Key Insights

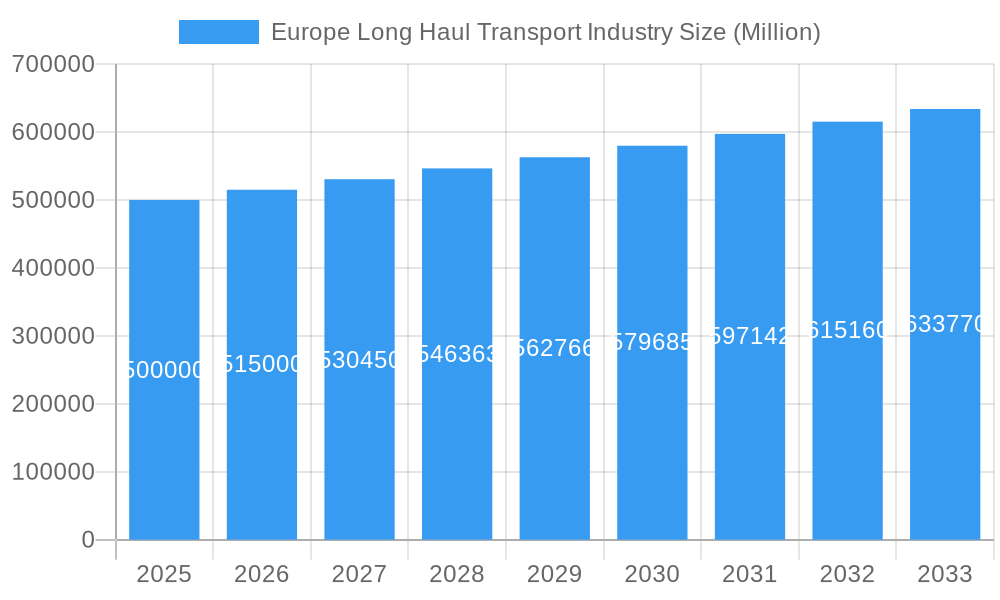

The European Long-Haul Transport market, valued at 554.8 billion in 2025, is forecast to grow at a CAGR of 1.9% through 2033. This expansion is driven by the robust growth of e-commerce, necessitating efficient logistics networks. Increased manufacturing and automotive production, particularly in Germany, France, and the UK, further elevate freight volumes. The adoption of just-in-time inventory management also amplifies the demand for reliable long-haul solutions. While regulatory shifts and fuel price volatility present challenges, the market outlook remains positive. The cross-border segment shows significant potential due to expanding international trade. Key end-user industries contributing to growth include construction, oil & gas, and manufacturing. Leading companies like DPDgroup, Dachser, and DHL are investing in route optimization and sustainable transport technologies to enhance competitiveness and meet customer needs.

Europe Long Haul Transport Industry Market Size (In Billion)

The competitive environment features major multinational logistics providers and specialized regional operators, with consolidation expected to influence market dynamics. Geopolitical uncertainties are anticipated to be largely offset by growth in other European nations. The agricultural, fishing, and forestry sectors also contribute to market volume. The long-term forecast for the European long-haul transport sector is optimistic, supported by sustained demand, innovation, and growing cross-border trade. The increasing emphasis on sustainability and eco-friendly transport solutions will also shape future strategies.

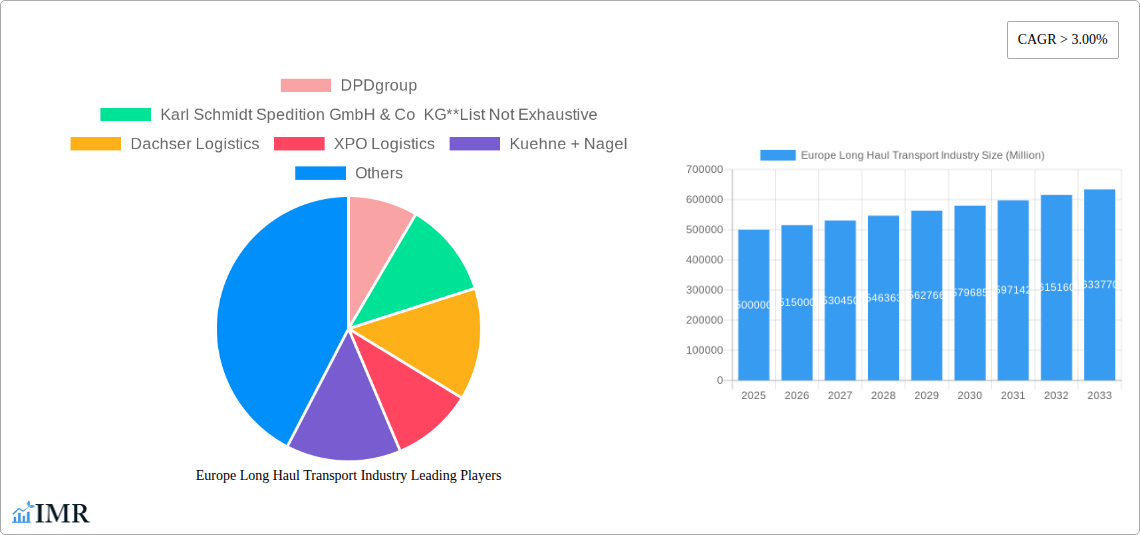

Europe Long Haul Transport Industry Company Market Share

Europe Long Haul Transport Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Long Haul Transport industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and strategic decision-makers seeking a clear understanding of this dynamic sector. The report analyzes the parent market of logistics and the child market of long-haul trucking.

Europe Long Haul Transport Industry Market Dynamics & Structure

The European long-haul transport market is a highly competitive landscape characterized by a mix of large multinational corporations and smaller, specialized operators. Market concentration is moderate, with several key players holding significant market share, but with opportunities for smaller companies to specialize. Technological innovation, driven by advancements in telematics, AI, and electric vehicle technology, is reshaping the industry. Stringent regulatory frameworks, including emission standards and driver regulations, significantly impact operational costs and strategies. Competitive substitutes include rail freight and maritime shipping, impacting market share depending on distance and goods type. End-user demographics are diverse, spanning various industries with varying transportation needs. M&A activity is relatively frequent, reflecting consolidation and strategic expansion efforts.

- Market Concentration: Moderate, with top 10 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on AI-powered route optimization, telematics for fleet management, and electric vehicle adoption. Barriers include high upfront investment costs and infrastructure limitations.

- Regulatory Framework: Stringent emission regulations (Euro VI and beyond), driver hours restrictions, and cross-border regulations impact operational efficiency.

- Competitive Substitutes: Rail and maritime transport pose significant competition for longer distances.

- M&A Activity: Annual deal volume estimated at xx deals in 2024, driven by consolidation and expansion.

Europe Long Haul Transport Industry Growth Trends & Insights

The European long-haul transport market experienced steady growth during the historical period (2019-2024), with a CAGR of xx%. Growth is driven by increasing e-commerce activity, cross-border trade, and the expansion of manufacturing and distribution networks. The market is projected to continue expanding during the forecast period (2025-2033), with a projected CAGR of xx%, fueled by e-commerce expansion and technological advancements. The adoption rate of telematics and other digital solutions is increasing, enhancing efficiency and reducing costs. Shifts in consumer behavior, particularly the rise of e-commerce and faster delivery expectations, are creating demand for more efficient and reliable long-haul transport solutions. Disruptive technologies, including autonomous driving and electric vehicles, are poised to transform the industry in the coming years, although widespread adoption faces challenges related to infrastructure and regulatory frameworks.

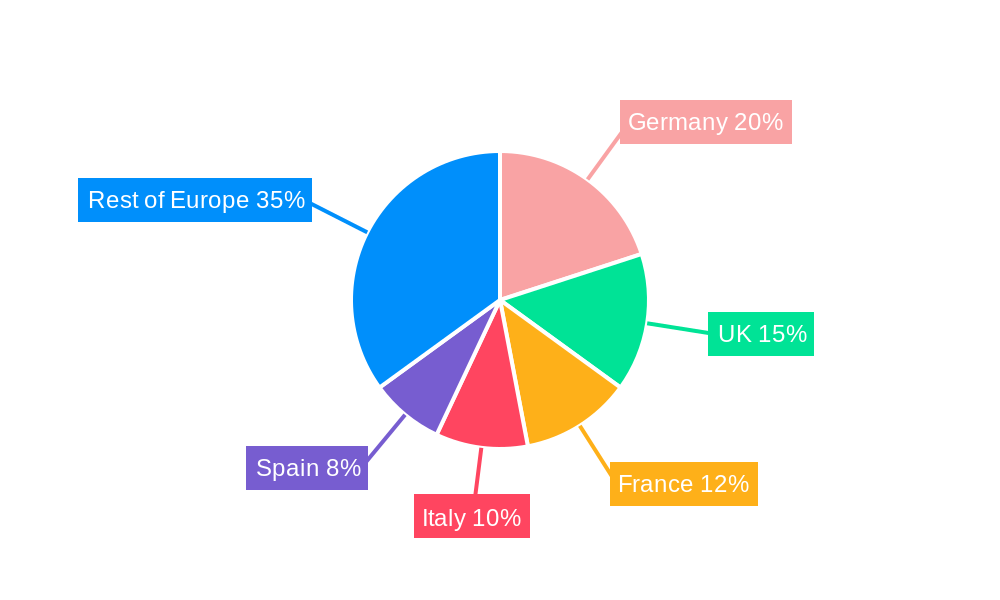

Dominant Regions, Countries, or Segments in Europe Long Haul Transport Industry

Germany, the United Kingdom, and France represent the largest national markets, driven by robust industrial activity and extensive transportation networks. The cross-border segment exhibits significant growth potential, fueled by increased international trade. Within end-users, the Manufacturing and Automotive sector dominates, followed by Distributive Trade.

Key Drivers:

- Germany: Strong manufacturing base and well-developed infrastructure.

- United Kingdom: Significant e-commerce activity and robust import/export trade.

- France: Extensive road network and strategic location within Europe.

- Cross-border Segment: Growth driven by increased international trade and supply chain globalization.

- Manufacturing & Automotive: High volume of goods requiring long-haul transport.

Dominance Factors:

- Market Size: Germany holds the largest market share, followed by the UK and France.

- Growth Potential: Cross-border and Eastern European markets show high growth potential.

Europe Long Haul Transport Industry Product Landscape

The product landscape is evolving rapidly, with a focus on enhanced efficiency, sustainability, and technological integration. Telematics systems provide real-time tracking and data analysis, optimizing routes and improving fleet management. Innovations in trailer design and load optimization improve cargo capacity and reduce fuel consumption. The increasing adoption of electric and alternative fuel vehicles is driven by environmental regulations and sustainability concerns. Key selling propositions include cost reduction, enhanced efficiency, and improved environmental performance.

Key Drivers, Barriers & Challenges in Europe Long Haul Transport Industry

Key Drivers:

- Rising e-commerce driving demand for faster delivery.

- Growth in cross-border trade and globalization of supply chains.

- Technological advancements (AI, telematics, electric vehicles).

- Government investment in infrastructure.

Key Challenges:

- Driver shortages and high labor costs.

- Fluctuating fuel prices and geopolitical uncertainty.

- Stringent environmental regulations increasing operational costs.

- Intense competition and pressure on margins. The impact of these challenges is estimated to reduce annual market growth by approximately xx% in 2025.

Emerging Opportunities in Europe Long Haul Transport Industry

- Sustainable Logistics: Growing demand for eco-friendly solutions, including electric and alternative fuel vehicles.

- Last-Mile Delivery Optimization: Integrating technology to enhance efficiency in final delivery stages.

- Digitalization and Automation: Implementing AI and automation to streamline operations and reduce costs.

- Expansion into Eastern European Markets: Untapped potential in less developed transportation infrastructure regions.

Growth Accelerators in the Europe Long Haul Transport Industry

Technological advancements, strategic partnerships, and expansion into new markets will drive long-term growth. The adoption of autonomous driving technology could significantly reduce operational costs and improve efficiency. Collaborations between transport companies and technology providers are fostering innovation. Expanding into less-developed markets in Eastern Europe presents significant opportunities for growth.

Key Players Shaping the Europe Long Haul Transport Industry Market

- DPDgroup

- Karl Schmidt Spedition GmbH & Co KG

- Dachser Logistics

- XPO Logistics

- Kuehne + Nagel

- FIEGE Logistics

- Ceva Logistics Limited

- Deutsche Post DHL Group

- Bollore Logistics

- Rhenus Logistics

- DSV Panalpina

Notable Milestones in Europe Long Haul Transport Industry Sector

- July 2023: Trucksters secures €33 million Series B funding to electrify its long-haul routes.

- March 2023: CEVA Logistics, ENGIE, and SANEF launch the ECTN Alliance to build a network of low-carbon truck terminals.

In-Depth Europe Long Haul Transport Industry Market Outlook

The European long-haul transport market is poised for significant growth driven by technological innovation, increasing e-commerce, and the expansion of cross-border trade. Strategic opportunities exist for companies that can adapt to evolving regulations, embrace sustainable practices, and leverage technology to improve efficiency. The market is expected to reach xx million units by 2033, representing substantial growth potential for both established players and new entrants.

Europe Long Haul Transport Industry Segmentation

-

1. Destination

- 1.1. Domestic

- 1.2. Cross-border

-

2. End User

- 2.1. Construction

- 2.2. Oil and Gas and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Manufacturing and Automotive

- 2.5. Distributive Trade

- 2.6. Other End-Users (Pharmaceutical and Healthcare)

Europe Long Haul Transport Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Long Haul Transport Industry Regional Market Share

Geographic Coverage of Europe Long Haul Transport Industry

Europe Long Haul Transport Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth In E-commerce is driving the market4.; Growing in Cross Border Activities is driving the market

- 3.3. Market Restrains

- 3.3.1. 4.; Shortage of Skilled labor

- 3.4. Market Trends

- 3.4.1. Shrinking Automotive Sector May Impact the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Long Haul Transport Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 5.1.1. Domestic

- 5.1.2. Cross-border

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Construction

- 5.2.2. Oil and Gas and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Manufacturing and Automotive

- 5.2.5. Distributive Trade

- 5.2.6. Other End-Users (Pharmaceutical and Healthcare)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Destination

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DPDgroup

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Karl Schmidt Spedition GmbH & Co KG**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dachser Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 XPO Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Kuehne + Nagel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FIEGE Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ceva Logistics Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Deutsche Post DHL Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bollore Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rhenus Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DSV Panalpina

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DPDgroup

List of Figures

- Figure 1: Europe Long Haul Transport Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Long Haul Transport Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Long Haul Transport Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 2: Europe Long Haul Transport Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Europe Long Haul Transport Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Long Haul Transport Industry Revenue billion Forecast, by Destination 2020 & 2033

- Table 5: Europe Long Haul Transport Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Europe Long Haul Transport Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Long Haul Transport Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Long Haul Transport Industry?

The projected CAGR is approximately 1.9%.

2. Which companies are prominent players in the Europe Long Haul Transport Industry?

Key companies in the market include DPDgroup, Karl Schmidt Spedition GmbH & Co KG**List Not Exhaustive, Dachser Logistics, XPO Logistics, Kuehne + Nagel, FIEGE Logistics, Ceva Logistics Limited, Deutsche Post DHL Group, Bollore Logistics, Rhenus Logistics, DSV Panalpina.

3. What are the main segments of the Europe Long Haul Transport Industry?

The market segments include Destination, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 554.8 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth In E-commerce is driving the market4.; Growing in Cross Border Activities is driving the market.

6. What are the notable trends driving market growth?

Shrinking Automotive Sector May Impact the Market Growth.

7. Are there any restraints impacting market growth?

4.; Shortage of Skilled labor.

8. Can you provide examples of recent developments in the market?

July 2023: Trucksters, a Spanish road freight operator which has disrupted the long-haul sector with the use of AI and big data, has closed a Series B round of €33 million. The new capital injection, backed up by new and existing investors, will be used to fulfil some of the company’s strategic objectives including electrifying its routes, potentially making Trucksters the first electric long-haul operator in Europe

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Long Haul Transport Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Long Haul Transport Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Long Haul Transport Industry?

To stay informed about further developments, trends, and reports in the Europe Long Haul Transport Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence