Key Insights

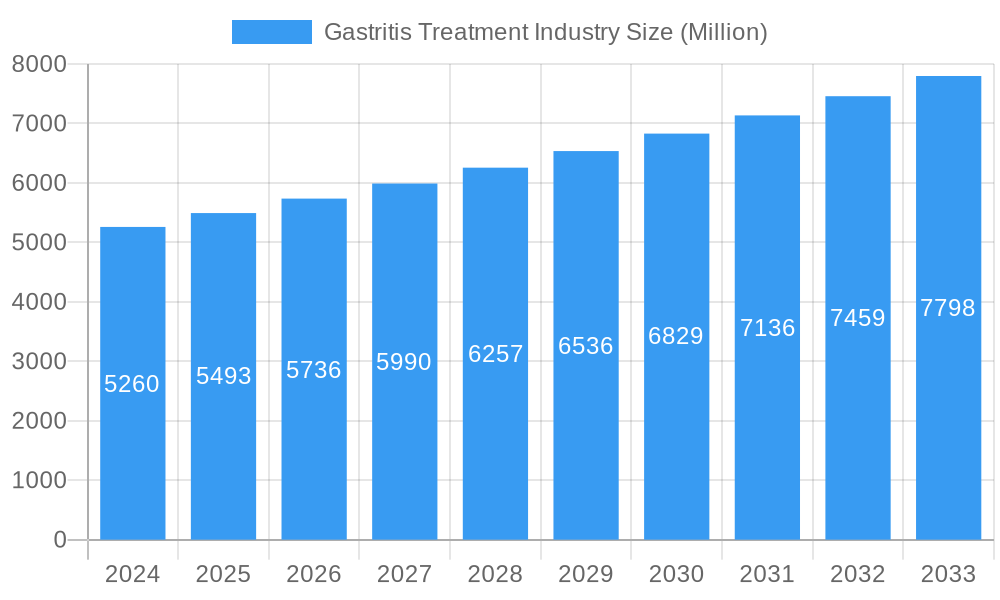

The Gastritis Treatment Market is poised for significant expansion, projected to reach USD 5.26 billion in 2024 and grow at a robust Compound Annual Growth Rate (CAGR) of 4.5% through 2033. This upward trajectory is primarily fueled by a growing global incidence of gastritis, driven by factors such as poor dietary habits, increased stress levels, and the prevalence of Helicobacter pylori infections. Advancements in endoscopic technologies, particularly in minimally invasive diagnostic and therapeutic devices, are also acting as powerful market drivers. These innovative solutions offer improved precision, reduced patient discomfort, and faster recovery times, thus encouraging their adoption by healthcare professionals and institutions worldwide. The increasing focus on early diagnosis and personalized treatment approaches further bolsters market confidence and investment.

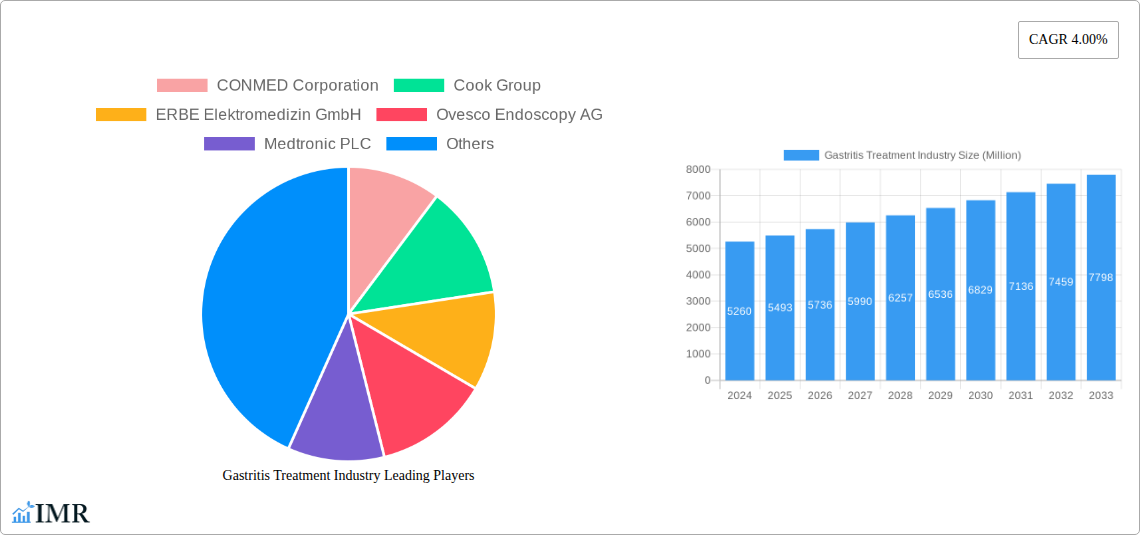

Gastritis Treatment Industry Market Size (In Billion)

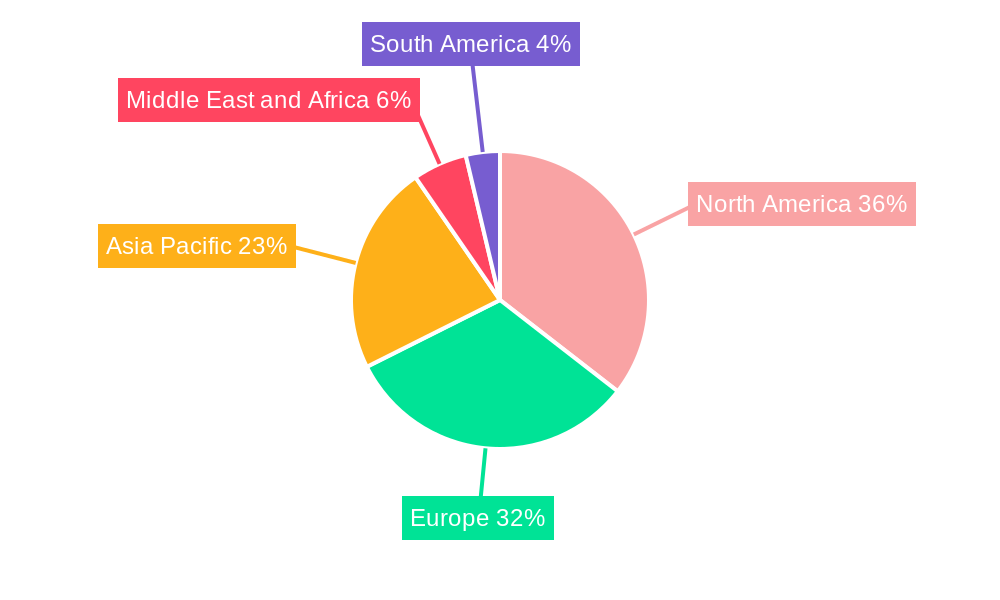

The market segmentation reveals a dynamic landscape, with Endoscopic Mechanical Devices and Endoscopic Thermal Devices leading the charge within the product category due to their therapeutic efficacy. The Upper GI Tract segment also holds substantial importance, reflecting the higher prevalence of related conditions. Hospitals and clinics represent the dominant end-user segment, owing to their established infrastructure and patient flow for gastritis management. Geographically, North America and Europe are expected to maintain their leading positions, driven by advanced healthcare systems and high awareness levels. However, the Asia Pacific region is anticipated to witness the fastest growth, propelled by a burgeoning population, increasing healthcare expenditure, and a rising demand for advanced medical treatments. Despite these positive trends, challenges such as the high cost of advanced endoscopic equipment and the availability of generic medications for symptomatic relief may temper growth in certain segments.

Gastritis Treatment Industry Company Market Share

This in-depth report offers a panoramic view of the gastritis treatment industry, meticulously analyzing its current state and projecting its trajectory through 2033. Delving into the intricate dynamics, growth trends, regional dominance, product innovations, and key players, this research is an indispensable resource for industry professionals, investors, and stakeholders seeking to navigate this rapidly evolving market. The report covers global and regional market sizes, CAGR, market share, and competitive landscape, providing actionable insights for strategic decision-making. All financial values are presented in billions of USD.

Gastritis Treatment Industry Market Dynamics & Structure

The gastritis treatment market is characterized by a moderate to high level of market concentration, with key players investing heavily in research and development to introduce advanced treatment modalities. Technological innovation is a primary driver, propelled by the increasing prevalence of gastrointestinal disorders and a growing demand for minimally invasive procedures. Regulatory frameworks, such as FDA approvals and CE markings, play a crucial role in shaping market entry and product adoption. Competitive product substitutes, including pharmacological interventions and lifestyle modifications, exert influence, although the focus remains on innovative endoscopic and surgical solutions. End-user demographics, primarily an aging population and individuals with lifestyle-induced gastric issues, are shifting demand towards effective and less intrusive treatments. Mergers and acquisitions (M&A) are a significant trend, with larger companies acquiring innovative startups to expand their product portfolios and market reach.

- Market Concentration: Dominated by a few key global players with significant R&D investments.

- Technological Innovation Drivers: Growing incidence of gastritis, technological advancements in endoscopy, and demand for targeted therapies.

- Regulatory Frameworks: FDA, EMA, and other regional bodies dictate product approval and market access.

- Competitive Product Substitutes: Pharmaceuticals and lifestyle changes offer alternatives, but are increasingly complemented by advanced medical devices.

- End-User Demographics: Aging population, increasing awareness of GI health, and rising prevalence of H. pylori infections and GERD.

- M&A Trends: Strategic acquisitions and partnerships to consolidate market share and acquire novel technologies.

Gastritis Treatment Industry Growth Trends & Insights

The gastritis treatment industry is poised for robust growth, driven by an escalating global burden of gastrointestinal ailments and a continuous stream of medical innovations. The market size is projected to expand significantly, fueled by increasing adoption rates of advanced endoscopic techniques and therapeutic devices designed for early diagnosis and precise intervention. Technological disruptions, such as the development of AI-powered diagnostic tools and advanced robotic-assisted surgery for complex gastrointestinal conditions, are redefining treatment paradigms. Shifts in consumer behavior are also playing a pivotal role, with patients increasingly seeking out minimally invasive procedures that offer faster recovery times and reduced post-operative complications. The rising awareness of gastrointestinal health issues and the demand for personalized treatment plans are further augmenting market expansion. The projected Compound Annual Growth Rate (CAGR) of xx% over the forecast period 2025-2033 underscores the substantial market potential. Market penetration is expected to deepen as healthcare infrastructure improves in emerging economies, making advanced gastritis treatments more accessible.

Dominant Regions, Countries, or Segments in Gastritis Treatment Industry

The gastritis treatment industry exhibits distinct regional dominance and segment leadership. North America, particularly the United States, consistently emerges as a leading region due to its advanced healthcare infrastructure, high disposable income, and early adoption of cutting-edge medical technologies. This dominance is further bolstered by a strong presence of leading gastrology and endoscopic device manufacturers. Within product segments, Endoscopic Mechanical Devices and Endoscopic Thermal Devices are critical growth drivers, representing a substantial portion of the market share in 2025, estimated at $xx billion and $xx billion respectively. The Upper GI Tract division, encompassing treatments for conditions like GERD and peptic ulcers, commands a larger market share due to the higher incidence of these conditions compared to the lower GI tract. Hospitals/Clinics remain the primary end-users, accounting for an estimated market share of xx% in 2025, owing to their comprehensive diagnostic and treatment capabilities.

- North America's Leadership: Driven by robust R&D, advanced healthcare systems, and high patient awareness.

- Endoscopic Mechanical Devices Dominance: Essential for procedures like dilation, stenting, and polyp removal, with a market size of $xx billion in 2025.

- Endoscopic Thermal Devices Significance: Crucial for hemostasis and lesion ablation, contributing $xx billion to the market in 2025.

- Upper GI Tract Focus: Higher prevalence of gastritis and related disorders in this segment fuels demand.

- Hospitals/Clinics as Primary End-Users: Equipped with advanced technology and specialized personnel for gastritis management.

- Emerging Markets' Growth Potential: Increasing healthcare expenditure and improving access to advanced treatments in regions like Asia Pacific and Latin America.

Gastritis Treatment Industry Product Landscape

The product landscape within the gastritis treatment industry is characterized by continuous innovation, focusing on enhanced precision, efficacy, and patient comfort. Endoscopic mechanical devices, such as advanced biopsy forceps, retrieval devices, and dilation balloons, offer minimally invasive solutions for diagnosis and intervention. Endoscopic thermal devices, including electrocautery, argon plasma coagulation, and laser therapy devices, provide precise tissue ablation and hemostasis capabilities. Innovations are increasingly incorporating advanced imaging technologies and intelligent feedback systems to optimize treatment outcomes. The development of novel drug-eluting stents and bio-absorbable materials for gastrointestinal repair further expands the therapeutic armamentarium. The performance metrics of these products are continuously improving, with a focus on reduced procedure times, minimized tissue damage, and improved patient recovery.

Key Drivers, Barriers & Challenges in Gastritis Treatment Industry

Key Drivers:

- Rising Incidence of Gastrointestinal Disorders: Increasing prevalence of H. pylori infections, GERD, and peptic ulcers.

- Technological Advancements: Development of sophisticated endoscopic devices and therapeutic technologies.

- Aging Global Population: Age-related increase in gastrointestinal issues and demand for effective treatments.

- Growing Healthcare Expenditure: Increased investment in healthcare infrastructure and advanced medical solutions globally.

- Patient Demand for Minimally Invasive Procedures: Preference for treatments with faster recovery and fewer complications.

Barriers & Challenges:

- High Cost of Advanced Medical Devices: Significant investment required for sophisticated equipment can limit access in developing economies.

- Regulatory Hurdles and Approval Processes: Stringent and time-consuming approval pathways for new medical devices.

- Reimbursement Policies: Inconsistent reimbursement rates for endoscopic procedures can impact market adoption.

- Skilled Workforce Shortage: Demand for trained endoscopists and gastroenterologists to perform complex procedures.

- Competition from Pharmaceutical Treatments: Ongoing competition from drug-based therapies for gastritis management.

- Supply Chain Disruptions: Potential disruptions in the manufacturing and distribution of medical devices.

Emerging Opportunities in Gastritis Treatment Industry

Emerging opportunities in the gastritis treatment industry lie in the development of personalized medicine approaches and the integration of artificial intelligence into diagnostic and therapeutic workflows. The untapped potential in emerging economies, where access to advanced gastroenterological care is rapidly expanding, presents significant growth avenues. Innovations in targeted drug delivery systems and novel biomaterials for tissue regeneration offer promising avenues for enhanced treatment efficacy. Furthermore, the growing demand for remote patient monitoring and telemedicine solutions for chronic gastrointestinal conditions opens up new service-based opportunities. The increasing focus on preventative healthcare and early detection of gastric precancerous lesions will also drive the adoption of advanced diagnostic tools.

Growth Accelerators in the Gastritis Treatment Industry Industry

Several factors are acting as significant growth accelerators for the gastritis treatment industry. Continuous technological breakthroughs in endoscopy, such as high-definition imaging, miniaturized devices, and improved maneuverability, are enhancing procedural accuracy and patient outcomes. Strategic partnerships and collaborations between medical device manufacturers and research institutions are fostering rapid innovation and product development. Furthermore, market expansion strategies, including penetration into underserved geographies and the development of cost-effective solutions, are driving increased adoption. Government initiatives promoting advanced healthcare infrastructure and increased awareness campaigns regarding gastrointestinal health are also contributing to the industry's rapid growth trajectory.

Key Players Shaping the Gastritis Treatment Industry Market

- CONMED Corporation

- Cook Group

- ERBE Elektromedizin GmbH

- Ovesco Endoscopy AG

- Medtronic PLC

- Boston Scientific Corporation

- US Medical Innovations

- STERIS PLC

- Olympus Corporation

- Pfizer Inc

Notable Milestones in Gastritis Treatment Industry Sector

- May 2022: Limaca Medical's Precision-GI Endoscopic Ultrasound Biopsy Product received a Breakthrough Device Designation from the Food and Drug Administration (FDA), signaling a significant advancement in minimally invasive biopsy techniques.

- Feb 2022: The Ambu aScope Gastro and Ambu aBox 2 was granted 510(k) regulatory clearance in the US. Ambu's first sterile single-use gastroscope, the aScope Gastro, combines cutting-edge display and processing technology with new sophisticated imaging features, enhancing diagnostic capabilities and infection control.

In-Depth Gastritis Treatment Industry Market Outlook

The future outlook for the gastritis treatment industry remains exceptionally promising, driven by a confluence of technological innovation, expanding healthcare access, and evolving patient needs. Growth accelerators such as advancements in AI-powered diagnostics, robotic-assisted surgery for complex GI procedures, and the development of novel drug delivery systems will continue to shape the market. Strategic partnerships and market expansion into burgeoning economies in Asia Pacific and Latin America offer substantial untapped potential. The increasing focus on preventative care and early detection of gastric diseases will further bolster demand for advanced endoscopic and diagnostic tools. Stakeholders are well-positioned to capitalize on these trends by investing in research and development, forging strategic alliances, and adapting to the evolving healthcare landscape to provide improved patient outcomes and drive market growth.

Gastritis Treatment Industry Segmentation

-

1. Product

- 1.1. Endoscopic Mechanical Devices

- 1.2. Endoscopic Thermal Devices

- 1.3. Other Products

-

2. GI Tract Division

- 2.1. Upper GI Tract

- 2.2. Lower GI Tract

-

3. End User

- 3.1. Hospitals/Clinics

- 3.2. Ambulatory Surgical Centres

- 3.3. Other End Users

Gastritis Treatment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Gastritis Treatment Industry Regional Market Share

Geographic Coverage of Gastritis Treatment Industry

Gastritis Treatment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Upper Gastrointestinal Bleeding; Technology Advancements Related to Gastrointestinal Diseases Treatment

- 3.3. Market Restrains

- 3.3.1. Dearth of Skilled Labor

- 3.4. Market Trends

- 3.4.1. Upper GI Tract Segment is Expected to Register a Good Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gastritis Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Endoscopic Mechanical Devices

- 5.1.2. Endoscopic Thermal Devices

- 5.1.3. Other Products

- 5.2. Market Analysis, Insights and Forecast - by GI Tract Division

- 5.2.1. Upper GI Tract

- 5.2.2. Lower GI Tract

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals/Clinics

- 5.3.2. Ambulatory Surgical Centres

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Gastritis Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Endoscopic Mechanical Devices

- 6.1.2. Endoscopic Thermal Devices

- 6.1.3. Other Products

- 6.2. Market Analysis, Insights and Forecast - by GI Tract Division

- 6.2.1. Upper GI Tract

- 6.2.2. Lower GI Tract

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Hospitals/Clinics

- 6.3.2. Ambulatory Surgical Centres

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Gastritis Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Endoscopic Mechanical Devices

- 7.1.2. Endoscopic Thermal Devices

- 7.1.3. Other Products

- 7.2. Market Analysis, Insights and Forecast - by GI Tract Division

- 7.2.1. Upper GI Tract

- 7.2.2. Lower GI Tract

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Hospitals/Clinics

- 7.3.2. Ambulatory Surgical Centres

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Gastritis Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Endoscopic Mechanical Devices

- 8.1.2. Endoscopic Thermal Devices

- 8.1.3. Other Products

- 8.2. Market Analysis, Insights and Forecast - by GI Tract Division

- 8.2.1. Upper GI Tract

- 8.2.2. Lower GI Tract

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Hospitals/Clinics

- 8.3.2. Ambulatory Surgical Centres

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Gastritis Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Endoscopic Mechanical Devices

- 9.1.2. Endoscopic Thermal Devices

- 9.1.3. Other Products

- 9.2. Market Analysis, Insights and Forecast - by GI Tract Division

- 9.2.1. Upper GI Tract

- 9.2.2. Lower GI Tract

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Hospitals/Clinics

- 9.3.2. Ambulatory Surgical Centres

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Gastritis Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Endoscopic Mechanical Devices

- 10.1.2. Endoscopic Thermal Devices

- 10.1.3. Other Products

- 10.2. Market Analysis, Insights and Forecast - by GI Tract Division

- 10.2.1. Upper GI Tract

- 10.2.2. Lower GI Tract

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Hospitals/Clinics

- 10.3.2. Ambulatory Surgical Centres

- 10.3.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CONMED Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cook Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ERBE Elektromedizin GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ovesco Endoscopy AG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Medtronic PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Boston Scientific Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 US Medical Innovations*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 STERIS PLC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Olympus Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pfizer Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 CONMED Corporation

List of Figures

- Figure 1: Global Gastritis Treatment Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Gastritis Treatment Industry Revenue (undefined), by Product 2025 & 2033

- Figure 3: North America Gastritis Treatment Industry Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Gastritis Treatment Industry Revenue (undefined), by GI Tract Division 2025 & 2033

- Figure 5: North America Gastritis Treatment Industry Revenue Share (%), by GI Tract Division 2025 & 2033

- Figure 6: North America Gastritis Treatment Industry Revenue (undefined), by End User 2025 & 2033

- Figure 7: North America Gastritis Treatment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Gastritis Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Gastritis Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Gastritis Treatment Industry Revenue (undefined), by Product 2025 & 2033

- Figure 11: Europe Gastritis Treatment Industry Revenue Share (%), by Product 2025 & 2033

- Figure 12: Europe Gastritis Treatment Industry Revenue (undefined), by GI Tract Division 2025 & 2033

- Figure 13: Europe Gastritis Treatment Industry Revenue Share (%), by GI Tract Division 2025 & 2033

- Figure 14: Europe Gastritis Treatment Industry Revenue (undefined), by End User 2025 & 2033

- Figure 15: Europe Gastritis Treatment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Gastritis Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Gastritis Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Gastritis Treatment Industry Revenue (undefined), by Product 2025 & 2033

- Figure 19: Asia Pacific Gastritis Treatment Industry Revenue Share (%), by Product 2025 & 2033

- Figure 20: Asia Pacific Gastritis Treatment Industry Revenue (undefined), by GI Tract Division 2025 & 2033

- Figure 21: Asia Pacific Gastritis Treatment Industry Revenue Share (%), by GI Tract Division 2025 & 2033

- Figure 22: Asia Pacific Gastritis Treatment Industry Revenue (undefined), by End User 2025 & 2033

- Figure 23: Asia Pacific Gastritis Treatment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Gastritis Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Gastritis Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Gastritis Treatment Industry Revenue (undefined), by Product 2025 & 2033

- Figure 27: Middle East and Africa Gastritis Treatment Industry Revenue Share (%), by Product 2025 & 2033

- Figure 28: Middle East and Africa Gastritis Treatment Industry Revenue (undefined), by GI Tract Division 2025 & 2033

- Figure 29: Middle East and Africa Gastritis Treatment Industry Revenue Share (%), by GI Tract Division 2025 & 2033

- Figure 30: Middle East and Africa Gastritis Treatment Industry Revenue (undefined), by End User 2025 & 2033

- Figure 31: Middle East and Africa Gastritis Treatment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East and Africa Gastritis Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East and Africa Gastritis Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Gastritis Treatment Industry Revenue (undefined), by Product 2025 & 2033

- Figure 35: South America Gastritis Treatment Industry Revenue Share (%), by Product 2025 & 2033

- Figure 36: South America Gastritis Treatment Industry Revenue (undefined), by GI Tract Division 2025 & 2033

- Figure 37: South America Gastritis Treatment Industry Revenue Share (%), by GI Tract Division 2025 & 2033

- Figure 38: South America Gastritis Treatment Industry Revenue (undefined), by End User 2025 & 2033

- Figure 39: South America Gastritis Treatment Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: South America Gastritis Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: South America Gastritis Treatment Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gastritis Treatment Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Global Gastritis Treatment Industry Revenue undefined Forecast, by GI Tract Division 2020 & 2033

- Table 3: Global Gastritis Treatment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Global Gastritis Treatment Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Gastritis Treatment Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 6: Global Gastritis Treatment Industry Revenue undefined Forecast, by GI Tract Division 2020 & 2033

- Table 7: Global Gastritis Treatment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Global Gastritis Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Gastritis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Gastritis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Gastritis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Gastritis Treatment Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 13: Global Gastritis Treatment Industry Revenue undefined Forecast, by GI Tract Division 2020 & 2033

- Table 14: Global Gastritis Treatment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Global Gastritis Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Gastritis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Gastritis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Gastritis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Italy Gastritis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain Gastritis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Gastritis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Gastritis Treatment Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 23: Global Gastritis Treatment Industry Revenue undefined Forecast, by GI Tract Division 2020 & 2033

- Table 24: Global Gastritis Treatment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 25: Global Gastritis Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: China Gastritis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Japan Gastritis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: India Gastritis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Australia Gastritis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: South Korea Gastritis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Gastritis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Gastritis Treatment Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 33: Global Gastritis Treatment Industry Revenue undefined Forecast, by GI Tract Division 2020 & 2033

- Table 34: Global Gastritis Treatment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 35: Global Gastritis Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: GCC Gastritis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: South Africa Gastritis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Gastritis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Global Gastritis Treatment Industry Revenue undefined Forecast, by Product 2020 & 2033

- Table 40: Global Gastritis Treatment Industry Revenue undefined Forecast, by GI Tract Division 2020 & 2033

- Table 41: Global Gastritis Treatment Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 42: Global Gastritis Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: Brazil Gastritis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Argentina Gastritis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Gastritis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gastritis Treatment Industry?

The projected CAGR is approximately 15.64%.

2. Which companies are prominent players in the Gastritis Treatment Industry?

Key companies in the market include CONMED Corporation, Cook Group, ERBE Elektromedizin GmbH, Ovesco Endoscopy AG, Medtronic PLC, Boston Scientific Corporation, US Medical Innovations*List Not Exhaustive, STERIS PLC, Olympus Corporation, Pfizer Inc.

3. What are the main segments of the Gastritis Treatment Industry?

The market segments include Product, GI Tract Division, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Upper Gastrointestinal Bleeding; Technology Advancements Related to Gastrointestinal Diseases Treatment.

6. What are the notable trends driving market growth?

Upper GI Tract Segment is Expected to Register a Good Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Dearth of Skilled Labor.

8. Can you provide examples of recent developments in the market?

May 2022: Limaca Medical's Precision-GI Endoscopic Ultrasound Biopsy Product received a Breakthrough Device Designation from the Food and Drug Administration (FDA).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gastritis Treatment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gastritis Treatment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gastritis Treatment Industry?

To stay informed about further developments, trends, and reports in the Gastritis Treatment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence