Key Insights

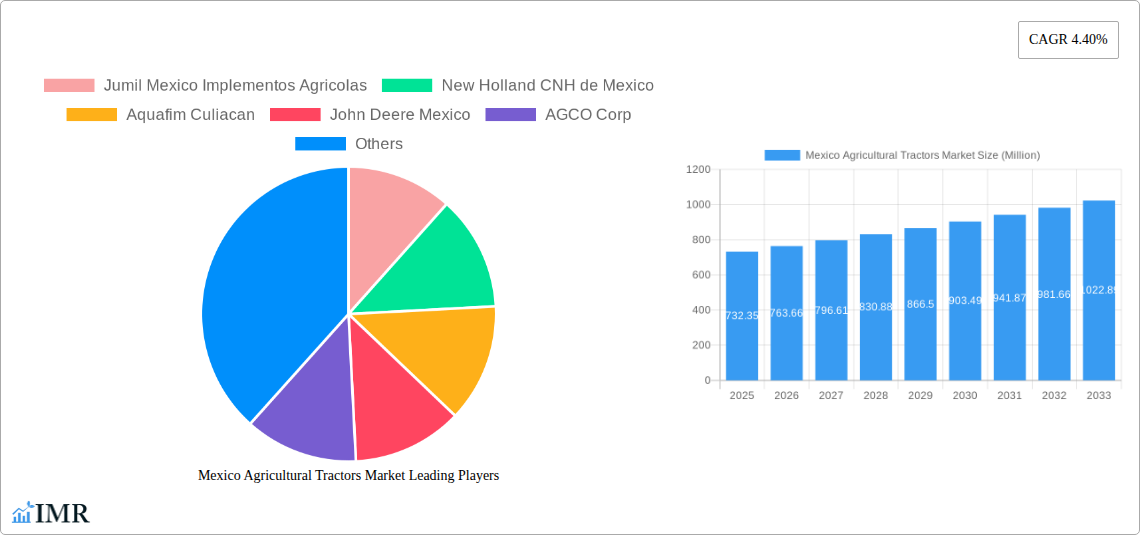

The Mexico agricultural tractors market, valued at $732.35 million in 2025, is projected to experience robust growth, driven by several key factors. Increasing government initiatives promoting agricultural modernization and intensification, coupled with a rising demand for efficient farming practices to meet the growing population's food needs, are major contributors to this expansion. Furthermore, the adoption of advanced technologies like precision farming and GPS-guided tractors is expected to further boost market growth. The market is segmented by tractor engine power (categorized into horsepower ranges), equipment types (plows, harrows, rotovators, cultivators, irrigation machinery, harvesting machinery, and haying/forage machinery), and prominent players like John Deere Mexico, Mahindra & Mahindra, and CNH Industrial. The diverse agricultural landscape of Mexico, encompassing various crops and farming techniques, necessitates a broad range of equipment, contributing to the market's dynamism. Challenges include fluctuating fuel prices, which directly impact operational costs, and the need for skilled labor to operate and maintain sophisticated machinery. However, ongoing investments in agricultural infrastructure and farmer training programs are mitigating these concerns.

Mexico Agricultural Tractors Market Market Size (In Million)

The forecast period of 2025-2033 anticipates a continued upward trajectory for the market, primarily fueled by the ongoing modernization of farming practices. The competitive landscape is characterized by both global and domestic players, resulting in a mix of advanced technologies and cost-effective solutions. Specific segments like irrigation machinery and harvesting machinery are poised for particularly strong growth due to the increasing emphasis on water conservation and efficient post-harvest management. While challenges remain, the overall outlook for the Mexico agricultural tractors market remains positive, indicating significant growth opportunities for market participants throughout the forecast period. Further research into specific sub-segments, like the impact of government subsidies on tractor adoption, would provide a more granular understanding of future market trends.

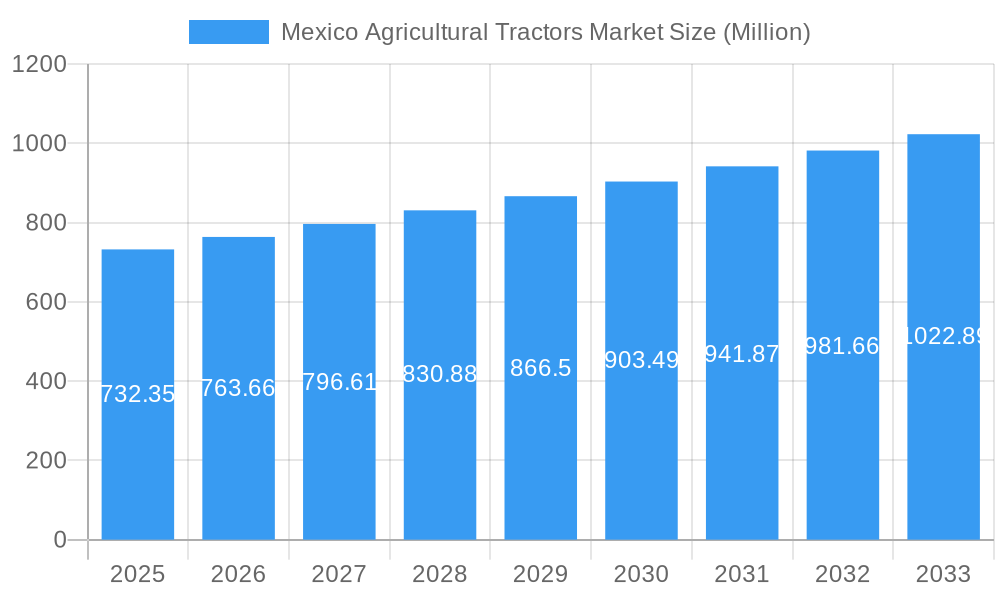

Mexico Agricultural Tractors Market Company Market Share

Mexico Agricultural Tractors Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Mexico agricultural tractors market, encompassing market dynamics, growth trends, key players, and future outlook. With a detailed examination of segments including tractors, irrigation machinery, harvesting machinery, and haying and forage machinery, this report is an invaluable resource for industry professionals, investors, and anyone seeking to understand this dynamic market. The study period covers 2019-2033, with 2025 as the base year and forecast period from 2025-2033.

Mexico Agricultural Tractors Market Market Dynamics & Structure

The Mexico agricultural tractors market exhibits a moderately concentrated structure, with key players like John Deere Mexico, AGCO Corp, Kubota Mexico S A de CV, and CNH Industrial NV holding significant market share (estimated at xx%). Technological innovation, driven by the need for increased efficiency and precision agriculture, is a key growth driver. Government regulations related to emissions and safety standards, along with the availability of affordable credit and government subsidies, influence market dynamics. Competition from imported tractors, particularly from countries with lower manufacturing costs, poses a challenge. The increasing adoption of precision farming technologies and the rising demand for high-horsepower tractors are shaping market trends. Furthermore, the market is witnessing an increase in M&A activity, with an estimated xx number of deals in the past five years, primarily focused on enhancing technological capabilities and expanding market reach.

- Market Concentration: Moderately concentrated, with top players holding xx% market share.

- Technological Innovation: Precision agriculture, automation, and GPS-guided systems are driving growth.

- Regulatory Framework: Emissions standards and safety regulations influence product development.

- Competitive Substitutes: Imported tractors from countries with lower production costs.

- End-User Demographics: Primarily large-scale commercial farms and increasingly smaller farms adopting mechanization.

- M&A Trends: xx deals in the last 5 years, focused on technological advancements and market expansion.

Mexico Agricultural Tractors Market Growth Trends & Insights

The Mexico agricultural tractors market is experiencing substantial growth, fueled by factors such as rising agricultural output, government initiatives promoting agricultural modernization, and increasing adoption of mechanization among smallholder farmers. The market size, estimated at xx million units in 2025, is projected to reach xx million units by 2033, registering a CAGR of xx% during the forecast period. This growth is driven by the rising demand for high-efficiency tractors, the adoption of advanced technologies such as GPS-guided systems and precision farming tools, and favorable government policies supporting agricultural mechanization. Consumer behavior is shifting towards a preference for fuel-efficient and technologically advanced tractors, impacting manufacturers’ product development strategies. Disruptions from new entrants and technological advancements such as electric tractors are creating new dynamics in the market.

Dominant Regions, Countries, or Segments in Mexico Agricultural Tractors Market

The Northern region of Mexico, encompassing states like Sonora, Sinaloa, and Baja California, currently dominates the agricultural tractors market due to its large-scale commercial farms and favorable climate for agricultural activities. This region's strong agricultural output and government investments in agricultural infrastructure significantly contribute to its market leadership. Within the product segments, high-horsepower tractors (engine power >100 HP) and equipment like plows, harrows, and cultivators are the leading segments due to the demand for efficient land preparation for large-scale farming. Irrigation machinery, specifically drip irrigation, is witnessing significant growth due to the increasing need for water conservation in the face of water scarcity.

- Key Drivers:

- Government incentives and subsidies for agricultural mechanization.

- Growing adoption of precision agriculture techniques.

- Rising demand for efficient water management solutions.

- Increasing agricultural output and land under cultivation.

- Dominant Regions: Northern Mexico (Sonora, Sinaloa, Baja California).

- Dominant Segments: High-horsepower tractors, plows, harrows, cultivators, drip irrigation systems.

Mexico Agricultural Tractors Market Product Landscape

The Mexican agricultural tractor market showcases a wide range of products catering to diverse farming needs. Tractors are available across various engine power categories, from small-scale units for smaller farms to large, high-horsepower models suitable for extensive commercial operations. Equipment choices include a broad spectrum of implements like plows, harrows, cultivators, and specialized tools for precision planting and fertilization. Irrigation machinery encompasses sprinkler, drip, and other advanced systems, while harvesting machinery includes combine harvesters and forage harvesters tailored for various crops. Key product innovations focus on fuel efficiency, enhanced precision, and ease of operation. Manufacturers are increasingly emphasizing features like GPS guidance, automated controls, and telematics for data-driven decision-making in agriculture.

Key Drivers, Barriers & Challenges in Mexico Agricultural Tractors Market

Key Drivers:

- Government support for agricultural modernization.

- Growing demand for higher yields and efficiency.

- Rising adoption of precision farming techniques.

- Increasing investment in agricultural infrastructure.

Challenges and Restraints:

- High initial investment costs for machinery.

- Limited access to financing options for smallholder farmers.

- Fluctuating fuel prices impacting operational costs.

- Competition from imported, lower-cost tractors.

Emerging Opportunities in Mexico Agricultural Tractors Market

- Growing demand for sustainable and environmentally friendly agricultural practices offers opportunities for manufacturers to develop and market electric tractors and related technologies.

- The increasing use of data analytics and precision agriculture provides opportunities for value-added services and precision farming solutions.

- The untapped potential in smaller farming operations presents an opportunity to develop affordable and adaptable machinery.

Growth Accelerators in the Mexico Agricultural Tractors Market Industry

Technological advancements in tractor design, precision farming tools, and automation are major growth catalysts. Strategic partnerships between tractor manufacturers and agricultural technology companies are fostering innovation. Market expansion strategies targeting smaller farms and diversification into specialized crop production are further accelerating market growth.

Key Players Shaping the Mexico Agricultural Tractors Market Market

- Jumil Mexico Implementos Agricolas

- New Holland CNH de Mexico

- Aquafim Culiacan

- John Deere Mexico

- AGCO Corp

- Valmont Industries Inc

- Kubota Mexico S A de CV

- Massey Ferguson

- CNH Industrial NV

- CLAAS KGaA mbH

- Mahindra & Mahindra Limite

- Case IH

- EnorossiMexicana SA de C

Notable Milestones in Mexico Agricultural Tractors Market Sector

- June 2022: John Deere expands tractor and cab production to Mexico from its Waterloo, Iowa plant due to labor market constraints in the US. This signifies a significant shift in manufacturing strategy and enhances Mexico's position in the global agricultural machinery supply chain.

- February 2022: Cellestial E-Mobility partners with Grupo Marvelsa to import electric tractors into Mexico. This marks the entry of electric tractors into the Mexican market and represents a significant step towards sustainable agriculture practices.

In-Depth Mexico Agricultural Tractors Market Market Outlook

The future of the Mexico agricultural tractors market appears promising, driven by continued growth in the agricultural sector, technological advancements, and supportive government policies. Strategic investments in research and development, strategic partnerships, and expansion into new markets will further fuel growth. The market's potential lies in catering to diverse farming needs, from small-scale operations to large-scale commercial farms, through product innovation and accessible financing solutions. The growing adoption of sustainable agricultural practices and precision farming technologies will shape the industry's trajectory in the coming years, presenting significant opportunities for manufacturers and service providers.

Mexico Agricultural Tractors Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Mexico Agricultural Tractors Market Segmentation By Geography

- 1. Mexico

Mexico Agricultural Tractors Market Regional Market Share

Geographic Coverage of Mexico Agricultural Tractors Market

Mexico Agricultural Tractors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Threat of Water Scarcity; Favorable Government Policies and Subsidies

- 3.3. Market Restrains

- 3.3.1. High Initial Capital Investments

- 3.4. Market Trends

- 3.4.1. Farm Labor Shortage And Decreasing Arable Land

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Agricultural Tractors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Jumil Mexico Implementos Agricolas

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 New Holland CNH de Mexico

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aquafim Culiacan

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 John Deere Mexico

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AGCO Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Valmont Industries Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kubota Mexico S A de CV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Massey Ferguson

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CNH Industrial NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CLAAS KGaA mbH

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Mahindra & Mahindra Limite

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Case IH

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 EnorossiMexicana SA de C

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Jumil Mexico Implementos Agricolas

List of Figures

- Figure 1: Mexico Agricultural Tractors Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico Agricultural Tractors Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Agricultural Tractors Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Mexico Agricultural Tractors Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Mexico Agricultural Tractors Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Mexico Agricultural Tractors Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Mexico Agricultural Tractors Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Mexico Agricultural Tractors Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Mexico Agricultural Tractors Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Mexico Agricultural Tractors Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Mexico Agricultural Tractors Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Mexico Agricultural Tractors Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Mexico Agricultural Tractors Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Mexico Agricultural Tractors Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Agricultural Tractors Market?

The projected CAGR is approximately 4.40%.

2. Which companies are prominent players in the Mexico Agricultural Tractors Market?

Key companies in the market include Jumil Mexico Implementos Agricolas, New Holland CNH de Mexico, Aquafim Culiacan, John Deere Mexico, AGCO Corp, Valmont Industries Inc, Kubota Mexico S A de CV, Massey Ferguson, CNH Industrial NV, CLAAS KGaA mbH, Mahindra & Mahindra Limite, Case IH, EnorossiMexicana SA de C.

3. What are the main segments of the Mexico Agricultural Tractors Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 732.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Threat of Water Scarcity; Favorable Government Policies and Subsidies.

6. What are the notable trends driving market growth?

Farm Labor Shortage And Decreasing Arable Land.

7. Are there any restraints impacting market growth?

High Initial Capital Investments.

8. Can you provide examples of recent developments in the market?

June 2022: John Deere has expanded the company's tractors and cab production from its Waterloo, Iowa plant to Mexico due to a tight labor market in the United States.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Agricultural Tractors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Agricultural Tractors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Agricultural Tractors Market?

To stay informed about further developments, trends, and reports in the Mexico Agricultural Tractors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence