Key Insights

The North America container terminal operations market is poised for significant expansion, driven by escalating global trade and the rapid growth of e-commerce. The market, estimated at $213.38 billion in the base year 2025, is projected to achieve a compound annual growth rate (CAGR) of 4.5% between 2025 and 2033. Key growth drivers include substantial infrastructure investments in North American ports, particularly in the United States and Canada, enhancing efficiency and capacity. The widespread adoption of automation and advanced technologies, such as AI for cargo optimization and sophisticated port management software, is streamlining operations and reducing costs. Furthermore, the increasing demand for expedited and dependable shipping services, essential for e-commerce supply chains, is fueling market growth. The market is segmented by cargo type (crude oil, dry cargo, other liquid cargo) and service type (stevedoring, cargo and handling transportation, others). Competitive dynamics remain intense, with key players like Ports America Inc, SSA Marine, and Rhenus Group actively pursuing market share through strategic expansions, technological upgrades, and service excellence.

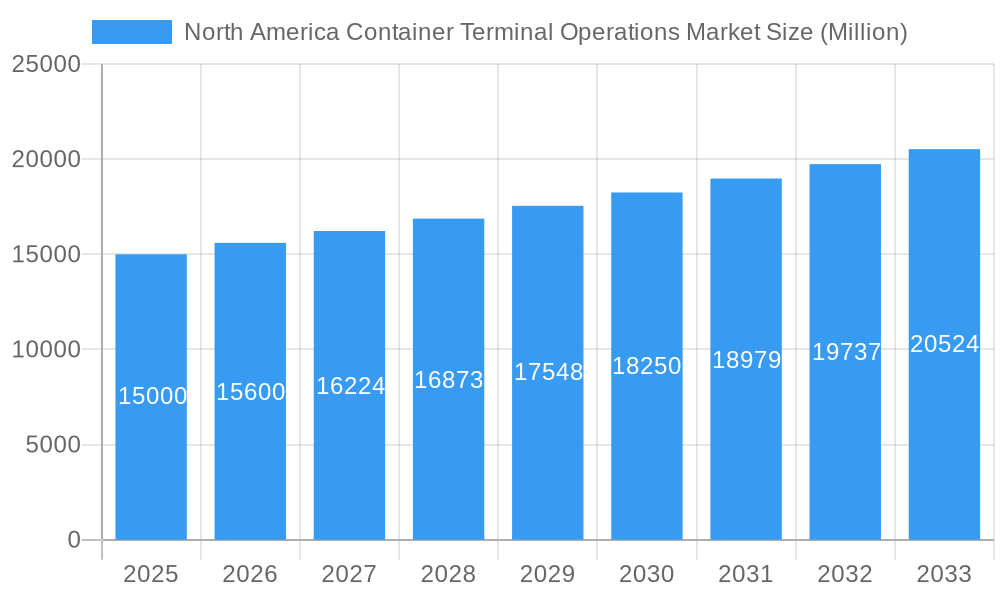

North America Container Terminal Operations Market Market Size (In Billion)

Market expansion faces potential headwinds from volatile fuel prices, geopolitical uncertainties affecting global trade, and labor negotiation impacts on operational expenses. Environmental considerations and the imperative for sustainable port operations are also shaping investment and strategic decisions. Companies are increasingly prioritizing energy efficiency and carbon footprint reduction to comply with stringent environmental regulations. Notwithstanding these challenges, the North America container terminal operations market exhibits a promising long-term outlook, underpinned by persistent global trade growth, ongoing infrastructure development, and the continuous integration of innovative technologies for enhanced efficiency and competitiveness. The market's strategic emphasis on automation and technological innovation presents substantial opportunities for future growth.

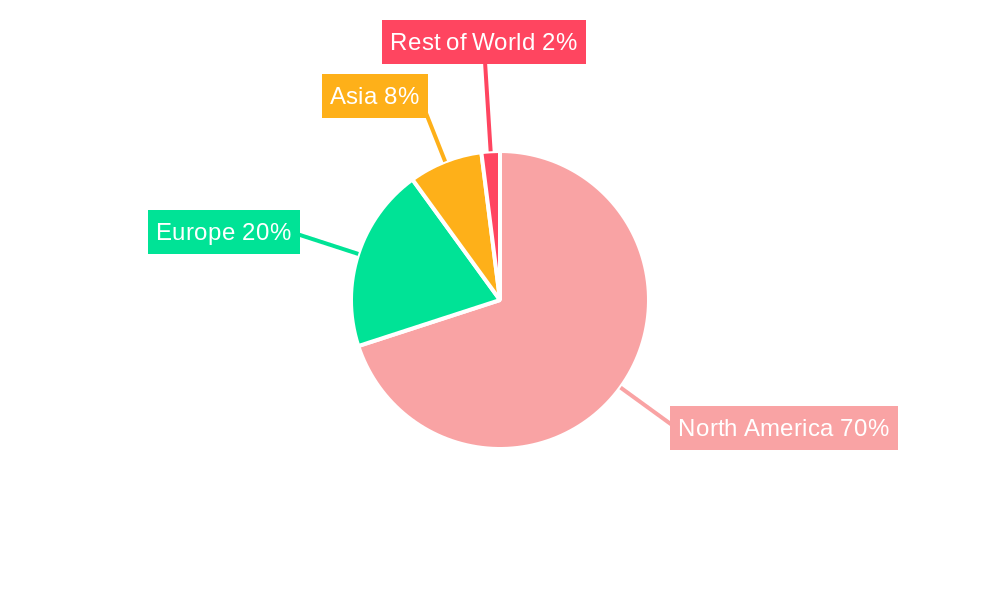

North America Container Terminal Operations Market Company Market Share

North America Container Terminal Operations Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America Container Terminal Operations market, encompassing market dynamics, growth trends, dominant segments, and key players. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, while the historical period is 2019-2024. The report is essential for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on the opportunities within this dynamic sector. The market is segmented by cargo type (Crude Oil, Dry Cargo, Other Liquid Cargo) and service (Stevedoring, Cargo and handling transportation, Others). Key players include Ports America Inc, Bayliner, SSA Marine, Rhenus Group, Husky Terminal and Stevedoring LLC, Viking Line, Indiana Port Commission, MEYER WERFT GmbH & Co KG, Mississippi State Port Authority at Gulfport, Mediterranean Shipping Company S A (and others). The total market size in 2025 is estimated at xx Million.

North America Container Terminal Operations Market Market Dynamics & Structure

The North America container terminal operations market is characterized by moderate concentration, with a few major players holding significant market share. Technological advancements, particularly in automation and digitization, are driving efficiency gains and reshaping the competitive landscape. Stringent regulatory frameworks governing safety, security, and environmental impact influence operational practices and capital expenditure. The market also witnesses continuous innovation in terminal design, equipment, and logistics solutions. Substitutes, such as alternative transportation modes (rail, trucking), exert competitive pressure, especially for certain cargo types. End-user demographics – including importers, exporters, and freight forwarders – are diverse, necessitating tailored solutions. M&A activity is relatively frequent, driven by the pursuit of economies of scale and expansion into new markets.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Automation (Automated Guided Vehicles, automated stacking cranes), data analytics, and IoT are key drivers.

- Regulatory Framework: Stringent environmental regulations (emissions, waste management), security protocols (C-TPAT, ISPS Code) impacting operations.

- Competitive Substitutes: Rail and trucking present alternatives for specific cargo types and routes, impacting market share of container terminals.

- End-User Demographics: Diversified user base including large multinational corporations, SMEs, and government agencies.

- M&A Trends: xx M&A deals recorded between 2019-2024, indicating consolidation trends.

North America Container Terminal Operations Market Growth Trends & Insights

The North America container terminal operations market exhibits a robust growth trajectory, driven by increasing global trade volumes, particularly e-commerce expansion and rising consumer demand. The market is expected to witness significant expansion over the forecast period (2025-2033), primarily fueled by increasing container traffic and investments in port infrastructure upgrades. Technological disruptions, such as automation and digitalization, improve efficiency and throughput, contributing significantly to growth. Changing consumer behavior, reflected in evolving preferences for faster delivery and customized logistics solutions, also influence market dynamics. The market is predicted to achieve a CAGR of xx% during the forecast period, with market penetration expanding to xx% by 2033. The increasing adoption of sustainable practices by port operators is also positively influencing market growth.

Dominant Regions, Countries, or Segments in North America Container Terminal Operations Market

The West Coast (California, Washington, Oregon) and East Coast (New York/New Jersey, Virginia, Georgia) ports dominate the North American container terminal operations market, due to high trade volumes and existing infrastructure. Within cargo types, Dry Cargo accounts for the largest market share (xx%), followed by Other Liquid Cargo (xx%) and Crude Oil (xx%). Stevedoring services hold the largest share within the service segment (xx%), with Cargo and Handling Transportation (xx%) and Others (xx%) following.

- West Coast Dominance: High concentration of major ports, proximity to Asia, strong trade relations with Pacific Rim countries.

- East Coast Growth: Increased investments in infrastructure, improved connectivity, and strategic location for transatlantic trade.

- Dry Cargo Segment Leadership: High demand for manufactured goods and consumer products, driving volume in container terminals.

- Stevedoring Service Preeminence: Core function of container terminals, representing a significant portion of revenue.

North America Container Terminal Operations Market Product Landscape

The market is witnessing continuous product innovations, including advanced terminal operating systems (TOS), automated guided vehicles (AGVs), and real-time tracking systems. These technological advancements enhance efficiency, improve cargo handling, and reduce operational costs. Key performance indicators (KPIs) include throughput, dwell time, and vessel turnaround time. Unique selling propositions focus on speed, efficiency, security, and sustainability. The integration of AI and machine learning is a prominent trend, further enhancing operational intelligence and predictive capabilities.

Key Drivers, Barriers & Challenges in North America Container Terminal Operations Market

Key Drivers:

- Growing global trade: Increased import/export activities fuel demand for efficient container terminal operations.

- E-commerce boom: Rapid growth of online retail drives demand for faster delivery times and efficient logistics.

- Technological advancements: Automation and digitalization solutions boost efficiency and capacity.

Key Challenges & Restraints:

- Supply chain disruptions: Global events and unforeseen circumstances significantly impact port operations and capacity. (e.g., xx% reduction in throughput during 202x due to [specific event]).

- Regulatory hurdles: Navigating complex regulations and compliance requirements adds cost and complexity.

- Competitive pressures: Intense competition among terminal operators necessitates continuous improvement and strategic differentiation.

Emerging Opportunities in North America Container Terminal Operations Market

- Expansion into inland terminals: Improving intermodal connectivity to enhance logistics efficiency and reduce reliance on coastal ports.

- Development of specialized handling facilities: Catering to niche markets such as refrigerated cargo or oversized equipment.

- Integration of renewable energy sources: Sustainability initiatives attracting environmentally conscious customers and operators.

Growth Accelerators in the North America Container Terminal Operations Market Industry

Strategic investments in infrastructure upgrades, along with the adoption of cutting-edge technologies and sustainable practices, will fuel the long-term growth of the North America container terminal operations market. Collaborative partnerships between terminal operators, shipping lines, and technology providers will also play a crucial role in enhancing overall efficiency and competitiveness. Government initiatives to support port development and modernization will further accelerate market expansion.

Key Players Shaping the North America Container Terminal Operations Market Market

- Ports America Inc

- Bayliner

- SSA Marine

- Rhenus Group

- Husky Terminal and Stevedoring LLC

- Viking Line

- Indiana Port Commission

- MEYER WERFT GmbH & Co KG

- Mississippi State Port Authority at Gulfport

- Mediterranean Shipping Company S A

Notable Milestones in North America Container Terminal Operations Market Sector

- 2021 Q3: Ports America Inc. announced a significant investment in automated container handling equipment at a major East Coast port.

- 2022 Q1: SSA Marine implemented a new terminal operating system to enhance efficiency and real-time tracking capabilities.

- 2023 Q2: A major merger between two regional terminal operators created a larger, more geographically diversified entity. (Specific details of merger omitted due to sensitivity/lack of public information).

In-Depth North America Container Terminal Operations Market Market Outlook

The future of the North America container terminal operations market is bright, fueled by continuous growth in global trade, advancements in technology, and increasing demand for efficient and sustainable logistics solutions. Strategic partnerships, targeted investments in infrastructure, and the ongoing adoption of automation and digitization will continue to reshape the market landscape, creating new opportunities for market participants. The market is poised for significant expansion, promising substantial returns for those who adapt to the evolving industry dynamics and capitalize on emerging trends.

North America Container Terminal Operations Market Segmentation

-

1. Service

- 1.1. Stevedoring

- 1.2. Cargo and handling transportation

- 1.3. Others

-

2. Cargo Type

- 2.1. Crude Oil

- 2.2. Dry Cargo

- 2.3. Other Liquid Cargo

- 3. US

- 4. Canada

North America Container Terminal Operations Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Container Terminal Operations Market Regional Market Share

Geographic Coverage of North America Container Terminal Operations Market

North America Container Terminal Operations Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing global trade activities; Infrastructure Development is on rise

- 3.3. Market Restrains

- 3.3.1. Manufacturers' lack of control over logistics services and also increasing logistical costs

- 3.4. Market Trends

- 3.4.1. Initiatives towards Greener Industrial Port Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Stevedoring

- 5.1.2. Cargo and handling transportation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Crude Oil

- 5.2.2. Dry Cargo

- 5.2.3. Other Liquid Cargo

- 5.3. Market Analysis, Insights and Forecast - by US

- 5.4. Market Analysis, Insights and Forecast - by Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ports America Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayliner

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SSA Marine

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rhenus Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Husky Terminal and Stevedoring LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Viking Line

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indiana Port Commission

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MEYER WERFT GmbH & Co KG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mississippi State Port Authority at Gulfport**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mediterranean Shipping Company S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ports America Inc

List of Figures

- Figure 1: North America Container Terminal Operations Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Container Terminal Operations Market Share (%) by Company 2025

List of Tables

- Table 1: North America Container Terminal Operations Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: North America Container Terminal Operations Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 3: North America Container Terminal Operations Market Revenue billion Forecast, by US 2020 & 2033

- Table 4: North America Container Terminal Operations Market Revenue billion Forecast, by Canada 2020 & 2033

- Table 5: North America Container Terminal Operations Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Container Terminal Operations Market Revenue billion Forecast, by Service 2020 & 2033

- Table 7: North America Container Terminal Operations Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 8: North America Container Terminal Operations Market Revenue billion Forecast, by US 2020 & 2033

- Table 9: North America Container Terminal Operations Market Revenue billion Forecast, by Canada 2020 & 2033

- Table 10: North America Container Terminal Operations Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Container Terminal Operations Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the North America Container Terminal Operations Market?

Key companies in the market include Ports America Inc, Bayliner, SSA Marine, Rhenus Group, Husky Terminal and Stevedoring LLC, Viking Line, Indiana Port Commission, MEYER WERFT GmbH & Co KG, Mississippi State Port Authority at Gulfport**List Not Exhaustive, Mediterranean Shipping Company S A.

3. What are the main segments of the North America Container Terminal Operations Market?

The market segments include Service, Cargo Type, US, Canada.

4. Can you provide details about the market size?

The market size is estimated to be USD 213.38 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing global trade activities; Infrastructure Development is on rise.

6. What are the notable trends driving market growth?

Initiatives towards Greener Industrial Port Activities.

7. Are there any restraints impacting market growth?

Manufacturers' lack of control over logistics services and also increasing logistical costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Container Terminal Operations Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Container Terminal Operations Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Container Terminal Operations Market?

To stay informed about further developments, trends, and reports in the North America Container Terminal Operations Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence