Key Insights

The Indonesian e-commerce logistics market is poised for significant expansion, driven by robust e-commerce sector growth, increasing internet and smartphone penetration, a growing middle class, and supportive government digitalization initiatives. This dynamic market is projected to experience a Compound Annual Growth Rate (CAGR) of 14.8% from 2025 to 2033. Key growth drivers include the dominance of B2C deliveries, fueled by evolving consumer shopping habits, and the transportation of high-demand product categories such as fashion and apparel, consumer electronics, and home appliances. The expansion of value-added services, including labeling and packaging, further enhances market efficiency. Strategic investments in logistics infrastructure and technological advancements, such as automated warehousing and advanced delivery tracking, are actively addressing challenges like regional infrastructure disparities and cross-border complexities. Prominent players, including global entities and local Indonesian providers, contribute to a competitive and evolving market landscape.

Indonesia eCommerce Logistics Market Market Size (In Billion)

Market segmentation reveals crucial insights. While B2C transactions lead, the B2B segment is exhibiting substantial growth, reflecting the rise of online business-to-business commerce. The international/cross-border segment is expected to expand significantly, benefiting from increased global trade and Indonesia's economic integration. The concentration of certain product categories highlights consumer preferences and presents opportunities for specialized logistics providers. Strategic alliances between e-commerce platforms and logistics companies, alongside continuous investment in technological innovation, will be pivotal in shaping the future trajectory of Indonesia's e-commerce logistics sector. The overall market outlook remains highly positive, indicating sustained and strong expansion.

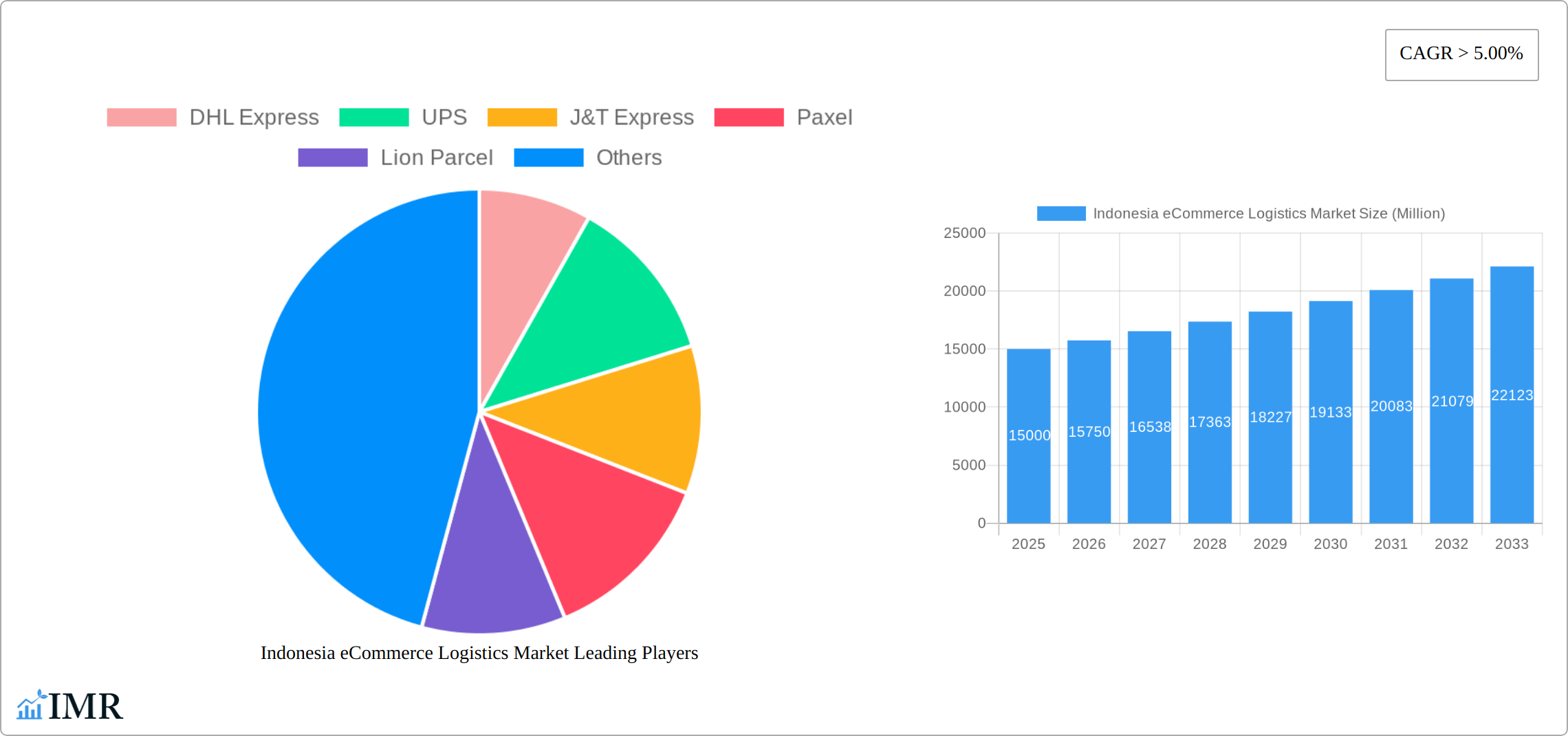

Indonesia eCommerce Logistics Market Company Market Share

Indonesia E-commerce Logistics Market Analysis: Growth, Trends, and Forecast (2019-2033)

This comprehensive report delivers an in-depth analysis of the Indonesian e-commerce logistics market, covering market dynamics, growth trajectories, dominant segments, key stakeholders, and future projections. The report period spans from 2019 to 2033, with 2025 serving as the base year and 2025-2033 as the forecast period. Market segmentation includes service types (transportation, warehousing, value-added services), business models (B2B, B2C), destination (domestic, international), and product categories (fashion, electronics, home appliances, furniture, beauty, others). The market size was valued at $848.87 billion in 2025 and is forecasted to reach substantial figures by 2033. This report is an indispensable resource for businesses, investors, and policymakers seeking critical insights into this rapidly expanding market.

Indonesia eCommerce Logistics Market Dynamics & Structure

The Indonesian eCommerce logistics market is characterized by intense competition, rapid technological advancements, and evolving regulatory frameworks. Market concentration is relatively high, with several major players controlling significant market share, yet a considerable number of smaller, more specialized firms also contribute significantly. The market is driven by the booming eCommerce sector, increasing internet and smartphone penetration, and a growing middle class. However, challenges remain, including infrastructure limitations in certain regions and the need for improved supply chain efficiency.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025, while the remaining share is distributed across numerous smaller players.

- Technological Innovation: The adoption of automation technologies such as AI-powered sorting systems and drone delivery is accelerating, improving efficiency and reducing costs. However, high initial investment costs pose a barrier for smaller firms.

- Regulatory Framework: Government regulations aimed at promoting eCommerce growth and improving logistics infrastructure are creating a more favorable environment for market expansion, albeit with ongoing adjustments needed for optimal efficiency.

- Competitive Product Substitutes: Limited direct substitutes exist, with the primary competition stemming from the pricing and service offerings of different logistics providers.

- End-User Demographics: The market is driven largely by a young, tech-savvy population with a high propensity for online shopping. This demographic is fueling demand for fast, reliable, and convenient delivery services.

- M&A Trends: The number of M&A deals in the sector has increased in recent years, indicating consolidation among players seeking to expand their reach and service offerings. An estimated xx M&A deals occurred between 2019 and 2024.

Indonesia eCommerce Logistics Market Growth Trends & Insights

The Indonesian eCommerce logistics market is experiencing a dynamic period of robust expansion, fueled by the unceasing growth of the digital retail sector and the escalating demand for online shopping convenience among consumers. Between 2019 and 2024, the market size demonstrated a significant Compound Annual Growth Rate (CAGR) of [Insert specific CAGR value]%, projecting to reach an estimated [Insert specific market size value] Million units by the end of 2024. The increasing adoption of specialized eCommerce logistics services underscores the Indonesian consumer's growing preference for the ease and accessibility of online purchasing. Disruptive technological advancements, including the widespread implementation of sophisticated real-time tracking systems and the innovative deployment of last-mile delivery solutions, are fundamentally reshaping the market's operational landscape and driving substantial improvements in efficiency. Furthermore, the evolution of consumer behavior, characterized by an increasing expectation for same-day or next-day delivery, is exerting considerable pressure on logistics providers to continually elevate their speed, reliability, and overall service quality. This trend is further amplified by the pervasive popularity of mobile commerce, which continues to drive transactional volumes. The market is poised for sustained strong growth, with a projected CAGR of [Insert specific future CAGR value]% anticipated from 2025 to 2033. Market penetration is forecasted to reach an impressive [Insert specific penetration value]% by 2033.

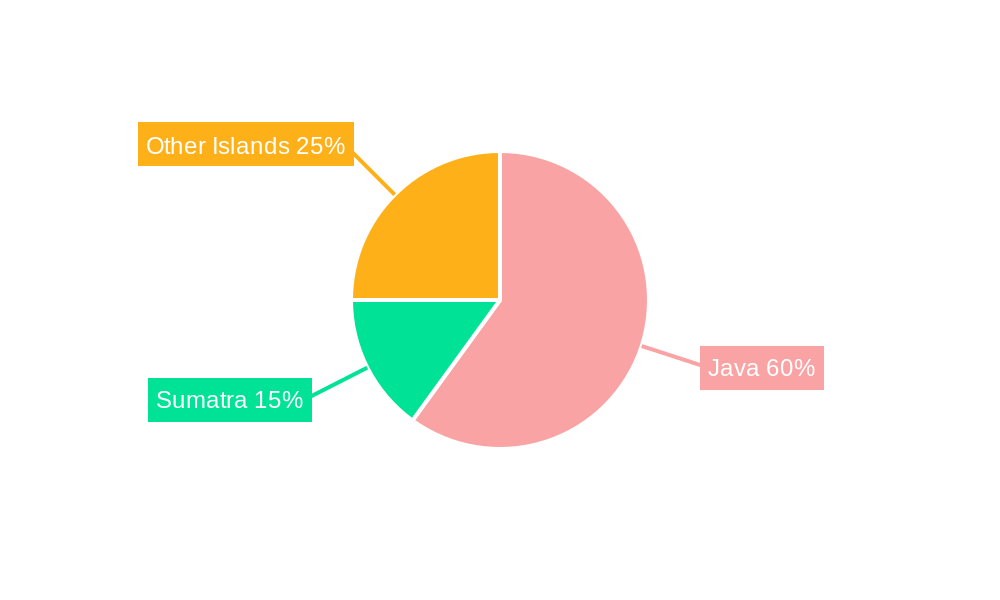

Dominant Regions, Countries, or Segments in Indonesia eCommerce Logistics Market

The domestic segment stands as the primary engine of growth within the Indonesian eCommerce logistics market, accounting for a substantial [Insert specific percentage]% of the total market value in 2025. This dominance is primarily a consequence of the high population density concentrated in major urban centers and the progressively widening penetration of eCommerce across diverse geographical regions of the archipelago. The Business-to-Consumer (B2C) segment commands a significantly larger market share compared to the Business-to-Business (B2B) segment, a clear reflection of the prevailing consumer-centric nature of current eCommerce activities. Within the array of logistics services, transportation emerges as the largest contributor, closely followed by warehousing and inventory management, with value-added services rounding out the segment. The fashion and apparel product category acts as a key demand driver, with consumer electronics and home appliances also playing significant roles. Geographically, the island of Java leads as the dominant region, driven by its exceptional population density and its position as a hub for eCommerce activity.

- Key Drivers for Domestic Segment Dominance:

- High population density concentrated in key urban centers and metropolitan areas.

- Accelerated expansion and maturity of the domestic eCommerce sector.

- Widespread adoption of smartphones and increased internet connectivity nationwide.

- Growth of the middle class, leading to increased disposable income and consumer spending power.

- Key Drivers for B2C Segment Dominance:

- Unmatched convenience and accessibility offered by online shopping platforms.

- Extensive and diverse range of product offerings available to consumers.

- Rising levels of consumer trust and confidence in the security of online transactions.

- Key Drivers for Transportation Services Dominance:

- The fundamental and indispensable component of the entire eCommerce delivery ecosystem.

- Escalating demand for expedited and highly reliable delivery options from consumers.

Indonesia eCommerce Logistics Market Product Landscape

The Indonesian eCommerce logistics market offers a diverse range of services, including express delivery, standard delivery, freight forwarding, warehousing, and value-added services such as packaging and labeling. Technological advancements, including real-time tracking, automated sorting systems, and data analytics platforms, are enhancing the efficiency and reliability of these services. Many providers offer customized solutions to meet specific customer needs, providing competitive advantages. These solutions increasingly integrate advanced technologies to optimize delivery routes, predict demand, and improve inventory management. The unique selling propositions of different providers frequently involve speed, cost-effectiveness, reliability, and specialized handling for fragile or high-value goods.

Key Drivers, Barriers & Challenges in Indonesia eCommerce Logistics Market

Key Drivers: The primary drivers include the booming eCommerce market, government initiatives to improve infrastructure, rising internet and smartphone penetration, and a growing preference for online shopping among consumers. The expansion of logistics networks, coupled with the implementation of advanced technologies, is also playing a crucial role.

Key Challenges: Significant challenges include infrastructure limitations, especially in less developed regions, leading to higher transportation costs and delivery times. Regulatory hurdles and customs procedures can hinder cross-border shipments. Intense competition and fluctuating fuel prices also pose significant challenges to profitability and sustainability. Furthermore, maintaining a reliable and secure supply chain amidst the variability of consumer demand and seasonal peaks presents a continuous operational challenge. The total estimated impact of these challenges on market growth is approximately xx%.

Emerging Opportunities in Indonesia eCommerce Logistics Market

Emerging opportunities include the expansion of services into underserved areas, the adoption of sustainable logistics practices, the integration of fintech solutions for payments and financing, and the growth of specialized services catering to specific product categories (e.g., temperature-controlled transport for food products). The increasing adoption of omnichannel strategies by businesses also creates opportunities for integrated logistics solutions. Finally, the potential for utilizing drone technology and automated vehicles to enhance last-mile delivery offers promising new avenues for growth and efficiency improvements.

Growth Accelerators in the Indonesia eCommerce Logistics Market Industry

Long-term growth will be accelerated by technological breakthroughs in areas such as automation and AI, strategic partnerships between logistics providers and eCommerce platforms, and government initiatives to improve infrastructure and reduce regulatory barriers. Expansion into rural markets, the increasing adoption of digital technologies across the supply chain, and the development of innovative logistics solutions tailored to specific industry needs will further drive market expansion.

Key Players Shaping the Indonesia eCommerce Logistics Market Market

- DHL Express (DHL Express)

- UPS (UPS)

- J&T Express

- Paxel

- Lion Parcel

- Ninja Xpress

- POS Indonesia

- JNE Express

- SiCepat Ekspres Indonesia

- Wahana Express

Notable Milestones in Indonesia eCommerce Logistics Market Sector

- August 2022: J&T Express significantly bolstered its operational capacity by expanding two key sorting centers located in Madiun and Banjarmasin. This expansion coincided with their seventh-anniversary celebration, marked by a highly successful free shipping campaign, enhancing customer reach and service efficiency.

- December 2022: Ninja Van forged a strategic partnership with Trigana Air, an initiative aimed at substantially enhancing their package delivery capabilities to the critical regions of Sulawesi, Kalimantan, and Sumatra through the utilization of air freight services. Concurrently, the company launched 'Logistics+', an innovative supply chain management solution specifically designed to empower and support Small and Medium-sized Enterprises (SMEs).

In-Depth Indonesia eCommerce Logistics Market Market Outlook

The Indonesian eCommerce logistics market is poised for continued strong growth, driven by a combination of factors including increasing eCommerce adoption, expanding infrastructure, and technological advancements. Strategic opportunities exist for companies that can effectively navigate the challenges and leverage the emerging trends in this dynamic market. Focusing on innovation, sustainability, and customer-centric solutions will be crucial for success in the years to come. The long-term outlook is positive, with significant potential for market expansion and the emergence of new business models.

Indonesia eCommerce Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Inventory Management

- 1.3. Value added services (Labeling, Packaging)

-

2. Business

- 2.1. B2B

- 2.2. B2C

-

3. Destination

- 3.1. Domestic

- 3.2. International/Cross-border

-

4. Product

- 4.1. Fashion and Apparel

- 4.2. Consumer Electronics

- 4.3. Home Appliances

- 4.4. Furniture

- 4.5. Beauty and Personal care products

- 4.6. Other products (Toys, Food Products, etc.)

Indonesia eCommerce Logistics Market Segmentation By Geography

- 1. Indonesia

Indonesia eCommerce Logistics Market Regional Market Share

Geographic Coverage of Indonesia eCommerce Logistics Market

Indonesia eCommerce Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in global trade activites; Increase in infrastrustrure and construction

- 3.3. Market Restrains

- 3.3.1. Long distances and sometimes difficult terrain can contribute to increased transportation costs

- 3.4. Market Trends

- 3.4.1. Live Commerce Contributing in Market Expansion

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia eCommerce Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Inventory Management

- 5.1.3. Value added services (Labeling, Packaging)

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. B2B

- 5.2.2. B2C

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International/Cross-border

- 5.4. Market Analysis, Insights and Forecast - by Product

- 5.4.1. Fashion and Apparel

- 5.4.2. Consumer Electronics

- 5.4.3. Home Appliances

- 5.4.4. Furniture

- 5.4.5. Beauty and Personal care products

- 5.4.6. Other products (Toys, Food Products, etc.)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL Express

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 UPS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 J&T Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Paxel

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lion Parcel

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ninja Xpress

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 POS Indonesia**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 JNE Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SiCepat Ekspres Indonesia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Wahana Express

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DHL Express

List of Figures

- Figure 1: Indonesia eCommerce Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Indonesia eCommerce Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia eCommerce Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Indonesia eCommerce Logistics Market Revenue billion Forecast, by Business 2020 & 2033

- Table 3: Indonesia eCommerce Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 4: Indonesia eCommerce Logistics Market Revenue billion Forecast, by Product 2020 & 2033

- Table 5: Indonesia eCommerce Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Indonesia eCommerce Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 7: Indonesia eCommerce Logistics Market Revenue billion Forecast, by Business 2020 & 2033

- Table 8: Indonesia eCommerce Logistics Market Revenue billion Forecast, by Destination 2020 & 2033

- Table 9: Indonesia eCommerce Logistics Market Revenue billion Forecast, by Product 2020 & 2033

- Table 10: Indonesia eCommerce Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia eCommerce Logistics Market?

The projected CAGR is approximately 14.8%.

2. Which companies are prominent players in the Indonesia eCommerce Logistics Market?

Key companies in the market include DHL Express, UPS, J&T Express, Paxel, Lion Parcel, Ninja Xpress, POS Indonesia**List Not Exhaustive, JNE Express, SiCepat Ekspres Indonesia, Wahana Express.

3. What are the main segments of the Indonesia eCommerce Logistics Market?

The market segments include Service, Business, Destination, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 848.87 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in global trade activites; Increase in infrastrustrure and construction.

6. What are the notable trends driving market growth?

Live Commerce Contributing in Market Expansion.

7. Are there any restraints impacting market growth?

Long distances and sometimes difficult terrain can contribute to increased transportation costs.

8. Can you provide examples of recent developments in the market?

August 2022: Global logistics service provider J&T Express announced the expansion of two sorting centers in Indonesia to meet growing local business demand and upgrade the work environment for employees, along with a free shipping campaign for customers, in celebration of the company's seventh anniversary in the country. To meet the rising demand for delivery services, the two upgraded sorting warehouses in the cities of Madiun and Banjarmasin each cover an area of about 20,000 square meters, with a building area of more than 12,000 square meters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia eCommerce Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia eCommerce Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia eCommerce Logistics Market?

To stay informed about further developments, trends, and reports in the Indonesia eCommerce Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence