Key Insights

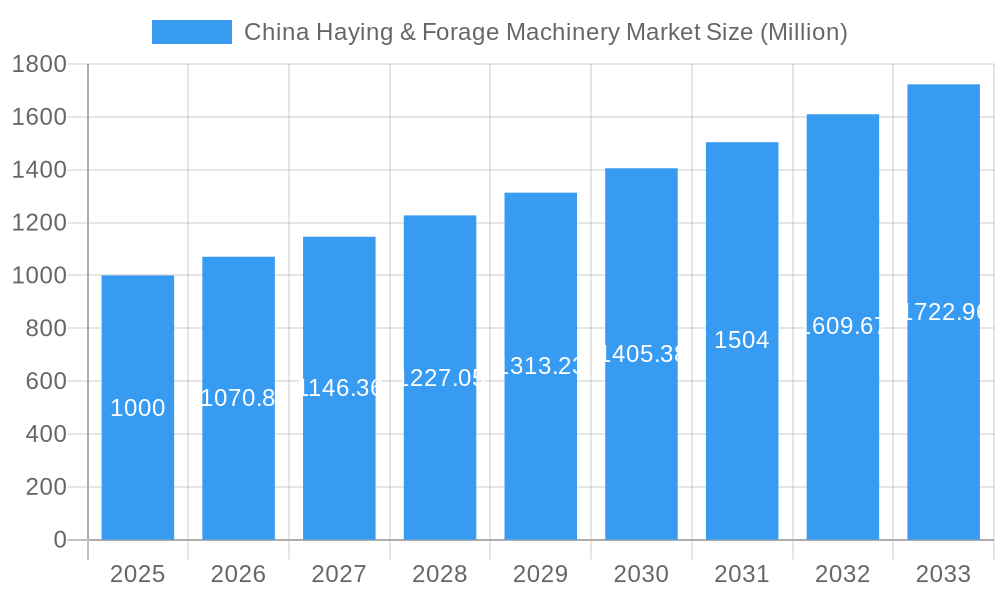

The China Haying & Forage Machinery Market, valued at approximately $X million in 2025 (assuming a logical extrapolation from the provided CAGR and study period), is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) of 7.08% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing livestock production within China necessitates efficient and modernized haying and forage harvesting techniques. Government initiatives promoting agricultural modernization and improved farming practices further stimulate market demand. The rising adoption of large-scale farming operations, coupled with a growing awareness of the benefits of mechanized harvesting—improved efficiency, reduced labor costs, and minimized crop losses—is also contributing to market growth. Furthermore, technological advancements in machinery design, incorporating features like precision farming and automation, are enhancing productivity and attracting investments. However, the market faces certain challenges, including high initial investment costs for machinery, limited access to credit for smaller farmers, and a potential reliance on imported components for some higher-end models. Segmentation analysis reveals that mowers, balers, and harvesters represent the major segments within this market, each responding differently to the aforementioned factors.

China Haying & Forage Machinery Market Market Size (In Billion)

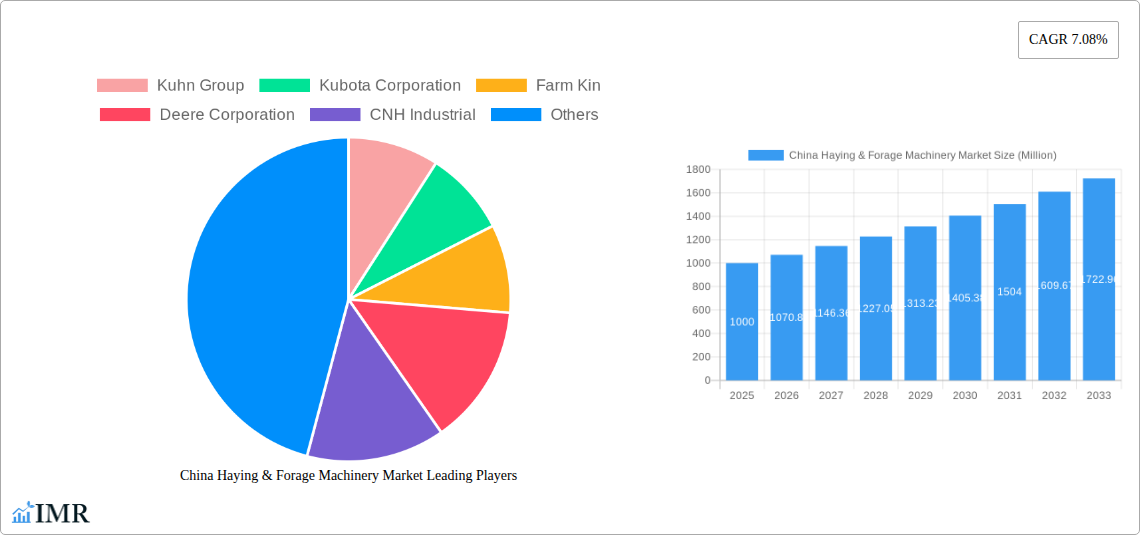

The competitive landscape is dominated by both international and domestic players. Key companies like Deere & Company, CNH Industrial, AGCO Corporation, and Kubota Corporation are leveraging their global presence and technological expertise to establish a strong foothold in the Chinese market. Simultaneously, domestic manufacturers are actively developing and offering cost-competitive alternatives, catering to the diverse needs of farmers. The geographic focus, currently centered on China, indicates significant potential for expansion within other regions of the country as agricultural modernization efforts spread. The forecast period of 2025-2033 paints a positive outlook, with continued growth predicted based on the ongoing trends of increased mechanization and governmental support within the agricultural sector. Strategic partnerships between international and domestic players will likely play a crucial role in shaping the future dynamics of this dynamic market.

China Haying & Forage Machinery Market Company Market Share

China Haying & Forage Machinery Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the China Haying & Forage Machinery market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. This report is an essential resource for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The parent market is the broader agricultural machinery sector in China, while the child market specifically focuses on equipment for haying and forage production.

China Haying & Forage Machinery Market Market Dynamics & Structure

This section delves into the intricacies of the China Haying & Forage Machinery market structure, examining market concentration, technological advancements, regulatory landscapes, competitive dynamics, and market consolidation trends. We analyze the competitive landscape, identifying key players like Kuhn Group, Kubota Corporation, Farm Kin, Deere & Company, CNH Industrial, Krone North America Inc, Yanmar Company Limited, AGCO Corporation, and CLAAS, and their respective market shares. The report also investigates the influence of government regulations, technological innovations (like automation and precision agriculture), and the presence of substitute products on market growth. Mergers and acquisitions (M&A) activity within the sector is analyzed, providing quantitative insights into deal volumes and qualitative assessments of their impact.

- Market Concentration: The market is moderately concentrated, with the top five players holding approximately xx% of the market share in 2024.

- Technological Innovation: Precision farming technologies, including GPS-guided machinery and automated balers, are driving significant innovation.

- Regulatory Framework: Government policies promoting agricultural modernization and sustainable farming practices influence market growth.

- Competitive Substitutes: Manually operated equipment and older generation machinery represent the main substitutes.

- End-User Demographics: The report examines the size and characteristics of the end-user base, including smallholder farmers, large-scale agricultural operations, and government-owned farms.

- M&A Trends: An analysis of recent M&A activity reveals xx deals in the last five years, primarily focused on enhancing technological capabilities and market reach.

China Haying & Forage Machinery Market Growth Trends & Insights

This section provides a detailed analysis of the China Haying & Forage Machinery market's growth trajectory. We use robust quantitative data to illustrate market size evolution (in Million units), adoption rates of new technologies, the impact of technological disruptions, and evolving consumer behaviors. The analysis considers factors such as changing farming practices, government initiatives, and economic growth, offering a nuanced understanding of market dynamics. Specific metrics like Compound Annual Growth Rate (CAGR) and market penetration are incorporated to offer deeper insights. The forecasted market size for 2033 is estimated at xx Million units, indicating a robust CAGR of xx% during the forecast period.

Dominant Regions, Countries, or Segments in China Haying & Forage Machinery Market

This section pinpoints the leading regions, countries, and market segments (By Type: Mowers, Balers, Harvesters, Others) within the China Haying & Forage Machinery market. We analyze the factors driving market dominance, including economic policies, infrastructure development, and regional agricultural output. Market share data and growth projections for each segment are provided, highlighting potential investment opportunities. The analysis shows that the xx region/province currently holds the largest market share, driven by factors such as:

- High Agricultural Output: The region is a major producer of hay and forage crops.

- Government Support: Favorable government policies and subsidies promote the adoption of modern machinery.

- Infrastructure Development: Efficient transportation networks facilitate the distribution and sale of hay and forage machinery.

China Haying & Forage Machinery Market Product Landscape

This section explores the product landscape, highlighting technological advancements and key features of mowers, balers, harvesters, and other equipment within the hay and forage machinery segment. We analyze the unique selling propositions (USPs) of different products, discussing innovations like improved efficiency, reduced fuel consumption, and enhanced ease of operation.

The market exhibits a trend towards larger capacity, more efficient, and technologically advanced machinery that can improve productivity and reduce labor costs.

Key Drivers, Barriers & Challenges in China Haying & Forage Machinery Market

This section identifies the key drivers and challenges affecting the China Haying & Forage Machinery market. Drivers include:

- Growing Demand for Animal Feed: Increasing livestock production necessitates an improved and efficient system for producing high-quality animal feed, driving demand for modern haying and forage machinery.

- Government Initiatives: Government policies promoting agricultural modernization and mechanization significantly boost market growth.

- Technological Advancements: Automation and precision technologies enhance efficiency and reduce labor costs.

Challenges include:

- High Initial Investment Costs: The high cost of modern machinery can limit adoption among smallholder farmers.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of components.

- Competition: Competition from both domestic and international players can exert downward pressure on prices.

Emerging Opportunities in China Haying & Forage Machinery Market

This section identifies emerging opportunities within the China Haying & Forage Machinery market. Key opportunities include:

- Expanding into Underserved Markets: Reaching smaller farmers with appropriate financing and support programs can unlock significant growth potential.

- Developing Specialized Equipment: Tailoring machinery to specific crops and farming practices can create new market niches.

- Embracing Digital Technologies: Integrating precision agriculture technologies and data analytics can improve farming efficiency and productivity.

Growth Accelerators in the China Haying & Forage Machinery Market Industry

Several factors are poised to accelerate long-term growth in the China Haying & Forage Machinery market. These include ongoing technological innovations in machine automation and precision agriculture, strategic partnerships between equipment manufacturers and agricultural service providers, and the continuous expansion of the market into previously underserved regions. Government initiatives aimed at improving agricultural efficiency and supporting the adoption of modern machinery further propel market growth.

Key Players Shaping the China Haying & Forage Machinery Market Market

Notable Milestones in China Haying & Forage Machinery Market Sector

- 2021 Q3: Introduction of a new line of automated balers by Deere & Company.

- 2022 Q1: Kubota Corporation and a local Chinese manufacturer announce a joint venture to produce small-scale forage harvesters.

- 2023 Q4: New government subsidies are announced to support the adoption of precision agriculture technology among smallholder farmers. (More milestones can be added here as the data becomes available)

In-Depth China Haying & Forage Machinery Market Market Outlook

The China Haying & Forage Machinery market is poised for robust growth in the coming years, driven by technological advancements, favorable government policies, and the increasing demand for high-quality animal feed. Strategic partnerships between equipment manufacturers and agricultural service providers will play a crucial role in driving market expansion and ensuring greater adoption of modern machinery. This translates to significant growth opportunities for businesses involved in the production, distribution, and servicing of haying and forage machinery in China. The market is expected to reach xx Million units by 2033, presenting substantial opportunities for investment and expansion.

China Haying & Forage Machinery Market Segmentation

-

1. Type

- 1.1. Mowers

- 1.2. Balers

- 1.3. Harvesters

- 1.4. Others

-

2. Type

- 2.1. Mowers

- 2.2. Balers

- 2.3. Harvesters

- 2.4. Others

China Haying & Forage Machinery Market Segmentation By Geography

- 1. China

China Haying & Forage Machinery Market Regional Market Share

Geographic Coverage of China Haying & Forage Machinery Market

China Haying & Forage Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Rising Demand For Balers In Livestock Feedlots

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Haying & Forage Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mowers

- 5.1.2. Balers

- 5.1.3. Harvesters

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Mowers

- 5.2.2. Balers

- 5.2.3. Harvesters

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kuhn Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kubota Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Farm Kin

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Deere Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CNH Industrial

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Krone North America Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yanmar Company Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AGCO Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CLAAS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Kuhn Group

List of Figures

- Figure 1: China Haying & Forage Machinery Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: China Haying & Forage Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: China Haying & Forage Machinery Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: China Haying & Forage Machinery Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: China Haying & Forage Machinery Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: China Haying & Forage Machinery Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: China Haying & Forage Machinery Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: China Haying & Forage Machinery Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Haying & Forage Machinery Market?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the China Haying & Forage Machinery Market?

Key companies in the market include Kuhn Group, Kubota Corporation, Farm Kin, Deere Corporation, CNH Industrial, Krone North America Inc, Yanmar Company Limited, AGCO Corporation, CLAAS.

3. What are the main segments of the China Haying & Forage Machinery Market?

The market segments include Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Rising Demand For Balers In Livestock Feedlots.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Haying & Forage Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Haying & Forage Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Haying & Forage Machinery Market?

To stay informed about further developments, trends, and reports in the China Haying & Forage Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence