Key Insights

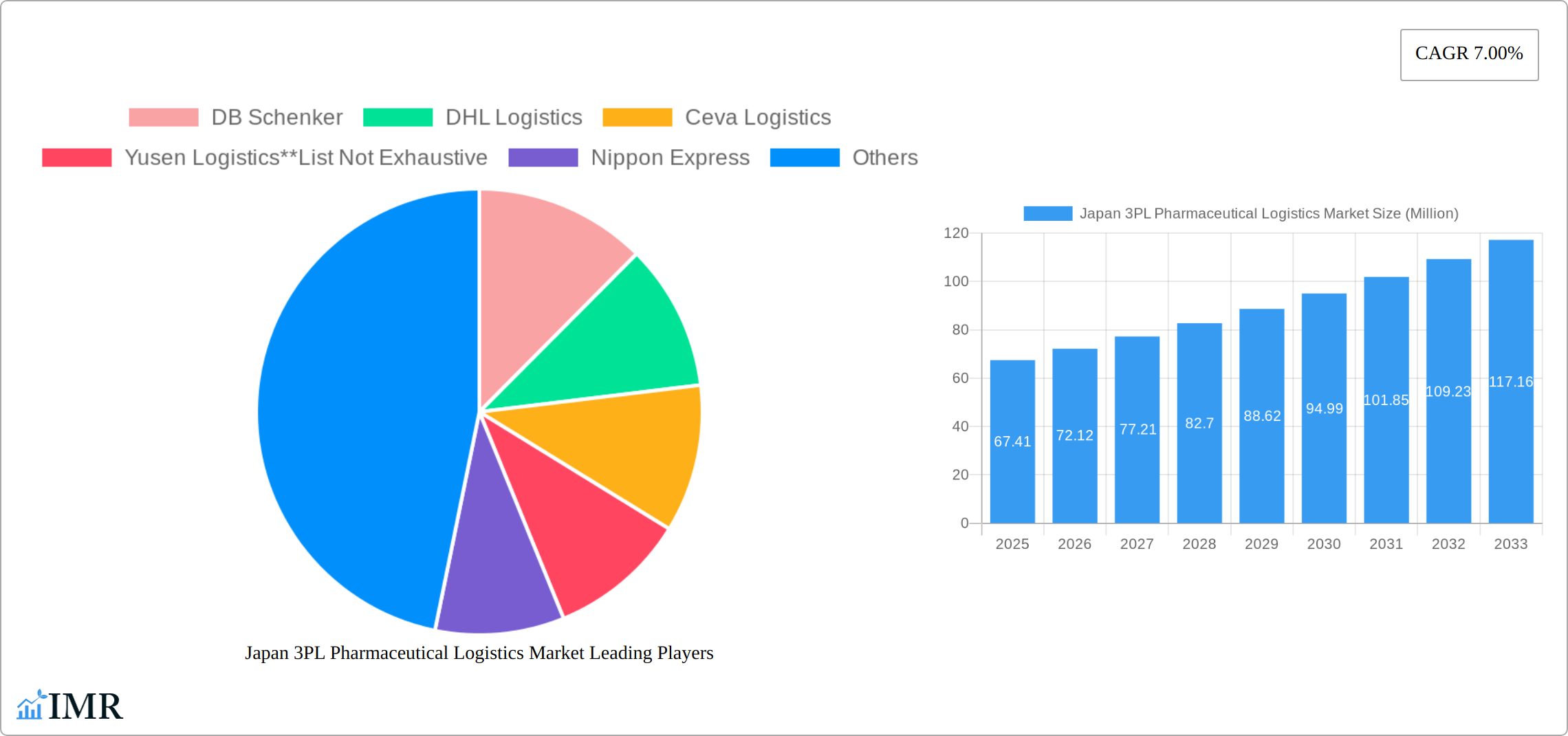

The Japan 3PL Pharmaceutical Logistics market, valued at $67.41 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.00% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for temperature-sensitive pharmaceutical products, coupled with stringent regulatory requirements for their safe and timely transportation and storage, fuels the need for specialized 3PL services. Furthermore, the rising prevalence of chronic diseases in Japan necessitates efficient and reliable supply chains to ensure consistent patient access to medication. Growth is also fueled by pharmaceutical companies' focus on outsourcing non-core logistics activities to streamline operations and reduce costs. The market is segmented by service type (domestic and international transportation management, value-added warehousing and distribution) and temperature control (controlled/cold chain and non-controlled/non-cold chain logistics). Major players like DB Schenker, DHL Logistics, and Kuehne + Nagel compete in this market, leveraging their extensive networks and technological capabilities to offer comprehensive solutions. Regional variations exist, with high concentrations of activity in regions like Kanto, Kansai, and Chubu, reflecting the distribution of pharmaceutical companies and healthcare facilities.

Japan 3PL Pharmaceutical Logistics Market Market Size (In Million)

The forecast period (2025-2033) projects continued market expansion, fueled by ongoing technological advancements in cold chain logistics, such as real-time tracking and monitoring systems that enhance supply chain visibility and ensure product integrity. The Japanese government's initiatives to modernize healthcare infrastructure and improve supply chain efficiency further contribute to market growth. However, potential challenges include stringent regulatory compliance requirements and the need for continuous investment in specialized infrastructure and technology to maintain cold chain integrity. Competitive pressures from existing and emerging players will also influence market dynamics. The market is expected to witness mergers and acquisitions as companies seek to expand their market share and service offerings.

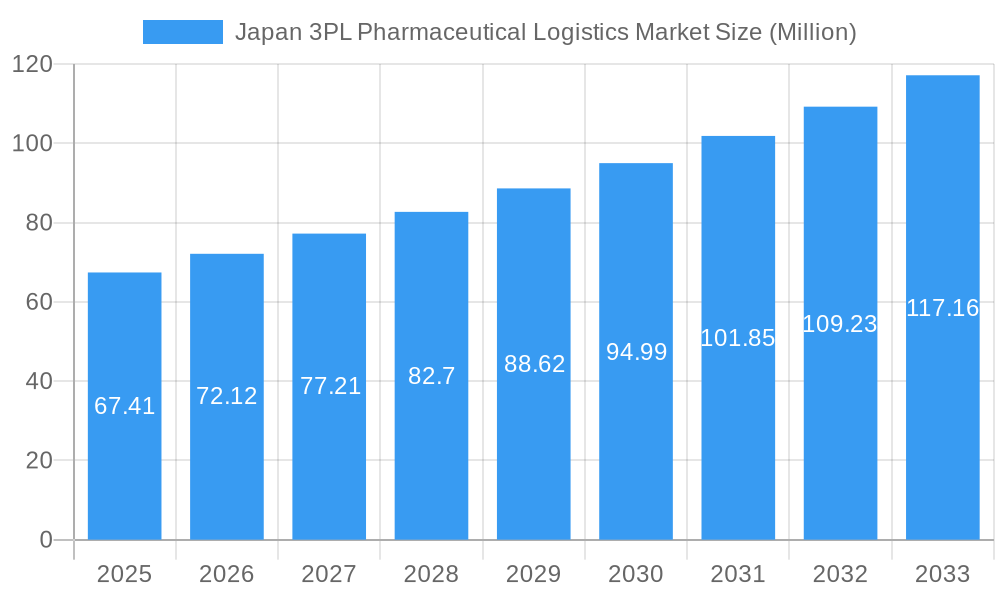

Japan 3PL Pharmaceutical Logistics Market Company Market Share

Japan 3PL Pharmaceutical Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Japan 3PL Pharmaceutical Logistics Market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The report covers the parent market (3PL Logistics in Japan) and the child market (Pharmaceutical Logistics within 3PL). It offers invaluable insights for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic sector. The study period spans 2019-2033, with 2025 as the base and estimated year.

Japan 3PL Pharmaceutical Logistics Market Dynamics & Structure

The Japanese 3PL pharmaceutical logistics market is characterized by a moderately concentrated landscape, with key players such as DB Schenker, DHL Logistics, Ceva Logistics, Yusen Logistics, Nippon Express, FedEx, Mitsubishi Logistics, Kuehne + Nagel, Kerry Logistics, and Suzuken Group vying for market share. The market's structure is influenced by stringent regulatory frameworks, technological advancements in cold chain logistics, and increasing demand for value-added services. Significant M&A activity further shapes the competitive dynamics.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025, indicating a moderately concentrated market.

- Technological Innovation: Adoption of automation, AI, and IoT in warehousing and transportation is driving efficiency and reducing costs. However, high initial investment costs present a barrier to entry for smaller players.

- Regulatory Framework: Stringent regulations regarding drug handling, storage, and transportation necessitate significant investment in compliance measures. This also impacts smaller players, raising the barrier to market entry.

- Competitive Product Substitutes: Limited direct substitutes exist, but enhanced in-house logistics capabilities by pharmaceutical companies can be viewed as indirect competition.

- End-User Demographics: The market is primarily driven by large pharmaceutical companies and specialized healthcare distributors. Growth is fueled by an aging population and increasing demand for pharmaceuticals.

- M&A Trends: Recent years have seen an increase in mergers and acquisitions, with an estimated xx M&A deals closed in the historical period (2019-2024). This consolidation trend is expected to continue.

Japan 3PL Pharmaceutical Logistics Market Growth Trends & Insights

The Japan 3PL pharmaceutical logistics market is experiencing robust growth, driven by factors such as increasing pharmaceutical sales, the growing demand for cold chain logistics, and the rising adoption of advanced technologies. The market size, currently estimated at xx Million units in 2025, is projected to reach xx Million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by the increasing demand for specialized logistics solutions, including temperature-controlled transportation and warehousing for sensitive pharmaceutical products. Furthermore, e-commerce penetration in the pharmaceutical sector and growing emphasis on supply chain resilience are significant contributors to market expansion. The adoption rate of advanced technologies is increasing steadily, with xx% of pharmaceutical companies currently utilizing technology-enabled logistics solutions. Consumer behavior shifts include a growing preference for online pharmaceutical purchases, driving the demand for efficient last-mile delivery solutions.

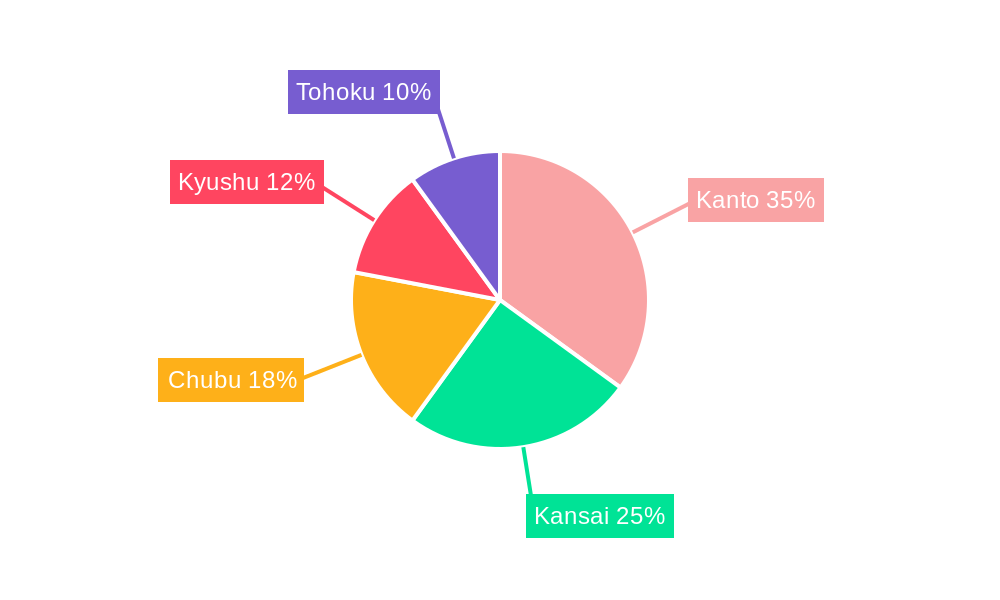

Dominant Regions, Countries, or Segments in Japan 3PL Pharmaceutical Logistics Market

The Kanto region, encompassing the vibrant economic hub of Tokyo and its surrounding areas, stands as the undisputed leader in the Japan 3PL pharmaceutical logistics market. This region is projected to hold a significant market share of approximately 65-70% in 2025, a testament to its strategic importance. This dominance is driven by the unparalleled concentration of leading pharmaceutical manufacturers, research and development facilities, and a highly developed, sophisticated distribution network that facilitates efficient movement of goods. The Kansai region, with its own strong industrial base and burgeoning healthcare sector, is also demonstrating considerable growth, presenting significant opportunities for expansion.

- By Service: The landscape of services is rapidly evolving, with value-added warehousing and distribution services emerging as the fastest-growing segment. This surge is directly linked to the increasing demand for specialized storage solutions, meticulous handling protocols, and bespoke value-added services such as serialization, cold chain management, and patient-specific dispensing for pharmaceuticals. Concurrently, International Transportation Management is proving to be a crucial and expanding segment, reflecting the globalization of pharmaceutical supply chains and the increasing import/export of critical medicines.

- By Temperature Control: The imperative to maintain product integrity for sensitive biopharmaceuticals and advanced therapies has solidified the controlled/cold chain logistics segment as the dominant force in the market, commanding the largest market share. This segment is not only substantial but also experiencing higher growth rates compared to the non-controlled segment. This accelerated growth is a direct consequence of increasingly stringent global regulatory requirements, the inherent sensitivity of new drug formulations, and a growing emphasis on patient safety.

- Key Drivers: The market's robust growth trajectory is significantly propelled by proactive government initiatives aimed at fostering a world-class healthcare infrastructure and enhancing the efficiency of pharmaceutical supply chains. Furthermore, substantial investments in advanced cold chain infrastructure, including specialized warehousing and transportation fleets, are pivotal in supporting the market's expansion and ensuring the reliable delivery of temperature-sensitive products. The growing aging population and the increasing prevalence of chronic diseases also contribute to higher demand for pharmaceutical products, thereby fueling the logistics sector.

Japan 3PL Pharmaceutical Logistics Market Product Landscape

The product and service portfolio within the Japan 3PL pharmaceutical logistics market is comprehensive and increasingly specialized. It encompasses a broad spectrum of offerings, including meticulous domestic and international transportation management, advanced warehousing solutions designed for pharmaceutical products, and a suite of critical value-added services. These services are tailored to meet specific industry needs and often include intricate processes like serialization and track-and-trace capabilities, specialized labeling, compliant packaging, and sophisticated kitting operations for clinical trials and patient adherence programs. The market's trajectory is clearly marked by a pronounced shift towards highly specialized solutions, particularly in temperature-controlled transportation and storage, which are paramount for maintaining the efficacy and safety of pharmaceuticals requiring precise environmental conditions throughout their journey. Technological innovation is a cornerstone of this evolution, driving the widespread adoption of state-of-the-art technologies such as real-time tracking and monitoring systems, highly automated warehousing solutions powered by robotics and AI, and advanced data analytics platforms. These advancements are instrumental in achieving enhanced operational efficiency, bolstering supply chain visibility, and significantly mitigating risks associated with pharmaceutical distribution. The unique selling propositions of leading 3PL providers are increasingly centered on their seamless technology integration, profound specialized expertise in handling sensitive and high-value pharmaceuticals, and an unwavering commitment to rigorous regulatory compliance, ensuring adherence to the strictest national and international standards.

Key Drivers, Barriers & Challenges in Japan 3PL Pharmaceutical Logistics Market

Key Drivers:

- Stringent regulatory compliance driving demand for specialized services.

- Increasing demand for cold chain logistics.

- Technological advancements improving efficiency and transparency.

- Growth of e-commerce in pharmaceuticals.

Challenges & Restraints:

- High infrastructure costs for cold chain facilities.

- Skilled labor shortages in the logistics sector.

- Intense competition from established players.

- Stringent regulatory compliance requirements leading to high operational costs.

Emerging Opportunities in Japan 3PL Pharmaceutical Logistics Market

- Expansion into niche segments like personalized medicine and biopharmaceuticals.

- Development of integrated, end-to-end solutions incorporating AI and machine learning.

- Increased focus on sustainability and eco-friendly logistics practices.

- Growing demand for specialized services like last-mile delivery for home healthcare.

Growth Accelerators in the Japan 3PL Pharmaceutical Logistics Market Industry

The long-term expansion and vitality of the Japan 3PL pharmaceutical logistics market are being significantly accelerated by continuous and rapid technological advancements. Innovations in areas such as advanced automation, artificial intelligence (AI), and sophisticated data analytics are revolutionizing supply chain operations. These technologies are enabling unprecedented levels of supply chain visibility, driving substantial improvements in operational efficiency, and empowering predictive capabilities that can anticipate and mitigate potential disruptions. Furthermore, the cultivation of robust and collaborative strategic partnerships between established 3PL providers and pharmaceutical companies is a powerful catalyst for innovation. These alliances foster the development of tailored solutions and drive market expansion by addressing evolving industry needs. The Japanese government's strategic focus on enhancing the nation's healthcare infrastructure and its commitment to streamlining and modernizing regulatory frameworks are creating an increasingly conducive and supportive environment for market growth. The increasing demand for biologics, gene therapies, and personalized medicines, all of which require specialized logistics, is also a major growth driver.

Key Players Shaping the Japan 3PL Pharmaceutical Logistics Market Market

- DB Schenker

- DHL Logistics

- Ceva Logistics

- Yusen Logistics

- Nippon Express

- FedEx Logistics

- Mitsubishi Logistics Corporation

- Kuehne + Nagel

- Kerry Logistics Network

- Suzuken Co., Ltd.

Notable Milestones in Japan 3PL Pharmaceutical Logistics Market Sector

- May 2023: Nippon Express's acquisition of Cargo-Partner signifies a major consolidation in the global logistics market, impacting the competitive landscape in Japan.

- December 2022: JCR Pharmaceuticals' collaboration to establish a European logistics platform highlights the increasing globalization of the pharmaceutical industry and the growing demand for robust international logistics capabilities.

In-Depth Japan 3PL Pharmaceutical Logistics Market Outlook

The Japan 3PL pharmaceutical logistics market holds immense future potential, driven by continued technological innovation, strategic partnerships, and growing demand for specialized services. The market is expected to witness significant expansion, particularly in the cold chain and value-added services segments. Companies that successfully adapt to the evolving regulatory landscape and embrace technological advancements will be well-positioned to capitalize on the numerous opportunities in this dynamic sector. Strategic investments in infrastructure, technology, and talent development will be crucial for long-term success.

Japan 3PL Pharmaceutical Logistics Market Segmentation

-

1. Service

- 1.1. Domestic Transportation Management

- 1.2. International Transportation Management

- 1.3. Value-added Warehousing and Distribution

-

2. Temperature Control

- 2.1. Controlled/Cold Chain Logistics

- 2.2. Non-controlled/Non-Cold Chain Logistics

Japan 3PL Pharmaceutical Logistics Market Segmentation By Geography

- 1. Japan

Japan 3PL Pharmaceutical Logistics Market Regional Market Share

Geographic Coverage of Japan 3PL Pharmaceutical Logistics Market

Japan 3PL Pharmaceutical Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Consumption of Frozen Food Driving the Market

- 3.3. Market Restrains

- 3.3.1. 4.; Constantly Increasing Fuel Costs

- 3.4. Market Trends

- 3.4.1. Generics drugs market growing in the country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan 3PL Pharmaceutical Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Domestic Transportation Management

- 5.1.2. International Transportation Management

- 5.1.3. Value-added Warehousing and Distribution

- 5.2. Market Analysis, Insights and Forecast - by Temperature Control

- 5.2.1. Controlled/Cold Chain Logistics

- 5.2.2. Non-controlled/Non-Cold Chain Logistics

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ceva Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Yusen Logistics**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nippon Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 FedEx

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mitsubishi Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kuehne + Nagel

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kerry Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Suzuken Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Japan 3PL Pharmaceutical Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan 3PL Pharmaceutical Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Japan 3PL Pharmaceutical Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Japan 3PL Pharmaceutical Logistics Market Revenue Million Forecast, by Temperature Control 2020 & 2033

- Table 3: Japan 3PL Pharmaceutical Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Japan 3PL Pharmaceutical Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Japan 3PL Pharmaceutical Logistics Market Revenue Million Forecast, by Temperature Control 2020 & 2033

- Table 6: Japan 3PL Pharmaceutical Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan 3PL Pharmaceutical Logistics Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Japan 3PL Pharmaceutical Logistics Market?

Key companies in the market include DB Schenker, DHL Logistics, Ceva Logistics, Yusen Logistics**List Not Exhaustive, Nippon Express, FedEx, Mitsubishi Logistics, Kuehne + Nagel, Kerry Logistics, Suzuken Group.

3. What are the main segments of the Japan 3PL Pharmaceutical Logistics Market?

The market segments include Service, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD 67.41 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Consumption of Frozen Food Driving the Market.

6. What are the notable trends driving market growth?

Generics drugs market growing in the country.

7. Are there any restraints impacting market growth?

4.; Constantly Increasing Fuel Costs.

8. Can you provide examples of recent developments in the market?

May 2023: Nippon Express, the seventh-largest third-party logistics provider in the world by gross revenue, has agreed to acquire Austrian logistics company Cargo-Partner for up to $1.5 billion, advancing its strategy to become a global mega-freight forwarder.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan 3PL Pharmaceutical Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan 3PL Pharmaceutical Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan 3PL Pharmaceutical Logistics Market?

To stay informed about further developments, trends, and reports in the Japan 3PL Pharmaceutical Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence