Key Insights

The Indonesia Oil and Gas Midstream Market is projected for substantial growth, fueled by robust domestic energy demand and strategic infrastructure investments. The market size was valued at 281.5 billion in 2023, and is expected to expand at a Compound Annual Growth Rate (CAGR) of 7.66% between 2023 and 2033. This expansion is driven by government initiatives to bolster energy security and an increase in exploration and production, necessitating enhanced midstream capacity. Key areas like pipelines, storage terminals, and processing facilities are set to receive significant investment as Indonesia strives to optimize its oil and gas value chain, from extraction to distribution.

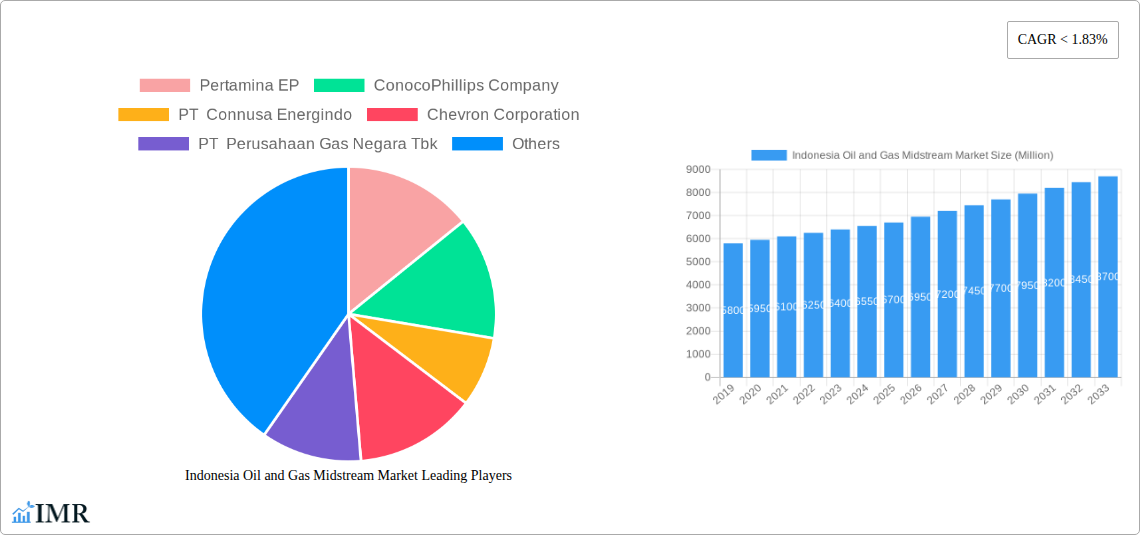

Indonesia Oil and Gas Midstream Market Market Size (In Billion)

The forecast period (2023-2033) anticipates accelerated development, focusing on the expansion and modernization of existing midstream infrastructure, alongside the construction of new facilities to accommodate emerging discoveries and rising domestic consumption. Government efforts to attract foreign investment and foster public-private partnerships will be vital for realizing this potential. The growing prominence of natural gas as a cleaner energy source is expected to stimulate investment in gas pipelines and LNG regasification terminals. While the market is primarily domestic, leveraging Indonesia's strategic location for regional energy trade offers potential long-term growth opportunities. Market dynamics are intrinsically linked to global oil and gas prices, regulatory reforms, and the successful completion of upstream projects.

Indonesia Oil and Gas Midstream Market Company Market Share

Indonesia Oil and Gas Midstream Market: Comprehensive Report

This report provides an in-depth analysis of the Indonesia Oil and Gas Midstream Market, covering critical segments like Transportation, Storage, and LNG Terminals. We delve into the current market structure, growth trends, dominant regions, product landscape, key drivers, barriers, emerging opportunities, and growth accelerators. The report also highlights key players and notable milestones shaping this vital sector of Indonesia's energy landscape. With a study period spanning from 2019 to 2033, including a base year of 2025 and a forecast period from 2025 to 2033, this comprehensive market intelligence offers actionable insights for industry professionals.

Indonesia Oil and Gas Midstream Market Market Dynamics & Structure

The Indonesia Oil and Gas Midstream Market exhibits a moderately consolidated structure, with major players like Pertamina EP, ConocoPhillips Company, Chevron Corporation, and PT Perusahaan Gas Negara Tbk holding significant market share. Technological innovation is a key driver, particularly in optimizing pipeline efficiency, enhancing storage solutions, and developing advanced LNG terminal technologies. Regulatory frameworks, established by the Indonesian government, play a crucial role in shaping project approvals, tariff structures, and environmental compliance. Competitive product substitutes, such as alternative transportation modes for oil and gas, are present but generally less efficient and cost-effective for large-scale midstream operations. End-user demographics are primarily industrial, including power generation, petrochemical industries, and manufacturing sectors, all demanding reliable and continuous supply of oil and gas. Mergers and acquisitions (M&A) trends indicate a strategic consolidation to achieve economies of scale and expand operational capabilities. For instance, recent M&A activities in the sector are estimated to be in the range of 350 Million USD, aiming to integrate upstream and downstream capabilities. The market is characterized by high capital expenditure requirements and long gestation periods for new infrastructure development, posing a barrier to entry for smaller players. Innovation barriers include the need for specialized engineering expertise and navigating complex land acquisition processes.

Indonesia Oil and Gas Midstream Market Growth Trends & Insights

The Indonesia Oil and Gas Midstream Market is projected for robust growth, with an estimated Compound Annual Growth Rate (CAGR) of 6.5% over the forecast period (2025-2033). This growth is underpinned by Indonesia's increasing energy demand, driven by its expanding economy and population. Market size evolution indicates a significant increase from an estimated USD 15,000 Million in 2025 to an anticipated USD 25,000 Million by 2033. Adoption rates for advanced midstream technologies are steadily increasing, with a focus on digitalization for operational efficiency and enhanced safety. Technological disruptions, such as the implementation of smart pipelines with real-time monitoring capabilities and the development of modular LNG terminal solutions, are gaining traction. Consumer behavior shifts are evident in the growing preference for cleaner energy sources, which, while impacting upstream demand, indirectly fuels the need for efficient midstream infrastructure to handle diverse energy commodities, including natural gas and LNG. Market penetration of specialized midstream services is also on the rise, as companies seek to optimize their supply chains and reduce operational costs. The increasing focus on energy security and the government's commitment to developing domestic energy resources further contribute to the positive market outlook. The adoption of automation in storage facilities is expected to improve inventory management and reduce wastage.

Dominant Regions, Countries, or Segments in Indonesia Oil and Gas Midstream Market

The Transportation segment, particularly the pipeline sub-segment, is a dominant force within the Indonesia Oil and Gas Midstream Market. Indonesia's vast archipelago necessitates extensive pipeline networks to connect remote production sites to consumption centers. The existing infrastructure for oil and gas pipelines is substantial, with an estimated 75,000 Kilometers of operational pipelines as of 2025. Projects in the pipeline include the development of new cross-island pipelines and the expansion of existing networks to cater to increased production and demand. Upcoming projects, such as the Trans-Sumatra gas pipeline, are critical for enhancing energy distribution across the nation. The Storage segment, while significant, is secondary to transportation in terms of market share. Existing storage infrastructure, primarily oil and gas tank farms, is estimated at 50 Million Cubic Meters capacity. Projects in the pipeline focus on expanding storage capacity to meet growing demand and for strategic reserve purposes. The LNG Terminals segment is experiencing rapid growth due to Indonesia's strategic position as a major LNG producer and exporter, as well as its increasing domestic gas demand. Existing LNG terminal infrastructure has a regasification capacity of 20 Million Tons Per Annum. Projects in the pipeline include the development of new floating storage and regasification units (FSRUs) and land-based LNG terminals to serve various islands. Key drivers for the dominance of the transportation segment include economic policies promoting energy independence and infrastructure development, significant government investment in pipeline networks, and the sheer geographical challenge of energy distribution across Indonesia. The West Java region, due to its high industrial concentration and population density, leads in terms of demand and infrastructure development for midstream services, particularly for gas transportation and storage. The growth potential in this region is further amplified by ongoing industrial expansion and the government's focus on developing gas-fired power plants.

Indonesia Oil and Gas Midstream Market Product Landscape

The product landscape within the Indonesia Oil and Gas Midstream Market is characterized by a range of specialized equipment and services designed for the efficient and safe handling of oil and natural gas. This includes high-grade steel pipes for pipelines, sophisticated pumping stations, and advanced storage tanks. For LNG terminals, the product landscape features cryogenic storage tanks, regasification units, and specialized loading/unloading arms. Innovations are focused on improving operational efficiency, reducing energy consumption, and enhancing safety. For instance, the development of smart pipeline monitoring systems with integrated sensors and data analytics provides real-time insights into pipeline integrity and flow rates. Performance metrics are crucial, with emphasis on leak detection rates, energy efficiency of compression and pumping equipment, and turnaround times for LNG terminal operations. Unique selling propositions often revolve around durability, compliance with international safety standards, and the ability to operate in diverse environmental conditions prevalent in Indonesia. Technological advancements are also directed towards modularization of LNG terminal components, enabling faster deployment and greater flexibility.

Key Drivers, Barriers & Challenges in Indonesia Oil and Gas Midstream Market

Key Drivers:

- Increasing Energy Demand: Indonesia's growing economy and population are driving a consistent demand for oil and gas, necessitating robust midstream infrastructure.

- Government Support and Investment: The Indonesian government prioritizes energy security and infrastructure development, actively supporting midstream projects through policy initiatives and investment.

- Unlocking Domestic Reserves: Developing midstream infrastructure is crucial for transporting oil and gas from newly discovered or remote fields to processing facilities and markets.

- Technological Advancements: Adoption of digitalization, automation, and advanced materials enhances efficiency, safety, and cost-effectiveness in midstream operations.

- Strategic Location and Export Potential: Indonesia's role as a major energy producer and exporter fuels the demand for efficient LNG terminals and export pipelines.

Barriers & Challenges:

- High Capital Expenditure: The development of midstream infrastructure, particularly pipelines and large-scale storage facilities, requires significant upfront investment, often exceeding USD 500 Million per major project.

- Regulatory Hurdles and Land Acquisition: Navigating complex regulatory processes and securing land rights for pipeline routes and terminal sites can cause project delays.

- Geographical Complexity: The archipelagic nature of Indonesia presents logistical challenges for infrastructure development and maintenance, increasing costs.

- Supply Chain Disruptions: Sourcing specialized equipment and materials, especially during periods of high global demand, can lead to project delays and cost overruns.

- Environmental Concerns and Social Acceptance: Ensuring environmental compliance and gaining social acceptance for infrastructure projects, particularly in sensitive areas, are ongoing challenges. The cost associated with environmental mitigation measures can add up to 5% of the total project cost.

Emerging Opportunities in Indonesia Oil and Gas Midstream Market

Emerging opportunities in the Indonesia Oil and Gas Midstream Market lie in the expansion of natural gas infrastructure to support the country's energy transition and the increasing demand for cleaner fuels. The development of smaller, modular LNG terminals to serve distributed markets and remote islands presents a significant growth avenue. Furthermore, the modernization of existing pipeline networks with smart technologies for enhanced integrity management and leak detection offers lucrative opportunities for service providers. The growing petrochemical sector also fuels the demand for reliable and efficient transportation and storage of feedstocks. Opportunities also exist in the development of infrastructure for the transportation of associated gas from oil fields, which is currently underutilized, thereby contributing to reduced flaring and environmental impact.

Growth Accelerators in the Indonesia Oil and Gas Midstream Market Industry

Several key catalysts are accelerating growth in the Indonesia Oil and Gas Midstream Market. Technological breakthroughs in materials science are enabling the development of more durable and corrosion-resistant pipelines, reducing maintenance costs and extending asset life. Strategic partnerships between state-owned enterprises and international energy companies are crucial for bringing in capital, expertise, and advanced technologies for large-scale projects. Market expansion strategies focused on developing new pipeline corridors to underserved regions and expanding LNG import/export capabilities are also significant growth drivers. The government's ongoing commitment to improving the ease of doing business and streamlining investment procedures is further fostering a conducive environment for midstream development. Investment in offshore processing and transportation solutions is also expected to increase.

Key Players Shaping the Indonesia Oil and Gas Midstream Market Market

- Pertamina EP

- ConocoPhillips Company

- PT Connusa Energindo

- Chevron Corporation

- PT Perusahaan Gas Negara Tbk

Notable Milestones in Indonesia Oil and Gas Midstream Market Sector

- 2021/05: Pertamina completes the Arun-Belawan pipeline expansion, increasing gas transmission capacity to support industrial growth in North Sumatra.

- 2022/08: ConocoPhillips begins construction of a new offshore gas pipeline to connect its offshore production to the national grid.

- 2023/02: PT Perusahaan Gas Negara Tbk announces plans to develop a new regasification terminal in West Java to boost LNG import capacity.

- 2024/01: Chevron Corporation achieves a significant milestone in its pipeline maintenance program, enhancing operational safety and efficiency.

- 2024/07: PT Connusa Energindo secures contracts for the construction of new gas distribution pipelines in East Kalimantan.

In-Depth Indonesia Oil and Gas Midstream Market Market Outlook

The outlook for the Indonesia Oil and Gas Midstream Market remains highly positive, driven by the country's sustained energy demand and government commitment to infrastructure development. Growth accelerators, including technological adoption and strategic partnerships, are expected to continue fueling expansion across all segments. Future market potential lies in the development of integrated midstream solutions that connect upstream production to downstream consumption more efficiently. Strategic opportunities include investing in the modernization of aging infrastructure, expanding LNG receiving and distribution capabilities to meet regional demand, and developing specialized midstream services for emerging energy resources. The market is poised for substantial growth as Indonesia continues to leverage its rich hydrocarbon resources while transitioning towards a more diversified energy mix.

Indonesia Oil and Gas Midstream Market Segmentation

-

1. Transportation

-

1.1. Overview

- 1.1.1. Existing Infrastructure

- 1.1.2. Projects in Pipeline

- 1.1.3. Upcoming Projects

-

1.1. Overview

-

2. Storage

-

2.1. Overview

- 2.1.1. Existing Infrastructure

- 2.1.2. Projects in Pipeline

- 2.1.3. Upcoming Projects

-

2.1. Overview

-

3. LNG Terminals

-

3.1. Overview

- 3.1.1. Existing Infrastructure

- 3.1.2. Projects in Pipeline

- 3.1.3. Upcoming Projects

-

3.1. Overview

Indonesia Oil and Gas Midstream Market Segmentation By Geography

- 1. Indonesia

Indonesia Oil and Gas Midstream Market Regional Market Share

Geographic Coverage of Indonesia Oil and Gas Midstream Market

Indonesia Oil and Gas Midstream Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas

- 3.3. Market Restrains

- 3.3.1. 4.; High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. Pipeline Capacity to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Oil and Gas Midstream Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 5.1.1. Overview

- 5.1.1.1. Existing Infrastructure

- 5.1.1.2. Projects in Pipeline

- 5.1.1.3. Upcoming Projects

- 5.1.1. Overview

- 5.2. Market Analysis, Insights and Forecast - by Storage

- 5.2.1. Overview

- 5.2.1.1. Existing Infrastructure

- 5.2.1.2. Projects in Pipeline

- 5.2.1.3. Upcoming Projects

- 5.2.1. Overview

- 5.3. Market Analysis, Insights and Forecast - by LNG Terminals

- 5.3.1. Overview

- 5.3.1.1. Existing Infrastructure

- 5.3.1.2. Projects in Pipeline

- 5.3.1.3. Upcoming Projects

- 5.3.1. Overview

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Transportation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Pertamina EP

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ConocoPhillips Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Connusa Energindo

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chevron Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Perusahaan Gas Negara Tbk

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Pertamina EP

List of Figures

- Figure 1: Indonesia Oil and Gas Midstream Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Indonesia Oil and Gas Midstream Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Oil and Gas Midstream Market Revenue billion Forecast, by Transportation 2020 & 2033

- Table 2: Indonesia Oil and Gas Midstream Market Volume Million Forecast, by Transportation 2020 & 2033

- Table 3: Indonesia Oil and Gas Midstream Market Revenue billion Forecast, by Storage 2020 & 2033

- Table 4: Indonesia Oil and Gas Midstream Market Volume Million Forecast, by Storage 2020 & 2033

- Table 5: Indonesia Oil and Gas Midstream Market Revenue billion Forecast, by LNG Terminals 2020 & 2033

- Table 6: Indonesia Oil and Gas Midstream Market Volume Million Forecast, by LNG Terminals 2020 & 2033

- Table 7: Indonesia Oil and Gas Midstream Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Indonesia Oil and Gas Midstream Market Volume Million Forecast, by Region 2020 & 2033

- Table 9: Indonesia Oil and Gas Midstream Market Revenue billion Forecast, by Transportation 2020 & 2033

- Table 10: Indonesia Oil and Gas Midstream Market Volume Million Forecast, by Transportation 2020 & 2033

- Table 11: Indonesia Oil and Gas Midstream Market Revenue billion Forecast, by Storage 2020 & 2033

- Table 12: Indonesia Oil and Gas Midstream Market Volume Million Forecast, by Storage 2020 & 2033

- Table 13: Indonesia Oil and Gas Midstream Market Revenue billion Forecast, by LNG Terminals 2020 & 2033

- Table 14: Indonesia Oil and Gas Midstream Market Volume Million Forecast, by LNG Terminals 2020 & 2033

- Table 15: Indonesia Oil and Gas Midstream Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Indonesia Oil and Gas Midstream Market Volume Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Oil and Gas Midstream Market?

The projected CAGR is approximately 7.66%.

2. Which companies are prominent players in the Indonesia Oil and Gas Midstream Market?

Key companies in the market include Pertamina EP, ConocoPhillips Company, PT Connusa Energindo, Chevron Corporation, PT Perusahaan Gas Negara Tbk.

3. What are the main segments of the Indonesia Oil and Gas Midstream Market?

The market segments include Transportation, Storage, LNG Terminals.

4. Can you provide details about the market size?

The market size is estimated to be USD 281.5 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Industrialization across the Globe4.; Increasing Utilization of Natural Gas.

6. What are the notable trends driving market growth?

Pipeline Capacity to Witness Growth.

7. Are there any restraints impacting market growth?

4.; High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Oil and Gas Midstream Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Oil and Gas Midstream Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Oil and Gas Midstream Market?

To stay informed about further developments, trends, and reports in the Indonesia Oil and Gas Midstream Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence