Key Insights

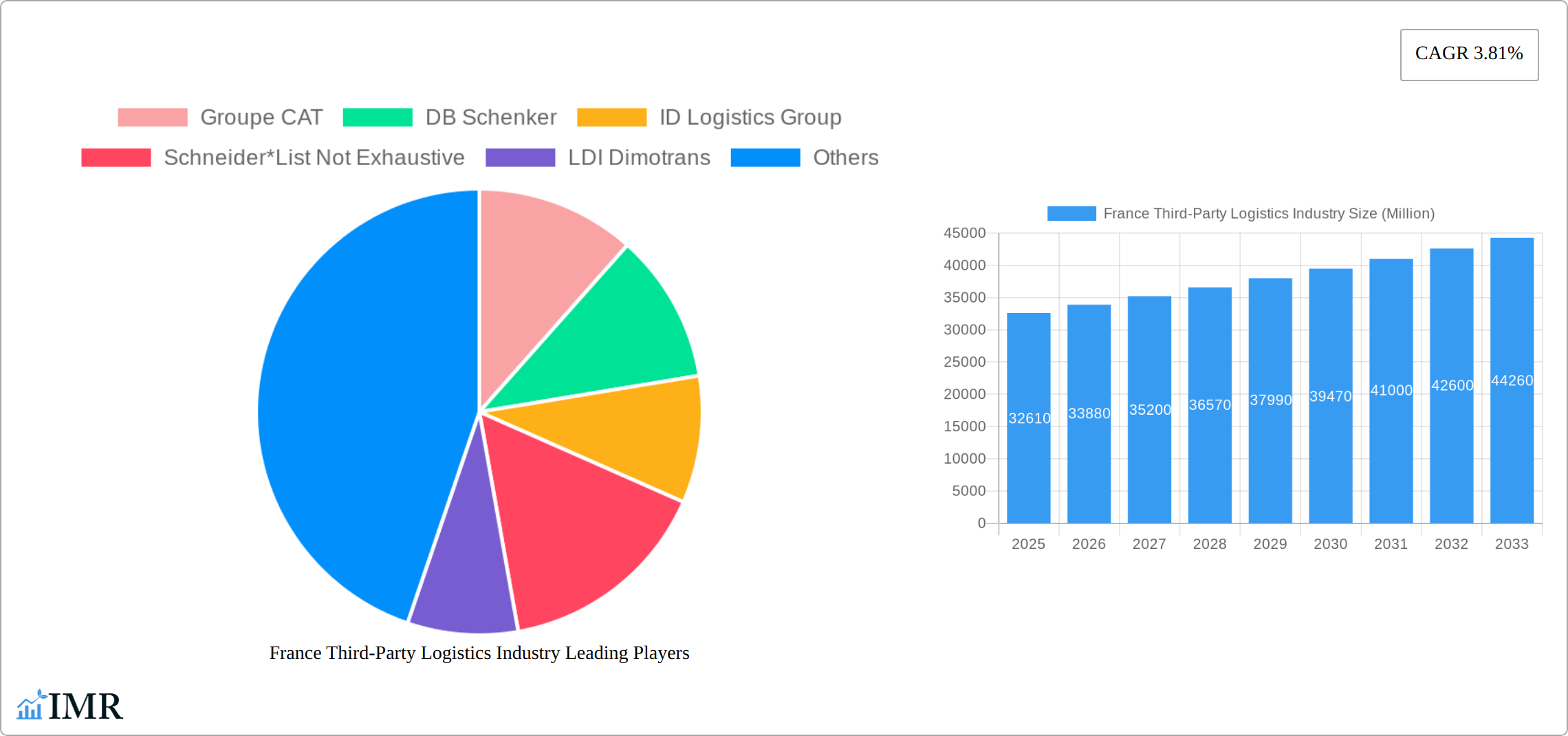

The French third-party logistics (3PL) market, valued at €32.61 billion in 2025, is poised for steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.81% from 2025 to 2033. This expansion is driven by several key factors. The rise of e-commerce continues to fuel demand for efficient warehousing and distribution solutions, particularly within the retail and technology sectors. Furthermore, the increasing complexity of global supply chains is prompting businesses to outsource logistics operations to specialized 3PL providers, benefiting companies like Groupe CAT, DB Schenker, and DHL Supply Chain operating within France. The automotive, chemical, and manufacturing industries are significant contributors to market growth, relying on 3PLs for domestic and international transportation management and value-added services. While regulatory changes and fluctuating fuel costs present potential restraints, the overall market outlook remains positive, fueled by the ongoing adoption of advanced technologies such as automation and data analytics within logistics operations. The market segmentation reveals a robust demand for domestic and international transportation management services, complemented by the growing need for sophisticated value-added warehousing and distribution solutions. This demand is expected to stimulate innovation and further consolidation within the 3PL sector in France over the forecast period.

France Third-Party Logistics Industry Market Size (In Billion)

The competitive landscape is characterized by a mix of large multinational corporations and smaller, specialized providers. Major players are investing heavily in technological advancements and expanding their service portfolios to meet the evolving needs of their clients. This competitive pressure drives efficiency improvements and enhances the overall quality of logistics services available in France. The continued growth of e-commerce, coupled with the increasing focus on supply chain optimization and resilience, will further propel the demand for 3PL services in the coming years. This creates lucrative opportunities for both established players and new entrants to the market. Analyzing regional variations within France could offer more granular insights into market dynamics, as certain regions might experience higher growth due to specific industry concentrations or infrastructure developments. Further research into specific value-added services and emerging trends like sustainable logistics could provide deeper insights for strategic planning and investment.

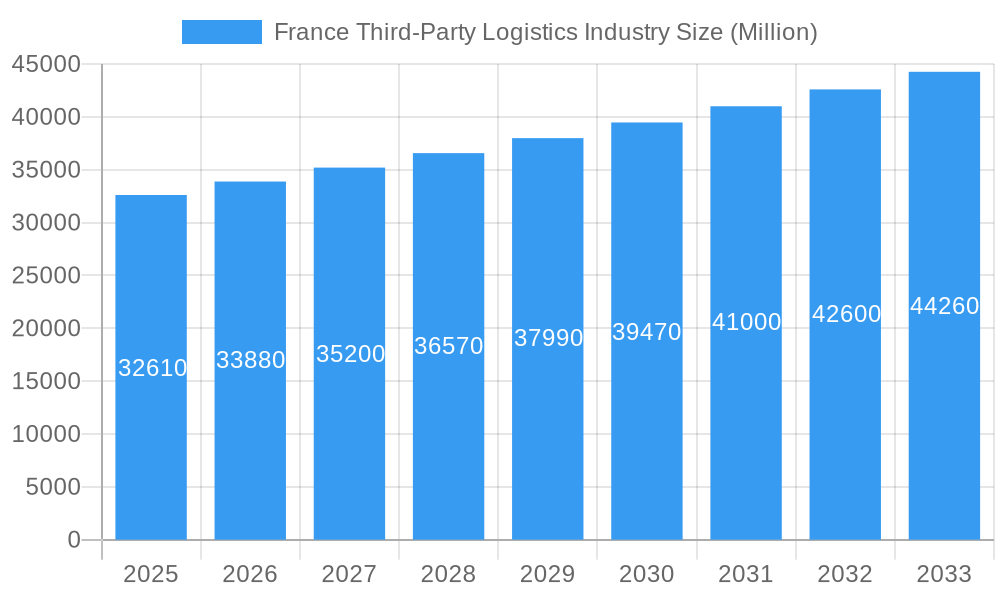

France Third-Party Logistics Industry Company Market Share

France Third-Party Logistics (3PL) Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the France 3PL market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. It covers market dynamics, growth trends, key players, and future outlook, with a focus on the period 2019-2033, using 2025 as the base year. The report segments the market by services (Domestic Transportation Management, International Transportation Management, Value-added Warehousing and Distribution) and end-users (Automobile, Chemicals, Construction, Energy, Manufacturing, Life Sciences and Healthcare, Retail, Technology, Others).

France Third-Party Logistics Industry Market Dynamics & Structure

The French 3PL market presents a dynamic interplay of established giants and agile specialists, shaped by technological advancements, regulatory shifts, and ongoing consolidation. This section delves into the competitive landscape, analyzing market concentration, technological innovation, regulatory frameworks, and M&A activity to provide a comprehensive understanding of the industry's structure.

- Market Concentration & Competitive Landscape: While a few major players like Groupe CAT, Geodis, and DHL Supply Chain hold substantial market share (e.g., a combined xx% in 2025), the French 3PL market displays moderate concentration. A significant number of smaller, specialized providers cater to niche segments, fostering competition and innovation. This diverse landscape offers both opportunities and challenges for market entrants.

- Technological Innovation & Adoption: The industry is undergoing a digital transformation driven by AI, blockchain, and IoT. These technologies promise increased efficiency, transparency, and traceability. However, adoption rates vary significantly due to factors such as company size, budget constraints, and integration complexities with legacy systems. Overcoming these barriers requires strategic investment and collaborative partnerships.

- Regulatory Framework & Compliance: The French regulatory environment, emphasizing data privacy (GDPR compliance), environmental sustainability, and labor laws, significantly impacts operational costs and strategic decision-making. Navigating this landscape requires robust compliance strategies and proactive engagement with regulatory bodies. The government's focus on sustainable logistics presents opportunities for companies adopting eco-friendly practices.

- Competitive Disruption & Adaptation: The emergence of collaborative platforms and on-demand delivery services presents a competitive challenge to traditional 3PL providers. Successful players are responding by offering flexible, integrated solutions and adapting their service portfolios to meet the demands of the evolving marketplace.

- Key Market Segments & End-User Demand: The manufacturing, retail, and e-commerce sectors are major drivers of 3PL demand in France. The rapid expansion of e-commerce, particularly omnichannel retail, is significantly influencing service requirements, pushing for faster delivery times, increased transparency, and enhanced last-mile solutions.

- M&A Activity & Market Consolidation: Consolidation is a defining characteristic of the French 3PL market. Larger players are actively acquiring smaller firms to expand their service offerings, geographical reach, and expertise. The average number of M&A deals from 2019 to 2024 was xx per year, representing a total deal value of €xx million, highlighting the ongoing trend of industry consolidation.

France Third-Party Logistics Industry Growth Trends & Insights

The French 3PL market exhibited robust growth from 2019 to 2024, fueled by e-commerce expansion, globalization, and a rising focus on supply chain optimization. The market size reached an estimated €xx million in 2025 and is projected to reach €xx million by 2033, reflecting a CAGR of xx% during the forecast period (2025-2033). This growth trajectory is underpinned by increasing demand for efficient and reliable logistics services across various industries. Technological advancements, particularly the adoption of automation and data analytics, are accelerating this growth. Moreover, evolving consumer preferences, emphasizing faster delivery and greater transparency, are driving the adoption of sophisticated 3PL solutions. The market penetration of advanced technologies is also noteworthy, with xx% of 3PL providers utilizing AI-powered solutions by 2025.

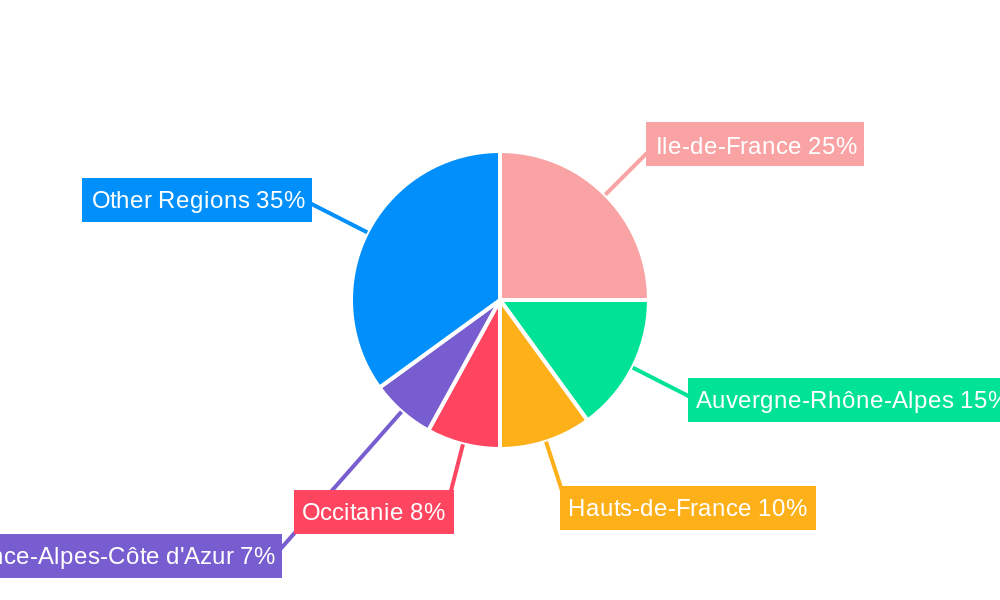

Dominant Regions, Countries, or Segments in France Third-Party Logistics Industry

The Île-de-France region, due to its central location and high concentration of businesses, dominates the French 3PL market. Within the service segments, Value-added Warehousing and Distribution is experiencing the fastest growth, driven by the increasing demand for customized warehousing solutions and specialized logistics services. The automobile, retail, and manufacturing sectors are the leading end-users of 3PL services in France.

- Key Drivers:

- Strong economic growth: France's robust economy supports increased demand for logistics services.

- Well-developed infrastructure: A comprehensive road, rail, and port network facilitates efficient logistics operations.

- Government support for logistics innovation: Initiatives promoting digitalization and sustainable logistics boost industry growth.

- Dominance Factors:

- High concentration of businesses: Île-de-France's large number of companies drives demand for logistics services.

- Strategic location: Its central location provides easy access to major markets within France and internationally.

- Specialized service providers: A range of 3PL providers catering to specific industry needs fuels growth.

France Third-Party Logistics Industry Product Landscape

The French 3PL market offers a diverse range of products and services, including traditional transportation and warehousing solutions, as well as specialized services like contract logistics, reverse logistics, and last-mile delivery. Recent innovations include the use of robotics and automation in warehouses, AI-powered route optimization software, and blockchain technology for enhanced supply chain transparency. These advancements offer increased efficiency, cost savings, and improved traceability. Unique selling propositions include tailored solutions to meet specific industry requirements, flexible contract options, and a focus on sustainability.

Key Drivers, Barriers & Challenges in France Third-Party Logistics Industry

Key Drivers: The rise of e-commerce, globalization, and the increasing complexity of supply chains are driving significant growth in the French 3PL market. Government initiatives promoting digitalization and sustainable logistics are also key catalysts. The need for optimized supply chain management and cost reduction is further driving demand.

Key Challenges: Stringent regulations, competition from new entrants, and the high cost of labor and infrastructure pose significant challenges. Supply chain disruptions, such as those experienced during the COVID-19 pandemic, highlight the need for resilience and agility. Finding skilled labor and adapting to changing technological landscapes are also important issues. The environmental impact of logistics operations is increasing regulatory pressure leading to higher operational costs.

Emerging Opportunities in France Third-Party Logistics Industry

Several key opportunities are shaping the future of the French 3PL market. The sustained growth of e-commerce and omnichannel retail creates significant demand for efficient last-mile delivery solutions and flexible warehousing capabilities. The increasing emphasis on sustainable logistics presents a compelling opportunity for companies to offer eco-friendly solutions, meeting the growing environmental concerns of businesses and consumers. Furthermore, the development and adoption of innovative technologies, such as AI-powered warehouse management systems and autonomous vehicles, are creating new avenues for efficiency gains and cost reductions. Finally, specialized logistics services for sectors like life sciences and healthcare represent significant untapped potential for growth.

Growth Accelerators in the France Third-Party Logistics Industry Industry

Technological advancements, strategic partnerships, and market expansion strategies are key accelerators of long-term growth. The integration of AI, IoT, and blockchain technologies is enhancing efficiency and transparency across the supply chain. Collaboration between 3PL providers and technology companies is driving innovation. Expansion into new markets, such as emerging economies and specialized industry segments, will further fuel market growth.

Key Players Shaping the France Third-Party Logistics Industry Market

- Groupe CAT

- DB Schenker

- ID Logistics Group

- Schneider

- LDI Dimotrans

- GEFCO

- DHL Supply Chain

- Geodis

- Bansard International

- Bolloré Logistics

- HLOG

Notable Milestones in France Third-Party Logistics Industry Sector

- 2020: Increased adoption of digital technologies in response to the COVID-19 pandemic.

- 2021: Several major 3PL providers invested heavily in warehouse automation.

- 2022: Government initiatives focused on promoting sustainable logistics practices.

- 2023: Significant M&A activity amongst 3PL providers.

- 2024: Expansion of last-mile delivery services to meet growing e-commerce demand.

In-Depth France Third-Party Logistics Industry Market Outlook

The French 3PL market is poised for continued expansion, driven by a confluence of factors: technological advancements, evolving consumer expectations, and the inherent complexities of global supply chains. Companies that effectively leverage cutting-edge technologies to create innovative solutions, cater to specific industry needs, and prioritize sustainability will be best positioned for success. Adaptability, innovation, and a proactive approach to market dynamics are key to thriving in this competitive and rapidly evolving landscape.

France Third-Party Logistics Industry Segmentation

-

1. Services

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. End-User

- 2.1. Automobile

- 2.2. Chemicals

- 2.3. Construction

- 2.4. Energy

- 2.5. Manufacturing

- 2.6. Life Sciences and Healthcare

- 2.7. Retail

- 2.8. Technology

- 2.9. Others

France Third-Party Logistics Industry Segmentation By Geography

- 1. France

France Third-Party Logistics Industry Regional Market Share

Geographic Coverage of France Third-Party Logistics Industry

France Third-Party Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-commerce Fueling the Growth of 3PL Market

- 3.3. Market Restrains

- 3.3.1. Slow Infrastructure Development

- 3.4. Market Trends

- 3.4.1. Warehousing Trends in France

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Third-Party Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Automobile

- 5.2.2. Chemicals

- 5.2.3. Construction

- 5.2.4. Energy

- 5.2.5. Manufacturing

- 5.2.6. Life Sciences and Healthcare

- 5.2.7. Retail

- 5.2.8. Technology

- 5.2.9. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Groupe CAT

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DB Schenker

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ID Logistics Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schneider*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 LDI Dimotrans

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 GEFCO

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DHLSupply Chain

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Geodis

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bansard International

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bollore Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 HLOG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Groupe CAT

List of Figures

- Figure 1: France Third-Party Logistics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: France Third-Party Logistics Industry Share (%) by Company 2025

List of Tables

- Table 1: France Third-Party Logistics Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 2: France Third-Party Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: France Third-Party Logistics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: France Third-Party Logistics Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 5: France Third-Party Logistics Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: France Third-Party Logistics Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Third-Party Logistics Industry?

The projected CAGR is approximately 3.81%.

2. Which companies are prominent players in the France Third-Party Logistics Industry?

Key companies in the market include Groupe CAT, DB Schenker, ID Logistics Group, Schneider*List Not Exhaustive, LDI Dimotrans, GEFCO, DHLSupply Chain, Geodis, Bansard International, Bollore Logistics, HLOG.

3. What are the main segments of the France Third-Party Logistics Industry?

The market segments include Services, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 32.61 Million as of 2022.

5. What are some drivers contributing to market growth?

E-commerce Fueling the Growth of 3PL Market.

6. What are the notable trends driving market growth?

Warehousing Trends in France.

7. Are there any restraints impacting market growth?

Slow Infrastructure Development.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Third-Party Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Third-Party Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Third-Party Logistics Industry?

To stay informed about further developments, trends, and reports in the France Third-Party Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence