Key Insights

The Latin America Wind Turbine Market is projected to reach $6.6 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 7.6%. This growth is driven by increasing demand for clean energy, supportive government policies, and growing environmental consciousness. Key markets include Brazil, Mexico, and Chile, benefiting from abundant wind resources and declining technology costs. Investment in onshore and offshore wind farms is a significant trend.

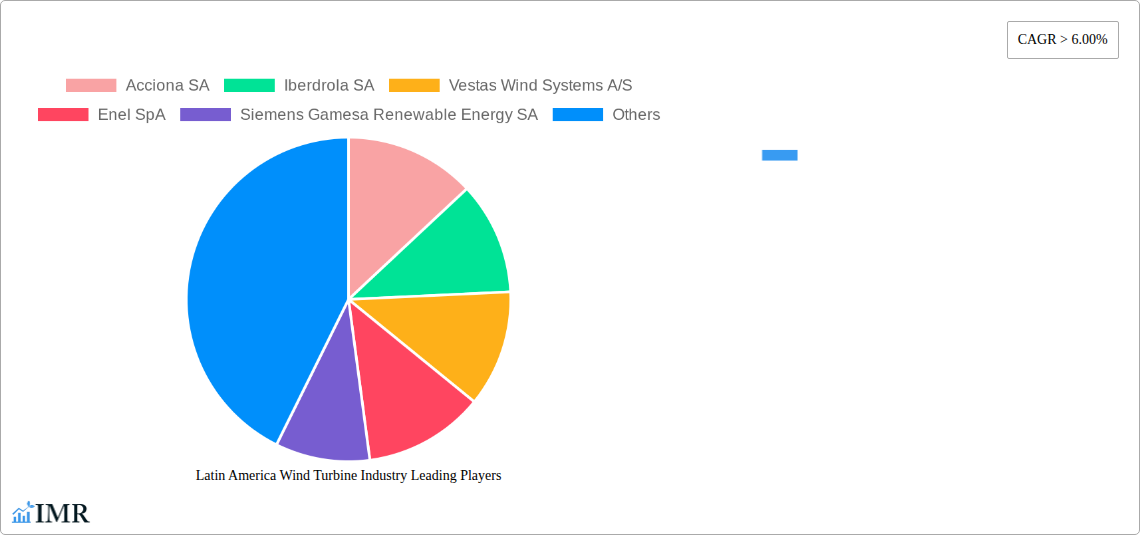

Latin America Wind Turbine Industry Market Size (In Billion)

Challenges such as grid infrastructure limitations, workforce skills, and regulatory complexities exist. However, technological advancements in turbine efficiency and energy storage, alongside the involvement of major global players, are expected to overcome these obstacles. Strategic partnerships and regional manufacturing expansion are strengthening Latin America's position in the global wind energy sector.

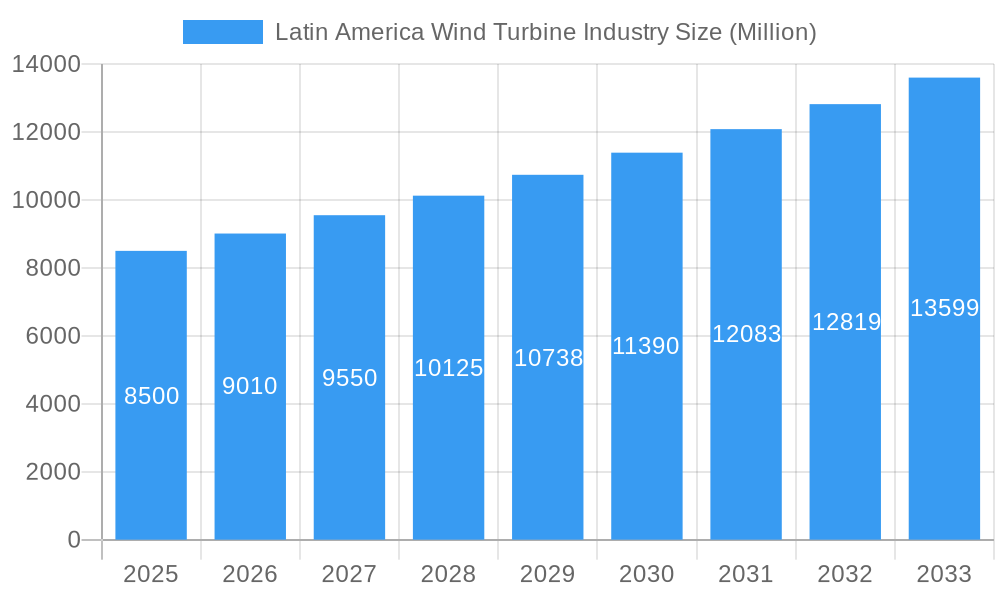

Latin America Wind Turbine Industry Company Market Share

Latin America Wind Turbine Industry: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the Latin America wind turbine industry, covering market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, opportunities, and a detailed outlook for the period of 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this report offers actionable insights for stakeholders seeking to capitalize on the burgeoning renewable energy sector in Latin America. All market values are presented in Million Units.

Latin America Wind Turbine Industry Market Dynamics & Structure

The Latin America wind turbine market is characterized by a moderately concentrated landscape, with key players like Acciona SA, Iberdrola SA, Vestas Wind Systems A/S, Enel SpA, and Siemens Gamesa Renewable Energy SA holding significant sway. Technological innovation is a primary driver, fueled by advancements in turbine efficiency, energy storage integration, and digital monitoring solutions. Favorable regulatory frameworks and government incentives for renewable energy deployment across countries like Brazil and Mexico are further accelerating market penetration. While direct competitive product substitutes are limited, the integration of solar PV and battery storage solutions presents a nuanced competitive dynamic. End-user demographics are increasingly shifting towards utility-scale power generation and corporate Power Purchase Agreements (PPAs), driven by the demand for cleaner energy sources and cost-effectiveness. Mergers and acquisitions (M&A) are anticipated to play a crucial role in market consolidation and strategic expansion, with an estimated volume of 5-8 major M&A deals expected within the forecast period. Innovation barriers include the need for robust grid infrastructure upgrades and skilled labor development.

- Market Concentration: Moderate, with top 5 players holding an estimated 65% market share.

- Technological Innovation Drivers: Increased turbine size and efficiency, advanced grid integration, predictive maintenance technologies.

- Regulatory Frameworks: Government subsidies, renewable portfolio standards, tax incentives.

- Competitive Product Substitutes: Solar PV, battery energy storage systems (BESS).

- End-User Demographics: Utilities, independent power producers (IPPs), industrial consumers.

- M&A Trends: Expected 5-8 significant deals, focus on expanding operational capacity and technological integration.

- Innovation Barriers: Grid modernization costs, workforce training requirements, land acquisition complexities.

Latin America Wind Turbine Industry Growth Trends & Insights

The Latin America wind turbine industry is poised for substantial growth, driven by a global imperative for decarbonization and the region's abundant wind resources. The market size is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 8-10% during the forecast period. Adoption rates for wind energy are rapidly increasing, propelled by declining levelized cost of energy (LCOE) for wind power and supportive government policies. Technological disruptions, such as the development of larger and more efficient turbine models, are key to unlocking new wind potential and enhancing energy yields. Consumer behavior is evolving, with an increasing preference for renewable energy sources among corporations and a growing awareness of climate change impacts. Market penetration is expected to reach over 25% of the total electricity generation mix in key Latin American countries by 2033.

The historical period (2019-2024) has witnessed consistent expansion, laying a strong foundation for future growth. The base year of 2025 is expected to see significant new capacity additions, reflecting the momentum built over the past few years. The forecast period (2025-2033) will be characterized by accelerated deployment, particularly in onshore wind, while offshore wind projects are expected to gain traction in later years. The report leverages advanced analytical models and extensive data from across the region to provide precise market size evolution projections. Insights into adoption rates are derived from analyses of installed capacity versus total energy demand. Technological disruptions are identified through a review of R&D investments and patent filings by leading manufacturers. Consumer behavior shifts are assessed through surveys and demand analysis from corporate off-takers. The report quantifies market penetration by comparing wind energy's contribution to the overall electricity generation mix.

The estimated market size in 2025 is projected to be around 15,000 Million Units, with an anticipated expansion to over 30,000 Million Units by 2033, driven by these growth trends. The CAGR is a critical metric that underscores the rapid development of this sector, reflecting ongoing investment and supportive policy environments. Key insights will focus on the specific drivers behind these adoption rates, such as tender results, auction outcomes, and private sector investment trends. The evolving landscape of energy storage solutions and their integration with wind power will be a significant theme, impacting the overall reliability and dispatchability of wind energy. Furthermore, the report will delve into how advancements in digital technologies, including AI and IoT, are optimizing wind farm operations and maintenance, thereby improving the economic viability of wind projects. The strategic importance of local manufacturing and supply chain development within Latin America will also be a key focus, contributing to job creation and economic development alongside environmental benefits.

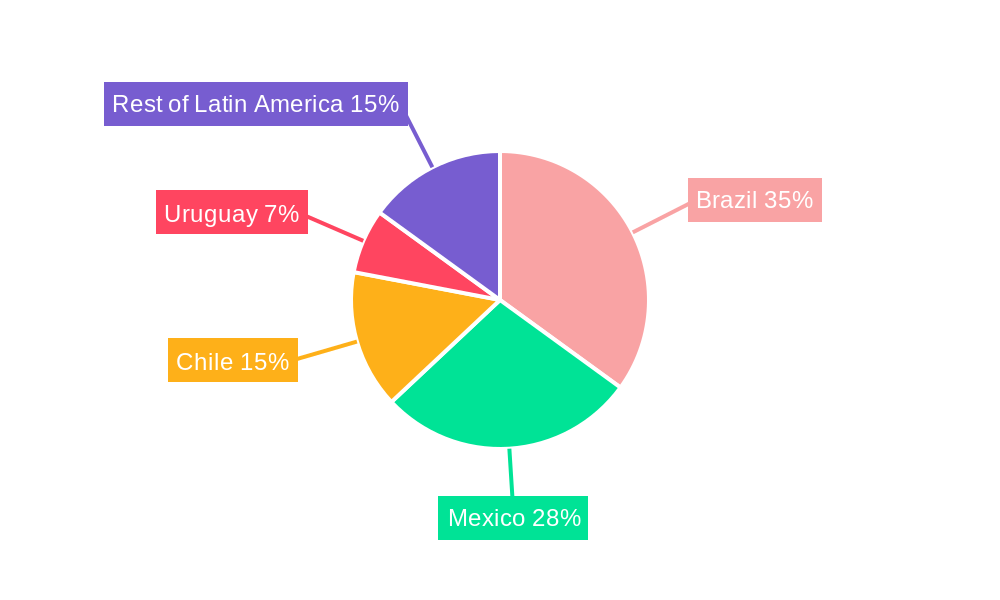

Dominant Regions, Countries, or Segments in Latin America Wind Turbine Industry

Brazil stands out as the dominant region in the Latin America wind turbine industry, driven by its vast landmass, strong wind resource potential, and a well-established regulatory framework that has consistently supported renewable energy development. The Onshore segment, in particular, is the primary driver of market growth, accounting for an estimated 95% of the total installed capacity. Brazil's commitment to diversifying its energy matrix away from hydro and fossil fuels has led to significant investments in wind power. Large-scale wind farms are being developed in its northeastern region, benefiting from consistent and strong wind speeds.

Chile and Mexico also represent significant markets, with Chile showcasing remarkable growth in its central and southern regions, leveraging its unique geographical advantages for wind energy. Mexico, despite facing some policy uncertainties in the past, continues to hold substantial potential with favorable wind conditions in its Isthmus of Tehuantepec region. Uruguay has emerged as a leader in per capita wind energy consumption, demonstrating a strong national commitment to renewables. The "Rest of Latin America" category, while currently smaller, holds immense untapped potential, with countries like Argentina and Colombia showing increasing interest and investment in wind power projects.

- Dominant Country: Brazil, consistently leading in installed wind capacity.

- Dominant Segment: Onshore wind deployment, offering cost-effectiveness and ease of installation.

- Key Drivers in Brazil: Favorable auction mechanisms, long-term power purchase agreements, expansion of transmission infrastructure, abundant wind resources in the Northeast.

- Growth Potential in Chile: Favorable wind regimes in the Atacama and Magallanes regions, supportive regulatory environment, increasing demand from mining and industrial sectors.

- Mexico's Potential: Significant wind resources in the Isthmus of Tehuantepec, evolving regulatory landscape, and potential for private sector investment.

- Uruguay's Leadership: High per capita wind energy consumption, strong governmental support, and ambitious renewable energy targets.

- Emerging Markets (Rest of Latin America): Argentina's Patagonia region, Colombia's La Guajira peninsula, offering substantial unexploited wind potential.

- Market Share (Estimated): Brazil (approx. 50%), Mexico (approx. 20%), Chile (approx. 15%), Rest of Latin America (approx. 15%).

- Growth Outlook: Brazil and Mexico expected to continue leading in absolute capacity additions, while Chile and Colombia are poised for rapid percentage growth.

Latin America Wind Turbine Industry Product Landscape

The Latin America wind turbine product landscape is dominated by advanced, multi-megawatt (MW) onshore wind turbines designed for optimal performance in diverse regional conditions. Manufacturers are focusing on enhancing turbine reliability, reducing maintenance costs, and maximizing energy capture through improved aerodynamics and control systems. Innovations include taller towers for accessing stronger winds at higher altitudes and sophisticated blade designs that are lighter, more durable, and more efficient. The application spectrum spans utility-scale power generation, contributing significantly to national grids, and increasingly, to distributed generation projects and corporate energy solutions. Performance metrics are continuously being refined, with advancements in capacity factor, reduced noise emissions, and improved grid code compliance. Unique selling propositions for leading manufacturers include enhanced operational efficiency, extended turbine lifespans, and comprehensive after-sales service packages tailored for the Latin American market.

Key Drivers, Barriers & Challenges in Latin America Wind Turbine Industry

Key Drivers:

- Abundant Wind Resources: Latin America boasts some of the world's most consistent and powerful wind resources.

- Favorable Government Policies: Renewable energy targets, tax incentives, and competitive auctions are driving investment.

- Declining LCOE: Wind energy is increasingly cost-competitive with traditional power sources.

- Growing Demand for Clean Energy: Corporate sustainability goals and public pressure for decarbonization.

- Energy Security & Diversification: Reducing reliance on fossil fuels and enhancing energy independence.

Barriers & Challenges:

- Grid Infrastructure Limitations: Insufficient transmission capacity and grid instability can hinder large-scale integration.

- Regulatory Uncertainty: Inconsistent policy frameworks and changes in government can deter investment.

- Supply Chain Development: Reliance on imported components and the need for local manufacturing capacity.

- Land Acquisition & Permitting: Complexities in securing land rights and obtaining necessary permits.

- Financing & Investment Risks: Perceived political and economic risks in some countries can impact project financing.

- Skilled Labor Shortages: A need for trained personnel for installation, operation, and maintenance.

Emerging Opportunities in Latin America Wind Turbine Industry

Emerging opportunities in the Latin America wind turbine industry lie in the development of offshore wind projects, particularly in coastal regions with high wind speeds and deep waters. The integration of hybrid renewable energy systems, combining wind turbines with solar PV and battery storage, presents a significant avenue for enhancing grid stability and reliability. Furthermore, the growing corporate demand for renewable energy through Power Purchase Agreements (PPAs) is creating a substantial market for distributed wind generation and direct sourcing from wind farms. Untapped markets in countries like Colombia and Peru, with their significant wind potential and expanding energy needs, offer substantial growth prospects. Evolving consumer preferences are also driving the demand for green energy certificates and community-owned renewable projects.

Growth Accelerators in the Latin America Wind Turbine Industry Industry

Several growth accelerators are poised to propel the Latin America wind turbine industry forward. Technological breakthroughs in turbine design, such as larger rotor diameters and more efficient power electronics, will enhance energy yields and reduce costs. Strategic partnerships between international turbine manufacturers, local developers, and financial institutions will facilitate the deployment of larger-scale projects and de-risk investments. Market expansion strategies, including the development of new project pipelines and the exploration of emerging markets within the region, will be crucial. The increasing focus on domestic manufacturing and supply chain localization will foster economic development and create a more resilient industry.

Key Players Shaping the Latin America Wind Turbine Industry Market

- Acciona SA

- Iberdrola SA

- Vestas Wind Systems A/S

- Enel SpA

- Siemens Gamesa Renewable Energy SA

- Colbun SA

- Latin America Power S A (LAP)

Notable Milestones in Latin America Wind Turbine Industry Sector

- 2019: Brazil's A-4 and A-6 energy auctions award significant wind power capacity, driving new project development.

- 2020: Vestas delivers its first V150-4.2 MW turbines in Chile, marking a technological advancement in the region.

- 2021: Siemens Gamesa secures a major contract for the supply of turbines for a large offshore wind project in the planning stages in Brazil.

- 2022: Iberdrola announces substantial investment plans for wind energy expansion in Mexico, reaffirming its commitment to the market.

- 2023: Enel Green Power commissions a significant wind farm in Argentina, contributing to the country's renewable energy goals.

- 2024: Colbun SA advances its renewable energy portfolio with the ongoing development of new wind power projects in Chile.

In-Depth Latin America Wind Turbine Industry Market Outlook

The future market outlook for the Latin America wind turbine industry is exceptionally bright, characterized by sustained growth and increasing innovation. The combination of robust wind resources, supportive government policies, and a growing demand for clean energy will continue to be the primary growth accelerators. Strategic partnerships and technological advancements are expected to further optimize project economics and expand deployment into new territories. The industry is moving towards greater localization of manufacturing and supply chains, fostering economic development and creating a more resilient regional market. Future market potential lies in the ambitious renewable energy targets set by various nations, coupled with the increasing interest from international investors seeking opportunities in a rapidly decarbonizing sector. Stakeholders can anticipate a dynamic and expanding market landscape.

Latin America Wind Turbine Industry Segmentation

-

1. Location of Deployment

- 1.1. Onshore

- 1.2. Offshore

-

2. Geography

- 2.1. Brazil

- 2.2. Mexico

- 2.3. Chile

- 2.4. Uruguay

- 2.5. Rest of Latin America

Latin America Wind Turbine Industry Segmentation By Geography

- 1. Brazil

- 2. Mexico

- 3. Chile

- 4. Uruguay

- 5. Rest of Latin America

Latin America Wind Turbine Industry Regional Market Share

Geographic Coverage of Latin America Wind Turbine Industry

Latin America Wind Turbine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth in Industrial Projects4.; Escalating Natural Gas Demand for Various Applications

- 3.3. Market Restrains

- 3.3.1. 4.; High Installation Costs

- 3.4. Market Trends

- 3.4.1. Onshore Wind Turbine Dominating the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Wind Turbine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 5.1.1. Onshore

- 5.1.2. Offshore

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Mexico

- 5.2.3. Chile

- 5.2.4. Uruguay

- 5.2.5. Rest of Latin America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Mexico

- 5.3.3. Chile

- 5.3.4. Uruguay

- 5.3.5. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6. Brazil Latin America Wind Turbine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 6.1.1. Onshore

- 6.1.2. Offshore

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Mexico

- 6.2.3. Chile

- 6.2.4. Uruguay

- 6.2.5. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7. Mexico Latin America Wind Turbine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 7.1.1. Onshore

- 7.1.2. Offshore

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Mexico

- 7.2.3. Chile

- 7.2.4. Uruguay

- 7.2.5. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8. Chile Latin America Wind Turbine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 8.1.1. Onshore

- 8.1.2. Offshore

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Mexico

- 8.2.3. Chile

- 8.2.4. Uruguay

- 8.2.5. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9. Uruguay Latin America Wind Turbine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 9.1.1. Onshore

- 9.1.2. Offshore

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Mexico

- 9.2.3. Chile

- 9.2.4. Uruguay

- 9.2.5. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10. Rest of Latin America Latin America Wind Turbine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 10.1.1. Onshore

- 10.1.2. Offshore

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Brazil

- 10.2.2. Mexico

- 10.2.3. Chile

- 10.2.4. Uruguay

- 10.2.5. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Location of Deployment

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Acciona SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Iberdrola SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vestas Wind Systems A/S

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Enel SpA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Siemens Gamesa Renewable Energy SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Colbun SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Latin America Power S A (LAP)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Acciona SA

List of Figures

- Figure 1: Latin America Wind Turbine Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Wind Turbine Industry Share (%) by Company 2025

List of Tables

- Table 1: Latin America Wind Turbine Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 2: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Location of Deployment 2020 & 2033

- Table 3: Latin America Wind Turbine Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 5: Latin America Wind Turbine Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Region 2020 & 2033

- Table 7: Latin America Wind Turbine Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 8: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Location of Deployment 2020 & 2033

- Table 9: Latin America Wind Turbine Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 11: Latin America Wind Turbine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 13: Latin America Wind Turbine Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 14: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Location of Deployment 2020 & 2033

- Table 15: Latin America Wind Turbine Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 17: Latin America Wind Turbine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 19: Latin America Wind Turbine Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 20: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Location of Deployment 2020 & 2033

- Table 21: Latin America Wind Turbine Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 23: Latin America Wind Turbine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 25: Latin America Wind Turbine Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 26: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Location of Deployment 2020 & 2033

- Table 27: Latin America Wind Turbine Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 29: Latin America Wind Turbine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Country 2020 & 2033

- Table 31: Latin America Wind Turbine Industry Revenue billion Forecast, by Location of Deployment 2020 & 2033

- Table 32: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Location of Deployment 2020 & 2033

- Table 33: Latin America Wind Turbine Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 34: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Geography 2020 & 2033

- Table 35: Latin America Wind Turbine Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Latin America Wind Turbine Industry Volume Gigawatt Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Wind Turbine Industry?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the Latin America Wind Turbine Industry?

Key companies in the market include Acciona SA, Iberdrola SA, Vestas Wind Systems A/S, Enel SpA, Siemens Gamesa Renewable Energy SA, Colbun SA, Latin America Power S A (LAP).

3. What are the main segments of the Latin America Wind Turbine Industry?

The market segments include Location of Deployment, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.6 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth in Industrial Projects4.; Escalating Natural Gas Demand for Various Applications.

6. What are the notable trends driving market growth?

Onshore Wind Turbine Dominating the Market.

7. Are there any restraints impacting market growth?

4.; High Installation Costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in Gigawatt.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Wind Turbine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Wind Turbine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Wind Turbine Industry?

To stay informed about further developments, trends, and reports in the Latin America Wind Turbine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence