Key Insights

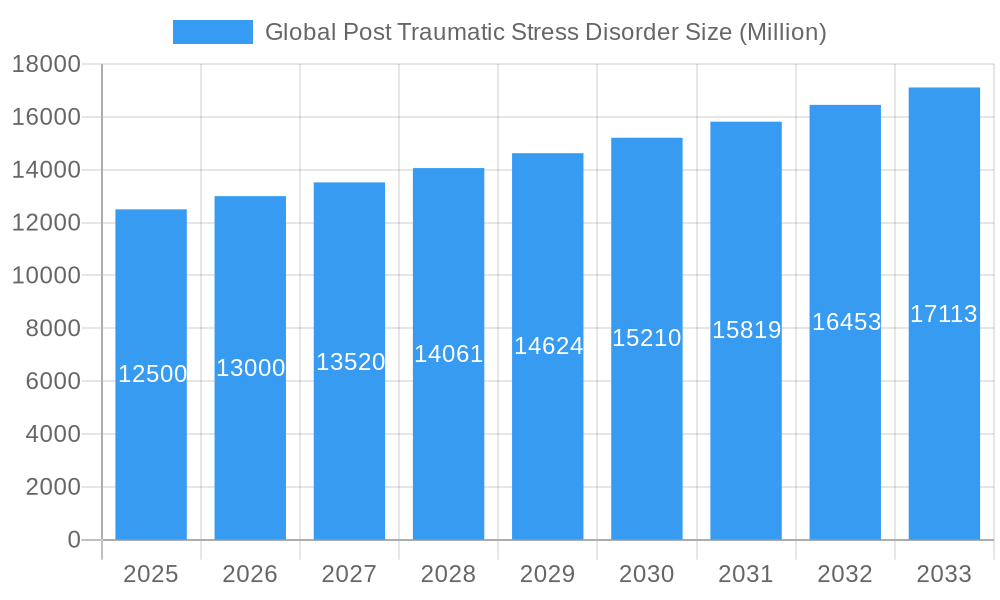

The global Post Traumatic Stress Disorder (PTSD) market is projected for significant expansion, with an estimated market size of $11.41 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 11.2% through 2033. Growth is driven by increased PTSD awareness and diagnosis, heightened demand for effective therapies following global events, and a growing understanding of trauma's long-term mental health impacts. Advances in pharmacological treatments, including ketamine-based therapies and psychedelic-assisted psychotherapy, alongside robust R&D investments from leading pharmaceutical firms, are further propelling market buoyancy and addressing unmet patient needs.

Global Post Traumatic Stress Disorder Market Size (In Billion)

Evolving treatment paradigms and an expanding patient base across all age demographics are shaping market growth. Distribution channels are adapting with hospital pharmacies, retail pharmacies, specialized mental health clinics, and telehealth platforms enhancing accessibility and convenience. Key industry players like Pfizer Inc., GlaxoSmithKline plc, and Jazz Pharmaceuticals are driving innovation. While antidepressants and anti-anxiety drugs currently dominate, a diversification into antipsychotics and other emerging drug classes is evident. However, challenges such as mental health stigma, limited access to specialized care, and the complex long-term management of PTSD may temper accelerated market growth.

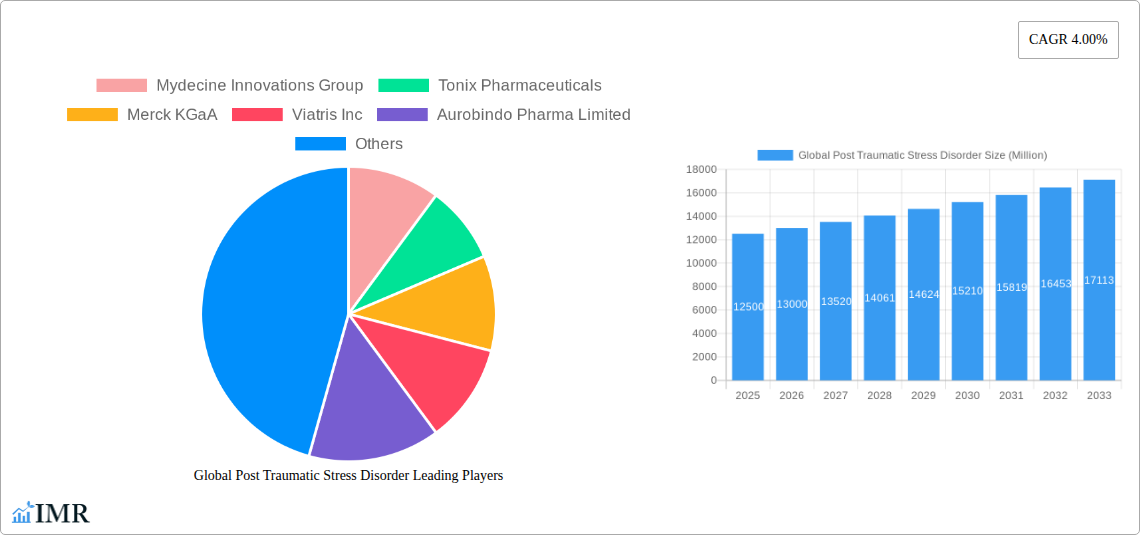

Global Post Traumatic Stress Disorder Company Market Share

Global Post Traumatic Stress Disorder (PTSD) Market Analysis: 2025-2033 Growth Forecast

This comprehensive report provides a critical analysis and forecast of the global Post Traumatic Stress Disorder (PTSD) market from 2025 to 2033. With a base year of 2025, this report is an essential resource for industry professionals, researchers, and investors seeking to understand market dynamics, trends, and opportunities in PTSD therapeutics. Examine drug classes, patient demographics, distribution channels, and key industry developments shaping the future of PTSD treatment. Leverage quantitative data and expert insights for strategic decision-making in this evolving healthcare landscape.

Global Post Traumatic Stress Disorder Market Dynamics & Structure

The global Post Traumatic Stress Disorder (PTSD) market is characterized by a dynamic interplay of factors influencing its structure and growth. Market concentration is gradually shifting as novel therapeutic approaches gain traction, challenging the dominance of established pharmaceutical players. Technological innovation is a primary driver, with advancements in pharmacotherapy, digital therapeutics, and neuromodulation techniques offering new avenues for treatment. Regulatory frameworks, while often stringent, are also adapting to accommodate innovative therapies, particularly those derived from research into psychedelics and advanced drug delivery systems. Competitive product substitutes are expanding, ranging from traditional antidepressant and anti-anxiety medications to emerging non-pharmacological interventions. End-user demographics reveal a growing awareness and diagnosis of PTSD across adult and, to a lesser extent, pediatric populations, driven by increased global conflict, natural disasters, and mental health advocacy. Mergers and acquisitions (M&A) trends indicate strategic consolidation and investment in companies with promising PTSD treatment pipelines, signaling a maturation of the market.

- Market Concentration: Fragmented with increasing consolidation in advanced therapy segments.

- Technological Innovation Drivers: Psilocybin-assisted therapy, nanotechnology, digital therapeutics, and novel psychiatric drug development.

- Regulatory Frameworks: Evolving to incorporate novel psychoactive substances for therapeutic use, alongside traditional drug approval pathways.

- Competitive Product Substitutes: Wide spectrum from SSRIs to advanced psychotherapy and digital tools.

- End-User Demographics: Predominantly adult, with a rising focus on veteran and first responder populations, and increasing recognition in pediatric trauma.

- M&A Trends: Strategic acquisitions of early-stage biotech firms with novel PTSD therapies.

Global Post Traumatic Stress Disorder Growth Trends & Insights

The global Post Traumatic Stress Disorder (PTSD) market is poised for significant expansion, driven by an increasing prevalence of trauma-related incidents and a growing global emphasis on mental health. The market size evolution is projected to witness a robust Compound Annual Growth Rate (CAGR) over the forecast period, fueled by enhanced diagnostic capabilities and a broader acceptance of mental health treatment. Adoption rates for both traditional and novel PTSD therapies are on an upward trajectory, as awareness campaigns and destigmatization efforts gain momentum. Technological disruptions are at the forefront of this growth, with the exploration of psilocybin-assisted psychotherapy, advancements in nanotechnology for drug delivery, and the integration of artificial intelligence in diagnosis and treatment planning. Consumer behavior shifts are also playing a crucial role, with patients actively seeking more effective and holistic treatment options, moving beyond solely pharmacotherapy. This evolving landscape presents a fertile ground for innovation and investment, as the demand for comprehensive PTSD solutions intensifies. The market penetration for specialized PTSD treatments is expected to deepen, particularly in regions with high trauma exposure and advanced healthcare infrastructure.

- Market Size Evolution: Experiencing steady growth driven by increasing diagnoses and treatment accessibility.

- Adoption Rates: Rising for both conventional and novel therapeutic interventions for PTSD.

- Technological Disruptions: Psilocybin research, nanomedicine, and digital health solutions are transforming treatment paradigms.

- Consumer Behavior Shifts: Patients are seeking personalized, evidence-based, and often integrated treatment approaches.

- Market Penetration: Expanding as awareness grows and treatment options diversify across global populations.

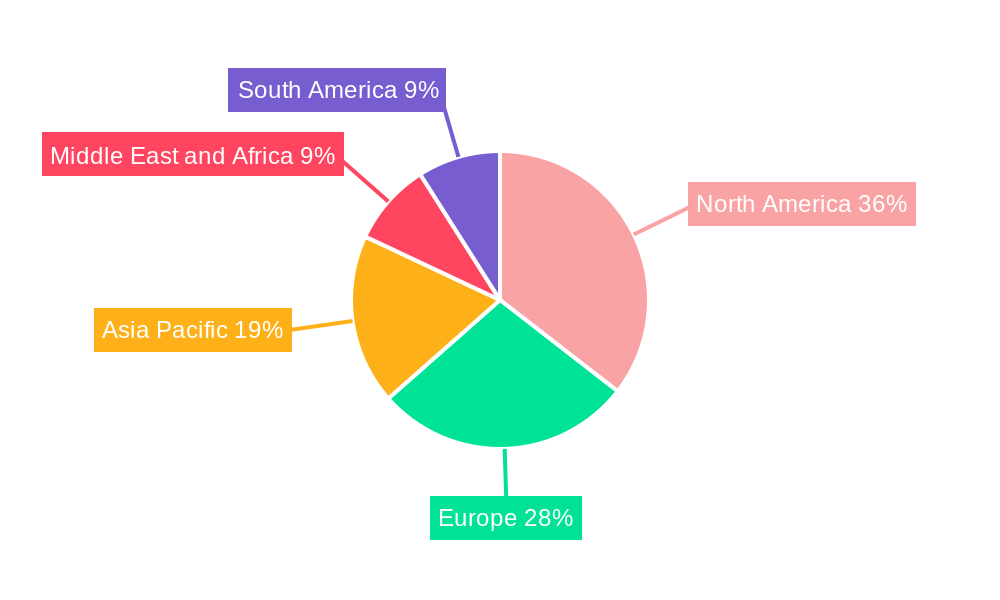

Dominant Regions, Countries, or Segments in Global Post Traumatic Stress Disorder

North America currently dominates the global Post Traumatic Stress Disorder (PTSD) market, driven by a confluence of factors including high per capita healthcare spending, a robust research and development infrastructure, and significant government investment in veteran healthcare. The United States, in particular, accounts for a substantial market share due to the large veteran population and increasing awareness and diagnosis of PTSD. Government initiatives and a supportive regulatory environment for novel mental health treatments further bolster its leadership. Within the drug class segment, Antidepressants and Anti-anxiety Drugs currently hold the largest share, forming the first-line of treatment for many PTSD patients. However, the "Other Drug Classes" segment, encompassing emerging therapies like psilocybin and novel psychotherapeutics, is exhibiting the most rapid growth potential. The adult patient segment overwhelmingly drives market demand, given the higher incidence rates and broader recognition of PTSD in this demographic. In terms of distribution channels, Hospital Pharmacies represent a significant channel, particularly for acute care and inpatient treatment, while Retail Pharmacies cater to the long-term management of the condition. The emergence of telehealth and specialized mental health clinics is contributing to the growth of "Other Distribution Channels."

- Dominant Region: North America, spearheaded by the United States.

- Key Drivers in Dominant Region: High healthcare expenditure, advanced R&D, strong government support for mental health, and a large veteran population.

- Dominant Drug Class (Current): Antidepressants and Anti-anxiety Drugs.

- Fastest Growing Drug Class: Other Drug Classes (e.g., psychedelic-assisted therapies, novel psychotherapeutics).

- Dominant Patient Segment: Adult.

- Dominant Distribution Channel: Hospital Pharmacies (for acute care), Retail Pharmacies (for chronic management).

- Emerging Distribution Channel: Telehealth platforms and specialized mental health clinics.

Global Post Traumatic Stress Disorder Product Landscape

The global Post Traumatic Stress Disorder (PTSD) product landscape is evolving with a focus on enhanced efficacy and reduced side effects. Beyond established antidepressant and anti-anxiety medications, the market is witnessing innovation in areas such as adjunctive therapies and novel drug formulations. For instance, advancements in nanotechnology, as demonstrated by Madrigal Mental Care's introduction, aim to improve drug delivery and therapeutic outcomes for PTSD. The exploration of psilocybin as a therapeutic agent, particularly in combination with psychotherapy, represents a significant paradigm shift, with companies like Mydecine Innovations Group actively pursuing this avenue. These developments are characterized by unique selling propositions centered on accelerated symptom relief, improved tolerability, and the potential for transformative healing. Technological advancements are also extending to digital therapeutics, offering accessible and scalable support for individuals managing PTSD.

Key Drivers, Barriers & Challenges in Global Post Traumatic Stress Disorder

Key Drivers:

- Increasing Global Trauma Incidence: Rising numbers of individuals experiencing traumatic events due to conflicts, natural disasters, and societal stressors directly fuel the demand for PTSD treatment.

- Growing Mental Health Awareness and Destigmatization: Public and governmental focus on mental well-being is leading to greater diagnosis and treatment-seeking behavior.

- Advancements in Pharmacotherapy and Psychotherapy: Development of more effective and targeted medications, alongside evidence-based psychotherapeutic approaches like EMDR and CBT, are key growth accelerators.

- Research into Novel Therapies: Promising clinical trials involving psychedelics (e.g., psilocybin) and other innovative modalities are attracting significant investment and research interest.

Barriers & Challenges:

- Stigma and Misunderstanding: Despite progress, societal stigma surrounding mental health issues, including PTSD, can deter individuals from seeking help.

- Diagnostic Challenges: Accurate and timely diagnosis can be complex, with symptom overlap with other mental health conditions.

- Regulatory Hurdles for Novel Therapies: The path to approval for innovative treatments, especially those involving controlled substances, can be lengthy and complex.

- Limited Access to Specialized Care: In many regions, access to trained mental health professionals and specialized PTSD treatment centers remains limited, particularly in underserved communities.

- High Cost of Treatment: Comprehensive PTSD treatment, especially those involving specialized therapies and long-term support, can be financially burdensome for individuals and healthcare systems.

Emerging Opportunities in Global Post Traumatic Stress Disorder

Emerging opportunities in the global Post Traumatic Stress Disorder (PTSD) market lie in the development of personalized treatment approaches and the expansion of digital health solutions. The growing understanding of PTSD's complex neurobiological underpinnings is paving the way for precision medicine, tailoring therapies based on individual genetic profiles and symptom presentations. Furthermore, the untapped potential of remote patient monitoring and AI-driven therapeutic interventions presents a significant avenue for growth, offering increased accessibility and scalability, especially in underserved regions. The integration of wearable technology for real-time data collection on stress levels and physiological responses also holds promise for more proactive and effective PTSD management.

Growth Accelerators in the Global Post Traumatic Stress Disorder Industry

Several key catalysts are accelerating the growth of the global Post Traumatic Stress Disorder (PTSD) industry. Breakthroughs in understanding the neurobiology of PTSD are driving the development of more targeted and effective pharmacological interventions, including novel drug candidates and improved formulations. The burgeoning research and clinical application of psychedelic-assisted therapies, notably psilocybin-assisted psychotherapy, represent a significant growth accelerator, demonstrating promising results in treating severe PTSD. Strategic partnerships between pharmaceutical companies, research institutions, and mental health organizations are fostering collaborative innovation and speeding up the drug development process. Furthermore, increased government funding for mental health research and veteran care initiatives globally is providing substantial impetus for market expansion.

Key Players Shaping the Global Post Traumatic Stress Disorder Market

- Mydecine Innovations Group

- Tonix Pharmaceuticals

- Merck KGaA

- Viatris Inc

- Aurobindo Pharma Limited

- GlaxoSmithKline plc

- Jazz Pharmaceuticals

- Teva Pharmaceutical Industries Ltd

- Jubilant Pharmova

- Lupin Limited

- Otsuka Pharmaceutical Co Ltd

- Pfizer Inc

Notable Milestones in Global Post Traumatic Stress Disorder Sector

- January 2022: Mydecine Innovations Group Inc. entered a partnership with Combat Stress and the King's College London to utilize psilocybin as part of psychoactive-assisted psychotherapy treatment for post-traumatic stress disorder (PTSD) in veterans.

- May 2022: Madrigal Mental Care introduced its nanotechnology for the treatment and prevention of post-traumatic stress disorder at Biomed Israel.

In-Depth Global Post Traumatic Stress Disorder Market Outlook

The global Post Traumatic Stress Disorder (PTSD) market is set for a period of transformative growth, driven by a convergence of scientific innovation and increasing global demand for effective mental health solutions. The outlook is characterized by the substantial potential of emerging therapies, such as psilocybin-assisted psychotherapy, which are poised to revolutionize treatment paradigms and address unmet needs in severe cases. Strategic investments in research and development, coupled with evolving regulatory pathways, will foster a dynamic landscape of novel product launches and market entrants. The increasing integration of digital health tools and personalized treatment strategies will further enhance patient access and therapeutic outcomes. This optimistic outlook signals a robust future for the PTSD market, promising significant advancements in patient care and recovery.

Global Post Traumatic Stress Disorder Segmentation

-

1. Drug Class

- 1.1. Antidepressants

- 1.2. Anti-anxiety Drugs

- 1.3. Antipsychotics

- 1.4. Other Drug Classes

-

2. Patient

- 2.1. Adult

- 2.2. Children

-

3. Distribution Channel

- 3.1. Hospital Pharmacies

- 3.2. Retail Pharmacies

- 3.3. Other Distribution Channel

Global Post Traumatic Stress Disorder Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Global Post Traumatic Stress Disorder Regional Market Share

Geographic Coverage of Global Post Traumatic Stress Disorder

Global Post Traumatic Stress Disorder REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Burden of Post-Traumatic Stress Disorder (PTSD) Worldwide; Rise in Number of Clinical Trials Pertaining to Post-Traumatic Stress Disorder (PTSD) Treatment; Increasing Research and Development for Novel Therapies and Drugs

- 3.3. Market Restrains

- 3.3.1. Side Effects Associated with Post-Traumatic Stress Disorder Treatment; Hight Cost of the Treatment

- 3.4. Market Trends

- 3.4.1. Antidepressants Segment is Expected to Hold a Significant Market Share in the Post Traumatic Stress Disorder Treatment Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Post Traumatic Stress Disorder Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 5.1.1. Antidepressants

- 5.1.2. Anti-anxiety Drugs

- 5.1.3. Antipsychotics

- 5.1.4. Other Drug Classes

- 5.2. Market Analysis, Insights and Forecast - by Patient

- 5.2.1. Adult

- 5.2.2. Children

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Hospital Pharmacies

- 5.3.2. Retail Pharmacies

- 5.3.3. Other Distribution Channel

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Drug Class

- 6. North America Global Post Traumatic Stress Disorder Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 6.1.1. Antidepressants

- 6.1.2. Anti-anxiety Drugs

- 6.1.3. Antipsychotics

- 6.1.4. Other Drug Classes

- 6.2. Market Analysis, Insights and Forecast - by Patient

- 6.2.1. Adult

- 6.2.2. Children

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Hospital Pharmacies

- 6.3.2. Retail Pharmacies

- 6.3.3. Other Distribution Channel

- 6.1. Market Analysis, Insights and Forecast - by Drug Class

- 7. Europe Global Post Traumatic Stress Disorder Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 7.1.1. Antidepressants

- 7.1.2. Anti-anxiety Drugs

- 7.1.3. Antipsychotics

- 7.1.4. Other Drug Classes

- 7.2. Market Analysis, Insights and Forecast - by Patient

- 7.2.1. Adult

- 7.2.2. Children

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Hospital Pharmacies

- 7.3.2. Retail Pharmacies

- 7.3.3. Other Distribution Channel

- 7.1. Market Analysis, Insights and Forecast - by Drug Class

- 8. Asia Pacific Global Post Traumatic Stress Disorder Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 8.1.1. Antidepressants

- 8.1.2. Anti-anxiety Drugs

- 8.1.3. Antipsychotics

- 8.1.4. Other Drug Classes

- 8.2. Market Analysis, Insights and Forecast - by Patient

- 8.2.1. Adult

- 8.2.2. Children

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Hospital Pharmacies

- 8.3.2. Retail Pharmacies

- 8.3.3. Other Distribution Channel

- 8.1. Market Analysis, Insights and Forecast - by Drug Class

- 9. Middle East and Africa Global Post Traumatic Stress Disorder Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 9.1.1. Antidepressants

- 9.1.2. Anti-anxiety Drugs

- 9.1.3. Antipsychotics

- 9.1.4. Other Drug Classes

- 9.2. Market Analysis, Insights and Forecast - by Patient

- 9.2.1. Adult

- 9.2.2. Children

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Hospital Pharmacies

- 9.3.2. Retail Pharmacies

- 9.3.3. Other Distribution Channel

- 9.1. Market Analysis, Insights and Forecast - by Drug Class

- 10. South America Global Post Traumatic Stress Disorder Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 10.1.1. Antidepressants

- 10.1.2. Anti-anxiety Drugs

- 10.1.3. Antipsychotics

- 10.1.4. Other Drug Classes

- 10.2. Market Analysis, Insights and Forecast - by Patient

- 10.2.1. Adult

- 10.2.2. Children

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Hospital Pharmacies

- 10.3.2. Retail Pharmacies

- 10.3.3. Other Distribution Channel

- 10.1. Market Analysis, Insights and Forecast - by Drug Class

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Mydecine Innovations Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tonix Pharmaceuticals

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Merck KGaA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Viatris Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Aurobindo Pharma Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GlaxoSmithKline plc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Jazz Pharmaceuticals

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Teva Pharmaceutical Industries Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Jubilant Pharmova*List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lupin Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Otsuka Pharmaceutical Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Pfizer Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Mydecine Innovations Group

List of Figures

- Figure 1: Global Global Post Traumatic Stress Disorder Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Global Post Traumatic Stress Disorder Revenue (billion), by Drug Class 2025 & 2033

- Figure 3: North America Global Post Traumatic Stress Disorder Revenue Share (%), by Drug Class 2025 & 2033

- Figure 4: North America Global Post Traumatic Stress Disorder Revenue (billion), by Patient 2025 & 2033

- Figure 5: North America Global Post Traumatic Stress Disorder Revenue Share (%), by Patient 2025 & 2033

- Figure 6: North America Global Post Traumatic Stress Disorder Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 7: North America Global Post Traumatic Stress Disorder Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Global Post Traumatic Stress Disorder Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Global Post Traumatic Stress Disorder Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Global Post Traumatic Stress Disorder Revenue (billion), by Drug Class 2025 & 2033

- Figure 11: Europe Global Post Traumatic Stress Disorder Revenue Share (%), by Drug Class 2025 & 2033

- Figure 12: Europe Global Post Traumatic Stress Disorder Revenue (billion), by Patient 2025 & 2033

- Figure 13: Europe Global Post Traumatic Stress Disorder Revenue Share (%), by Patient 2025 & 2033

- Figure 14: Europe Global Post Traumatic Stress Disorder Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 15: Europe Global Post Traumatic Stress Disorder Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Global Post Traumatic Stress Disorder Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Global Post Traumatic Stress Disorder Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Global Post Traumatic Stress Disorder Revenue (billion), by Drug Class 2025 & 2033

- Figure 19: Asia Pacific Global Post Traumatic Stress Disorder Revenue Share (%), by Drug Class 2025 & 2033

- Figure 20: Asia Pacific Global Post Traumatic Stress Disorder Revenue (billion), by Patient 2025 & 2033

- Figure 21: Asia Pacific Global Post Traumatic Stress Disorder Revenue Share (%), by Patient 2025 & 2033

- Figure 22: Asia Pacific Global Post Traumatic Stress Disorder Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Global Post Traumatic Stress Disorder Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Global Post Traumatic Stress Disorder Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Global Post Traumatic Stress Disorder Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Global Post Traumatic Stress Disorder Revenue (billion), by Drug Class 2025 & 2033

- Figure 27: Middle East and Africa Global Post Traumatic Stress Disorder Revenue Share (%), by Drug Class 2025 & 2033

- Figure 28: Middle East and Africa Global Post Traumatic Stress Disorder Revenue (billion), by Patient 2025 & 2033

- Figure 29: Middle East and Africa Global Post Traumatic Stress Disorder Revenue Share (%), by Patient 2025 & 2033

- Figure 30: Middle East and Africa Global Post Traumatic Stress Disorder Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 31: Middle East and Africa Global Post Traumatic Stress Disorder Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East and Africa Global Post Traumatic Stress Disorder Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Global Post Traumatic Stress Disorder Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Global Post Traumatic Stress Disorder Revenue (billion), by Drug Class 2025 & 2033

- Figure 35: South America Global Post Traumatic Stress Disorder Revenue Share (%), by Drug Class 2025 & 2033

- Figure 36: South America Global Post Traumatic Stress Disorder Revenue (billion), by Patient 2025 & 2033

- Figure 37: South America Global Post Traumatic Stress Disorder Revenue Share (%), by Patient 2025 & 2033

- Figure 38: South America Global Post Traumatic Stress Disorder Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 39: South America Global Post Traumatic Stress Disorder Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: South America Global Post Traumatic Stress Disorder Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Global Post Traumatic Stress Disorder Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 2: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Patient 2020 & 2033

- Table 3: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 6: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Patient 2020 & 2033

- Table 7: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Global Post Traumatic Stress Disorder Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Global Post Traumatic Stress Disorder Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Global Post Traumatic Stress Disorder Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 13: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Patient 2020 & 2033

- Table 14: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Global Post Traumatic Stress Disorder Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Global Post Traumatic Stress Disorder Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Global Post Traumatic Stress Disorder Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Global Post Traumatic Stress Disorder Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Global Post Traumatic Stress Disorder Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Global Post Traumatic Stress Disorder Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 23: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Patient 2020 & 2033

- Table 24: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 25: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Global Post Traumatic Stress Disorder Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Global Post Traumatic Stress Disorder Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: India Global Post Traumatic Stress Disorder Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Australia Global Post Traumatic Stress Disorder Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Global Post Traumatic Stress Disorder Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Global Post Traumatic Stress Disorder Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 33: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Patient 2020 & 2033

- Table 34: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Country 2020 & 2033

- Table 36: GCC Global Post Traumatic Stress Disorder Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Africa Global Post Traumatic Stress Disorder Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Global Post Traumatic Stress Disorder Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Drug Class 2020 & 2033

- Table 40: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Patient 2020 & 2033

- Table 41: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 42: Global Post Traumatic Stress Disorder Revenue billion Forecast, by Country 2020 & 2033

- Table 43: Brazil Global Post Traumatic Stress Disorder Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Argentina Global Post Traumatic Stress Disorder Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Global Post Traumatic Stress Disorder Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Post Traumatic Stress Disorder?

The projected CAGR is approximately 11.2%.

2. Which companies are prominent players in the Global Post Traumatic Stress Disorder?

Key companies in the market include Mydecine Innovations Group, Tonix Pharmaceuticals, Merck KGaA, Viatris Inc, Aurobindo Pharma Limited, GlaxoSmithKline plc, Jazz Pharmaceuticals, Teva Pharmaceutical Industries Ltd, Jubilant Pharmova*List Not Exhaustive, Lupin Limited, Otsuka Pharmaceutical Co Ltd, Pfizer Inc.

3. What are the main segments of the Global Post Traumatic Stress Disorder?

The market segments include Drug Class, Patient, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.41 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Burden of Post-Traumatic Stress Disorder (PTSD) Worldwide; Rise in Number of Clinical Trials Pertaining to Post-Traumatic Stress Disorder (PTSD) Treatment; Increasing Research and Development for Novel Therapies and Drugs.

6. What are the notable trends driving market growth?

Antidepressants Segment is Expected to Hold a Significant Market Share in the Post Traumatic Stress Disorder Treatment Market.

7. Are there any restraints impacting market growth?

Side Effects Associated with Post-Traumatic Stress Disorder Treatment; Hight Cost of the Treatment.

8. Can you provide examples of recent developments in the market?

In May 2022 Madrigal Mental Care introduced its nanotechnology for the treatment and prevention of post-traumatic stress disorder at Biomed Israel.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Post Traumatic Stress Disorder," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Post Traumatic Stress Disorder report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Post Traumatic Stress Disorder?

To stay informed about further developments, trends, and reports in the Global Post Traumatic Stress Disorder, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence