Key Insights

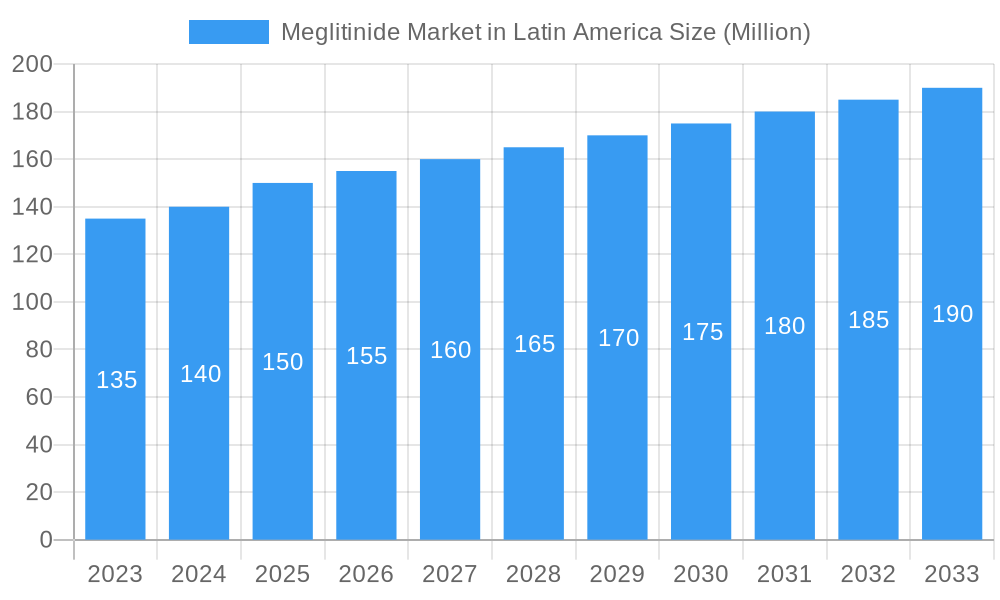

The Latin American meglitinide market is projected to reach USD 47.1 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 3.9% through 2033. This growth is attributed to the rising incidence of type 2 diabetes, linked to lifestyle shifts, increasing obesity, and an aging demographic. Meglitinides are essential for managing postprandial hyperglycemia, a key factor in diabetes care. Brazil and Mexico are expected to lead the market due to their substantial patient populations and established healthcare systems. Enhanced awareness and accessibility of diabetes management solutions further support market expansion.

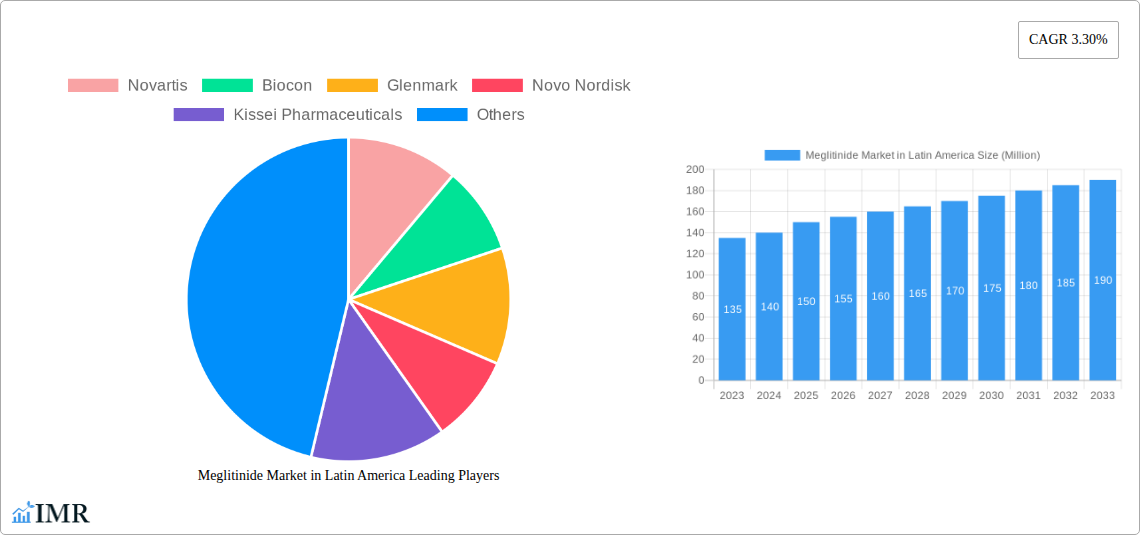

Meglitinide Market in Latin America Market Size (In Billion)

Market expansion is influenced by updated treatment guidelines and a focus on personalized diabetes management. Pharmaceutical companies are broadening their product offerings and market presence to meet Latin American patient needs. Potential challenges include competition from novel antidiabetic classes, regulatory hurdles, and price sensitivity. Nevertheless, the ongoing demand for effective postprandial glucose control and the proven efficacy of meglitinides will maintain market momentum. Strategic partnerships, innovation, and targeted strategies by key companies will be crucial for leveraging growth opportunities in this evolving market.

Meglitinide Market in Latin America Company Market Share

Meglitinide Market in Latin America: Comprehensive Market Analysis and Future Outlook (2019-2033)

Unlock critical insights into the burgeoning Latin American meglitinide market. This in-depth report provides a detailed analysis of market dynamics, growth trends, regional dominance, product innovations, and key players. With a focus on the parent meglitinide market and its child markets across Brazil, Mexico, and the Rest of Latin America, this study offers essential intelligence for stakeholders seeking to capitalize on opportunities in this vital therapeutic area. Forecasted to reach significant growth from its 2025 base year through 2033, this report equips you with data-driven strategies for success.

Meglitinide Market in Latin America Market Dynamics & Structure

The Latin American meglitinide market is characterized by a dynamic interplay of factors influencing its structure and growth trajectory. Market concentration varies across key economies, with established pharmaceutical giants and emerging local players contributing to a competitive yet evolving landscape. Technological innovation remains a crucial driver, with ongoing research and development focused on enhancing efficacy and patient compliance for type 2 diabetes management. Robust regulatory frameworks, while essential for drug safety and efficacy, can also present hurdles for market entry and product approvals. The presence of competitive product substitutes, including other oral hypoglycemic agents and newer treatment modalities, necessitates continuous innovation and value proposition refinement. End-user demographics, primarily individuals with type 2 diabetes, are expanding due to rising obesity rates and an aging population across the region. Mergers and acquisitions (M&A) trends, though currently moderate, present opportunities for market consolidation and strategic expansion, particularly for companies seeking to broaden their portfolios and market reach. The market is projected to witness a steady increase in M&A activities as companies aim to enhance their competitive standing. For instance, the market share of key players is estimated to be around 65% for the top five companies, indicating a moderately concentrated market. Innovation barriers, such as high R&D costs and stringent clinical trial requirements, are significant considerations for new entrants.

Meglitinide Market in Latin America Growth Trends & Insights

The meglitinide market in Latin America is poised for substantial expansion, driven by an escalating prevalence of type 2 diabetes and an increasing demand for effective oral antidiabetic medications. Market size evolution is expected to be robust, reflecting the growing patient pool and the adoption of meglitinides as a vital component of diabetes management regimens. The adoption rates of meglitinides are projected to climb steadily, buoyed by physician preference for their rapid onset of action and their utility in postprandial glucose control. Technological disruptions, while not as pronounced as in some other pharmaceutical sectors, are subtly influencing the market through advancements in drug formulation and delivery systems, aiming to improve patient convenience and adherence. Consumer behavior shifts are also playing a crucial role, with a growing awareness among patients and healthcare providers regarding the benefits of personalized diabetes management strategies. This includes a greater inclination towards oral medications that offer flexibility and fewer side effects compared to older treatment options. The market is anticipated to experience a Compound Annual Growth Rate (CAGR) of approximately 5.5% from 2025 to 2033. Market penetration of meglitinides is projected to rise from around 18% in the base year of 2025 to an estimated 25% by 2033, signifying increased accessibility and acceptance. The continuous research into combination therapies and novel drug combinations further bolsters the growth trajectory. The economic development and increasing healthcare expenditure across Latin American nations also contribute significantly to the overall market expansion, making advanced diabetes treatments more accessible to a wider population segment.

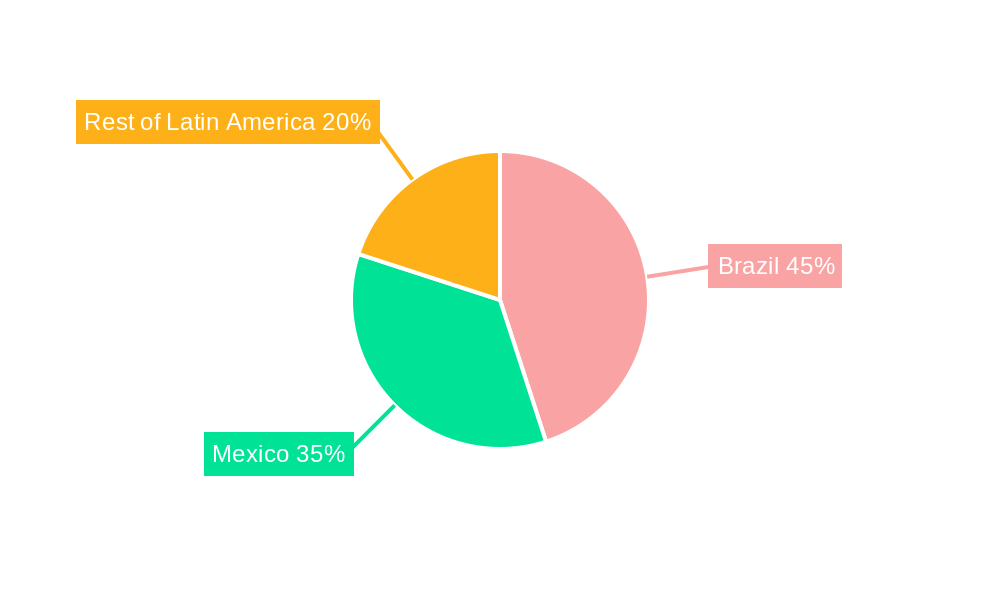

Dominant Regions, Countries, or Segments in Meglitinide Market in Latin America

Within the Latin American meglitinide market, Brazil stands out as the dominant region, spearheading growth and market penetration for the Drug: Meglitinides segment. This regional leadership is attributable to a confluence of factors, including a large and growing patient population suffering from type 2 diabetes, which is exacerbated by rising rates of obesity and sedentary lifestyles. Brazil’s robust healthcare infrastructure, coupled with increasing government initiatives focused on chronic disease management, further bolsters the demand for effective antidiabetic medications like meglitinides.

Key drivers contributing to Brazil's dominance include:

- High Prevalence of Type 2 Diabetes: Brazil consistently ranks among countries with a high prevalence of diabetes, creating a substantial patient pool requiring consistent and effective treatment.

- Expanding Healthcare Access: Improvements in healthcare access and insurance coverage allow more individuals to seek and afford necessary medical interventions, including diabetes medications.

- Favorable Reimbursement Policies: The presence of supportive reimbursement policies for oral antidiabetic drugs facilitates broader patient access to meglitinides.

- Active Pharmaceutical Market: A well-established pharmaceutical market with a strong presence of both multinational corporations and local manufacturers ensures a consistent supply and diverse product offerings.

- Increased Awareness and Education: Growing public awareness campaigns and educational initiatives regarding diabetes management empower patients to engage more actively in their treatment.

Mexico, while a significant market, follows Brazil in terms of market share and growth potential within the meglitinide sector. The Rest of Latin America, encompassing countries like Argentina, Colombia, and Chile, represents a fragmented yet collectively important market with considerable untapped potential. The growth in these sub-regions is often influenced by country-specific economic policies, healthcare reforms, and the adoption rates of newer therapeutic agents.

The dominance of Brazil is further solidified by its market share, estimated to be around 45% of the total Latin American meglitinide market in 2025. The growth potential in Mexico is projected at a CAGR of approximately 4.8%, while the Rest of Latin America is anticipated to grow at a CAGR of 4.5%. The meglitinides segment itself is the primary focus, as other antidiabetic drug classes represent distinct market segments. The combined effect of a large patient base, improving healthcare infrastructure, and proactive disease management strategies positions Brazil as the pivotal market for meglitinides in Latin America.

Meglitinide Market in Latin America Product Landscape

The product landscape for meglitinides in Latin America is characterized by established formulations and emerging innovations aimed at enhancing patient outcomes. Key products within the meglitinide class, such as Repaglinide and Nateglinide, are widely available and prescribed for their effectiveness in managing postprandial hyperglycemia. Manufacturers are focusing on optimizing these existing molecules through improved drug delivery systems and combination therapies. Unique selling propositions revolve around their rapid onset of action, enabling flexible dosing around meal times, and their relatively favorable safety profiles compared to some other antidiabetic classes. Technological advancements are subtly influencing the market, with a focus on developing formulations that offer improved patient compliance and potentially reduced side effect profiles. The performance metrics of these products are continuously evaluated through clinical studies and real-world evidence, guiding their positioning in the competitive market.

Key Drivers, Barriers & Challenges in Meglitinide Market in Latin America

Key Drivers:

The growth of the meglitinide market in Latin America is propelled by several significant factors. The escalating prevalence of type 2 diabetes, driven by lifestyle changes and an aging population, creates a sustained and growing demand for effective treatments. Increasing healthcare expenditure across the region enhances accessibility to pharmaceutical products. Furthermore, the established efficacy and relatively favorable safety profile of meglitinides, particularly for postprandial glucose control, make them a preferred choice for a significant patient segment. Technological advancements leading to improved drug formulations and combination therapies also act as crucial growth accelerators.

Barriers & Challenges:

Despite the positive outlook, the meglitinide market faces several barriers and challenges. The presence of competitive product substitutes, including other oral antidiabetic agents and newer classes of drugs like SGLT2 inhibitors and GLP-1 receptor agonists, poses a significant competitive threat, with an estimated market share erosion of approximately 10% due to newer entrants. Stringent regulatory approval processes in some Latin American countries can lead to delays in market access. Economic volatility and varying levels of healthcare infrastructure across the region can impact affordability and accessibility for a substantial portion of the population. Supply chain disruptions and geopolitical uncertainties can also affect the consistent availability of these medications, with an estimated 5% impact on market access.

Emerging Opportunities in Meglitinide Market in Latin America

Emerging opportunities in the Latin American meglitinide market lie in underserved patient populations and the development of innovative therapeutic approaches. The growing awareness and diagnosis of diabetes in younger adults present an untapped market for flexible and effective oral treatments. The development of fixed-dose combination therapies that integrate meglitinides with other antidiabetic agents could significantly improve patient adherence and treatment outcomes, tapping into a potential market expansion of 15%. Furthermore, exploring partnerships with local healthcare providers and government entities to implement targeted diabetes management programs can foster greater market penetration and patient engagement.

Growth Accelerators in the Meglitinide Market in Latin America Industry

The long-term growth of the meglitinide market in Latin America is set to be accelerated by several key catalysts. Continued advancements in pharmaceutical research and development are expected to yield novel formulations and potential combination therapies that offer enhanced efficacy and patient convenience. Strategic partnerships between global pharmaceutical companies and local distributors are crucial for expanding market reach and navigating diverse regulatory landscapes across the region. Furthermore, increased investment in diabetes awareness campaigns and patient education programs will drive higher demand and improved adherence, solidifying the position of meglitinides within comprehensive diabetes management strategies.

Key Players Shaping the Meglitinide Market in Latin America Market

- Novartis

- Biocon

- Glenmark

- Novo Nordisk

- Kissei Pharmaceuticals

- Boehringer Ingelheim

Notable Milestones in Meglitinide Market in Latin America Sector

- March 2023: A Randomized, Open-Label, Controlled, Parallel-group, Multicenter Trial is being conducted to evaluate the efficacy and safety of INS068 once daily (QD) in subjects with type 2 diabetes not adequately controlled with oral antidiabetic drugs compared to insulin Glargine QD for 26+26 weeks. This signifies ongoing research into novel treatment modalities that could impact the meglitinide landscape.

- January 2023: OXJournal reviewed the effects of meglitinides as a class of oral medications for treating type 2 diabetes, especially in young adults. This academic review highlights the continued relevance and potential therapeutic positioning of meglitinides for specific patient demographics.

In-Depth Meglitinide Market in Latin America Market Outlook

The future market potential for meglitinides in Latin America is robust, driven by the persistent and growing burden of type 2 diabetes and the ongoing need for effective oral therapies. Strategic opportunities lie in further optimizing existing meglitinide molecules and exploring innovative combination therapies that address the complex needs of diabetic patients. The expanding middle class and increased healthcare spending across the region are expected to fuel demand for advanced treatment options. Moreover, forging strong collaborations with regional health authorities and key opinion leaders will be instrumental in shaping prescribing patterns and ensuring sustained market growth. The market is projected to witness sustained growth from its 2025 base, with an anticipated market size of over $700 Million units by 2033.

Meglitinide Market in Latin America Segmentation

-

1. Drug

- 1.1. Meglitinides

-

2. Geography

- 2.1. Brazil

- 2.2. Mexico

- 2.3. Rest of Latin America

Meglitinide Market in Latin America Segmentation By Geography

- 1. Brazil

- 2. Mexico

- 3. Rest of Latin America

Meglitinide Market in Latin America Regional Market Share

Geographic Coverage of Meglitinide Market in Latin America

Meglitinide Market in Latin America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies

- 3.3. Market Restrains

- 3.3.1 ; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures

- 3.3.2 Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products

- 3.4. Market Trends

- 3.4.1. Rising Diabetes Prevalence in Latin America Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Meglitinide Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Drug

- 5.1.1. Meglitinides

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Mexico

- 5.2.3. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Mexico

- 5.3.3. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Drug

- 6. Brazil Meglitinide Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Drug

- 6.1.1. Meglitinides

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Mexico

- 6.2.3. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Drug

- 7. Mexico Meglitinide Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Drug

- 7.1.1. Meglitinides

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Mexico

- 7.2.3. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Drug

- 8. Rest of Latin America Meglitinide Market in Latin America Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Drug

- 8.1.1. Meglitinides

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Mexico

- 8.2.3. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Drug

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Novartis

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Biocon

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Glenmark

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Novo Nordisk

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Kissei Pharmaceuticals

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Boehringer Ingelheim

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.1 Novartis

List of Figures

- Figure 1: Meglitinide Market in Latin America Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Meglitinide Market in Latin America Share (%) by Company 2025

List of Tables

- Table 1: Meglitinide Market in Latin America Revenue billion Forecast, by Drug 2020 & 2033

- Table 2: Meglitinide Market in Latin America Volume K Unit Forecast, by Drug 2020 & 2033

- Table 3: Meglitinide Market in Latin America Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Meglitinide Market in Latin America Volume K Unit Forecast, by Geography 2020 & 2033

- Table 5: Meglitinide Market in Latin America Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Meglitinide Market in Latin America Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Meglitinide Market in Latin America Revenue billion Forecast, by Drug 2020 & 2033

- Table 8: Meglitinide Market in Latin America Volume K Unit Forecast, by Drug 2020 & 2033

- Table 9: Meglitinide Market in Latin America Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Meglitinide Market in Latin America Volume K Unit Forecast, by Geography 2020 & 2033

- Table 11: Meglitinide Market in Latin America Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Meglitinide Market in Latin America Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Meglitinide Market in Latin America Revenue billion Forecast, by Drug 2020 & 2033

- Table 14: Meglitinide Market in Latin America Volume K Unit Forecast, by Drug 2020 & 2033

- Table 15: Meglitinide Market in Latin America Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Meglitinide Market in Latin America Volume K Unit Forecast, by Geography 2020 & 2033

- Table 17: Meglitinide Market in Latin America Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Meglitinide Market in Latin America Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Meglitinide Market in Latin America Revenue billion Forecast, by Drug 2020 & 2033

- Table 20: Meglitinide Market in Latin America Volume K Unit Forecast, by Drug 2020 & 2033

- Table 21: Meglitinide Market in Latin America Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Meglitinide Market in Latin America Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: Meglitinide Market in Latin America Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Meglitinide Market in Latin America Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Meglitinide Market in Latin America?

The projected CAGR is approximately 3.9%.

2. Which companies are prominent players in the Meglitinide Market in Latin America?

Key companies in the market include Novartis, Biocon, Glenmark, Novo Nordisk, Kissei Pharmaceuticals, Boehringer Ingelheim.

3. What are the main segments of the Meglitinide Market in Latin America?

The market segments include Drug, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 47.1 billion as of 2022.

5. What are some drivers contributing to market growth?

; The Rise in Global Prevalence of Cases of Obesity due to Modern Sedentary Lifestyles; Rise in Awareness and Disposable Income in Developed Economies.

6. What are the notable trends driving market growth?

Rising Diabetes Prevalence in Latin America Region.

7. Are there any restraints impacting market growth?

; Highly Cost of Branded Products in Emerging Countries; Severe Adverse Associated with Medication Including Seizures. Suicidal Attempts and Even Death; Adoption of Traditional Yoga and Herbal Products.

8. Can you provide examples of recent developments in the market?

March 2023: A Randomized, Open-Label, Controlled, Parallel-group, Multicenter Trial is being conducted to evaluate the efficacy and safety of INS068 once daily (QD) in subjects with type 2 diabetes not adequately controlled with oral antidiabetic drugs compared to insulin Glargine QD for 26+26 weeks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Meglitinide Market in Latin America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Meglitinide Market in Latin America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Meglitinide Market in Latin America?

To stay informed about further developments, trends, and reports in the Meglitinide Market in Latin America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence