Key Insights

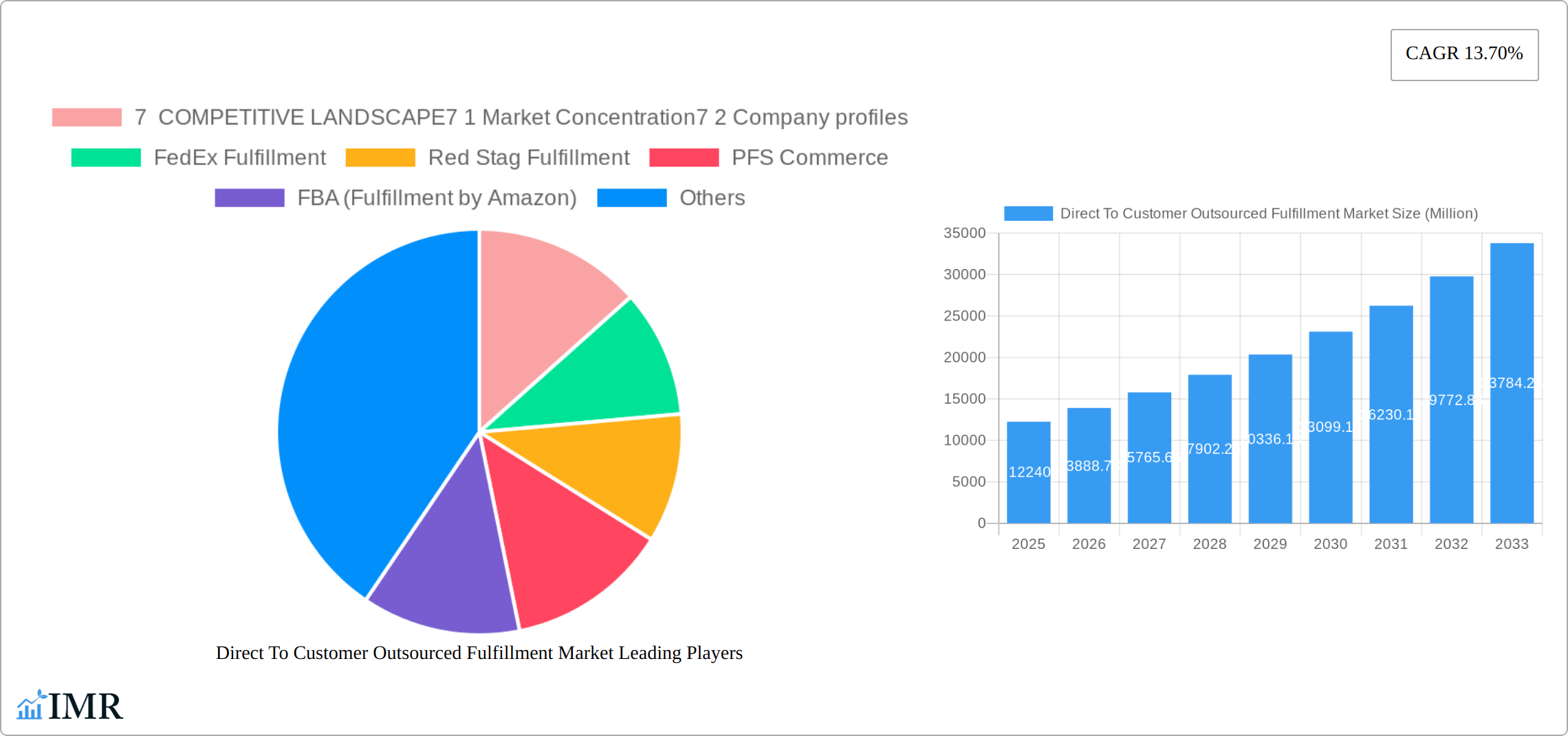

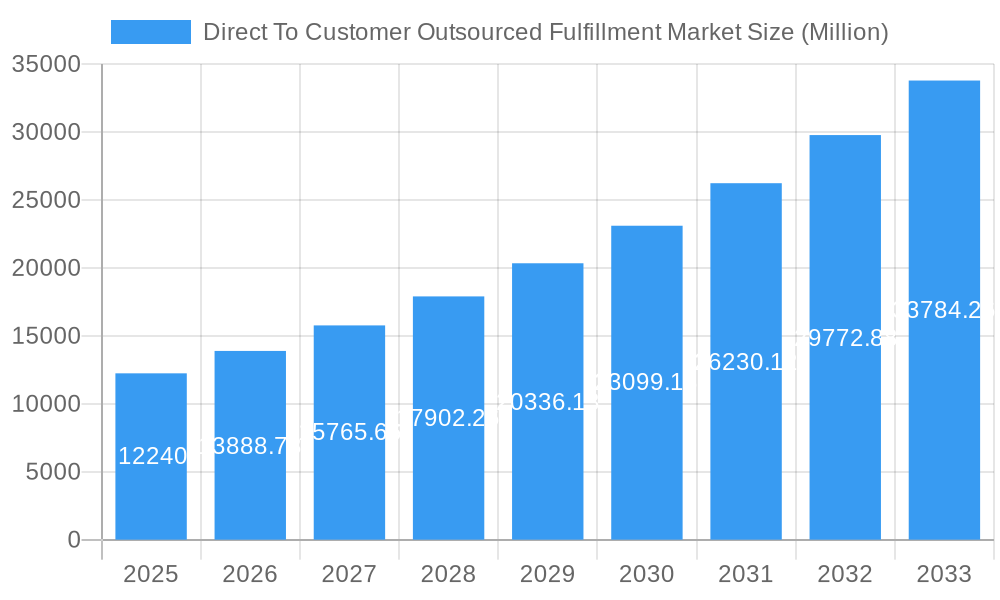

The Direct-to-Consumer (DTC) Outsourced Fulfillment market is experiencing robust growth, projected to reach $12.24 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 13.70% from 2025 to 2033. This expansion is driven primarily by the escalating popularity of e-commerce, particularly DTC brands seeking to scale operations efficiently without significant upfront capital investment in warehousing and logistics infrastructure. The increasing complexity of order fulfillment, including managing returns and offering diverse shipping options, further fuels the demand for specialized outsourced services. Key trends shaping this market include the rise of omnichannel fulfillment strategies, a growing focus on sustainability in logistics, and the adoption of advanced technologies like automation and artificial intelligence to improve efficiency and reduce costs. While potential restraints exist, such as fluctuating fuel prices and labor shortages, the overall market outlook remains positive, fueled by continuous e-commerce growth and the increasing preference for convenient and fast delivery among consumers. The competitive landscape is relatively fragmented, with numerous players offering a range of services. Major players like FedEx Fulfillment, Amazon FBA, and DHL Fulfillment compete with smaller, more specialized providers like ShipMonk and WareIQ, catering to the diverse needs of DTC brands of varying sizes.

Direct To Customer Outsourced Fulfillment Market Market Size (In Billion)

The competitive landscape's fragmentation offers opportunities for both established players and emerging companies. Larger players leverage their extensive networks and technological capabilities to serve large enterprises, while smaller companies are focusing on niche markets and providing specialized services, such as sustainable packaging or hyperlocal delivery. The continued adoption of advanced technologies, such as warehouse management systems (WMS) and order management systems (OMS), will further influence the market, leading to greater efficiency and increased transparency for clients. Future growth will be contingent on factors such as economic stability, technological advancements, and the ongoing evolution of consumer expectations regarding delivery speed and options. Companies focusing on providing flexible, scalable, and technologically advanced solutions are well-positioned to succeed in this dynamic market.

Direct To Customer Outsourced Fulfillment Market Company Market Share

Direct To Customer Outsourced Fulfillment Market Report: 2019-2033

This comprehensive report provides a deep dive into the dynamic Direct To Customer (DTC) Outsourced Fulfillment market, encompassing its parent market (outsourced logistics) and child markets (e-commerce fulfillment, 3PL services). We analyze market trends, competitive landscapes, and future growth opportunities from 2019 to 2033, with a focus on key players and emerging technologies. The report utilizes data from 2019-2024 (historical period), with a base year of 2025 and a forecast period extending to 2033. Market values are presented in millions of units.

Direct To Customer Outsourced Fulfillment Market Dynamics & Structure

This section analyzes the market's competitive intensity, technological advancements driving growth, regulatory influences, substitute products, end-user demographics, and mergers & acquisitions (M&A) activity. The global DTC outsourced fulfillment market size in 2024 was estimated at xx million, with a projected value of xx million by 2033.

Market Concentration: The market exhibits a moderately concentrated structure, with a few major players commanding significant shares. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a xx level of concentration. This is influenced by the high barriers to entry, including significant capital investment in infrastructure and technology.

Technological Innovation: Automation, AI-powered solutions, and advanced analytics are key drivers of innovation, improving efficiency and reducing costs. However, implementation costs and integration challenges represent significant barriers.

Regulatory Framework: Government regulations concerning data privacy, labor laws, and environmental compliance impact operational costs and strategies. Regional variations in regulations add to the complexity.

Competitive Product Substitutes: In-house fulfillment remains a viable option for some companies, while internal resource constraints often favor outsourcing. The choice depends on factors such as order volume, scalability needs, and technological capabilities.

End-User Demographics: The market is predominantly driven by businesses with high order volumes and a growing DTC presence, encompassing diverse industry sectors from apparel and cosmetics to electronics and food.

M&A Trends: The past five years have witnessed xx M&A deals in the DTC outsourced fulfillment sector, with larger companies actively acquiring smaller firms to expand their service offerings and geographic reach.

Direct To Customer Outsourced Fulfillment Market Growth Trends & Insights

The DTC outsourced fulfillment market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is fueled by the exponential rise of e-commerce, changing consumer expectations regarding delivery speed and convenience, and the increasing adoption of omnichannel strategies. Market penetration in the key segments is expected to reach xx% by 2033. Technological disruptions like automation and AI are further accelerating this growth, while shifting consumer preferences towards sustainable and personalized fulfillment solutions are reshaping the market landscape. The market size is projected to reach xx million by 2033.

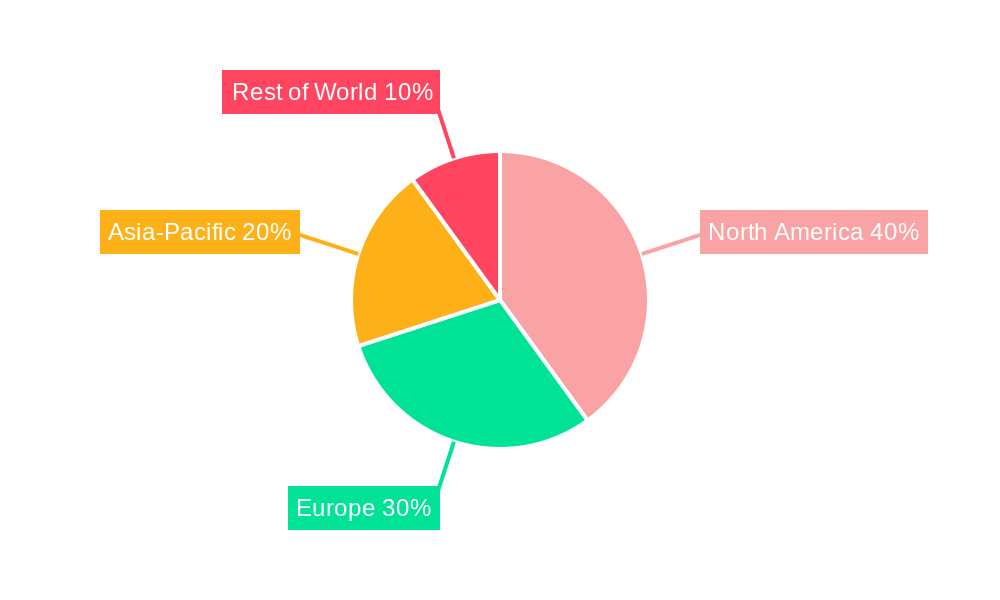

Dominant Regions, Countries, or Segments in Direct To Customer Outsourced Fulfillment Market

North America currently holds the largest market share, driven by strong e-commerce growth and the presence of established 3PL providers. However, Asia-Pacific is anticipated to exhibit the highest CAGR during the forecast period, fueled by rapid e-commerce adoption and expanding infrastructure.

North America: Strong e-commerce infrastructure, established logistics networks, and high consumer demand contribute to its dominance.

Asia-Pacific: Rapid e-commerce growth, a large and expanding consumer base, and government initiatives to improve logistics infrastructure fuel significant growth potential.

Europe: A mature e-commerce market with a focus on sustainable and efficient logistics solutions.

Other Regions: Latin America, the Middle East, and Africa present emerging opportunities but face challenges related to infrastructure development and regulatory frameworks.

Direct To Customer Outsourced Fulfillment Market Product Landscape

The direct-to-customer (DTC) outsourced fulfillment market is characterized by a comprehensive suite of services designed to streamline the journey of products from warehouse to end consumer. This includes robust warehousing and storage, efficient order picking and packing, strategic shipping and logistics, and sophisticated returns management. The landscape is continuously evolving with the integration of cutting-edge solutions. Expect to see widespread adoption of automated picking and packing systems, leveraging robotics and advanced algorithms for speed and accuracy. AI-powered inventory management is crucial for optimizing stock levels, predicting demand, and reducing carrying costs. Furthermore, real-time order tracking provides unparalleled transparency, enhancing the customer experience and fostering trust. Unique selling propositions often revolve around specialized handling capabilities for delicate, perishable, or high-value items, alongside seamless integration with a wide array of e-commerce platforms, marketplaces, and enterprise resource planning (ERP) systems.

Key Drivers, Barriers & Challenges in Direct To Customer Outsourced Fulfillment Market

Key Drivers:

- The relentless and accelerating growth of the global e-commerce sector, fueled by shifting consumer shopping habits.

- Escalating consumer expectations for speed, accuracy, and convenience in delivery, often demanding same-day or next-day options.

- Pervasive technological advancements, including sophisticated automation, artificial intelligence (AI), and the Internet of Things (IoT), which drive efficiency and scalability.

- The strategic imperative for businesses to adopt and excel in omnichannel retail strategies, requiring integrated and responsive fulfillment operations.

- The increasing desire for businesses, especially emerging brands, to focus on core competencies like product development and marketing, offloading complex logistics to specialized partners.

Key Challenges & Restraints:

- The inherent volatility of fuel prices and associated transportation costs, significantly impacting delivery economics.

- Persistent labor shortages across the logistics industry and the upward pressure on labor wages, affecting operational capacity and cost.

- Navigating complex and evolving regulatory landscapes across different regions, including customs, tariffs, and compliance requirements.

- The intensely competitive nature of the 3PL provider market, leading to price pressures and the need for continuous differentiation.

- Managing the complexities of reverse logistics and efficient returns processing, which can be a significant drain on resources if not optimized.

Emerging Opportunities in Direct To Customer Outsourced Fulfillment Market

- Sustainable and Eco-Friendly Fulfillment: A significant and growing consumer demand for environmentally conscious shipping and packaging solutions, including reduced plastic usage, carbon-neutral shipping options, and sustainable materials.

- Hyper-Personalized and Experiential Fulfillment: Moving beyond standard delivery to offer highly tailored experiences, such as custom packaging, personalized inserts, curated unboxing experiences, and on-demand fulfillment options.

- Expansion into Emerging and Underserved Markets: Tapping into the vast potential of rapidly growing e-commerce sectors in emerging economies, requiring adaptable and localized fulfillment solutions.

- Integration with Next-Generation Technologies: Harnessing the power of technologies like blockchain for enhanced supply chain transparency and security, exploring the potential of drone and autonomous vehicle delivery for last-mile innovation, and leveraging advanced analytics for predictive logistics.

- Specialized Niche Fulfillment: Developing expertise in highly specialized areas such as cold chain logistics, oversized items, white-glove delivery, or subscription box fulfillment to cater to specific industry needs.

Growth Accelerators in the Direct To Customer Outsourced Fulfillment Market Industry

The direct-to-customer outsourced fulfillment market is poised for significant expansion, propelled by several key growth accelerators. Strategic alliances and collaborations between leading 3PL providers and innovative technology companies are paramount, fostering the development and adoption of cutting-edge solutions that enhance efficiency, reduce costs, and improve customer satisfaction. Substantial investments in advanced automation, including robotics, intelligent sorting systems, and AI-driven decision-making tools, will be critical in meeting the escalating demands of e-commerce. Geographic expansion into new and rapidly developing regions, particularly in emerging economies where e-commerce penetration is on the rise, presents substantial opportunities for market penetration and revenue growth. Furthermore, a strong and demonstrable commitment to sustainable and ethical fulfillment practices will increasingly attract environmentally conscious businesses and consumers alike, becoming a key differentiator and a powerful driver of loyalty and market share.

Key Players Shaping the Direct To Customer Outsourced Fulfillment Market Market

- FedEx Fulfillment

- Red Stag Fulfillment

- PFS Commerce

- FBA (Fulfillment by Amazon)

- DCL Logistics

- Sekel Tech

- WareIQ

- Ship Network (Formerly Rakuten Super Logistics)

- DHL Fulfillment

- ShipMonk

- Whiplash (A Part of Ryder System Inc)

- List Not Exhaustive

Notable Milestones in Direct To Customer Outsourced Fulfillment Market Sector

January 2024: Ryder System Inc. and Kodiak Robotics Inc. announced a collaboration to integrate autonomous trucking into Ryder's service network. This development signifies a move towards increased efficiency and reduced transportation costs in the long term.

January 2024: GXO Logistics Inc. acquired PFSweb, expanding its capabilities in high-end DTC fulfillment and securing Glossier as a major client. This acquisition highlights the trend of consolidation and the increasing demand for specialized fulfillment solutions.

In-Depth Direct To Customer Outsourced Fulfillment Market Market Outlook

The DTC outsourced fulfillment market is poised for continued strong growth driven by technological innovation, e-commerce expansion, and evolving consumer preferences. Strategic investments in automation, sustainable practices, and advanced analytics will be critical for success. The focus will shift toward creating highly personalized, efficient, and environmentally conscious fulfillment solutions to meet the growing demands of the ever-evolving e-commerce landscape.

Direct To Customer Outsourced Fulfillment Market Segmentation

-

1. Service

- 1.1. Warehousing and Storage

- 1.2. Distribution

- 1.3. Value-Added Services

-

2. Application

- 2.1. Fashion and Apparel

- 2.2. Consumer Electronics

- 2.3. Home Appliances

- 2.4. Furniture

- 2.5. Beauty and Personal Care Products

- 2.6. Other Applications (Toys, Food Products, Etc.)

Direct To Customer Outsourced Fulfillment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Singapore

- 3.5. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. Saudi Arabia

- 4.2. United Arab Emirates

- 4.3. Oman

- 4.4. Egypt

- 4.5. South Africa

- 4.6. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Mexico

- 5.3. Rest of South America

Direct To Customer Outsourced Fulfillment Market Regional Market Share

Geographic Coverage of Direct To Customer Outsourced Fulfillment Market

Direct To Customer Outsourced Fulfillment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The rapid expansion of e-commerce globally driving the market; Increasing technological advancements in warehousing automation and inventory management

- 3.3. Market Restrains

- 3.3.1. The rapid expansion of e-commerce globally driving the market; Increasing technological advancements in warehousing automation and inventory management

- 3.4. Market Trends

- 3.4.1. Warehousing and Storage Segment to Drive Market Growth in the Near Future

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Direct To Customer Outsourced Fulfillment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Warehousing and Storage

- 5.1.2. Distribution

- 5.1.3. Value-Added Services

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Fashion and Apparel

- 5.2.2. Consumer Electronics

- 5.2.3. Home Appliances

- 5.2.4. Furniture

- 5.2.5. Beauty and Personal Care Products

- 5.2.6. Other Applications (Toys, Food Products, Etc.)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Direct To Customer Outsourced Fulfillment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Warehousing and Storage

- 6.1.2. Distribution

- 6.1.3. Value-Added Services

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Fashion and Apparel

- 6.2.2. Consumer Electronics

- 6.2.3. Home Appliances

- 6.2.4. Furniture

- 6.2.5. Beauty and Personal Care Products

- 6.2.6. Other Applications (Toys, Food Products, Etc.)

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Direct To Customer Outsourced Fulfillment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Warehousing and Storage

- 7.1.2. Distribution

- 7.1.3. Value-Added Services

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Fashion and Apparel

- 7.2.2. Consumer Electronics

- 7.2.3. Home Appliances

- 7.2.4. Furniture

- 7.2.5. Beauty and Personal Care Products

- 7.2.6. Other Applications (Toys, Food Products, Etc.)

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Pacific Direct To Customer Outsourced Fulfillment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Warehousing and Storage

- 8.1.2. Distribution

- 8.1.3. Value-Added Services

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Fashion and Apparel

- 8.2.2. Consumer Electronics

- 8.2.3. Home Appliances

- 8.2.4. Furniture

- 8.2.5. Beauty and Personal Care Products

- 8.2.6. Other Applications (Toys, Food Products, Etc.)

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East and Africa Direct To Customer Outsourced Fulfillment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Warehousing and Storage

- 9.1.2. Distribution

- 9.1.3. Value-Added Services

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Fashion and Apparel

- 9.2.2. Consumer Electronics

- 9.2.3. Home Appliances

- 9.2.4. Furniture

- 9.2.5. Beauty and Personal Care Products

- 9.2.6. Other Applications (Toys, Food Products, Etc.)

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. South America Direct To Customer Outsourced Fulfillment Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Warehousing and Storage

- 10.1.2. Distribution

- 10.1.3. Value-Added Services

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Fashion and Apparel

- 10.2.2. Consumer Electronics

- 10.2.3. Home Appliances

- 10.2.4. Furniture

- 10.2.5. Beauty and Personal Care Products

- 10.2.6. Other Applications (Toys, Food Products, Etc.)

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 7 COMPETITIVE LANDSCAPE7 1 Market Concentration7 2 Company profiles

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 FedEx Fulfillment

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Red Stag Fulfillment

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PFS Commerce

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 FBA (Fulfillment by Amazon)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DCL Logistics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sekel Tech

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 WareIQ

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ship Network (Formerly Rakuten Super Logistics)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 DHL Fulfillment

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ShipMonk

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Whiplash (A Part of Ryder System Inc )**List Not Exhaustive 7 3 Other companie

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 7 COMPETITIVE LANDSCAPE7 1 Market Concentration7 2 Company profiles

List of Figures

- Figure 1: Global Direct To Customer Outsourced Fulfillment Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Direct To Customer Outsourced Fulfillment Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Service 2025 & 2033

- Figure 4: North America Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Service 2025 & 2033

- Figure 5: North America Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Service 2025 & 2033

- Figure 6: North America Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Service 2025 & 2033

- Figure 7: North America Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Application 2025 & 2033

- Figure 8: North America Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Application 2025 & 2033

- Figure 9: North America Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Service 2025 & 2033

- Figure 16: Europe Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Service 2025 & 2033

- Figure 17: Europe Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Service 2025 & 2033

- Figure 18: Europe Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Service 2025 & 2033

- Figure 19: Europe Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Application 2025 & 2033

- Figure 20: Europe Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Application 2025 & 2033

- Figure 21: Europe Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Europe Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Service 2025 & 2033

- Figure 28: Asia Pacific Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Service 2025 & 2033

- Figure 29: Asia Pacific Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Service 2025 & 2033

- Figure 30: Asia Pacific Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Service 2025 & 2033

- Figure 31: Asia Pacific Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Application 2025 & 2033

- Figure 32: Asia Pacific Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Application 2025 & 2033

- Figure 33: Asia Pacific Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Application 2025 & 2033

- Figure 34: Asia Pacific Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Application 2025 & 2033

- Figure 35: Asia Pacific Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Service 2025 & 2033

- Figure 40: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Service 2025 & 2033

- Figure 41: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Service 2025 & 2033

- Figure 42: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Service 2025 & 2033

- Figure 43: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Application 2025 & 2033

- Figure 44: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Application 2025 & 2033

- Figure 45: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Application 2025 & 2033

- Figure 46: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Application 2025 & 2033

- Figure 47: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Service 2025 & 2033

- Figure 52: South America Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Service 2025 & 2033

- Figure 53: South America Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Service 2025 & 2033

- Figure 54: South America Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Service 2025 & 2033

- Figure 55: South America Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Application 2025 & 2033

- Figure 56: South America Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Application 2025 & 2033

- Figure 57: South America Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Application 2025 & 2033

- Figure 58: South America Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Application 2025 & 2033

- Figure 59: South America Direct To Customer Outsourced Fulfillment Market Revenue (Million), by Country 2025 & 2033

- Figure 60: South America Direct To Customer Outsourced Fulfillment Market Volume (Billion), by Country 2025 & 2033

- Figure 61: South America Direct To Customer Outsourced Fulfillment Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Direct To Customer Outsourced Fulfillment Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Service 2020 & 2033

- Table 3: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Service 2020 & 2033

- Table 8: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Service 2020 & 2033

- Table 9: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Service 2020 & 2033

- Table 18: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Service 2020 & 2033

- Table 19: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 20: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Application 2020 & 2033

- Table 21: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: United Kingdom Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Germany Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Germany Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: France Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: France Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Spain Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Spain Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Europe Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Service 2020 & 2033

- Table 34: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Service 2020 & 2033

- Table 35: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Application 2020 & 2033

- Table 37: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Country 2020 & 2033

- Table 39: China Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: China Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: India Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: India Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Japan Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Japan Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Singapore Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Singapore Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Asia Pacific Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Service 2020 & 2033

- Table 50: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Service 2020 & 2033

- Table 51: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 52: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Application 2020 & 2033

- Table 53: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Country 2020 & 2033

- Table 55: Saudi Arabia Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Saudi Arabia Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: United Arab Emirates Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: United Arab Emirates Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Oman Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Oman Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Egypt Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Egypt Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: South Africa Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: South Africa Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Service 2020 & 2033

- Table 68: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Service 2020 & 2033

- Table 69: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Application 2020 & 2033

- Table 70: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Application 2020 & 2033

- Table 71: Global Direct To Customer Outsourced Fulfillment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 72: Global Direct To Customer Outsourced Fulfillment Market Volume Billion Forecast, by Country 2020 & 2033

- Table 73: Brazil Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Brazil Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 75: Mexico Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: Mexico Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Direct To Customer Outsourced Fulfillment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Direct To Customer Outsourced Fulfillment Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Direct To Customer Outsourced Fulfillment Market?

The projected CAGR is approximately 13.70%.

2. Which companies are prominent players in the Direct To Customer Outsourced Fulfillment Market?

Key companies in the market include 7 COMPETITIVE LANDSCAPE7 1 Market Concentration7 2 Company profiles, FedEx Fulfillment, Red Stag Fulfillment, PFS Commerce, FBA (Fulfillment by Amazon), DCL Logistics, Sekel Tech, WareIQ, Ship Network (Formerly Rakuten Super Logistics), DHL Fulfillment, ShipMonk, Whiplash (A Part of Ryder System Inc )**List Not Exhaustive 7 3 Other companie.

3. What are the main segments of the Direct To Customer Outsourced Fulfillment Market?

The market segments include Service, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.24 Million as of 2022.

5. What are some drivers contributing to market growth?

The rapid expansion of e-commerce globally driving the market; Increasing technological advancements in warehousing automation and inventory management.

6. What are the notable trends driving market growth?

Warehousing and Storage Segment to Drive Market Growth in the Near Future.

7. Are there any restraints impacting market growth?

The rapid expansion of e-commerce globally driving the market; Increasing technological advancements in warehousing automation and inventory management.

8. Can you provide examples of recent developments in the market?

January 2024: Ryder System Inc., a leader in the supply chain, transportation, and fleet management solutions, and Kodiak Robotics Inc., a leading autonomous trucking company, announced a collaboration to leverage Ryder’s service network to enable the commercialization and scaling of Kodiak’s autonomous truck solution.January 2024: GXO Logistics Inc. announced that following its successful acquisition of PFSweb (PFS), it had won Glossier’s direct-to-consumer fulfillment operations and will manage its business-to-business order fulfillment to its retail partners in the United States. Together with PFS, GXO now expands its capabilities to provide bespoke, high-end customer experiences to leading beauty and wellness companies, from start-ups to iconic, globally recognized brands. Pick and pack operations are handled according to the most detailed specifications, giving the consumer a memorable unboxing experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Direct To Customer Outsourced Fulfillment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Direct To Customer Outsourced Fulfillment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Direct To Customer Outsourced Fulfillment Market?

To stay informed about further developments, trends, and reports in the Direct To Customer Outsourced Fulfillment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence