Key Insights

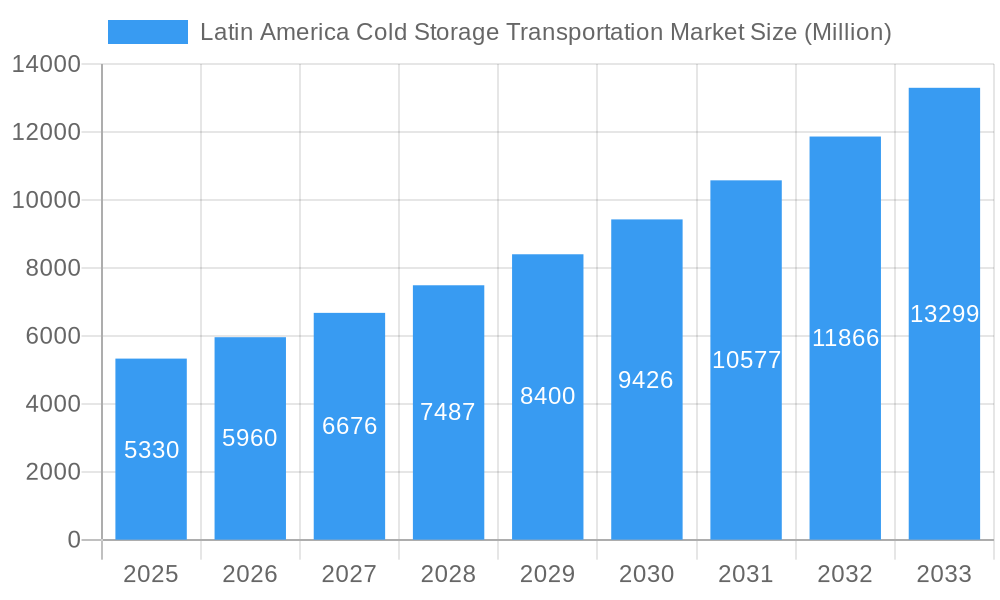

The Latin American cold storage and transportation market, valued at $5.33 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 11.60% from 2025 to 2033. This surge is driven by several key factors. The region's burgeoning food and beverage industry, particularly the increasing demand for processed foods, dairy products, and perishable goods, necessitates efficient cold chain solutions. Furthermore, rising consumer incomes and changing lifestyles are fueling greater consumption of temperature-sensitive products, stimulating market demand. Growth in e-commerce and the rise of organized retail are also contributing factors, as these sectors require reliable cold chain logistics for timely and quality product delivery. Government initiatives promoting food safety and infrastructure development in several Latin American countries are further bolstering market expansion. However, challenges remain, including the need for modernization of existing infrastructure, inconsistent regulatory frameworks across different nations, and high initial investment costs associated with adopting advanced cold chain technologies.

Latin America Cold Storage Transportation Market Market Size (In Billion)

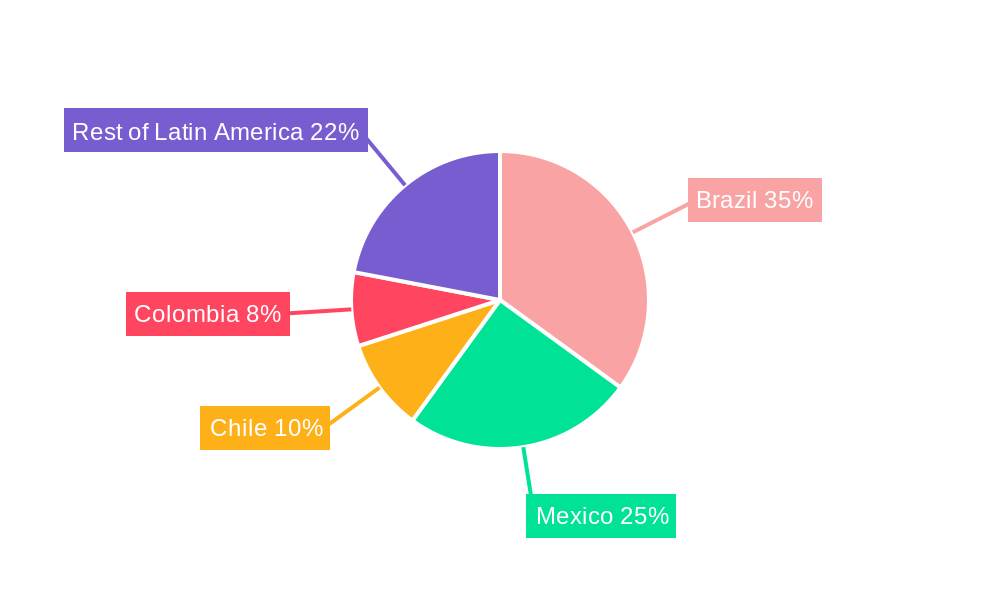

Significant segmental variations exist within the market. The cold storage/refrigerated warehousing segment dominates, followed by refrigerated transportation. Value-added services, such as order management and blast freezing, are witnessing increased adoption, reflecting the growing need for sophisticated supply chain management. Among end-users, fruits and vegetables, dairy products, and meat and seafood represent major market segments. Brazil, Mexico, and Chile are the leading national markets, exhibiting substantial growth potential due to their expanding economies and population size. Competition in this market is intense, with both domestic and international players vying for market share. Key players are focusing on strategic expansions, acquisitions, and technological advancements to strengthen their market positions. The forecast period (2025-2033) presents substantial opportunities for growth, driven by continuous market expansion and innovative cold chain solutions. However, companies need to address the challenges presented by infrastructure limitations and regulatory variations to effectively capitalize on this potential.

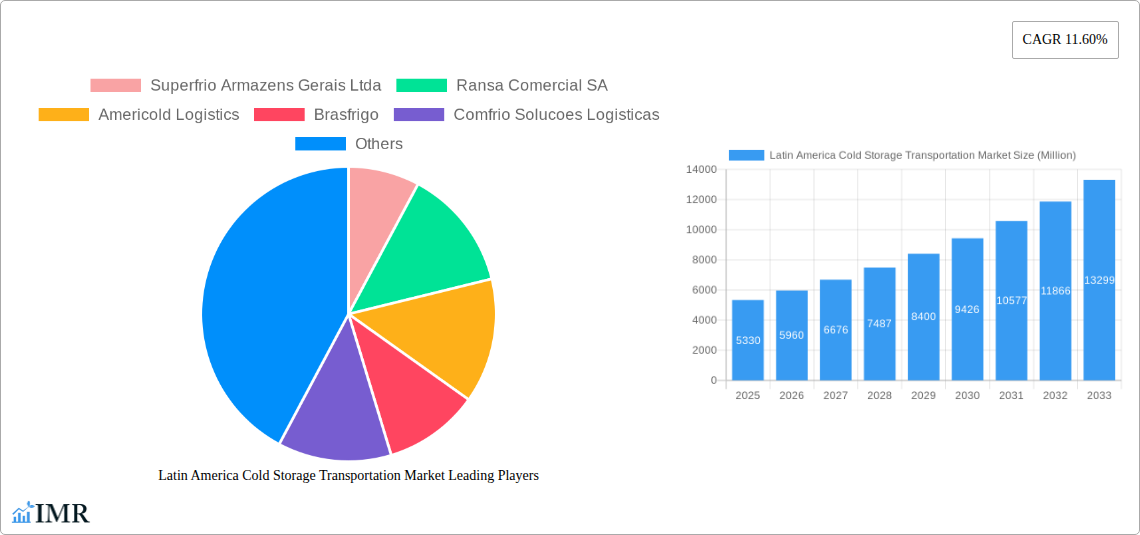

Latin America Cold Storage Transportation Market Company Market Share

Latin America Cold Storage Transportation Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America cold storage transportation market, encompassing market dynamics, growth trends, key players, and future outlook. The report covers the parent market of cold chain logistics and the child markets of cold storage warehousing, refrigerated transportation, and value-added services across various temperature ranges and end-user segments in key Latin American countries. The study period spans from 2019 to 2033, with 2025 as the base year and a forecast period of 2025-2033. The market size is valued in million units.

Latin America Cold Storage Transportation Market Dynamics & Structure

This section analyzes the market's competitive landscape, technological advancements, regulatory influences, and market trends. The report delves into market concentration, examining the market share held by key players like Superfrio Armazens Gerais Ltda, Ransa Comercial SA, Americold Logistics, Brasfrigo, Comfrio Solucoes Logisticas, and Qualianz, alongside six other significant companies. We analyze M&A activity within the sector, quantifying deal volumes over the historical period and identifying emerging trends. The impact of technological innovations, such as automated storage and retrieval systems (ASRS) and temperature monitoring technologies, is assessed. Regulatory frameworks impacting the cold chain industry, including food safety regulations and transportation standards, are also examined. Finally, the report analyzes the influence of substitute products and the demographic shifts among end-users, affecting demand patterns.

- Market Concentration: xx% held by top 6 players in 2024 (estimated).

- M&A Activity: xx deals in the historical period (2019-2024), indicating a trend of consolidation.

- Technological Innovation: Adoption of IoT and AI in cold chain monitoring is accelerating, but high initial investment costs remain a barrier for smaller players.

- Regulatory Landscape: Stringent food safety regulations are driving the need for advanced temperature control and traceability systems.

Latin America Cold Storage Transportation Market Growth Trends & Insights

This section presents a detailed analysis of the Latin America cold storage transportation market's growth trajectory. Using extensive data analysis, the report examines the market's evolution in terms of size, adoption rates, technological disruptions, and consumer behavior. Specific metrics, including Compound Annual Growth Rate (CAGR) and market penetration rates, are provided for key segments and regions. The analysis encompasses the impact of factors like rising disposable incomes, changing dietary habits, and the growth of e-commerce on the demand for cold storage and transportation services. The influence of emerging technologies on market dynamics is also highlighted.

- Market Size: xx Million Units in 2024 (estimated), projected to reach xx Million Units by 2033.

- CAGR: xx% during the forecast period (2025-2033).

- Adoption Rates: Increasing adoption of temperature-controlled packaging and advanced logistics solutions.

- Consumer Behavior Shifts: Growing demand for fresh and processed foods, particularly in urban areas, is driving market growth.

Dominant Regions, Countries, or Segments in Latin America Cold Storage Transportation Market

This section pinpoints the leading regions, countries, and segments driving market expansion within Latin America. It analyzes market share and growth potential across various service types (Cold Storage/Refrigerated Warehousing, Refrigerated Transportation, Value-added Services), temperature categories (Chilled, Frozen, Ambient), end-user sectors (Fruits and Vegetables, Dairy Products, Fish, Meat and Seafood, Processed Food, Pharmaceutical, Bakery and Confectionery, Other), and countries (Mexico, Brazil, Chile, Colombia, Rest of Latin America). Key growth drivers, such as economic policies, infrastructure development, and consumer preferences, are identified using bullet points, while dominance factors are analyzed in detail within paragraphs.

- Dominant Region: Brazil, due to its large population and robust agricultural sector.

- Fastest-Growing Segment: Value-added services, driven by the demand for efficient supply chain solutions.

- Key Drivers: Expanding middle class, increasing urbanization, and government initiatives to improve infrastructure.

Latin America Cold Storage Transportation Market Product Landscape

This section provides a concise overview of the product innovations, applications, and performance metrics within the market. It highlights the unique selling propositions and technological advancements shaping the industry, including the integration of advanced technologies like IoT sensors for real-time monitoring and automated systems for improved efficiency and cost reduction.

This section will discuss the advanced features offered by various cold storage solutions and refrigerated transportation methods, highlighting improvements in temperature control precision, reduced energy consumption, and enhanced safety features. Emphasis is placed on products that deliver enhanced traceability, inventory management, and overall supply chain visibility.

Key Drivers, Barriers & Challenges in Latin America Cold Storage Transportation Market

This section identifies and analyzes the primary growth drivers and constraints within the Latin America cold storage transportation market. Growth drivers include factors such as rising demand for perishable goods, e-commerce expansion, and investment in cold chain infrastructure. Conversely, key challenges include supply chain disruptions, regulatory hurdles, and intense competition. Quantifiable impacts of these challenges on market growth are presented.

- Key Drivers: Growing middle class, increased demand for processed foods, government initiatives to improve infrastructure.

- Key Challenges: Fluctuations in energy prices, lack of skilled labor, and inefficient transportation networks.

Emerging Opportunities in Latin America Cold Storage Transportation Market

This section outlines promising opportunities for growth in the Latin America cold storage transportation market. These include expanding into underserved regions, developing specialized services for niche products, leveraging technological advancements like blockchain for improved traceability, and catering to the growing demand for sustainable and eco-friendly cold chain solutions.

Growth Accelerators in the Latin America Cold Storage Transportation Market Industry

This section discusses the long-term growth catalysts within the Latin America cold storage transportation market. It emphasizes technological advancements, strategic partnerships, and market expansion strategies that will drive sustainable growth in the years ahead. This includes the integration of advanced technologies, collaborations between logistics providers and technology companies, and expansion into new markets and product categories.

Key Players Shaping the Latin America Cold Storage Transportation Market Market

This section profiles key players in the Latin America cold storage transportation market, including:

- Superfrio Armazens Gerais Ltda

- Ransa Comercial SA

- Americold Logistics

- Brasfrigo

- Comfrio Solucoes Logisticas

- Qualianz

- Frialsa Frigorificos SA

- Arfrio Armazens Gerais Frigorificos

- Friozem Armazens Frigorificos Ltda

- Localfrio

- 3 Other Companies (Key Information/Overview)

Notable Milestones in Latin America Cold Storage Transportation Market Sector

- June 2023: Canadian Pacific's partnership to develop cold storage facilities integrated with rail transport in Kansas City, impacting cross-border logistics between the US and Mexico.

- November 2022: Emergent Cold LatAm's acquisition of a distribution facility in Recife, Brazil, expanding its presence in the Northeast.

- October 2022: Expansion of a temperature-controlled facility in Panama City, Panama, increasing storage capacity.

In-Depth Latin America Cold Storage Transportation Market Market Outlook

This concluding section summarizes the key growth accelerators and strategic opportunities within the Latin America cold storage transportation market. It focuses on future market potential and highlights the potential for continued growth driven by factors such as technological innovation, infrastructure development, and evolving consumer preferences. The report emphasizes the strategic opportunities for businesses to capitalize on the market's dynamic nature and contribute to the development of a more efficient and resilient cold chain infrastructure in Latin America.

Latin America Cold Storage Transportation Market Segmentation

-

1. Service

- 1.1. Cold Storage/Refrigerated Warehousing

- 1.2. Refrigerated Transportation

- 1.3. Value-ad

-

2. Temperature

- 2.1. Chilled

- 2.2. Frozen

- 2.3. Ambient

-

3. End User

- 3.1. Fruits and Vegetables

- 3.2. Dairy Pr

- 3.3. Fish, Meat, and Seafood

- 3.4. Processed Food

- 3.5. Pharmaceutical (Includes Biopharma)

- 3.6. Bakery and Confectionery

- 3.7. Other End Users

Latin America Cold Storage Transportation Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Cold Storage Transportation Market Regional Market Share

Geographic Coverage of Latin America Cold Storage Transportation Market

Latin America Cold Storage Transportation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth in E-commerce4.; Healthcare Sector is the market

- 3.3. Market Restrains

- 3.3.1. 4.; Supply Chain Disruptions4.; Lack of Temperature- Controlled Warehouses

- 3.4. Market Trends

- 3.4.1. Increasing Consumer Demand for Perishable Goods the warehousing space is growing in the region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Cold Storage Transportation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Cold Storage/Refrigerated Warehousing

- 5.1.2. Refrigerated Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.2.3. Ambient

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Fruits and Vegetables

- 5.3.2. Dairy Pr

- 5.3.3. Fish, Meat, and Seafood

- 5.3.4. Processed Food

- 5.3.5. Pharmaceutical (Includes Biopharma)

- 5.3.6. Bakery and Confectionery

- 5.3.7. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Superfrio Armazens Gerais Ltda

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ransa Comercial SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Americold Logistics

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Brasfrigo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Comfrio Solucoes Logisticas

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Qualianz**List Not Exhaustive 6 3 Other Companies (Key Information/Overview)6 4 Key Vendors and Suppliers (Cold Storage Equipment Manufacturers Carrier Manufacturers and Technology Providers for the Cold Chain Industry

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Frialsa Frigorificos SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arfrio Armazens Gerais Frigorificos

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Friozem Armazens Frigorificos Ltda

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Localfrio

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Superfrio Armazens Gerais Ltda

List of Figures

- Figure 1: Latin America Cold Storage Transportation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Cold Storage Transportation Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Cold Storage Transportation Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Latin America Cold Storage Transportation Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 3: Latin America Cold Storage Transportation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Latin America Cold Storage Transportation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Latin America Cold Storage Transportation Market Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Latin America Cold Storage Transportation Market Revenue Million Forecast, by Temperature 2020 & 2033

- Table 7: Latin America Cold Storage Transportation Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Latin America Cold Storage Transportation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Brazil Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Argentina Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Chile Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Colombia Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Peru Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Venezuela Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Ecuador Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Bolivia Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Paraguay Latin America Cold Storage Transportation Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Cold Storage Transportation Market?

The projected CAGR is approximately 11.60%.

2. Which companies are prominent players in the Latin America Cold Storage Transportation Market?

Key companies in the market include Superfrio Armazens Gerais Ltda, Ransa Comercial SA, Americold Logistics, Brasfrigo, Comfrio Solucoes Logisticas, Qualianz**List Not Exhaustive 6 3 Other Companies (Key Information/Overview)6 4 Key Vendors and Suppliers (Cold Storage Equipment Manufacturers Carrier Manufacturers and Technology Providers for the Cold Chain Industry, Frialsa Frigorificos SA, Arfrio Armazens Gerais Frigorificos, Friozem Armazens Frigorificos Ltda, Localfrio.

3. What are the main segments of the Latin America Cold Storage Transportation Market?

The market segments include Service, Temperature, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.33 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth in E-commerce4.; Healthcare Sector is the market.

6. What are the notable trends driving market growth?

Increasing Consumer Demand for Perishable Goods the warehousing space is growing in the region.

7. Are there any restraints impacting market growth?

4.; Supply Chain Disruptions4.; Lack of Temperature- Controlled Warehouses.

8. Can you provide examples of recent developments in the market?

June 2023: Canadian Pacific announced a strategic partnership to co-host American warehouse facilities on Canadian Pacific's (CPKC) network. Supported by rail transportation, the goal is to construct the first facility on CPKC's network in Kansas City (Mo.), Kansas, to combine cold storage and added-value services with accelerated intermodal transport solutions connecting key markets in the U.S., Midwest, and Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Cold Storage Transportation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Cold Storage Transportation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Cold Storage Transportation Market?

To stay informed about further developments, trends, and reports in the Latin America Cold Storage Transportation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence