies. The market is segmented across various product categories, with Cell Lines, Reagents and Kits, and Microplates forming the core offerings. Technological innovations like Flow Cytometry and High-throughput Screening are central to the market's evolution, facilitating more comprehensive and efficient analyses. Geographically, North America and Europe currently dominate the market due to established research infrastructure and significant R&D investments. However, the Asia Pacific region is emerging as a high-growth area, fueled by increasing government support for life sciences research and the burgeoning pharmaceutical industry in countries like China and India. Major players like Thermo Fisher Scientific, Danaher Corporation, and Becton Dickinson and Company are actively shaping the market through strategic investments in R&D and acquisitions.

Cell-Based Assay Screening Industry Company Market Share

Cell-Based Assay Screening Industry: Market Analysis & Forecast 2025-2033

This comprehensive report offers an in-depth analysis of the global Cell-Based Assay Screening market, a critical segment within life sciences research and drug discovery. Navigating the complexities of high-throughput screening (HTS), drug development pipelines, and personalized medicine, this report provides actionable insights for stakeholders across the pharmaceutical, biotechnology, and academic sectors. We meticulously examine market dynamics, growth trends, regional dominance, product innovations, key drivers, challenges, and emerging opportunities, all while providing a detailed outlook on the cell-based assay services market and its intricate parent and child market structures.

Cell-Based Assay Screening Industry Market Dynamics & Structure

The Cell-Based Assay Screening market is characterized by a moderately consolidated structure, with leading players like Thermo Fisher Scientific Inc., Danaher Corporation, and Merck KGaA holding significant market shares. Technological innovation is the primary driver, fueled by the relentless demand for more predictive and translatable in vitro models for drug discovery and toxicology testing. The integration of automation, advanced imaging techniques, and omics technologies is transforming screening platforms. Regulatory frameworks, particularly concerning the approval of new drug candidates, indirectly shape market demand by emphasizing robust preclinical testing. Competitive product substitutes include traditional biochemical assays and animal models, though cell-based assays are increasingly favored for their physiological relevance and ethical advantages. End-user demographics are shifting towards a greater reliance on specialized contract research organizations (CROs) and academic institutions investing heavily in cutting-edge screening technologies. Merger and acquisition (M&A) trends are prevalent, as larger companies seek to expand their assay development capabilities and gain access to novel cell line technologies and screening services.

- Market Concentration: Moderately consolidated, driven by strategic acquisitions and organic growth of established players.

- Technological Innovation Drivers: Demand for accurate drug screening, development of novel cell models, and advancements in automation and data analysis.

- Regulatory Frameworks: FDA and EMA guidelines for drug safety and efficacy testing indirectly influence the adoption of advanced cell-based screening methods.

- Competitive Product Substitutes: Biochemical assays, in silico modeling, and animal testing, though cell-based assays offer superior predictive power.

- End-User Demographics: Growing adoption by pharmaceutical and biotechnology companies, alongside expansion in academic and government research institutes.

- M&A Trends: Strategic acquisitions to enhance screening portfolios, acquire proprietary cell line libraries, and expand service offerings.

Cell-Based Assay Screening Industry Growth Trends & Insights

The Cell-Based Assay Screening market is poised for robust growth, projected to expand from an estimated XX Million in the base year 2025 to a projected XX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025–2033). This expansion is underpinned by several key growth trends and insights. The increasing prevalence of chronic diseases and the escalating need for novel therapeutics are significantly driving the adoption of cell-based screening platforms in drug discovery. Furthermore, advancements in stem cell research, particularly induced pluripotent stem cells (iPSCs), are enabling the development of more patient-specific disease models, enhancing the predictive power of screening assays. The rising trend of outsourcing drug discovery services to specialized CROs further fuels market growth, as these organizations invest in state-of-the-art cell-based assay capabilities. Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) for data analysis and target identification within screening campaigns, are also shaping market dynamics. Consumer behavior shifts, driven by a growing emphasis on personalized medicine and the demand for safer and more effective drugs, are pushing the industry towards more sophisticated in vitro testing methodologies. The penetration of high-throughput screening technologies in both established and emerging markets is steadily increasing, reflecting a broader acceptance and reliance on these advanced screening methods. 3D cell culture models, including organoids and spheroids, are gaining traction due to their ability to mimic in vivo microenvironments, leading to more physiologically relevant screening data. The growing demand for drug repurposing and the need to identify new indications for existing drugs also contribute to the sustained growth of the cell-based assay screening market. The report quantises these trends, showing a market that is not only expanding in size but also deepening its impact on the pharmaceutical R&D lifecycle.

Dominant Regions, Countries, or Segments in Cell-Based Assay Screening Industry

The Cell-Based Assay Screening market exhibits distinct regional dominance, with North America currently leading, driven by its robust pharmaceutical and biotechnology ecosystem, substantial R&D investments, and a strong presence of key players like Becton Dickinson and Company, Promega Corporation, and Thermo Fisher Scientific Inc. Within the Product segment, Reagents and Kits are projected to dominate, accounting for a substantial market share, owing to their essential role in various cell-based assays and the constant demand for novel and optimized reagents. Primary Cell Lines also represent a significant sub-segment within Cell Lines, crucial for representing native cellular responses.

In terms of Technology, Automated Handling systems are experiencing rapid adoption, enhancing efficiency and throughput in high-throughput screening. This is closely followed by Flow Cytometry, which remains a cornerstone for cell analysis and sorting in drug discovery. The Application segment is overwhelmingly driven by Drug Discovery, which constitutes the largest portion of the market, reflecting its critical importance in identifying and validating novel therapeutic targets and candidates. The End-user segment is dominated by Pharmaceutical and Biotechnology Companies, who are the primary adopters of these advanced screening solutions for their extensive R&D pipelines.

- Dominant Region: North America, due to significant R&D expenditure and a well-established life sciences industry.

- Leading Product Segment: Reagents and Kits, essential for the broad application of cell-based assays.

- Key Driver: Continuous innovation in assay reagents and the need for specialized kits for specific research areas.

- Leading Technology: Automated Handling systems, improving efficiency and scalability of screening processes.

- Key Driver: Increasing demand for high-throughput screening and reduced manual labor.

- Dominant Application: Drug Discovery, representing the core use case for cell-based assay screening.

- Key Driver: The relentless pursuit of novel therapeutics and the need for predictive preclinical models.

- Dominant End-user: Pharmaceutical and Biotechnology Companies, driving significant market demand through their extensive R&D activities.

- Key Driver: The high cost and complexity of drug development necessitating advanced screening tools.

Cell-Based Assay Screening Industry Product Landscape

The Cell-Based Assay Screening industry boasts a diverse product landscape, encompassing essential Cell Lines (including Primary Cell Lines, Stem Cell Lines, and Others), a wide array of Reagents and Kits tailored for specific assays, specialized Microplates, and various Other Consumables. Innovations are focused on developing more physiologically relevant cell models, such as 3D spheroids and organoids, for enhanced predictive accuracy in drug screening. The development of sensitive and specific reagents for detecting cellular responses, alongside advanced microplate technologies that improve assay performance and reduce background noise, are key performance metrics. Companies are also focusing on developing integrated solutions that combine hardware, software, and consumables for streamlined screening workflows.

Key Drivers, Barriers & Challenges in Cell-Based Assay Screening Industry

Key Drivers:

- Growing R&D Investment in Drug Discovery: Increasing funding from pharmaceutical and biotechnology companies for novel therapeutic development.

- Advancements in Cell Biology and Technology: Development of more sophisticated cell models and screening technologies.

- Demand for Predictive Preclinical Models: The need for assays that better predict in vivo efficacy and toxicity.

- Rise of Personalized Medicine: The demand for patient-specific assays to tailor treatments.

- Outsourcing Trends: Increased reliance on Contract Research Organizations (CROs) with specialized cell-based screening capabilities.

Barriers & Challenges:

- High Cost of Instrumentation and Reagents: Significant capital investment required for advanced screening platforms.

- Complexity of Assay Development and Validation: Developing robust and reproducible assays can be time-consuming and resource-intensive.

- Data Interpretation and Standardization: Challenges in standardizing data analysis across different platforms and assays.

- Regulatory Hurdles: Navigating evolving regulatory requirements for drug approval.

- Skill Shortage: Demand for highly skilled personnel in cell biology, assay development, and data analysis.

Emerging Opportunities in Cell-Based Assay Screening Industry

Emerging opportunities in the Cell-Based Assay Screening industry lie in the expansion of organ-on-a-chip technologies, offering unparalleled physiological relevance for drug testing. The growing interest in cell therapy development presents a significant avenue, requiring specialized cell-based assays for quality control and efficacy assessment. Untapped markets in emerging economies with increasing healthcare expenditure also offer substantial growth potential. Furthermore, the integration of AI and machine learning in screening data analysis presents an opportunity to accelerate drug discovery timelines and identify novel drug targets more effectively. The increasing focus on rare disease research will also necessitate the development of specialized cell models and assays.

Growth Accelerators in the Cell-Based Assay Screening Industry Industry

Several factors are accelerating the long-term growth of the Cell-Based Assay Screening industry. Technological breakthroughs in CRISPR-Cas9 gene editing are enabling the creation of highly specific disease models, thereby enhancing the precision of screening campaigns. Strategic partnerships between technology providers and pharmaceutical companies are fostering innovation and accelerating the adoption of new screening platforms. Market expansion strategies focusing on personalized medicine and companion diagnostics are creating new revenue streams. The increasing adoption of automated liquid handling systems and robotic platforms is also significantly boosting throughput and efficiency, further driving market expansion. The growing emphasis on drug safety and toxicology screening using in vitro methods is also a significant growth accelerator.

Key Players Shaping the Cell-Based Assay Screening Industry Market

Becton Dickinson and Company Promega Corporation Bio-Rad Laboratories Inc Merck KGaA Lonza Group Thermo Fisher Scientific Inc Danaher Corporation Corning Inc Cell Signalling Technology Perkin Elmer Inc

Notable Milestones in Cell-Based Assay Screening Industry Sector

- August 2022: Life Net Health LifeSciences launched the Cell-Based Assay Services including cytotoxicity screening, biocompatibility assays, and others, enhancing the availability of specialized screening solutions.

- May 2022: Beckman Coulter Life Sciences launched the Aquios STEM system to provide a new solution for stem cell analysis. This innovation significantly reduces the turnaround time while decreasing manual and error-prone steps, improving efficiency in stem cell research.

In-Depth Cell-Based Assay Screening Industry Market Outlook

The Cell-Based Assay Screening industry is set for continued expansion, driven by an insatiable demand for more accurate and predictive drug discovery tools. Future market potential is significantly influenced by ongoing advancements in 3D cell culture, organ-on-a-chip technologies, and the seamless integration of AI and machine learning into screening workflows. Strategic opportunities abound in the development of specialized cell models for emerging therapeutic areas like cell and gene therapies and the growing field of neuroscience research. The increasing global focus on addressing unmet medical needs will further fuel the need for efficient and reliable cell-based screening platforms, ensuring a dynamic and growth-oriented future for the industry.

Cell-Based Assay Screening Industry Segmentation

-

1. Product

-

1.1. Cell Lines

- 1.1.1. Primary Cell Lines

- 1.1.2. Stem Cell Lines

- 1.1.3. Others

- 1.2. Reagents and Kits

- 1.3. Microplates

- 1.4. Other Consumables

-

1.1. Cell Lines

-

2. Technology

- 2.1. Automated Handling

- 2.2. Flow Cytometry

- 2.3. Label-free Detection

- 2.4. High-throughput Screening

- 2.5. Others

-

3. Application

- 3.1. Drug Discovery

- 3.2. Other Applications

-

4. End-user

- 4.1. Academic & Government Institutes

- 4.2. Pharmaceutical and Biotechnology Companies

- 4.3. Others

Cell-Based Assay Screening Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Cell-Based Assay Screening Industry Regional Market Share

Geographic Coverage of Cell-Based Assay Screening Industry

Cell-Based Assay Screening Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.52% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Prevalence of Chronic Diseases and Lifestyle Disorders; Increasing Investments in R&D for Drug Discovery; Rise in Technological Advancements in Cell-based Methodologies

- 3.3. Market Restrains

- 3.3.1. High Maintenance and Operational Costs; Lack of Skilled Personnel to Operate these Technologies

- 3.4. Market Trends

- 3.4.1. Drug Discovery is Expected to be the Fast Growing Segment in the Cell-Based Assay Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cell-Based Assay Screening Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Cell Lines

- 5.1.1.1. Primary Cell Lines

- 5.1.1.2. Stem Cell Lines

- 5.1.1.3. Others

- 5.1.2. Reagents and Kits

- 5.1.3. Microplates

- 5.1.4. Other Consumables

- 5.1.1. Cell Lines

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Automated Handling

- 5.2.2. Flow Cytometry

- 5.2.3. Label-free Detection

- 5.2.4. High-throughput Screening

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Drug Discovery

- 5.3.2. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End-user

- 5.4.1. Academic & Government Institutes

- 5.4.2. Pharmaceutical and Biotechnology Companies

- 5.4.3. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East and Africa

- 5.5.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Cell-Based Assay Screening Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Cell Lines

- 6.1.1.1. Primary Cell Lines

- 6.1.1.2. Stem Cell Lines

- 6.1.1.3. Others

- 6.1.2. Reagents and Kits

- 6.1.3. Microplates

- 6.1.4. Other Consumables

- 6.1.1. Cell Lines

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Automated Handling

- 6.2.2. Flow Cytometry

- 6.2.3. Label-free Detection

- 6.2.4. High-throughput Screening

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Drug Discovery

- 6.3.2. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by End-user

- 6.4.1. Academic & Government Institutes

- 6.4.2. Pharmaceutical and Biotechnology Companies

- 6.4.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Cell-Based Assay Screening Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Cell Lines

- 7.1.1.1. Primary Cell Lines

- 7.1.1.2. Stem Cell Lines

- 7.1.1.3. Others

- 7.1.2. Reagents and Kits

- 7.1.3. Microplates

- 7.1.4. Other Consumables

- 7.1.1. Cell Lines

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Automated Handling

- 7.2.2. Flow Cytometry

- 7.2.3. Label-free Detection

- 7.2.4. High-throughput Screening

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Drug Discovery

- 7.3.2. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by End-user

- 7.4.1. Academic & Government Institutes

- 7.4.2. Pharmaceutical and Biotechnology Companies

- 7.4.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Cell-Based Assay Screening Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Cell Lines

- 8.1.1.1. Primary Cell Lines

- 8.1.1.2. Stem Cell Lines

- 8.1.1.3. Others

- 8.1.2. Reagents and Kits

- 8.1.3. Microplates

- 8.1.4. Other Consumables

- 8.1.1. Cell Lines

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Automated Handling

- 8.2.2. Flow Cytometry

- 8.2.3. Label-free Detection

- 8.2.4. High-throughput Screening

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Drug Discovery

- 8.3.2. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by End-user

- 8.4.1. Academic & Government Institutes

- 8.4.2. Pharmaceutical and Biotechnology Companies

- 8.4.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Cell-Based Assay Screening Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Cell Lines

- 9.1.1.1. Primary Cell Lines

- 9.1.1.2. Stem Cell Lines

- 9.1.1.3. Others

- 9.1.2. Reagents and Kits

- 9.1.3. Microplates

- 9.1.4. Other Consumables

- 9.1.1. Cell Lines

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Automated Handling

- 9.2.2. Flow Cytometry

- 9.2.3. Label-free Detection

- 9.2.4. High-throughput Screening

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Drug Discovery

- 9.3.2. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by End-user

- 9.4.1. Academic & Government Institutes

- 9.4.2. Pharmaceutical and Biotechnology Companies

- 9.4.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Cell-Based Assay Screening Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Cell Lines

- 10.1.1.1. Primary Cell Lines

- 10.1.1.2. Stem Cell Lines

- 10.1.1.3. Others

- 10.1.2. Reagents and Kits

- 10.1.3. Microplates

- 10.1.4. Other Consumables

- 10.1.1. Cell Lines

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Automated Handling

- 10.2.2. Flow Cytometry

- 10.2.3. Label-free Detection

- 10.2.4. High-throughput Screening

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Drug Discovery

- 10.3.2. Other Applications

- 10.4. Market Analysis, Insights and Forecast - by End-user

- 10.4.1. Academic & Government Institutes

- 10.4.2. Pharmaceutical and Biotechnology Companies

- 10.4.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Becton Dickinson and Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Promega Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bio-Rad Laboratories Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Merck KGaA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lonza Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Thermo Fisher Scientific Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Danaher Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Corning Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Cell Singnalling Technology*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Perkin Elmer Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Cell-Based Assay Screening Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cell-Based Assay Screening Industry Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Cell-Based Assay Screening Industry Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Cell-Based Assay Screening Industry Revenue (Million), by Technology 2025 & 2033

- Figure 5: North America Cell-Based Assay Screening Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Cell-Based Assay Screening Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Cell-Based Assay Screening Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Cell-Based Assay Screening Industry Revenue (Million), by End-user 2025 & 2033

- Figure 9: North America Cell-Based Assay Screening Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 10: North America Cell-Based Assay Screening Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Cell-Based Assay Screening Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Cell-Based Assay Screening Industry Revenue (Million), by Product 2025 & 2033

- Figure 13: Europe Cell-Based Assay Screening Industry Revenue Share (%), by Product 2025 & 2033

- Figure 14: Europe Cell-Based Assay Screening Industry Revenue (Million), by Technology 2025 & 2033

- Figure 15: Europe Cell-Based Assay Screening Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Europe Cell-Based Assay Screening Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Europe Cell-Based Assay Screening Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Cell-Based Assay Screening Industry Revenue (Million), by End-user 2025 & 2033

- Figure 19: Europe Cell-Based Assay Screening Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 20: Europe Cell-Based Assay Screening Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Cell-Based Assay Screening Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Cell-Based Assay Screening Industry Revenue (Million), by Product 2025 & 2033

- Figure 23: Asia Pacific Cell-Based Assay Screening Industry Revenue Share (%), by Product 2025 & 2033

- Figure 24: Asia Pacific Cell-Based Assay Screening Industry Revenue (Million), by Technology 2025 & 2033

- Figure 25: Asia Pacific Cell-Based Assay Screening Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 26: Asia Pacific Cell-Based Assay Screening Industry Revenue (Million), by Application 2025 & 2033

- Figure 27: Asia Pacific Cell-Based Assay Screening Industry Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Cell-Based Assay Screening Industry Revenue (Million), by End-user 2025 & 2033

- Figure 29: Asia Pacific Cell-Based Assay Screening Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 30: Asia Pacific Cell-Based Assay Screening Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Cell-Based Assay Screening Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Cell-Based Assay Screening Industry Revenue (Million), by Product 2025 & 2033

- Figure 33: Middle East and Africa Cell-Based Assay Screening Industry Revenue Share (%), by Product 2025 & 2033

- Figure 34: Middle East and Africa Cell-Based Assay Screening Industry Revenue (Million), by Technology 2025 & 2033

- Figure 35: Middle East and Africa Cell-Based Assay Screening Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 36: Middle East and Africa Cell-Based Assay Screening Industry Revenue (Million), by Application 2025 & 2033

- Figure 37: Middle East and Africa Cell-Based Assay Screening Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa Cell-Based Assay Screening Industry Revenue (Million), by End-user 2025 & 2033

- Figure 39: Middle East and Africa Cell-Based Assay Screening Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 40: Middle East and Africa Cell-Based Assay Screening Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Cell-Based Assay Screening Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: South America Cell-Based Assay Screening Industry Revenue (Million), by Product 2025 & 2033

- Figure 43: South America Cell-Based Assay Screening Industry Revenue Share (%), by Product 2025 & 2033

- Figure 44: South America Cell-Based Assay Screening Industry Revenue (Million), by Technology 2025 & 2033

- Figure 45: South America Cell-Based Assay Screening Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 46: South America Cell-Based Assay Screening Industry Revenue (Million), by Application 2025 & 2033

- Figure 47: South America Cell-Based Assay Screening Industry Revenue Share (%), by Application 2025 & 2033

- Figure 48: South America Cell-Based Assay Screening Industry Revenue (Million), by End-user 2025 & 2033

- Figure 49: South America Cell-Based Assay Screening Industry Revenue Share (%), by End-user 2025 & 2033

- Figure 50: South America Cell-Based Assay Screening Industry Revenue (Million), by Country 2025 & 2033

- Figure 51: South America Cell-Based Assay Screening Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 5: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 7: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 8: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 10: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United States Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 15: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 16: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 18: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Germany Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of Europe Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 26: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 27: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 29: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: China Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Japan Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: India Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Australia Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: South Korea Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Rest of Asia Pacific Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 37: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 38: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 39: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 40: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: GCC Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: South Africa Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Product 2020 & 2033

- Table 45: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 46: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 47: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by End-user 2020 & 2033

- Table 48: Global Cell-Based Assay Screening Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 49: Brazil Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Argentina Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of South America Cell-Based Assay Screening Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cell-Based Assay Screening Industry?

The projected CAGR is approximately 6.52%.

2. Which companies are prominent players in the Cell-Based Assay Screening Industry?

Key companies in the market include Becton Dickinson and Company, Promega Corporation, Bio-Rad Laboratories Inc, Merck KGaA, Lonza Group, Thermo Fisher Scientific Inc, Danaher Corporation, Corning Inc, Cell Singnalling Technology*List Not Exhaustive, Perkin Elmer Inc.

3. What are the main segments of the Cell-Based Assay Screening Industry?

The market segments include Product, Technology, Application, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Prevalence of Chronic Diseases and Lifestyle Disorders; Increasing Investments in R&D for Drug Discovery; Rise in Technological Advancements in Cell-based Methodologies.

6. What are the notable trends driving market growth?

Drug Discovery is Expected to be the Fast Growing Segment in the Cell-Based Assay Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Maintenance and Operational Costs; Lack of Skilled Personnel to Operate these Technologies.

8. Can you provide examples of recent developments in the market?

In August 2022, Life Net Health LifeSciences launched the Cell-Based Assay Services including cytotoxicity screening, biocompatibility assays, and others

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cell-Based Assay Screening Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cell-Based Assay Screening Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cell-Based Assay Screening Industry?

To stay informed about further developments, trends, and reports in the Cell-Based Assay Screening Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence