Key Insights

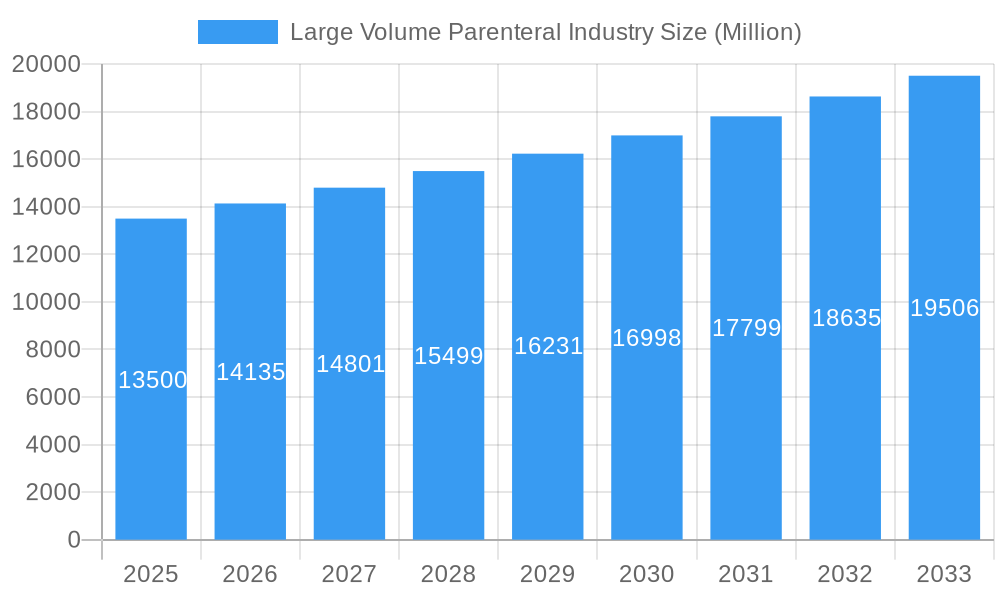

The global Large Volume Parenteral (LVP) market is poised for significant expansion, projected to reach $12.385 billion by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 5.05%. This robust growth is fueled by the rising incidence of chronic diseases, increased demand for intravenous therapies, and advancements in drug delivery systems. LVPs are critical in intensive care, post-operative recovery, and managing hydration and nutritional deficiencies. Key growth drivers include an aging global population, expanding therapeutic applications for injectable drugs, and enhanced sterile manufacturing technologies.

Large Volume Parenteral Industry Market Size (In Billion)

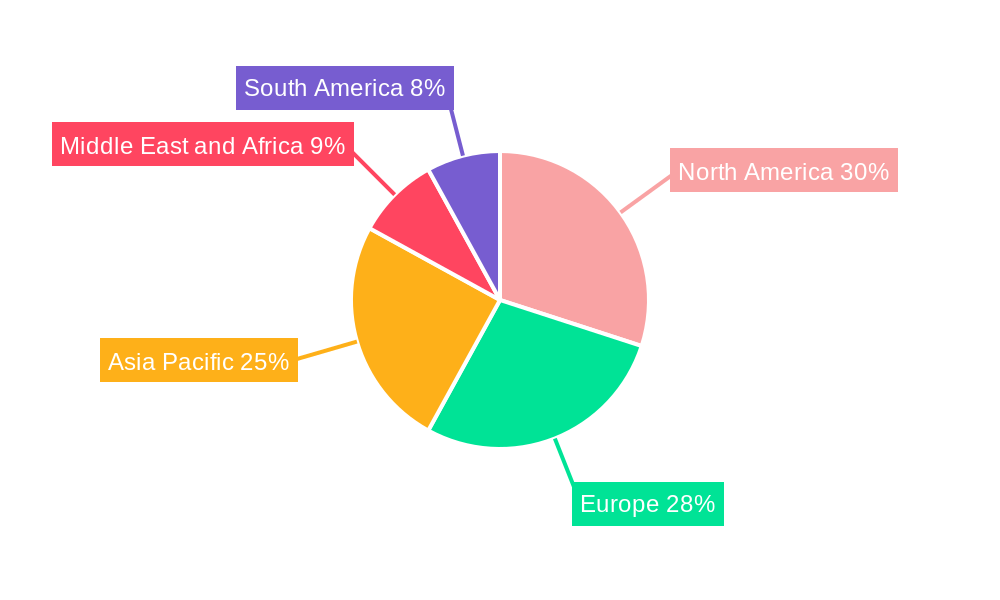

Market segmentation includes volume, application, and packaging. The 500 ml - 1000 ml and 1000 ml - 2000 ml volume segments are anticipated to lead. Therapeutic injections, driven by new biopharmaceuticals and generics, represent the largest application, alongside vital fluid balance injections. The packaging segment is shifting towards IV bags for their flexibility, ease of use, and sterility benefits over glass bottles. Geographically, North America and Europe currently lead, while the Asia Pacific region shows high growth potential due to improving healthcare access and rising incomes. Challenges like stringent regulations are being mitigated by enhanced quality control and global harmonization. Leading companies are investing in R&D and capacity expansion to meet escalating global demand.

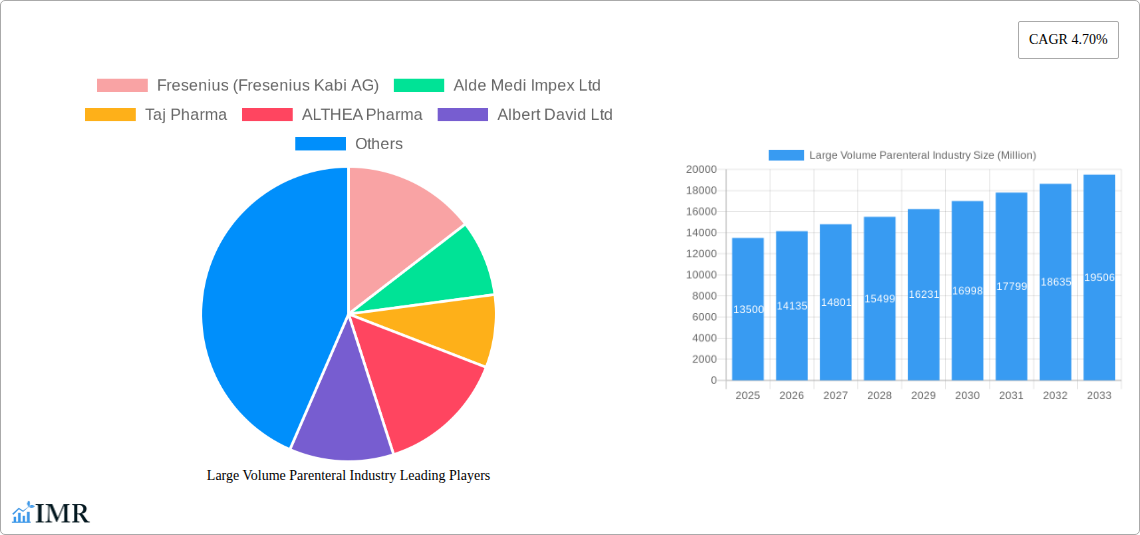

Large Volume Parenteral Industry Company Market Share

Large Volume Parenteral Industry Report: Market Dynamics, Growth, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the Large Volume Parenteral (LVP) Industry, a critical segment of the pharmaceutical and healthcare sector. Covering the historical period from 2019 to 2024 and forecasting through 2033, with a base and estimated year of 2025, this report provides actionable insights for stakeholders. We delve into market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, emerging opportunities, growth accelerators, and the pivotal role of key players. The report meticulously examines the parent market (the overall LVP industry) and its intricate child markets (specific segments, applications, and packaging types), providing a granular view of market evolution and future potential. All volume-related figures are presented in Million Units.

Large Volume Parenteral Industry Market Dynamics & Structure

The global LVP market exhibits a moderately concentrated structure, with a few key players holding significant market share. Technological innovation is a primary driver, fueled by advancements in aseptic manufacturing, lyophilization, and automated filling technologies. Robust regulatory frameworks, including stringent GMP guidelines and pharmacopoeial standards, shape product development and market entry. While direct substitutes are limited due to the nature of parenteral administration, alternative delivery methods for certain therapeutic agents can present indirect competition. End-user demographics, particularly the increasing elderly population and the rising prevalence of chronic diseases, significantly influence demand. Mergers and acquisitions (M&A) are ongoing, consolidating market share and enhancing R&D capabilities. For instance, the acquisition of smaller specialized LVP manufacturers by larger pharmaceutical giants is a recurring trend to expand product portfolios and geographic reach. The market's maturity in developed regions contrasts with the rapid growth potential in emerging economies, creating a dynamic competitive landscape. Barriers to entry include high capital investment for sterile manufacturing facilities, complex regulatory approvals, and the need for specialized expertise in formulation and sterile processing.

- Market Concentration: Moderately concentrated with key global players.

- Technological Drivers: Aseptic processing, advanced lyophilization, automated filling, sterile filtration.

- Regulatory Frameworks: GMP, FDA, EMA, national regulatory bodies.

- Competitive Landscape: Dominated by established pharmaceutical and contract manufacturing organizations (CMOs).

- End-User Demographics: Aging population, chronic disease prevalence, hospital and clinic demand.

- M&A Trends: Consolidation for portfolio expansion and R&D enhancement.

Large Volume Parenteral Industry Growth Trends & Insights

The Large Volume Parenteral Industry is poised for substantial growth, driven by escalating healthcare needs and advancements in drug delivery systems. The global LVP market size is projected to experience a robust Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. This expansion is propelled by a confluence of factors, including the rising incidence of chronic diseases like cancer, diabetes, and cardiovascular ailments, which often necessitate parenteral administration of life-saving medications. The increasing preference for intravenous fluid therapy to manage hydration and electrolyte imbalances, particularly in hospital settings and critical care units, further bolsters demand.

Technological disruptions are playing a pivotal role in shaping the LVP market. Innovations in drug formulation, such as the development of more stable parenteral drugs, are expanding therapeutic applications. Furthermore, the adoption of advanced manufacturing technologies, including isolator technology and single-use systems, enhances product safety, reduces contamination risks, and improves production efficiency. The shift towards personalized medicine and the development of biologics and complex molecules, which are often administered parenterally, are significant market disruptors.

Consumer behavior shifts also contribute to market dynamics. Patients and healthcare providers are increasingly seeking convenient and effective drug delivery methods. The growing demand for home healthcare services and the development of user-friendly parenteral formulations are influencing product development and market penetration strategies. The LVP market penetration is also being driven by a growing awareness of the benefits of parenteral nutrition in specific patient populations, including those with gastrointestinal disorders or critical illnesses. The increasing volume of therapeutic injections and fluid balance injections underscores the fundamental role of LVPs in modern medicine.

Dominant Regions, Countries, or Segments in Large Volume Parenteral Industry

The Large Volume Parenteral Industry is experiencing robust growth across various regions and segments, with North America and Europe currently leading in terms of market share and technological adoption. However, the Asia-Pacific region is emerging as a significant growth engine, driven by a burgeoning healthcare infrastructure, a large and growing patient population, and increasing investments in pharmaceutical manufacturing.

Within the parent market, the child market segments based on Volume play a crucial role. The 250 ml - 500 ml and 500 ml - 1000 ml volume categories are currently dominant, driven by their widespread use in fluid therapy and the administration of various therapeutic agents. The 1000 ml - 2000 ml and 2000 ml and more segments are also witnessing steady growth, particularly in critical care settings and for large-volume fluid replacement.

In terms of Application, Fluid Balance Injections represent a substantial portion of the market, reflecting the continuous need for intravenous hydration and electrolyte management. Therapeutic Injections are another major segment, encompassing a vast array of drugs for various medical conditions, including antibiotics, chemotherapy agents, and pain management medications. Nutritious Injections, primarily parenteral nutrition solutions, are also experiencing a steady upward trend, especially in catering to malnourished or critically ill patients.

The Type of Packaging also influences market dynamics. While Bottles remain a traditional and widely used packaging format, Bags (such as IV bags made from flexible plastic materials) are gaining significant traction due to their ease of handling, reduced breakage risk, and integration with advanced infusion systems. The preference for bags is particularly pronounced in hospital environments.

Key drivers for regional dominance include:

- Economic Policies: Favorable government initiatives and investments in healthcare infrastructure, particularly in countries like China, India, and Brazil, are fueling market expansion.

- Infrastructure: Well-established healthcare systems, advanced hospital facilities, and robust distribution networks in North America and Europe contribute to their market leadership.

- Technological Adoption: Higher adoption rates of advanced manufacturing technologies and sterile processing in developed nations contribute to their market share.

- Disease Burden: The prevalence of chronic diseases and the demand for specialized treatments directly correlate with the consumption of LVPs.

- Regulatory Environment: Clear and supportive regulatory pathways for pharmaceutical product approvals can accelerate market growth in specific regions.

The market share within these segments is dynamic, with continuous innovation and strategic partnerships influencing competitive positioning. The growth potential in the Asia-Pacific region, driven by increasing healthcare expenditure and a rising middle class, suggests a future shift in regional dominance towards this area.

Large Volume Parenteral Industry Product Landscape

The Large Volume Parenteral Industry product landscape is characterized by a continuous stream of innovations aimed at enhancing drug efficacy, safety, and patient convenience. Key product developments include the introduction of pre-mixed solutions for complex drug formulations, reducing preparation time and potential errors in clinical settings. Advanced drug delivery systems, such as extended-release parenteral formulations, are also gaining prominence, offering improved patient compliance and therapeutic outcomes. The development of novel excipients and stabilization technologies allows for the formulation of previously unstable therapeutic agents into safe and effective parenteral products. Furthermore, there is a growing focus on environmentally friendly and sustainable packaging solutions, including the development of recyclable or biodegradable IV bags and bottles. The performance metrics of these products are rigorously evaluated for sterility, pyrogenicity, particle load, and drug stability, ensuring compliance with stringent regulatory standards and delivering reliable therapeutic benefits.

Key Drivers, Barriers & Challenges in Large Volume Parenteral Industry

The Large Volume Parenteral Industry is propelled by several key drivers. The escalating global burden of chronic diseases, such as cancer and diabetes, which often require intravenous drug administration, is a primary growth catalyst. Advancements in biotechnology and the development of complex biologic drugs and vaccines, many of which are administered parenterally, are also significantly expanding the market. Furthermore, the increasing demand for parenteral nutrition in critically ill patients and the growing trend towards home healthcare, which necessitates easy-to-administer parenteral solutions, are substantial growth accelerators.

- Key Drivers:

- Rising prevalence of chronic diseases.

- Development of biologics and complex pharmaceutical molecules.

- Increasing demand for parenteral nutrition.

- Growth of home healthcare services.

- Technological advancements in sterile manufacturing.

Conversely, the industry faces significant barriers and challenges. The stringent regulatory requirements for parenteral products, including rigorous quality control and sterile manufacturing processes, pose a substantial hurdle for new entrants and can prolong product approval timelines. High capital investments required for establishing and maintaining state-of-the-art sterile manufacturing facilities are also a considerable barrier. Supply chain disruptions, particularly for raw materials and specialized excipients, can impact production and lead to shortages. Moreover, the threat of counterfeit or substandard parenteral products, along with increasing price pressures from healthcare payers and governments, presents ongoing challenges.

- Key Barriers & Challenges:

- Stringent regulatory compliance and lengthy approval processes.

- High capital investment for sterile manufacturing facilities.

- Supply chain vulnerabilities and raw material shortages.

- Risk of counterfeit and substandard products.

- Intensifying price pressures and cost containment measures.

Emerging Opportunities in Large Volume Parenteral Industry

Emerging opportunities within the Large Volume Parenteral Industry are centered around innovation and unmet medical needs. The development of novel parenteral formulations for rare diseases and orphan drugs presents a significant untapped market. Advancements in nanotechnology and targeted drug delivery systems offer the potential for more efficacious and less toxic parenteral therapies. The growing demand for lyophilized parenteral drugs, which offer extended shelf life and stability, is another area of opportunity, especially for biologics and sensitive molecules. Furthermore, the expansion of healthcare access in emerging economies, coupled with increasing disposable incomes, is creating new markets for standard and specialized parenteral products. The adoption of single-use technologies in aseptic manufacturing also presents opportunities for cost-effectiveness and increased flexibility in production.

Growth Accelerators in the Large Volume Parenteral Industry Industry

Several catalysts are accelerating the long-term growth of the Large Volume Parenteral Industry. Technological breakthroughs in aseptic processing, such as continuous manufacturing and advanced isolator technologies, are enhancing efficiency and product quality. Strategic partnerships between pharmaceutical companies and contract manufacturing organizations (CMOs) are facilitating faster product development and market entry, especially for complex parenteral drugs. The increasing investment in research and development for novel therapeutic areas, including oncology, immunology, and infectious diseases, which heavily rely on parenteral delivery, is a significant growth driver. Moreover, the expanding global reach of healthcare services and the growing demand for advanced medical treatments in developing nations are creating substantial market expansion opportunities.

Key Players Shaping the Large Volume Parenteral Industry Market

- Fresenius (Fresenius Kabi AG)

- Alde Medi Impex Ltd

- Taj Pharma

- ALTHEA Pharma

- Albert David Ltd

- Higgs Healthcare

- Grifols S A

- Baxter International

- B Braun SE

- BML Parenteral Drugs

- Pfizer Inc

Notable Milestones in Large Volume Parenteral Industry Sector

- November 2022: WuXi STA, a subsidiary of WuXi AppTec, inaugurated a new parenteral formulation manufacturing line in Wuxi City, China. This facility features a fully automatic vial loading/unloading system and a 15 m2 lyophiliser within an enclosed isolator, capable of filling 200 vials per minute, significantly boosting large-volume parenteral drug production speed.

- June 2022: Akums Drugs & Pharmaceuticals Ltd., an Indian contract manufacturing pharmaceutical company, secured European Union (EU) GMP approval for two manufacturing units in Haridwar. One unit is dedicated to solid oral dosage forms, while the other specializes in both large and small-volume parenteral lines, including vials, ampoules, eyedrops, FFS, and dry powder injections.

In-Depth Large Volume Parenteral Industry Market Outlook

The Large Volume Parenteral Industry is characterized by a robust and optimistic market outlook, driven by sustained demand from critical healthcare applications and continuous innovation. Growth accelerators such as technological advancements in sterile manufacturing, strategic collaborations between key industry players, and expanding global healthcare access are poised to propel the market forward. The increasing development of complex biologic drugs and personalized therapies, which are inherently reliant on parenteral administration, will further fuel market expansion. Strategic opportunities lie in leveraging emerging markets, investing in R&D for novel drug delivery systems, and focusing on sustainable manufacturing practices. The industry is expected to witness consistent growth, driven by the essential role LVPs play in patient care worldwide.

Large Volume Parenteral Industry Segmentation

-

1. Volume

- 1.1. 100 ml - 250 ml

- 1.2. 250 ml - 500 ml

- 1.3. 500 ml - 1000 ml

- 1.4. 1000 ml - 2000 ml

- 1.5. 2000 ml and more

-

2. Application

- 2.1. Therapeutic Injections

- 2.2. Fluid Balance Injections

- 2.3. Nutritious Injections

-

3. Type of Packaging

- 3.1. Bottles

- 3.2. Bags

Large Volume Parenteral Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Large Volume Parenteral Industry Regional Market Share

Geographic Coverage of Large Volume Parenteral Industry

Large Volume Parenteral Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Number of Surgeries; Increase in Prevalence of Chronic Diseases and Rise in Adoption of Fluid Replacement Therapies

- 3.3. Market Restrains

- 3.3.1. Challenges in Formulation of LVPs

- 3.4. Market Trends

- 3.4.1. Therapeutics Injections Segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Large Volume Parenteral Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Volume

- 5.1.1. 100 ml - 250 ml

- 5.1.2. 250 ml - 500 ml

- 5.1.3. 500 ml - 1000 ml

- 5.1.4. 1000 ml - 2000 ml

- 5.1.5. 2000 ml and more

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Therapeutic Injections

- 5.2.2. Fluid Balance Injections

- 5.2.3. Nutritious Injections

- 5.3. Market Analysis, Insights and Forecast - by Type of Packaging

- 5.3.1. Bottles

- 5.3.2. Bags

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Volume

- 6. North America Large Volume Parenteral Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Volume

- 6.1.1. 100 ml - 250 ml

- 6.1.2. 250 ml - 500 ml

- 6.1.3. 500 ml - 1000 ml

- 6.1.4. 1000 ml - 2000 ml

- 6.1.5. 2000 ml and more

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Therapeutic Injections

- 6.2.2. Fluid Balance Injections

- 6.2.3. Nutritious Injections

- 6.3. Market Analysis, Insights and Forecast - by Type of Packaging

- 6.3.1. Bottles

- 6.3.2. Bags

- 6.1. Market Analysis, Insights and Forecast - by Volume

- 7. Europe Large Volume Parenteral Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Volume

- 7.1.1. 100 ml - 250 ml

- 7.1.2. 250 ml - 500 ml

- 7.1.3. 500 ml - 1000 ml

- 7.1.4. 1000 ml - 2000 ml

- 7.1.5. 2000 ml and more

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Therapeutic Injections

- 7.2.2. Fluid Balance Injections

- 7.2.3. Nutritious Injections

- 7.3. Market Analysis, Insights and Forecast - by Type of Packaging

- 7.3.1. Bottles

- 7.3.2. Bags

- 7.1. Market Analysis, Insights and Forecast - by Volume

- 8. Asia Pacific Large Volume Parenteral Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Volume

- 8.1.1. 100 ml - 250 ml

- 8.1.2. 250 ml - 500 ml

- 8.1.3. 500 ml - 1000 ml

- 8.1.4. 1000 ml - 2000 ml

- 8.1.5. 2000 ml and more

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Therapeutic Injections

- 8.2.2. Fluid Balance Injections

- 8.2.3. Nutritious Injections

- 8.3. Market Analysis, Insights and Forecast - by Type of Packaging

- 8.3.1. Bottles

- 8.3.2. Bags

- 8.1. Market Analysis, Insights and Forecast - by Volume

- 9. Middle East and Africa Large Volume Parenteral Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Volume

- 9.1.1. 100 ml - 250 ml

- 9.1.2. 250 ml - 500 ml

- 9.1.3. 500 ml - 1000 ml

- 9.1.4. 1000 ml - 2000 ml

- 9.1.5. 2000 ml and more

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Therapeutic Injections

- 9.2.2. Fluid Balance Injections

- 9.2.3. Nutritious Injections

- 9.3. Market Analysis, Insights and Forecast - by Type of Packaging

- 9.3.1. Bottles

- 9.3.2. Bags

- 9.1. Market Analysis, Insights and Forecast - by Volume

- 10. South America Large Volume Parenteral Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Volume

- 10.1.1. 100 ml - 250 ml

- 10.1.2. 250 ml - 500 ml

- 10.1.3. 500 ml - 1000 ml

- 10.1.4. 1000 ml - 2000 ml

- 10.1.5. 2000 ml and more

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Therapeutic Injections

- 10.2.2. Fluid Balance Injections

- 10.2.3. Nutritious Injections

- 10.3. Market Analysis, Insights and Forecast - by Type of Packaging

- 10.3.1. Bottles

- 10.3.2. Bags

- 10.1. Market Analysis, Insights and Forecast - by Volume

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Fresenius (Fresenius Kabi AG)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Alde Medi Impex Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Taj Pharma

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ALTHEA Pharma

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Albert David Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Higgs Healthcae

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Grifols S A

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Baxter International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 B Braun SE

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BML Parenteral Drugs

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pfizer Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Fresenius (Fresenius Kabi AG)

List of Figures

- Figure 1: Global Large Volume Parenteral Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Large Volume Parenteral Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Large Volume Parenteral Industry Revenue (billion), by Volume 2025 & 2033

- Figure 4: North America Large Volume Parenteral Industry Volume (K Unit), by Volume 2025 & 2033

- Figure 5: North America Large Volume Parenteral Industry Revenue Share (%), by Volume 2025 & 2033

- Figure 6: North America Large Volume Parenteral Industry Volume Share (%), by Volume 2025 & 2033

- Figure 7: North America Large Volume Parenteral Industry Revenue (billion), by Application 2025 & 2033

- Figure 8: North America Large Volume Parenteral Industry Volume (K Unit), by Application 2025 & 2033

- Figure 9: North America Large Volume Parenteral Industry Revenue Share (%), by Application 2025 & 2033

- Figure 10: North America Large Volume Parenteral Industry Volume Share (%), by Application 2025 & 2033

- Figure 11: North America Large Volume Parenteral Industry Revenue (billion), by Type of Packaging 2025 & 2033

- Figure 12: North America Large Volume Parenteral Industry Volume (K Unit), by Type of Packaging 2025 & 2033

- Figure 13: North America Large Volume Parenteral Industry Revenue Share (%), by Type of Packaging 2025 & 2033

- Figure 14: North America Large Volume Parenteral Industry Volume Share (%), by Type of Packaging 2025 & 2033

- Figure 15: North America Large Volume Parenteral Industry Revenue (billion), by Country 2025 & 2033

- Figure 16: North America Large Volume Parenteral Industry Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Large Volume Parenteral Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Large Volume Parenteral Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Large Volume Parenteral Industry Revenue (billion), by Volume 2025 & 2033

- Figure 20: Europe Large Volume Parenteral Industry Volume (K Unit), by Volume 2025 & 2033

- Figure 21: Europe Large Volume Parenteral Industry Revenue Share (%), by Volume 2025 & 2033

- Figure 22: Europe Large Volume Parenteral Industry Volume Share (%), by Volume 2025 & 2033

- Figure 23: Europe Large Volume Parenteral Industry Revenue (billion), by Application 2025 & 2033

- Figure 24: Europe Large Volume Parenteral Industry Volume (K Unit), by Application 2025 & 2033

- Figure 25: Europe Large Volume Parenteral Industry Revenue Share (%), by Application 2025 & 2033

- Figure 26: Europe Large Volume Parenteral Industry Volume Share (%), by Application 2025 & 2033

- Figure 27: Europe Large Volume Parenteral Industry Revenue (billion), by Type of Packaging 2025 & 2033

- Figure 28: Europe Large Volume Parenteral Industry Volume (K Unit), by Type of Packaging 2025 & 2033

- Figure 29: Europe Large Volume Parenteral Industry Revenue Share (%), by Type of Packaging 2025 & 2033

- Figure 30: Europe Large Volume Parenteral Industry Volume Share (%), by Type of Packaging 2025 & 2033

- Figure 31: Europe Large Volume Parenteral Industry Revenue (billion), by Country 2025 & 2033

- Figure 32: Europe Large Volume Parenteral Industry Volume (K Unit), by Country 2025 & 2033

- Figure 33: Europe Large Volume Parenteral Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Large Volume Parenteral Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Large Volume Parenteral Industry Revenue (billion), by Volume 2025 & 2033

- Figure 36: Asia Pacific Large Volume Parenteral Industry Volume (K Unit), by Volume 2025 & 2033

- Figure 37: Asia Pacific Large Volume Parenteral Industry Revenue Share (%), by Volume 2025 & 2033

- Figure 38: Asia Pacific Large Volume Parenteral Industry Volume Share (%), by Volume 2025 & 2033

- Figure 39: Asia Pacific Large Volume Parenteral Industry Revenue (billion), by Application 2025 & 2033

- Figure 40: Asia Pacific Large Volume Parenteral Industry Volume (K Unit), by Application 2025 & 2033

- Figure 41: Asia Pacific Large Volume Parenteral Industry Revenue Share (%), by Application 2025 & 2033

- Figure 42: Asia Pacific Large Volume Parenteral Industry Volume Share (%), by Application 2025 & 2033

- Figure 43: Asia Pacific Large Volume Parenteral Industry Revenue (billion), by Type of Packaging 2025 & 2033

- Figure 44: Asia Pacific Large Volume Parenteral Industry Volume (K Unit), by Type of Packaging 2025 & 2033

- Figure 45: Asia Pacific Large Volume Parenteral Industry Revenue Share (%), by Type of Packaging 2025 & 2033

- Figure 46: Asia Pacific Large Volume Parenteral Industry Volume Share (%), by Type of Packaging 2025 & 2033

- Figure 47: Asia Pacific Large Volume Parenteral Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Asia Pacific Large Volume Parenteral Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Asia Pacific Large Volume Parenteral Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Large Volume Parenteral Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Large Volume Parenteral Industry Revenue (billion), by Volume 2025 & 2033

- Figure 52: Middle East and Africa Large Volume Parenteral Industry Volume (K Unit), by Volume 2025 & 2033

- Figure 53: Middle East and Africa Large Volume Parenteral Industry Revenue Share (%), by Volume 2025 & 2033

- Figure 54: Middle East and Africa Large Volume Parenteral Industry Volume Share (%), by Volume 2025 & 2033

- Figure 55: Middle East and Africa Large Volume Parenteral Industry Revenue (billion), by Application 2025 & 2033

- Figure 56: Middle East and Africa Large Volume Parenteral Industry Volume (K Unit), by Application 2025 & 2033

- Figure 57: Middle East and Africa Large Volume Parenteral Industry Revenue Share (%), by Application 2025 & 2033

- Figure 58: Middle East and Africa Large Volume Parenteral Industry Volume Share (%), by Application 2025 & 2033

- Figure 59: Middle East and Africa Large Volume Parenteral Industry Revenue (billion), by Type of Packaging 2025 & 2033

- Figure 60: Middle East and Africa Large Volume Parenteral Industry Volume (K Unit), by Type of Packaging 2025 & 2033

- Figure 61: Middle East and Africa Large Volume Parenteral Industry Revenue Share (%), by Type of Packaging 2025 & 2033

- Figure 62: Middle East and Africa Large Volume Parenteral Industry Volume Share (%), by Type of Packaging 2025 & 2033

- Figure 63: Middle East and Africa Large Volume Parenteral Industry Revenue (billion), by Country 2025 & 2033

- Figure 64: Middle East and Africa Large Volume Parenteral Industry Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East and Africa Large Volume Parenteral Industry Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East and Africa Large Volume Parenteral Industry Volume Share (%), by Country 2025 & 2033

- Figure 67: South America Large Volume Parenteral Industry Revenue (billion), by Volume 2025 & 2033

- Figure 68: South America Large Volume Parenteral Industry Volume (K Unit), by Volume 2025 & 2033

- Figure 69: South America Large Volume Parenteral Industry Revenue Share (%), by Volume 2025 & 2033

- Figure 70: South America Large Volume Parenteral Industry Volume Share (%), by Volume 2025 & 2033

- Figure 71: South America Large Volume Parenteral Industry Revenue (billion), by Application 2025 & 2033

- Figure 72: South America Large Volume Parenteral Industry Volume (K Unit), by Application 2025 & 2033

- Figure 73: South America Large Volume Parenteral Industry Revenue Share (%), by Application 2025 & 2033

- Figure 74: South America Large Volume Parenteral Industry Volume Share (%), by Application 2025 & 2033

- Figure 75: South America Large Volume Parenteral Industry Revenue (billion), by Type of Packaging 2025 & 2033

- Figure 76: South America Large Volume Parenteral Industry Volume (K Unit), by Type of Packaging 2025 & 2033

- Figure 77: South America Large Volume Parenteral Industry Revenue Share (%), by Type of Packaging 2025 & 2033

- Figure 78: South America Large Volume Parenteral Industry Volume Share (%), by Type of Packaging 2025 & 2033

- Figure 79: South America Large Volume Parenteral Industry Revenue (billion), by Country 2025 & 2033

- Figure 80: South America Large Volume Parenteral Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: South America Large Volume Parenteral Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: South America Large Volume Parenteral Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Large Volume Parenteral Industry Revenue billion Forecast, by Volume 2020 & 2033

- Table 2: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Volume 2020 & 2033

- Table 3: Global Large Volume Parenteral Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Global Large Volume Parenteral Industry Revenue billion Forecast, by Type of Packaging 2020 & 2033

- Table 6: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Type of Packaging 2020 & 2033

- Table 7: Global Large Volume Parenteral Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Large Volume Parenteral Industry Revenue billion Forecast, by Volume 2020 & 2033

- Table 10: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Volume 2020 & 2033

- Table 11: Global Large Volume Parenteral Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 12: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Global Large Volume Parenteral Industry Revenue billion Forecast, by Type of Packaging 2020 & 2033

- Table 14: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Type of Packaging 2020 & 2033

- Table 15: Global Large Volume Parenteral Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Large Volume Parenteral Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: United States Large Volume Parenteral Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Large Volume Parenteral Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada Large Volume Parenteral Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Large Volume Parenteral Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Mexico Large Volume Parenteral Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Large Volume Parenteral Industry Revenue billion Forecast, by Volume 2020 & 2033

- Table 24: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Volume 2020 & 2033

- Table 25: Global Large Volume Parenteral Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 26: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 27: Global Large Volume Parenteral Industry Revenue billion Forecast, by Type of Packaging 2020 & 2033

- Table 28: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Type of Packaging 2020 & 2033

- Table 29: Global Large Volume Parenteral Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Germany Large Volume Parenteral Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Germany Large Volume Parenteral Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Large Volume Parenteral Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Large Volume Parenteral Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: France Large Volume Parenteral Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: France Large Volume Parenteral Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Italy Large Volume Parenteral Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Italy Large Volume Parenteral Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Spain Large Volume Parenteral Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Spain Large Volume Parenteral Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Large Volume Parenteral Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Large Volume Parenteral Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Global Large Volume Parenteral Industry Revenue billion Forecast, by Volume 2020 & 2033

- Table 44: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Volume 2020 & 2033

- Table 45: Global Large Volume Parenteral Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 46: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 47: Global Large Volume Parenteral Industry Revenue billion Forecast, by Type of Packaging 2020 & 2033

- Table 48: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Type of Packaging 2020 & 2033

- Table 49: Global Large Volume Parenteral Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: China Large Volume Parenteral Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: China Large Volume Parenteral Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Japan Large Volume Parenteral Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Japan Large Volume Parenteral Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: India Large Volume Parenteral Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: India Large Volume Parenteral Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Australia Large Volume Parenteral Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: Australia Large Volume Parenteral Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Korea Large Volume Parenteral Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: South Korea Large Volume Parenteral Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Asia Pacific Large Volume Parenteral Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Rest of Asia Pacific Large Volume Parenteral Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Large Volume Parenteral Industry Revenue billion Forecast, by Volume 2020 & 2033

- Table 64: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Volume 2020 & 2033

- Table 65: Global Large Volume Parenteral Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 66: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 67: Global Large Volume Parenteral Industry Revenue billion Forecast, by Type of Packaging 2020 & 2033

- Table 68: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Type of Packaging 2020 & 2033

- Table 69: Global Large Volume Parenteral Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 70: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: GCC Large Volume Parenteral Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: GCC Large Volume Parenteral Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Africa Large Volume Parenteral Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: South Africa Large Volume Parenteral Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Rest of Middle East and Africa Large Volume Parenteral Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Rest of Middle East and Africa Large Volume Parenteral Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Global Large Volume Parenteral Industry Revenue billion Forecast, by Volume 2020 & 2033

- Table 78: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Volume 2020 & 2033

- Table 79: Global Large Volume Parenteral Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 80: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 81: Global Large Volume Parenteral Industry Revenue billion Forecast, by Type of Packaging 2020 & 2033

- Table 82: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Type of Packaging 2020 & 2033

- Table 83: Global Large Volume Parenteral Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 84: Global Large Volume Parenteral Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 85: Brazil Large Volume Parenteral Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 86: Brazil Large Volume Parenteral Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Argentina Large Volume Parenteral Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 88: Argentina Large Volume Parenteral Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 89: Rest of South America Large Volume Parenteral Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 90: Rest of South America Large Volume Parenteral Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Large Volume Parenteral Industry?

The projected CAGR is approximately 5.05%.

2. Which companies are prominent players in the Large Volume Parenteral Industry?

Key companies in the market include Fresenius (Fresenius Kabi AG), Alde Medi Impex Ltd, Taj Pharma, ALTHEA Pharma, Albert David Ltd, Higgs Healthcae, Grifols S A, Baxter International, B Braun SE, BML Parenteral Drugs, Pfizer Inc.

3. What are the main segments of the Large Volume Parenteral Industry?

The market segments include Volume, Application, Type of Packaging.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.385 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Number of Surgeries; Increase in Prevalence of Chronic Diseases and Rise in Adoption of Fluid Replacement Therapies.

6. What are the notable trends driving market growth?

Therapeutics Injections Segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Challenges in Formulation of LVPs.

8. Can you provide examples of recent developments in the market?

In November 2022, WuXi STA, a subsidiary of WuXi AppTec, started operating a new parenteral formulation manufacturing line at the drug product site in Wuxi City, China. This new line features a fully automatic vial loading/unloading system and a built-in 15 m2 lyophiliser in a fully enclosed isolator. The filling speed can reach 200 vials per minute, significantly accelerating large-volume parental drug product production speed.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Large Volume Parenteral Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Large Volume Parenteral Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Large Volume Parenteral Industry?

To stay informed about further developments, trends, and reports in the Large Volume Parenteral Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence