Key Insights

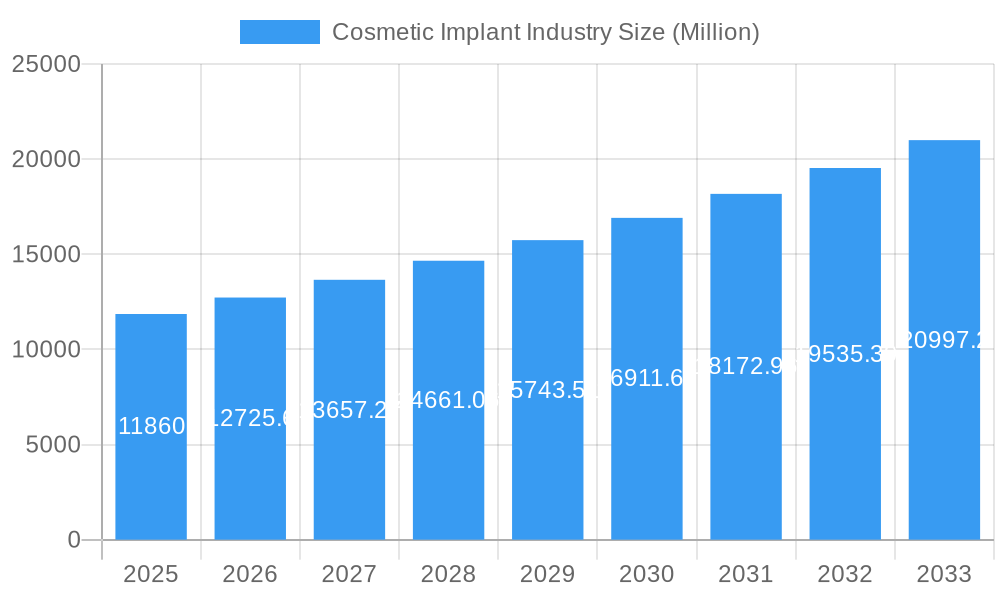

The global Cosmetic Implant Industry is poised for substantial growth, with a current market size of approximately USD 11.86 billion in 2025. This upward trajectory is fueled by a projected Compound Annual Growth Rate (CAGR) of 7.49% over the forecast period of 2025-2033, indicating a robust expansion in demand for aesthetic and reconstructive procedures. The increasing societal acceptance of cosmetic enhancements, coupled with advancements in implant technology leading to safer and more effective outcomes, are key drivers. Furthermore, a growing disposable income in emerging economies and the continuous innovation in biomaterials, such as advanced polymers and biocompatible ceramics, are contributing to the market's expansion. The industry is witnessing a diversification of applications, moving beyond traditional breast and facial implants to include specialized reconstructive and augmentation procedures.

Cosmetic Implant Industry Market Size (In Billion)

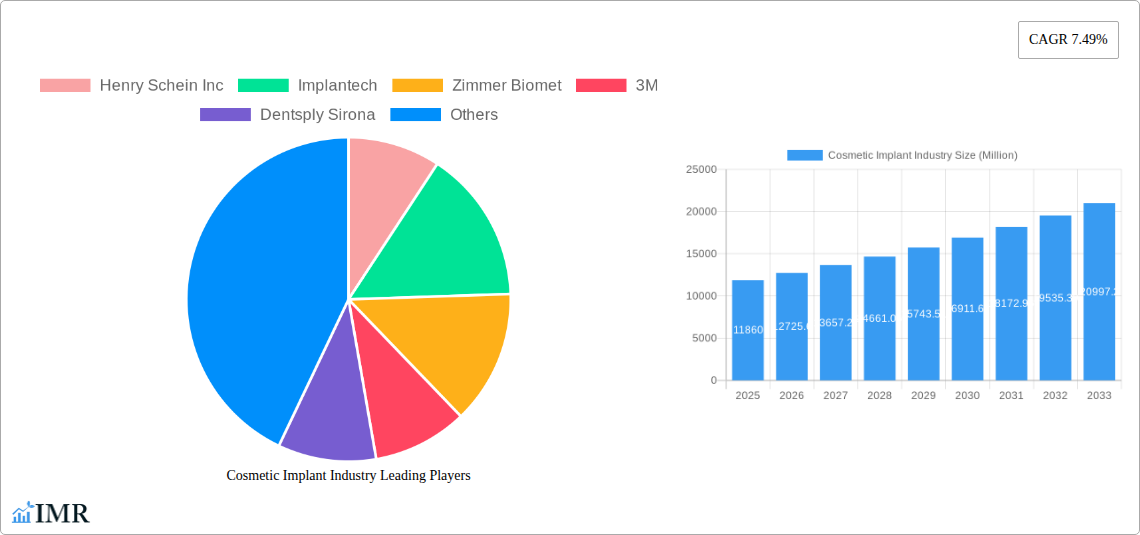

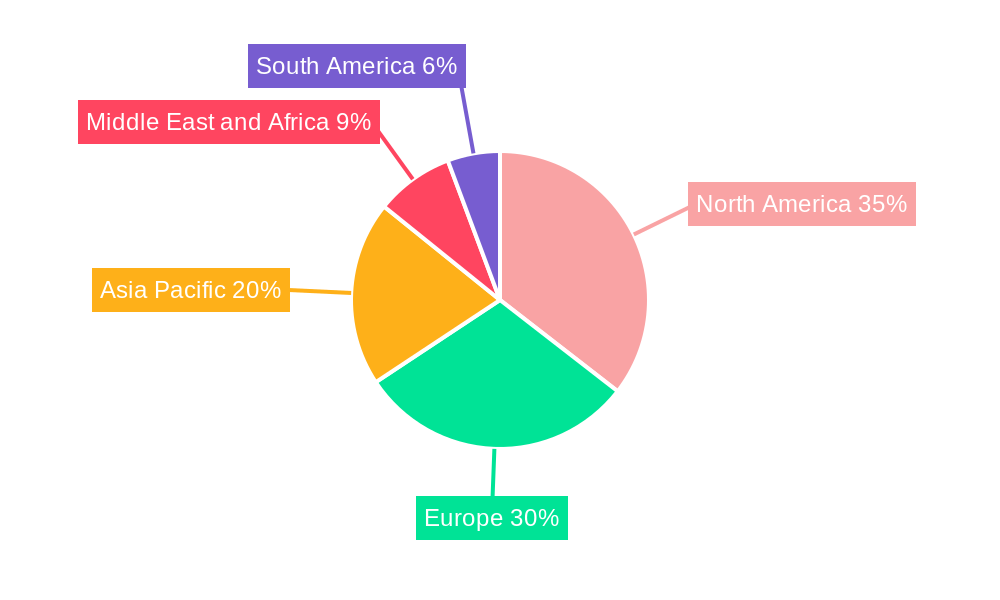

The Cosmetic Implant Industry is characterized by a dynamic interplay of growth drivers and restraints. Key growth drivers include the rising prevalence of aesthetic consciousness, the development of minimally invasive surgical techniques, and the increasing availability of sophisticated implant materials that mimic natural tissues. The market is segmented into various raw material types, with polymer and metal implants holding significant shares due to their established efficacy and widespread use. Application-wise, dental and breast implants remain dominant segments, driven by aging populations seeking tooth replacement and ongoing trends in aesthetic body contouring. However, the industry also faces restraints such as stringent regulatory approvals for new medical devices, the potential for complications, and the high cost associated with certain advanced implant procedures. Nevertheless, the sustained demand for improved self-image and the continuous innovation by leading companies like Henry Schein Inc., Zimmer Biomet, and Johnson & Johnson are expected to propel the market forward, with North America and Europe currently leading in market share, while the Asia Pacific region shows promising growth potential.

Cosmetic Implant Industry Company Market Share

Cosmetic Implant Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the global Cosmetic Implant Industry, encompassing its market dynamics, growth trajectory, competitive landscape, and future potential. Leveraging extensive data from 2019-2024 (Historical Period) and projecting forward to 2033 (Forecast Period) with a Base Year of 2025, this report is an essential resource for industry professionals, investors, and stakeholders seeking to understand the evolving market for dental implants, breast implants, and facial implants. The report delves into parent and child markets, offering granular insights into market segmentation by raw material (Polymer implants, Ceramic implants, Metal implants, Biological material implants) and application.

Cosmetic Implant Industry Market Dynamics & Structure

The cosmetic implant industry is characterized by a moderate market concentration, with leading players like Henry Schein Inc., Zimmer Biomet, 3M, Dentsply Sirona, and Johnson & Johnson holding significant market share. However, the presence of numerous specialized manufacturers and the constant influx of innovative start-ups contribute to a dynamic competitive environment. Technological innovation is a primary driver, fueled by advancements in biomaterials, 3D printing, and minimally invasive surgical techniques, leading to improved patient outcomes and reduced recovery times for procedures such as dental implants and breast augmentation. Regulatory frameworks, while stringent, are also evolving to accommodate new technologies and materials. Competitive product substitutes include non-implantable aesthetic procedures and less permanent reconstructive options. End-user demographics are expanding beyond traditional age groups, with increasing demand from younger populations seeking preventative aesthetic enhancements and older individuals opting for reconstructive solutions. Mergers and acquisitions (M&A) trends indicate a consolidation of market power among larger entities seeking to expand their product portfolios and geographic reach. For instance, recent M&A activity has seen significant deal volumes in the dental implant and facial implant segments. Barriers to innovation include the lengthy and costly research and development cycles, rigorous clinical trials, and the need for specialized manufacturing expertise.

- Market Concentration: Moderate, with key players holding substantial, yet not dominant, market shares.

- Technological Innovation: Driven by biomaterial science, additive manufacturing, and advanced surgical instrumentation.

- Regulatory Frameworks: Evolving to support new product approvals and patient safety standards.

- Competitive Substitutes: Non-surgical aesthetic treatments, fillers, and alternative reconstructive techniques.

- End-User Demographics: Growing demand across a wider age spectrum and diverse aesthetic/reconstructive needs.

- M&A Trends: Increasing consolidation, particularly in high-growth application areas like dental implants.

Cosmetic Implant Industry Growth Trends & Insights

The global cosmetic implant industry is poised for robust growth, projected to expand at a significant Compound Annual Growth Rate (CAGR) throughout the forecast period. This expansion is underpinned by a confluence of factors including escalating consumer demand for aesthetic procedures, advancements in surgical techniques, and increasing disposable incomes worldwide. The market size evolution for dental implants, driven by the aging global population and a growing awareness of oral health, is a key contributor to overall industry growth. Similarly, the breast implant market is experiencing heightened demand, influenced by celebrity culture, social media trends, and a greater acceptance of body modification. Furthermore, the facial implant segment is witnessing a surge in interest, propelled by novel implant designs offering more natural-looking and personalized results. Technological disruptions, such as the development of bio-compatible materials and innovative implant designs, are continuously reshaping the product landscape, offering enhanced safety profiles and improved patient satisfaction. Consumer behavior shifts are also playing a crucial role, with an increasing emphasis on minimally invasive procedures, faster recovery times, and personalized treatment plans. The adoption rates for advanced implant technologies are accelerating as both patients and surgeons recognize their benefits. The penetration of the cosmetic implant market is expected to deepen across both developed and emerging economies as awareness and accessibility increase. The integration of digital technologies in surgical planning and implant customization is further enhancing the perceived value and effectiveness of these procedures.

Dominant Regions, Countries, or Segments in Cosmetic Implant Industry

The dental implant segment is unequivocally the dominant force driving the global cosmetic implant industry. This dominance stems from a confluence of factors including the universal need for tooth replacement due to aging, decay, and injury, coupled with a growing emphasis on oral health and aesthetics. North America, particularly the United States, represents a leading country within this segment, characterized by high disposable incomes, advanced healthcare infrastructure, and a well-established market for elective procedures. The region benefits from a high adoption rate of innovative dental technologies and a proactive approach to preventative and restorative oral care. Economic policies supportive of healthcare innovation and consumer spending on aesthetic treatments further bolster its position. The presence of major players like Henry Schein Inc. and Dentsply Sirona in this region signifies its strategic importance.

In terms of raw materials, Polymer implants are experiencing significant growth due to their versatility, biocompatibility, and cost-effectiveness, particularly in applications like breast implants and certain facial implants. However, Metal implants, primarily titanium and its alloys, remain foundational, especially for dental implants due to their exceptional osseointegration properties and durability.

The dominance of the dental implant segment is further amplified by:

- Aging Global Population: Increasing prevalence of tooth loss and the demand for long-term tooth replacement solutions.

- Enhanced Oral Health Awareness: Growing understanding of the importance of dental implants for overall well-being and appearance.

- Technological Advancements: Development of smaller, more efficient implant designs and materials leading to less invasive procedures.

- Insurance Coverage: Expanding coverage for dental implants in various countries, making them more accessible.

- Market Penetration: High market penetration in developed countries and significant growth potential in emerging economies.

The breast implant market, while significant, is more influenced by aesthetic trends and regulatory scrutiny. The facial implant segment, encompassing chin, cheek, and nasal implants, is experiencing rapid growth due to advancements in customized implant design and a rising demand for facial rejuvenation and contouring.

Cosmetic Implant Industry Product Landscape

The cosmetic implant industry is characterized by a continuous stream of product innovations focused on enhancing patient outcomes and procedural efficiency. Dental implants are seeing advancements in materials science, leading to more biocompatible and aesthetically pleasing prosthetic teeth, alongside minimally invasive surgical techniques that reduce patient discomfort and recovery time. Breast implants are evolving with improved shell technologies and cohesive gel fillers offering a more natural feel and appearance, addressing patient safety concerns and aesthetic preferences. Facial implants, such as those for cheeks and chins, are increasingly being designed using advanced imaging and 3D printing technologies to achieve precise anatomical fit and customized aesthetics. The integration of antimicrobial coatings and enhanced surface textures across all implant types is a key trend aimed at reducing infection rates and promoting better integration with surrounding tissues. Performance metrics such as implant longevity, osseointegration rates, and patient satisfaction scores are continuously being improved through rigorous research and development.

Key Drivers, Barriers & Challenges in Cosmetic Implant Industry

Key Drivers:

- Increasing Demand for Aesthetic Procedures: A rising global consciousness towards appearance and a desire for self-improvement are fueling demand for cosmetic implants across all application areas.

- Technological Advancements: Innovations in biomaterials, 3D printing, and surgical techniques are leading to safer, more effective, and less invasive implant solutions.

- Aging Global Population: The growing elderly demographic presents a significant market for dental implants and reconstructive procedures.

- Improved Patient Outcomes: Advances in implant design and surgical protocols are leading to higher success rates and greater patient satisfaction.

- Expanding Disposable Income: Increased economic prosperity, particularly in emerging markets, allows more individuals to afford elective cosmetic procedures.

Barriers & Challenges:

- High Cost of Procedures: Cosmetic implant procedures can be expensive, limiting accessibility for a significant portion of the population.

- Regulatory Hurdles: Stringent approval processes for new implant technologies and materials can be time-consuming and costly.

- Risk of Complications: Although decreasing with technological advancements, risks such as infection, implant failure, and aesthetic dissatisfaction remain a concern.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability and cost of raw materials and finished implant products, as seen with fluctuations in material costs impacting the polymer implants and metal implants markets.

- Ethical and Societal Perceptions: Varying societal views on cosmetic surgery and implants can influence demand and market growth.

Emerging Opportunities in Cosmetic Implant Industry

Emerging opportunities within the cosmetic implant industry lie in the development of personalized and regenerative implant solutions. The growing interest in 3D bio-printed regenerative breast implants highlights a future where implants not only restore form but also promote tissue regeneration, addressing reconstructive needs more holistically. The expansion of mini dental implants for more accessible and less invasive tooth replacement presents a significant opportunity to tap into a broader patient base. Furthermore, the increasing use of artificial intelligence (AI) in implant design and surgical planning offers immense potential for tailored solutions that precisely match patient anatomy, driving innovation in facial implants and other reconstructive applications. Untapped markets in developing economies, coupled with a growing demand for less invasive and faster recovery procedures, present substantial growth avenues.

Growth Accelerators in the Cosmetic Implant Industry Industry

Several catalysts are accelerating growth within the cosmetic implant industry. Technological breakthroughs in biomaterials science are leading to implants with superior biocompatibility, reduced rejection rates, and enhanced longevity. The widespread adoption of 3D printing is revolutionizing implant manufacturing, enabling the creation of highly customized and patient-specific devices, particularly beneficial for facial implants and complex reconstructive surgeries. Strategic partnerships between technology companies and medical device manufacturers are fostering innovation and expediting the development of next-generation implants. Market expansion strategies focused on increasing accessibility and affordability in emerging economies, combined with robust marketing campaigns highlighting the benefits of modern cosmetic implant procedures, are further fueling industry expansion.

Key Players Shaping the Cosmetic Implant Industry Market

- Henry Schein Inc.

- Implantech

- Zimmer Biomet

- 3M

- Dentsply Sirona

- Sientra Inc.

- Cochlear Ltd

- Johnson & Johnson

- Allergan

- GC Aesthetics

Notable Milestones in Cosmetic Implant Industry Sector

- May 2022: A New Zealand scientist launched mini dental implants for tooth replacement which use the latest dental technology to provide the same functional and aesthetic benefits as traditional implants in a much shorter time and with far less inconvenience to the patient.

- June 2022: Coll Plant announced the initiation of a study in large animals for its 3D bio-printed regenerative breast implant program, addressing the demands of breast reconstruction.

In-Depth Cosmetic Implant Industry Market Outlook

The cosmetic implant industry is projected for sustained and significant growth, driven by a combination of technological advancements, shifting consumer preferences, and an expanding global market. The increasing sophistication of implant materials and designs, particularly in dental implants and breast implants, alongside the advent of regenerative technologies, promises enhanced patient safety and superior aesthetic and functional outcomes. Growth accelerators such as AI-driven personalization and the proliferation of minimally invasive techniques will continue to expand the market's reach. Strategic investments in research and development, coupled with market expansion initiatives in underserved regions, will be crucial for stakeholders looking to capitalize on the vast future potential of this dynamic industry. The outlook remains overwhelmingly positive, with innovation at the forefront of driving value for both patients and industry players.

Cosmetic Implant Industry Segmentation

-

1. Raw Material

- 1.1. Polymer implants

- 1.2. Ceramic implants

- 1.3. Metal implants

- 1.4. Biological material implants

-

2. Application

- 2.1. Dental implants

- 2.2. Breast implants

- 2.3. Facial implants

- 2.4. Others

Cosmetic Implant Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Cosmetic Implant Industry Regional Market Share

Geographic Coverage of Cosmetic Implant Industry

Cosmetic Implant Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The overall rise in cosmetic surgeries

- 3.2.2 including both surgical and non-surgical options

- 3.2.3 is boosting the market for implants

- 3.3. Market Restrains

- 3.3.1. The high costs associated with cosmetic implant surgeries can limit access for many individuals

- 3.4. Market Trends

- 3.4.1. Advances in minimally invasive surgical techniques and less invasive procedures will likely expand the market for cosmetic implants

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cosmetic Implant Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Polymer implants

- 5.1.2. Ceramic implants

- 5.1.3. Metal implants

- 5.1.4. Biological material implants

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dental implants

- 5.2.2. Breast implants

- 5.2.3. Facial implants

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. North America Cosmetic Implant Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 6.1.1. Polymer implants

- 6.1.2. Ceramic implants

- 6.1.3. Metal implants

- 6.1.4. Biological material implants

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Dental implants

- 6.2.2. Breast implants

- 6.2.3. Facial implants

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 7. Europe Cosmetic Implant Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 7.1.1. Polymer implants

- 7.1.2. Ceramic implants

- 7.1.3. Metal implants

- 7.1.4. Biological material implants

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Dental implants

- 7.2.2. Breast implants

- 7.2.3. Facial implants

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 8. Asia Pacific Cosmetic Implant Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 8.1.1. Polymer implants

- 8.1.2. Ceramic implants

- 8.1.3. Metal implants

- 8.1.4. Biological material implants

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Dental implants

- 8.2.2. Breast implants

- 8.2.3. Facial implants

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 9. Middle East and Africa Cosmetic Implant Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 9.1.1. Polymer implants

- 9.1.2. Ceramic implants

- 9.1.3. Metal implants

- 9.1.4. Biological material implants

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Dental implants

- 9.2.2. Breast implants

- 9.2.3. Facial implants

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 10. South America Cosmetic Implant Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 10.1.1. Polymer implants

- 10.1.2. Ceramic implants

- 10.1.3. Metal implants

- 10.1.4. Biological material implants

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Dental implants

- 10.2.2. Breast implants

- 10.2.3. Facial implants

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Henry Schein Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Implantech

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Zimmer Biomet

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 3M

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Dentsply Sirona

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Sientra Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cochlear Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Johnson & Johnson

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Allergan

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 GC Aesthetics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Henry Schein Inc

List of Figures

- Figure 1: Global Cosmetic Implant Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cosmetic Implant Industry Revenue (Million), by Raw Material 2025 & 2033

- Figure 3: North America Cosmetic Implant Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 4: North America Cosmetic Implant Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Cosmetic Implant Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Cosmetic Implant Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Cosmetic Implant Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Cosmetic Implant Industry Revenue (Million), by Raw Material 2025 & 2033

- Figure 9: Europe Cosmetic Implant Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 10: Europe Cosmetic Implant Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Cosmetic Implant Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Cosmetic Implant Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Cosmetic Implant Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Cosmetic Implant Industry Revenue (Million), by Raw Material 2025 & 2033

- Figure 15: Asia Pacific Cosmetic Implant Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 16: Asia Pacific Cosmetic Implant Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Pacific Cosmetic Implant Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Cosmetic Implant Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Cosmetic Implant Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Cosmetic Implant Industry Revenue (Million), by Raw Material 2025 & 2033

- Figure 21: Middle East and Africa Cosmetic Implant Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 22: Middle East and Africa Cosmetic Implant Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Middle East and Africa Cosmetic Implant Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Middle East and Africa Cosmetic Implant Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Cosmetic Implant Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Cosmetic Implant Industry Revenue (Million), by Raw Material 2025 & 2033

- Figure 27: South America Cosmetic Implant Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 28: South America Cosmetic Implant Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: South America Cosmetic Implant Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Cosmetic Implant Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: South America Cosmetic Implant Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cosmetic Implant Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 2: Global Cosmetic Implant Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Cosmetic Implant Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Cosmetic Implant Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 5: Global Cosmetic Implant Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Cosmetic Implant Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Cosmetic Implant Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Cosmetic Implant Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Cosmetic Implant Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Cosmetic Implant Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 11: Global Cosmetic Implant Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Cosmetic Implant Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany Cosmetic Implant Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Cosmetic Implant Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France Cosmetic Implant Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Italy Cosmetic Implant Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Spain Cosmetic Implant Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Cosmetic Implant Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Cosmetic Implant Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 20: Global Cosmetic Implant Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Cosmetic Implant Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: China Cosmetic Implant Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Japan Cosmetic Implant Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Cosmetic Implant Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Australia Cosmetic Implant Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: South Korea Cosmetic Implant Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Cosmetic Implant Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Cosmetic Implant Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 29: Global Cosmetic Implant Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Cosmetic Implant Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: GCC Cosmetic Implant Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: South Africa Cosmetic Implant Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Middle East and Africa Cosmetic Implant Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Cosmetic Implant Industry Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 35: Global Cosmetic Implant Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Cosmetic Implant Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Cosmetic Implant Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Cosmetic Implant Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Cosmetic Implant Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cosmetic Implant Industry?

The projected CAGR is approximately 7.49%.

2. Which companies are prominent players in the Cosmetic Implant Industry?

Key companies in the market include Henry Schein Inc, Implantech, Zimmer Biomet, 3M, Dentsply Sirona, Sientra Inc, Cochlear Ltd, Johnson & Johnson, Allergan, GC Aesthetics.

3. What are the main segments of the Cosmetic Implant Industry?

The market segments include Raw Material, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.86 Million as of 2022.

5. What are some drivers contributing to market growth?

The overall rise in cosmetic surgeries. including both surgical and non-surgical options. is boosting the market for implants.

6. What are the notable trends driving market growth?

Advances in minimally invasive surgical techniques and less invasive procedures will likely expand the market for cosmetic implants.

7. Are there any restraints impacting market growth?

The high costs associated with cosmetic implant surgeries can limit access for many individuals.

8. Can you provide examples of recent developments in the market?

May 2022: A New Zealand scientist launched mini dental implants for tooth replacement which use the latest dental technology to provide the same functional and aesthetic benefits as traditional implants in a much shorter time and with far less inconvenience to the patient.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cosmetic Implant Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cosmetic Implant Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cosmetic Implant Industry?

To stay informed about further developments, trends, and reports in the Cosmetic Implant Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence