Key Insights

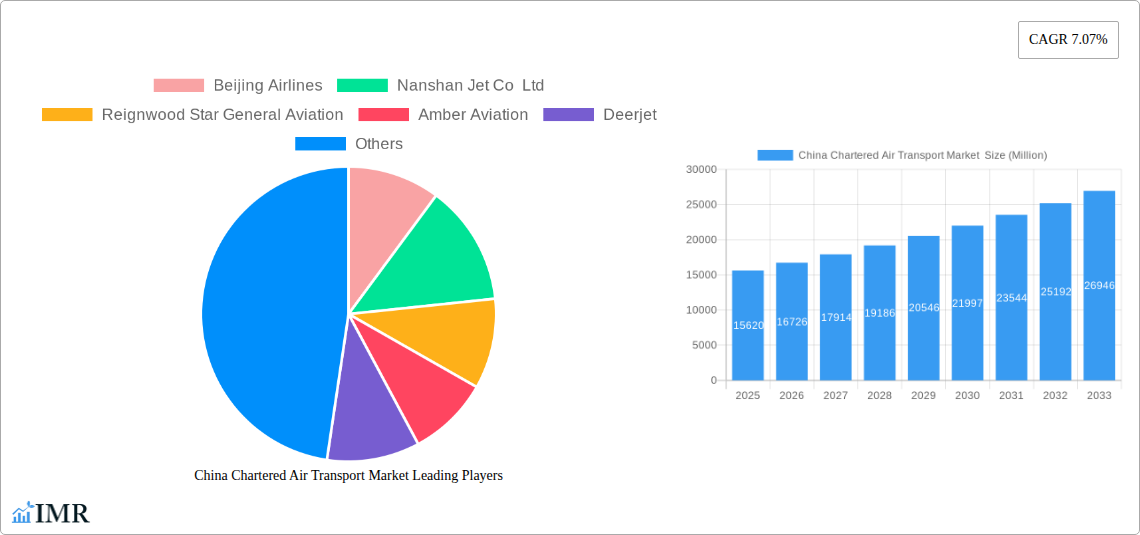

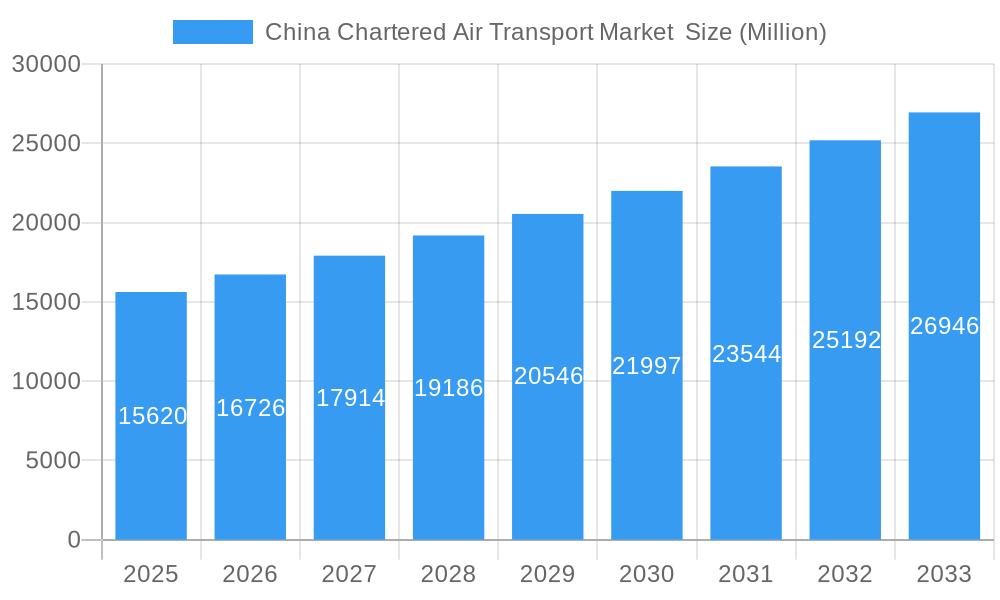

The China chartered air transport market is experiencing robust growth, projected to reach $15.62 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 7.07% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing affluence of China's population is driving demand for premium travel experiences, with chartered flights offering unparalleled convenience and flexibility. Secondly, the burgeoning e-commerce sector necessitates efficient and reliable transportation of time-sensitive goods, boosting the demand for chartered air cargo services, particularly in sectors like pharmaceuticals and high-value electronics. Thirdly, the growth of business travel, especially within the rapidly expanding Chinese business landscape, further contributes to market growth. The market is segmented by cargo type, including time-critical cargo, heavy and oversized cargo, dangerous goods, animal transportation, and other cargo types. Leading players like Beijing Airlines, Nanshan Jet Co Ltd, and others, are capitalizing on this growth by investing in modern fleets and expanding their service offerings. The market's regional focus is predominantly China, although international connections are becoming increasingly relevant.

China Chartered Air Transport Market Market Size (In Billion)

While the market demonstrates significant promise, certain challenges remain. Competition among established players and new entrants could intensify pricing pressures. Furthermore, potential regulatory changes and fluctuations in fuel prices pose ongoing risks. However, the overall market outlook remains positive, driven by sustained economic growth and evolving consumer preferences. The strong emphasis on infrastructure development within China, particularly concerning airports and air traffic management, is also expected to further facilitate growth within the chartered air transport sector. The market’s continued segmentation based on cargo type allows for specialized service offerings, enhancing operational efficiency and potentially mitigating some of the challenges mentioned above.

China Chartered Air Transport Market Company Market Share

China Chartered Air Transport Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China chartered air transport market, encompassing its current dynamics, growth trajectory, key players, and future outlook. The report covers the parent market of air freight transportation in China and the child market of chartered air transport, offering a granular perspective for investors, industry professionals, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The market size is presented in million units.

China Chartered Air Transport Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the Chinese chartered air transport sector. The market is characterized by a moderately concentrated structure with key players holding significant market share. However, emerging players are continuously challenging the status quo through innovation and strategic partnerships. Technological advancements, such as improved flight management systems and enhanced safety protocols, are significant drivers. Stringent regulatory frameworks, particularly concerning safety and operational standards, shape market dynamics. Substitute modes of transportation, such as rail and road freight, pose competitive pressure, particularly for less time-sensitive cargo. The end-user demographics encompass a wide range of industries, including manufacturing, e-commerce, and pharmaceuticals. M&A activity has been moderate, with a total of xx deals recorded between 2019 and 2024, resulting in a market consolidation of approximately xx%.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Driven by advancements in flight management systems, aircraft technology, and logistics software.

- Regulatory Framework: Stringent safety and operational regulations influence market access and operations.

- Competitive Substitutes: Rail and road freight pose competition, particularly for non-time-sensitive goods.

- End-User Demographics: Diverse, encompassing manufacturing, e-commerce, pharmaceuticals, and other sectors.

- M&A Trends: Moderate activity observed between 2019 and 2024, with xx deals resulting in xx% market consolidation. Further consolidation is expected in the forecast period.

China Chartered Air Transport Market Growth Trends & Insights

The China chartered air transport market exhibits robust growth, driven by the expansion of e-commerce, increasing demand for time-sensitive goods, and the overall growth of the Chinese economy. The market size witnessed a CAGR of xx% during the historical period (2019-2024), reaching xx million units in 2024. This growth is projected to continue at a CAGR of xx% during the forecast period (2025-2033), reaching xx million units by 2033. Technological disruptions, such as the adoption of drone technology for specific cargo types, are accelerating market growth. Changing consumer behavior, particularly towards faster delivery times, further fuels market expansion. Market penetration is currently at xx%, with significant potential for future growth in less-developed regions.

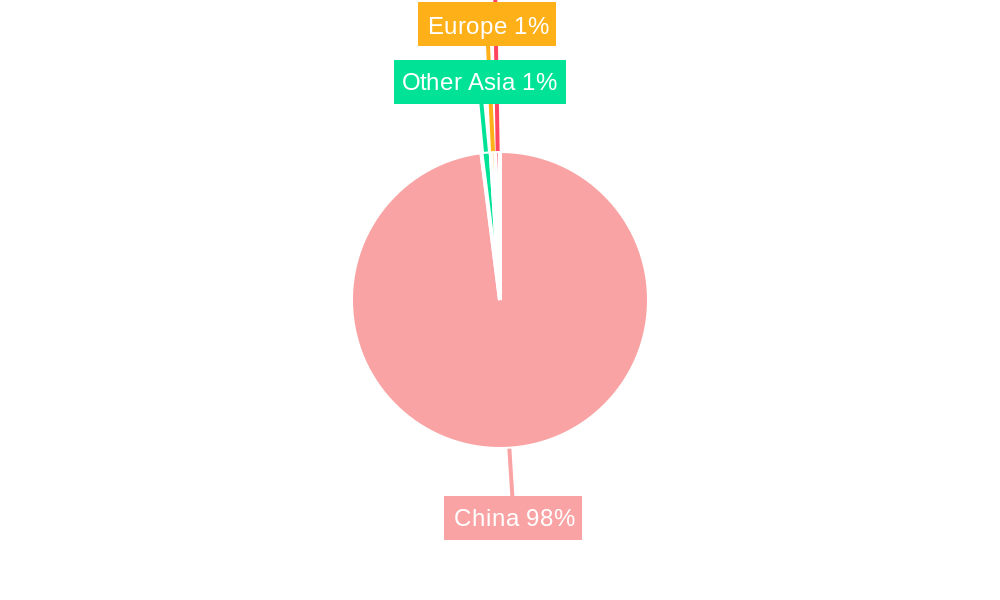

Dominant Regions, Countries, or Segments in China Chartered Air Transport Market

The coastal regions of China, particularly those surrounding Shanghai, Guangdong, and Jiangsu provinces, dominate the chartered air transport market. These regions benefit from well-established infrastructure, proximity to major manufacturing hubs, and high economic activity. The Time Critical Cargo segment holds the largest market share due to the increasing demand for rapid delivery of high-value goods and perishables. Heavy and oversized cargo also contributes significantly, driven by the growth in industrial manufacturing and infrastructure development.

- Key Drivers for Coastal Regions: Well-developed infrastructure, proximity to major manufacturing centers, and high economic activity.

- Time Critical Cargo Dominance: Driven by e-commerce expansion and the demand for rapid delivery of high-value and perishable goods.

- Heavy & Oversized Cargo Growth: Fueled by increased industrial manufacturing and infrastructure projects.

- Other Segments: Animal transportation and dangerous goods show steady growth, albeit at a slower pace compared to time-critical and heavy cargo.

China Chartered Air Transport Market Product Landscape

The chartered air transport market offers diverse services, including specialized aircraft for various cargo types (e.g., temperature-controlled containers for pharmaceuticals, specialized handling for livestock). Continuous improvements in aircraft technology, including fuel efficiency and payload capacity, are driving product innovation. The key selling propositions are speed, reliability, and customized solutions tailored to specific cargo requirements and client needs. Technological advancements in tracking and monitoring systems enhance transparency and safety.

Key Drivers, Barriers & Challenges in China Chartered Air Transport Market

Key Drivers: The burgeoning e-commerce sector, increasing demand for faster delivery, and growth of industries requiring specialized air freight solutions are key drivers. Government initiatives promoting infrastructure development and logistics optimization further stimulate market growth.

Key Challenges: Stringent regulatory compliance, rising fuel costs, and the need for skilled personnel pose significant challenges. Supply chain disruptions caused by geopolitical events can impact operational efficiency. Competition from alternative modes of transportation adds further pressure.

Emerging Opportunities in China Chartered Air Transport Market

Untapped markets in less-developed regions, expansion into niche segments (e.g., medical supplies transportation), and the increasing adoption of advanced technologies (e.g., drone delivery) present significant opportunities. Developing tailored solutions for specific industry needs, focusing on sustainability and environmental concerns, and leveraging digitalization for greater efficiency are key avenues for growth.

Growth Accelerators in the China Chartered Air Transport Market Industry

Technological advancements in aircraft design and logistics management, strategic partnerships between air charter operators and logistics providers, and expansion into new geographic markets are accelerating long-term growth. Government support for infrastructure development and initiatives promoting efficient logistics networks also contribute to the market's expansion.

Key Players Shaping the China Chartered Air Transport Market Market

- Beijing Airlines

- Nanshan Jet Co Ltd

- Reignwood Star General Aviation

- Amber Aviation

- Deerjet

- ZYB Lily Jet Ltd

- China Southern Airlines General Aviation

- Sino Jet

- Baa Jet Management Ltd

- Donghai Jet Co Ltd

- Jiangsu Jet

- List Not Exhaustive

Notable Milestones in China Chartered Air Transport Market Sector

- October 2023: Air Charter Services expands its Shanghai office, focusing on Zhejiang and Jiangsu provinces. This signifies increased market focus on these key regions.

- July 2023: Jayud launches new air charter services, strengthening its Southeast Asian presence and improving logistics solutions for its customers. This indicates growing competition and a focus on regional expansion.

In-Depth China Chartered Air Transport Market Market Outlook

The future of the China chartered air transport market is bright, with continued growth driven by technological innovation, increasing demand from various industries, and supportive government policies. Strategic partnerships, expansion into new geographic areas, and the focus on sustainable practices will shape market dynamics in the coming years. The market presents substantial opportunities for companies willing to adopt innovative strategies and adapt to evolving industry trends.

China Chartered Air Transport Market Segmentation

-

1. type

- 1.1. Time Critical Cargo

- 1.2. Heavy and Oversized Cargo

- 1.3. Dangerous Cargo

- 1.4. Animal Transportation

- 1.5. Other Cargo Types

China Chartered Air Transport Market Segmentation By Geography

- 1. China

China Chartered Air Transport Market Regional Market Share

Geographic Coverage of China Chartered Air Transport Market

China Chartered Air Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for businesses; Increasing disposable income

- 3.3. Market Restrains

- 3.3.1. Regulatory challenges; Infrastructure limitations

- 3.4. Market Trends

- 3.4.1. Booming Chartered Freight Transport Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Chartered Air Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by type

- 5.1.1. Time Critical Cargo

- 5.1.2. Heavy and Oversized Cargo

- 5.1.3. Dangerous Cargo

- 5.1.4. Animal Transportation

- 5.1.5. Other Cargo Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Beijing Airlines

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nanshan Jet Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Reignwood Star General Aviation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amber Aviation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Deerjet

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ZYB Lily Jet Ltd *List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Southern Airlines General Aviation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sino Jet

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Baa Jet Management Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Donghai Jet Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Jiangsu Jet

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Beijing Airlines

List of Figures

- Figure 1: China Chartered Air Transport Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Chartered Air Transport Market Share (%) by Company 2025

List of Tables

- Table 1: China Chartered Air Transport Market Revenue Million Forecast, by type 2020 & 2033

- Table 2: China Chartered Air Transport Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: China Chartered Air Transport Market Revenue Million Forecast, by type 2020 & 2033

- Table 4: China Chartered Air Transport Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Chartered Air Transport Market ?

The projected CAGR is approximately 7.07%.

2. Which companies are prominent players in the China Chartered Air Transport Market ?

Key companies in the market include Beijing Airlines, Nanshan Jet Co Ltd, Reignwood Star General Aviation, Amber Aviation, Deerjet, ZYB Lily Jet Ltd *List Not Exhaustive, China Southern Airlines General Aviation, Sino Jet, Baa Jet Management Ltd, Donghai Jet Co Ltd, Jiangsu Jet.

3. What are the main segments of the China Chartered Air Transport Market ?

The market segments include type.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for businesses; Increasing disposable income.

6. What are the notable trends driving market growth?

Booming Chartered Freight Transport Segment.

7. Are there any restraints impacting market growth?

Regulatory challenges; Infrastructure limitations.

8. Can you provide examples of recent developments in the market?

October 2023: Air Charter Services, the aircraft charter broker, has increased its efforts to concentrate on Shanghai and the surrounding provinces, including Zhejiang and Jiangsu, by relocating its office in Shanghai to bigger premises.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Chartered Air Transport Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Chartered Air Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Chartered Air Transport Market ?

To stay informed about further developments, trends, and reports in the China Chartered Air Transport Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence