Key Insights

The global Healthcare Additive Manufacturing market is projected for substantial growth, with an estimated market size of $13.33 billion in 2025, forecasted to reach new heights by 2033, driven by a robust Compound Annual Growth Rate (CAGR) of 22.13%. This expansion is propelled by the increasing demand for personalized medical devices, the rising integration of 3D printing in surgical planning and training, and continuous advancements in biocompatible materials. Key growth catalysts include the escalating prevalence of chronic diseases necessitating custom prosthetics and implants, the inherent cost-efficiency and speed of additive manufacturing for complex anatomical models, and ongoing innovations in stereolithography, deposition modeling, and electron beam melting technologies, which are becoming more accessible and sophisticated. The medical implants segment is anticipated to lead, fueled by breakthroughs in patient-specific orthopedic and dental solutions, alongside significant uptake in prosthetics and wearable devices due to enhanced functionality and patient comfort.

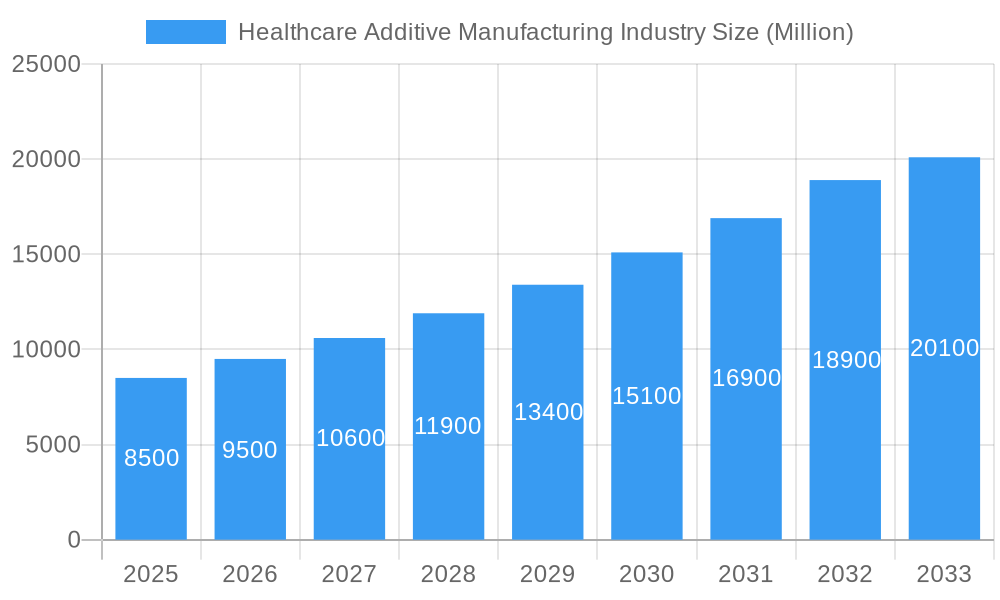

Healthcare Additive Manufacturing Industry Market Size (In Billion)

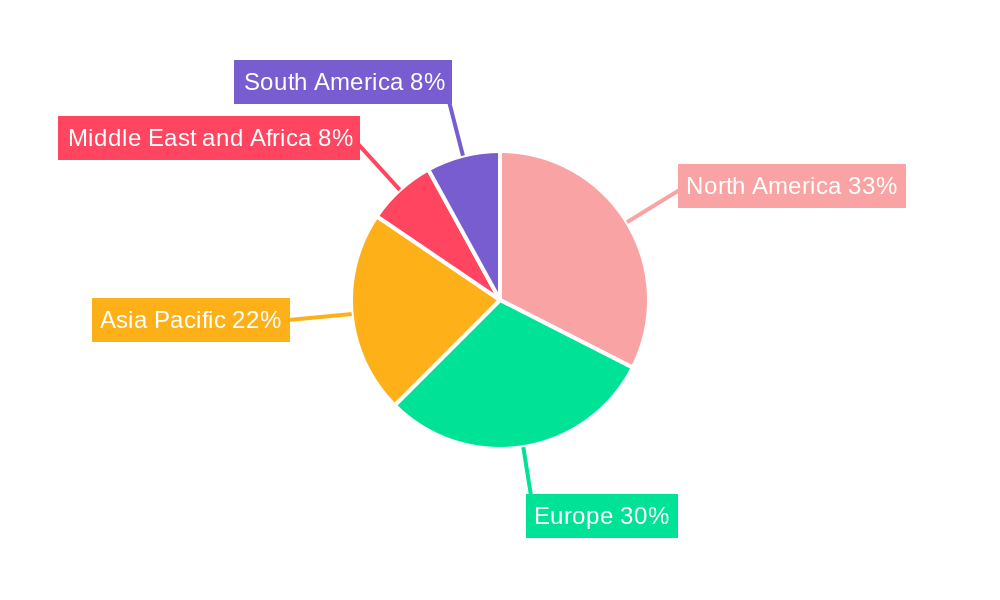

While the growth trajectory is strong, certain factors may moderate the market's pace. These include stringent regulatory approvals for additive manufactured medical devices, substantial initial investment in advanced 3D printing infrastructure, and a scarcity of skilled professionals proficient in operating and designing for these sophisticated systems. Nevertheless, evolving regulatory frameworks, increasing availability of cost-effective 3D printing solutions, and expanding educational initiatives are actively addressing these challenges. Emerging trends, such as the integration of AI and machine learning for design optimization, the development of novel bio-inks for tissue engineering, and the expanded use of 3D printing in drug delivery systems, are set to further accelerate market expansion. Geographically, North America and Europe are expected to maintain leading market shares owing to advanced healthcare infrastructure and significant R&D investments, with the Asia Pacific region rapidly emerging as a crucial hub for additive manufacturing adoption in healthcare.

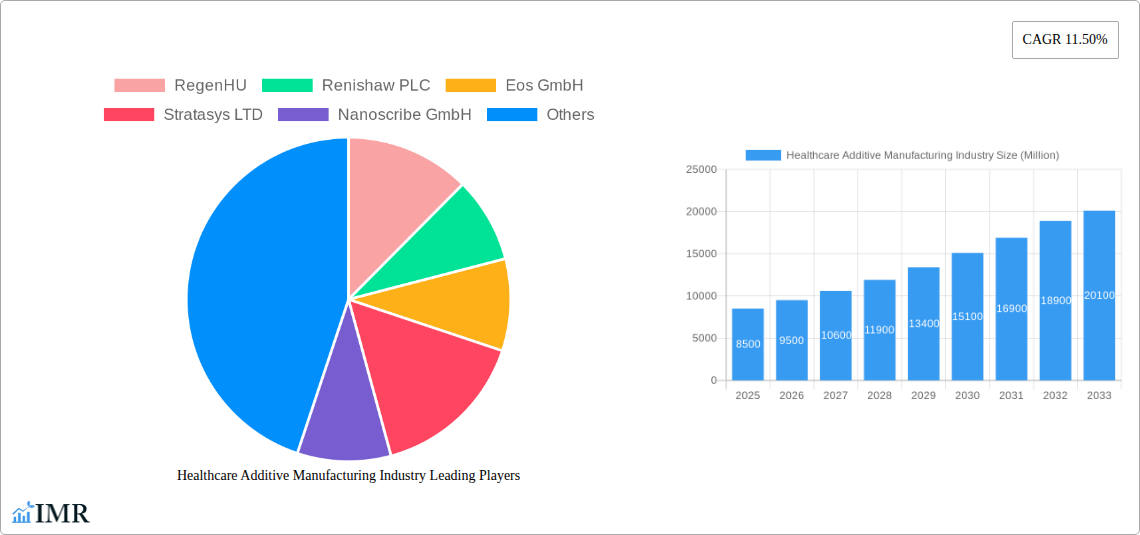

Healthcare Additive Manufacturing Industry Company Market Share

This comprehensive report offers a definitive analysis of the Healthcare Additive Manufacturing Industry, a dynamic sector poised for significant advancement. The study period covers 2019-2033, including historical data (2019-2024), a base year of 2025, and a detailed forecast (2025-2033), providing unparalleled insights into market dynamics, growth patterns, and future opportunities. Our thorough analysis delivers actionable intelligence for stakeholders, including manufacturers, suppliers, investors, and regulatory bodies. The report emphasizes high-impact keywords such as 3D printing in healthcare, medical additive manufacturing, bioprinting market, and personalized medicine technologies, maximizing search engine visibility for professionals seeking to understand this vital industry.

Healthcare Additive Manufacturing Industry Market Dynamics & Structure

The healthcare additive manufacturing industry is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and increasing demand for personalized medical solutions. Market concentration is moderate, with several key players establishing strong footholds while smaller, specialized companies focus on niche applications. 3D printing in healthcare is a primary driver, fueling advancements in medical implant manufacturing, prosthetics design, and tissue engineering. The competitive landscape is shaped by proprietary technologies, material science breakthroughs, and strategic partnerships. Regulatory frameworks, particularly those from the FDA and EMA, are maturing, providing clearer pathways for the approval of 3D-printed medical devices, though compliance remains a significant undertaking.

- Technological Innovation Drivers: Advancements in biocompatible materials, miniaturization capabilities, and high-resolution printing technologies are critical. The integration of AI and machine learning for design optimization and predictive maintenance is also gaining traction.

- Regulatory Frameworks: Stringent quality control, biocompatibility testing, and post-market surveillance are paramount. The evolving nature of these regulations influences product development cycles and market entry strategies.

- Competitive Product Substitutes: While additive manufacturing offers unique advantages, traditional manufacturing methods for certain components still present a competitive alternative. However, for highly customized or complex geometries, additive manufacturing has no direct substitute.

- End-User Demographics: A growing aging population, increasing prevalence of chronic diseases, and a rising demand for patient-specific treatments are fueling market growth. Healthcare providers, researchers, and individual patients are becoming more receptive to additive manufacturing solutions.

- M&A Trends: Mergers and acquisitions are driven by the desire to expand technological portfolios, gain access to new markets, and consolidate expertise in areas like bioprinting and advanced material development. Approximately xx M&A deals were observed in the historical period, with expectations for a higher volume in the forecast period.

Healthcare Additive Manufacturing Industry Growth Trends & Insights

The healthcare additive manufacturing market is experiencing robust growth, projected to accelerate significantly over the forecast period. This expansion is underpinned by increasing adoption rates across various medical disciplines, driven by the inherent advantages of 3D printing for medical applications, including enhanced customization, reduced lead times, and the creation of intricate designs previously impossible. The market size evolution is marked by a consistent upward trend, reflecting the growing acceptance and integration of additive manufacturing solutions into mainstream healthcare practices. Technological disruptions, such as the development of novel biocompatible polymers and advanced metal alloys for implants, are continually redefining the possibilities within the sector.

Consumer behavior shifts are also playing a crucial role. Patients are increasingly seeking personalized treatments and devices tailored to their specific anatomy and needs, a demand perfectly met by custom 3D printed medical devices. This demand is further amplified by healthcare professionals recognizing the clinical benefits and cost-effectiveness of additive manufacturing for certain procedures. The overall market penetration is steadily increasing, moving beyond niche applications to become an integral part of surgical planning, implant design, and the development of advanced prosthetics and orthotics. The CAGR for the healthcare additive manufacturing market is estimated to be xx% during the forecast period, a testament to its sustained growth momentum.

The integration of bioprinting technology for regenerative medicine and drug discovery represents a significant growth frontier, attracting substantial investment and research. As these technologies mature and gain regulatory approval, their market impact will become increasingly profound. Furthermore, the ability to produce complex anatomical models for surgical training and patient education enhances procedural efficiency and outcomes, contributing to the widespread adoption of these technologies. The ongoing research and development efforts, coupled with increasing investment from both established players and venture capitalists, ensure a continuous pipeline of innovation that will further propel the market forward. The market size is anticipated to grow from approximately $xx billion in 2025 to $xx billion by 2033, reflecting a compounded annual growth rate of xx%.

Dominant Regions, Countries, or Segments in Healthcare Additive Manufacturing Industry

The healthcare additive manufacturing industry exhibits a clear dominance across specific regions and technology segments, driven by a confluence of factors including robust healthcare infrastructure, supportive government initiatives, and significant investment in research and development. North America, particularly the United States, currently leads the market, owing to its advanced healthcare system, high disposable income, and a strong emphasis on technological innovation. The region benefits from a well-established ecosystem of medical device manufacturers, research institutions, and regulatory bodies that foster the adoption of cutting-edge technologies like 3D printing for prosthetics and custom medical implants.

Europe, especially countries like Germany, the UK, and France, represents another dominant force. This is attributed to strong governmental support for advanced manufacturing, a large patient population demanding personalized healthcare solutions, and a concentration of leading academic and research institutions specializing in medical 3D printing. The region's emphasis on patient-centric care and the increasing application of additive manufacturing in orthopedics further bolster its market position.

In terms of technology segments, Laser Sintering and Stereolithography are currently the most prominent, widely utilized for producing complex geometries with high precision, essential for medical implants and surgical guides. However, Electron Beam Melting is gaining significant traction for its ability to produce high-strength metal implants, particularly for orthopedic and dental applications. Deposition Modeling remains crucial for prototyping and the creation of anatomical models.

The Application segment of Medical Implants is the largest revenue generator, driven by the growing demand for personalized hip, knee, and spinal implants, as well as dental prosthetics. The Material segment of Metals and Alloys (such as titanium and cobalt-chrome) is dominant due to their biocompatibility, strength, and durability, making them ideal for implantable devices. However, Polymers are rapidly expanding their market share, especially for prosthetics, wearables, and bioprinting applications.

- Key Drivers for Regional Dominance:

- North America: High healthcare expenditure, strong R&D investment, favorable regulatory pathways, and a large patient pool with unmet needs for personalized treatments.

- Europe: Government incentives for advanced manufacturing, a mature healthcare system, a focus on patient outcomes, and leading academic research in biotechnology and 3D printing.

- Key Drivers for Segment Dominance:

- Technology (Laser Sintering, Stereolithography): High precision, ability to produce complex geometries, and established use in critical medical applications.

- Application (Medical Implants): Growing prevalence of orthopedic conditions, aging population, and demand for customized solutions.

- Material (Metals and Alloys): Biocompatibility, mechanical strength, and long-term performance in the human body.

Asia Pacific is emerging as a significant growth region, fueled by increasing healthcare investments, a rising middle class with greater access to advanced medical care, and government initiatives promoting domestic manufacturing capabilities in 3D printing for healthcare. Countries like China and India are expected to witness substantial growth in the coming years.

Healthcare Additive Manufacturing Industry Product Landscape

The healthcare additive manufacturing industry is witnessing a surge in innovative product developments, primarily focused on enhancing patient outcomes and procedural efficiency. Companies are introducing advanced 3D printed implants with patient-specific geometries, reducing surgery times and improving recovery rates. Innovations extend to highly customized prosthetics and orthotics, offering improved functionality and aesthetics. The development of novel biocompatible materials, including advanced polymers and bio-inks, is paving the way for breakthroughs in tissue engineering and regenerative medicine. Performance metrics are continuously being enhanced, with increased precision, speed, and material integrity in printing processes. Unique selling propositions revolve around the ability to create complex internal structures, porosity for osseointegration, and lightweight yet durable designs. Technological advancements in multi-material printing and in-situ monitoring are further pushing the boundaries of what is possible.

Key Drivers, Barriers & Challenges in Healthcare Additive Manufacturing Industry

Key Drivers:

The healthcare additive manufacturing industry is propelled by several key drivers, including the burgeoning demand for personalized medicine, advancements in 3D printing technology and materials, and the increasing need for cost-effective and efficient healthcare solutions. The growing prevalence of chronic diseases and an aging global population necessitate customized treatment options, which additive manufacturing is uniquely positioned to provide.

- Demand for Personalization: Tailored medical implants, prosthetics, and surgical guides based on individual patient anatomy.

- Technological Advancements: Development of new biocompatible materials, higher resolution printing, and faster build speeds.

- Cost-Effectiveness: Reduced waste, on-demand production, and potential for lower manufacturing costs for complex parts.

- Surgical Planning & Training: Creation of realistic anatomical models for pre-surgical rehearsal and medical education.

Barriers & Challenges:

Despite its immense potential, the industry faces significant barriers and challenges. Regulatory hurdles, the high initial cost of equipment and materials, and the need for specialized expertise can slow down widespread adoption. Ensuring consistent quality, sterility, and long-term biocompatibility of 3D-printed devices is paramount and requires rigorous validation.

- Regulatory Compliance: Navigating complex and evolving approval processes for medical devices.

- High Initial Investment: Significant capital expenditure for printers, software, and post-processing equipment.

- Material Limitations: Limited range of approved and extensively tested biocompatible materials for specific applications.

- Skilled Workforce Shortage: Lack of trained personnel in additive manufacturing processes and medical device design.

- Scalability for Mass Production: Challenges in scaling up production for high-volume demand while maintaining quality.

Emerging Opportunities in Healthcare Additive Manufacturing Industry

Emerging opportunities in the healthcare additive manufacturing industry are vast and transformative. The burgeoning field of bioprinting holds immense promise for organ transplantation and regenerative medicine, with ongoing research into printing functional tissues and organs. The development of advanced wearable medical devices with integrated sensors, enabled by flexible and customized 3D printing, presents another significant growth avenue. Furthermore, the application of additive manufacturing in drug delivery systems, creating personalized dosage forms and complex release profiles, is an area ripe for innovation. The increasing focus on home healthcare and remote patient monitoring also creates demand for compact, customized medical devices.

Growth Accelerators in the Healthcare Additive Manufacturing Industry Industry

Several key catalysts are accelerating the growth of the healthcare additive manufacturing industry. Continuous innovation in biocompatible materials, such as advanced polymers and metal alloys specifically engineered for medical applications, is expanding the range of products that can be manufactured. Strategic partnerships between technology providers, material suppliers, and healthcare institutions are fostering collaboration and accelerating product development and clinical validation. Furthermore, increasing investment in research and development for 3D printing in healthcare is driving technological breakthroughs and market penetration. The growing acceptance and reimbursement policies for 3D-printed medical devices by insurance providers also play a crucial role in market expansion.

Key Players Shaping the Healthcare Additive Manufacturing Industry Market

- RegenHU

- Renishaw PLC

- Eos GmbH

- Stratasys LTD

- Nanoscribe GmbH

- 3D Systems Inc

- GPI Prototype and Manufacturing Services LLC

- EnvisionTEC

- Materialise NV

- General Electric Company

Notable Milestones in Healthcare Additive Manufacturing Industry Sector

- November 2022: Evonik launched three new INFINAM photopolymers for industrial 3D applications, expanding their photo-resins product line. The product line is intended for use in common UV-curing 3D printing processes. The INFINAM RG 2000 L is a photo resin for the eyewear industry. This development signifies advancements in material science, potentially impacting the development of biocompatible resins for medical applications.

- June 2022: Belgian contract manufacturer Amnovis and medical device service provider BAAT Medical teamed up to offer an innovative and rapid turnaround process for 3D-printed medical devices. Both Amnovis and BAAT Medical have experience in 3D printing medical devices for a range of certified end-use applications. This partnership highlights the growing trend of collaborative efforts to streamline the production and delivery of 3D-printed medical solutions.

In-Depth Healthcare Additive Manufacturing Industry Market Outlook

The future outlook for the healthcare additive manufacturing industry is exceptionally bright, driven by sustained innovation and increasing adoption across a multitude of medical specialties. Growth accelerators such as the expanding repertoire of biocompatible materials, the increasing number of FDA-approved 3D-printed medical devices, and the continuous refinement of 3D printing technologies will continue to fuel market expansion. Strategic opportunities lie in further developing personalized treatment solutions, advancing the capabilities of bioprinting for regenerative medicine, and enhancing the integration of AI for design and quality control. The market is poised for significant growth, transforming patient care and medical device manufacturing for decades to come.

Healthcare Additive Manufacturing Industry Segmentation

-

1. Technology

- 1.1. Stereolithography

- 1.2. Deposition Modeling

- 1.3. Electron Beam Melting

- 1.4. Laser Sintering

- 1.5. Jetting Technology

- 1.6. Laminated Object Manufacturing

- 1.7. Other Technologies

-

2. Application

- 2.1. Medical Implants

- 2.2. Prosthetics

- 2.3. Wearable Devices

- 2.4. Tissue Engineering

- 2.5. Other Applications

-

3. Material

- 3.1. Metals and Alloys

- 3.2. Polymers

- 3.3. Other Materials

Healthcare Additive Manufacturing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Healthcare Additive Manufacturing Industry Regional Market Share

Geographic Coverage of Healthcare Additive Manufacturing Industry

Healthcare Additive Manufacturing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend in Customized Additive Manufacturing; Rising Demand Driven by the Increasing Medical Applications

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Additive Manufacturing; Lack of Skilled Professionals

- 3.4. Market Trends

- 3.4.1. Polymers Segment are Expected to Register a Significant Growth in Healthcare 3D Printing (Additive Manufacturing) Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Healthcare Additive Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Stereolithography

- 5.1.2. Deposition Modeling

- 5.1.3. Electron Beam Melting

- 5.1.4. Laser Sintering

- 5.1.5. Jetting Technology

- 5.1.6. Laminated Object Manufacturing

- 5.1.7. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Medical Implants

- 5.2.2. Prosthetics

- 5.2.3. Wearable Devices

- 5.2.4. Tissue Engineering

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Material

- 5.3.1. Metals and Alloys

- 5.3.2. Polymers

- 5.3.3. Other Materials

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Healthcare Additive Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Stereolithography

- 6.1.2. Deposition Modeling

- 6.1.3. Electron Beam Melting

- 6.1.4. Laser Sintering

- 6.1.5. Jetting Technology

- 6.1.6. Laminated Object Manufacturing

- 6.1.7. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Medical Implants

- 6.2.2. Prosthetics

- 6.2.3. Wearable Devices

- 6.2.4. Tissue Engineering

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Material

- 6.3.1. Metals and Alloys

- 6.3.2. Polymers

- 6.3.3. Other Materials

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Healthcare Additive Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Stereolithography

- 7.1.2. Deposition Modeling

- 7.1.3. Electron Beam Melting

- 7.1.4. Laser Sintering

- 7.1.5. Jetting Technology

- 7.1.6. Laminated Object Manufacturing

- 7.1.7. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Medical Implants

- 7.2.2. Prosthetics

- 7.2.3. Wearable Devices

- 7.2.4. Tissue Engineering

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Material

- 7.3.1. Metals and Alloys

- 7.3.2. Polymers

- 7.3.3. Other Materials

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Healthcare Additive Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Stereolithography

- 8.1.2. Deposition Modeling

- 8.1.3. Electron Beam Melting

- 8.1.4. Laser Sintering

- 8.1.5. Jetting Technology

- 8.1.6. Laminated Object Manufacturing

- 8.1.7. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Medical Implants

- 8.2.2. Prosthetics

- 8.2.3. Wearable Devices

- 8.2.4. Tissue Engineering

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Material

- 8.3.1. Metals and Alloys

- 8.3.2. Polymers

- 8.3.3. Other Materials

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Middle East and Africa Healthcare Additive Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Stereolithography

- 9.1.2. Deposition Modeling

- 9.1.3. Electron Beam Melting

- 9.1.4. Laser Sintering

- 9.1.5. Jetting Technology

- 9.1.6. Laminated Object Manufacturing

- 9.1.7. Other Technologies

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Medical Implants

- 9.2.2. Prosthetics

- 9.2.3. Wearable Devices

- 9.2.4. Tissue Engineering

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Material

- 9.3.1. Metals and Alloys

- 9.3.2. Polymers

- 9.3.3. Other Materials

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. South America Healthcare Additive Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Stereolithography

- 10.1.2. Deposition Modeling

- 10.1.3. Electron Beam Melting

- 10.1.4. Laser Sintering

- 10.1.5. Jetting Technology

- 10.1.6. Laminated Object Manufacturing

- 10.1.7. Other Technologies

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Medical Implants

- 10.2.2. Prosthetics

- 10.2.3. Wearable Devices

- 10.2.4. Tissue Engineering

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Material

- 10.3.1. Metals and Alloys

- 10.3.2. Polymers

- 10.3.3. Other Materials

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 RegenHU

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Renishaw PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eos GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Stratasys LTD

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nanoscribe GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 3D Systems Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GPI Prototype and Manufacturing Services LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 EnvisionTEC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Materialise NV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 General Electric Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 RegenHU

List of Figures

- Figure 1: Global Healthcare Additive Manufacturing Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Healthcare Additive Manufacturing Industry Revenue (billion), by Technology 2025 & 2033

- Figure 3: North America Healthcare Additive Manufacturing Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Healthcare Additive Manufacturing Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Healthcare Additive Manufacturing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Healthcare Additive Manufacturing Industry Revenue (billion), by Material 2025 & 2033

- Figure 7: North America Healthcare Additive Manufacturing Industry Revenue Share (%), by Material 2025 & 2033

- Figure 8: North America Healthcare Additive Manufacturing Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Healthcare Additive Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Healthcare Additive Manufacturing Industry Revenue (billion), by Technology 2025 & 2033

- Figure 11: Europe Healthcare Additive Manufacturing Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 12: Europe Healthcare Additive Manufacturing Industry Revenue (billion), by Application 2025 & 2033

- Figure 13: Europe Healthcare Additive Manufacturing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Healthcare Additive Manufacturing Industry Revenue (billion), by Material 2025 & 2033

- Figure 15: Europe Healthcare Additive Manufacturing Industry Revenue Share (%), by Material 2025 & 2033

- Figure 16: Europe Healthcare Additive Manufacturing Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Healthcare Additive Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Healthcare Additive Manufacturing Industry Revenue (billion), by Technology 2025 & 2033

- Figure 19: Asia Pacific Healthcare Additive Manufacturing Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 20: Asia Pacific Healthcare Additive Manufacturing Industry Revenue (billion), by Application 2025 & 2033

- Figure 21: Asia Pacific Healthcare Additive Manufacturing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Healthcare Additive Manufacturing Industry Revenue (billion), by Material 2025 & 2033

- Figure 23: Asia Pacific Healthcare Additive Manufacturing Industry Revenue Share (%), by Material 2025 & 2033

- Figure 24: Asia Pacific Healthcare Additive Manufacturing Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Healthcare Additive Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Healthcare Additive Manufacturing Industry Revenue (billion), by Technology 2025 & 2033

- Figure 27: Middle East and Africa Healthcare Additive Manufacturing Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 28: Middle East and Africa Healthcare Additive Manufacturing Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Healthcare Additive Manufacturing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Healthcare Additive Manufacturing Industry Revenue (billion), by Material 2025 & 2033

- Figure 31: Middle East and Africa Healthcare Additive Manufacturing Industry Revenue Share (%), by Material 2025 & 2033

- Figure 32: Middle East and Africa Healthcare Additive Manufacturing Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Healthcare Additive Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Healthcare Additive Manufacturing Industry Revenue (billion), by Technology 2025 & 2033

- Figure 35: South America Healthcare Additive Manufacturing Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 36: South America Healthcare Additive Manufacturing Industry Revenue (billion), by Application 2025 & 2033

- Figure 37: South America Healthcare Additive Manufacturing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: South America Healthcare Additive Manufacturing Industry Revenue (billion), by Material 2025 & 2033

- Figure 39: South America Healthcare Additive Manufacturing Industry Revenue Share (%), by Material 2025 & 2033

- Figure 40: South America Healthcare Additive Manufacturing Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Healthcare Additive Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 2: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 4: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 6: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 8: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Healthcare Additive Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Healthcare Additive Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Healthcare Additive Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 13: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 15: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Healthcare Additive Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Healthcare Additive Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Healthcare Additive Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Healthcare Additive Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Healthcare Additive Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Healthcare Additive Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 23: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 25: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Healthcare Additive Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Healthcare Additive Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: India Healthcare Additive Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Australia Healthcare Additive Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Healthcare Additive Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Healthcare Additive Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 33: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 35: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: GCC Healthcare Additive Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Africa Healthcare Additive Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Healthcare Additive Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Technology 2020 & 2033

- Table 40: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 41: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 42: Global Healthcare Additive Manufacturing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 43: Brazil Healthcare Additive Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Argentina Healthcare Additive Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Healthcare Additive Manufacturing Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Healthcare Additive Manufacturing Industry?

The projected CAGR is approximately 22.13%.

2. Which companies are prominent players in the Healthcare Additive Manufacturing Industry?

Key companies in the market include RegenHU, Renishaw PLC, Eos GmbH, Stratasys LTD, Nanoscribe GmbH, 3D Systems Inc, GPI Prototype and Manufacturing Services LLC, EnvisionTEC, Materialise NV, General Electric Company.

3. What are the main segments of the Healthcare Additive Manufacturing Industry?

The market segments include Technology, Application, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.33 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend in Customized Additive Manufacturing; Rising Demand Driven by the Increasing Medical Applications.

6. What are the notable trends driving market growth?

Polymers Segment are Expected to Register a Significant Growth in Healthcare 3D Printing (Additive Manufacturing) Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Costs Associated with Additive Manufacturing; Lack of Skilled Professionals.

8. Can you provide examples of recent developments in the market?

November 2022: Evonik launched three new INFINAM photopolymers for industrial 3D applications, expanding their photo-resins product line. The product line is intended for use in common UV-curing 3D printing processes. The INFINAM RG 2000 L is a photo resin for the eyewear industry.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Healthcare Additive Manufacturing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Healthcare Additive Manufacturing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Healthcare Additive Manufacturing Industry?

To stay informed about further developments, trends, and reports in the Healthcare Additive Manufacturing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence